What is the Athletic Footwear Market Size?

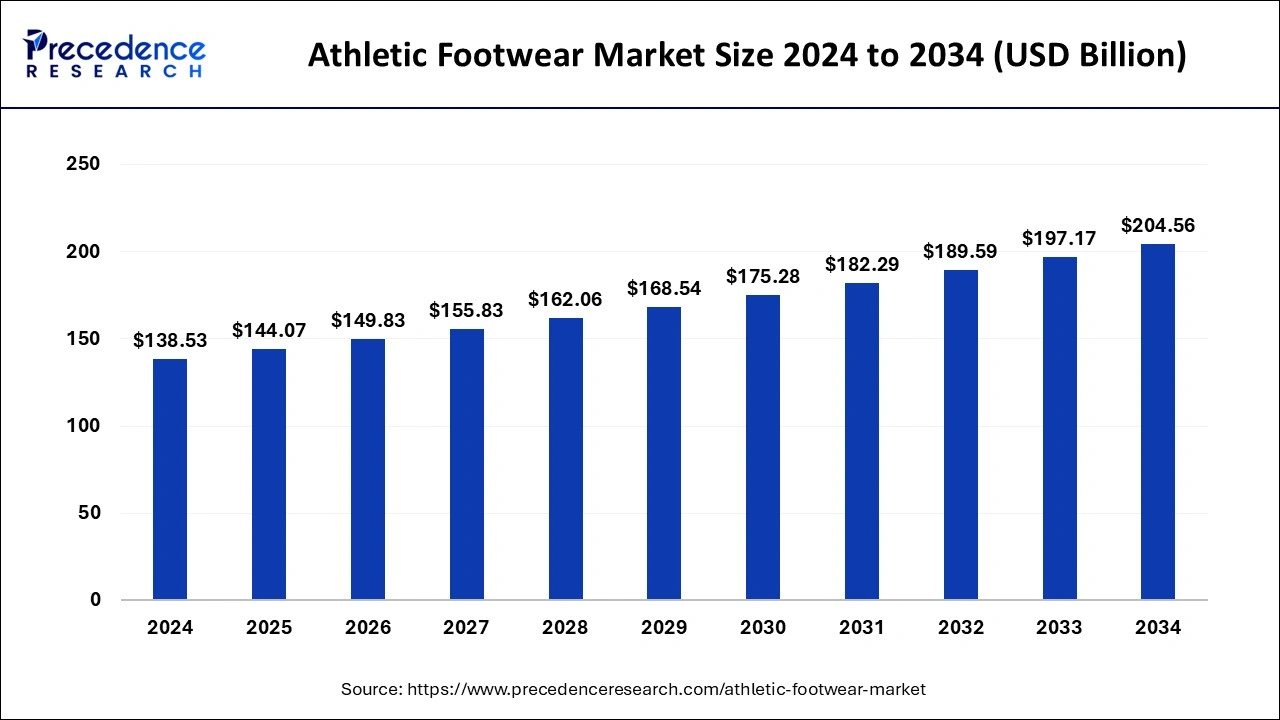

The global athletic footwear market size accounted for USD 144.07 billion in 2025 and is predicted to increase from USD 149.83 billion in 2026 to approximately USD 212.08 billion by 2035, expanding at a CAGR of 3.94% from 2026 to 2035. Growing enthusiasm and awareness regarding the health benefits of sports and fitness activities are estimated to be the key trends driving the athletic footwear market growth.

Athletic Footwear Market Key Takeaways

- The global athletic footwear market was valued at USD 144.07billion in 2025.

- It is projected to reach USD 212.08billion by 2035.

- The market is expected to grow at a CAGR of 3.94% from 2026 to 2035.

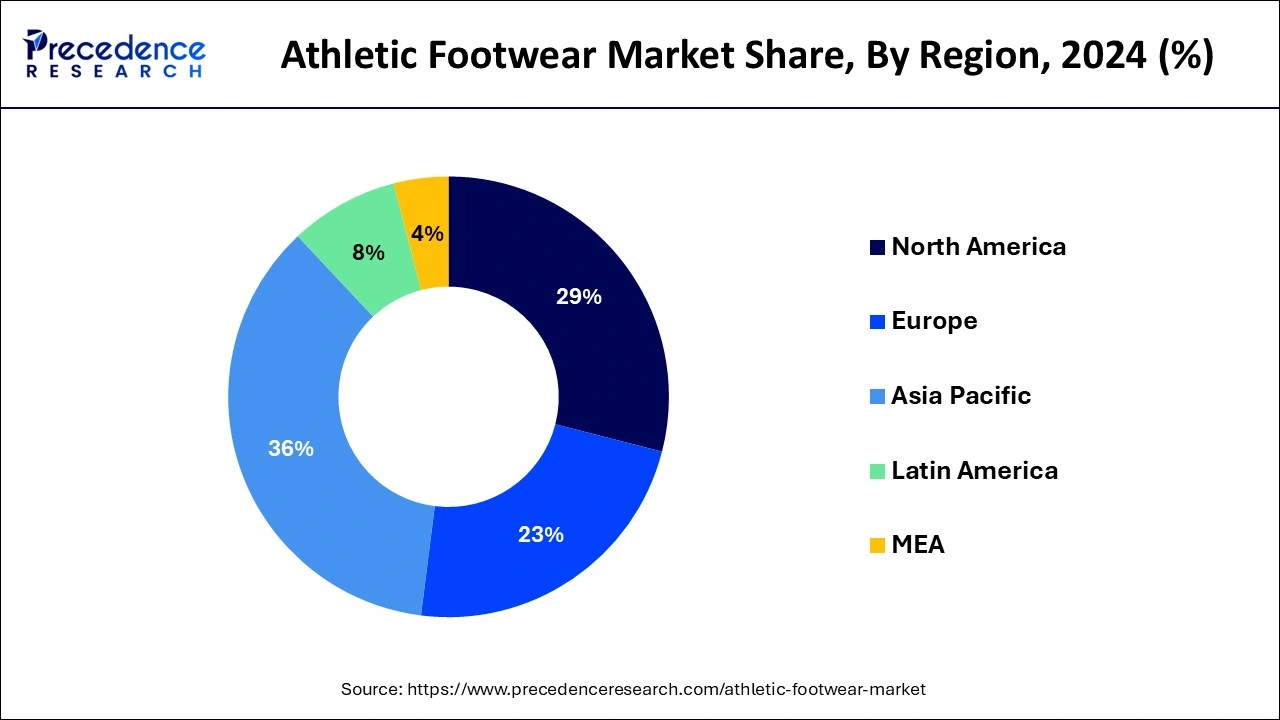

- Asia Pacific dominated the market with the biggest market share of 36% in 2025.

- North America is expected to grow at the fastest rate over the forecast period.

- By type, the running shoes segment has contributed more than 37% of the market share in 2025.

- By type, the trekking and hiking segment is expected to grow at a significant rate over the forecast period.

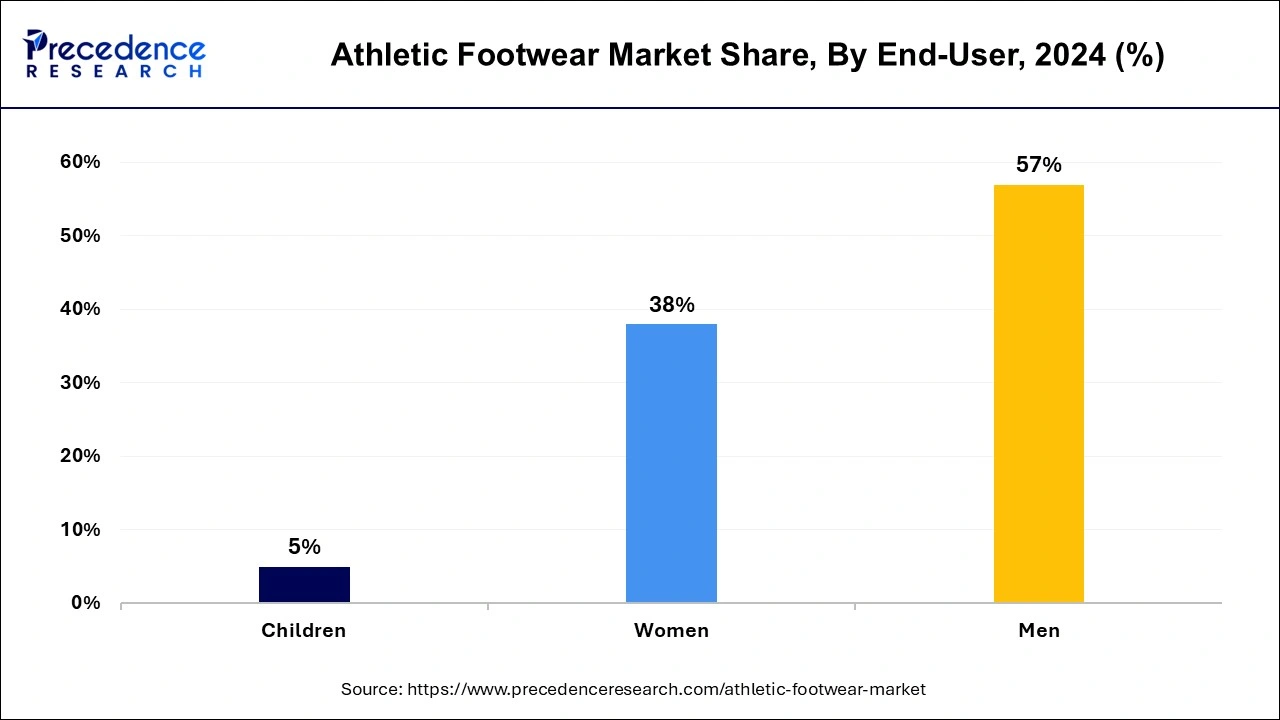

- By end use, the men's segment has held the largest market share of 57% in 2025.

- By end use, the women's segment is expected to expand rapidly during the projected period.

What is Athletic Footwear?

Athletic footwear, also known as sports shoes or sneakers, is specially designed footwear tailored for various physical activities, sports, and workouts. These shoes are crafted to ensure comfort, support, and protection for the feet during dynamic movements, high-impact exercises, and prolonged wear. They often feature cushioned midsoles, sturdy outsoles, breathable uppers, and other performance-oriented features customized for specific sports or activities. Sports footwear caters to a wide range of sports and recreational pursuits, including basketball, tennis, running, walking, soccer, and hiking.

Moreover, their utility extends beyond sports to everyday wear. This is because of the rising popularity of athleisure fashion trends. Athleisure encompasses comfortable and stylish sneakers suitable for both active pursuits and casual outings. Athletic footwear also plays a vital role in injury prevention and performance enhancement by giving athletes and fitness enthusiasts the necessary confidence and support to pursue their fitness objectives safely and effectively.

How is AI contributing to the Athletic Footwear Industry?

AI designs athletic shoes in an automated fashion, creates high-precision shoes, personalized shopping experiences, performance measurements, predictive demand, quality control, sustainability optimization, authentication, and targeted marketing, making it hyper-personalized, wastage-reducing, cycle-accelerating, constantly accurate fit, injury-aversion, globally beneficial.

Technological Advancement

Technological advancements in the athletic footwear market feature smart footwear, advanced materials, and customization. The smart footwear integrates connective features, sensors, and a performance activity tracker. A calculative approach to footwear is a modern advancement in the market, recording an individual's data on metrics such as distance, foot strikes, and speed. The additional enhancements to meet the comfort of the customers are highly advanced.

The advanced materials are used by most of the brands, covering factors like lightweight construction and 3D printed midsoles. The new synthetic material is in high demand. The advancement in personalized customization is adopted by companies to offer the option of AI-powered design and 3D printing for a better customer experience, improving performance. The materials used in product making are supported by technology, serving sustainable results of growth.

Athletic Footwear Market Growth Factors

- People are becoming more aware of health and fitness. This factor can contribute to market expansion.

- People are also realizing the importance of utilizing a proper type of shoes for sports activities, which can fuel the growth of the athletic footwear market.

- Technological advancements in material and design can drive the market growth of the athletic footwear market.

- Collaborations between athletic shoemakers, designers, and celebrity influencers can boost the athletic footwear market growth shortly.

- Growing e-commerce activities such as buying and selling services and products can propel the growth of the athletic footwear market.

Market Outlook

- Industry Growth Overview: The industry is growing due to the increase in health awareness, development in sports participation, and the power of athleisure.

- Sustainability Trends: Brands emphasize the use of recycled materials, bio-based materials, and circular design approaches to minimize environmental impact.

- Global Expansion: The growth has shifted to the Asia-Pacific, where the brands invest more in digital direct-to-consumer channels by making a strategic expansion.

- Key Investors: Tavistock Group, PreIPO Capital, Triodos Investment Management, Virat Kohli, and Major Investors are all active investors.

- Startup Ecosystem: The startup ecosystem operates successfully due to the success of niche brands focusing on sustainability, comfort, specialization, and direct-to-consumer reach.

Athletic Footwear Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 212.08Billion |

| Market Size in 2025 | USD 144.07Billion |

| Market Size in 2026 | USD 149.83 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.94% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancements in manufacturing techniques

Advancements in manufacturing techniques, materials, and cushioning technologies are elevating the support, energy rebound, and impact absorption capabilities of footwear. The use of lightweight materials reduces strain on the shoe by promoting agility and responsiveness. Enhanced comfort and breathability are achieved through moisture-wicking fabrics and well-ventilated designs. Upgrades in outsole construction provide improved durability and traction, which ensure better resilience on various surfaces. Furthermore, the integration of wearable tech enables the collection and analysis of performance metrics on an individual level. These technological breakthroughs not only improve athletic performance but also appeal to consumers seeking innovative features in their footwear choices.

- In January 2024, footwear brand New Balance opened four concept stores in Phnom Penh, marking its entry into the Cambodian athletic footwear market. MAP Active Cambodia, a sports and lifestyle brands importer and distributor that manages the stores, also intends to open two more New Balance stores in the country this year as part of a long-term plan to expand New Balance's footprint in the country.

Restraint

Increasing competition among players

Rising competition among athletic footwear brands poses a significant obstacle to the athletic footwear market expansion. With an increasing array of brands and products available, companies face challenges in distinguishing themselves and capturing consumer attention in a crowded marketplace. Moreover, the growing price sensitivity among consumers prompts them to switch brands in pursuit of better deals, which can pose hurdles to building brand loyalty and retaining market share. As consumers seek versatile and comfortable footwear suitable for diverse occasions, the demand for casual and lifestyle footwear options rises, offering more style and fashion choices. Also, consumers desire personalized features and benefits, prompting companies to innovate and deliver specific solutions on a broader scale.

Opportunities

Athleisure's influence and growing sports participation

Consumers are attracted more towards designer athletic shoes that blend sports elements with fashion, aligning with the athleisure trend. The global demand for cycling and running footwear is propelled by a shift towards more active lifestyles among consumers. The rising popularity of fitness and sports activities like swimming, jogging, aerobics, and yoga presents abundant opportunities for players in the global athletic footwear market. Additionally, the growing participation of women in sports and fitness activities fuels the demand for stylish and comfortable sports shoes. Consumers, especially women, are investing more in athletic footwear. Also, the surge in Athleisure's popularity impacts the sports footwear preferences of millennial parents. Athletic footwear finds favor across all age groups, including baby boomers, Generation Z, Generation X, and millennials, as they all engage in sports and fitness activities.

- In October 2023, the Sports and athleisure footwear brand, Campus Activewear collaborates with Sonam Bajwa to launch the Chunky Sneaker collection. The brand aims to set new pathways with the launch of the Chunky Sneaker collection.

The rising popularity of eco-friendly footwear

The growing emphasis on sustainability is a notable trend shaping market dynamics. Consumers are increasingly mindful of the environmental impact of their purchases, and this trend is evident specifically in the U.S. athletic footwear market. Brands are investing in eco-friendly materials, manufacturing processes, and packaging to cater to environmentally conscious consumers. There's a rising demand for sustainable and eco-friendly footwear as consumers prioritize products that minimize carbon footprints. Athletic footwear brands are continually innovating with new materials and technologies to enhance product performance in terms of comfort and durability.

Segment Insights

Type Insights

The running shoes segment dominated the athletic footwear market in 2024. Running shoes cater to a diverse range of activities, including advanced running, trail running, and track running, among others. Their versatility and suitability for daily wear contribute significantly to their widespread popularity. Furthermore, the running shoe segment is propelled by the growing recognition of the importance of engaging in physical activities to prevent chronic illnesses. In response to consumer preferences, many companies are focusing on creating stylish athletic footwear options.

- In September 2023, CovationBio PDO launched a Saucony running shoe powered by Susterra. The launch is part of Saucony's recent sustainability goals to have 90% of its products contain organic, recycled, or renewable materials by 2025, with 100% by 2030.

The trekking and hiking segment is expected to grow at a significant rate in the athletic footwear market over the forecast period. With advancements in technology, hiking footwear has become more comfortable and flexible for outdoor enthusiasts. These shoes are vital for protecting the feet and ankles during hikes, as they offer strength and durability and require a break-in period for optimal performance. Companies like Amer Sports, Nike, Puma, and Adidas have introduced specialized hiking and trail running footwear, capitalizing on innovations in fabrication, design, and product development. This has also led to the premiumization of hiking and trail running footwear in recent years.

End-use Insights

The men's segment dominated the athletic footwear market in 2024. Throughout history, men have been closely linked with sports and physical activities, and they remain a key demographic for athletic footwear. By Engaging in a diverse array of sports like basketball, soccer, running, and tennis, men rely on specialized athletic shoes tailored to their requirements. Many athletic shoe brands have expanded their offerings for men, focusing on attributes such as stability, durability, and performance enhancements when crafting athletic footwear.

The women's segment is expected to expand rapidly during the projected period. As women's interest in sports continues to rise, particularly in previously untapped countries, Traditionally, women have been less involved in sports and fitness activities compared to men. However, in recent years, there has been a significant increase in the participation of women in activities such as marathons, running, and jogging, contributing to the growth of the athletic footwear industry. Developed nations tend to have a higher proportion of female athletes participating in major sporting events compared to developing and underdeveloped countries.

- In May 2023, Green Market, a heritage company with more than 50 years of footwear-making experience, announced the launch of greenReActives, a sustainably made line of indoor-outdoor women's footwear that's part shoe and part slipper.

Regional Insights

What is the Asia Pacific Athletic Footwear Market Size?

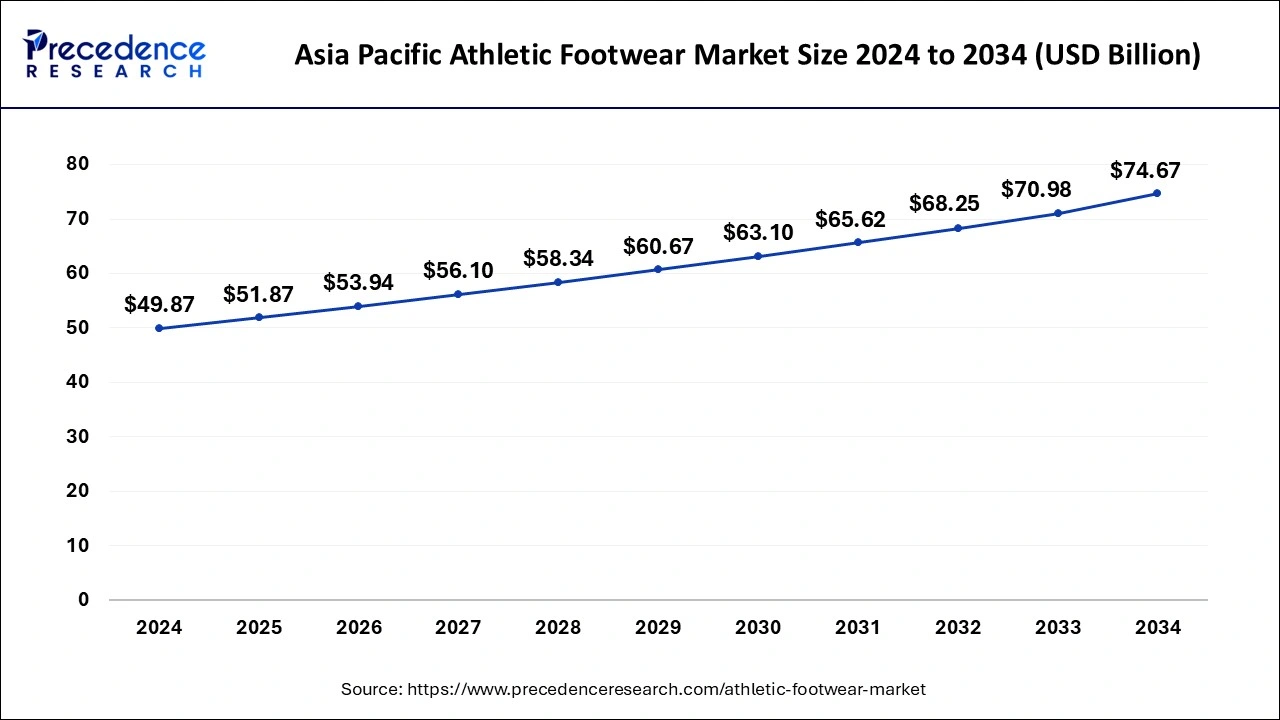

The Asia Pacific athletic footwear market size was exhibited at USD 51.87 billion in 2025 and is projected to be worth around USD 77.72 billion by 2035, growing at a CAGR of 4.13% from 2026 to 2035.

Asia Pacific dominated the athletic footwear market globally in 2024. This trend is expected to persist, with the region maintaining its leadership position throughout the forecast period. The region is also anticipated to experience the highest growth rate, propelled by factors such as rising disposable incomes and the expanding reach ofe-commerce platforms. Moreover, the growing interest in sports events like the Asian Games, the ICC Cricket World Cup, and the ACC Asia Cup is further driving the demand for athletic footwear across the region.

- In August 2022, the ranch luxury menswear brand Berluti expanded its digital footprint in China by launching Alibaba Group's Tmall Luxury Pavilion. During the hard launch, Berluti will offer Tmall shoppers exclusive access to its global debut of Playoff sneakers.

- Currently, Asia Pacific is dominating the athletic footwear market. The rising demand for athletic footwear among youth and the health-conscious population is accelerating the market in the region.

China Athletic Footwear Market Trends

China is the biggest consumer base of athletic footwear and has good manufacturing capacity. The performance and the casual demand run across the board. An increase in disposable income, fitness consciousness, and a growing e-commerce spectrum drives domestic consumption at a greater rate and supports the image of the nation as a manufacturing hub of the world.

North America is expected to grow at the fastest rate over the forecast period. The region boasts a strong culture of sports and leisure activities, which drives substantial demand for athletic footwear. Major sporting spectacles like the Super Bowl and NBA championships add further momentum to the market. Moreover, the region benefits from the presence of renowned athletic footwear brands and a well-established retail network, bolstering market expansion. Continuous advancements in technology and materials by manufacturers in North America contribute to market growth by giving athletes and fitness enthusiasts a diverse array of performance-enhancing choices.

- In November 2023, JD Sports, the leading global sports fashion retailer, and Instacart, the leading grocery technology company in North America, announced a new partnership to launch same-day delivery from more than 500 JD Sports and Finish Line stores nationwide via the Instacart App and website. JD Sports is one of the first sports-fashion retail partners to leverage Instacart's technologies, giving customers access to same-day delivery for more than 16,000 products, including popular athletic footwear and apparel brands like Nike, Jordan, Adidas, Puma, and more, delivered in as fast an hour.

U.S. Athletic Footwear Market Trends

The demand for athletic footwear in the U.S. is a factor that shows performance-based preferences, integration of lifestyle, and premiumization. The culture of innovation is supported by high sports participation and fitness. The use of personalization technologies helps to build loyalty to the brand, whereas traditional retail and online channels maintain a steady consumption of competitive and brand-conscious groups of consumers.

What Are the Driving Factors of The Athletic Footwear Market in Europe

Europe is expected to grow at a significant rate during the forecast period. The demand for athletic footwear in Europe is very high and influenced by the sustainability concerns and sourcing ethics. Consumers prefer green-oriented materials, stability, and comfort. Germany, the UK, and France are the top interests in running and hiking segments, helping premium, responsibly made footwear in the global markets.

Germany Athletic Footwear Market Trends

The athletic footwear market in Germany focuses on engineering quality, comfort, and sustainability. The consumers appreciate technologically superior running and lifestyle sneakers. Natural demand is driven by health awareness, involvement in outdoor sports, and environmentally friendly preferences, which makes Germany a model market, with a strong impact on the level of innovation and responsibility.

Value Chain Analysis of the Athletic Footwear Market

- Product Conceptualization and Design: The research and development influence the development of innovative footwear ideas, specifications, and performance-oriented designs.

Key Players: Nike, Adidas, Puma, Under Armour - Manufacturing and Assembly: The manufacturing and assembly operations are used to convert sourced material and components into a reliable finished athletic footwear product.

Key Players: Nike, Adidas - Branding and Packaging: Marketing engages in value proposition development, brand recognition, and gets products ready to be distributed.

Key Players: Nike, Adidas, Puma, Under Armour - Retail Distribution of the Athletic Footwear: Outbound store, ship, and deliver goods using the channel of sale.

Key Players: Dick's Sporting Goods, Amazon, Walmart, Target

Athletic Footwear Market Companies

- Adidas AG: Adidas AG concentrates on high-performance football and running shoes with a combination of innovative cushioning technologies, sustainable materials, and design development around the globe.

- ASICS Corporation: ASICS Corporation provides high-performance-based athletic shoes with the incorporation of the latest cushioning technology to support the comfort, stability, and long distances of runners across the globe.

- Armour, Inc.: Armour, Inc. creates performance athletic shoes and equipment, and sensor-powered designs that can help users enjoy data-driven training and enhanced athletic performance.

Other Major Key Players

- Fila Inc.

- Under Armour, Inc.

- Lotto Sport Italia S.p.A

- New Balance Athletics, Inc.

- Vans, Inc.

- Nike, Inc.

- Puma SE

- Reebok International Ltd.

Recent Developments

- In July 2025, the British multinational company Coats Group plans to acquire premium insole leader OrthoLite Holdings LLC in a $770 million deal. Coats Group is looking to expand its supplier capabilities further. This deal will boost the companies strategy for its footwear division to become a “super tear 2” supplier in footwear components through its entrance into the fastest growing open sale premium insole market. (Source: https://wwd.com)

- In May 2025, Skechers USA which is one of the fortune 500 and third largest footwear company globally declared that it is going to be acquired by 3G capital which is a global investment firm built on an owner-operator approach considering long term investing. Skechers is one of the biggest founder lead consumer product organisation on a global level with around $ 9 billion annual sales, which is a considerable growth in last 30 years driven by relentless focus on delivering style, comfort, quality, and innovation at an cost effective price. This company is mostly popular for its comfort and growth oriented product driven brand with a diverse distribution network which provides them a highly loyal customer and consumer base. (Source: https://www.fibre2fashion.com)

- In June 2025, Basketball legend Dwyane Wade and NBA star the D'Angelo Russell have been partners in the footwear market for around 7 years now, it is primarily due to the Li-Ning connection. Now they are building and looking for major investment in a global snicker platform wade advocates the long term ownership of athlete brands and creative control considering their Li-Ning connection and their global influence, makes the deep rooted legacy and his way of wade brand. (Source: https://www.si.com)

- In Feb 2025, Fleet Fleet which is one of the biggest franchisor specialized in running stores declared the opening of its recently acquired location in York Pennsylvania located at 1511 Mount Rose Ave., York, PA 17403,the new store will take over the space previously occupied by Flying Feet Sports Shoes in Mechanicsburg and Harrisburg by Shelby and Fred Joslyn. (Source:https://shop-eat-surf-outdoor.com)

- In June 2025, Jumbotail raised $ 120 million funding in order to complete the acquisition of Solv. Jumbotail and Solv are B2B e-commerce platforms which are currently operating in sector of serving kiranas, MSMEs, and brands across food and grocery, apparel and fashion, home furnishing, toys and sports, footwear, and consumer electronics. (Source: https://www.newindianexpress.com)

- In May 2025, Dick's Sporting Goods announced an agreement with Foot Locker to acquire the retail chain in a deal worth USD 2.4 billion, creating a global presence of more than 3,200 retail stores, a large online retail platform, and deep relationships with athletic brands. (Source - https://www.nytimes.com)

- In December 2024, Tamil Nadu chief minister M.K. Stalin laid the foundation stone for a non-leather footwear and athletic footwear products unit in Ranipet district. The unit is being established by the Taiwanese company Hong Fu Group with an investment of USD 1,500 crore. (Source - https://www.thehindu.com)

- In January 2025, Nike upgraded its brand by harnessing generative AI and embracing distributed methods. The company is focusing on 3D printing, integrating with its project, Athlete Imagined Revolution (AIR). (Source - https://manufacturingdigital.com)

- In August 2023, Nike introduced the world's first hydrogen-powered inland container ship, the “H 2 Barge 1, which will take products for Europe, sailing between Rotterdam in the Netherlands and Nike's European Logistics Campus in Belgium.

- April 2023, Joe Freshgoods released new campaign images that showcase the Joe Freshgoods x New Balance 610 shoe and Rainier boot, in addition to clothing in tones of cream, brown, orange, and green.

- In August 2023, ASICS introduced the GEL-KAYANO 30, featuring adaptive technology for stability and comfort, continuing its legacy of performance-oriented footwear. The shoe combines advanced features like 4D GUIDANCE SYSTEM, PureGEL, and FF BLAST PLUS ECO cushioning for enhanced shock absorption and overall comfort during runs.

Segments Covered in the Report

By Type

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking & Hiking Shoes

- Sports Shoes

By End-user

- Men

- Women

- Children

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting