Lung Stent Market Size and Forecast 2025 to 2034

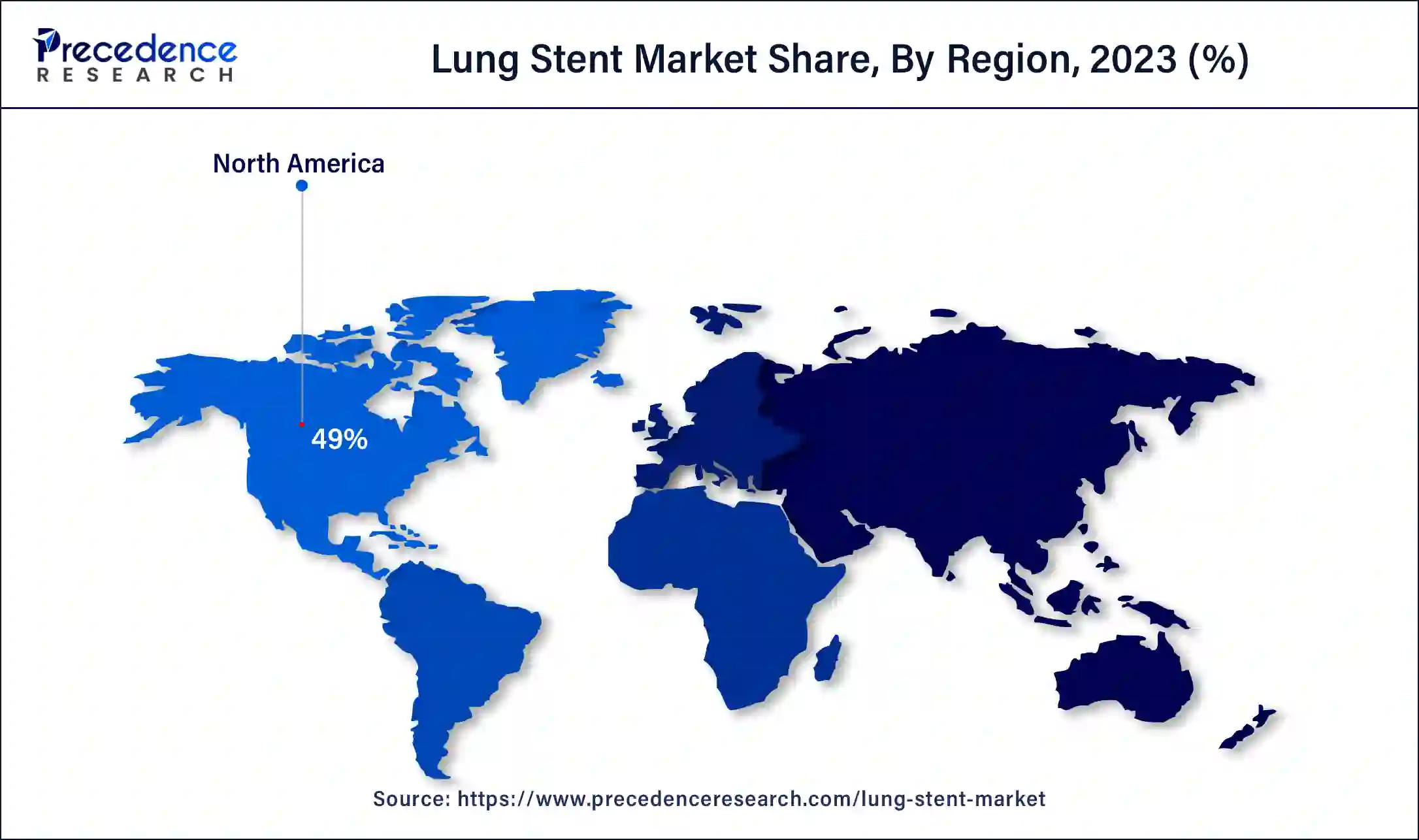

The global lung stent market size is projected to be worth around USD 629.72 million by 2034 from USD 211.46 million in 2024, at a CAGR of 11.53% from 2025 to 2034. The North America lung stent market size reached USD 103.62 million in 2024. The rising investment by private and public organizations for the development of the non-vascular stent is driving the growth of the market. The growing number of lung-related disorders is increasing the demand for lung stents.

Lung Stent Market Key Takeaways

- The global lung stent market was valued at USD 211.46 million in 2024.

- It is projected to reach USD 629.72 million by 2034.

- The lung stent market is expected to grow at a CAGR of 11.53% from 2025 to 2034.

- North America dominated the lung stent market with the largest market share of 49% in 2024.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034.

- By product, the tracheal stents segment recorded more than 70% of market share in 2024.

- By product, the bronchial stents segment is expected to be the fastest-growing during the forecast period.

- By materials, the hybrid segment dominated the market in 2024.

- By materials, the silicon segment is estimated to be the fastest-growing during the forecast period.

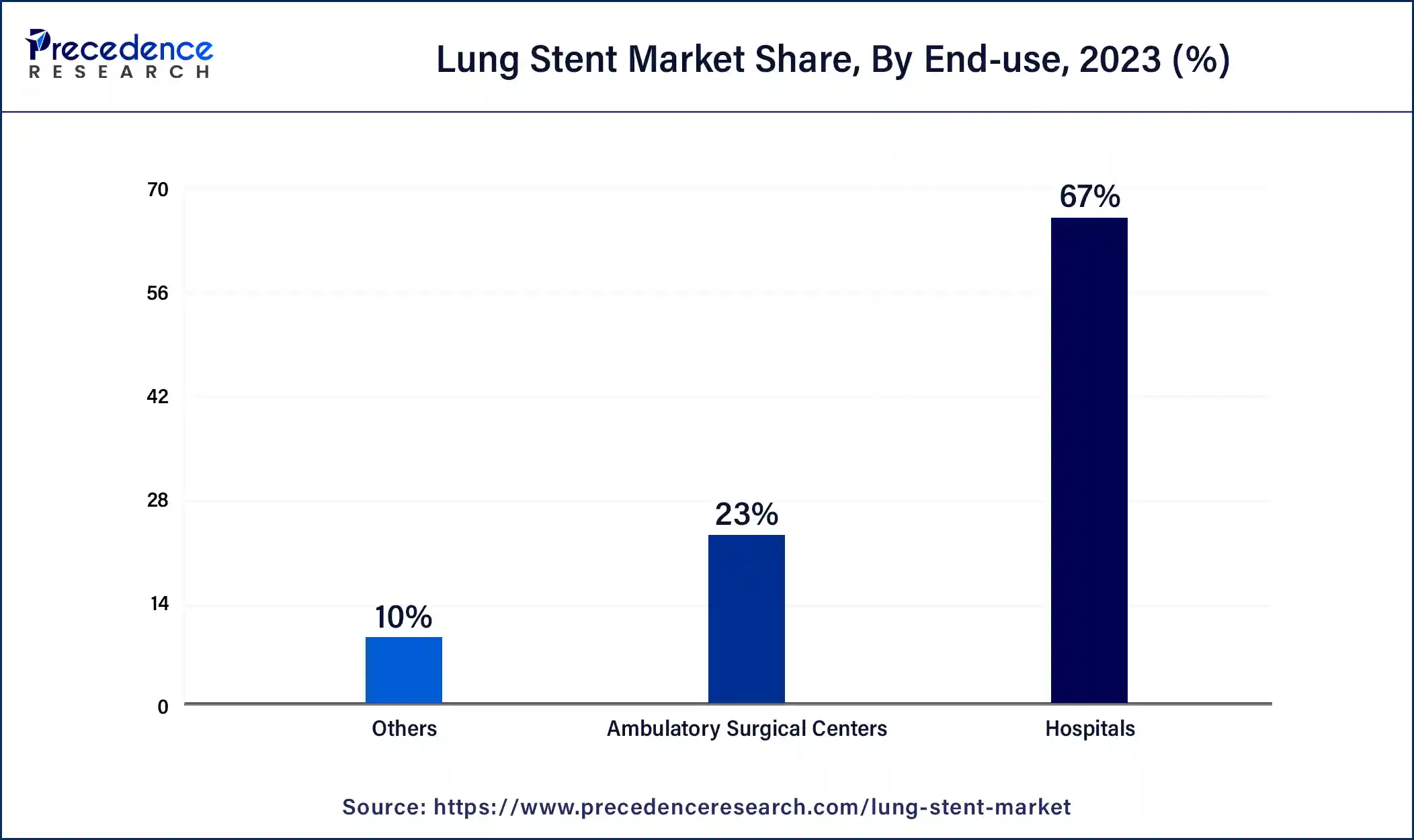

- By end-use, the hospitals segment contributed the largest market share of 67% in 2024.

- By end-use, the ambulatory surgical centers segment is anticipated to be the fastest-growing during the forecast period.

How is AI Revolutionizing the Lung Stent?

The use of artificial intelligence (AI) in the lung stent plays a significant role in the growth of the lung stent market. The benefits of AI-based lung stents include improved diagnosis and planning; AI-based lung stents help to analyze imaging data to identify accurate locations and better extent of airway obstructions. AI can process a high amount of patient data to modify treatments. AI-based tools can improve stent placement accuracy. AI can predict complications by analyzing patient data and historical outcomes.

- In October 2023, in India, an AI-driven coronary imaging software, named ‘Ultreon 1.0' was launched by Abbott. This software merged OTC (optical coherence tomography) with AI (artificial intelligence), which provides physicians with a view of blockages and blood flow in coronary arteries. This software can measure vessel diameter, detect the strength of calcium-based blockages, and differentiate between non-calcified and calcified blockages.

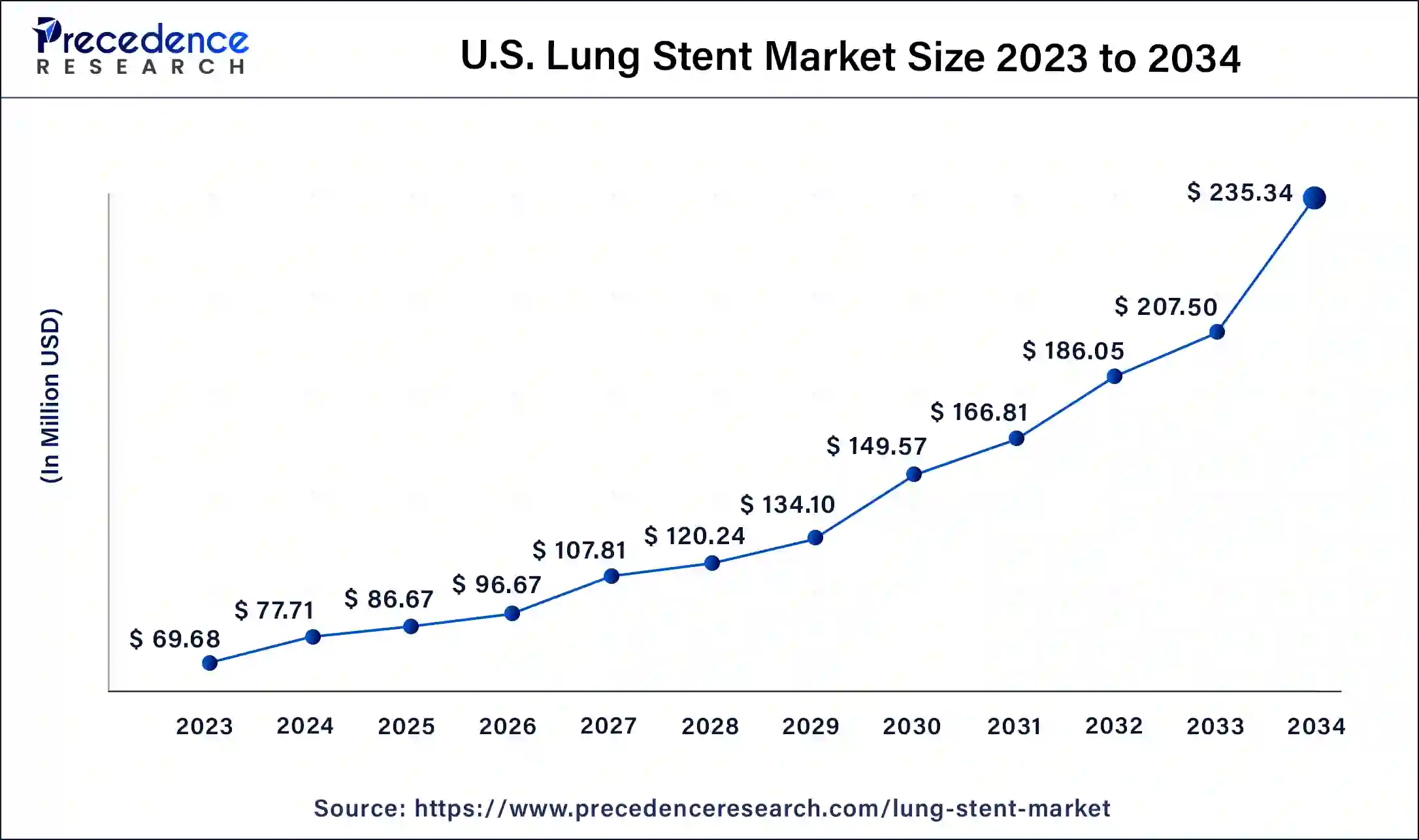

U.S. Lung Stent Market Size and Growth 2025 to 2034

The U.S. lung stent market size was exhibited at USD 77.71 million in 2024 and is projected to be worth around USD 235.34 million by 2034, poised to grow at a CAGR of 11.72% from 2025 to 2034.

North America dominated the lung stent market in 2024. The increase in hospitalizations for respiratory diseases contributes to the growth of the market in the North American region. The high healthcare investment, renowned healthcare infrastructure, and the presence of leading medical device industries drive the market growth. The robust focus on research and development led to a novel product launch for the expansion of the market.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. Rapidly developing economies like India and China contribute to the growth of the lung stent market in the Asia-Pacific region. The high investment opportunities, expanding healthcare infrastructure, rising healthcare expenditures, increasing preference for minimally invasive procedures in patients, improving reimbursement policies, and regulatory guidelines contribute to the market's growth.

- In September 2023, in Chennai, the Kauvery Heart Institute on World Heart Day was launched by Kauvery Hospital Vadapalani. The institute was launched by Thiru P K Sekar Babu, Honorable Minister for Hindu Religious and Charitable Endowments Department, Government of Tamil Nadu. A committed catheterization lab is in place for highly experienced interventional cardiologists who are capable of performing all critical interventional cardiology processes in addition to standard stent and angioplasty placement.

Market Overview

The lung stent market refers to buyers and sellers of lung stents, which are small mesh tubes that are inserted into the lung airways of the lungs by a minor procedure known as bronchoscopy. A lung stent is a hollow tube that is placed in the airways to help breathe and open a narrowed area. It may be placed in either the bronchi or trachea, depending on the narrowing area. The stent can be used to treat narrowed airways in the lungs because of many procedures or conditions, including diseases or infections that may cause congenital conditions, swelling, or other problems that press on the lungs.

Lung Stent Market Growth Factors

- The benefits of lung stents include that they can help treat the narrowed arteries, reduce symptoms, and prevent future health problems that may result from low blood flow.

- In lung disorders, stents can help in the treatment of narrowed airways in the lungs, which helps the growth of the lung stent market.

- Doctors prefer to use stents when the bronchi in the lungs are at risk of collapse.

- Stents are used to treat narrowed airways in the lungs because of many procedures or conditions, including diseases or infections that can cause congenital conditions, swelling, or any other problems in the body that may press on the lungs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 629.72 Million |

| Market Size in 2025 | USD 235.84 Million |

| Market Size in 2024 | USD 211.46 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Material, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of lung cancer

The increasing prevalence of lung cancer demands treatments, which contribute to the growth of the lung stent market. The causes of lung cancer include cigarette smoking; there are chances of getting lung cancer for non-smokers, also. Cigarette smoke enters the lung, which causes lung tissue damage. It also includes radiation therapy, a family history of lung cancer, asbestos, and other heavy metals like selenium, cadmium, etc., which can also increase the risks. Air pollution and radon gas may also cause lung cancer, which needs lung stents for the treatment of disorders.

- According to the Global Cancer Observatory, lung cancer cases and deaths worldwide in 2022. Data covers 185 countries and 36 cancers.

- Lung cancer was the most commonly occurring cancer globally, with 2.5 million cases accounting for 12.4% of the total new cases. Female breast cancer (2.3 million cases, 11.6%), colorectal cancer (1.9 million cases, 9.6%), prostate cancer (1.5 million cases, 7.3%), and stomach cancer (970000 cases, 4.9%).

- Lung cancer was the leading cause of cancer death (1.8 million deaths, 18.7% of total cancer deaths), colorectal cancers (900000 deaths, 9.3%), liver cancer (760000 deaths, 7.8%), breast cancer (670000 deaths, 6.9%), and stomach cancer (660000 deaths, 6.8%).

Restraint

Presence of alternative treatments

The presence of alternative treatments and other disadvantages like strict regulations, blood vessels may collapse, side effects of medicated coatings on the lung stents, formation of scar tissue around the lung stents, procedure-related issues like damage to blood vessels on the lung stent blood clot formation, allergic reactions due to lung stent material, etc. can hamper the lung stent market growth. Problems with living with a stent include lung infection, which may possibly be a risk from an airway stent; mucus may form in the stent and block it.

Opportunity

Development of resorbable and biodegradable stents

The development of resorbable and biodegradable stents is an opportunity for the growth of the lung stent market. The benefits of biodegradable stents include no permanent metal, no more lifelong dedication to a metal stent, the fact that it allows the artery to regain its ability to dilate and constrict naturally, preservation options, etc. Most biodegradable or resorbable stents are made of a naturally dissolvable material, polylactic acid, which is used in medical implants to dissolve sutures.

- In May 2022, the next-generation drug-eluting coronary stent system, named 'Onyx Frontier,' received the United States Food and Drug Administration (U.S. FDA) approval and was launched by a global leader in healthcare technology, Medtronic, Plc.

Product Insights

The tracheal stents segment dominated the lung stent market in 2024. Tracheal and laryngeal stents are made from hollow and solid materials to prevent the airway lumen collapse. These stents help to stabilize the surgical reconstructions of the trachea or larynx and expand areas mechanically that are affected by tumor encroachment or scar tissue. It is treated with surgery to remove the narrowed area of the trachea or stretch trachea. The artificial tracheal stent's structure and material may be selected from many options as a proper way to get over the lack of grafted tissue. These artificial tracheal stents can help the growth of the market and signaling molecules that support the development of cells, tissue, proliferation, and differentiation.

- In February 2022, the first self-expanding Y-shaped tracheobronchial stent system was launched by Micro-Tech Endoscopy. The Y-shaped tracheal Stent System is designed to be a compliant, flexible device to aid in the treatment of malignant neoplasm at the tracheobronchial carina.

The bronchial stents segment is expected to be the fastest-growing during the forecast period. The benefits of bronchial stent benefits include disease or many disease complications that can block or narrow the airway, causing it to feel short of breath, which helps the growth of the lung stent market. If one of the bronchi is narrowed, the bronchial stent may be used to enhance that narrowing, and hence, it helps to enhance breathing. The insertion of bronchial stent feels that this is the best option.

Material Insights

The hybrid segment dominated the lung stent market in 2024. The benefits of hybrid lung stents include these are advanced medical devices, robotic hybrid coronary revascularization combined coronary stents to enhance long-term survival, better appearance due to those incisions leaving less visible scars, faster recovery, less time in the hospital, ICU, and more freedom to resume daily activities, lower risks of complications like reduced infection risk and bleeding, less pain due to smaller incisions mean less discomfort which contributes to the growth of the market.

The silicon segment is estimated to be the fastest-growing during the forecast period. Silicone-based lung stents play a significant role in managing many respiratory diseases, which contributes to the lung stent market. The benefits of silicone-based lung stents include airway restoration, customization of silicone lung stents for each patient, which helps to ensure better outcomes and enhanced patient comfort, innovations in 3D printing silicone stents, safe imaging, minimally invasive procedures, clinical improvement, etc.

- In August 2024, the procedure of multi-level tracheal dilatation and Y-stent installation inside the windpipe was performed by a team of doctors, and the surgery was performed at Wockhardt Hospital.

End Use Insights

The hospitals segment dominated the lung stent market in 2024. The benefits of lung stents include allowing people to breathe more easily or allowing blood and other fluids to continue flowing freely through the body. People may require a stent placement because of lung cancer, heart attack, or other conditions that affect passageways in the body. The benefits of hospitals include health insurance, life insurance, flexible spending accounts, retirement plans, time off, family medical leave, extended sick leave, work/life balance programs, etc.

- In August 2023, a new heart laser procedure, a minimally invasive procedure named ELSA (Excimer laser coronary atherectomy), was launched to speed up treatment times to treat narrowed stents, avoiding the need for heart bypass surgery.

The ambulatory surgical centers segment is anticipated to be the fastest-growing during the forecast period. The ambulatory surgical centers offer many benefits, including less time-intensive procedures carried out at a lower cost, cost savings of 45-60% compared to hospitals, predictable scheduling, more personalized care, high patient satisfaction, efficiency, etc., contributing to the growth of the lung stent market.

Lung Stent Market Companies

- Novatech SA

- Taewoong Medical Co Ltd.

- Cook Group

- Hood Laboratories

- Micro-Tech (Nanjing) Co., Ltd.

- Boston Scientific Corporation

- Merit Medical Systems, Inc.

- Abbott

Recent Developments

- In May 2024, in India, an everolimus-eluting coronary stent system, XIENCE Sierra, was launched by Abbott, a global healthcare. The new system has received approval from the CDSCO (Central Drugs Standard Control Organization).

- In June 2024, an implantable medical device, a Duo Venous Stent System for the treatment of symptomatic venous outflow obstruction in patients with CVI (chronic venous insufficiency), was launched by a global leader in health technology, Royal Philips. By following PMA (premarket approval) from the United States Food and Drug Administration.

Segments Covered in the Report

By Products

- Tracheal Stents

- Bronchial Stents

- Laryngeal Stents

By Material

- Metal

- Stainless

- Nitinol

- Silicone

- Hybrid

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting