What is the Non-Invasive Ventilators Market Size?

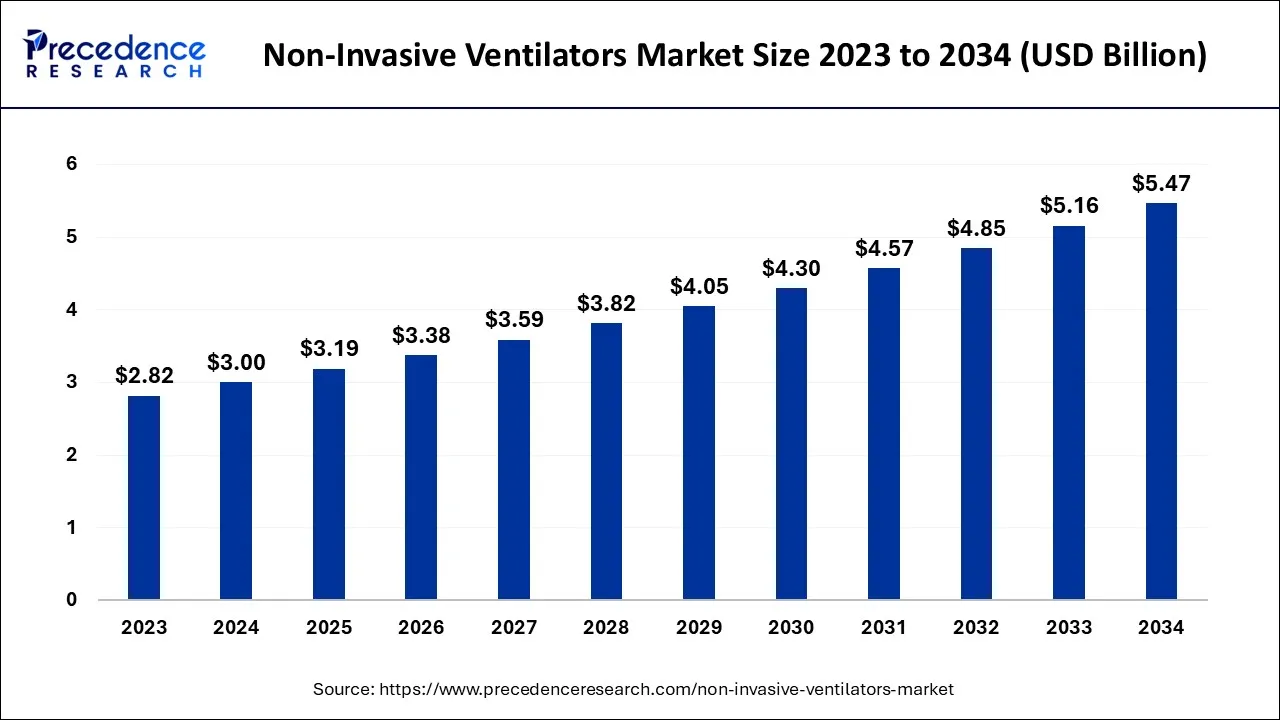

The global non-invasive ventilatorsmarket size is calculated at USD 3.19 billion in 2025 and is predicted to increase from USD 3.38 billion in 2026 to approximately USD 5.78 billion by 2035, expanding at a CAGR of 6.12% from 2026 to 2035.

Non-Invasive Ventilators Market Key Takeaways

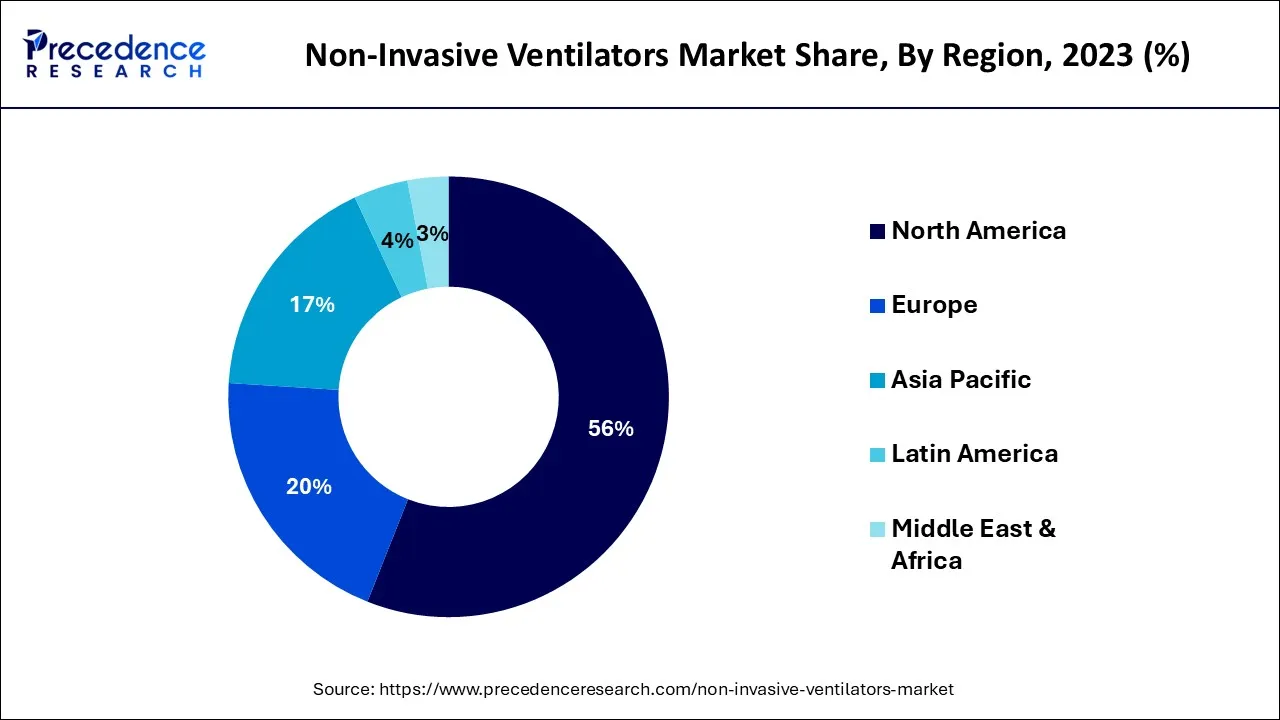

- North America generated more than 56% of the revenue share in 2025.

- By Application, the COPD and asthma segment is expected to expand at a remarkable CAGR between 2026 to 2035.

- By End User, the hospitals segment captured more than 16% of revenue share in 2025.

Market Overview

A ventilator is a life-supporting system that is used to inhale oxygen and exhale carbon dioxide from the body. it helps patients breathe easier who are suffering from breathing difficulty. A ventilator is also used during anesthesia, as anesthesia can disrupt normal breathing functionality, and theventilatorensures that the normal breathing process is carried out efficiently during surgery.

Non-Invasive Ventilators Market Growth Factor

The prevalence of chronic obstructive pulmonary disease (COPD) is on the increase, the elderly population is aging quickly, and technical advancements will likely push the market during the forecast era. The development of patient-friendly, cost-effective, and portable gadgets can further promote their utilization.

For instance, InnAccel Technologies revealed the release of a non-invasive ventilation device for ICU use with COVID-19 patients in April 2020. COPD and asthma are the most common respiratory diseases across the globe. 3.23 million people died from COPD in 2019, making it the third largest cause of mortality in the world, according to the WHO. A silent respirator for COPD patients, the respirator BiPAP A40 Expiratory Flow Limitation (EFL), was unveiled by Philips in November 2020.

As a result, doctors can accurately administer homecare treatment to hypercapnic COPD patients by detecting EFL at the point of care. In the upcoming years, it is expected that rising demand for home healthcare will favorably affect the market for home care ventilators.

The COVID-19 pandemic was beneficial for the industry and had a favorable effect on the market expansion. The COVID-19 outbreak's demand for ventilation facilities rapidly increased daily operational capacities. In order to provide respiratory technicians with training on using ventilators during COVID-19, the American Association for Respiratory Care collaborated with various groups. This has further encouraged market participants to boost their manufacturing capabilities in order to satisfy the increased demand.

During the epidemic, many producers were overrun with orders. Philips declared in March 2020 that it had increased the output of critical care goods and solutions to help with COVID-19 patient diagnosis and care. In order to address a variety of breathing disorders, the business also expanded the manufacturing of portable ventilators, patient vital sign devices, and consumables for both invasive and noninvasive ventilation.

- During the projection period, factors like rising respiratory disease instances and a sharp rise in demand for minimally invasive treatments are expected to propel market development.

- Other elements contributing to the growing popularity of the devices and the expansion of the market for non-invasive (NIV) ventilators include their benefits.

- The prevalence of different respiratory illnesses is rising, as is the number of products getting clearance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.19 Billion |

| Market Size in 2026 | USD 3.38 Billion |

| Market Size by 2035 | USD 5.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.12% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

High prevalence of persistent illnesses

A chronic condition is an illness or condition affecting human health that manifests itself over an extended period of time or whose symptoms are enduring. A chronic disease typically impacts several body parts, does not completely respond to therapy, and lasts a long time.

The CDC (Centers for Disease Control and Prevention) results indicate that 51.8% of the people in America had at least one chronic condition, & nearly 27.2% suffer from numerous chronic instances. Women, non-Hispanic white adults, individuals 65 and older, and people living in rural regions had the greatest prevalence rates.

Increasing the number of patients admitted to intensive care

Patients who need or are likely to need advanced respiratory support, patients who need the support of two or more organ systems, and patients who have chronic impairment of one or more organ systems who also need support for an acute reversible failure of another organ should all be placed in intensive care.

According to the Society of Critical Care Medicine, over 5 million patients are admitted to ICUs each year in the United States for invasive and intensive monitoring, airway support, breathing, or circulation, stabilization of various life-threatening medical issues, thorough management of injury or illness, & improvement in the comfort level for dying patients.

Key Market Challenges

High price

Patients with COPD have few choices for therapy and care, which puts them at risk for expensive and frequent hospitalization. The American Thoracic Society (ATS) estimates that the expense of a ventilation system includes $4,298 for equipment, $10,805 for medical appointments, $758 for medicine, and $8,598 for exacerbation therapy.

Key Market Opportunities

Technological progress

Innovation in the field of positive airway pressure (PAP) devices, mobility, and an increase in battery life are clearing the way for working efficiency. Due to the high demand for portable ventilators that can be used in a variety of situations, including ambulances, homecare, and remote medical centers, the portable ventilator market is expanding quickly. Research on the various ventilation techniques, such as Assist/Control ventilation (A/C), Pressure Support Ventilation (PSV), and Synchronized Intermittent Mandatory Ventilation, is increasing.

The increasing number of seniors

As you age, your body experiences a number of alterations that could reduce your lung capacity: Alveoli may sag and lose their form. Over time, the diaphragm may weaken and become less effective at both inhaling and exhaling. The elderly populace is significantly impacted by pulmonary illness. The American Lung Association's results show that people 65 years of age or higher account for the majority (86%) of deaths caused by chronic obstructive pulmonary disease.

Segment Insights

Application Type Insights

The prevalence of COPD and asthma is anticipated to rise significantly over the forecast period. Breathlessness is a symptom of COPD, a respiratory condition that worsens with exercise and puts a person at risk for exacerbations. Furthermore, a severe sickness may result in a long-term increase in the need for emergency care. In addition, among the target population's complicated heterogeneous inflammatory airway diseases, asthma is one of the most prevalent cases. Thus, it is anticipated that more NIV will be applied as a result of the high prevalence of respiratory crises like asthma and COPD, which will quicken segmental development.

Nearly 1 in 10 individuals worldwide are affected by COPD each year, according to a September 2022 piece in the American Journal of Respiratory and Critical Care Medicine. Additionally, according to data released on World Lung Day 2022 by the Global Initiative for Chronic Obstructive Lung Disease, an estimated 200 million people had COPD in the previous year, and asthma, one of the most common respiratory illnesses, affects roughly 262 million people each year. Numerous studies indicate that NIV is more advantageous for people with asthma and COPD. As a result, it is expected that the high prevalence of diseases will increase demand for NIV usage and propel the segment's development.

Additionally, ipratropium bromide combined with non-invasive ventilation is efficient in the therapy of people with COPD and respiratory failure, according to a study released in the American Journal of Translational Research (AJTR) in May 2022. The devices can greatly reduce circulatory inflammation, and enhance patient pulmonary function, blood gas levels, and therapy effectiveness. Thus, it is expected that the systems' advantages will support the segment's expansion during the forecast era. Therefore, it is expected that the benefits of the systems and apps in treating COPD patients will spur competition among the participants and aid in the segment's expansion.

End Use Type Insights

With a revenue share of more than 16% in 2023, the hospital industry sector ruled. This is because institutions are spending more money, which enables the use of ventilators with cutting-edge technology. The segment is expanding as a result of the accessibility of qualified healthcare professionals who can run these ventilators, the growing focus on better health outcomes, and increased hospital efficiency. Additionally, the continuous supervision provided by hospital personnel is likely to increase patients' preference for these medical centers.

During the forecast period, the residential healthcare sector is anticipated to expand at the fastest rate. The market is expanding as a result of a growing number of government programs that encourage home healthcare in an effort to reduce healthcare costs. Value-based healthcare is a significant driver of industry expansion. Medicare payments in the US are very advantageous in delivering value-based healthcare for better patient results at a low cost. As a result, in-home care has emerged as a popular form of therapy and is predicted to expand significantly over the coming years.

Regional Insights

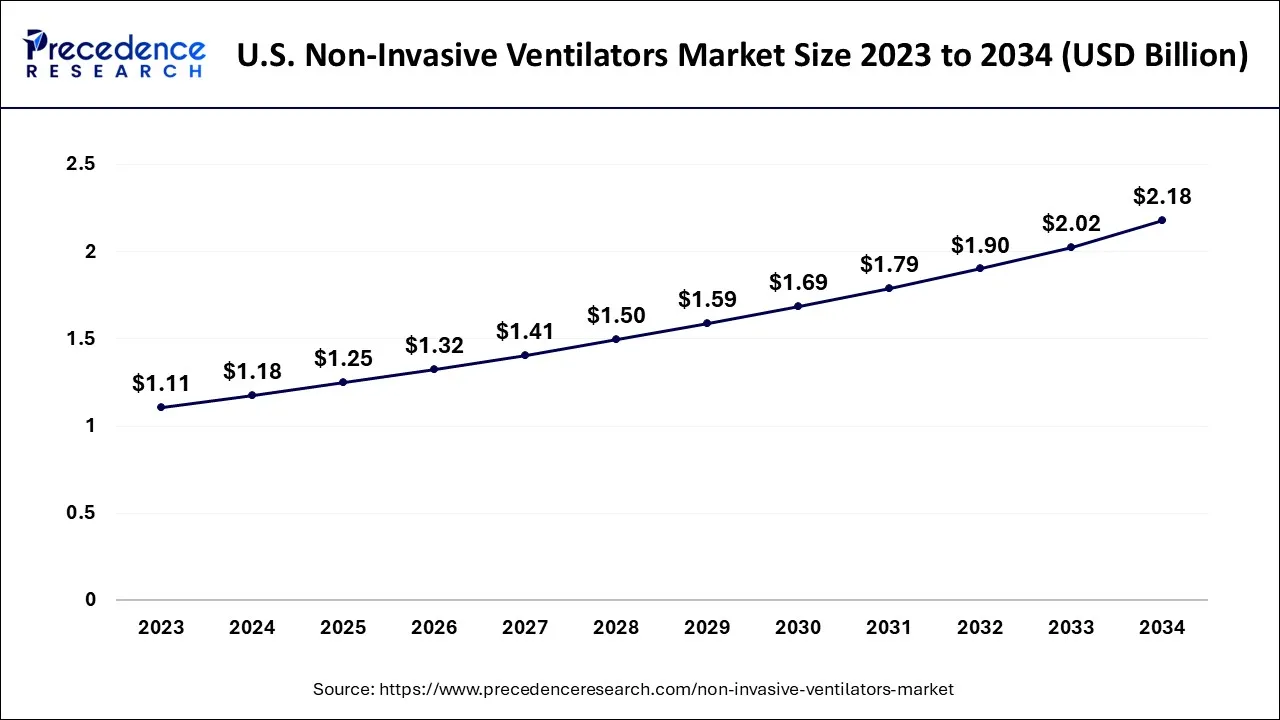

What is the U.S. Non-Invasive Ventilators Market Size?

The U.S. non-invasive ventilators market size is exhibited at USD 1.25 billion in 2025 and is projected to be worth around USD 2.31 billion by 2035, growing at a CAGR of 6.33% from 2026 to 2035.

In 2023, North America held a sales share of more than 56%, dominating the industry.The region's market is primarily driven by an increase in the number of severely ill COVID-19 patients in the United States and the existence of top manufacturers adopting output increases. In order to assist the government with the shortage issues of these devices, U.S. automobile titans like Tesla, Ford, and GM have shifted their manufacturing lines formedical supplieslike masks, mechanical ventilators, and othermedical devices. The local industry as a whole experienced considerable growth as a consequence.

The region's dominance in the market is further attributed to its advanced healthcare infrastructure, high demand for respiratory care devices, and significant investments in medical technologies. The region, particularly the U.S., has a large aging population and a high incidence of respiratory diseases, driving the need for non-invasive ventilation solutions. Additionally, the region benefits from strong regulatory frameworks, widespread insurance coverage, and early adoption of innovative medical technologies, which further enhance the accessibility and growth of non-invasive ventilators in hospitals, homecare settings, and emergency medical services.

U.S. Market Analysis

The U.S. dominates the non-invasive ventilators market in North America due to advanced healthcare infrastructure, high adoption of innovative respiratory devices, strong presence of key manufacturers, and increasing prevalence of respiratory diseases like COPD and sleep apnea. Additionally, supportive government initiatives, robust reimbursement policies, and continuous technological advancements in ventilator systems drive widespread usage across hospitals and home-care settings.

Why is Europe undergoing the Fastest Growth in the Non-Invasive Ventilators Market?

Europe is estimated to grow at a notable CAGR during the forecast period, due to the aging population and a very high rate of chronic respiratory diseases like COPD, sleep apnea, and neuromuscular conditions. Such countries as Germany, the UK, France, and Italy have well-developed healthcare systems that facilitate the early diagnosis and long-term respiratory management.

The high government funding, positive reimbursement policies, and universal use of home healthcare services are hastening the demand for non-invasive ventilators in the hospital and home-based setups. The shift towards non-invasive ventilation is further promoted by the focus of Europe on the concept of patient safety, infection control, and shorter hospitalization.

Europe: A Notably Growing Area

Europe is expected to witness a notable growth in the non-invasive ventilators market due to rising respiratory disease prevalence, increasing geriatric population, and growing demand for home healthcare solutions. Technological advancements, favorable reimbursement policies, and strong investments in healthcare infrastructure further boost adoption. Key players' strategic initiatives, including product launches and collaborations, also drive regional market growth.

UK Market Analysis

The UK non-invasive ventilators market is projected to grow rapidly due to rising prevalence of respiratory disorders, an increasing elderly population, and a growing preference for home-based care. Supportive NHS initiatives, advanced healthcare infrastructure, and adoption of innovative ventilator technologies further drive demand. Additionally, key players' product launches, partnerships, and awareness campaigns contribute to the market's accelerated growth.

Why Is the Asia Pacific Non-Invasive Ventilators Market Experiencing Notable Growth?

The Asia Pacific non-invasive ventilators market is registering tremendous growth due to the growing respiratory illness load, growing healthcare spending, and growing access to critical care. Rapid urbanization, air pollution, and high rates of smoking have contributed to an increasing incidence of asthma, COPD, and acute respiratory infection in places like China and India.

The governments spend a lot of money on preparing the healthcare infrastructure, emergency preparedness, and the capacity of ICUs, which increases the demand for non-invasive ventilation systems. An increasing trend in the trend in use of home care and sleep therapy devices, coupled with increasing awareness of the cost-effective respiratory support, also facilitates a rise in the market.

Due to rising COVID 19 cases, rising healthcare costs, numerous collaborations, new product launches, and strategic agreements made by regional players during the pandemic, the Asia Pacific market is expected to experience significant growth over the coming years. For instance, CSIR-NAL created the Swasth Vayu non-invasive lung pressure respirator in January 2021.

In a similar vein, Spicejet unveiled Spiceoxy, a lightweight, non-invasive ventilation system, in August 2020. In the upcoming years, their adoption is anticipated to increase as a result of the launch of such affordable goods. Additionally, the increase in this area can be attributed to the creation of infrastructure and healthcare regulations that support improved patient treatment. Growing lifestyle behaviors like smoking and genetic allergic research that hasten the occurrence of respiratory disorders further support market expansion.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to be the fastest-growing market for non-invasive ventilators due to the increasing number of cases of respiratory disease, a large geriatric population, and rising awareness of home healthcare solutions. Rapid healthcare infrastructure development, government initiatives, and the expanding presence of key manufacturers further drive market growth.

India Market Analysis

India's non-invasive ventilators market is growing due to rising cases of respiratory diseases, increasing geriatric population, and growing demand for home healthcare solutions. Strengthening healthcare infrastructure and government initiatives promoting advanced medical devices also contribute to market growth. Moreover, rising healthcare expenditure and growing concerns over air pollution are boosting the market growth.

Why Is the MEA Non-Invasive Ventilators Market Gaining Momentum?

The Middle East and Africa non-invasive ventilators market is ambitious because of the rising investment in critical and emergency care and the enhancement of healthcare facilities. The count of hospitals in the Gulf Cooperation Council (GCC) countries is being increased, and the countries are adopting the latest technology of respiratory care in order to cope with the rising cases of respiratory diseases, which are chronic and sleep-related disorders that cause breathing disorders.

The trend in the use of non-invasive ventilation has increased awareness of the use of non-invasive ventilation as safer and more cost-effective in comparison with invasive techniques in urban hospitals and regional care centers in Africa. The healthcare modernization efforts led by the government, as well as the partnership between the state and the business sector, are enhancing the availability of respiratory support equipment.

Why Is the Latin American Non-Invasive Ventilators Market Emerging Rapidly?

The Latin American non-invasive ventilators market is expanding rapidly because healthcare facilities are focusing on economical respiratory treatment. The demand for non-invasive ventilation is increasing in Brazil, Mexico, and Argentina, which are the leading causes of COPD, sleep apnea due to obesity, and respiratory infections.

The market is growing because of the home care services and the growing knowledge about the use of sleep-disordered breathing therapies. The expanding developments and government programmes to modernize the medical infrastructure are making it easier to implement.

Non-Invasive Ventilators Market Value Chain Analysis

- Research & Development (R&D)

R&D focuses on developing advanced, more efficient, and user-friendly non-invasive ventilator technologies, including innovations in airflow, portability, and patient comfort.

Key players: Philips Healthcare, Medtronic, ResMed, Fisher & Paykel Healthcare. - Component Sourcing & Manufacturing

This stage involves sourcing critical components such as sensors, motors, valves, and displays, which are then assembled into fully functional non-invasive ventilators.

Key players: TE Connectivity, Nidec Corporation, Heraeus, Medtronic, Philips Healthcare. - Product Assembly & Integration

At this stage, the sourced components are assembled into final products, which include both the ventilator units and associated accessories like masks, tubing, and filters.

Key players: ResMed, Philips Healthcare, Fisher & Paykel Healthcare, Drägerwerk AG. - Distribution & Sales Channels

Finished products are distributed through hospitals, homecare services, medical equipment distributors, and direct sales to reach end users such as healthcare facilities and patients.

Key players: McKesson Medical-Surgical, Cardinal Health, Medtronic, Fisher & Paykel Healthcare, Philips Healthcare.

Non-Invasive Ventilators Market Companies

- ResMed Inc.: Provides advanced non-invasive ventilators, masks, and digital solutions for sleep apnea and respiratory care, emphasizing patient comfort, home monitoring, and clinical effectiveness.

- Teleflex Incorporated: Offers non-invasive ventilation accessories and respiratory support devices, focusing on patient safety, ease of use, and integration with hospital and home-care respiratory systems.

- Hamilton Bonaduz AG: Designs and manufactures innovative ventilators for ICU and home use, featuring adaptive ventilation modes, patient monitoring, and AI-assisted respiratory management.

- HEYER Medical AG: Specializes in non-invasive ventilation equipment and accessories, including masks and circuits, targeting hospitals and home healthcare for effective respiratory therapy.

- Respironics: Produces a range of non-invasive ventilators, masks, and monitoring solutions for sleep apnea and critical care, supporting both clinical and home-based therapy.

- Airon Corporation: Develops portable and stationary non-invasive ventilators and respiratory support devices, focusing on patient comfort, mobility, and seamless clinical monitoring.

Other Major key players

- Fisher & Paykel Healthcare

- Magnamed

- Medin Medical Innovations GmbH

- Mindray Medical International Limited

- O-Two Medical Technologies Inc.

- Phoenix Medical Systems Pvt. Ltd.

- Phillips Healthcare

- Smiths Medical

- WILAmed GmbH

Recent Developments

- Iraq placed a £1.3 million contract with Inspiration Healthcare in June 2022 for SLE ventilators and Viomedex supplies. The SLE ventilators are advanced neonatal ventilators with a variety of conventional settings in addition to non-invasive ventilation (NIV), high-frequency oscillation ventilation (HFOV), and high flow oxygen therapy. They are frequently used to heal sick and preterm infants in Neonatal Intensive Care Units around the globe.

- Due to possible health risks, Philips Respironics issued a recall for specific Trilogy Evo ventilators with specific serial codes in January 2022. The Trilogy Evo ventilators in question had their silencer component made of non-conforming polyester-based polyurethane (PE-PUR) sound abatement foam. These devices may deteriorate and allow particles of the polyester-based polyurethane (PE-PUR) sound abatement foam to infiltrate the air passage. For individuals requiring artificial ventilation who weigh around 2.5 kg and require continuous or sporadic positive pressure breathing, the Trilogy Evo ventilator can be used.

- In November 2023, the Inspiration Healthcare Group plc introduced the SLE1500, a miniature neonatal ventilator, which provides advanced non-invasive ventilation (NIV) to the premature and weak newborns. The system helps in the provision of soft respiratory supports to the weak neonatal lungs and provides flexibility in the specialist neonatal intensive care units. (Source: research-tree.com

- In July 2023, Getinge turbine-driven Servo-air Lite ventilator was cleared by the U.S. FDA to use as a non-invasive device to provide respiratory support to spontaneously breathing patients who needed respiratory support. This portable unit does not require a wall gas supply and was scheduled to be available in the U.S. market as early as September 2023, which will broaden the range of available flexible NIV solutions in care settings. (Source: getinge.com/ )

- In February 2024, Getinge introduced the Servo-c mechanical ventilator in India, designed to deliver lung-protective therapy and meet the country's growing and evolving healthcare needs.

(Source: www.healthcareradius.in)

Segments Covered in the Report

By Application

- Respiratory Distress Syndrome

- Asthma & COPD

- Others

By End User

- Ambulatory Surgical Centers

- Hospitals and Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting