What is the Pharmacovigilance and Drug Safety Software Market?

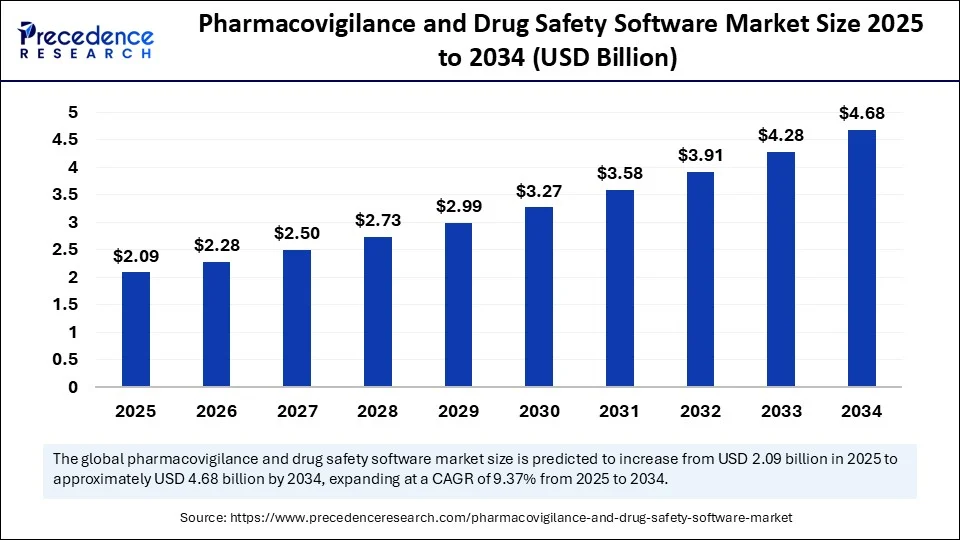

The global pharmacovigilance and drug safety software market size is calculated at USD 2.09 billion in 2025 and is predicted to increase from USD 2.28 billion in 2026 to approximately USD 5.06 billion by 2035, expanding at a CAGR of 9.24% from 2026 to 2035.

Pharmacovigilance and Drug Safety Software Market Key Takeaways

- In terms of revenue, the global pharmacovigilance and drug safety software market was valued at USD 2.09 billion in 2025.

- It is projected to reach USD 5.06 billion by 2035.

- The market is expected to grow at a CAGR of 9.21% from 2026 to 2035.

- North America dominated the global pharmacovigilance and drug safety software market with the largest share of 51.50% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2035.

- By software type, the adverse event reporting software segment contributed the biggest market share of 38.50% in 2025.

- By software type, the signal detection software segment is expected to grow at a significant CAGR over the projected period.

- By delivery mode, the on-premise segment captured the highest market share of 46.50% in 2024.

- By delivery mode, the cloud-based software segment is anticipated to grow at a significant CAGR from 2026 to 2035.

- By functionality, the case data entry and processing segment held the major market share of 333.50% in 2025.

- By functionality, the regulatory submission and signal management segment is expected to expand at a significant CAGR from 2026 to 2035.

- By end user, the pharma and biotech companies segment generated the largest market share of 54.50% in 2025.

- By end user, the regulatory agencies and CROs segment is expected to grow at the fastest CAGR between 2026 and 2035.

What is the Pharmacovigilance and Drug Safety Software Market?

The pharmacovigilance and drug safety software market comprises specialized digital platforms and tools used throughout the lifecycle of pharmaceutical and biological products to detect, assess, monitor, and prevent adverse drug reactions (ADRs) and other drug-related issues. These solutions streamline case intake, signal detection, regulatory reporting, data integration, and compliance, supporting manufacturers, regulators, and service providers in ensuring patient safety and meeting global pharmacovigilance standards (such as FDA, EMA, MHRA, PMDA, and WHO Uppsala Monitoring Centre guidelines). These systems are essential for enabling automated workflows, AI-driven signal analysis, real-time reporting, and integration with electronic health records (EHRs), safety databases, and spontaneous reporting systems. The market is growing rapidly due to rising ADR incidences, stringent regulations regarding drug safety, and increased adoption of automation in pharmacovigilance processes.

How is AI Impacting the Pharmacovigilance and Drug Safety Software Market?

Artificial intelligence is transforming the market for pharmacovigilance and drug safety software by improving signal detection, automating case processing, and providing predictive analytics for better patient outcomes. AI-powered tools can analyze vast datasets from sources like social media and electronic health records to detect potential adverse drug reactions more quickly and effectively than traditional methods. This leads to faster safety signal detection, improved risk assessment, and, ultimately, safer drugs. AI also facilitates predictive analytics and personalized safety assessments, contributing to better patient outcomes.

What are the Key Trends in the Pharmacovigilance and Drug Safety Software Market?

- Growing Pharmaceutical research and development Funding:Increased investment in pharmaceutical research and development leads to more drug approvals and, consequently, a greater demand for post-market surveillance. This is furthered by raising awareness about the importance of pharmacovigilance among healthcare professionals.

- Demand for Cloud-Based Solutions: The adoption of cloud-based solutions (SaaS) is expected to drive the growth of the on-demand software segment, offering scalability and cost-effectiveness of cloud-based PV software is also contributing to market growth.

- Adoption by Outsourcing Companies:Contract research organizations (CROs), business process outsourcing (BPO) firms, and other outsourcing firms are increasingly adopting PV software to handle the growing volume of drug safety data, further contributing to market growth.

- Stringent Regulatory Requirements:Stringent regulatory bodies like the FDA and EMA are intensifying safety regulations, increasing pressure on pharmaceutical companies to manufacture safe drugs and evaluate both pre- and post-market drug surveillance, driving the adoption of PV software.

- Technological Advancements:Innovations in areas like AI and ML are enhancing the accuracy and efficiency of drug safety assessments and data analysis within these software solutions, necessitating more robust monitoring and reporting systems.

Pharmacovigilance and Drug Safety Software Market Outlook

The market is expected to grow at a significant rate from 2025 to 2034 as pharmaceutical companies and regulators demand robust safety monitoring, adverse‑event reporting, and compliance tools to ensure patient safety and regulatory adherence.

The sustainability trend is reshaping the market by encouraging cloud-based, energy-efficient, and paperless solutions that reduce environmental impact while streamlining safety reporting. Additionally, companies are prioritizing platforms that optimize resource use, support long-term compliance, and integrate sustainable IT practices across drug safety operations.

The market is growing worldwide due to increasing regulatory requirements, expanding drug pipelines, and the rising need for real-time monitoring of adverse events to ensure patient safety. Emerging regions offer significant opportunities as expanding pharmaceutical industries, improving healthcare infrastructure, and growing adoption of digital health technologies drive demand for efficient, cloud-based, and scalable drug safety solutions.

Major investors in the market include pharmaceutical companies, healthcare IT firms, and venture capitalists who fund the development of advanced, compliant, and cloud-based safety platforms. Their investments drive innovation, expand software capabilities, and enable global adoption of efficient systems for adverse-event reporting, risk management, and regulatory compliance.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 5.06 Billion |

| Market Size in 2025 | USD 2.09 Billion |

| Market Size in 2026 | USD 2.28 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Software Type, Delivery Mode, Functionality, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Occurrence of Adverse Drug Reactions (ADRs)

A key driver in the pharmacovigilance and drug safety software market is the rising occurrence of adverse drug reactions (ADRs). This increase, observed in both clinical trials and post-market surveillance, calls for robust systems for detection, evaluation, and management. Increased awareness of drug safety and stringent regulatory standards drive the demand for advanced software solutions to manage and reduce adverse effects caused by drugs. Regulatory agencies, such as the FDA and EMA, are imposing strict guidelines, prompting companies to adopt more sophisticated software to ensure compliance. Additionally, the growing use of pharmacovigilance and drug safety software by outsourcing firms such as CROs and CMOs further propels market growth, as these entities handle large data volumes and require efficient systems.

Restraint

High Cost of Implementation and Maintenance

The primary restraint in this market is the high cost of implementation and maintenance, especially for small and medium-sized enterprises. This includes expenses related to software licenses, infrastructure, and ongoing support. Integrating new pharmacovigilance systems with existing IT infrastructure can be complex and costly, particularly for organizations with legacy systems. Maintaining these systems requires specialized personnel and continual updates to meet evolving regulations, which can impose a significant financial burden on smaller businesses. Moreover, linking pharmacovigilance software with other healthcare IT systems, such as EHRs and LIMS, can be challenging, requiring extensive customization that adds to costs and complexity.

Opportunity

Integration of Advanced Technologies

A significant opportunity for the pharmacovigilance and drug safety software market lies in the integration of advanced technologies, such as AI and ML. This trend is driven by the need for more efficient and precise data analysis in pharmacovigilance, especially for identifying adverse drug reactions and ensuring regulatory compliance. These technologies are integrated into pharmacovigilance software to automate tasks such as adverse event reporting, analyzing large datasets, and predicting potential safety signals. This accelerates the detection of safety issues and streamlines decision-making, enabling the identification of previously unknown safety concerns and enhancing drug safety monitoring. Moreover, expanding pharmacovigilance practices in emerging markets with a growing pharmaceutical industry presents new growth opportunities.

Pharmacovigilance and Drug Safety Software Market Segment Insights

Software Type Insights

The adverse event reporting software segment dominated the market with the largest share of 38.50% in 2024. This dominance is mainly attributed to its vital role in regulatory compliance and data management, ensuring data collection, handling, and reporting align with global standards like those from the FDA and WHO. This software provides a centralized platform for capturing, storing, and managing large volumes of adverse event data, including both structured and unstructured data, such as case reports, medical literature, and social media information. It simplifies reporting processes, making them more efficient and less prone to errors while accommodating the growing volume of data from clinical trials and post-market surveillance.

- In August 2025, as part of 'Digital India', the Hon'ble Minister of Health & Family Welfare and Minister of Chemicals and Fertilizers, Shri J.P. Nadda launched an online indigenously developed ADRMS software of the Pharmacovigilance Programme of India (PvPI) during the 1st Policy Makers Forum meeting held at Dr. Ambedkar International Centre, New Delhi. This software facilitates adverse event reporting related to medicines and medical devices, streamlines reporting by patients, caregivers, and healthcare providers, and empowers Indian pharmaceutical companies to report adverse events directly through a User Gateway.

(Source: https://ipc.gov.in)

The signal detection software segment is expected to grow at the fastest CAGR during the forecast period. This is mainly because of its critical role in proactively identifying potential safety risks, especially as drug development becomes more complex and regulations become more stringent. This software relies on analyzing large datasets from adverse event reports, clinical trial data, and real-world evidence, necessitating advanced analytical tools. It focuses on early detection of potential ADRs, allowing pharmaceutical firms and regulators to act swiftly to reduce risks and improve patient safety.

Delivery Mode Insights

The on-premise segment dominated the market while holding the largest share of 46.50% in 2025. The segment's dominance stems from increased concerns over data privacy and security and performance requirements. On-premises software offers greater control and security over sensitive data, which is especially important in the highly regulated pharmaceutical industry. This delivery method allows for extensive customization, integration with existing systems, and data sovereignty, features highly valued by large pharmaceutical firms handling complex IT environments. On-premises software allows for extensive customization and seamless integration with other existing systems, ensuring continuous access to critical pharmacovigilance data.

The cloud-based segment is expected to grow at the fastest rate during the projection period due to its enhanced collaboration, scalability, cost-effectiveness, and accessibility. Cloud-based software solutions support seamless data sharing, integration, and collaboration across different locations and organizations, which are crucial for meeting global regulatory standards. They enable data integration from diverse sources like EHRs, social media, and wearable devices, allowing comprehensive analysis and quicker detection of signals. Cloud-based systems can be accessed from anywhere with internet access, supporting real-time collaboration and data accessibility for remote or geographically dispersed teams. Furthermore, the shift toward cloud-based solutions is driven by the need for scalability, real-time data access, and cost savings. Cloud solutions enable remote data access and simplify collaboration among different teams.

Functionality Insights

The case data entry and processing segment captured the largest market share of 33.50% in 2025, owing to its vital role in ensuring accurate and efficient management of adverse drug reactions and other safety reports, which are essential for regulatory compliance. The ability to accurately collect, track, and manage safety data is critical, as errors in data can lead to incorrect analysis, delayed corrective actions, and potentially serious patient safety consequences. Case data entry and processing ensure data integrity and reliability, helping in decision-making related to drug safety. The increasing number of reported ADRs and increasing drug development ensure the long-term growth of the segment.

The regulatory submission & signal management segment is likely to grow at a rapid pace in the upcoming period, driven by increased regulatory stringency, a rise in new drug approvals, and the need for efficient data management and analysis. Regulatory submission and signal management are crucial in pharmacovigilance, which ensures drug safety. This segment focuses on streamlining the reporting of ADRs and managing potential safety signals for regulatory bodies, ensuring compliance and patient safety. Advanced pharmacovigilance software uses signal detection algorithms to identify possible safety signals, such as patterns of ADRs from large datasets of ICSRs, enabling early intervention to mitigate risks based on event severity and regional regulatory requirements.

End User Insights

The pharma and biotech companies segment led the market with a major revenue share of 54.50% in 2025, driven by an increased drug pipeline. As these companies are ultimately responsible for the safety and efficacy of the drugs they develop and market, regulations worldwide mandate robust pharmacovigilance systems. The necessity to comply with strict regulations, manage clinical trials, and ensure patient safety accelerates cloud solution adoption. These companies increasingly leverage AI-powered analytics, real-time safety monitoring, and cloud platforms to enhance their pharmacovigilance processes.

The regulatory agencies and CROs segment is expected to experience the fastest growth in the market, primarily due to the increasing trend of outsourcing drug development and quality assurance activities and the demand for regulatory compliance. CROs are fueling this growth as pharmaceutical companies rely on them for clinical trial management and adverse event reporting, seeking cost-effective and flexible solutions for managing complex data and regulatory requirements. Regulatory agencies require robust software tools to monitor drug safety and ensure compliance with evolving regulations.

Pharmacovigilance and Drug Safety Software Market Regional Insights

The U.S. pharmacovigilance and drug safety software market size is exhibited at USD 753.45 million in 2025 and is projected to be worth around USD 1862.19 million by 2035, growing at a CAGR of 9.47% from 2026 to 2035.

North America dominated the market while holding the largest share of 51.50% in 2025. This is primarily due to its well-establishedpharmaceutical industry, strict regulatory environment, and focus on technological innovation. The region is home to prominent global pharmaceutical and biotech companies. Significant R&D investments and increased development of novel drugs bolstered the market in the region. There is a high adoption rate of AI and cloud-based software, which contributes to market growth. Moreover, there is a high volume of clinical trials, boosting the demand for robust pharmacovigilance systems and drug safety software. The U.S. FDA has established rigorous regulations for drug safety and pharmacovigilance, driving the adoption of specialized software.

The U.S. plays a pivotal role in the market within North America due to its robust pharmaceutical industry, a strong regulatory framework, and an advanced IT infrastructure. It is a leading market for pharmacovigilance software, with a growing demand for solutions that ensure drug safety and compliance. Initiatives like OpenFDA and Mini-Sentinel showcase the U.S.'s commitment to leveraging technology for enhanced drug safety monitoring. Government initiatives like the Risk Evaluation and Mitigation Strategies (REMS) program further support regional market growth.

- In May 2025, the U.S. FDA's REMS program mandated certain drug manufacturers to manage serious risks with their medications, often using specialized software to track adverse events. This is required for drugs with significant safety concerns to ensure their benefits outweigh their risks. While safety labeling is provided for all medications, only some require REMS.

(Source: https://www.fda.gov)

Asia Pacific is expected to experience the fastest growth in the market. This is due to the rapidly expanding pharmaceutical industry, increasing healthcare spending, and a surge in the number of clinical trials. As the region has become a hub for clinical trials, countries like South Korea, Taiwan, Singapore, and China are attracting global clinical trials because of factors like faster recruitment times and lower costs. The regional market growth is further driven by government initiatives promoting digital health and the adoption of advanced technologies like AI in drug safety research. Rising government investment in drug development and a greater need for robust pharmacovigilance systems are likely to support market growth.

China plays a major role in the market, especially due to its large pharmaceutical industry and evolving regulatory landscape. The country is actively working to standardize and improve its pharmacovigilance system, including implementing Good Pharmacovigilance Practices (GVP) to ensure drug safety and promote public health. China is a major player in the global pharmaceutical industry. The country is seeking to improve its pharmacovigilance practices for traditional Chinese medicine, supporting market expansion.

Europe is considered a notable region in the market. The growth of the market within Europe is driven by its strong regulatory framework and focus on patient safety. Recent developments include integrating AI and cloud-based solutions for real-time monitoring and utilizing real-world evidence (RWE) to support regulatory decisions. Additionally, Europe emphasizes patient safety and the safe use of medicines throughout their lifecycle. This focus increases demand for advanced pharmacovigilance and drug safety software capable of identifying, assessing, and preventing adverse drug reactions through real-time adverse event monitoring and quicker responses to safety signals.

Latin America is projected to experience significant growth in the foreseeable future. This is mainly due to the increased investments in healthcare modernization, rising awareness of drug safety, and growing government backing for improved patient care. Countries like Brazil, Mexico, and Argentina have imposed stringent regulations regarding drug safety, which boosts the demand for pharmacovigilance systems and drug safety software. Furthermore, national regulatory agencies such as ANVISA in Brazil, COFEPRIS in Mexico, and INVIMA in Colombia have mandated post-market drug safety monitoring, encouraging the adoption of pharmacovigilance software.

The market within the Middle East & Africa is expected to grow at a steady rate due to heightened regulatory oversight, rising prevalence of chronic diseases, and an expanding pharmaceutical industry. The growth of the pharmaceutical and biotechnology sectors in the MEA region, along with increased clinical trial activity, further fuels demand for advanced pharmacovigilance tools. Several initiatives, like the Middle East Regulatory Network (MERN) working with the Saudi Food and Drug Authority (SFDA), are also contributing to market expansion by focusing on developing regulatory practices for drug development and safety.

Pharmacovigilance and Drug Safety Software Market Value Chain Analysis

At this stage, safety data is captured during preclinical and clinical trials to monitor potential adverse effects of new drugs. Efficient pharmacovigilance software ensures accurate data collection, real-time reporting, and compliance with regulatory standards from the outset of drug development.

Key Players: Oracle Health Sciences, Veeva Systems, ArisGlobal

Spontaneous and solicited reports from patients, healthcare providers, and literature are gathered, validated, and recorded in this stage. Software solutions streamline case intake, minimize errors, and maintain a centralized repository for safety data.

Key Players: IQVIA, Ennov, EXTEDO

This stage involves processing reported cases, assessing causality, assigning severity, and ensuring completeness before submission. Automation and workflow management in software enhance efficiency, reduce manual errors, and improve regulatory compliance.

Key Players:ArisGlobal, Veeva Systems, Oracle Health Sciences

Data is analyzed to detect potential safety signals and evaluate drug-related risks. Advanced analytics, AI, and machine learning enable early identification of safety issues, supporting proactive risk management and mitigation.

Key Players: ArisGlobal, Oracle Health Sciences, IQVIA

Pharmacovigilance and Drug Safety Software Market Companies

It offers Argus Safety for comprehensive adverse event management, regulatory reporting, and AI-assisted intake, supporting global drug safety operations.

One of the services offered by ArisGlobal is LifeSphere Safety, which features AI-powered touchless case processing, real-time signal detection, and global compliance within cloud-based safety workflows.

Vault Safety is one of Veeva's products that unify case management, analytics, and compliance within a cloud-native platform supporting integrated global pharmacovigilance operations.

Other Major Key Players

- IQVIA

- AB Cube

- Ennov

- Extedo

- Sparta Systems (a Honeywell company)

- Sarjen Systems

- Max Application

- TCS ADD Safety (Tata Consultancy Services)

- Indegene

- Foresight Group International

- Navitas Life Sciences

- Bioclinica (now part of Clario)

- Online Business Applications Inc. (Argus safety partner)

- Medidata Solutions (Dassault Systemes)

- Polaris Group

- RxLogix

- Cognizant (PV technology services)

Recent Developments

- In March 2025, Tech Mahindra entered into a partnership with NVIDIA to launch an AI-powered pharmacovigilance solution to enhance drug safety monitoring and streamline pharmaceutical data management. This solution delivers 40% faster turnaround times for ADR case handling, 30% improvement in data accuracy, and 25% reduction in operational costs.

(Source: https://www.btabloid.com) - In December 2024, PubHive Ltd. announced the launch of its Advanced Pharmacovigilance Services to revolutionize drug safety and compliance. This new offering helps organizations meet the increasing regulatory demands of global health authorities while streamlining their pharmacovigilance operations.

(Source: https://pubhive.com) - In September 2025, the IPC launched the 5th National Pharmacovigilance Week from September 17th to 23rd at Bharat Mandapam, New Delhi, under the theme "Your Safety, Just a Click Away: Report to PvPI", promoting ADR reporting through digital platforms.

(Source: https://www.pib.gov.in)

Segments Covered in the Report

By Software Type

- Adverse Event Reporting Software

- Drug Safety Data Management Software

- Signal Detection Software

- Risk Management Software

- Regulatory Compliance Software

- Electronic Data Capture (EDC) & Analytics Integration Tools

By Delivery Mode

- On-Premise Software

- Cloud-Based Software

- Web-Based Software

By Functionality

- Case Data Entry & Processing

- Signal Detection & Management

- Benefit-Risk Evaluation

- Submission to Regulatory Authorities

- Data Integration (EHR, EDC, CRO)

- Analytics & Dashboards

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Regulatory Agencies

- Business Process Outsourcing (BPO) Firms

- Hospitals & Healthcare Providers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting