Maritime Surveillance Market Size and Forecast 2025 to 2034

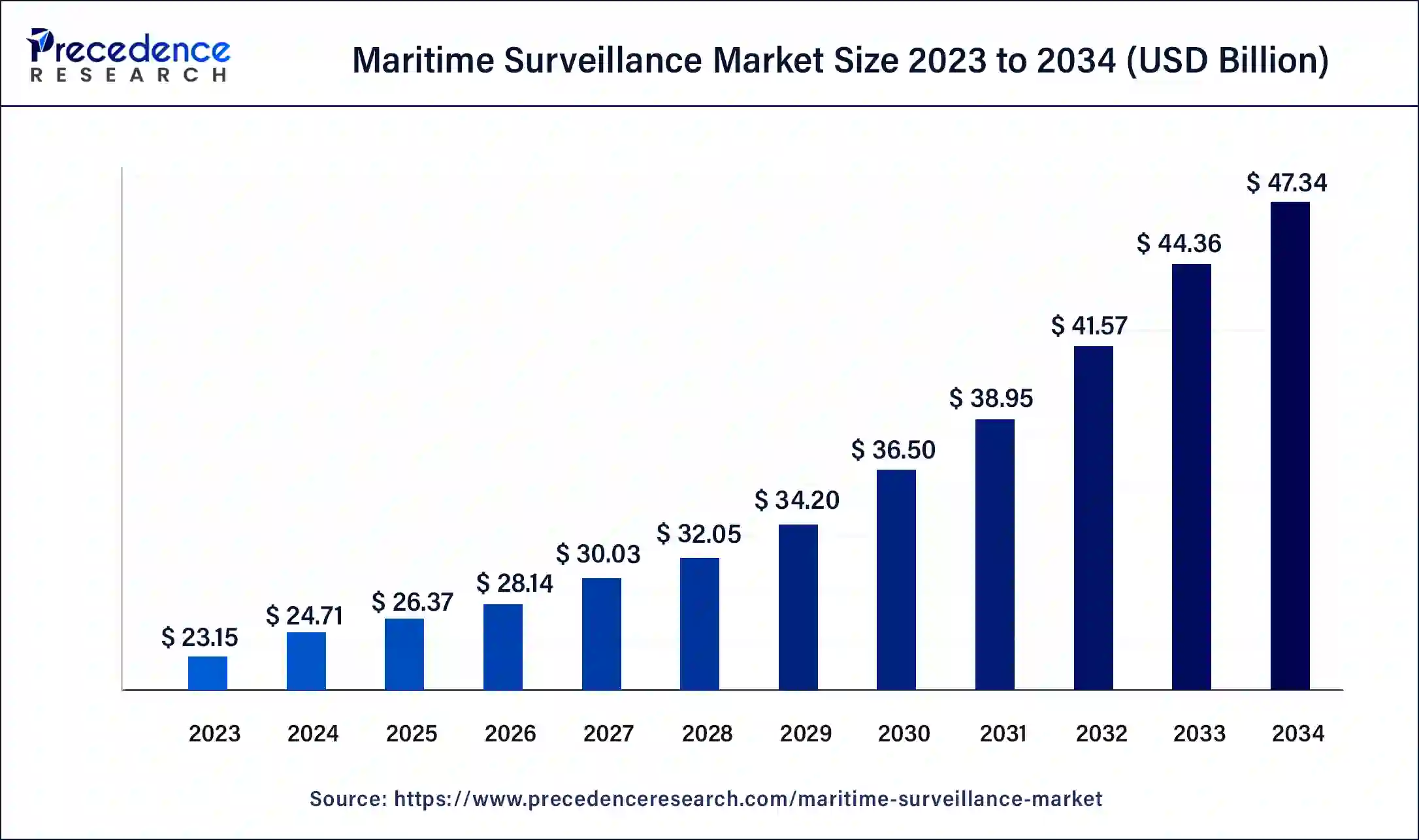

The global maritime surveillance market size is expected to be valued at USD 24.71 billion in 2024 and is anticipated to reach around USD 47.34 billion by 2034, expanding at a solid CAGR of 6.72% over the forecast period 2025 to 2034. The North America maritime surveillance market size reached USD 8.65 billion in 2024. The increasing need for national security is the key factor driving the maritime surveillance market growth.

Maritime Surveillance Market Key Takeaways

- The global maritime surveillance market was valued at USD 24.71 billion in 2024.

- It is projected to reach USD 47.34 billion by 2034.

- The maritime surveillance market is expected to grow at a CAGR of 6.72% from 2025 to 2034.

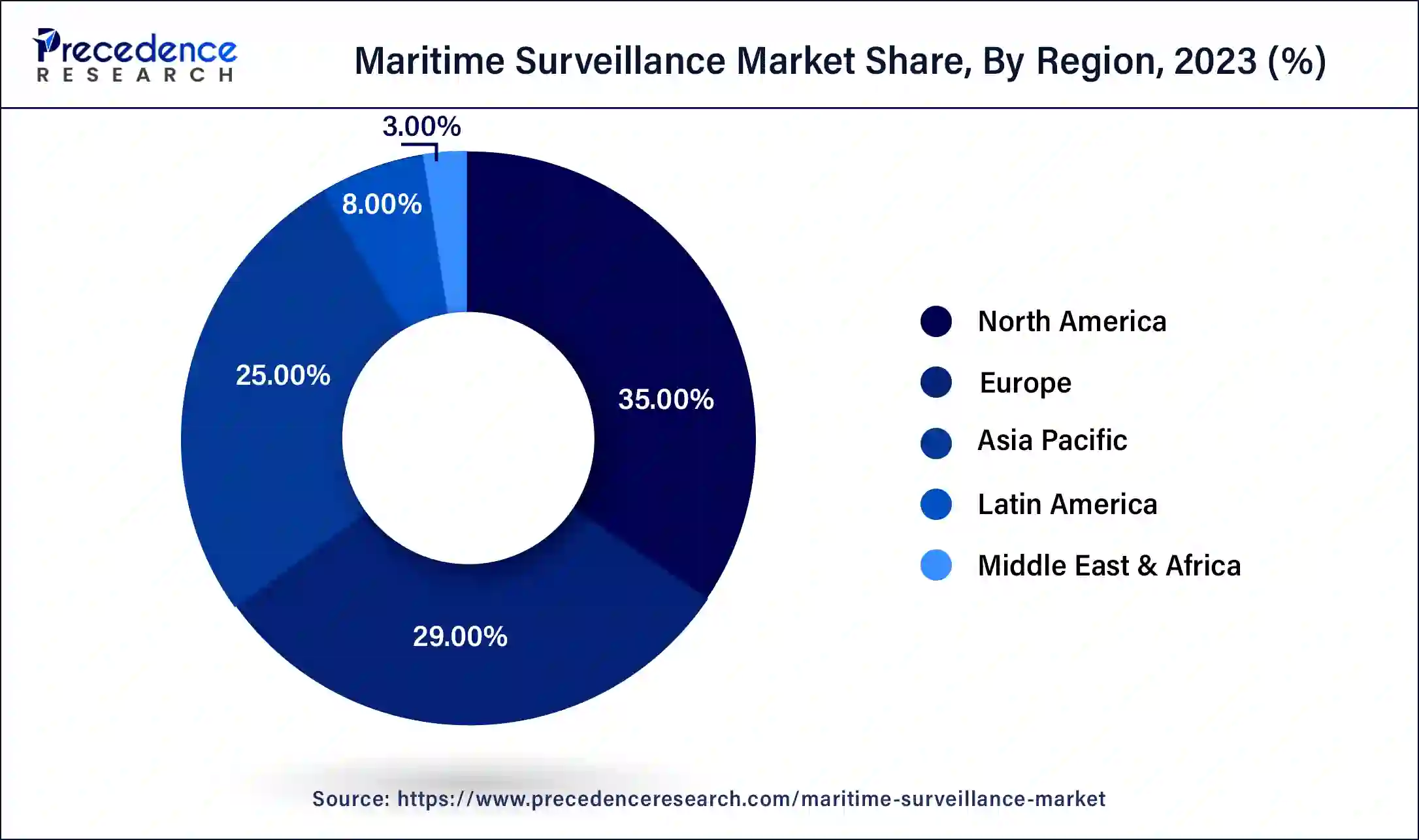

- North America dominated the maritime surveillance market with the largest market share of 35% in 2024.

- Asia Pacific will witness the fastest growth in the market over the forecast period.

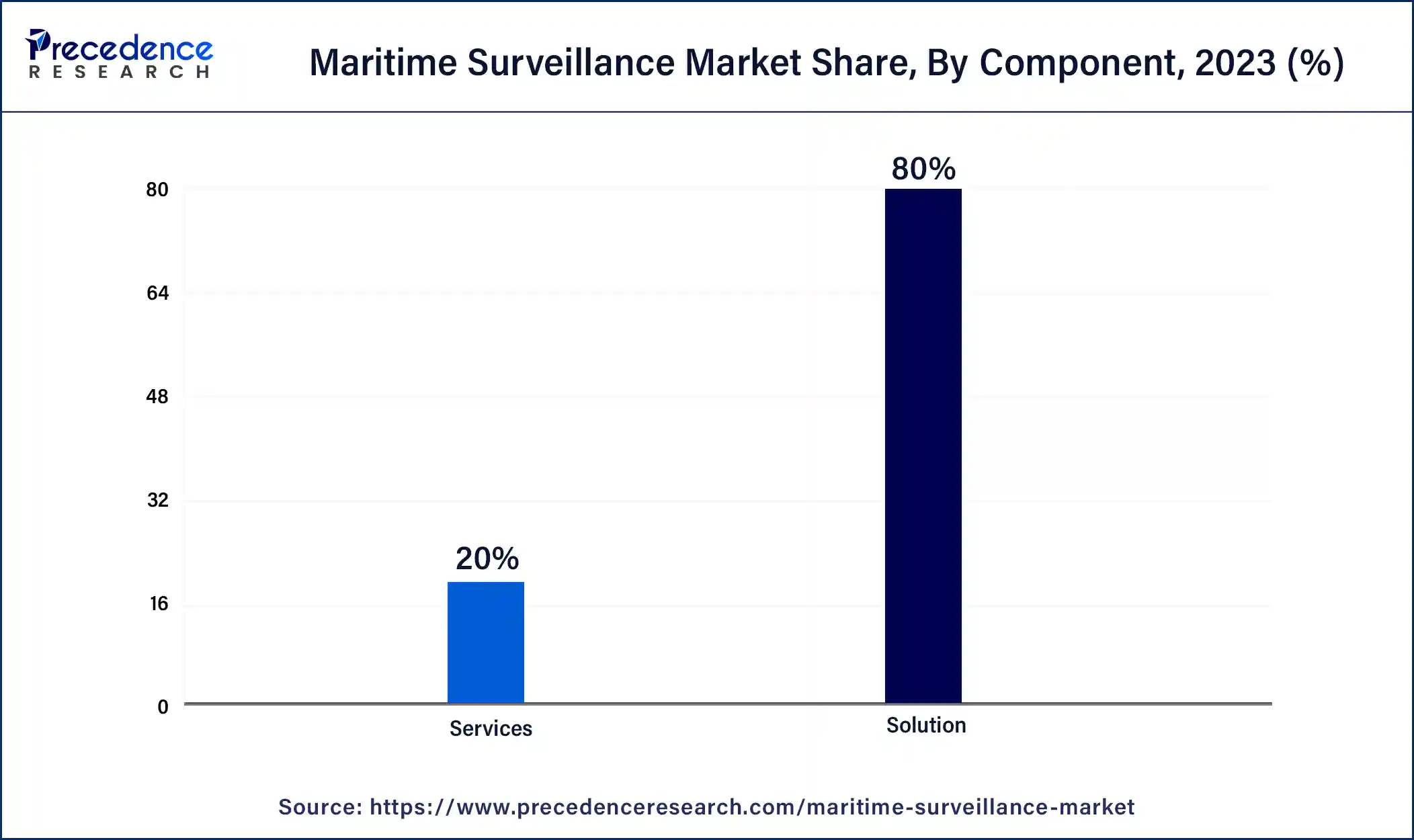

- By component, the solution segment contributed more than 80% of market share in 2024.

- By component, the services segment is expected to show the fastest growth in the market over the forecast period.

- By application, the surveillance & tracking segment led the global market in 2024.

- By application, the search & rescue segment is expected to show the fastest growth in the market over the studied period.

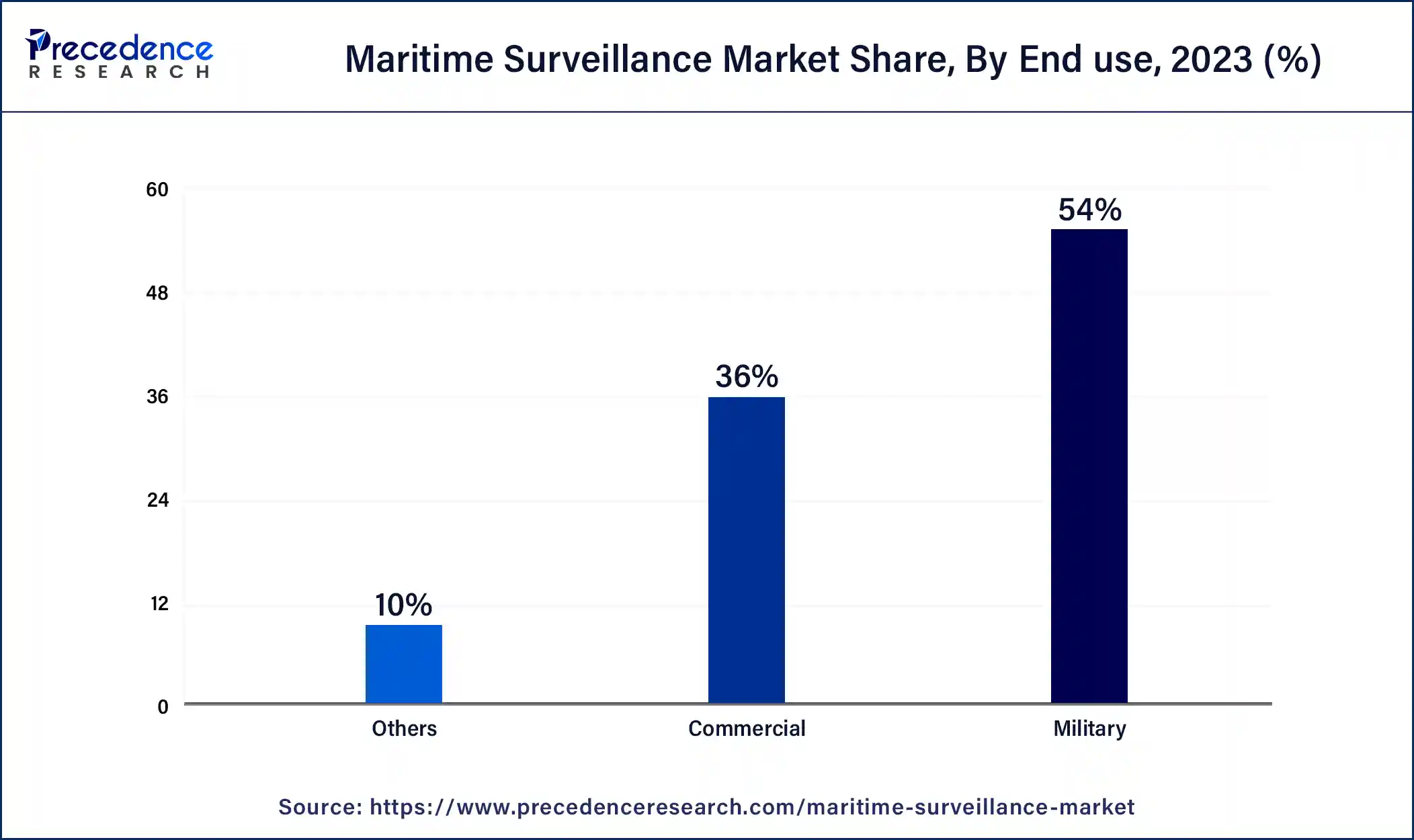

- By end use, the military segment generated the highest market share of 54% in 2024.

- By end use, the commercial segment is projected to grow significantly in the market during the forecast period.

Role of Artificial Intelligence in the Maritime Surveillance Market

In the maritime surveillance market, artificial intelligence (AI) plays an important role in improving naval forces' capabilities and defending maritime borders. Hence, AI-powered security systems are creating lucrative opportunities in the industry. Furthermore, AI transformed and bolstered the ability to perform surveillance and intelligence gathering. It enables AI to track, identify, and execute actions, which can further enhance maritime capabilities.

- In September 2024, Seadronix, a leading developer of AI and autonomous ship navigation solutions, announces the launch of its latest innovation, the NAVISS 2.0 True-AI Ship Navigation and Monitoring System, at the 2024 Maritime Fair. This enhanced version represents a significant leap forward in maritime situational awareness and safety.

U.S. Maritime Surveillance Market Size and Growth 2025 to 2034

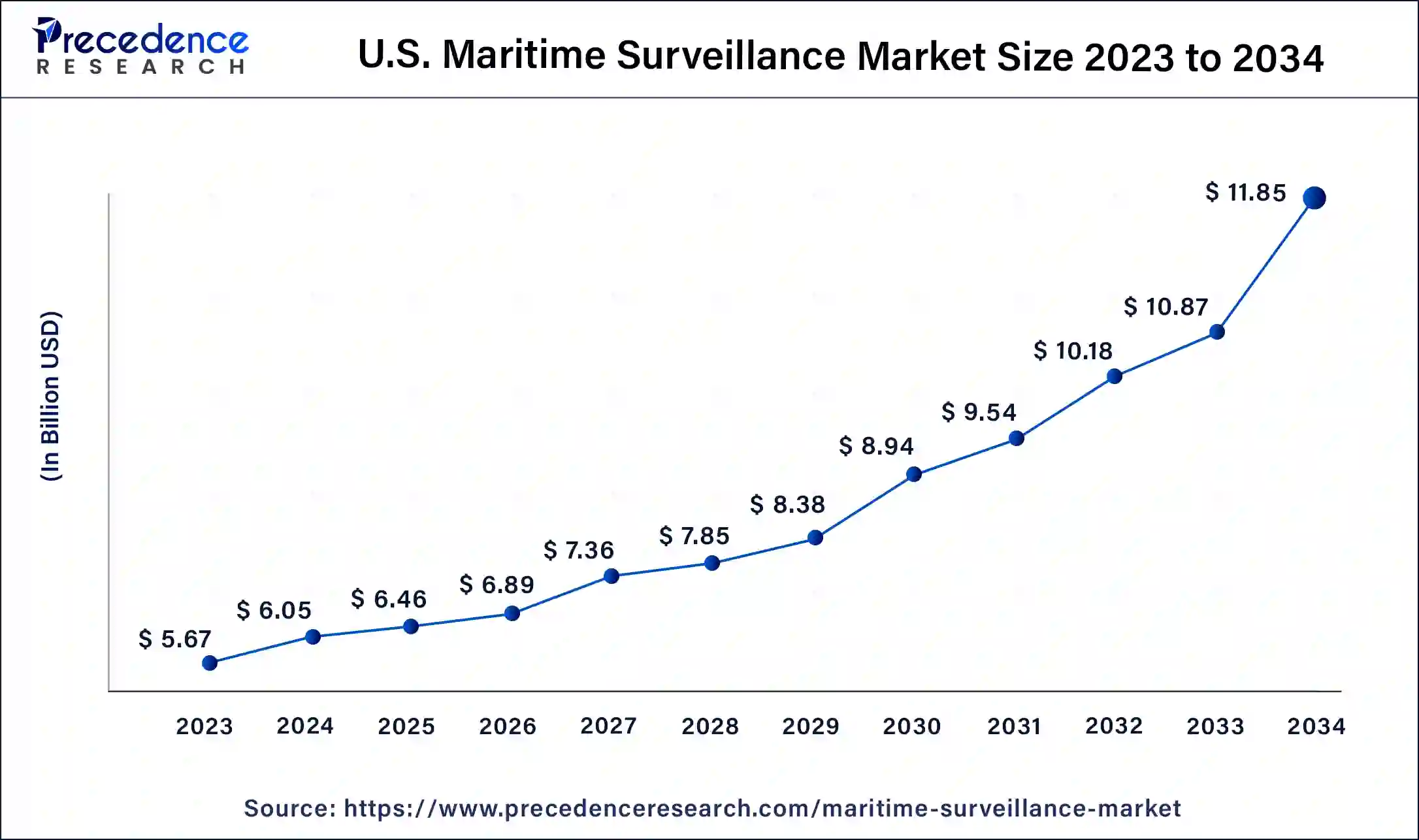

The U.S. maritime surveillance market size was exhibited at USD 6.05 billion in 2024 and is projected to be worth around USD 11.85 billion by 2034, poised to grow at a CAGR of 6.95% from 2025 to 2034.

North America dominated the maritime surveillance market in 2024. The dominance of the region can be linked to the increasing integration of surveillance systems with homeland security systems. In North America, the U.S. holds a major market share due to intuitive marine technology and the increasing demand for maritime security. Furthermore, the U.S. Coast Guard and Navy update their surveillance capabilities regularly.

- In February 2024, French maritime surveillance provider Unseenlabs planned to launch its 12th and 13th nanosatellite no earlier than March, passing the halfway mark for a constellation slated to begin tracking vessels in near real-time in 2025. its radio-frequency geolocation network of 11 satellites can currently monitor and track signals from ships across the world's oceans every four to six hours.

Asia Pacific will witness the fastest growth in the maritime surveillance market over the forecast period, driven by the region's extensive maritime boundaries and strategic importance coupled with the growing maritime trade activities. Moreover, Countries such as China, Japan, and India are investing largely in innovative surveillance technologies to protect their waters.

Market Overview

Maritime surveillance includes monitoring and observing maritime activities to ensure the security, effective management, and safety of seas and oceans. The maritime surveillance market encompasses a wide range of products, services, and solutions created for different stakeholders, including maritime authorities and governments. The process mainly includes tracking and detecting vessels, monitoring unethical activities such as piracy and smuggling, safeguarding navigation, and managing resources like fisheries.

Top 10 countries with the highest military expenditures in 2024

| Rank | Country | Spending (USD Billion) |

| 1. | United States | 905.5 |

| 2. | China | 407.9 |

| 3. | Russia | 294.6 |

| 4. | India | 73.6 |

| 5. | United Kingdom | 73.5 |

| 6.. | Saudi Arabia | 69.1 |

| 7. | Germany | 63.7 |

| 8. | France | 60.0 |

| 9. | Japan | 49.0 |

| 10. | South Korea | 43.8 |

Maritime Surveillance Market Growth Factors

- Increasing piracy and illegal activities are expected to propel market growth shortly.

- An increase in geopolitical tensions and territorial disputes.

- Innovations in technologies such as radar, sonar, and satellite imagery will likely help in the market expansion soon.

- The growing adoption of unmanned aerial vehicles (UAVs).

- Growing government investment in advanced surveillance systems to monitor and secure their coastlines can fuel the maritime surveillance market growth further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.34 Billion |

| Market Size in 2025 | USD 26.37 Billion |

| Market Size in 2024 | USD 24.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Expansion of maritime infrastructure

The ongoing modernization and expansion of maritime infrastructure globally is a crucial factor driving the growth of the maritime surveillance market. Additionally, there is an increasing need to protect this critical infrastructure against emerging threats. Investments in new terminals and economic zones that include advanced security technologies can help in the market expansion further along with the implementation of next-generation security solutions.

- In May 2024, NATO officially launched a new Maritime Centre for Security of Critical Undersea Infrastructure. The NATO Maritime Centre for Security of Critical Undersea Infrastructure (CUI) is a networking and knowledge center concentrating on CUI, which assists Commander MARCOM in making decisions, deploying forces, and coordinating action.

Restraint

Regulatory and compliance issues

The maritime surveillance market faces constraints regarding standardization of security protocols and regulatory compliance. Moreover, the regulatory environment generates a complex landscape for market players to navigate, which can potentially hamper the rapid deployment of innovative technologies and operational practices.

Opportunity

Clean energy and decarbonization

Rising shifts towards low-carbon fuels and technologies in the maritime surveillance market have introduced advanced security dynamics around the use of technology and fuel supply chains. Furthermore, the growing incorporation and utilization of 5G technology is anticipated to enhance communication capabilities in maritime operations for real-time data exchange and better coordination among operators.

- In July 2024, Latvian mobile communications and technology company LMT, in cooperation with the capital company of the Freeport of Riga Authority, provider of the port technical services SIA ‘LVR Flote,' conducted a maritime 5G demonstration in the port of Riga, providing a 5G connectivity solution after numerous tests and measurements.

Component Insights

The solution segment dominated the maritime surveillance market in 2024. The dominance of the segment can be attributed to the rising demand for integrated systems, including sensors, cameras, radars, and central control rooms. These comprehensive solutions also improve maritime security and situational awareness. As maritime activities continue to grow across the globe, the solution segment's dominance is anticipated to stay fueled by the increasing complexity of maritime threats and technological advancements.

The services segment is expected to show the fastest growth in the maritime surveillance market over the forecast period. The growth of the segment can be linked to the increasing need for system integration, maintenance, and data analysis. As maritime surveillance systems become more tedious, the requirement for skilled professionals to optimize and manage these systems is expected to propel substantially.

Application Insights

The surveillance & tracking segment led the global maritime surveillance market in 2024. This is due to the increasing need for continuous monitoring and safeguarding of maritime borders along with the growing incidence of maritime threats such as piracy, smuggling, etc. Furthermore, these systems enable real-time monitoring of suspicious activities and vessel movements, which can sustain the dominance of the segment throughout the projected period.

- In October 2023, Thuraya Telecommunications, the mobility arm of the UAE's flagship satellite solutions provider, Yahsat, announced the release of the CyLock-Satcom product, an industry-first IoT (Internet of Things) shipping tracking and monitoring product, CyLock, developed by Norway-based Cypod Solutions will use Thuraya's network to offer a wide range of tracking features that include real-time capabilities for precise location data, remote locking, and unlocking.

The search & rescue segment is expected to show the fastest growth in the maritime surveillance market over the studied period. This is because of the increasing volume of maritime traffic coupled with the increasing incidence of natural disasters and maritime disasters. Moreover, Innovations such as real-time tracking, automated distress signals, and AI-driven decision support systems are improving the efficiency and speed of search, boosting segment growth.

End-use Insights

The military segment dominated the global maritime surveillance market in 2024. The dominance of the segment can be credited to the increasing reliance of Military organizations on advanced surveillance technologies to secure strategic assets and monitor maritime borders. Additionally, The segment uses a wide range of sophisticated systems involving sonar, satellite imaging, and advanced radar systems.

The commercial segment is projected to grow significantly in the maritime surveillance market during the forecast period. This is because of key market players like port authorities, shipping companies, and offshore energy operators. They are increasingly adopting advanced surveillance technologies to protect their assets and ensure safe navigation. Rising maritime trade is also driving commercial players to adopt maritime surveillance solutions.

Maritime Surveillance Market Companies

- Indra Sistemas, SA

- Raytheon Technologies Corporation

- Saab AB; Elbit Systems Ltd.

- Bharat Electronics Limited

- Thales Group; Dassault Aviation SA

- Kongsberg Gruppen ASA

- Furuno Electric Co., Ltd.

- SRT Marine Systems plc.

Recent Developments

- In January 2024, PierSight, a provider of satellite-based surveillance for the maritime industry, raised USD 6 million in a seed funding round co-led by Elevation Capital and Alpha Wave Ventures.

- In April 2023, Honeywell announced the acquisition of Compressor Controls Corporation (CCC) for USD 670 million. CCC specializes in turbomachinery control and optimization solutions, which aligns with Honeywell's strategy to expand its automation and control systems, including applications in maritime environments.

- In June 2023, Harris Corporation completed its merger with L3 Technologies, forming L3Harris Technologies. The merger aims to create a more robust portfolio of maritime security solutions.

- In October 2023, Raytheon Anschutz GmbH Announced a new integrated bridge system for naval applications designed to improve navigation and operational efficiency for maritime vessels..

Segments Covered in the Reports

By Component

- Solution

- Services

By Application

- Surveillance & Tracking

- Navigation

- Maritime Traffic Management

- Search & Rescue

- Others

By End use

- Military

- Commercial

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content