Liquid Waste Management Market Size and Forecast 2025 to 2034

The global liquid waste management market size was calculated at USD 100.31 billion in 2024 and is predicted to increase from USD 102.82 billion in 2025 to approximately USD 128.29 billion by 2034, expanding at a CAGR of 2.49% from 2025 to 2034.

Liquid Waste Management Market Key Takeaways

- The global liquid waste management market was valued at USD 100.31 billion in 2024.

- It is projected to reach USD 128.29 billion by 2034.

- The liquid waste management market is expected to grow at a CAGR of 2.49% from 2025 to 2034.

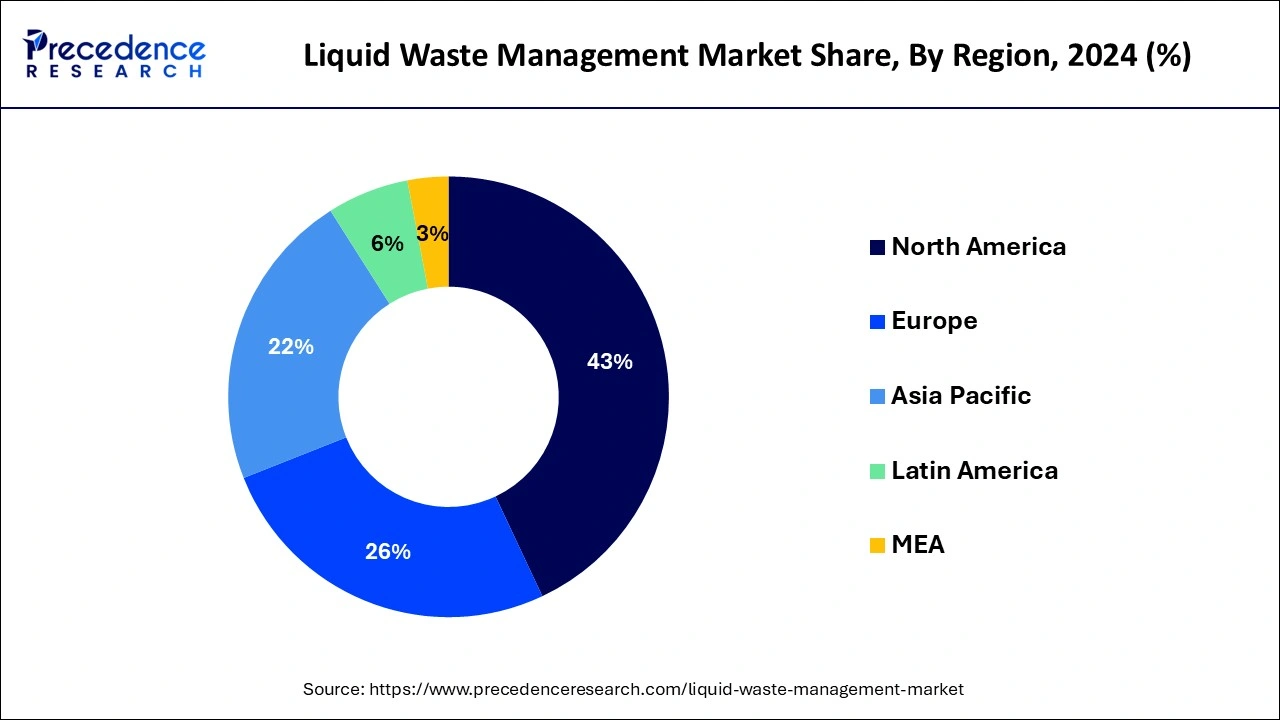

- North America contributed more than 43% of revenue share in 2024.

- Asia-Pacific is estimated to witness the fastest CAGR between 2025 and 2034.

- By source, the residential segment has held the largest market share of 43% in 2024.

- By source, the commercial segment is anticipated to grow at a remarkable CAGR of 3.3% between 2025 and 2034.

- By industry, the iron & steel segment generated over 35% of revenue share in 2024.

- By industry, the oil & gas segment is expected to expand at the fastest CAGR over the projected period.

- By service, the transportation segment generated over 49% of revenue share in 2024.

- By service, the treatment segment is expected to expand at the fastest CAGR over the projected period.

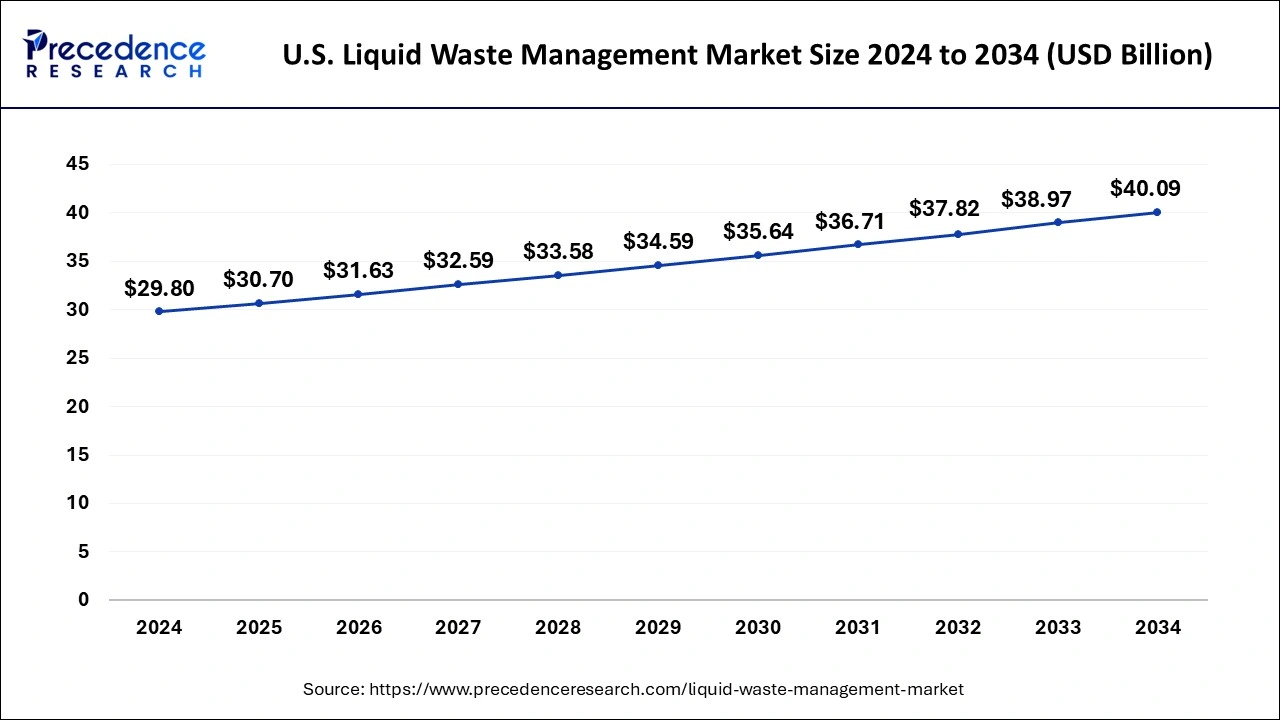

U.S. Liquid Waste Management Market Size and Growth 2025 to 2034

The U.S. liquid waste management market size was evaluated at USD 29.80 billion in 2024 and is projected to be worth around USD 40.09 billion by 2034, growing at a CAGR of 3.01% from 2025 to 2034.

North America has held the largest revenue share of 43% in 2024.North America holds a major share in the liquid waste management market due to a combination of robust industrialization, stringent environmental regulations, and a well-established waste management infrastructure. The region's advanced technologies and high awareness levels contribute to the effective treatment and disposal of liquid waste.

Additionally, increasing concerns about environmental sustainability and water pollution drive the demand for sophisticated waste management solutions. The presence of key market players, coupled with proactive government initiatives and a growing emphasis on circular economy practices, further solidify North America's dominant position in the liquid waste management market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a major share in the liquid waste management market due to rapid urbanization, industrialization, and population growth in the region. The increasing industrial activities generate substantial liquid waste, necessitating effective management solutions. Moreover, stringent environmental regulations, rising awareness about the importance of proper waste disposal, and government initiatives contribute to the demand for advanced liquid waste management services. As urban centers expand, the need for sustainable and efficient waste treatment and disposal practices in Asia-Pacific propels the region's dominance in the liquid waste management market.

Market Overview

Liquid waste management refers to the systematic handling, treatment, and disposal of liquid waste materials generated from various industrial, commercial, and domestic sources. This includes wastewater from manufacturing processes, sewage, contaminated water, and other liquid by-products. The goal of liquid waste management is to minimize environmental impact, protect public health, and adhere to regulatory standards. Effective liquid waste management involves several key steps. Initially, liquid waste is collected and transported to treatment facilities using specialized equipment. Treatment processes may include physical, chemical, or biological methods to remove pollutants and contaminants from liquid waste.

Once treated, the resulting effluent may be discharged safely into the environment or reused for non-potable purposes. Additionally, some liquid waste may undergo further processing to extract valuable resources or to reduce its volume for more efficient disposal. Sustainable liquid waste management practices play a crucial role in mitigating pollution, conserving water resources, and promoting a healthier environment for communities worldwide.

Liquid Waste Management Market Growth Factors

- As urban areas expand, the volume of liquid waste generated rises, driving the demand for efficient waste management solutions.

- Growing environmental awareness and stricter regulations necessitate advanced liquid waste treatment technologies, boosting the market for compliance solutions.

- The continual growth of industries results in higher liquid waste production, fostering the need for specialized management services tailored to industrial waste streams.

- Ongoing advancements in waste treatment technologies enhance the efficiency and sustainability of liquid waste management practices, attracting investment.

- Water Scarcity Concerns: Heightened awareness of water scarcity prompts the development of water recycling and reclamation systems, propelling the liquid waste management market.

- Increasing concerns about waterborne diseases and contamination underscores the importance of proper liquid waste disposal, stimulating market growth.

- The global population surge leads to increased wastewater production, emphasizing the importance of scalable liquid waste management infrastructure.

- Supportive government policies and initiatives aimed at promoting sustainable waste management practices contribute to market expansion.

- Infrastructure development projects generate substantial liquid waste, creating opportunities for comprehensive waste management services.

- Collaborations between public and private entities facilitate the development of robust liquid waste management systems, addressing complex challenges.

- Industries recognizing the economic and environmental benefits of responsible liquid waste management contribute to market growth.

- Urbanization trends in emerging economies lead to a surge in liquid waste, driving demand for efficient management solutions.

- The exploration of waste-to-energy technologies encourages sustainable practices and creates new avenues for market expansion.

- Growing consumer awareness and demand for eco-friendly products drive industries to adopt environmentally responsible liquid waste management strategies.

- The globalization of industries results in diverse waste streams, necessitating adaptive and comprehensive liquid waste management solutions.

- Companies increasingly recognize the importance of managing liquid waste to mitigate environmental and reputational risks.

- Implementation of smart city concepts includes intelligent waste management systems, elevating the efficiency and effectiveness of liquid waste disposal.

- Partnerships with research institutions promote innovation in waste management technologies, fostering market growth through cutting-edge solutions.

- The preference for decentralized liquid waste treatment systems, especially in remote areas, stimulates market growth by addressing specific localized needs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 102.82 Billion |

| Market Size in 2024 | USD 100.31 Billion |

| Market Size by 2034 | USD 128.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Industry, and Service |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Smart city initiatives and globalization of industries

Smart city initiatives play a pivotal role in surging demand for liquid waste management solutions by integrating advanced technologies to optimize waste collection, treatment, and recycling processes. Intelligent waste management systems deployed in smart cities leverage sensors, data analytics, and real-time monitoring to enhance operational efficiency, reduce environmental impact, and improve overall sustainability.

As urban areas embrace these initiatives, the demand for innovative liquid waste management solutions rises, creating opportunities for companies offering advanced technologies and services tailored to the unique challenges of modern, technology-driven cities. The globalization of industries results in diverse waste streams with varying characteristics and disposal requirements.

As companies expand their operations globally, the demand for adaptable and comprehensive liquid waste management solutions increases. Industries operating across borders seek integrated waste management strategies that align with different environmental regulations and local conditions. This trend drives the liquid waste management market, prompting the development of scalable and flexible solutions to address the unique challenges posed by the globalization of industrial activities. Companies offering globally applicable, technology-driven liquid waste management solutions are well-positioned to meet this growing demand.

Restraint

Lack of infrastructure in developing regions and resistance to change

The lack of adequate infrastructure in developing regions poses a significant challenge to the liquid waste management market. These regions often struggle with insufficient facilities for the collection, treatment, and disposal of liquid waste, hampering the implementation of effective waste management systems. Limited access to modern technologies, transportation networks, and treatment plants impedes the proper handling of liquid waste, leading to environmental pollution and public health concerns.

The absence of robust infrastructure inhibits the growth potential of the liquid waste management market in these areas, hindering efforts to establish sustainable and efficient waste disposal practices. Resistance to change within industries and communities presents another restraint for the liquid waste management market.

Established practices and traditional waste disposal methods may be deeply ingrained, making it challenging to persuade stakeholders to adopt innovative and environmentally friendly solutions. Resistance can stem from concerns about operational disruptions, unfamiliarity with new technologies, or a reluctance to invest in updated infrastructure. Overcoming this resistance requires comprehensive awareness campaigns, educational initiatives, and showcasing the long-term benefits of modern liquid waste management. Without addressing this resistance, the market faces obstacles in implementing advanced technologies and achieving widespread adoption of sustainable waste management practices.

Opportunity

Circular economy integration

The integration of circular economy principles creates significant opportunities in the liquid waste management market by transforming waste into a valuable resource. Companies can seize this opportunity by developing and implementing solutions that prioritize resource recovery and recycling from liquid waste. By adopting circular practices, the market can not only reduce environmental impact but also create new revenue streams through the extraction and repurposing of valuable materials. This approach aligns with sustainability goals, offering businesses a chance to contribute to a more resource-efficient and eco-friendly waste management ecosystem.

Source Insights

In 2024, the residential segment held the highest market share of 43% based on the source. In the liquid waste management market, the residential segment encompasses waste generated from households. This includes wastewater from kitchens, bathrooms, and other domestic sources. Residential liquid waste often contains a mix of organic and inorganic materials, necessitating efficient collection and treatment methods to ensure environmental sustainability and public health. Current trends in residential liquid waste management focus on decentralized treatment systems, incorporating smart technologies for monitoring and optimizing waste collection. Additionally, there is an increasing emphasis on educating homeowners about proper disposal practices to minimize contamination and promote recycling initiatives within residential communities.

The commercial segment is anticipated to expand at a significant CAGR of 3.3% during the projected period. In the liquid waste management market, the commercial segment refers to waste generated from businesses, office complexes, retail establishments, and other non-industrial entities. This includes liquid waste such as wastewater, chemicals, and other by-products produced in commercial operations.

A notable trend in the commercial segment of the liquid waste management market involves an increasing emphasis on sustainable practices. Businesses are adopting advanced treatment technologies to minimize environmental impact, comply with regulations, and align with corporate sustainability goals. Additionally, there's a growing interest in circular economy principles, driving efforts to recover valuable resources from commercial liquid waste streams.

Industry Insights

According to the Industry, the iron & steel segment held a 35% revenue share in 2024. The iron and steel industry, known for its heavy industrial processes, generates significant liquid waste. This segment of the liquid waste management market involves the collection, treatment, and disposal of wastewater and by-products produced during steel manufacturing. Liquid waste in this industry typically contains various pollutants, necessitating specialized solutions for efficient management and environmental compliance.

Trends in the liquid waste management of the iron and steel segment include a growing focus on water recycling, the adoption of advanced treatment technologies, and the exploration of circular economy principles to extract value from waste by-products. Stricter environmental regulations are also driving the industry towards sustainable practices in liquid waste disposal, fostering the development of innovative solutions for this specific industrial segment.

The oil & gas segment is anticipated to expand fastest over the projected period. Within the liquid waste management market, the oil & gas segment deals with efficiently managing and disposing of liquid waste produced during oil and gas activities. This encompasses handling wastewater, drilling mud, and by-products containing hydrocarbons, heavy metals, and chemicals associated with oil and gas operations.

A prominent trend in the oil & gas segment of liquid waste management is the increasing adoption of advanced treatment technologies to address the industry's unique waste characteristics. Additionally, there's a growing emphasis on sustainable practices, such as water recycling and reclamation, aligning with broader environmental goals in the oil and gas sector.

Service Insights

According to the service, the transportation segment held 49% revenue share in 2024. In the liquid waste management market, the transportation segment involves the efficient and safe movement of liquid waste from its point of origin to treatment or disposal facilities. This service includes specialized vehicles, such as tankers and trucks, equipped to handle various types of liquid waste. Key trends in this segment include the adoption of technology-driven logistics for real-time tracking, route optimization, and regulatory compliance. Additionally, companies are focusing on enhancing the safety and sustainability of transportation methods to align with environmental standards and reduce the carbon footprint associated with liquid waste transportation.

The treatment segment is anticipated to expand fastest over the projected period. In the liquid waste management market, the treatment segment involves the application of various processes to eliminate or neutralize contaminants in liquid waste. Treatment methods include physical, chemical, and biological processes, aiming to ensure compliance with environmental regulations and reduce the environmental impact of liquid waste. Current trends in liquid waste treatment focus on sustainable and advanced technologies, such as membrane filtration, biological treatments, and innovative chemical processes.

The industry is increasingly adopting circular economy principles, emphasizing resource recovery and minimizing the volume of liquid waste through effective treatment methods. Additionally, the integration of smart technologies for real-time monitoring and optimization is gaining traction, enhancing the efficiency and eco-friendliness of liquid waste treatment processes.

Liquid Waste Management Market Companies

- Veolia Environnement

- Suez

- Clean Harbors

- Waste Management, Inc.

- Stericycle, Inc.

- Republic Services, Inc.

- Advanced Disposal Services

- Remondis SE & Co. KG

- Sembcorp Industries

- Biffa plc

- China Everbright International Limited

- Covanta Holding Corporation

- Waste Connections, Inc.

- Cleanaway Waste Management Limited

- UEM Edgenta Berhad

Recent Developments

- In February 2020, SUEZ NWS, Shanghai Chemical Industry Park (SCIP), and SAIC Motor formed a strategic partnership to manage hazardous liquid waste in an industrial park. This joint venture, initiated by SUEZ, focuses on delivering top-notch waste treatment services to SCIP and SAIC while also marking SUEZ's expansion into the Chinese market.

- In June 2019, AngloGold Ashanti, a leading gold producer, signed a contract with Veolia Ghana Limited to oversee all water treatment plants in Ghana. Veolia will be responsible for managing four wastewater treatment plants over a three-year period.

- March 2019saw Aqua America Inc.'s ambitious plan to invest $555 million in developing water and wastewater systems across eight U.S. states. Major projects include infrastructure enhancements in Aqua Indiana, Aqua Illinois, Aqua New Jersey, Aqua North Carolina, Aqua Ohio, Aqua Pennsylvania, Aqua Texas, and Aqua Virginia.

Segments Covered in the Report

By Device Type

- Residential

- Commercial

- Industrial

By Industry

- Textile

- Paper

- Iron & Steel

- Automotive

- Pharmaceutical

- Oil & Gas

- Others

By Service

- Transportation

- Collection

- Treatment

- Disposal/ Recycling

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting