What is the Maritime Safety System Market Size?

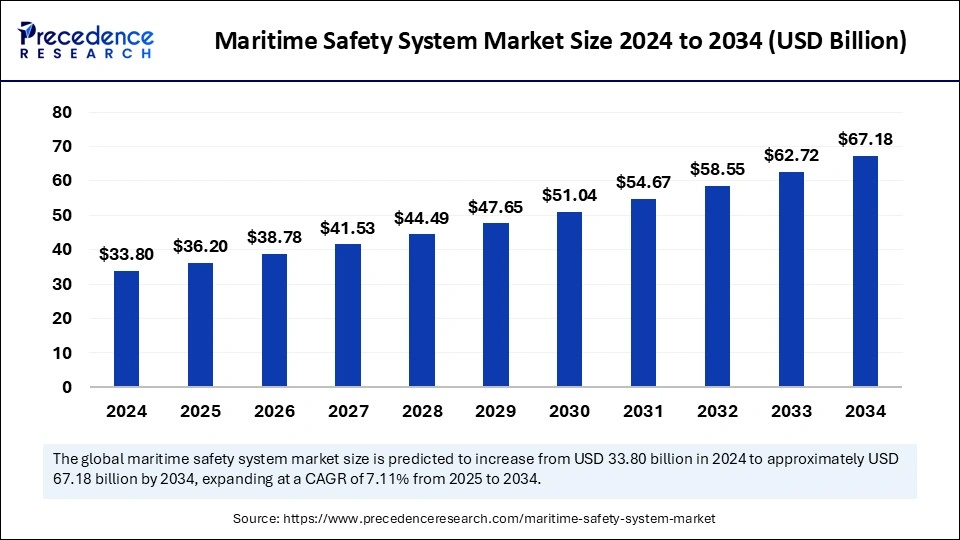

The global maritime safety system market size is calculated at USD 36.20 billion in 2025 and is predicted to increase from USD 38.78 billion in 2026 to approximately USD 67.18 billion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034.

Maritime Safety System Market Key Takeaways

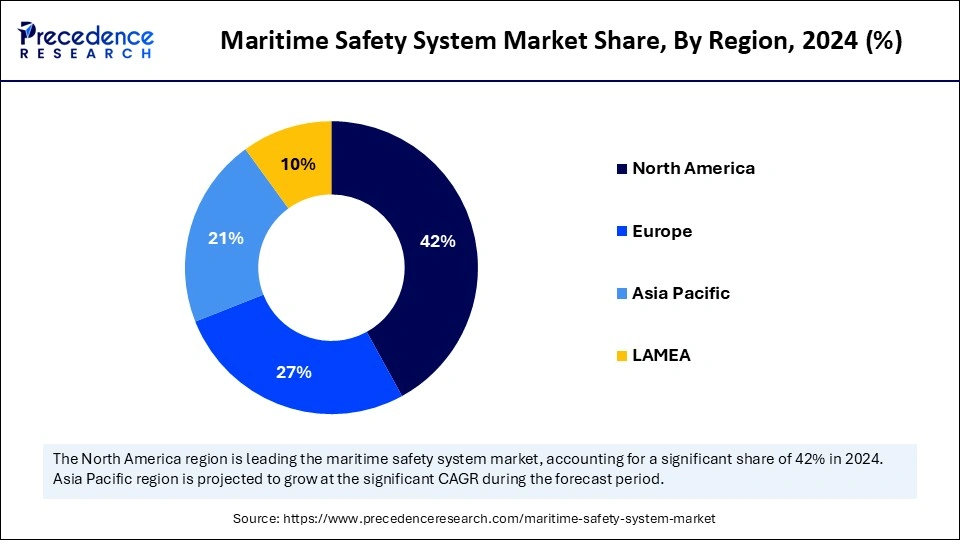

- North America dominated the market with the largest share of 42% in 2024.

- Europe is projected to witness the fastest growth in the coming years.

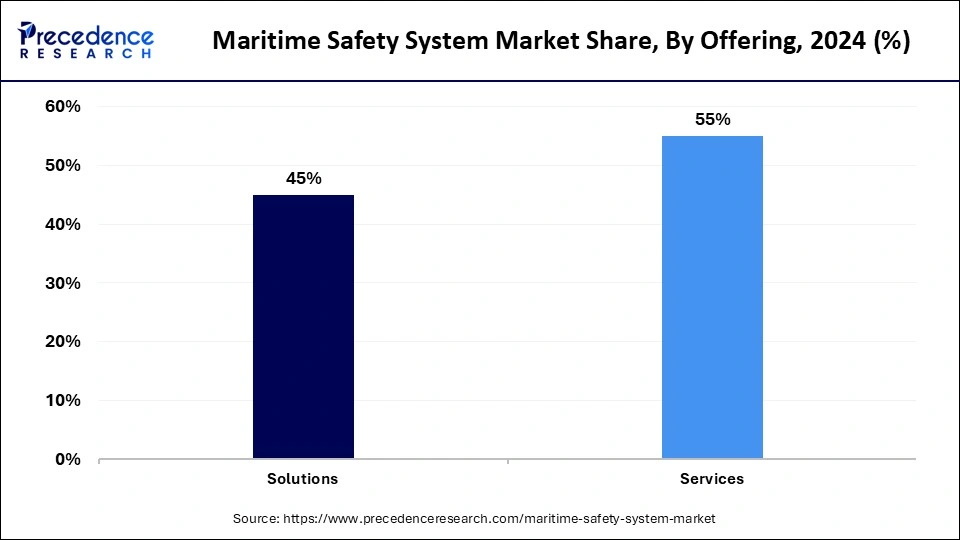

- By offering, the services segment accounted for the highest market share of 55% in 2024.

- By offering, the solutions segment is expected to be the fastest-growing segment throughout the forecast period.

- By security type, the port & critical infrastructure security segment registered dominance in the maritime safety system market in 2024.

- By system, the ship security reporting system segment dominated the market in 2024.

- By system, the automatic identification system (AIS) is expected to grow at a considerable rate over the studied period.

- By application, the monitoring & tracking segment led the market in 2024.

- By application, the security & safety segment is expected to grow rapidly during the projection period.

- By end-user, the marine & construction segment dominated the market in 2024.

- By end-user, the shipping & transportation segment is likely to grow at a notable rate in the upcoming period.

Market Overview

The maritime safety system market is expanding rapidly due to the growing concerns about piracy and terrorism. The maritime safety system ensures the safety and security of ships and crews. This system is mainly designed to prevent accidents underwater and protect against piracy. The rising marine trade activities further boost the growth of the market. The maritime sector plays a significant role in global trade, facilitating the movement of goods and resources worldwide. The maritime safety system ensures the safety of the supply of food, energy, and commodities. Stringent regulations regarding cargo safety and the growing need to protect marine ecosystems support market expansion. Regulatory bodies such as the International Maritime Organization (IMO), Global Maritime Distress and Safety System (GMDSS), and Safety of Life at Sea (SOLAS) have imposed several safety standards, influencing the market.

The maritime safety system market is evolving from standalone alarms and lifeboat gear to an integrated digital ecosystem that combines navigation, surveillance, communications, and emergency-response capabilities. Key drivers include stricter regulatory standards, increasing seaborne trade, offshore energy development, and the need to safeguard human lives and valuable assets from collision, grounding, piracy, and environmental hazards. Progressively, shore–ship data connections, sensor integration, and decision-support platforms enable earlier hazard detection and automated responses, while lifecycle services such as training, simulation, and maintenance generate ongoing revenue streams. Consequently, this market features hardware, software, analytics, and services working together to achieve measurable safety, compliance, and operational resilience outcomes.

Impact of Artificial Intelligence (AI) on the Maritime Safety System Market

The integration of artificial intelligence in maritime management has a significant impact, improving safety at sea security. Integrating AI algorithms in maritime safety systems analyzes large amounts of data from various sources to predict potential hazards. AI-driven maritime safety systems reduce human errors, which are a leading cause of maritime accidents. AI technologies are used to optimize shipping ways by analyzing data from various sources, like traffic, weather, and Global Positioning System (GPS) sensors. Moreover, AI analyzes sensor data from ship engines to identify the patterns that indicate when maintenance is needed, preventing unexpected breakdowns. AI is used to create autonomous ships that dock and navigate independently. AI significantly enhances maritime security by detecting malicious attacks and cyber threats.

Market Outlook

- Market Growth Overview: The maritime safety system market is growing steadily due to increasing global trade, rising focus on vessel security, and stricter regulations aimed at improving maritime situational awareness and emergency response. Advancements in technologies such as AIS, radar, satellite communication, and integrated surveillance solutions are further boosting adoption across commercial, defense, and offshore sectors.

- Investment Theme: Investors are targeting marine analytics platforms, satellite AIS augmentation services, autonomous surface vessel safety payloads, and integrated emergency response SaaS with subscription economics. Funding also targets ruggedized sensor manufacturing, certified training simulators, and regional service networks to shorten lead times in fast-growing ports. Insurers and classification societies may underwrite pilot deployments, accelerating the commercialization of validated safety technologies. Strategic M&A is likely, as large integrators acquire niche specialists to round out turnkey offerings.

- Sustainability Trend: The sustainability trend is reshaping the market by driving the adoption of eco-friendly technologies, such as energy-efficient navigation systems, low-emission vessels, and environmentally responsible emergency equipment. Companies are increasingly integrating sustainable materials, green power sources, and data-driven resource optimization to reduce environmental impact while maintaining safety and regulatory compliance.

Maritime Safety System Market Growth Factors

- The increasing use of autonomous and unmanned maritime surveillance vessels (USVs) is boosting the growth of the market. USVs reduce the risk of piracy and enhance security at sea.

- Increasing adoption of satellite-based monitoring systems, which help detect ships from satellite imagery and vessel traffic, drives the market's growth. This system provides immediate climate data, like wind direction, atmospheric pressure, speed of wind, and humidity levels, enhancing vessel safety.

- Rising development of innovative maritime safety platforms, such as E-navigation and L3Harris, to meet present and future shipping needs through harmonizing marine navigation systems and supporting shore services.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 67.18 Billion |

| Market Size in 2025 | USD 36.20 Billion |

| Market Size in 2026 | USD 38.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Security Type, System, Application, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Rising Government Investments

The significant increase in investments by governments to improve port infrastructure and maritime safety to reduce maritime threats and protect the maritime ecosystem is a major factor driving the growth of the maritime safety system market. Government investments in port modernization create a favorable environment for the adoption of maritime safety systems. In addition, the rising concerns about border security are driving the growth of the maritime safety market. With the growing concerns about border security, governments of various countries are providing grants and subsidies to encourage the adoption of innovative safety solutions at ports and coastlines.

- For instance, the Indian government has made significant strides in revitalizing the maritime. India's Sagarmala Program has 839 projects with a projected investment of ?5.8 lakh crore by 2035 for port modernization and connectivity. The program aims to optimize trade routes and improve maritime safety.

Restraint

Maritime Cybersecurity Challenges

Cybersecurity is a critical challenge in the maritime safety system, with increasing threats such as phishing, spear-phishing, malware, and ransomware attacks targeting ships and port infrastructure. Advanced maritime safety systems rely heavily on interconnected networks, creating cyberattack vulnerabilities. The lack of standardized protocols and interfaces further hinders interoperability and creates challenges for implementing safety systems.

Opportunity

Emerging Technologies

Ongoing technological advancements create immense opportunities in the maritime safety market. The emergence of innovative technologies, such as remote monitoring and tracking solutions, is improving maritime safety and security. Such innovations are enabling the real-time monitoring of vessels, reducing the risk of accidents. In addition, the Internet of Things and AI technologies are enabling the development of more sophisticated and effective maritime safety systems.

Segment Insights

Offering Insights

The services segment dominated the maritime safety system market with the largest share in 2024. This is mainly due to the increased demand for specialized expertise and support to upgrade safety systems. Service providers offer various services, including monitoring and management services, to streamline operations. This reduces the risk of accidents by detecting and mitigating risks at an early stage. Such services are important in ensuring seamless maritime operation.

On the other hand, the solutions segment is expected to expand at the fastest rate in the coming years. The growing focus on improving maritime safety is a major factor supporting segmental growth. Comprehensive solutions can streamline maritime operations by improving communication and reducing human errors. Advancements in technology lead to the development of sophisticated safety solutions, influencing the segment.

Security Type Insights

The port & critical infrastructure security segment led the market in 2024 as it protects against illicit operations and terrorism. This type of security provides a consistent, standardized approach to the maritime system by ensuring the safety of ships and ports. The rapid increase in ship traffic and trade activities further bolstered the segment's growth.

The coastal security segment is projected to grow at a considerable rate over the studied period. The segment growth is attributed to the increasing concerns about protecting coastal areas from threats like piracy and smuggling. Coastal security prevents smuggling activities, streamlining global trade.

System Insights

The ship security reporting system segment dominated the maritime safety system market in 2024. This system allows ships to navigate through the most vulnerable areas. This system ensures better maritime security. Ship reporting systems contribute to the safety of crews as well as passengers. The rise in suspicious activities and smuggling supported the segment's dominance.

The automatic identification system (AIS) is projected to grow at a considerable rate during the projected timeframe as it helps identify ships, assists in search and rescue operations, and simplifies information exchange. AIS provides major benefits in managing vessel traffic. It also helps with tracking vessels. It plays a crucial role in enhancing vessel safety.

Application Insights

The monitoring & tracking segment dominated the market in 2024 as it is crucial for enhancing fuel efficiency and complying with environmental regulations. Tracking and monitoring ships is important to ensure immediate help in times of any threats. Monitoring & Tracking systems enhance the safety and security of vessels as well as crew members. These systems allow vessel operators to track vessel movements in real-time, ensuring the safety of cargo.

The security & safety management segment is expected to grow rapidly during the projection period. The segment growth is attributed to the rising focus on risk management and safety protocols within the maritime industry. Security and safety management systems majorly focus on vessels' protection and their cargo from piracy and smuggling. They also help vessel operators identify and mitigate potential risks.

End-User Insights

The marine & construction segment dominated the maritime safety system market in 2024 due to stringent safety regulations for maritime construction activities. Maritime safety systems ensure the safety of workers during maritime construction. It is used to protect the ships and passengers aboard vessels and those working and living close to water bodies from the risk of injury or fatality and any hazardous situation during marine construction.

The shipping & transportation segment is expected to expand at a notable growth rate in the coming years. Maritime safety systems provide information about hazardous weather conditions, streamlining transportation and shipping operations. The rising trade activities further contribute to segmental growth.

Regional Insights

U.S. Maritime Safety System Market Size and Growth 2025 to 2034

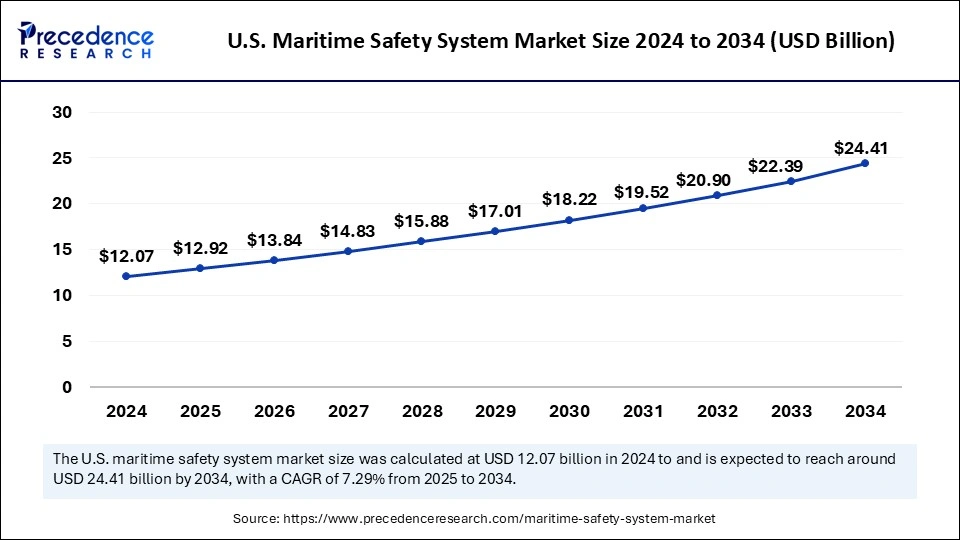

The U.S. maritime safety system market size is exhibited at USD 12.92 billion in 2025 and is projected to be worth around USD 24.41 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034.

Stringent Regulations Supported North America's Dominance

North America registered dominance in the maritime safety system market by capturing the largest share in 2024. This is mainly due to the robust regulatory frameworks that offer a strong foundation for improving the performance of the marine industry. Increased government investments in maritime security and safety further supported the region's market dominance. In addition, the region has a robust shipping industry with major ports and improved maritime infrastructure that contributes to market growth.

The U.S. and Canada play a key role in the North American maritime safety system market. The presence of major defense and shipping agencies in the U.S., such as the Defense Intelligence Agency (DIA), the National Security Agency (NSA), the National Geospatial-Intelligence Agency (NGA), the National Reconnaissance Office (NRO), UPS (United Parcel Service), FedEx, and USPS (United States Postal Service) contribute to the growth of the market. These countries also boast state-of-the-art marine infrastructure. The increasing focus on coastal security and the rising import & export activities further support market growth. Moreover, rising government funding to modernize port influence the market.

- For instance, in November 2023, the U.S. Department of Transportation's Maritime Administration (MARAD) announced over US$ 653 million to fund 41 port development projects across the country under the Port Infrastructure Development Program (PIDP).

Europe: The Fastest-Growing Region

Europe is expected to emerge as the fastest-growing region in the maritime safety system market due to the well-established shipping industry. The region has stringent maritime safety regulations. The European Maritime Safety Agency provides expertise to European countries to help enhance maritime safety and security. The U.K. is the world's leader in manufacturing and delivering smart shipping technologies. There is a strong emphasis on sustainable shipping practices, supporting market growth. In addition, Germany is the hub of around 130 shipyards. Rising marine engineering and shipbuilding further impacts the market.

Germany's shipbuilding and maritime-technology clusters incorporate robust safety subsystems, fire-suppression systems, and class-certified monitoring into high-value merchant and offshore vessels. Ports such as Hamburg invest in advanced VTS, digital port-twin platforms, and coordinated emergency services that connect municipal and federal agencies. German companies lead in engineering-approved retrofits and high-reliability lifecycle services for industrial fleets and offshore platforms. Close cooperation among shipyards, system integrators, and research centers speeds up the implementation of validated innovations into operational use. All these factors drive the market in Europe.

Asia Pacific Maritime Safety System Market Trends

Asia Pacific is projected to grow at a significant growth rate in the upcoming period. The rising government initiatives to enhance border and coastline safety are expected to drive market growth. The rapid expansion of the shipping industry further supports regional market growth. Moreover, increasing maritime trade activities boosts the demand for maritime safety systems to ensure the safety of cargo.

China is a major contributor to the Asia Pacific marine safety system market due to its expansive maritime industry, including commercial shipping, port operations, and offshore energy development. The country's heavy investments in modernizing ports, upgrading vessel fleets, and implementing advanced navigation and surveillance systems drive strong demand for marine safety solutions. Additionally, government regulations emphasizing maritime safety, environmental protection, and international compliance further reinforce China's leading position in the regional market.

What Potentiates the Maritime Safety System Market in the Middle East & Africa?

The market in the Middle East & Africa is driven by expanding offshore energy activities that require resilient maritime safety systems tailored to harsh environmental conditions. Gulf ports invest in integrated VTS, hydrocarbon-spill detection, and emergency response coordination to protect high-value cargo and energy infrastructure. Africa's port modernization programs are increasingly incorporating digital navigation aids, tug/pilot scheduling systems, and basic coastal surveillance to reduce costly delays and incidents.

The UAE is increasingly deploying advanced VTS, port security analytics, and integrated emergency response platforms at major terminals. Its sophisticated logistics and repair ecosystem enable rapid retrofitting, calibration, and certified training in line with international safety standards. Public-private collaboration supports drills, oil-spill preparedness, and multi-agency coordination in busy straits and terminals. The UAE also functions as a regional service hub for maritime safety equipment and consultancy.

Value Chain Analysis

- Component & Technology Suppliers

This stage includes providers of essential hardware, sensors, communication devices, radar systems, and navigation technologies that form the backbone of maritime safety systems. These components enable vessel tracking, collision avoidance, emergency signaling, and environmental monitoring.

Key Players: Raytheon Technologies, Furuno, Garmin, Honeywell, and Saab Group. - System Integration

System integrators design and assemble end-to-end maritime safety solutions that combine radar, AIS, VTS (Vessel Traffic Services), software platforms, and emergency response tools to create fully functional systems tailored for ports, offshore facilities, and fleets.

Key Players: Transas (Wärtsilä), Kongsberg Gruppen, Thales Group, Lockheed Martin, and Northrop Grumman. - Software & Platform Development

This stage focuses on developing software platforms for vessel monitoring, route optimization, emergency coordination, incident logging, and predictive analytics that enhance operational efficiency and maritime safety.

Key Players: ORBCOMM, Navis, StormGeo, Hexagon AB, and MarineTraffic. - Distribution & Logistics

Distributors, logistics partners, and authorized resellers manage the supply, delivery, and installation of maritime safety components and integrated systems across ports, shipping companies, and offshore facilities globally.

Key Players: Ingram Micro, WESCO Distribution, Anixter, and local maritime technology distributors.

Maritime Safety System Market Companies

- Honeywell (US)

- Thales Group (France)

- Smiths Group (UK)

- Elbit Systems (Israel)

- Northrop Grumman (US)

- Westminster Group (UK)

- Raytheon Anschutz (Germany)

- Saab Group (Sweden)

- OSI Maritime Systems (Canada)

- BAE Systems (UK)

Recent Developments

- In December 2024, Iridium Communications Inc. announced the launch of Iridium Certus GMDSS, a generational advancement in maritime satellite communication safety services. Iridium Certus GMDSS, the only truly global GMDSS service available, features safety voice, distress alert, and Maritime Safety Information (MSI) that includes extra regulated services like Long Range Identification and Tracking (LRIT) and Ship Security Alert System (SSAS), providing the fastest weather-resilient broadband service.

- In November 2024, ACUA Ocean, a small and medium enterprise (SME) based in Plymouth, UK, developed an unmanned surface vessel (USV) to provide a flexible platform capable of persistent surveillance and data collection in demanding sea conditions.

- In September 2023, the world leader in satellite-based maritime security, CLS, signed three major contracts with the governments of India, Sri Lanka, and Thailand to supply its advanced Maritime Awareness System (MAS), a unique real-time solution for detecting and surveillance challenges at sea.

Segments Covered in the Report

By Offering

- Solutions

- Services

By Security Type

- Port & Critical Infrastructure Security

- Coastal Security

- Vessel Security

- Crew Security

- Cargoes and Containers Safety

- Ship System and Equipment (SSE) Safety

- Others

By System

- Ship Security Reporting System

- Automatic Identification System (AIS)

- Global Maritime Distress Safety System (GMDSS)

- Long Range Tracking and Identification (LRIT) System

- Vessel Monitoring and Management System

- Others

By Application

- Loss Prevention & Detection

- Security & Safety Management

- Counter Piracy

- Monitoring & Tracking

- Environment Protection

- Search & Rescue

- Communication Management

- Others

By End-user

- Government & Defense

- Marine & Construction

- Oil & Gas

- Shipping & Transportation

- Shipping Companies

- Ship Crews

- Passengers & Cargo Owners

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting