Luxury Footwear Market Size and Forecast 2025 to 2034

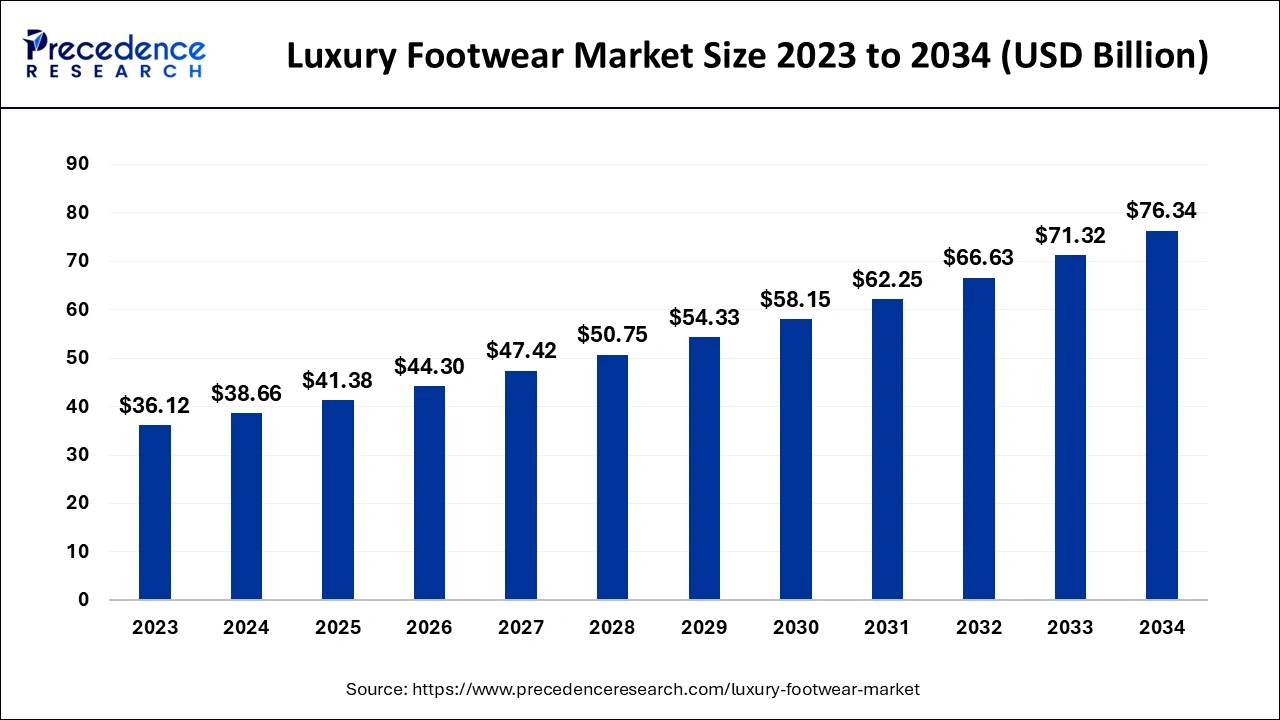

The global luxury footwear market size was calculated at USD 38.66 billion in 2024 and is estimated to hit around USD 76.34 billion by 2034, expanding at a CAGR of 7.04% from 2025 to 2034. The growing number of millionaires worldwide is the key factor driving the luxury footwear market growth. Also, increasing preference for attractive footwear coupled with the changing consumer lifestyles can fuel market growth further.

Luxury Footwear Market Key Takeaways

- The global luxury footwear market was valued at USD 38.66 billion in 2024.

- It is projected to reach USD 76.34 billion by 2034.

- The luxury footwear market is expected to grow at a CAGR of 7.04% from 2025 to 2034.

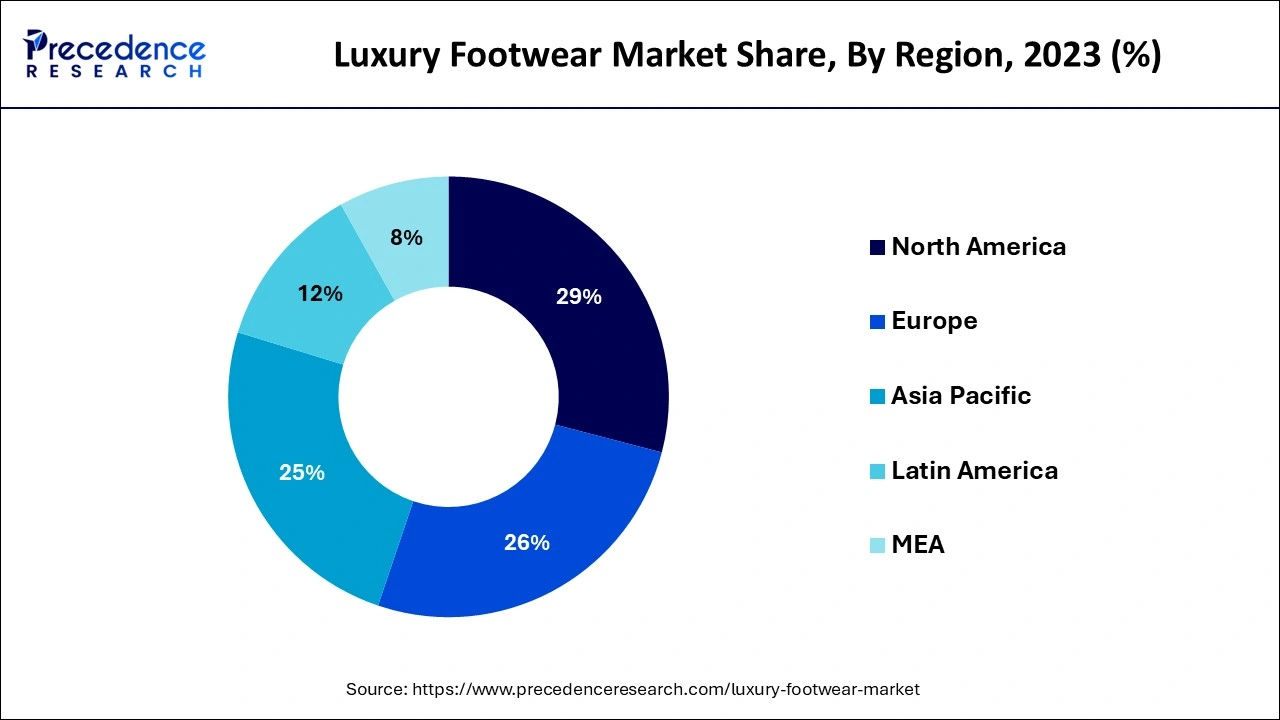

- North America dominated the luxury footwear market with the largest market share of 29.06% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 7.63% over the projected period.

- By product, the fashion luxury footwear segment c in 2023. contributed the highest market share of 41% in 2024.

- By product, the formal shoe segment is projected to grow at a notable CAGR of 5.62% during the forecast period.

- By price point type, the above USD 800 segment dominated the market in 2024.

- By price point type, the USD 400 to USD 800 segment is projected to expand at a solid CAGR of 8.5% over the studied period.

- By end use, the women segment dominated the global market in 2024.

- By end use, the men's segment is expected to grow at the fastest CAGR of 7.3% in the market over the projected period.

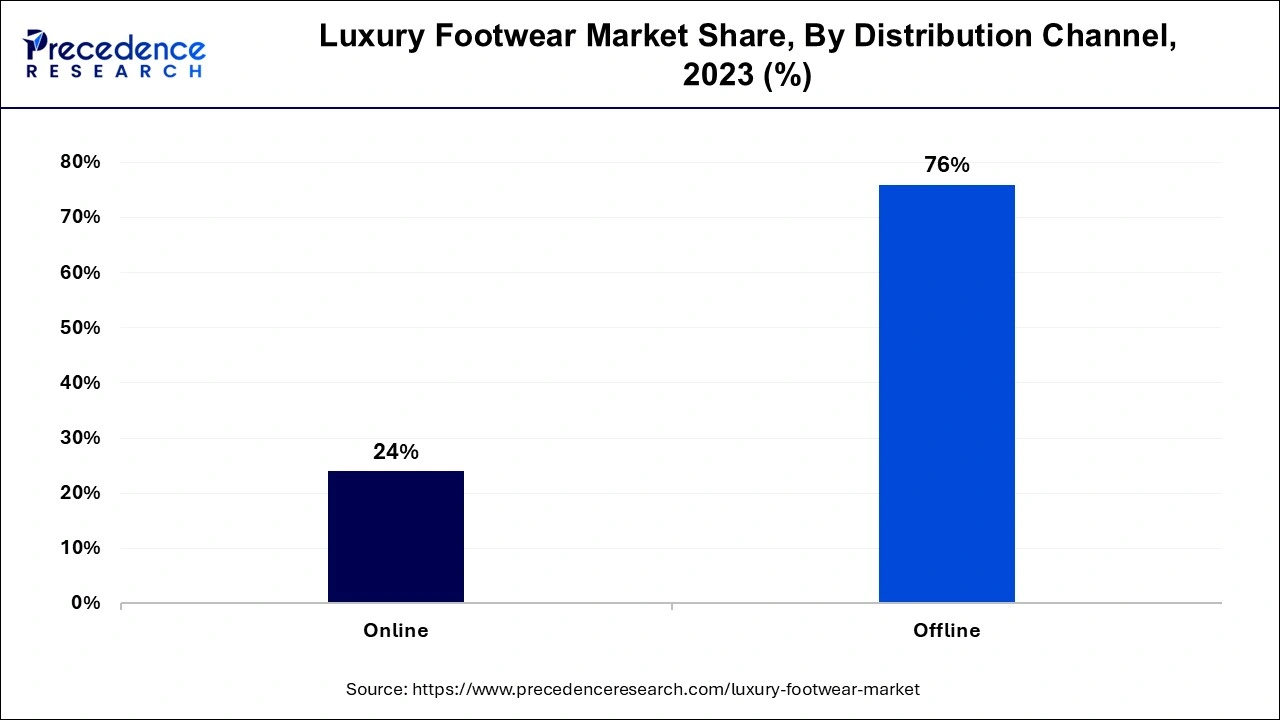

- By distribution channel, the offline segment accounted for the largest market share of 76% in 2024.

- By distribution channel, the online is estimated to witness the fastest growth in the market during the studied period.

How AI is Transforming the Luxury Footwear Market

AI is significantly changing the luxury footwear market, enabling the design of eco-friendly shoes with enhanced production and design. It also improves personalization, efficiency, and sustainability, creating a new era in the footwear market. Furthermore, AI has the ability to analyze the flexibility, strength, and weight of various materials. Which can be helpful to reduce the time required for material selection.

- In September 2023, Vibram3, a leader in the footwear industry, launched a new AI-driven website in partnership with Salesforce, providing customers with a more creative and efficient way to be served. Producing over 40 million soles yearly across 120 countries.

U.S. Luxury Footwear Market Size and Growth 2025 to 2034

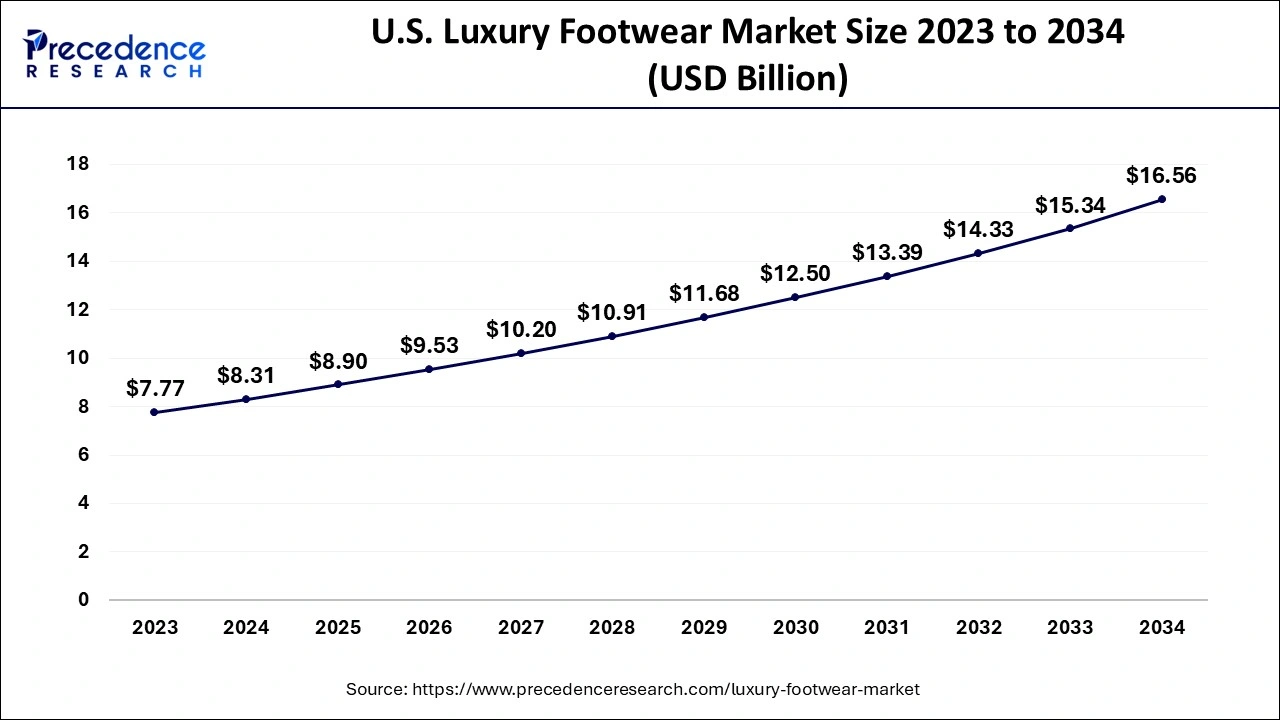

The U.S. luxury footwear market size was exhibited at USD 8.31 billion in 2024 and is expected to be worth around USD 16.56 billion by 2034, growing at a CAGR of 7.14% from 2025 to 2034.

North America dominated the luxury footwear market in 2024. The dominance of the region can be attributed to the high disposable income among the majority of the population due to the presence of a strong economy in the region. Furthermore, big metropolitan cities like Los Angeles, New York, and Toronto are major hubs for luxury products attracting consumers across the globe. The region also has iconic footwear brands such as Salvatore Ferragamo.

- In August 2022, Louis Vuitton Malletier SAS introduced eco-friendly sneakers designed by Virgil Abloh, an American fashion designer and entrepreneur. It is the latest version of LV trainer made from 90% recycled and organic material.

Asia Pacific is expected to show the fastest growth in the luxury footwear luxury footwear market over the projected period. The growth of the region can be linked to the rising purchasing power of the middle class in developing nations like China, India, and Japan. Moreover, there is increasing demand for luxury goods like branded footwear and premium products. Also, factors including celebrity endorsements are also impacting positive market growth in the region.

Market Overview

Luxury footwear is designer shoes designed with branders' premium materials and is popular because of its rarity, quality, and comfort. It is crafted from materials like suede and exotic skins. The luxury footwear market is known for its subtle detailing, convenient designs, and advanced craftsmanship. Due to its branded material design, luxury footwear is quite expensive. Luxury footwear includes leather footwear, athletic footwear, sandals, and sneakers.

Luxury Footwear Market Growth Factors

- Increasing disposable incomes, particularly in a middle-class family, is expected to boost luxury footwear market growth soon.

- Consumers are increasingly striving for a customized product with a unique design that can propel market growth shortly.

- The growth of online luxury apparel has made it easy to access luxury footwear for normal people which will likely contribute to the market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 76.34 Billion |

| Market Size in 2024 | USD 38.66 Billion |

| Market Size in 2025 | USD 41.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-user, Price Point Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Increasing demand for sustainable luxury footwear

As the environmental concerns are increasing luxury footwear brands are on the verge of capitalizing on this opportunity by providing sustainable footwear solutions to their customers. In addition, consumers' awareness regarding eco-friendly products is rising rapidly including footwear. Governments are launching new initiatives to promote the use of eco-friendly materials along with sustainable practices.

- In August 2024, Florsheim and Psudo launched the seven-piece capsule footwear collection. This collection combines traditional design with sustainability, aiming to attract new audiences. The line was produced at the Psudo factory in Los Angeles using U.S.-sourced materials.

- In September 2024, Hoka and Reformation joined forces to launch the sustainable shoe collab. The brand's lineup of driving and lifestyle shoes are supportive, approved by the American Podiatric Medical Association, and cute to boot.

Restraint

Economic uncertainty

Economic uncertainty and constant fluctuations in the spending of consumers can create substantial hurdles to the luxury footwear market. During the time of recession, consumers prefer to spend money on essential things rather than luxury items such as footwear. Moreover, trade policy uncertainty can raise the market players' overall production costs.

Opportunity

Increasing demand for exclusive designer collections

Luxury footwear market players exhibit exclusive, limited-edition products having high-quality materials like textiles, leather, and synthetics. This luxury footwear collection includes menswear like trainers and loafers and womenswear such as moccasins and stilettos. Furthermore, industry events such as exhibitions, shows, and trade fairs act as platforms for market players to launch new collections.

- In August 2024, Sara Blakely, the founder of the shapewear brand Spanx, launched the new luxury shoe brand Sneex, which combines the style of a conventional high heel with the performance and comfort of a sneaker.

Product Insights

The fashion luxury footwear segment led the luxury footwear market in 2024. The dominance of the segment is attributed to the shifting consumer preference from traditional to luxury footwear along with the features offered by this footwear including elegance, unique design, and attractive look. Additionally, an increasing preference for elegant luxury shoes serves as a symbol of status and luxury driving the market growth further.

- In September 2024, the footwear brand HeyDude was introduced in the Indian market through a retail collaboration with Metro Shoes, and its collection of casual styles has rolled out across select Metro Shoes locations throughout India.

The formal shoe segment is expected to grow at the fastest rate in the luxury footwear market over the forecast period. The growth of the segment can be credited to the rising importance of formal shoes in the fashion and the corporate world as they reflect one's professionalism at the workplace. The prime types of formal shoes are loafers, brogues, oxfords, boots, and Derbys. Formal shoes generally come in two colors, black or brown, and are also worn for parties and special events.

Price Point Insights

The above USD 800 segment dominated the luxury footwear market in 2024. The growth of the segment is due to the increasing focus of companies on an innovative parameter like product developments, advanced design, and innovative technical fabrications to fuel sales. Furthermore, stylish and luxurious designs aligned with the higher prices are the key selling points of this footwear. Footwear above USD 800 is generally costly and fashionable.

- In October 2023, Manolo Blahnik collaborated with The RealReal, a luxury resale platform, to launch a dedicated resale platform for its shoes. This move enables customers to buy and sell pre-owned Manolo Blahnik shoes.

The USD 400 to USD 800 segment is projected to grow at the fastest rate in the luxury footwear market over the studied period. The growth of the segment can be credited to the rising desire to experience a luxurious life, especially among millennials and Gen Z. In addition, there is a growing adoption of party culture in this generation, which demands expensive designer outfits and the appearance of which luxurious footwear is part. This factor can significantly impact the market growth further.

End-user Insights

The women segment dominated the global luxury footwear market. The dominance of the can be linked to the growing spending on branded footwear by Gen Z and millennials. Also, there is a surge in the number of women working in the workforce. As women's lifestyles change, preferences for a variety of footwear that can easily convert from work to leisure activities are in high demand.

The men's segment is expected to grow at the fastest rate in the market over the projected period. The growth of the segment is driven by rising men's preferences for versatile and more durable styles because they are involved in certain outdoor or sports activities. However, celebrity endorsements play a significant role in manipulating millennials to go for current fashion trends. Key brands like Burberry, Prada, Giorgio Arman, and Dolce & Gabbana substance spend on these endorsements.

Distribution Channel Insights

The offline segment accounted for the largest share of the luxury footwear market in 2024. The segment dominates because offline distribution channels such as boutiques and shops are popular among the majority of consumers. These facilities also rapidly adapt to the latest fashion trends in the market. Moreover, multi-brand luxury footwear channels are the most popular stores as they offer a wide variety of luxurious footwear options under one roof.

The online is estimated to witness the fastest growth in the luxury footwear market during the studied period. The growth of the segment can be driven by the increasing popularity of online distribution channels like Amazon and Flipkart, especially in emerging markets like China and India. Additionally, the online distribution channel provides greater product availability, leading to segment growth shortly.

Luxury Footwear Market Companies

- LVMH

- Chanel Limited

- Burberry Group PLC

- Silvano Lattanzi

- Prada S.p.A

- A.Testoni

- Dr. Martens

- Base London

- John Lobb Bootmaker

- Salvatore Ferragamo

- Lottusse - Mallorca

- Adidas AG

Latest Announcements by Industry Leaders

- In March 2023, Prada Group announced a major plan to recruit over 400 people by the end of the year to boost its production capacity and craftsmanship expertise in Italy. The investment plan is designed to develop the Group's facilities.

- In October 2024, Formula 1 announced that luxury brands group LVMH will become a Global Partner in 2025 – when the sport will be celebrating its 75th anniversary. The new 10-year deal will have several of LVMH's iconic Maisons, such as Louis Vuitton, Moët Hennessy, and TAG Heuer.

Recent Developments

- In January 2024, Gucci collaborated with Metaverse Platform Roblox to craft a virtual Gucci Garden experience. This experience allows users to purchase limited-edition virtual Gucci items for their avatars.

- In February 2024, Prada unveiled the NFT Collection with Adidas Originals. Prada partnered with Adidas Originals to release a limited-edition collection of physical and digital sneakers.

Segments Covered in the Report

By Product

- Sneakers

- Loafers

- Fashion Footwear

- Formal Footwear

- Others

By End-user

- Men

- Women

- Children

By Price Point Type

- Below USD 400

- Sneakers

- Loafers

- Fashion Footwear

- Formal Footwear

- Others

- USD 400 To USD 800

- Sneakers

- Loafers

- Fashion Footwear

- Formal Footwear

- Others

- Above USD 800

- Sneakers

- Loafers

- Fashion Footwear

- Formal Footwear

- Others

By Distribution Channel

- Online

- Offline

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting