What is the Luxury Handbags Market Size?

The global luxury handbags market size accounted for USD 35.83 billion in 2025, grew to USD 37.99 billion in 2026 and is projected to surpass around USD 60.42 billion by 2034, representing a healthy CAGR of 5.98% between 2025 and 2034. The luxury handbags market is driven by the growth of digital marketing and premium experiences offered online.

Market Highlights

- The global luxury handbags market was valued at USD 33.79 billion in 2024.

- It is projected to reach USD 60.42 billion by 2034.

- The market is expected to grow at a CAGR of 5.98% from 2025 to 2034.

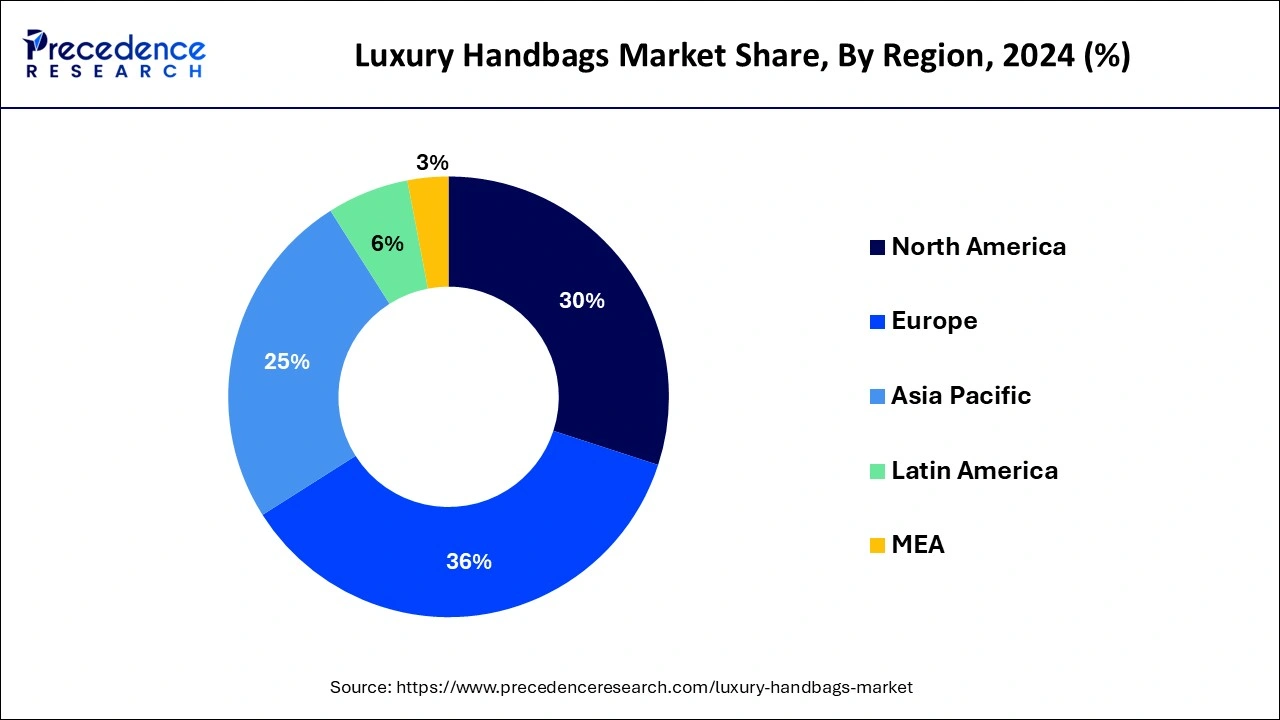

- Europe led the market with the biggest market share of 36% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By product, the handbags segment dominated the market in 2024.

- By product, the backpack segment is observed to witness the fastest rate of expansion during the forecast period of 2024-2034.

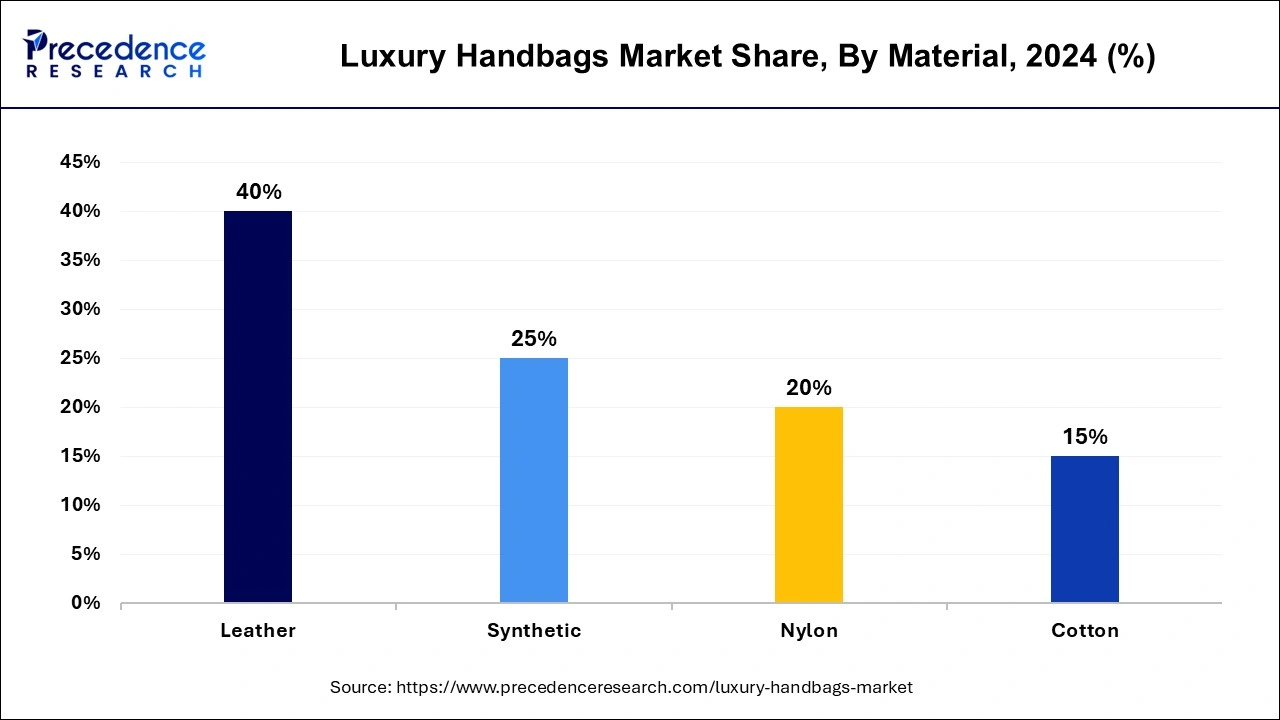

- By material, the leather segment registered a maximum market share of 40% in 2024.

- By material, the synthetic segment is observed to expand at a rapid pace during the forecast period.

- By end-user, the women segment dominated the market in 2024.

- By distribution channel, the offline segment dominated the market in 2024.

- By distribution channel, the online segment is observed to expand.

Market Size and Forecast

- Market Size in 2025: USD 35.83 Billion

- Market Size in 2026: USD 37.99 Billion

- Forecasted Market Size by 2034: USD 60.42 Billion

- CAGR (2025-2034): 5.98%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

There is a rising demand for handbags made of ethical production methods and sustainable materials. Clever features like integrated charging outlets or RFID chips for tracking and authentication are being investigated to improve usefulness and appeal to tech-savvy consumers. To accommodate different preferences and provide distinctive ownership experiences, the luxury handbags market provides individualized elements like initials, monograms, and custom designs. Due to the metaverse and virtual reality, there might be more chances to showcase and market luxury handbags in the future. Social media sites like Instagram, which highlight trends, influencer partnerships, and user-generated content, are essential marketing tools to increase brand awareness and demand.

- In November 2023, to better serve its clients on the West Coast, Tapestry, Inc. built a new, full-scale fulfillment center in North Las Vegas, Nevada. Utilizing some of the most recent developments in material handling technology, the new fulfillment center enhances Tapestry's fulfillment procedures. By 2029, it is anticipated that over 400 full-time jobs will be generated in the region.

Luxury Handbags Market Data and Statistics

- In January 2023, the website for Green Hermitage, a homegrown and up-and-coming brand of sustainable living items, was just created. The company has introduced its first collection of travel items and handbags manufactured from plant-derived leather. For anybody who values luxury and sustainability, Green Hermitage is a revolution in high-end bags and accessories, adhering to opulent aesthetics while striving to develop products that do not hurt the environment.

- In 2023, Rashki introduced the first-ever line of handbags in India crafted from banana leather to promote a socially conscious lifestyle.

Luxury Handbags Market Growth Factors

- A growing number of individuals can now afford luxuries like handbags because of growing economies, especially in emerging regions.

- Demand is fueled by the symbolism of luxury handbags, which convey wealth, social status, and individualism.

- In response to changing consumer tastes, brands introduce new styles, materials (sustainable options are becoming more popular), and features.

- Many people can now afford designer handbags due to accessible online buying channels.

- Craves for returned luxury goods are fueled by exposure to premium brands and cultures.

- Women's growing financial independence increases their ability to buy upscale products.

- The popularity of distinctive and eye-catching handbags is rising as self-expression and personal branding become increasingly important, while promoting the expansion of luxury handbags market.

- Customers are drawn to and kept by tailored recommendations and focused marketing initiatives.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.83 Billion |

| Market Size in 2026 | USD 37.99 Billion |

| Market Size by 2034 | USD 57.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.98% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Luxury Handbags Market Dynamics

Drivers

Increase in working women population

More women are joining the workforce, which leads to an increase in dual-income households and increased discretionary money, which makes it possible to spend more on upscale goods like handbags. Working women are likelier to keep up with current fashion trends and invest in classic, fine accessories like luxury purses to complete their appearance.

Demand for high-end brands is driven by working women's desire for luxury handbags as status symbols or to accessorize their professional outfits. Working women are more likely to treat themselves to luxury goods, such as handbags, as empowerment or self-reward when they have more financial independence.

Surge in usage of various social networking platforms

Social media sites are now considered influencer marketing's fertile field. Influencers frequently feature expensive handbags in their posts, setting an example for their followers and generating demand. Users may find and share trends more rapidly because of it. Because of this, when a high-end handbag becomes popular on social media due to celebrity or influencer endorsements, it may become viral and increase demand and sales. Thereby, the surge in usage of various social media platforms is observed to act as a driver for the luxury handbags market.

Social media is a valuable tool for luxury handbag businesses to collect client feedback and do market research. Social media interactions give brands insights into consumer preferences, enabling them to customize their services accordingly.

Restraint

Fake and replicas are major risks to the luxury handbag market

Products that are counterfeit damage the exclusivity and prestige attached to luxury brands. The brand's perceived value is diminished, and its image is diluted when counterfeit versions increase the market. It must commit significant resources to using the legal system to stop counterfeiting. This includes taking counterfeiters to court, which entails expensive and time-consuming legal procedures.

High-end brands suffer significant financial losses due to counterfeiters who offer phony products at reduced costs. This lowers overall profitability and affects sales of authentic products. Compared to authentic luxury items, lower-quality materials, and craftsmanship are frequently used when comparing replica handbags to authentic luxury items. Customers may become disappointed and link the brand to subpar products, harming its reputation.

Opportunities

Collaborations with artists and designers

Luxury handbag companies can produce distinctive, limited-edition pieces that stand out by collaborating with artists and designers. These partnerships provide new viewpoints and creative components to classic designs, drawing customers looking for uniqueness and creativity, while opening lucrative opportunities for the luxury handbags market. Limited-edition partnerships instill in customers a sense of urgency and exclusivity, which fuels demand and cultivates a collector's mindset. The limited quantity of these collaboration pieces raises their perceived worth, luring collectors of luxury handbags to buy and possibly even invest in these one-of-a-kind pieces.

Investing in e-commerce platforms

With the help of e-commerce platforms, luxury handbag companies may expand into new areas and reach a worldwide audience, overcoming regional constraints. Through features like virtual try-ons, product recommendations, and customized promos, it helps firms to offer a personalized shopping experience and build consumer loyalty. Running an online store is frequently less expensive than keeping physical locations open, which frees up funds for firms to invest in marketing campaigns and new product development.

Segments Insights

Product Insights

The handbags segment dominated the luxury handbags market in 2024.Luxurious handbag labels such as Gucci, Chanel, and Louis Vuitton have built significant brand awareness and brand loyalty among consumers across the globe, making their handbags extremely sought-after. Numerous luxury handbag companies have enduring designs that have come to represent refinement and status over time. Customers looking for investment and fashion pieces are drawn to these classic styles. Celebrities and influencers routinely promote luxury handbag manufacturers, who show off their products to millions of followers and increase their desirability and status.

The backpack segment is the fastest growing in the luxury handbags market during the forecast period. Consumer tastes have shifted in favor of more valuable and adaptable accessories. In today's world, where people want style and practicality, backpacks provide comfort and functionality. When making purchases, younger generations give priority to authenticity and ease. Luxury backpacks align with their principles, providing millennial and Gen Z customers with a functional and luxurious combination.

Backpacks are multipurpose accessories that can be used for daily use, travel, and work. Customers searching for multipurpose backpacks adaptable to various environments will find this adaptability appealing.

Material Insights

The leather segment is recorded more than 40% of revenue share in 2024.Leather is frequently thought of as being superior, enduring, and wealthy. High-end leather purses are luxurious and sophisticated, tempting buyers looking for status symbols. Handbags made of leather are known for their strength and longevity. Leather handbags are a worthy investment for customers since they are more resistant to wear and tear than purses made of other materials, including fabric or synthetic substitutes.

Numerous high-end companies offer leather handbag designs that have become timeless classics. The appeal and desirability of leather handbags among consumers are attributed to these designs and premium companies' rich legacy and reputation.

The synthetic segment is observed to be the fastest growing in the luxury handbags market during the forecast period. The development of high-quality, long-lasting, and aesthetically pleasing fabrics that closely resemble the look and feel of classic luxury materials like leather results from considerable developments in synthetic materials. Luxury handbags made of synthetic materials are frequently less expensive than those crafted from real leather or exotic skins. A broader spectrum of buyers who may be budget-conscious but still want to acquire luxury goods are drawn in by this accessibility.

End-user Insights

The women segment dominated the luxury handbags market in 2024. Handbags and other accessories are vital to a woman's outfit and are frequently featured in women's fashion trends. Women who wish to show off their sense of style and stay up-to-date drive demand for luxury handbags, which are viewed as status symbols and fashion statements.

- In February 2023, Owner of Michael Kors, Capri Holdings Ltd., opened a new tab, lowered its projected annual earnings, and gave a gloomy estimate for 2024, attributing the decline in department store demand for its upscale clothing and accessories to department shops. This caused the company's shares to plunge 24%.

The men segment is observed to witness the fastest growth rate in the luxury handbags market during the forecast period. Gender conventions are changing, and men are adopting and accepting expensive handbags at a higher rate. Gender-neutral fashion is embracing items that were once thought to be feminine, even for males. Men are investing more in luxury fashion items, such as handbags, due to rising disposable incomes and a growing emphasis on appearance and personal style. This tendency is especially apparent in younger generations that value fashion highly and individual expression. Luxurious brands are actively broadening their range of products to accommodate the changing tastes of men's consumers. This entails creating handbags with a more macho aesthetic, adding useful features, and providing a wider selection of sizes and styles to suit various preferences and ways of life.

Distribution Channel Insights

The offline segment dominated the luxury handbags market in 2024.Purchasing luxury handbags frequently entails a tailored, high-touch experience exclusive to physical stores. Consumers like talking with informed salespeople, touching the bags, and getting a close-up look at the craftsmanship. Physical flagship stores and boutiques are physical manifestations of the exclusivity and distinction of premium businesses. The luxurious retail spaces and excellent customer service add to the brand's and the product's appeal.

The online segment is the fastest growing in the luxury handbags market during the forecast period. Utilizing online channels, luxury firms may reach a wider audience than just those visiting their physical stores. Customers may explore and buy luxury handbags from the comfort of their homes or while on the road using mobile devices, providing convenience and flexibility. The demand for luxury handbags through online channels is driven by millennial and Gen Z consumers, who are increasingly shaping trends in the luxury sector. They are also more acclimated to online purchasing and digital interactions. Social media platforms are effective marketing tools for luxury businesses because they increase web traffic and revenue through influencer collaborations, relevant content, and well-targeted ads.

Regional Insights

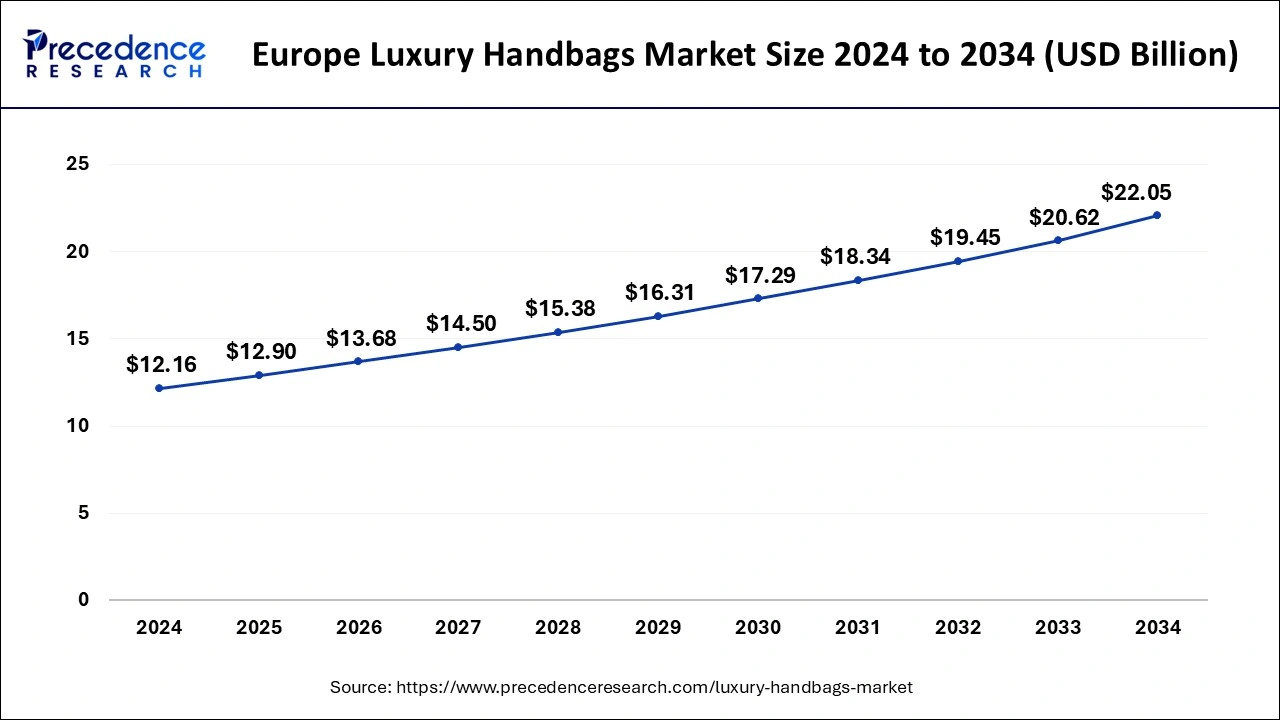

Europe Luxury Handbags Market Size and Growth 2025 to 2034

The Europe luxury handbags market size was valued at USD 12.90 billion in 2025 and is predicted to be worth around USD 22.05 billion by 2034, poised to grow at a CAGR of 6.13% from 2025 to 2034.

Europe has the largest market share of 36% in 2024in the luxury handbags market. With renowned labels, including Louis Vuitton, Chanel, Gucci, and Hermès, derived from nations like France, Italy, and Spain, Europe boasts a long tradition of exquisite artistry and fashion. European luxury brands are well known for their meticulous attention to detail, superb craftsmanship, and inventive ideas. They constantly set trends in the international fashion business by introducing new styles, materials, and technologies. Every year, millions of tourists flock here, many looking for upscale shopping experiences. Luxury handbag sales in the region are heavily influenced by tourists, particularly those from developing nations such as China and India.

- In April 2023, Hermès established three leather goods facilities in France to increase the manufacturing of its Kelly and Constance handbags in response to the surge in demand for its high-end handbags. The company is in Paris. All facets of the fashion business are suffering from supply chain issues. Thus, Hermès has significantly invested in domestic production to boost its output and keep up with demand. Even at 6,500 euros, a Constance shoulder bag is much sought after at Maison's 300 locations.

Asia-Pacific is the fastest-growing in the luxury handbags market during the forecast period. Due to the region's growing middle class and rising affluence, more people can purchase luxury products due to increased disposable income. As status symbols and fashion statements, luxury handbags are in higher demand due to shifting lifestyles and fashion preferences.

Furthermore, the emergence of e-commerce platforms has increased the accessibility of luxury handbags for customers in the Asia-Pacific region, including those residing in remote places. The demand has grown, and the market has expanded due to this greater accessibility.

- In January 2023, Anita Dongren, the designer behind House of Anita Dongre, just debuted a collection of opulent vegan belts and purses. Moreover, the line includes artisanal bags created from recycled glass beads.

North America is expected to grow significantly in the luxury handbags market during the forecast period. The presence of advanced luxury retailers and designer stores in North America is increasing the use of luxury handbags. At the same time, the growing use of social media is also attracting the population. Thus, this is promoting the market growth.

U.S.

The U.S. consists of well-established luxury retailers which in turn is enhancing the use of branded handbags. At the same time, various new launches by well-known companies are attracting the population. Moreover, the growing use of online platforms is increasing their purchase.

Canada

The designer stores and retailers in Canada are providing personalized handbags which is grabbing the attention of the population. Furthermore, new collaborations are also leading to new lunches of such luxury handbags.

Luxury Handbags Market Companies

- Furla S.p.A.

- GANNI A/S

- Giorgio Armani S.p.A. (Armani)

- Loeffler Randall

- LVMH Moet Hennessy Louis Vuitton SE

- Macy's Inc.

- MAUS Freres SA (The Lacoste Group)

- Michael Kors Holdings Limited

- MILLY NY

- Tapestry, Inc. (Coach, Inc.)

- PVH Corp. (Calvin Klein)

Recent Developments

- In July 2025, Louis Vuitton's Men's Spring/Summer 2026 collection, along with India, is advancing in the fashion world by stealing this season's spotlight. Furthermore, featuring designs that were inspired by traditional craftsmanship, the runway celebrated a heartfelt tribute to Indian culture. Thus, Louis Vuitton is attracting attention with its latest and one-of-a-kind handbag shaped similar to an autorickshaw, just after the launch of Prada's Kolhapuri sandals.(Source: https://www.msn.com)

- In April 2025, an announcement to move into Handbag Authentication was made by CheckCheck, which is a leading sneaker authentication company. The company is now expanding and will cover luxury handbags, accessories, and wallets after being established as the expert-driven authentication market leader. Moreover, to introduce an industry-first dual authentication system in India, a collaboration with India's biggest marketplace for authenticated hype and luxury fashion, that is Culture Circle, was announced. This, in turn, enhances the global presence of CheckCheck.(Source: https://menafn.com)

- In September 2023, With the introduction of eBay consignment for luxury goods, owners now have direct access to knowledgeable sellers who will list and sell their products. In 2024, the service will expand to include watches and jewelry in addition to its initial offering of designer handbags.

- In February 2023, A first-of-its-kind firm called CITIZEN HYDE has formally launched its fashionable and safe products for individuals on the go. Designer bags for every gender that lock like a safe are part of the first product line, which combines convenience, practical security, and privacy with elegance and flair.

Segments Covered in the Report

By Product

- Handbags

- Shoulder Bags

- Satchel Bags

- Handheld Bags

- Sling Bags

- Tote Bags

- Hobo Bags

- Others (Duffle Bags, Fanny/Waist Packs. etc.)

- Backpacks

- Wallets

- Others (Clutches, Laptop Bags, Messenger Bags, etc.)

By Material

- Nylon

- Leather

- Cotton

- Synthetic

By End-user

- Men

- Women

By Distribution Channel

- Online

- Company-owned Websites

- E-commerce Websites

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others (Small Retailers, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting