What is the Mechanical Ventilators Market Size?

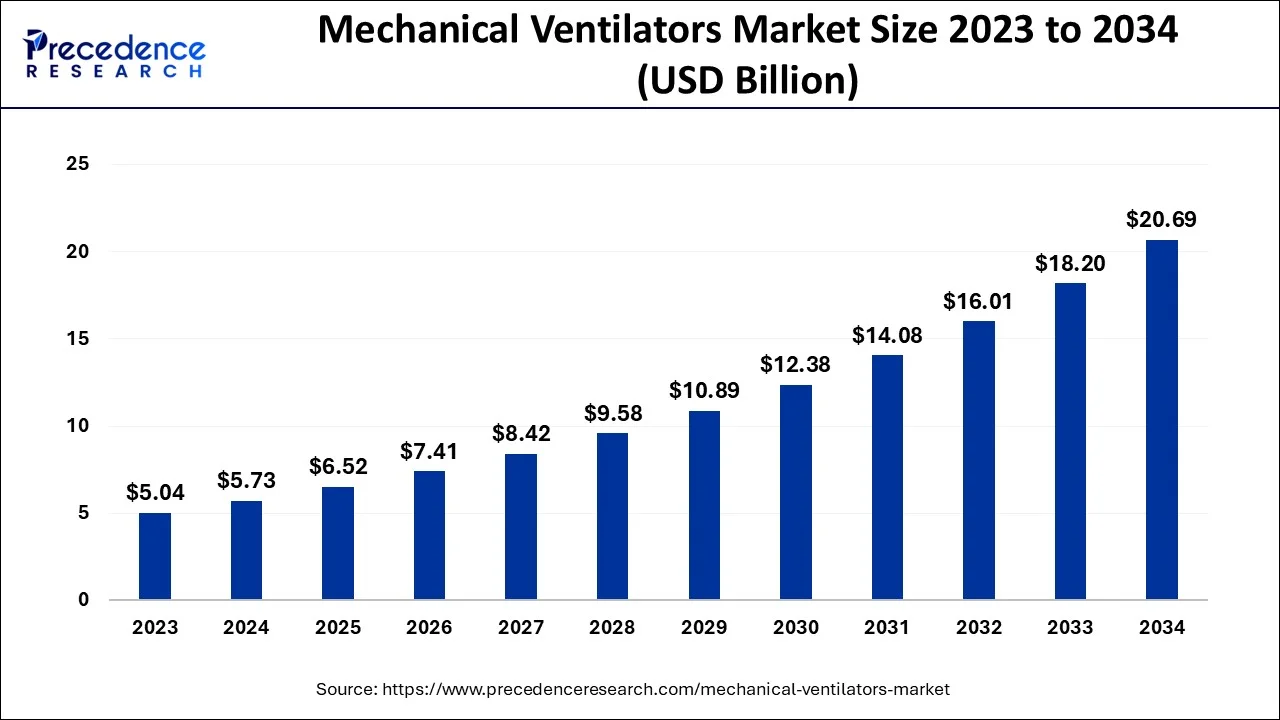

The global mechanical ventilators market size is calculated at USD 6.52 billion in 2025 and is predicted to increase from USD 7.41 billion in 2026 to approximately USD 22.98 billion by 2035, expanding at a CAGR of 14.53% from 2026 to 2035.

Mechanical Ventilators Market Key Takeaways

- By product, the critical care ventilators segment accounted for 36% market share in 2025.

- By ventilation mode, the non-invasive segment has reached 57% of the total revenue share in 2025.

- By end-use, the hospitals segment has held the highest revenue share of around 46% in 2025.

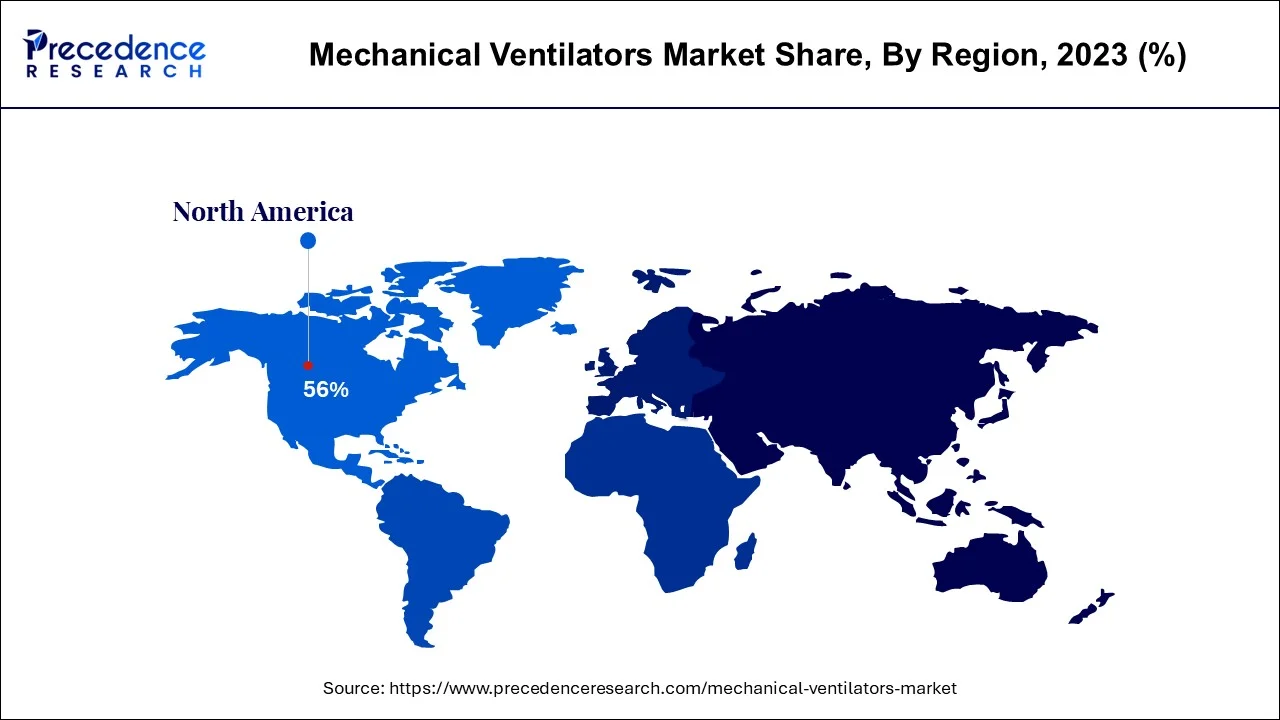

- North America region dominated the market with a market share of 56% in 2025.

Market Overview

A mechanical ventilator is a machine that helps a patient breathe (ventilate) when they are having surgery or cannot breathe on their own due to critical disease. The patient is connected to the ventilator with a hollow tube (artificial airway) that goes in their mouth and down into their main airway or trachea. The two most common methods of mechanical ventilation are positive pressure ventilation, in which air is forced into the lungs, and negative pressure ventilation, in which air is sucked into the lungs by the stimulating movement of the chest. Mechanical ventilators are most commonly used to treat respiratory problems, strokes, chronic obstructive pulmonary disease, and other conditions. Mechanical ventilation is a life-supporting technique that helps patients with serious diseases breathe just to stay alive.

An increase in the geriatric population and the prevailing chronic respiratory disorders are expected to boost the demand for ventilators. Growing awareness regarding lung cancer the symptoms of lung cancer and an increase in the number of patients in middle hospitals swelling create a great demand for the growth of the ventilators market. The use of mechanical ventilation could also hurt the industry growth because there is an increased risk of infection due to the entry of germs through the airway. There could also be chances of collapsing of the small air sacs of the lungs or there could be some probable damage to the lung because of repetitive opening or inflation. These are the risks that are associated with the use of mechanical ventilators and these could hamper the growth of the market.

Unlike other industries, the pandemic has proven extremely beneficial for the mechanical ventilators market and it has had a positive impact on the growth of the market. Ventilation facilities were extensively used during the COVID outbreak. There was an increasing demand for ventilation facilities across all the hospitals during the pandemic. The demand for ventilators had led to the production of these ventilators during the pandemic major industry players increased their production capabilities to meet the demand. To make sure that the patients have timely availability of mechanical ventilators during the pandemic, various government initiatives were taken to provide the same. Government organization supply chain networks and the industry players were working together to meet the rising global demand for ventilators across the globe.

What is the Role of AI in the Mechanical Ventilators Market?

The integration of AI algorithms allows for continuous monitoring of patient parameters, automatic adjustment of ventilator settings, and processing of vast patient data. AI allows faster and more accurate clinical decision-making by reducing the need for clinicians for interventions. AI alerts clinicians before a crisis occurs and helps predict potential respiratory deterioration. AI-driven systems hold an immense potential to process vast amounts of real-time data from ventilators and patient monitors.

They reduce the incidence of certain conditions and allow for more precise adjustments to ventilation settings. AI helps to reduce healthcare costs and optimize resource utilization. AI systems adapt to new data and practices, and ensure enhanced safety, increased efficiency, and improved patient outcomes.

Mechanical Ventilators Market Trends

Personalized Respiratory Care: The integration of AI enables automated adjustments of modern systems, determination of the optimal time for removing the ventilator, suggestions of preventative measures to clinicians, and prediction of patient decline before it happens. There is a rapid consumer shift from reactive life-support machines to intelligent predictive systems that are integrated with digital healthcare platforms.

Non-Invasive Ventilation: Clinicians increasingly prefer non-invasive methods to reduce risks associated with intubation complications and Ventilator-Associated Pneumonia (VAP). The innovative non-invasive ventilation technologies provide enhanced comfort and integrated modes. They offer more precise oxygen delivery and enable improved patient comfort.

Market Outlook

- Industry Overview: The ventilator industry consists of OEMs offering full ICU suites, the producers of transport and anesthesia ventilators, the suppliers of consumables (like circuits, filters), the integrators providing service contracts, and the distributors facilitating regional logistics and training. Major buyers include hospital networks, government procurement agencies, and emergency responders. CDMOs and contract manufacturers may also produce devices as OEM partners. This is a regulated and capital, heavy industry that requires quality management systems, clinical validation, and an after, sales service infrastructure.

- Sustainability trend: The focus of sustainability is on energy efficiency lower power consumption for long-term ventilation, longer device lifespans through modular designs, and the reduction of single-use plastic waste from breathing circuits when it is safe and feasible.

- Major investment: Investments are made in the next-generation ventilator platforms that integrate smart modes, AI, assisted weaning protocols, remote monitoring, and cloud-based fleet management. There is also a lot of money put aside for the factory expansions, localized assembly in the target markets, and service networks that support uptime.

- Startup ecosystem: Startups in this sector are typically theme-based and largely on the following issues: producing affordable emergency ventilators, making compact transport units, creating better patient interfaces, digital decision, support overlays, and remote monitoring add, Ons. The achievement of these startups is substantially dependent on getting regulatory clearance, clinical validation, and integration with hospital workflows.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Market Size in 2026 | USD 7.41 Billion |

| Market Size by 2035 | USD 22.98 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.53% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Ventilation Mode, Type, Component, Application, End-User, and Geography |

Market Dynamics

Due to the increasing number of COVID-19 cases, there was a demand for mechanical ventilators which helped in the growth of the market across many developed and developing nations and the increasing prevalence of chronic respiratory diseases which could be associated with pollution or any other factors has led to a growth in the market. There is a rise in healthcare expenditure in many nations and the general awareness regarding the existence of respiratory disorders has led to a growth in the market. Many hospitals are increasing the number of ICU beds or critical care beds post-pandemic to meet the demands of the future generation in case there is another pandemic. Growing research and development in this field and technological advancements are the reasons for the adoption of these mechanical ventilators across many hospitals or clinics.

The market is contributed by the increased frequency of respiratory disorders. Over the projection period, the use of long-term Home Mechanical Ventilation (HMV) for chronic respiratory failure caused by disorders such as thoracic disease, chronic obstructive pulmonary disease (COPD), and neuromuscular disease is expected to grow market. According to a World Health Organization report, COPD affects roughly 65 million people globally, making it the third biggest cause of mortality in 2020. The growing aging population, increased cigarette smoke exposure, and indoor as well as outdoor pollution, are driving the market growth.

Using ventilators comes with several risks because they need proper guidance to use them. In addition to this dearth of skilled technical people is found in the market. Mechanical ventilators are expensive and require special care while handling. Difficulties observed during mechanical ventilators as the inappropriate working of alarm, ventilation sequence, etc. These are the challenges that could restrict the growth of the mechanical ventilator market.

COVID-19 Impact

The COVID-19 pandemic has increased sales of mechanical ventilators across hospitals and clinics. Respiratory failure is a complication of the COVID-19 infection, demanding critical care and ventilator support. For critically unwell COVID-19 patients, mechanical breathing has frequently been used for external oxygen supply. Furthermore, new COVID-19 delta and omicron variants with rapid spread rates discovered in mid-November 2021 have raised the danger of the third wave globally. In addition, major producers in the mechanical ventilators market as well as the government have made steps to increase production to meet the increased demand for ventilators during the pandemic.

Thus, the existence of several producers and efforts made by the government to boost market supply has fueled the industry's progress. Nevertheless, over the projected period, market development is constrained by the high price of mechanical ventilators and the risk of ventilator-associated infections such as nosocomial pneumonia.

Segment Insights

Product Insights

Based on the product, the intensive care ventilator segment is expected to have significant market growth during the forecast period. The segment is expected to see growth due to various factors like the clinical benefits provided by the ventilator in acute respiratory failure, compromised lung functions, or any complications related to breathing. To maintain correct ventilation and provide support in health care facilities, these mechanical ventilators are widely used. Various functions like advanced monitoring and visual decision support are the driving factors of these mechanical ventilators and they will positively affect the mechanical ventilator's market share during the forecast period.

Ventilation Mode Insights

Based on the ventilation mode, the segment is divided into Invasive Ventilation and Non-Invasive Ventilation. The non-invasive ventilation segment is expected to grow well during the forecast. The benefits provided by these noninvasive mechanical ventilators are a higher concentration of oxygen and precision, these factors are driving the market.

The noninvasive ventilation method provides better oxygen and decreases diaphragmatic work. Owing to all of these factors the mechanical ventilator segment with the noninvasive interface is expected to grow during the forecast period.

Type Insights

Based on the type, the adult ventilators segment shall have a larger market share during the forecast period owing to the increasing geriatric population and growing pollution across the globe. Moreover, the growth in this segment is also driving due to the people suffering from chronic obstructive pulmonary disease, asthma, and other breathing issues. Chronic obstructive pulmonary disease is extremely common among the adult population across the globe. Due to all of these reasons, the market for the adult ventilator shall grow during the forecast period.

Component Insights

Based on the component, the market is categorized into devices and services. The device segment was the major contributor in 2022 and is expected to maintain its lead during the forecast period, owing to an increase in demand for the mechanical ventilators market. However, the services segment is expected to witness considerable growth during the forecast period, due to an increase in sales in the market.

End-User Insights

Based on the end-user segment, the hospital segment dominated the market till the year 2023. Increased availability of trained health care providers for operating and functioning these ventilators, there is enhanced productivity of hospitals in stimulating the revenue of this business and there is a growing emphasis on providing quality care services to the customers. These are the factors that help in the growth of the market and they shall drive the market during the forecast period.

Major players are expanding their hospital chains to offer better diagnoses and good treatment, these hospitals are developing their infrastructure services to provide a range of services that help in combating respiratory diseases. Owing to these reasons the market shall grow. There is a growing preference amongst customers to visit the hospital for the treatment of chronic respiratory diseases. As the hospitals can provide a range of novel technologies for treating these disorders and as they are easily accessible the health care facilities segment shall see growth.

Regional Insights

What is the U.S. Mechanical Ventilators Market Size?

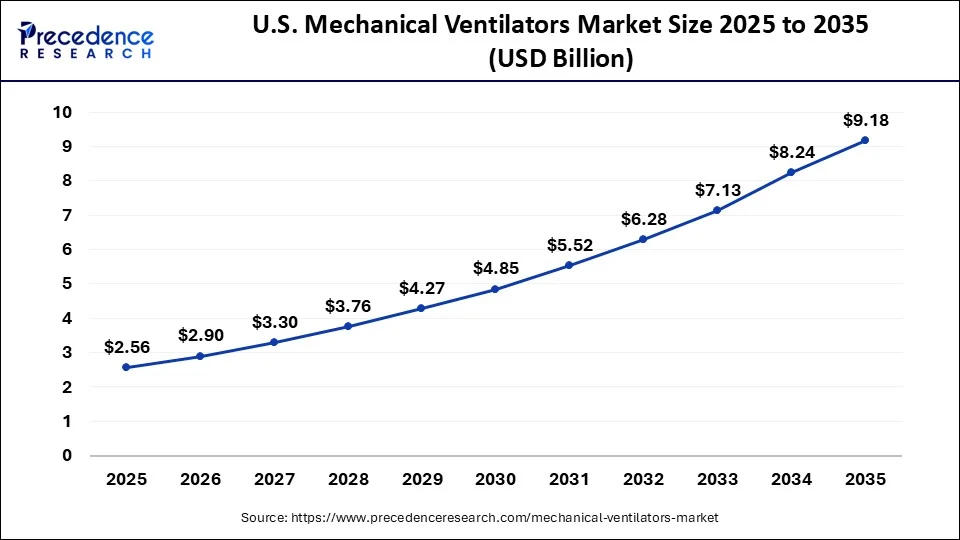

The U.S. mechanical ventilators market size is evaluated at USD 2.56 billion in 2025 and is predicted to be worth around USD 9.18 billion by 2035, rising at a CAGR of 14.86% from 2026 to 2035.

Why did North America dominate the Mechanical Ventilators Market?

The North America region dominated the market till the year 2025. The US had the largest market share in this region. The increasing prevalence of chronic respiratory diseases and also the presence of major market players in these countries which provide good accessibility to various advanced technologies are boosting the market in this region. The use of technically advanced ventilators and good services provided in this region are helping in the growth of the market. The availability of various treatment procedures shall drive the market during the forecast. Chronic obstructive pulmonary disease is a leading cause of death in the United States. This disease causes serious long-term disability and also early deaths which are creating a great demand for ventilators and helping in generating revenue for this market. The demand for mechanical ventilators is also expected to rise in Canada in the coming years. The use of noninvasive ventilators which help in avoiding lung injury is being used in this region which drives the growth of the mechanical ventilators market during the forecast period.

What Makes Asia Pacific the Most Opportunistic Market for Mechanical Ventilators?

The Asia Pacific is expected to be the most lucrative market during the study period. The frequency of respiratory disorders in the region is expected to grow due to increasing pollution as a result of increased urbanization and industry. Furthermore, increased government investments in the development of advanced healthcare infrastructure are likely to boost ventilator usage across the region's hospital facilities that supplement the market growth.

The market in Asia Pacific is also driven by its rapidly expanding healthcare infrastructure, growing hospital networks, and increasing critical care capacity across countries like China, India, Japan, and South Korea. Rising incidences of respiratory diseases, aging populations, and heightened awareness of intensive care needs are fueling demand. Additionally, emerging economies in Southeast Asia are investing in modern medical equipment and ventilator technology, creating untapped growth opportunities for both domestic and international manufacturers.

China Market Analysis

China is the major contributor to the Asia Pacific mechanical ventilators market. This is due to its large and rapidly expanding healthcare infrastructure, significant investments in critical care facilities, and the high prevalence of respiratory diseases and COVID-19-related demand surges. Additionally, China's robust domestic manufacturing capabilities allow for large-scale production of both conventional and advanced ventilators, making it the key driver of market growth in the region

Why Europe is Growing Notably in the Mechanical Ventilators Market?

The mechanical ventilator market in Europe remains a mature one, and it is largely influenced by the quality aspect of the products. Hospitals focus on buying state, of, the, art ICU ventilators that can help in the treatment of complex ARDS and multi, organ failure patients. Due to the increased focus on being prepared, having standardised ICU protocols, and training, it has become a trend that hospitals buy such devices that have better integration with monitoring systems and electronic health records. The procurement is usually clinical capability, driven and at the same time life, cycle service contracts and maintenance are also considered. There is a common public health care system and private hospital networks which are the main drivers of the purchasing activities.

Germany Mechanical Ventilators Market Trends

Germany has managed to keep the demand for a high level of ventilators due to its large and well, equipped intensive care infrastructures, high numbers of surgical operations, and strong purchasing power of top-class hospitals for ventilators. The UK is mainly concerned with the aspects of resilience and standardisation among NHS trusts, and therefore, they are putting their money into solutions that ease the fast redeployment and remote monitoring. France concentrates equally on ICU capacity and regional preparedness, and according to that, the ventilators are often a part of the integration within the broader plans for emergency.

Why Middle East & Africa is Growing Notably in the Mechanical Ventilators Market?

Middle East and Africa is a mixed market, on one hand, advanced centers in affluent countries buy high, end ICU ventilators, on the other hand, most regions lack rugged, inexpensive, and easy, to, maintain ventilators. The demand for complex ventilators is driven by urban hospitals and specialty centers, whereas the general national needs are mostly for portable units that can be used in emergencies and fieldwork. The purchasing decisions are very much influenced by supply, chain resilience, and local service capabilities; also, buyers choose vendors who have regional maintenance footprints.

South Africa is doing a balancing act while procuring advanced devices; at the same time, it puts an emphasis on the local service networks and the needs of public hospitals. Nigeria and Kenya are on the path of increasing demand for durable and low, maintenance ventilators, which will extend emergency and neonatal care in the regions that are not sufficiently provided with basic care.

Why Latin America is Growing Notably in the Mechanical Ventilators Market?

Latin America ventilator market is characterized by a combination of public procurement initiatives, private hospital modernization, and, also, an increasing interest in point, of, care respiratory devices. Governments are mainly concerned with the ICU capacity expansion and the area of public safety, hence, the need for fixed and portable ventilators rises accordingly. The limitations of the budgets and the complexities of the purchases create a place for mid, tier, affordable ventilator models that are in private hospitals along with the presence of premium devices.

Brazil Mechanical Ventilators Market Trends

Brazil holds the vibrant hospital network that leads the region, thus it is a major purchaser of ICU ventilators, grade, which is further supported by the local production and calibration capabilities. Mexico is characterized by the demand that is balanced between the Private and Public sectors, whereby funding for ventilators both for the large urban centers and for regional hospitals are the investments made. Argentina and Chile are centering their attention on reforms that will help public hospitals in terms of resources as well as ventilator maintenance frameworks.

Value Chain Analysis

- Research & Development (R&D): This stage focuses on designing innovative ventilator technologies, improving airflow control, monitoring capabilities, and integrating AI for predictive respiratory support.

Key Players: Medtronic, Drägerwerk AG, Getinge AB, Koninklijke Philips N.V. - Component Sourcing & Manufacturing: In this stage, manufacturers source high-quality components such as compressors, sensors, valves, and control systems.

Key Players: Vyaire Medical, Hamilton Medical, GE Healthcare, ResMed - Assembly & Quality Testing: Ventilators are assembled in controlled environments, followed by rigorous quality testing to ensure compliance with ISO and FDA standards. This stage ensures devices are safe, reliable, and ready for both ICU and emergency use.

Key Players: Dragerwerk AG, Medtronic, Getinge AB, Philips Healthcare

Some of the Prominent Players Profiled in the Report Include

- Getinge AB – Supplies advanced critical care ventilators and anesthesia machines, focusing on ICU and surgical applications globally.

- Medtronic – Offers a wide range of hospital-grade mechanical ventilators, including portable and ICU models, along with integrated monitoring solutions.

- Vyaire Medical Inc. – Provides comprehensive respiratory care solutions, including ventilators, breathing circuits, and related accessories for critical and non-critical care.

- Dragerwerk AG & Co. KGaA – Manufactures high-performance ventilators and anesthesia systems, emphasizing safety, precision, and adaptability for hospitals and emergency care.

- Koninklijke Philips N.V.– Delivers innovative ventilators with smart monitoring features, AI-enabled performance, and solutions for both ICU and homecare respiratory support.

Other Major Key Players

- Hamilton Medical

- General Electric Company

- ICU Medical, Inc.

- ZOLL Medical Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Mechanical Ventilators Market Companies

Mechanical ventilation is a quite competitive market. The market is growing because some of the leading companies are producing and introducing new goods, while others are distributing ventilators. Manufacturers are preparing to increase production capacity to fulfill increased worldwide demand and combat the COVID-19 outbreak. The British government placed an order for 10,000 ventilators with the German firm Drägerwerk AG & Co., which is equal to its yearly production capacity. Hamilton Medical has increased its yearly output of 15,000 mechanical ventilators by 30.0% to 40.0%, and now produces roughly 80 ventilators per day. In March 2020, this company sent approximately 400 ventilators to Italy.

The market is close to saturation, as several manufacturers have increased their manufacturing facilities to suit the demand during the COVID-19 peak, and ventilators will be abundant following the Covid-19 situation. However, as the prevalence of chronic diseases is predicted to rise, critical care units such as ventilators will continue to be in high demand in the coming years. Furthermore, technological advances are expected to boost demand for low-cost and advanced feature ventilators over the forecast period.

Recent Developments

- In August 2025, ICU Medical, Inc. announced $548.9 million in revenue for the second quarter of 2025. The company aims to continue its leading position in infusion systems, high-value critical care products, and infusion consumables used in home care settings, hospitals, and alternative sites. The entire team is focused on offering value, quality, and innovation to its clinical customers globally. (Source: https://ir.icumed.com )

- In March 2024, Wipro GE Healthcare announced an investment of over INR8000 Crores to accelerate local R&D and improve manufacturing output over the next 5 years. This investment aims to establish India's position as the hub of major innovation and manufacturing for MedTech. (Source: https://www.gehealthcare.in )

- In January 2022, OES Medical joined the ABHI UK Pavilion at Arab Health to launch a new mains-powered ICU ventilator to support hospitals to manage the oxygen demand for the patients.

- In May 2021, CorVent Medical received CE Mark approval and launched commercial use of its RESPOND-19 Ventilator in Europe. The novel system was designed to ease the usability, it has the flexible growth of critical care ventilation capacity to allow hospitals to improve the treatment of critical patients suffering from acute respiratory distress syndrome (ARDS).

- In January 2021, Inovytec signed an agreement with Italy, Brazil, and Israel to deliver 1,500 progressive portable ventilators. Patients with respiratory disorders benefited from portable ventilators during and after the COVID-19 pandemic.

- In April 2020, InnAccel Technologies announced the introduction of a non-invasive ventilation system intended for use in ICU with COVID-19 patients.

- In March 2020, Koninklijke Philips N.V. built a production of ventilator facilities in the United States to meet the increasing demand for ventilators during the COVID-19 pandemic.

- In March 2020, Zoll Medical Corporation increased in production capacity to 10,000 ventilators per month. This boost in production capacity benefited the treatment of COVID-19 patients and eventually helped to expand the market.

- In August 2019, Smiths Medical, teamed up with Medline Industries to market its port devices. The partnership focuses on non-acute and home care channels, as well as increasing the respiratory division's market internationally.

Segments Covered in the Report

By Product

- Intensive Care Ventilators

- High-end

- Mid-end

- Basic-end

- Portable/Transport/Ambulatory

- Neonatal Care

- Others

By Ventilation Mode

- Invasive Ventilation

- Non-Invasive Ventilation

- CPAP

- BiPAP

- Others

By Type

- Pediatric & Neonatal

- Adult

- Geriatric

By Component

- Devices

- Services

By Application

- Resuscitation

- Homecare Applications

- Emergency/Transport

- Sleep Apnea Therapy

- Anesthesiology

- Clinical Applications

- Others

By End-User

- Hospitals

- Home Healthcare

- Ambulatory Care Centers

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting