Medical Device Outsourcing Market Size and Forecast 2025 to 2034

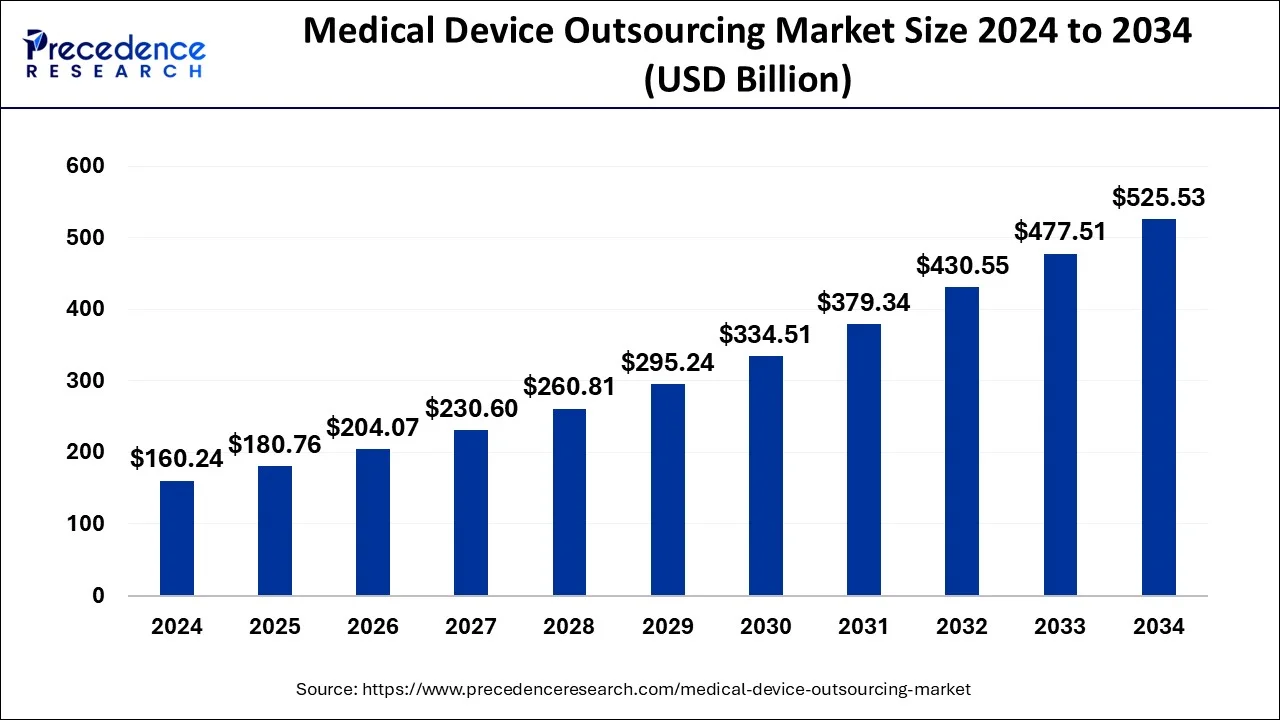

The global medical device outsourcing market size was estimated at USD 160.24 billion in 2024 and is anticipated to reach around USD 525.53 billion by 2034, expanding at a CAGR of 12.61% from 2025 to 2034. The increased demand for non-invasive medical devices is driving the growth of the global medical device outsourcing market. The growing need to reduce product costs and complexity enhances the adoption rate of outsourcing. Additionally, rising demand for affordable devices is fueling the market growth.

Medical Device Outsourcing Market Key Takeaways

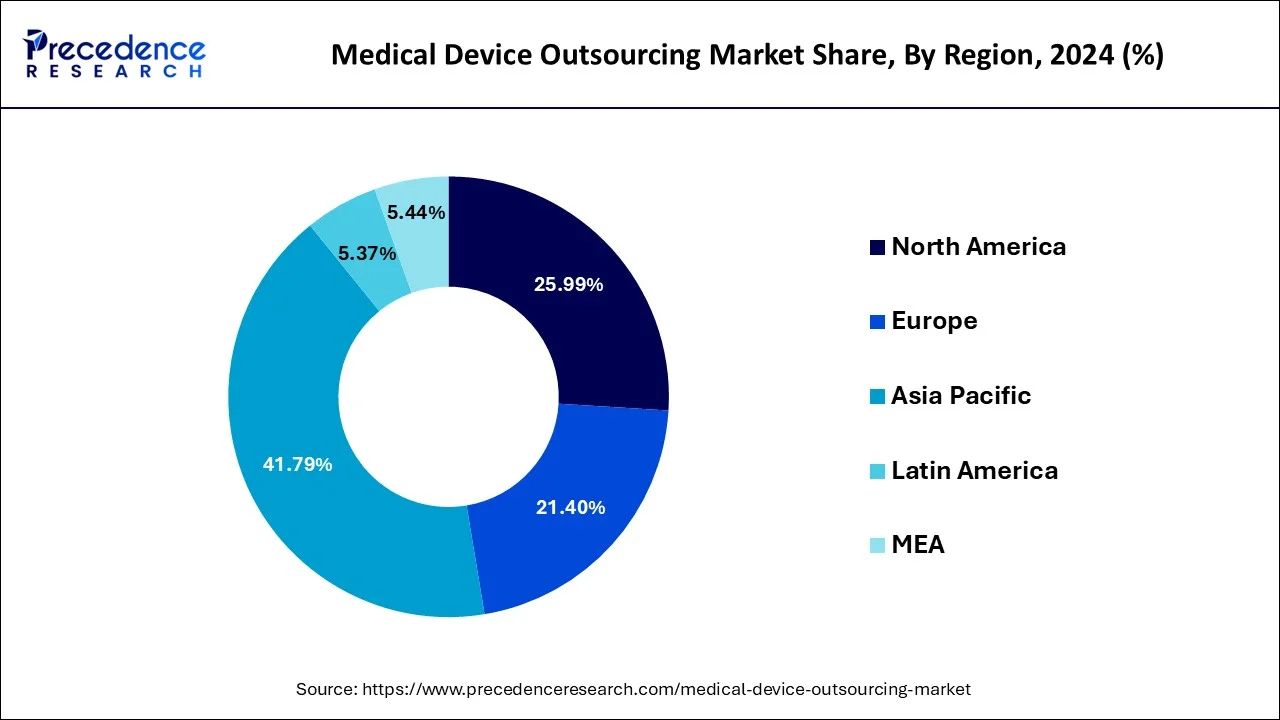

- Asia Pacific dominated the medical device outsourcing market with the largest market share of 41.79% in 2024.

- North America is expected to expand at the fastest CAGR of 12.5% during the forecast period.

- By application, the cardiology segment accounted for the largest share of the market in 2024

- By service, the quality assurance segment generated the biggest market share of 9.56% in 2024.

- By service, the regulatory affairs services is projected to grow at a double digit of CAGR of 13.5% during the forecast period.

What is the role of AI in the particular market?

- In November 2023, the launch of Evinova, a health technology business focused on bringing digital health solutions already in use globally by the pharma company to clinical research organizations (CROs), trial sponsors and care teams, and patients was announced by Pharmaceutical giant AstraZeneca.

AstraZeneca launches Evinova to bring AI to clinical trials | Mobi Health News

Asia Pacific Medical Device Outsourcing Market Size and Growth 2025 to 2034

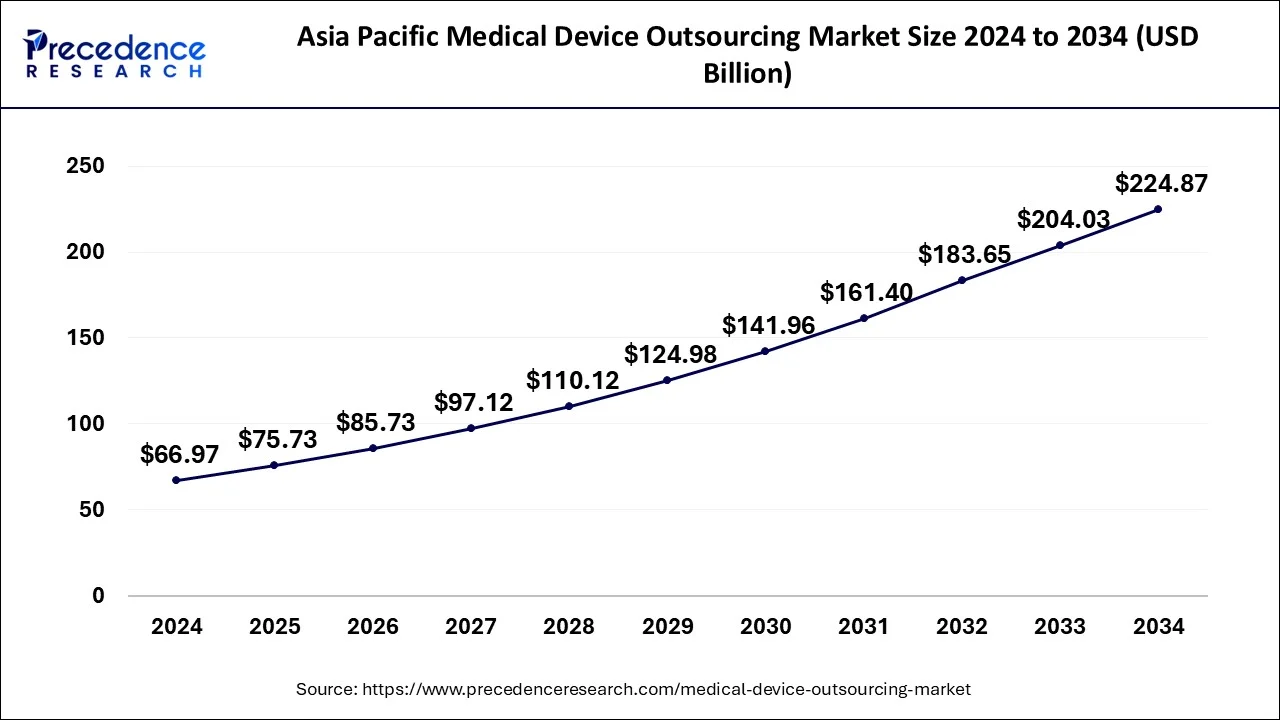

The Asia Pacific medical device outsourcing market size was evaluated at USD 66.97 billion in 2024 and is predicted to be worth around USD 224.87 billion by 2034, rising at a CAGR of 12.87% from 2025 to 2034.

Asia Pacific dominated the medical device outsourcing market with the largest market share of 41.79% in 2024.

For instance, In November 2024, the Indian government invested in a Rs 500 crore scheme aimed at strengthening key areas such as manufacturing, skill development, clinical studies, infrastructure, and industry promotion. The investment is expected to boost India's medical device industry.

North America s expected to expand at the fastest CAGR of 12.5% during the forecast period.

North America is expected to witness significant growth in the medical device outsourcing market due to the availability of advanced healthcare infrastructure, which supports the innovations and developments of advanced outsourcing medical devices. The expanding healthcare infrastructure in North America is contributing to the market growth. Additionally, government and regulatory initiatives and investments in the research & development sector are shaping the market in North America.

Though the total medical device industry in the U.S. is estimated to continue growing at a robust rate, the outsourced manufacturing market is anticipated to perceive even faster growth. As medical device producers attempt to recover margins and time to market, outsourced manufacturing will continue to grow in approval.

Asia Pacific dominated the global medical device outsourcing market in 2024. Rising adoption of connected medical care and smart devices, rising investments to outsource medical device designing and development, rising demand for surgical interventions and medical diagnosis, and rapid innovation in medical device technologies are driving the growth of the market in the Asia Pacific region.

- For instance, in July 2025, the Invisalign System with mandibular advancement featuring occlusal blocks, designed specifically to address Class II skeletal and dental correction by simultaneously advancing the mandible while aligning the teeth was launched by Align Technology Inc. in India.

New Mandibular Advancement for Invisalign System Released in India - Medical Product Outsourcing

North America is projected to host the fastest growing market in the coming years. Increased medical device consumption, increasing demand for cost-effective production solutions, enhanced healthcare infrastructure, and rapidly aging population are contributing the growth of the medical device outsourcing market.

- In April 2025, operations in the U.S. with MeKo MedTech Inc. in Bloomington, Minnesota was launched by MeKo Manufacturing. Sarstedt, Germany-based MeKo specializes in high-precision laser material processing, with more than three decades of experience with laser cutting, laser drilling, and laser welding of metals and other materials.

MeKo Manufacturing launches US medtech operations

Market Overview

The escalating trend toward outsourcing manufacturing operations has become essential as it helps to decrease direct expenses and modernize supply chains while balancing rising operating expenses. At present, a variety of influences are motivating growth in the contract manufacturing segment. Extreme competition has forced device producers to emphasize their core proficiencies of research and development, marketing, clinical education, and sales. Medical device outsourcing bids cost savings and better-quality service delivery. According to a present-day KPMG survey, out of 94 respondents in the medical service and device supplier industries, upgraded service delivery and cost drop are two of the primary influencers for outsourcing. IT outsourcing was recognized by 38% of respondents as the topmost way for cost reduction, whereas 26% of respondents observed it as a good technique to recover service delivery. In contrast, business process outsourcing (BPO) was regarded by 30% of respondents as an uppermost means for cost drop, whereas 19% of respondents thought it was a good method for developing service delivery.

The significance of regulatory compliance is anticipated to lift the growth of consulting services, including quality management systems, remediation, and compliance, thus backing the market growth. However, pricing pressure, budget scrutiny in established countries, and changes in repayment schemes are certain major features expected to upsurge the implementation of cost suppression procedures by the original equipment manufacturers (OEM). These factors are also anticipated to lift medical device outsourcing to emergent nations, including India and China.

Market Trends

- Technological advancements

- Demand for high quality medical devices

- Strategic partnership and acquisitions

- Development of innovative business models

- Digital transformation and automation

Medical Device Outsourcing Market Growth Factors

- Rising demand for non-invasive and minimally invasive medical devices is the key factor enhancing the growth of the market.

- The growing prevalence of the disease requires advanced medical devices, which has enhanced the production of medical devices. The need for reducing production costs and complexity is driving the need for outsourcing.

- The need to comply with regulatory compliance to maintain quality and safety standards is playing a favorable role in market growth.

- Rising numbers of cosmetic surgeries are requiring medical device outsourcing to prevent complexity and improve safety.

- The rising adoption of personalized medicines requires the development of customized medical devices, making outsourcing more essential.

- Government initiatives and investment in R&D healthcare and the pharmaceutical sector encourage manufacturing companies to adopt cutting-edge technologies.

- The growing adoption of outsourcing devices in medical device manufacturing is boosting the market growth.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 142.19 Billion |

| Market Size in 2025 | USD 142.19 Billion |

| Market Size by 2034 | USD 430.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.10% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Driver

Growing complexity and cost

The rising complexity and cost of medical device development and production are the key drivers of the global medical device outsourcing market. The rising prevalence of chronic disease and the number of surgeries is driving demand for advanced, safe, and more effective medical devices; however, the complexity and expensive production of medical devices occurring due to regulatory compliance, clinical trials, quality control, and quality assurance are driving the need for outsourcing. The rising need for specialized expertise to develop and maintain medical devices is fueling the market growth. Additionally, the need for increasing scalability, flexibility, cost-effectiveness, quality, and reliability of medical devices is driving the need for outsourcing, leading to a positive influence on the market.

Restraint

Data security

The medical devices outsourcing market significantly faces challenges in managing access to sensitive information such as patient data and product designs. The critical medical device development process is likely to be attacked by unauthorized aspects due to outsourcing. Additionally, the connection of medical device outsourcing can cause challenges such as cyber threats. The implementation of data security measures and risk assessment of outsourcing partners with data security practices can help to overcome such a restraint.

Opportunity

Rising demand for cost-effective medical devices

The rising prevalence of chronic disease and the number of surgeries requiring cutting-edge medical devices. However, the high costs of medical devices are hampering the healthcare expenditure. The rising demand for affordable medical devices by healthcare professionals and patients is holding market potential. Outsourcing is beneficial for low-cost manufacturing as it helps to reduce cost-related regulatory compliance, clinical trials, waste management, and complexity. Large-scale outsourcing helps to reduce overall medical device production and maintenance costs. Additionally, access to specialized expertise further helps to reduce risk and complexity, making more cost-effective production and manufacturing. The ability of outsourcing to reduce product development downtime is increasing their adoption in medical device manufacturing practice.

Application Insights

The cardiology segment underwent notable growth in the medical device outsourcing market during 2024. In cardiology, medical device outsourcing plays an important role. Cardiac implantable electronic devices including cardiac loop recorders, biventricular pacemakers, implantable cardioverter defibrillator (ICD), and pacemakers are designed to help control or monitor irregular heartbeats in people with specific heart rhythm disorders and heart failure.

- In March 2025, the U.S. launch of Flyrcado (flurpiridaz F 18) injection was announced by GE HealthCare. The company made the announcement as it prepares to showcase new artificial intelligence (AI)-powered innovations at the 2025 American College of Cardiology (ACC) Annual Scientific Session and Expo, reflecting its strategy to leverage AI to help increase efficiency and allow seamless data integration across the cardiology care pathway.

GE HealthCare Introduces Measures to Improve Cardiac Care Pathway - Medical Product Outsourcing

The general and plastic surgery device segment will gain a significant share of the market over the studied period of 2025 to 2034. General and plastic surgery benefits include psychological benefits, restored functionality, better physical health, improved self-confidence, and enhanced physical appearance. Plastic surgeries have been found to enhance the mental health of people. Researchers have found that plastic surgery can increase happiness and boost patient's self-esteem.

- In August 2025, the formation of wholly owned subsidiary in Australia and New Zealand, alongside an exclusive partnership with High Tech Medical Pty Ltd. to launch the ELIXIR MD Device across the region was announced by the ELIXIR MD, Inc., a pioneer in advanced medical technology and proprietary treatment protocols for plastic surgery.

Services Insights

The quality assurance segment enjoyed a prominent position in the market during 2024 and is predicted to witness significant growth in the market over the forecast period. Medical device quality assurance is important to ensure medical devices are of uniform and high quality. The purpose of QA in the medical device industry is to systematically ensure that devices consistently meet quality specifications and related needs through their lifecycle, from development to post-market.

- In March 2025, OpenQMS, an open access, web-based platform for helping companies navigate the Quality Management process throughout the medical device development lifecycle was launched by Archimedic, a medical device development firm that provides design, regulatory, and go-to-market services to its clients.

Archimedic Launches OpenQMS, an Open-Access Quality Platform for Medical Device Development

Key Companies & Market Share Insights

Outsourcing gives OEMs the prospect to take benefit of resources such as labor, machinery or materials. It proves cost-efficient to outsource production particularly if maneuvers and expertise of machinery can be handled from outside than to fetch an expert in the headquarters and then train individuals. Due to outsourcing despite of escalating operating expenses, the medical device manufacturing has exhibited significant growth during the last few years. For example, Medtech company have accomplished to sustain industry productivity by supporting an extremely high level of assurance to product innovation and by implementing a variety of creative cutbacks measures such as progressively popular approach of outsourced manufacturing.

Medical Device Outsourcing Market Companies

- Intertek Group PLC

- TüvSüd AG

- Wuxi Apptec

- SGS SA

- Toxikon, INC.

- Eurofins Scientific

- American Preclinical Services

- Sterigenics International LLC

- Pace Analytical Services LLC.

- North American Science Associates, Inc.

- Charles River Laboratories International, Inc.

Leader's Announcement

- In November 2024, Shri JP Nadda, Union Minister for Chemicals and Fertilizers, stated on the launching of a Rs 500 crore scheme for the medical device industry in India: “The investment may seem small, but the result is huge.”

Recent Developments

- In July 2025, the launch of NYEMED 7312, advanced non-PFAS damping grease specifically for the medical devices was announced by Fusch Lubricants Co. It provides reliability, motion control, and biocompatibility in critical medical applications.

Fuchs Lubricants launches non-PFAS damping grease for devices

- In November 2024, a new AI Innovation Lab to accelerate early-concept artificial intelligence (AI) solutions was opened by GE HealthCare. The projects are a part of GE Healthcare's broader AI and digital strategy, which is focused on integrating AI into medical devices, building AI applications that improve decision making across the care journey and disease states, and using AI to support better outcomes and operational efficiencies system wise.

GE Healthcare Launches New AI Innovation Lab - Medical Product Outsourcing

Segments Covered in the Report

By Service

- Product Upgrade Services

- Regulatory Affairs Services

- Legal representation

- Clinical trials applications

- Regulatory writing and publishing

- Quality Assurance

- Product Maintenance Services

- Product Testing & Sterilization Services

- Product Design and Development Services

- Molding

- Designing & engineering

- Machining

- Packaging

- Product Implementation Services

- Contract Manufacturing

- Accessories manufacturing

- Component manufacturing

- Device manufacturing

- Assembly manufacturing

By Application

- Drug delivery

- Dental

- Diabetes care

- Cardiology

- Endoscopy

- IVD

- Ophthalmic

- Diagnostic imaging

- Orthopedic

- General and plastic surgery

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content