What is Organic Food and Beverages Market Size?

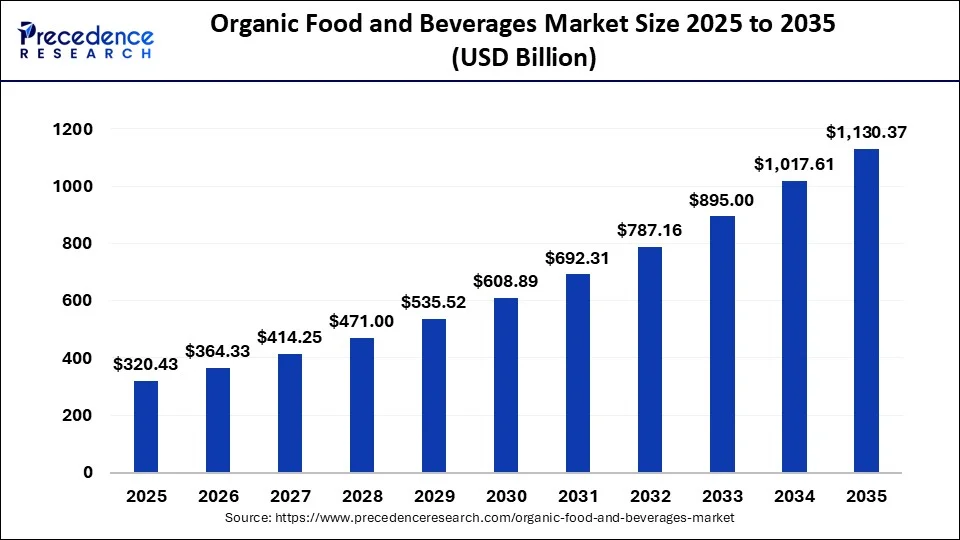

The global organic food and beverages market size is calculated at USD 320.43 billion in 2025 and is predicted to increase from USD 364.33 billion in 2026 to approximately USD 1130.37 billion by 2035, expanding at a CAGR of 13.44% from 2026 to 2035.

Market Highlights

- North America led the global market with the highest market share of 49% in 2025.

- By roduct, the vegetables and fruits segment residential the biggest market share of 41% in 2025.

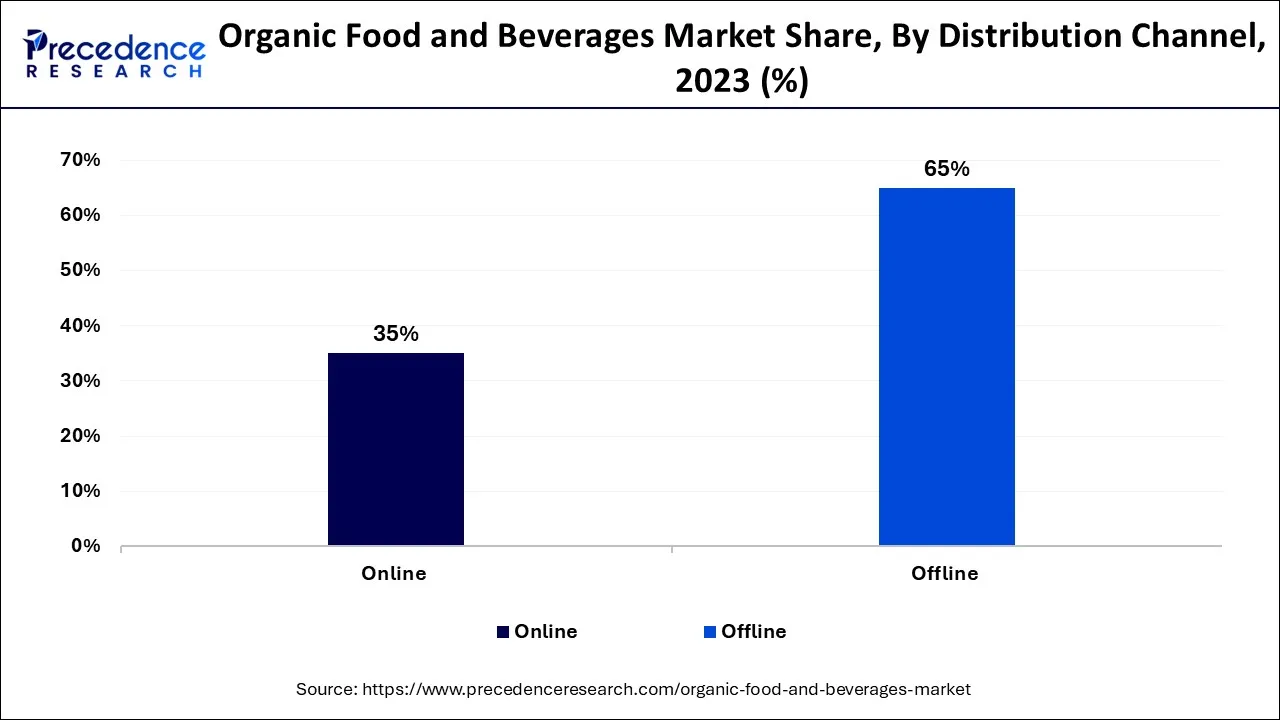

- By distribution channel, the offline segment has held the highest market share of 65% in 2025.

Market Overview

The increasing awareness regarding health among consumers and the awareness regarding the health benefits provided by the intake of organic foods and beverages will lead to growth in the market. The market for organic food and beverages shall grow during the forecast. The customers are aware of the environmental difficulties and also the risk which is associated with the consumption of inorganic or unclean chemicals. The toxic chemicals which are used for farming give negative consequences and therefore the demand for organic food and beverages is growing.

Due to the outbreak of the pandemic, developing, developed nations and underdeveloped nations across the globe had problems with the demand and supply chain. The pandemic has helped customers in recognizing and introspecting the ill effects of inorganic products. People are resorting to leading a healthier lifestyle and consuming products that are organic or made out of natural ingredients.

Organic Food and Beverages Market Growth Factors

There is a huge change in the lifestyle of the people and eating preferences of people. The governments of various nations are also organizing awareness campaigns to spread information regarding the benefits of organic foods and drinks. Major companies in various regions are making investments in order to produce the products internationally which would be organic. Consumers are seeking clean labels for the foods that they eat and the beverages that they drink. The prevailing illnesses like cancer, diabetes, cardiovascular diseases, or any other chronic diseases are going major factors for the customers to shift from inorganic products to more organic or natural products.

Key Factors Influencing Future Market Trends

- Environmental Sustainability Concerns:Environmental problems greatly influence people's decisions to buy organic food. With more concern about climate change, bad soil, and pollution, consumers are favoring brands that use eco-friendly ways to farm.

- Expanding Retail and E-Commerce Channel: The increase in organic offerings in stores and on the Internet is leading to faster market growth. The rise of easy online experiences, regular memberships, and targeted online advertising is leading more people to choose organic foods and driving their continued international growth.

- Government Regulations and Certifications:The organic market development largely depends on government policies and organic certifications. When products are made to strict rules and get certified, consumers can trust them.

- Advancements in Agricultural Technology:The benefit of using precision agriculture, natural pest management, and AI in farming is that farmers increase their food yields while still adhering to organic rules. The development of organic production helps encourage affordability and greater simplicity levels.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 320.43 Billion |

| Market Size in 2026 | USD 364.33 Billion |

| Market Size by 2035 | USD 1130.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.70% |

| Base Year | 2025 |

| Dominating Region | North America |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Product Insights

The vegetables and fruits segment has garnered a revenue share of around 41% in 2024. The fruits and vegetable sector has a great demand in developing as well as developed nations. European countries and North American countries are the largest consumers of organic foods. These nations are trendsetters in consuming organic fruits and vegetables. Just like vegetables and fruit, there is also a growth of 15% in the consumption of organic meat, poultry, and fish products. It would have the highest growth by the year 2030. Consumers are also very concerned about the additives and artificial preservatives that are added to the food and they shall doom in the coming years. Coffee & tea sales are expected to hit a CAGR of 13.44% from 2026 to 2035

Distribution Channel Insights

The offline distribution channel had a larger contribution of 65% in2024. Offline stores have a varied range of products. The branded, as well as domestic supermarkets and hypermarkets, also offer many organic foods and beverages. Other distribution channels are specialty stores, franchisee stores, etc. Purchasing organic foods and beverages is convenient when they are distributed through these channels. The offline stores are able to stock the popular brands that are rapidly growing in the market. The demand for the organic food and beverages market is continuously increasing through offline stores.

The online distribution channel is expected to grow at a CAGR of 14% during the forecast as there is the increased use of Internet services. There is Internet penetration in various regions and the companies are able to target the audience. These factors are responsible for increasing the sales of the organic food and beverages market. In the last two years, there has been an increase in sales and subscription boxes for organic produce. Due to the adoption of heart smartphones and the increasing use of the Internet post-pandemic, there has been a great increase in the purchase of organic foods and beverages through online stores.

Regional Insights

What Makes North America a Leader in the Organic Food & Beverages Industry?

There is strong consumer demand for organic food and beverages in North America, with increased consumer awareness and the ability to purchase organic foods and beverages easily. As health-conscious consumers seek clean label products, are concerned about food safety, and desire more healthy food options, the market for organic food and beverage products continues to grow.

U.S. Organic Food and Beverages Market Trends

As the largest market for organic food and beverages, the U.S. continues to lead the world in organic sales through strong organic consumption, a strong USFDA organic certification program, and the availability of organic products through a wide variety of retail and foodservice channels.

What Fuels Growth in the Asia-Pacific Region?

The Asia-Pacific is currently experiencing the fastest growth rate, thanks in part to higher disposable incomes, rapid urbanization, and an increase in health consciousness. There is a significant trend toward consumers purchasing food products without the use of chemicals or as minimally processed as possible due to concerns regarding food safety.The growth of organized retailing, e-commerce grocery delivery platforms, and government support of organic farming in developing nations will help to further encourage consumers to buy organic beverages, packaged foods, and fresh produce.

India Organic Food and Beverages Market Trends

India has been the leader in regional growth due to the growth of organic farming area, strong domestic consumer demand, and export-oriented production. The Indian government has implemented several initiatives aimed at encouraging sustainable agriculture practices, which, when combined with increasing urban consumer demand for organic staples, dairy alternatives, and beverages, will provide long-term upward momentum in the marketplace for these products.

Why is Organic Food and Beverages Momentum Strong in Europe?

Europe is the fastest-growing region globally due to a focus on sustainable consumerism. This growth is sustained by the consumption of ethically sourced, organic-certified products. Many of the European countries are committed to producing food in an environmentally sound manner and have reduced the application of pesticides. There is also a move toward greater transparency through labeling. As a result of the European commitment to sustainability, the organic dairy, bakery, and beverage segment is well-established amongst both mainstream grocery and specialty organic retailers.

Germany Organic Food and Beverages Market Trends

Germany is the top country in Europe with the largest percentage of consumers who trust organic labels and who purchase significantly more than in other countries. Sustainability policies implemented by the German government have significantly increased the number of organic products available in the marketplace and have created a well-established retail infrastructure within Germany that continues to support growth in a variety of food and beverage products.

What Drives Development in the Middle East and Africa?

With strong urbanization, increasing consciousness regarding health, and urges toward purchasing higher-quality food items throughout Africa and the Middle East, the rapid growth of both regions will be shaped by an increase in imported foods and organic products being part of their respective dietary patterns.

The UAE Organic Food and Beverages Market Trends

The United Arab Emirates, through its vast amounts of premium food imports and high density of specialty stores, as well as a strong culture of support for high-quality food safety regulations, will serve as the dominant country in terms of organic beverages, packaged foods, and fresh fruits and vegetables sales in the region.

Organic Food and Beverages Market Companies

- Hain Celestial

- Whole Foods Market L.P.

- THE HERSHEY COMPANY

- Amy's Kitchen, Inc.

- Organic Valley

- Conagra Brands, Inc.

- Nestlé

- Eden Foods

- SunOpta

- Dole Food Company, Inc

- Dairy Farmers of America, Inc.

- General Mills Inc.

- Danone

- United Natural Foods, Inc.

- Gujarat Cooperative Milk Marketing Federation (Amul)

Recent Developments

- In May 2025, Hewitt Foods USA, a subsidiary of Australian-based Hewitt Foods Pty Ltd, introduced a new brand, The Organic Meat Co., and its USDA-certified organic, grass-fed, and finished beef line. The new brand was developed to meet the increased consumer demand for organic meat and organic grass-fed beef.

- In February 2025, M2 Ingredients, a premier supplier of premium functional mushroom ingredients, announced that its new, state-of-the-art, 155,000 square foot facility is now operational. This growth is a significant milestone for the company and will allow M2 to respond to the unprecedented demand for its premium, organic, functional mushroom products while providing a level of service never seen in the industry.

- In October 2023, Dole Food Company, Inc. announced the launch of Dole Organics, a new division, and launched its 'GO Organic!' consumer brands at Fruit Attraction 2023 in Madrid, in October. Dole Organics is focused on jumpstarting the organic fresh produce category through cross-sector collaboration, streamlined supply chains, and the ongoing continuity and consistency of organic products.

- Sunopta which is a global pioneer in producing sustainable fruit and plant-based foods and beverages Launched OatGold TM in March 2020 it is a nutrient-rich powder that is used in the preparation of various products like bakery, savory snacks, and various spreads.

- Tyson Foods was acquired by General Mills Inc. It is an American multinational corporation and the second-largest processor and marketer of beef, pork, and chicken. The acquisition was done in order to reshape the portfolio and expand the business.

- Your heart, which is a top company in plant-based Pioneer was acquired by Dannon in February 2021. It has been done in order to expand the business and have different organic products in order to meet the demand of the customers.

- Amy's Kitchen launched gluten-free pizzas with vegetables in April 2020. They are made from organic sweet potato, broccoli, and cauliflower, and these pizzas are available in cheese and spinach varieties.

Segments Covered in the Report

By Product

- Organic Food

- Fruits & Vegetables

- Meat, Fish & Poultry

- Dairy Products

- Frozen & Processed Food

- Others

- Organic Beverages

- Non-dairy Beverages

- Coffee & Tea

- Beer & Wine

- Others

By Distribution Channel

- Offline

- Online

By Process

- Processed

- Unprocessed

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting