What is the Livestock Farm Equipment Market Size?

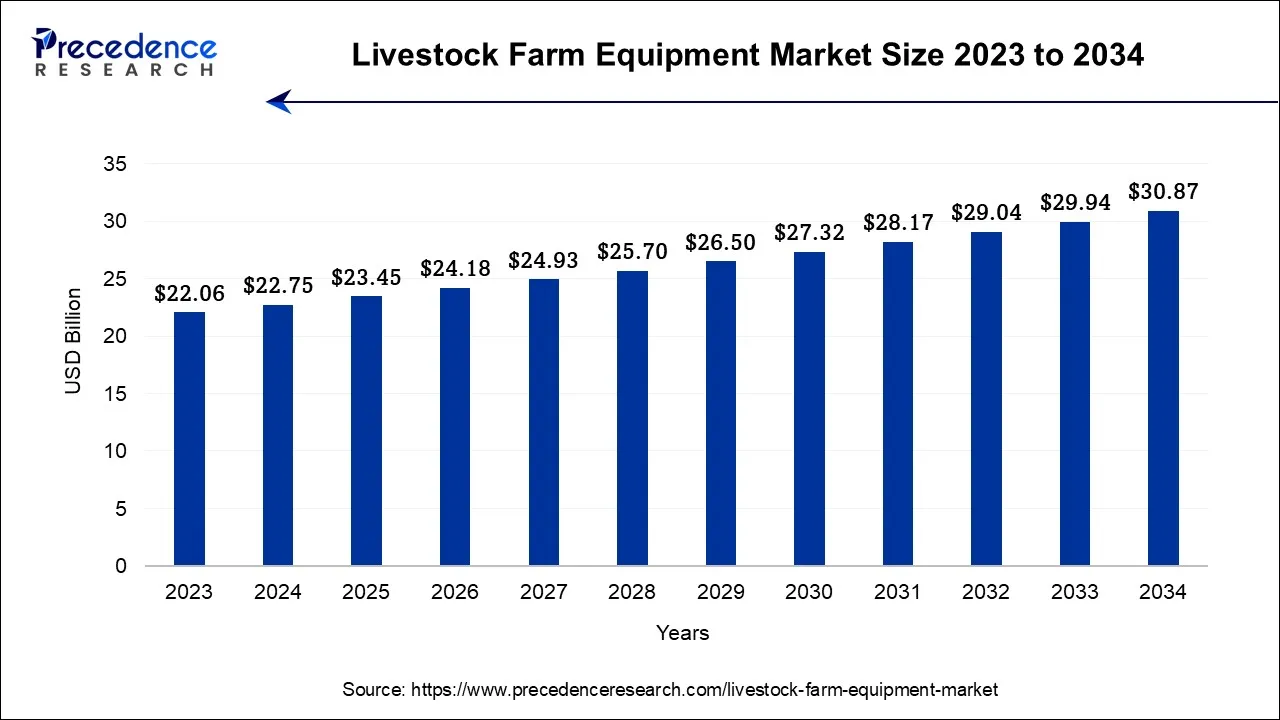

The global livestock farm equipment market size is calculated at USD 23.45 billion in 2025 and is predicted to increase from USD 24.18 billion in 2026 to approximately USD 31.78 billion by 2035, expanding at a CAGR of 3.09% from 2026 to 2035.

Livestock Farm Equipment Market Key Takeaways

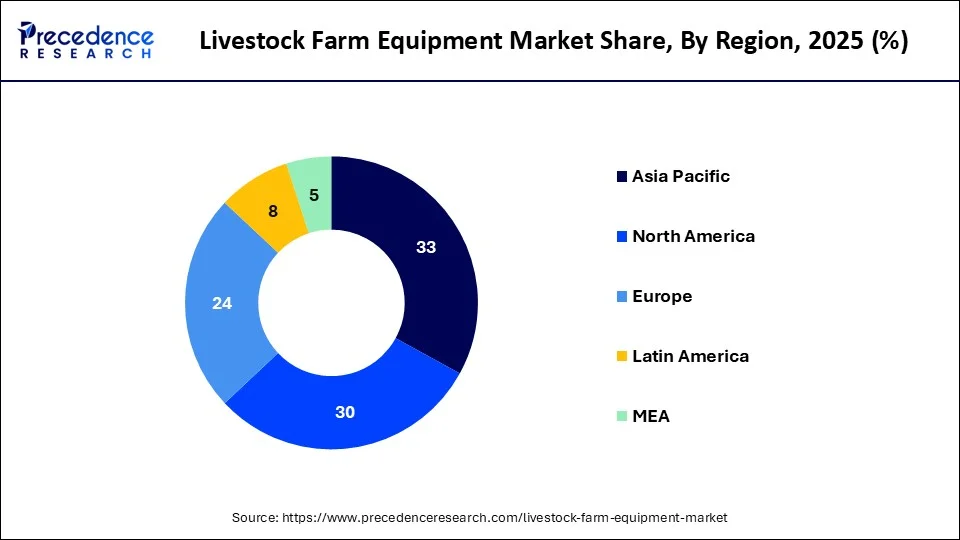

- Asia-Pacific contributed the largest revenue share of 33% in 2025.

- Europe region is expected to expand at the fastest CAGR between 2025 and 2035.

- By Product Type, the feed equipment segment contributed the highest market share of 23.5% in 2025.

- By Product Type, the housing equipment segment is anticipated to grow at a significant CAGR of 4.6% during the projected period.

- By End users, the poultry farm segment contributed the largest market share of 38.3% in 2025.

- By End users, the dairy farm segment is projected to expand at the fastest CAGR over the projected period.

What is Going on in the Global Livestock Farm Equipment Industry?

- The livestock farm equipment market encompasses the manufacturing, distribution, and sale of machinery, tools, and systems designed for livestock management, feeding, and housing in agricultural operations.

- This market caters to the needs of livestock farmers and ranchers, offering equipment such as feeders, milking machines, animal housing structures, and healthcare devices. It is characterized by innovations in automation and technology integration, aimed at improving livestock welfare, farm productivity, and sustainability, while also addressing the challenges of modern animal farming practices.

- Livestock farm equipment serves a multitude of critical purposes in modern agricultural operations. These tools and machinery are instrumental in ensuring the well-being and productivity of livestock.

- Feeders and watering systems provide efficient and consistent nourishment, while milking machines streamline the milking process, enhancing milk production. Animal housing structures offer shelter and protection from harsh weather conditions, ensuring the comfort and safety of livestock.

How is AI contributing to the Livestock Farm Equipment Industry?

Artificial intelligence has come to the aid of the livestock industry equipment by eliminating manual monitoring of the animals, efficient feeding, and introducing evermore intelligent grouping methods, not to mention the prediction of health problems by sensor, camera, and analytic data. While early detection of diseases is made possible, dependence on labor is decreased, welfare is improved, and operational efficiency is increased through the analysis of animal behavior, smart robotics, machine learning models, and data-driven farm management systems.

Livestock Farm Equipment Market Growth Factors

The livestock farm equipment market is poised for continuous growth, as Livestock farmers are increasingly investing in equipment that provides better living conditions for animals, reduces stress, and minimizes the environmental impact of farming practices. These considerations align with evolving consumer preferences for ethically produced and sustainable animal products. In addition, there is rising demand for animal-derived products such as meat, dairy, and eggs, such factors heightened demand necessitates higher levels of efficiency and productivity in livestock farming operations, spurring the adoption of advanced farm equipment.

Technological advancements play a pivotal role in the market's expansion. Automation and data-driven solutions have become integral components of modern livestock farming. Smart feeding systems, automated milking machines, and sensor-based monitoring devices enhance productivity, reduce labor costs, and optimize resource utilization, contributing to overall profitability. Furthermore, government initiatives and regulations promoting sustainable farming practices and the adoption of advanced technologies encourage farmers to invest in modern livestock farm equipment. Grants, subsidies, and incentives provided by governments further stimulate market growth.

Moreover, the globalization of the food supply chain and the need for efficient livestock operations to meet export requirements and international quality standards fuel the demand for advanced equipment. The integration of data analytics and precision agriculture techniques into livestock farming practices enhances decision-making, animal health management, and resource optimization. As the world grapples with increasing population and food security concerns, the Livestock Farm Equipment Market remains a vital component in addressing the challenges of sustainable, efficient, and responsible animal farming.

Market Outlook

- Industry Growth Overview: The strengthening of the long-term global market due to the rising focus on farm productivity, automation adoption, and efficiency improvements continues to be the same everywhere in the world.

- Sustainability Trends: The use of AI, IoT, and robots together always makes the best choice regarding the environment, i.e., through responsible resource usage, waste reduction, and livestock management that is environmentally optimized.

- Global Expansion: The adoption of advanced livestock technologies is getting faster globally as they contribute to food security, scalable farming, and modern agricultural practices.

- Major Investors: The investment made by private equity funds, investment management firms, and sovereign funds comprises the principal investors who support the technology-driven agricultural development.

- Startup Ecosystem: Situated in the agriculture sector, up-and-coming companies are predominantly dealing with intensive data livestock management, precision equipment, and innovative solutions offering increased operational visibility and better farm performance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.45Billion |

| Market Size in 2026 | USD 24.18 Billion |

| Market Size by 2035 | USD 31.78Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.09% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Precision livestock farming, automation, and IoT integration

Precision livestock farming (PLF) is propelling market demand in the livestock farm equipment market. PLF leverages advanced technologies such as IoT sensors and data analytics to monitor and manage livestock with precision. Farmers benefit from real-time insights into animal health, behavior, and feeding patterns. This not only enhances productivity and animal welfare but also optimizes resource utilization. The demand for PLF-driven equipment is rising as farmers seek to modernize operations, maximize efficiency, and meet sustainability goals. Moreover, automation and IoT integration drive market demand in the livestock farm equipment sector by enhancing operational efficiency and animal management. IoT sensors and smart devices monitor livestock health, feeding, and environmental conditions in real time, enabling timely interventions and resource optimization. This not only boosts productivity but also reduces labor costs and enhances animal welfare, making such equipment indispensable for modern, data-driven livestock farming practices.

Restraint

High initial investment and compatibility issues

The high initial investment required for livestock farm equipment poses a significant restraint on market demand. Many farmers, especially small-scale and resource-constrained operations, may find it challenging to afford the upfront costs associated with advanced equipment. This financial barrier can deter potential buyers from adopting modern farming technologies, limiting their ability to improve efficiency and productivity. Reduced affordability can hinder market growth and widen the technology gap between well-funded and less-resourced farms.

Moreover, compatibility issues in the livestock farm equipment market can hinder market demand by creating complexities for farmers. When equipment from different manufacturers is not seamlessly interoperable, it can lead to inefficiencies, increased costs, and operational disruptions. Farmers may hesitate to invest in equipment that doesn't integrate smoothly into their existing systems, delaying adoption and potentially opting for more compatible solutions or delaying upgrades, affecting market growth.

Opportunity

Data analytics and remote monitoring services

Data analytics surge market demand for livestock farm equipment by providing actionable insights into animal health, behavior, and productivity. Farmers can make informed decisions, optimize feeding regimes, detect diseases early, and improve overall management. This enhances efficiency, reduces operational costs, and increases yield. As the demand for sustainable and efficient livestock farming practices grows, equipment with data analytics capabilities becomes indispensable, driving its adoption and fueling market growth.

Moreover, remote monitoring services elevate market demand in the livestock farm equipment market by offering farmers real-time oversight of livestock operations. These services provide valuable data on animal health, feeding patterns, and environmental conditions, enabling proactive decision-making and preventing potential issues. This not only improves animal welfare but also enhances operational efficiency and profitability. Farmers increasingly recognize the benefits of these services, which foster higher adoption rates of advanced equipment integrated with remote monitoring capabilities.

Segment Insights

Product Type Insights

According to the product type, the feed equipment held a 23.5% revenue share in 2023. Feed equipment in the livestock farm equipment market includes tools and machinery designed for the efficient handling, storage, and distribution of animal feed. This encompasses feed mixers, silos, conveyors, and automated feeding systems. A key trend is the integration of digital technology, allowing precise control of feed portions and monitoring of consumption. This minimizes wastage, enhances nutrition management, and ultimately improves livestock health and productivity, aligning with modern farming practices that prioritize resource efficiency and sustainability.

The housing equipment sector is anticipated to expand at a significant CAGR of 4.6% during the projected period. Housing equipment in the livestock farm equipment market refers to structures and systems designed for sheltering and managing livestock. This includes barns, pens, feeding and watering systems, and ventilation solutions. Trends in this segment involve the integration of automation and IoT technologies to create smart and climate-controlled housing. Additionally, there is a growing focus on sustainability, with equipment designed for efficient resource utilization and eco-friendly materials, aligning with the broader agricultural industry's move towards environmentally responsible practices.

End Users Insights

Based on the end users, poultry farm is anticipated to hold the largest market share of 38.3% in 2023. Poultry farming involves the rearing of domesticated birds, primarily chickens, ducks, turkeys, and geese, for their meat, eggs, and feathers. In the Livestock Farm Equipment Market, poultry farms represent a significant end-user segment. Trends in this segment include a growing focus on automation, biosecurity measures, and sustainability. Equipment such as automated feeders, climate control systems, and disease monitoring technologies are increasingly adopted to enhance poultry welfare, productivity, and farm profitability while reducing environmental impact.

On the other hand, the dairy farm sector is projected to grow at the fastest rate over the projected period. Dairy farms are livestock farming operations primarily focused on the production of milk and dairy products. They house and manage dairy cattle, utilizing specialized equipment for milking, feeding, and animal health. In the Livestock Farm Equipment Market, trends related to dairy farms include the increasing adoption of automated milking systems, data-driven herd management solutions, and precision feeding equipment. These trends aim to enhance milk production efficiency, improve animal welfare, and align with sustainability goals in the dairy industry.

Regional Insights

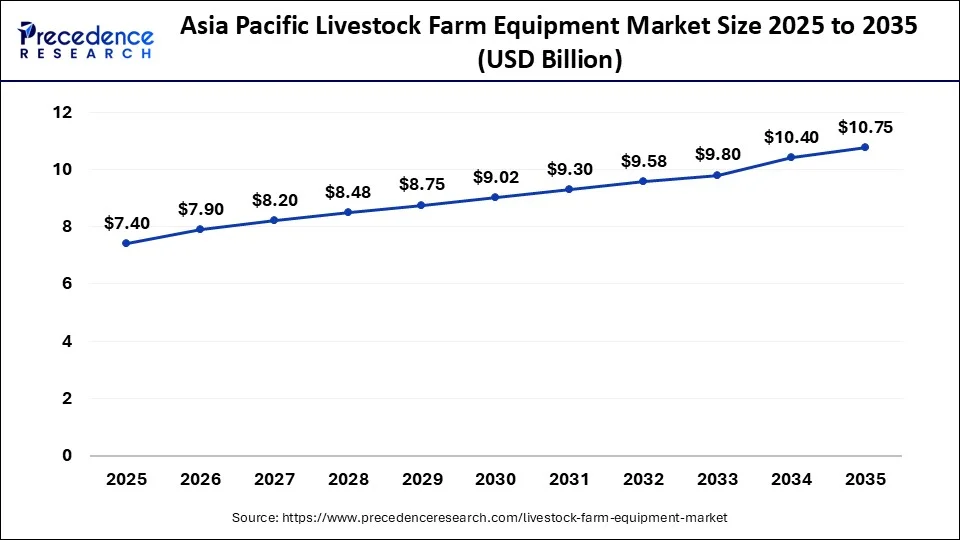

Asia Pacific Livestock Farm Equipment Market Size and Growth 2026 to 2035

The Asia Pacific livestock farm equipment market size is accounted for USD 7.74 billion in 2025 and is projected to be worth around USD 10.75 billion by 2034, poised to grow at a CAGR of 3.28% from 2026 to 2035.

Asia-Pacific has held the largest revenue share of 33% in 2025. In the Asia-Pacific region, the livestock farm equipment market is experiencing significant trends. The growing demand for high-quality animal products, driven by rising incomes and urbanization, fuels the adoption of advanced livestock equipment. Automation and digitalization are on the rise, enhancing farm productivity. Apart from this in Asia-Pacific, the trend of sustainable and eco-friendly farming practices has led to the adoption of equipment that reduces environmental impact. As the region continues to modernize its agriculture sector, the livestock farm equipment market is projected to witness substantial growth.

China Livestock Farm Equipment Market Trends:

China's market is bolstered by solid domestic demand and food safety expectations, which partly support the adoption of automated feeding, breeding, and monitoring systems to enhance livestock productivity, tracing, and control over the operations in commercial farming that is growing all over the country.

Europe is estimated to observe the fastest expansion. In Europe, the livestock farm equipment market is witnessing several key trends including a growing emphasis on animal welfare and sustainable farming practices, driving demand for equipment that enhances livestock comfort and reduces environmental impact. The adoption of precision livestock farming techniques, including IoT and data analytics, is on the rise, improving operational efficiency. Moreover, the pandemic has accelerated the adoption of remote monitoring and automation technologies, further fueling the market's growth in the region.

Germany Livestock Farm Equipment Market Trends:

Germany positions itself as a producer of precision livestock equipment with a focus on robotic milking, automated feeding, and climate-controlled housing systems that not only enhance productivity but also are environmentally friendly and comply with regulations.

Moreover, in the LAMEA (Latin America, Middle East, and Africa) region, the livestock farm equipment market is witnessing significant trends. The adoption of modern livestock farming practices is growing, driven by rising meat and dairy consumption. The market is also influenced by sustainability concerns, with an emphasis on eco-friendly equipment. Additionally, technological advancements, such as IoT integration for remote monitoring, are gaining traction, improving farm management efficiency. Overall, the LAMEA region is experiencing a shift toward advanced and sustainable livestock farming practices.

Brazil Livestock Farm Equipment Market Trends:

Brazilian livestock farms have large-scale operations that use advanced equipment and precision farming techniques, and thus started their training with the export-oriented production, climatic diversity, and the necessity to enhance resource efficiency and reduce the usage of the same.

Livestock Farm Equipment Market-Value Chain Analysis

- Raw Material Sourcing: Considers and judges the various factors like quality standards, cost structures, and logistics efficiency, besides the evaluation of metals and electronics suppliers.

Key players: BHP, Rio Tinto - Component Fabrication and Machining: Makes exact component parts out of the supplied materials via the fast, cheap, and technology-based manufacturing processes.

Key players: Deere & Company, CNH Industrial - Testing and Certification: Guarantees that the equipment is safe and regulatory-approved while of high quality through its existing inspection and validation procedures.

Key players: SGS, Bureau Veritas - Distribution and Sales of Livestock Farm Equipment: Controls the sales channels, logistics networks, market reach, and effective delivery strategies to farmers through management.

Key players: Tractor Supply Co.

Livestock Farm Equipment Market Companies

- Pearson International LLC: Pearson supplies equipment for the treatment of cattle, advanced automation for milking, software for herd management, and holistic health monitoring solutions for the dairy industry of the future.

- Bob-White Systems: Bob-White Systems has a range of items for micro dairy processing and has also provided low-impact pasteurizers as well as compact solutions that are ideal for small-scale milk processing operations.

- Murray Farmcare Ltd.: Murray Farmcare carries a wide range of livestock from health products and feeding systems to biosecurity solutions and grooming tools, medicines, etc. across all the major livestock categories.

Other Major Key Players

- Afimilk Ltd

- FarmTek

- Royal Livestock Farms

- Real Tuff Livestock Equipment

- DeLaval

- GEA Group AG

- Lely Holding S.A.R.L.

- Trioliet B.V.

- Agco Corporation

- Fancom B.V.

- Marel HF

- Big Dutchman International GmbH

- Ziemann Holvrieka GmbH

Recent Developments

- In October 2025, Zurich Group Germany introduced a modular insurance policy for small to medium agrivoltaic systems. The policy covers unique risks like crop, grazing animal, and machinery damage.

(Source: pv-magazine.com ) - In September 2025, Merck Animal Health launched Engemycin DD in Canada, a short-acting antibiotic for cattle, swine, and sheep. The product is aimed at assisting farmers in managing bacterial infections in livestock.

(Source: farms.com ) - In 2021,Texha designed the HitFeed Feeder for broilers, revolutionizing poultry farming. This innovative feeder ensures efficient and uniform feed distribution, optimizing broiler growth and minimizing wastage, ultimately improving productivity and profitability in poultry farming operations.

- In 2018, Cargill collaborated with Cainthus, an AI-based computer vision company, to enhance livestock monitoring and management. This partnership integrates advanced technology into Cargill's operations, improving animal welfare and farm efficiency in the livestock farm equipment market.

- In 2020, Zoetis, a global animal health company, acquired Performance Livestock Analytics, a livestock data management company. This acquisition strengthens Zoetis' digital offerings for livestock producers, providing advanced data solutions for improved herd management and productivity.

- In 2019, Allflex Livestock Intelligence has partnered with Kaleidoscope, leveraging Kaleidoscope's expertise in blockchain technology. This collaboration aims to enhance traceability and transparency in livestock farming, ensuring the authenticity and quality of livestock products.

- In 2018, Antelliq's Allflex, a livestock monitoring solutions provider, partnered with Nestlé farms to implement advanced monitoring technology in dairy farming. This collaboration enhances dairy herd management, ensuring better animal welfare and productivity.

- In 2017, Cargill Animal Nutrition acquired Diamond V, a global animal health and nutrition company. This acquisition enhances Cargill's portfolio of feed additives and solutions for livestock, reinforcing its commitment to improving animal health and performance.

Segments Covered in the Report:

By Product Type

- Milking Equipment

- Cleaning Equipment

- Egg Handling Equipment

- Feed Equipment

- Housing Equipment

- Livestock Handling

- Foggers, Coolers, and Heaters

- Others

By End Users

- Poultry Farm

- Dairy Farm

- Swine Farm

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting