What is the Malt Beverages Market Size?

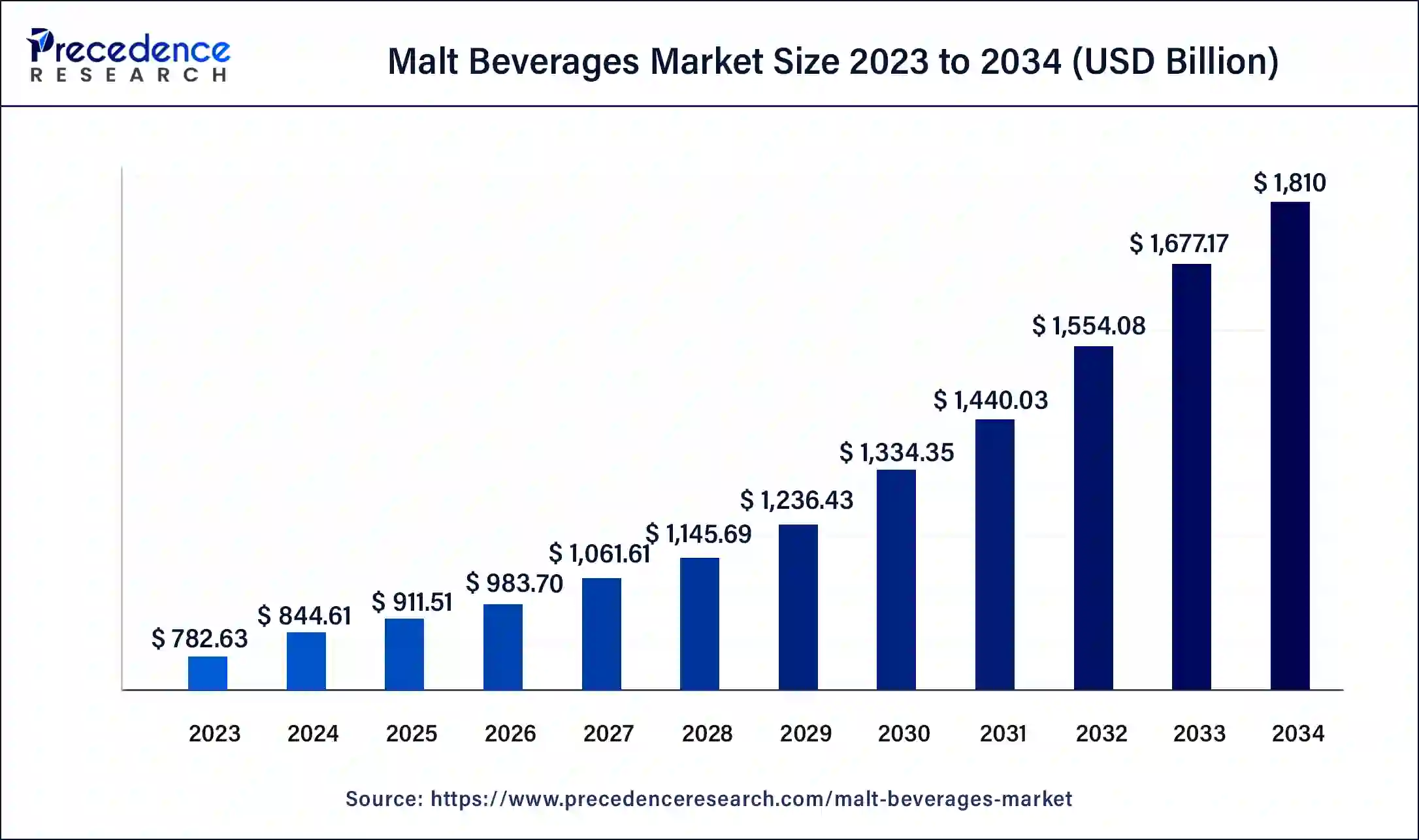

The global malt beverages market size is valued at USD 911.51 billion in 2025 and is predicted to increase from USD 983.70 billion in 2026 to approximately USD 1,942.83 billion by 2035, expanding at a CAGR of 7.86% from 2026 to 2035. Consumers' preference for more diverse and innovative flavors is the key factor driving market growth. Innovative product launches such as flavored malt beverages (FMBs) and hard seltzers can fuel market growth further. Rising health consciousness among consumers is expected to boost the malt beverages market growth soon.

Malt Beverages Market Key Takeaways

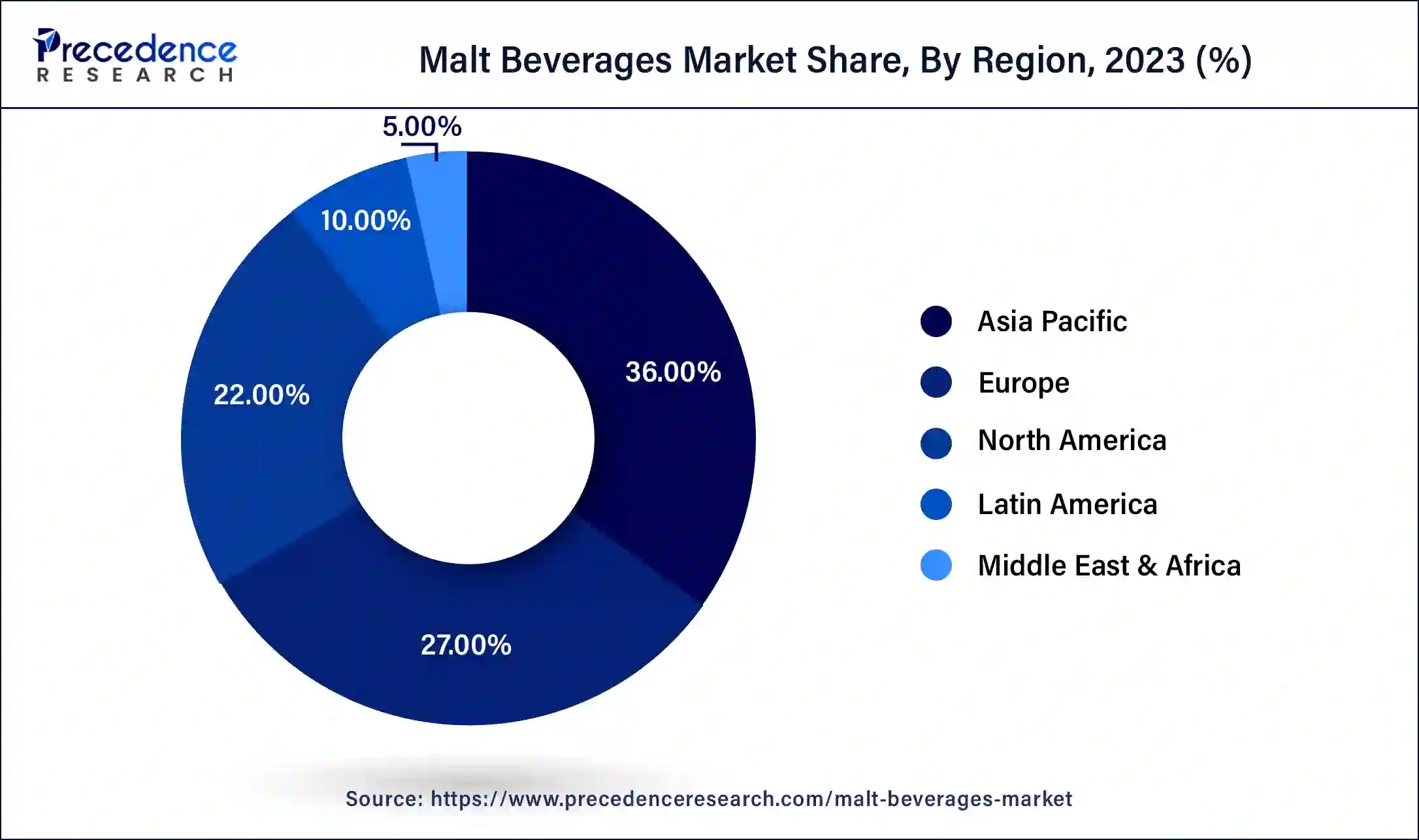

- Asia Pacific dominated the global malt beverages market with the largest market share of 36% in 2025.

- By product, the alcoholic malt beverages segment generated the largest market share of 98% in 2025.

- By product, the non-alcoholic malt beverages segment is expected to grow at a double digit CAGR of 8.8% during the forecast period.

- By distribution channel, the on-trade channel segment contributed to the market share of 50% 2025.

- By distribution channel, the off-trade channel is expected to grow at a CAGR of 7.03% over the projected period.

Market Overview

A malt beverage is a fermented drink made from malted seeds and grains such as barley, along with ingredients like yeast, hops, and water. The process of malting involves germinating and drying the grains, which activates enzymes that convert starches into sugars. Yeast fermentation can then be used to produce alcohol. It's important to note that not all malt beverages contain alcohol. Some are non-alcoholic and can be marketed as substitutes for alcoholic beverages.

How is AI Changing the Malt Beverages Market?

AI can help in analyzing personalizing customer experiences, and consumer trends and automating regulatory processes. This gives more time for creativity from drinks brands and supports efficiency across processes to enhance price points. Furthermore, AI can help drink brands plan and forecast. AI's ability to process many data sets and identify patterns along with anomalies can be used to analyze key trends in the malt beverages market with the competitor's activity.

- In April 2024, Coca-Cola built a musical instrument that purports to leverage both AI and neuroscience to simulate the experience of drinking one of its products. Through a new app called Coke SoundZ, users can create their melodies based on the sounds of cracking open and taking a sip from a bottle of Coke.

Malt Beverages Market Growth Factors

- The rising popularity of ready-to-go products is anticipated to boost the growth of the malt beverages market.

- Rising disposable income is expected to create lucrative.

- An increase in the millennial population can fuel the malt beverages market growth further.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1,942.83 Billion |

| Market Size in 2025 | USD 911.51 Billion |

| Market Size in 2026 | USD 983.70 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.86% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growth of craft beer market

The malt beverages market has seen exponential growth during the last couple of years. This is because the consumers seek something extremely tasty and special to drink. Additionally, smaller breweries are also experimenting with and producing new tastes and types of beer, which can drive market growth for malt beverages over the forecast period. Also, developing economies are witnessing growth and continued development in the production of malt beverages.

- In September 2024, American Brew Crafts Pvt Ltd (ABCL) unveiled its latest addition to the beverage market in Hyderabad with the launch of Flying Monkey, a Belgian-style craft Beer. The event, held in the vibrant city, featured an engaging bar pop-up, offering attendees a taste of the unique brew.

Restraint

Rising health consciousness regarding alcohol

The majority of the population is becoming more aware of the adverse effects of alcohol on health. This can hinder the growth of the malt beverages market. Consumption of alcohol causes different types of diseases like heart disease, strokes, cancer, and high blood pressure. Moreover, alcoholic beverages can strengthen the risk of certain types of cancer.

Opportunity

Rising adoption of online sales

Growing adoption of online sales is the key trend shaping the dynamics of the malt beverages market. This is because e-commerce has become a reliable and popular tool for marketing and selling alcoholic beverages. It has also been seen as the fastest-pacing distribution channel for malted beverage sales. Furthermore, e-commerce sales have helped many small enterprises that produce craft cocktails, craft spirits, and craft beers to sell their brands and products to a large pool of consumers.

- In November 2023, Beverage giant Coca-Cola India announced that it has joined the Open Network for Digital Commerce (ONDC), while also launching its marketplace, the ‘Coke Shop', on the platform. The initial association with ONDC is being supported through SellerApp, which will help the company leverage the ONDC network with its data-driven insights, market intelligence, and strategies.

Product Insights

The alcoholic malt beverages segment dominated the malt beverages market in 2025. The growth of the segment can be attributed to the increasing advancements in brewing technology, rising demand for malt flavors and types, and well-established marketing and distribution infrastructure for beverages. Additionally, alcoholic malt beverages have a strong cultural and social presence across the globe which makes it an important drink at social gatherings and events. driving segment growth over the forecast period.

- In December 2023, Liquor firm Pernod Ricard launched Longitude77, its first Indian single malt. The brand's name is inspired by the longitude that runs through the length of India at 77° east and marks India's position on the world map. The brand is a tribute to Pernod Ricard India's legacy in the country and has been specially crafted for seekers of authentic contemporary Indian luxury.

The non-alcoholic malt beverages segment is expected to grow at a significant rate in the malt beverages market during the forecast period. The growth of the segment can be credited to the evolving cultural and social attitudes toward inclusivity in social gatherings. Furthermore, Health-conscious consumers, including older adults and youngsters, are increasingly seeking new ways to provide the social experience of beer without alcohol. These shifts in consumer interests, along with seasonal trends like Dry January, are fueling the segment's growth in the upcoming years.

- In April 2024, Bottega will launch a non-alcoholic lemon liqueur at Vinitaly. Having produced lemon liqueurs for 30 years, Bottega has plenty of experience when it comes to the development of citrus-based drinks, but its latest release has a difference – it is alcohol-free. While there is no alcohol in the drink, Bottega has put as much effort into the product as it does for its other lemon liqueurs.

Distribution Channel Insights

The on-trade channel segment led the malt beverages market in 2025. The trade channel includes restaurants, bars, and pubs and is anticipated to experience steady growth due to the rising popularity of craft beers and increasing demand for premium malt beverages in social gatherings. Moreover, sales through food pubs and community pubs have increased exponentially in the last couple of years, which can also propel segment growth.

The off-trade channel is anticipated to grow rapidly in the malt beverages market over the projected period. The growth of the segment can be attributed to the rising shift of consumers towards e-commerce, which has boosted convenience and access and appealed to a wide range of audiences. Additionally, the increasing trend of purchasing alcohol alongside other groceries has made it more convenient for consumers to incorporate malt beverages into their regular shopping lists.

Regional Insights

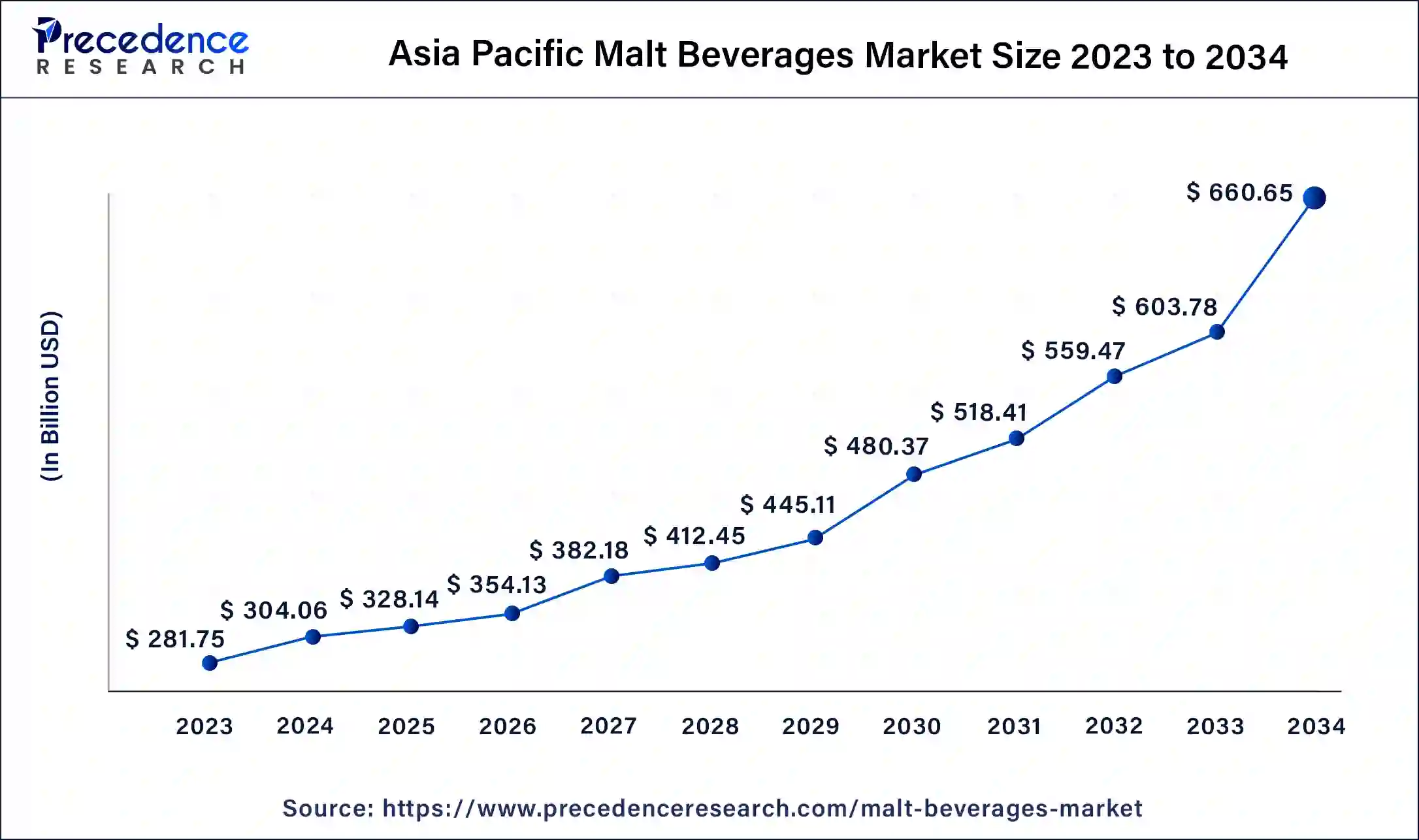

Asia Pacific Malt Beverages Market Size and Growth 2026 to 2035

The Asia Pacific malt beverages market size is exhibited at USD 328.14 billion in 2025 and is projected to be worth around USD 709.15 billion by 2035, poised to grow at a CAGR of 8.01% from 2026 to 2035.

Asia Pacific led the malt beverages market in 2025. This is due to the rising adoption of flavored drinks and growing preference for organic drinks, which is anticipated to present lucrative opportunities in the market during the projected period. Moreover, the increasing number of bars, pubs, and craft beer events in the region also contributes to the growth of the market.

China Market Trends

China's malt beverages market is growing due to rising health consciousness, increasing disposable incomes, and demand for convenient, functional drinks. There is a high demand for both alcoholic and non-alcoholic drinks, driven by innovative flavors like fruity, low-bitter, and reduced-sugar options, along with the expansion of online retail channels and premiumization trends, which is contributing to the market.

The dollar shares for each RTD category in September 2022 and the change over the previous year

| Category | Dollar share 2022 | Change 2022 vs. the previous year |

| Hard seltzer | 42.8% | -10.3% |

| Flavored malt beverages (e.g., hard teas/coffees/soda) | 37.0% | 12.0% |

| Spirits-based (e.g., cocktails, seltzers, frozen novelties) | 11.6% | 7.6% |

| Wine-based (excluding sake, dessert, and vermouth) in any container type that is 355 ml or smaller, 375 ml non-glass containers, or 500 ml tetra pack wine cocktails | 8.6% | -2.1% |

North America is observed to grow at a significant rate in the malt beverages market during the forecast period. The growth of the region can be attributed to the increasing consumer preference for vibrant beer culture and growing interest in craft beers. Furthermore, strategic initiatives by major industry players like Carlsberg and Anheuser Busch are driving market expansion further in the future. Also, the region's affection for popular beer brands like Corona and Budweiser strengthens the market presence of these brands.

- In March 2023, Jack Daniel's & Coca?Cola RTD, a pre-mixed, canned cocktail that first launched last fall in Mexico, is set to hit stores in the United States. The highly anticipated ready-to-drink (RTD) take on one of the world's most requested ‘bar calls' cocktails ordered by brand name balances the smooth character of Jack Daniel's Tennessee Whiskey with the refreshing taste of Coca?Cola.

U.S. Market Trends

The U.S. malt beverages market is growing due to consumers' shift toward healthier alternatives, driving demand for low- or no-alcohol malt drinks, hard seltzers, and low- or no-sugar options that align with wellness trends. Additionally, the rising popularity of craft beer fuels interest in unique, artisanal malt beverages with diverse brewing techniques, further expanding the market.

What Potentiates the Market in Europe?

Europe's malt beverages market is growing due to rising demand for non-alcoholic and low-alcohol options, functional ingredients like vitamins and minerals, and diverse flavors. Growth is further fueled by craft and specialty brews, online sales, and a strong focus on health consciousness and sustainable practices, driving innovation and market expansion. The UK is a major contributor to the European market. This is mainly due to the increasing need for low or no-alcohol alternatives, artisanal or craft products, and healthier options in beverages.

How is the Opportunistic Rise of Latin America in the Malt Beverages Market?

Latin America is experiencing an opportunistic rise in the market due to growing middle-class incomes, increased urbanization, and rising demand for both alcoholic and non-alcoholic options, with health-conscious consumers driving interest in non-alcoholic variants. The market is further fueled by demand for unique, high-quality, locally-produced craft malt beverages and the expansion of online retail platforms like Mercado Libre, which are enhancing accessibility and sales.

What Drives the Market in the Middle East & Africa?

The Middle East & Africa malt beverages market is driven by health-conscious consumers seeking non-alcoholic and low-ABV options, growing urbanization, and expanding tourism and expat populations. Market growth is further supported by product innovation in flavors, regulatory easing in countries like the UAE, and rising demand for high-quality, diverse, and craft malt beverages, with urban centers such as Doha, Al Rayyan, and Lusail leading consumption trends.

Value Chain Analysis

- Raw Material Procurement

It includes the sourcing and quality control of primary ingredients like malted barley, water, hops, and yeast.

Key Players: Malteurop, Soufflet Group, Boortmalt, Cargill, GrainCorp - Processing and Preservation

It includes malting, boiling, mashing, fermentation, and filtration of raw materials, while preservation mainly relies on pasteurization and packaging to guarantee microbial stability and extend shelf-life.

Key Players: GEA Group, Krones AG, Alfa Laval - Quality Testing and Certification

It includes rigorous in-house and third-party testing, adherence to national and international regulatory standards, and even voluntary certifications to guarantee product safety, consistency, and compliance.

Key Players: Eurofins, TÜV SÜD, QIMA

Malt Beverages Market Companies

- Nestle

- Mondelez International

- RateBeer, LLC.

- United Brands LLC

- Barbican Centre

- Monarch Beverages

- MusclePharm

- WOODBOLT DISTRIBUTION LLC

- BPI SPORTS

- Magnum Nutraceuticals

- GAT WHP

Recent Developments

- In April 2024, Boston Beer Company, Inc. introduced General Admission, a non-alcoholic ready-to-drink (RTD) fruit brew in the U.S. This new offering blends fruit-infused seltzer water with low-alcohol beer. Initially available in select markets such as New York, Albany, Raleigh, North Carolina, and Indiana, the product can also be purchased online for direct-to-consumer shipping across various states.

- In July 2024, Carlsberg Group expanded its partnership with Foodpanda to enhance consumer access to its range of beverages through digital transformation and e-commerce. This collaboration included campaigns such as exclusive gifts, special promotions, and bundles, leveraging Foodpanda's cloud grocery stores and extensive retail network.

- In November 2023, United Breweries, part of the HEINEKEN group, launched Heineken Silver Draught Beer in India, marking the brand's first entry into the draught beer market in the country. Initially available in premium bars and pubs across selected cities. This beer features a smooth, refreshing taste crafted from 100% malt and natural ingredients. The launch aims to cater to evolving consumer preferences and enhance the beer experience for a new generation of enthusiasts in India.

Segments Covered in the Report

By Product

- Alcoholic Malt Beverages

- Beer

- Ale

- Lager

- Stout

- Others

- Flavored Alcoholic Malt Beverages

- Hard Seltzers

- Malt-Based Cocktails

- Hard Tea

- RTD Malt Drinks

- Non-Alcoholic Malt Beverages

- Non-Alcoholic Beer

- Flavored Non-Alcoholic Malt Beverages

- Beer

By Distribution

- On-trade

- Off-trade

- Liquor Stores

- Hypermarkets/Supermarkets

- Online

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting