What is Recovery Footwear Market Size?

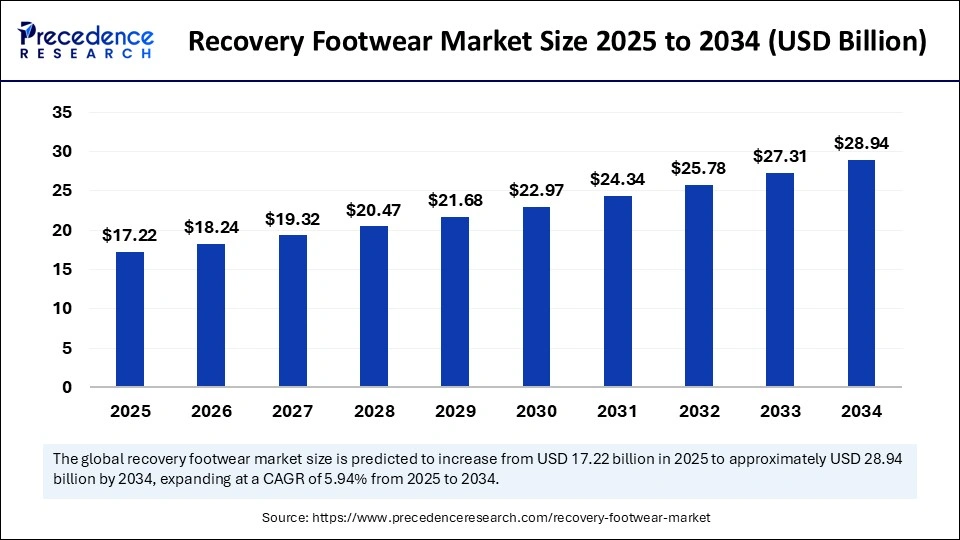

The global recovery footwear market size is calculated at USD 17.22 billion in 2025 and is predicted to increase from USD 18.24 billion in 2026 to approximately USD 28.94 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034. The recovery footwear market is growing at a rapid pace as a result of increased sports participation, technological advancements, and the need of aging populations to recover from injuries.

Market Highlights

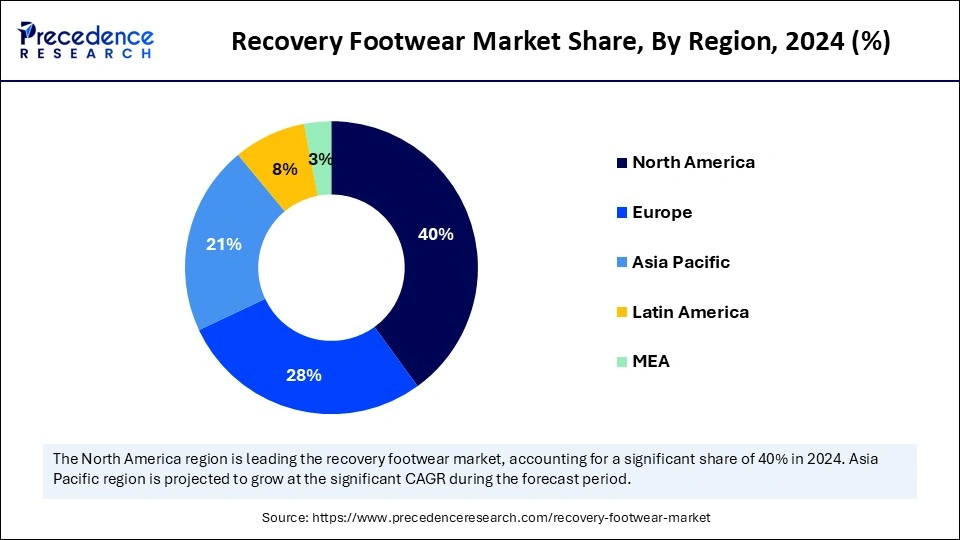

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia Pacific is anticipated to witness the fastest growth between 2025 and 2034.

- By product type, the flip-flop sandals segment held a significant share in 2024.

- By product type, the closed-toed shoes segment is anticipated to grow at a significant CAGR in the upcoming period.

- By consumer orientation, the men segment dominated the market with the largest share in 2024.

- By consumer orientation, the women segment is projected to expand at a significant CAGR over the forecast period.

- By sales channel, the multi-brand stores segment held the biggest market share in 2024.

- By sales channel, the online retailers segment is expected to grow rapidly during the projection period.

- By application, the after-foot surgery segment contributed the highest market share in 2024.

- By application, the after-workout segment is anticipated to show considerable growth over the forecast period.

Market Overview

Recovery footwear is specially designed to aid in muscle recovery post-physical activity like exercise and walking. These shoes are designed with specialized materials that offer relief through enhanced arch supports and good cushion, shock absorption, and other modern materials. They mainly help ease tired feet, soothe stressed muscles, and speed up healing. Unlike usual shoes, these are tailored to focus on providing relief to strained feet, ensuring the user easily regains comfort and mobility. New eco-friendly materials, along with advanced cushioning systems, cradle the body better and help protect the environment, encouraging more people to invest in them. Changes in demographics are also contributing to the market growth since the senior population requires footwear that helps relieve joint pain and supports healthy aging.

Artificial Intelligence Integration in the Recovery Footwear Market

Artificial Intelligence technologies enhance the design and manufacturing of recovery footwear. The development of personalized footwear is possible with AI since it studies each person's foot shape, areas of pressure, and walking habits. By personalizing footwear, recovery outcomes are better for users. AI and the use of smart materials, among other things, have strongly changed how recovery footwear is being made. AI helps reshape shoe design, and personalized shoes can be developed to closely match each person's style and the unique shape of their feet.

Recovery Footwear MarketGrowth Factors

- Increasing Sports Participation: With the increase of people engaging in running, going to the gym, or other forms of high-intensity training, there is an increased demand for footwear to reduce muscle fatigue, speed up recovery, and prevent injury. As athletes and fitness enthusiasts are more aware of the importance of post-exercise care, this trend has increased the demand and growth in the market.

- Technology Advancements: Technological innovations like AI can revolutionize how shoes are designed and also create more personalized shoes based on the individual's style patterns and structure of their foot. These advancements are influencing and increasing footwear products' functionality, comfort, and efficacy.

- Growing Health Awareness: With the growing health awareness, spending on specialized footwear is increasing, which improves cushioning support and adds therapeutic benefits to recovery, thereby assisting with steady global market growth.

- Increase in Online Retail: The quick growth of e-commerce platforms is supporting more accessible recovery footwear purchasing around the world. Improved digital shopping experiences for consumers with a virtual try, no hassle, free returns, etc., make it easier for consumers to go ahead and purchase specialized recovery footwear online, greatly contributing to many new players in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 17.22 Billion |

| Market Size in 2026 | USD 18.24 Billion |

| Market Size in 2034 | USD 28.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Consumer Orientation, Sales Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in Sports Participation and Athletic Activities

With the rising participation in sports, sportspersons and athletes are heavily investing in recovery footwear. Since recovery footwear supports rest, reduces tiredness, and avoids injuries, athletes and fitness enthusiasts should use it when exercise is infrequent. Due to activities such as running, working out at the gym, and sports have become popular around the world, people are paying more attention to recovery as part of their fitness plans. Due to their special design and strong material, recovery footwear can fulfill the increasing need for rehabilitation. In addition, sports organizations, fitness trainers, and health experts are suggesting that recovery plays a vital role in training, which is helping drive up the market demand. The growth of the recovery footwear market continues to be led by an increase in athletic activity worldwide.

Restraint

High Production Cost and Availability of Substitutes

The higher cost of making recovery shoes is a major factor hampering the growth of the market. Traditional footwear doesn't use the same advanced materials and technology, so recovery shoes are more expensive to make. When affordability is a main concern for buyers in many developing regions, most consumers prefer basic types of footwear that lack recovery options. The high costs discourage potential buyers from purchasing them, reducing sales. The availability of alternative recovery methods like massage and counterfeit products creates challenges in the market.

Opportunity

Personalized Recovery Solutions

There is an opportunity in the recovery footwear market to create personalized recovery solutions that fit each customer's needs. Integrating sensors in these shoes helps track users' steps, heart rate, and how each foot supports weight. This level of personalization enhances consumer satisfaction by promoting recovery. With advances in manufacturing processes, companies now provide adjustable arch support, different padding, and custom sizing, which attracts more consumers toward recovery footwear.

Segment Insights

Product Type Insights

The flip-flop sandals segment led the recovery footwear market with the largest share in 2024. They are comfortable and simple to use, making them ideal for recovery after a workout. The majority of recovery flip-flop sandals come with durable orthotic footbeds that give the arch support and cushioning people appreciate. Because they are affordable and come with useful tasks, they have enjoyed rising usage. Because people care more about their feet, flip-flops remain a popular choice for recovery footwear after working out.

The closed-toed shoes segment is anticipated to grow at a significant rate in the upcoming period. These shoes are made for complete protection, great support, and full coverage; they are recommended for people recovering from foot injuries or cooling down post-exercise. Built-in features of many closed-toe recovery shoes are reinforced arches, cushioned soles, shock-absorbing midsoles, and protection over the toe joint to ensure there is less strain and risk of further injury. Closed-toed footwear is stable, so it fixes the foot's position, especially for those suffering from constant foot problems. Since customers are looking for more complete recovery items, the need for shoes that provide therapeutic benefits and regular usage is expected to rise.

Consumer Orientation Insights

The men segment contributed the largest share of the recovery footwear market in 2024. Men actively participate in sports and high-intensity workouts, which means that the recovery shoes that relieve muscle soreness, take weight off the feet, and provide safety need to be made comfortable for the user. Those who engage in running or working out at the gym, heavily invest in recovery footwear.

The women segment is projected to expand at a significant CAGR over the forecast period. The participation of women in running, gym, and sports is rising. This creates the need for post-activity recovery shoes. Because more women are focusing on their health and exercise, the market is responding with shoes that fit women's feet. Women often prefer lighter, softer, and stylish features. Recovery footwear is being highlighted by brands as part of a regular self-care regimen, which seems to satisfy the needs of the expanding group of female customers.

Sales Channel Insights

The multi-brand stores segment held the largest share of the recovery footwear market in 2024. These stores enjoy a leading position because customers can see and compare them side by side. These stores enable consumers to choose their perfect fit from many brands and product types at one location. These stores enable consumers to physically check the quality of new shoes, check how they look, and receive expert guidance from staff. This further enhances customer satisfaction. Many multi-brand outlets offer discounts, attracting more consumers.

The online retailers segment is expected to grow rapidly during the projection period. Online Platforms make it easy for customers to look at different recovery footwear, study its details, and read customer reviews about products. This helps in making informed purchasing decisions. Online platforms enable consumers to purchase recovery footwear from anywhere and at any time. This convenience factor attracts more consumers. Moreover, these stores often provide doorstep delivery and discounts, encouraging people to purchase footwear from them.

Application Insights

The after-foot surgery segment held a significant share of the recovery footwear market in 2024. This is mainly due to the increased foot and ankle surgeries among aging population worldwide. Older people often experience orthopedic conditions like arthritis, which often require surgical interventions. Recovery shoes help lower the pressure on sensitive spots and promote healing after surgery. These types of shoes are made with solid soles, can be adjusted by straps, have orthopedic padding, and are reinforced at the toe to fix and protect the foot after surgery. They enable proper alignment, offer support, lessen pain, and help patients gain back their movement. Wearing this type of footwear is often suggested by doctors and therapists as a way to speed up recovery. Moreover, the increased occurrence of sports injuries bolstered the growth of the segment.

The after-workout segment is anticipated to show considerable growth over the forecast period. Most recovery shoes for after exercise are made with soft padding, support the arches and have soles that lower the impact on the body, which helps muscle recovery. They improve blood flow, reduce muscle discomfort, and lower the risk of overuse injury. Also, people are wearing athletic styles more often; they are looking for comfortable and attractive recovery shoes that can be worn at any time. Because of this, recovery footwear brands are seeing the biggest growth from the after-workout segment.

Regional Insights

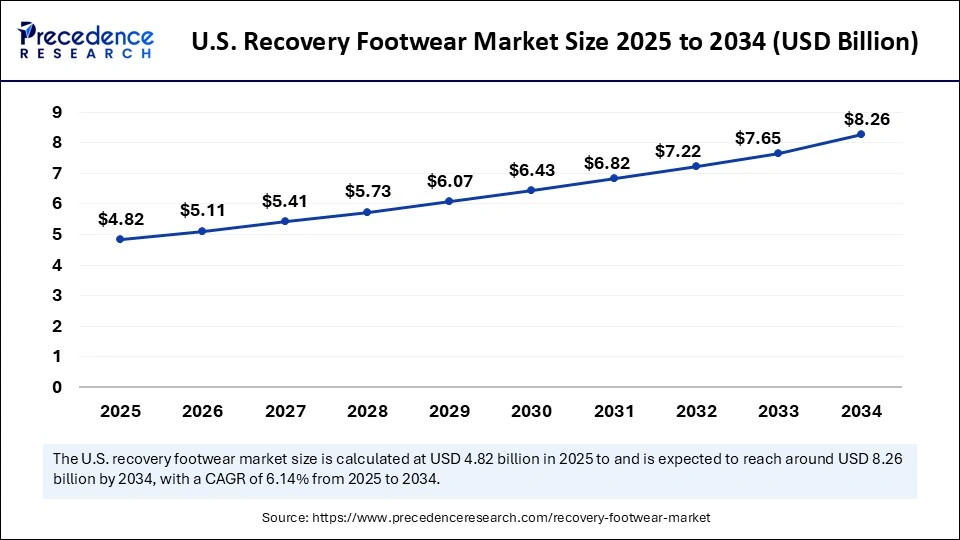

U.S. Recovery Footwear Market Size and Growth 2025 to 2034

The U.S. recovery footwear market size is exhibited at USD 4.82 billion in 2025 and is projected to be worth around USD 8.26 billion by 2034, growing at a CAGR of 6.14% from 2025 to 2034.

U.S. Recovery Footwear Market Trends

In the U.S., the market is witnessing significant growth as more consumers prioritize comfort, wellness, and post-activity recovery, particularly among athletes and fitness enthusiasts. In May 2025, the U.S. Footwear Manufacturers Association urged the U.S. government to reinvest in the domestic footwear industry to enhance competitiveness. Additionally, the U.S. Trade Representative (USTR) has been conducting reviews of intellectual property protection and market access, which indirectly impact the footwear sector.

Why Does North America Lead the Recovery Footwear Market?

North America registered dominance in the market by holding the largest share in 2024. As more people start fitness routines, there is heightened demand for shoes that help the feet after exercise. Most North American buyers have high disposable income, and many choose to invest in footwear that promotes health and recovery. More people in the region are paying attention to their health, increasing healthcare expenditures. The rising participation of women in sports and a strong emphasis on active lifestyles is likely to bolster the regional market growth.

What are the Major Factors Driving the Growth of the Recovery Footwear Market within Asia Pacific?

Asia Pacific is expected to witness the fastest growth during the forecast period. Consumers in the region are increasingly using recovery footwear as a way to prevent injuries and recover from activity-related weariness. With more people living in cities, people tend to depend on walking and taking public transport, which makes them more active each day while moving around. Growing awareness of health and wellness significantly supports market expansion. Moreover, the rise of e-commerce has increased accessibility to recovery footwear, sustaining the growth of the market in the region.

India Recovery Footwear Market Trends

In India, the market is gaining traction as consumers increasingly seek comfort and support for foot health, particularly among those engaged in sports, fitness, or long hours of standing. Additionally, as health and wellness trends continue to grow, Indian consumers are showing interest in eco-friendly, sustainable recovery footwear, driving innovation in product design and materials. The Indian Footwear and Leather Development Program (IFLDP) has been extended until 2026 with ₹1,700 crore, emphasizing sustainable technology, infrastructure development, brand promotion, and capacity building.

Why is Recovery Footwear Gaining Popularity Across Europe?

Europe is considered to be a significantly growing area. The growth of the recovery footwear market within Europe is driven by the rising participation of people in sports, physical activities, and exercise. This creates the need for recovery footwear to speed up recovery and prevent injuries. Higher awareness of recovery footwear among older people is supporting the market's growth. With the rising disposable income, many people in the region prefer customized and premium recovery footwear. In addition, growth in retail channels supports regional market growth.

France Recovery Footwear Market Trends

The market in France is experiencing growth as consumers increasingly prioritize comfort, health, and wellness, particularly in response to a rise in active lifestyles and sports participation. Additionally, eco-consciousness is influencing the market, with consumers seeking sustainable and natural materials in recovery footwear, prompting brands to innovate with environmentally friendly products. A government-funded program encourages clothing and shoe repairs. This initiative aims to cut waste in the fashion industry and support a circular economy. It is a vital part of France's "Recovery and Resilience Plan" and "France 2030" investment strategy.

What Potentiates the Growth of the Latin America Recovery Footwear Market?

The market in Latin America is driven by rising consumer focus on general wellness. Consumers in the region are seeking comfort and support to relieve foot pain and enhance recovery after physical activity. The growing popularity of fitness and sports activities, particularly among younger populations, is fueling demand for recovery footwear designed to aid in post-exercise recovery.

Brazil Recovery Footwear Market Trends

In Brazil, the market is gaining momentum as consumers increasingly prioritize post-activity comfort and wellness, especially after sports or long hours of standing. Brands are responding by introducing designs with enhanced cushioning, arch support, and ergonomic features that appeal to both fitness enthusiasts and everyday users. According to the Brazilian Footwear Industry Association, Brazil's footwear sector created 10,220 new jobs in the first four months of 2025. A strong domestic demand and improved economic conditions are driving the Brazilian footwear industry.

How is the Opportunistic Rise of the Middle East and Africa in the Recovery Footwear Market?

The Middle East and Africa (MEA) is experiencing an opportunistic rise in the market. There is growing consumer awareness of health and fitness. The government promotes trade policies and digital payment initiatives, contributing to market growth. Saudi Arabia is a major contributor to the market in the region. In June 2025, the Ministry of Investment of Saudi Arabia announced support for a new health and fitness event. The Saudi authorities have released official health and safety guidelines for Hajj and Umrah pilgrims, emphasizing foot care and the importance of wearing comfortable footwear.

Recent Developments

- In April 2025, Nike revealed its first line of recovery items, including a compression boot and vest, in collaboration with Hyperice. Initially, only a chosen few Nike athletes were meant to get these, because approximately 100 athletes used them during the 2024 Olympics.

- In November 2024, Kane Footwear, which leads in active recovery shoes, introduced its second model, the Kane Revive AC, for people who need footwear that works in every climate. Based on the recovery features of the Kane Revive, the Revive AC, which stands for All Conditions, comes with a weatherproof design so athletes can recover well in any weather.

- In August 2024, OOFOS, the global leader in Active Recovery footwear, launched its latest innovation in recovery footwear - the OOmy Stride. With this technology, a new platform offers OOFOS users the familiar comfort they know from the brand and an enhancement to their step, from when their heels hit the ground through their toes, leaving.

(Source: https://www.soleretriever.com)

(Source: https://www.businesswire.com)

(Source: https://www.prnewswire.com)

Recovery Footwear Market Companies

Segment covered in the report

By Product Type

- Flip-flop sandals

- Slides sandals

- Closed-toed shoes

- Others

By Consumer Orientation

- Men

- Women

- Children

By Sales Channel

- Convenience stores

- Multi-brand stores

- Exclusive stores

- Online retailers

- Others

By Application

- After-foot surgery

- After-workout

- Walking

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting