What is the Homeland Security Market Size?

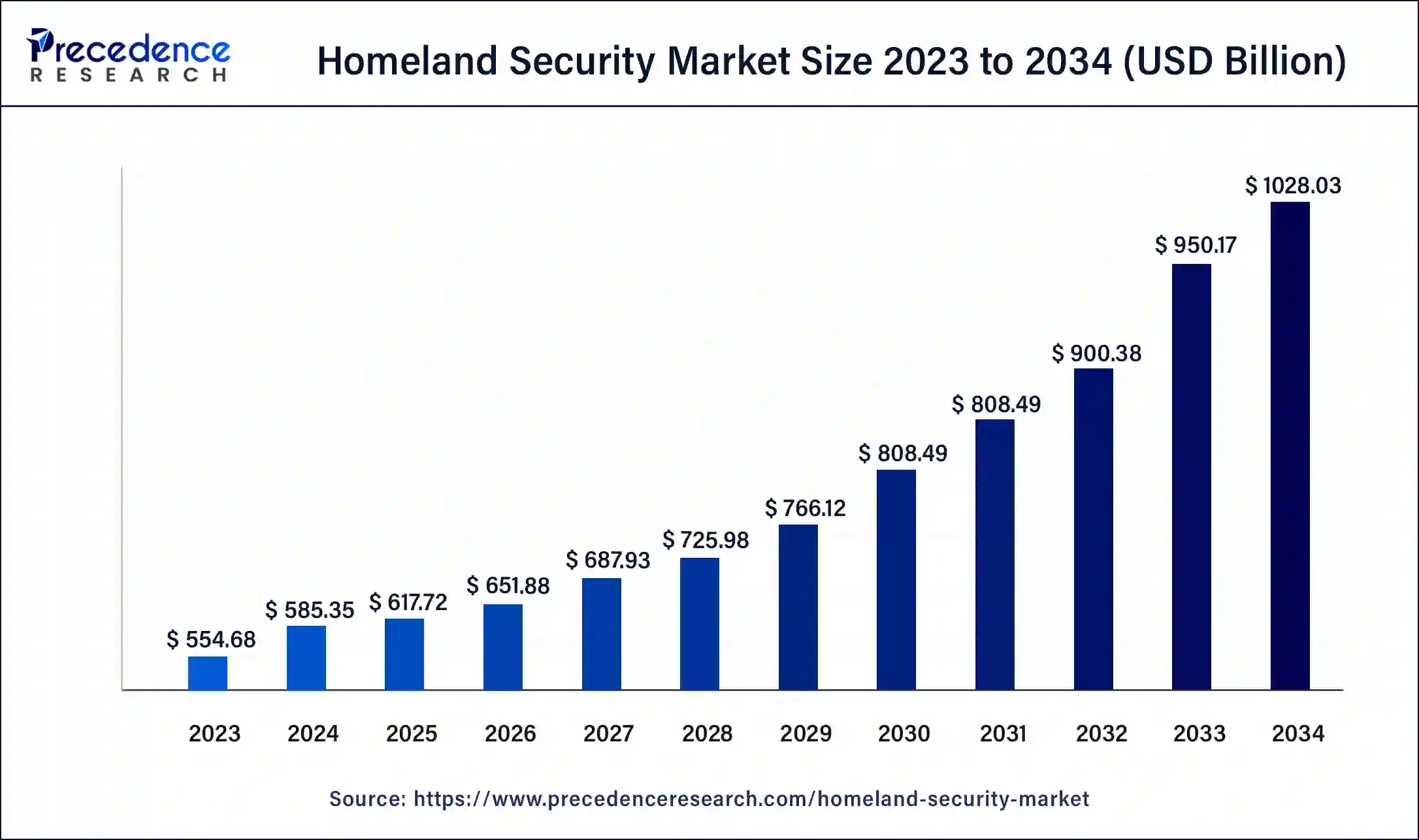

The global homeland security market size is calculated at USD 619.26 billion in 2025 and is predicted to increase from USD 655.14 billion in 2026 to approximately USD 1082.27 billion by 2035, expanding at a CAGR of 5.74% from 2026 to 2035.

Homeland Security Market Key Takeaways

- In terms of revenue, the homeland security market is valued at USD 617.72 billion in 2025.

- It is projected to reach USD 1082.27 billion by 2035.

- The homeland security market is expected to grow at a CAGR of 5.74% from 2026 to 2035.

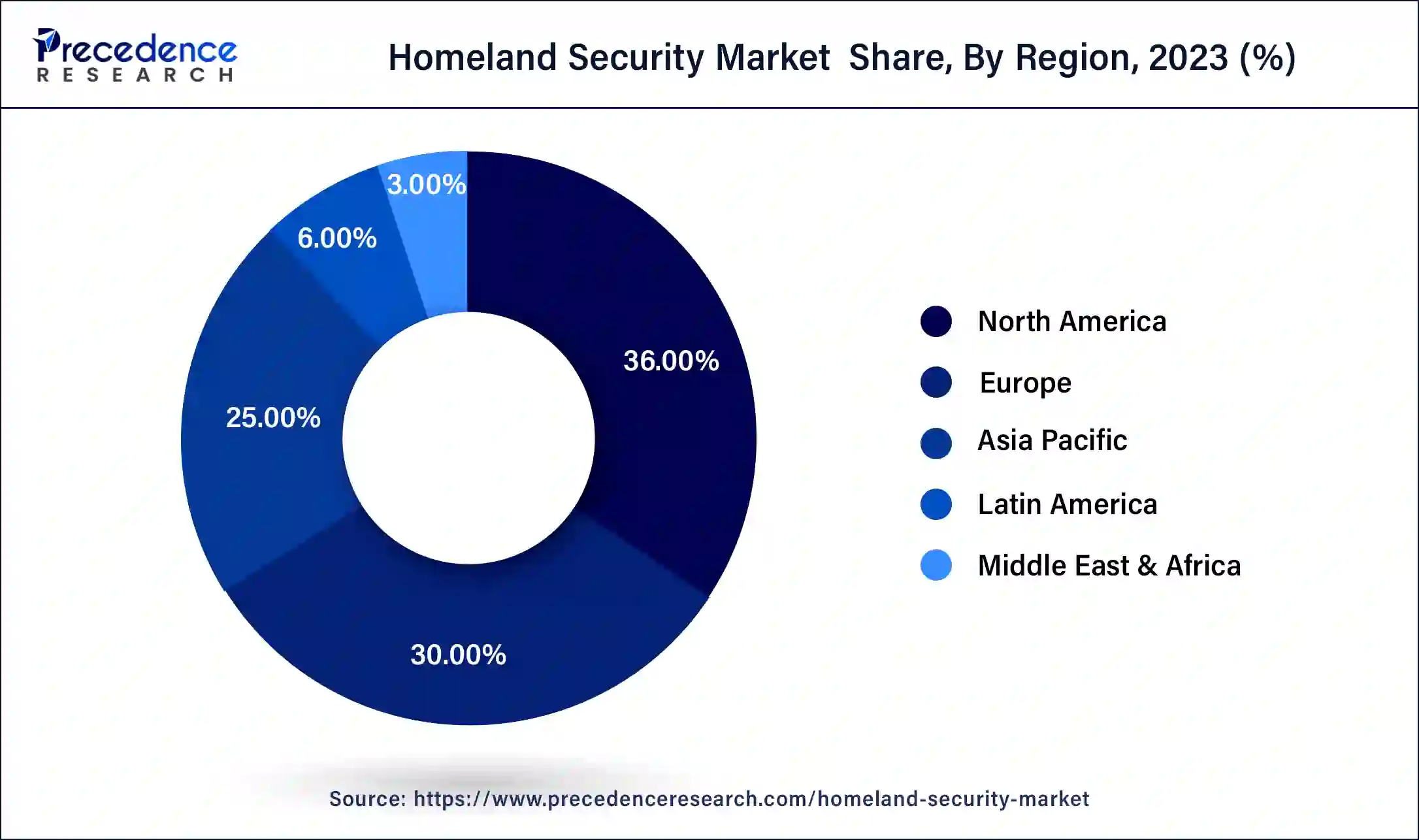

- North America dominated the market with the largest market share of 36% in 2025.

- By type, the critical infrastructure security segment held the largest market share.

- By technology, the AI-based solutions segment has captured the largest market share of 36% in 2025.

- By end-use, the public sector segment held the largest share of the market in 2025.

Market Overview

The Department of Homeland Security (DHS) is a crucial institution tasked with safeguarding the nation from multifaceted threats, necessitating the dedication of over 260,000 employees across diverse roles. Ranging from aviation and border security to emergency response and cybersecurity analysis, DHS operates at the forefront of defense. Central to its mission is preemptive counterterrorism measures, where DHS employs sophisticated strategies to outpace potential threats.

Additionally, DHS assumes responsibility for disaster preparedness and response, with agencies like the Federal Emergency Management Agency (FEMA), the U.S. Coast Guard, and Customs and Border Protection playing integral roles. Through coordinated efforts, DHS ensures that communities nationwide are equipped to confront and mitigate various emergencies.

- In March 2024, DHS commemorated its 20th anniversary. Born from the tragedy of 9/11, DHS remains steadfast in its commitment to securing the nation and safeguarding the American people. Continuously striving to enhance national security, DHS works diligently to ensure America is safer, stronger, and better equipped to confront any threats it may encounter.

- In August 2022, Operation Allies Welcome is initiated, with DHS taking the lead in coordinating federal efforts to assist Afghan nationals as they arrive and establish new lives in the United States.

- In March 2025, the DC area for its 18th iteration of the Homeland Security Week Summit was launched by the?IDGA (Institute for Defense & Government Advancement). The event allows leading experts and key decision-makers from DHS, DOJ, local law enforcement, and industry to come together to tackle the most pressing security challenges facing the U.S. homeland. ?

(Source: idga.org) - In January 2025, a memorandum?directing the Secretary of Homeland Security to extend Deferred Enforced Departure (DED) for certain Hong Kong residents was issued by President Biden to provide for continued work authorization through Feb. 5, 2027. The extension of DED-related Employment Authorization Documents (EADs) provided to certain Hong Kong residents has stopped.

(Source: uscis.gov)

Homeland Security Market Growth Factors

- The Department's multifaceted responsibilities, spanning customs, border enforcement, emergency response, antiterrorism, and cybersecurity, stimulate expansion in the homeland security market.

- Consolidation of primary federal security operations under the Department's purview, including assets from agencies like the Coast Guard, Customs Service, and Border Patrol, amplifies market growth opportunities.

- Assuming control over critical response assets such as the Nuclear Emergency Search Team and the National Pharmaceutical Stockpile, coupled with the integration of federal interagency emergency response plans, fosters growth in the homeland security market.

- The Department's leadership role in preparing for and responding to terrorist threats, coupled with setting national policy and guidelines for state and local governments, acts as a catalyst for market growth.

- Prioritizing efforts to prepare for and respond to threats involving weapons of mass destruction, including chemical, biological, radiological, and nuclear terrorism, contributes significantly to the growth of the homeland security market.

- The establishment of a national research and development enterprise for homeland security, comparable to existing programs supporting national security, augments market growth by fostering innovation and technological advancements.

- Consolidation and prioritization of disparate homeland security-related research and development programs assist state and local agencies in equipment evaluation and standard setting and enhance market growth prospects.

- Fusion and analysis of intelligence from multiple sources, including various governmental agencies and organizations, drive growth in the homeland security market by enabling more effective threat assessment and response strategies.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1028.03 Billion |

| Market Size in 2025 | USD 617.72 Billion |

| Market Size in 2026 | USD 655.14 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.74% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Types, Technology, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhanced national cybersecurity

The Department of Homeland Security (DHS) is poised to catalyze growth in the homeland security market through its commitment to fortifying national cybersecurity. With increasing reliance on the Internet for daily conveniences, critical services, and economic prosperity, the demand for robust cybersecurity measures has never been higher. DHS aims to address this need by bolstering cybersecurity risk management across government networks and critical infrastructure, curtailing illicit cyber activity, and enhancing responses to cyber incidents.

Through a unified departmental approach, strong leadership, and strategic partnerships with federal and nonfederal entities, DHS is paving the way for a more secure and resilient cyber ecosystem. By leveraging its broad resources and capabilities across the homeland security enterprise, DHS is positioned to drive innovation and effectively manage national cybersecurity risks, thereby fueling growth in the homeland security market.

- In March 2024, an initiative was announced by DHS and DG CONNECT to compare cyber incident reporting, aiming to better align efforts.

Comprehensive public safety education

Homeland security programs are instrumental in propelling growth within the homeland security market by offering students a comprehensive public safety education. Through a carefully crafted curriculum, students are equipped with the necessary skills and knowledge to pursue careers in firefighting, emergency medical response, fire protection, emergency health services, and emergency management. The curriculum encompasses a wide range of topics, including fire science focusing on prevention, firefighting, rescue techniques, and hazardous materials management, as well as emergency medical services covering first responder techniques, EMT training, and dispatch operations. This focused education not only prepares students for diverse roles within the public safety sector but also contributes to the expansion of the homeland security market by supplying skilled professionals to address evolving security challenges.

- In November 2024, DHS introduced the Shields Ready Campaign, aimed at promoting critical infrastructure security and resilience.

Restraint

Budgetary constraints

The homeland security market faces limitations due to the current budget environment, presenting challenges to programs and initiatives within the Department of Homeland Security (DHS). Competing funding demands from ongoing capital investment endeavors like the proposed border wall and ongoing recapitalization efforts, alongside staffing requirements for cybersecurity, border security, and immigration enforcement, create competition for limited funds both across the government and within DHS. These budgetary constraints pose significant restraints on the growth potential of the homeland security market, impeding the ability to invest in innovative solutions and expand critical capabilities to address emerging threats effectively.

Vulnerabilities in digital infrastructure

The rapid advancement of the digital revolution, while offering numerous benefits such as global connectivity and market efficiency, also introduces significant risks to cybersecurity. With more components of the global supply chain connected to the internet, the potential for malicious attacks or disruptions escalates. Moreover, the fast-paced nature of technological development often outpaces traditional government oversight, making it challenging to establish comprehensive security standards.

The COVID-19 pandemic further underscored the vulnerabilities inherent in a globally connected supply chain, prompting heightened awareness of cybersecurity risks. As the Department of Homeland Security (DHS) shifts its focus towards securing the nation's digital infrastructure, efforts to address these vulnerabilities may impose constraints on the growth of the homeland security market, as resources are redirected to mitigate cyber threats and enhance resilience against cyberattacks.

Opportunities

Leveraging advanced technologies

Recent advancements in technology, including artificial intelligence (AI) and machine learning, present significant opportunities for the homeland security market. Deployments by the Department of Homeland Security (DHS), such as face-recognition technology, fifth-generation network technology, counter-unmanned aircraft systems, and chemical and biological detection systems, offer a range of potential benefits.

Despite associated risks, developments such as the DHS Artificial Intelligence (AI) Task Force, digital transformation initiatives leveraging cloud and data analytics, advancements in tactical communications and edge computing, and innovative procurement techniques to support DHS mission outcomes create fertile ground for market growth. These developments not only enhance the effectiveness and efficiency of homeland security operations but also spur demand for innovative solutions and services, driving opportunities for growth and advancement in the homeland security market.

Trends in cybersecurity and resilience

The next decade is expected to witness significant opportunities in the homeland security market, driven by two prominent trends. Firstly, the expansion of cybersecurity capabilities emerges as a pivotal focus area. With cyber threats evolving in sophistication and complexity, there's a heightened emphasis on bolstering cybersecurity within homeland security and emergency management domains. This trend propels the demand for innovative solutions and services tailored to combat emerging cyber threats, thereby creating opportunities for market growth. Secondly, there's a notable shift towards prioritizing resilience and adaptation in the face of evolving risks.

There's a growing inclination toward adopting a robust approach centered on building resilience and fostering adaptation. This paradigm shift opens doors for market players to offer solutions that enhance organizational resilience and facilitate adaptive strategies, driving growth opportunities within the homeland security market.

Segment Insights

Type Insights

The critical infrastructure security segment is emerging as the dominant focus area within the homeland security market. Critical infrastructure encompasses vital systems such as highways, bridges, railways, utilities, and buildings, which are essential for maintaining daily life operations. Transportation, commerce, clean water, and electricity all rely on these interconnected networks.

To address the security challenges associated with critical infrastructure, there's a need for appropriate information-sharing mechanisms without risking antitrust liability. The establishment of a new legal regime enables the Department of Homeland Security (DHS) to provide assurances to private-sector owners and operators regarding the protection of sensitive or proprietary information shared with the government. These assurances serve as incentives for the private sector to collaborate and share vital information about infrastructure vulnerabilities, enhancing overall security.

Furthermore, DHS's Science and Technology Directorate (S&T) is actively involved in the development and testing of innovative concepts aimed at providing better protection against various threats, including flooding, explosive blasts, solar storms, and other natural or man-made disasters. By improving infrastructure resilience and reducing the risk of disruptions to daily commerce, these initiatives contribute significantly to enhancing national security and safeguarding critical infrastructure networks.

Technology Insights

The AI-based solutions segment held the largest share of the homeland security market in 2024. AI-driven analytics empower security personnel with predictive insights and anomaly detection capabilities. By leveraging machine learning algorithms, these solutions can identify patterns and trends indicative of suspicious behavior, even in the absence of explicit threat indicators. This proactive approach allows security agencies to anticipate and mitigate threats before they escalate, enhancing overall preparedness and response effectiveness. Additionally, AI-driven decision support systems provide commanders with actionable intelligence and situational awareness, facilitating informed decision-making in dynamic and high-pressure environments.

End-use Insights

The public sector held the largest share of the market in 2024. Governments around the world have the primary responsibility for protecting their citizens and national interests from a wide range of threats, including terrorism, cyberattacks, natural disasters, and pandemics. As such, they allocate significant resources to homeland security efforts, including the procurement of advanced technologies and services. Governments typically have larger budgets compared to private entities, allowing them to invest substantial funds into homeland security initiatives. These budgets are allocated to various departments and agencies tasked with protecting borders, critical infrastructure, transportation systems, and public safety.

Regional Insights

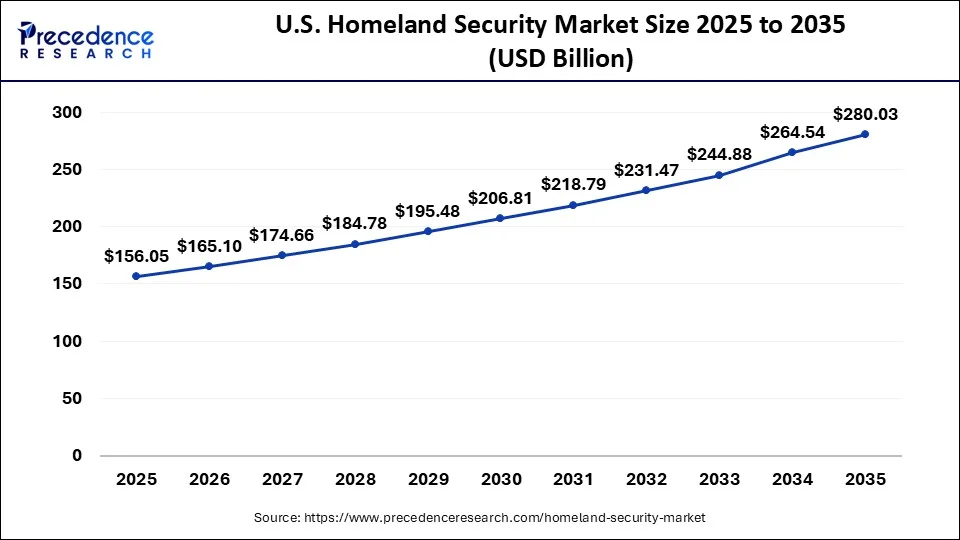

U.S. Homeland Security Market Growth 2026 to 2035

The U.S. homeland security market size was estimated at USD 156.05 billion in 2025 and is predicted to be worth around USD 280.03 billion by 2035 at a CAGR of 6.02% from 2026 to 2035.

North America led the market with the biggest market share of 36% in 2025., with the United States taking significant strides in fortifying its defenses against evolving threats. The U.S. Navy's historical engagement in homeland security and defense missions has been marked by episodic responses, often shifting focus towards forward operational concepts.

The establishment of the U.S. Department of Homeland Security and USNORTHCOM reflects a growing recognition of the need for a more sustained and focused commitment to safeguarding the nation's security. However, there remains considerable scope for enhancing maritime aspects of homeland security and defense, requiring collaborative efforts between senior leadership in both Canada and the United States.

Future steps should prioritize practical and cost-effective measures aimed at improving continental security against terrorism. By fostering joint initiatives and leveraging regional partnerships, North America can bolster its resilience against emerging threats and ensure the safety and security of its citizens.

Recent achievements within the Department of Homeland Security, such as reducing public burden by over 21 million hours through streamlined administrative processes, demonstrate the region's commitment to enhancing efficiency and effectiveness in homeland security operations. These efforts contribute to a more robust and resilient security framework, positioning North America as a leader in safeguarding its borders and citizens.

- In a significant development, U.S. Customs and Border Protection (CBP) successfully migrated ocean shipping data to digital formats, resulting in a drastic reduction in cargo clearance time, now taking mere minutes instead of hours.

- U.S. Immigration and Customs Enforcement (ICE) has implemented streamlined processes for student and exchange visitor applications by efficiently reusing data, enabling applicants to complete the procedure in just 5 minutes, a remarkable improvement compared to previous lengthy processing times.

- In January 2024, a joint statement was issued by the United States Secretary of Homeland Security Mayorkas and the European Union Commissioner for Internal Market Breton.

- In September 2024, CISA initiated a National Public Service Announcement Campaign urging Americans to adopt measures to safeguard themselves and their families online.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is anticipated to grow fastest over the forecast period due to rising terrorist activities, increased cyber and geopolitical threats, and natural disasters. Asia Pacific is focusing on the development of physical and cybersecurity systems. The government is investing heavily in homeland security infrastructure, advanced technologies, and services to improve national security.

China is a major country in the regional market, with growth driven by the country's robust focus on cybersecurity and border security. The rising government focus on critical infrastructure, like power plants, ports, and transportation, is fueling innovation and development in homeland security measures.

Why is Europe Considered a Notably Growing Area in the Market?

Europe is expected to grow at a notable rate in the homeland security market during the forecast period. This growth is primarily driven by the increasing adoption of digitalization across various industries and commercial sectors. As organizations continue to embrace cloud-based storage and digital infrastructure, the region has also seen a rise in cyberattacks, increasing the need for robust security solutions. Countries such as France, Germany, Italy, and the UK are leading contributors to this growth. Additionally, several European nations have significantly increased their security spending in recent years, which is accelerating the adoption of modernized and advanced homeland security equipment.

What Potentiates the homeland security Market in Latin America?

The market in Latin America is driven by the increasing concerns over national safety, the rise in cybersecurity threats, and continuous advancements being made in security technologies. The growing need for efficient emergency management systems, surveillance technologies, and border security solutions in the region has increased the demand for advanced security systems. The proliferation of extremist activities and the growing number of cyberattacks targeting critical infrastructure are boosting the demand for homeland security equipment across the region. Moreover, the rising integration of AI and ML technologies into homeland security infrastructure is expected to drive the region's market growth.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers significant opportunities for the homeland security market. These opportunities are driven by rising purchasing power, increasing regional tourism, and expanding business activities. The growth in air traffic across the region is further fueling demand for advanced aviation security solutions to ensure safety and operational efficiency at airports. In addition, stringent government security regulations are boosting the adoption of advanced security technologies. Several countries in the region are also making substantial investments in new airport infrastructure, which is expected to further accelerate market demand.

Homeland Security Market Companies

- Elbit Systems Ltd.: It provides advanced surveillance, border security, unmanned systems, and command-and-control solutions used for threat detection and national protection.

- Teledyne FLIR LLC: It offers thermal imaging cameras, sensor systems, and detection technologies used in border surveillance, critical infrastructure protection, and law enforcement.

- General Dynamics Corporation: It offers homeland security solutions, including secure communication systems, cybersecurity services, information technology platforms, and mission-critical infrastructure protection technologies.

- L3Harris Technologies, Inc.: It delivers integrated security solutions such as surveillance systems, public safety communications, sensors, and advanced threat monitoring technologies for homeland and border security operations.

Other Major Key Players

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- L-3 Communications Holding, Inc.

- Magal Security Systems Ltd.

- Raytheon Technologies Corporation

- Safran

- ThalesUnisys

Recent Developments

- In May 2025, Secretary of Homeland Security Kristi Noem determined that Afghanistan's conditions wouldn't support its designation for Temporary Protected Status, after reviewing country conditions and consulting with the appropriate U.S. government agencies. Kristi Noem has terminated Afghanistan's TPS designation and related benefits on July 12, 2025. (Source: https://www.uscis.gov)

- In April 2025, the Department of Homeland Security (DHS) launched a novel AI playbook, designed to revolutionize U.S. immigration processing. The title “Playbook for Public Sector Artificial Intelligence Deployment” comprehensive guide that reports details about AI modernization in the U.S. immigration system, promising increased efficiency.

- In March 2025, the United States Department of Homeland Security (DHS) Science and Technology Directorate (S&T) introduced a series of technology challenges running throughout 2025, the Remote Identity Validation Rally (RIVR), in collaboration with the Transportation Security Administration (TSA), Homeland Security Investigations Forensic Laboratory, and the National Institute of Standards and Technology (NIST).

(Source: passengerterminaltoday.com) - In February 2023, the Justice and Commerce Departments jointly announced the establishment of the Disruptive Technology Strike Force.

- In March 2023, the Biden-Harris Administration unveiled the National Cybersecurity Strategy.

- In March 2024, Alpha Omega declared an enhanced commitment to National Security, Climate Science, and Foreign Affairs.

Segments Covered in the Report

By Types

- Aviation Security

- Maritime Security

- Border Security

- Critical Infrastructure Security

- Cyber Security

- CBRN Security

- Mass Transit Security

- Others

By Technology

- Recognition and Surveillance Systems

- AI-based Solutions

- Security Platforms

- Others

By End-use

- Public Sector

- Private Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting