July 2025

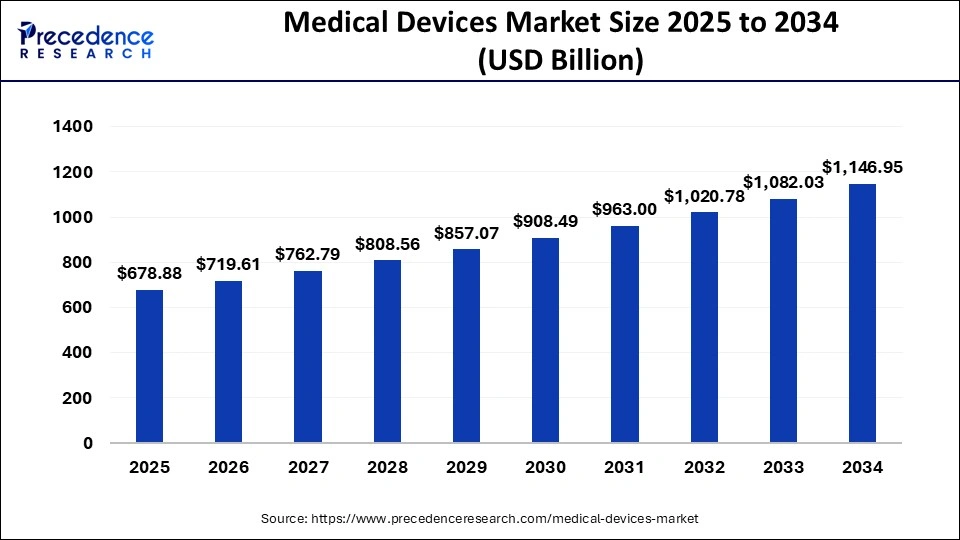

The global medical devices market size was exhibited at USD 640.45 billion in 2024 and is projected to increase from USD 678.88 billion in 2025 to approximately USD 1,146.95 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034.

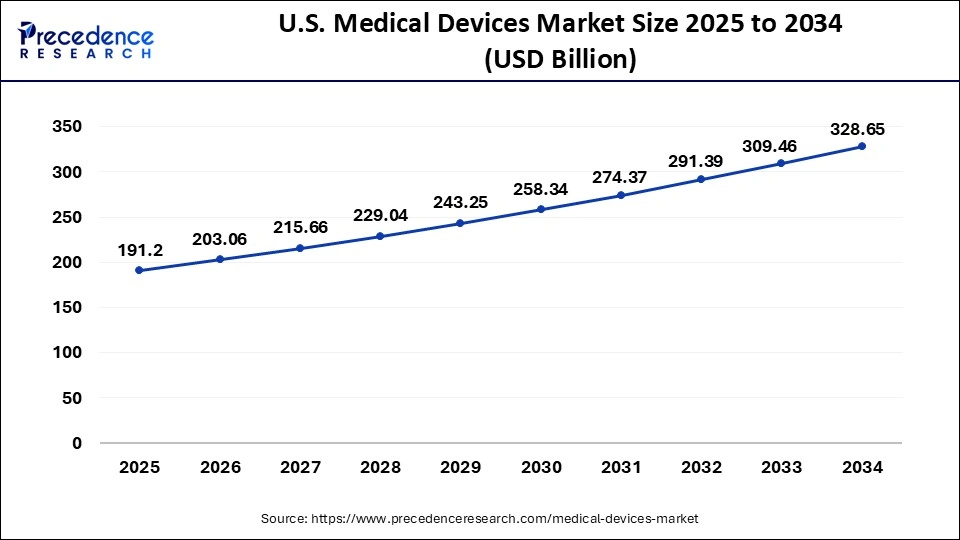

The U.S. medical devices market size was anticipated at USD 180.02 billion in 2024 and is predicted to be worth around USD 328.65 billion by 2034, at a CAGR of 6.2% from 2025 to 2034.

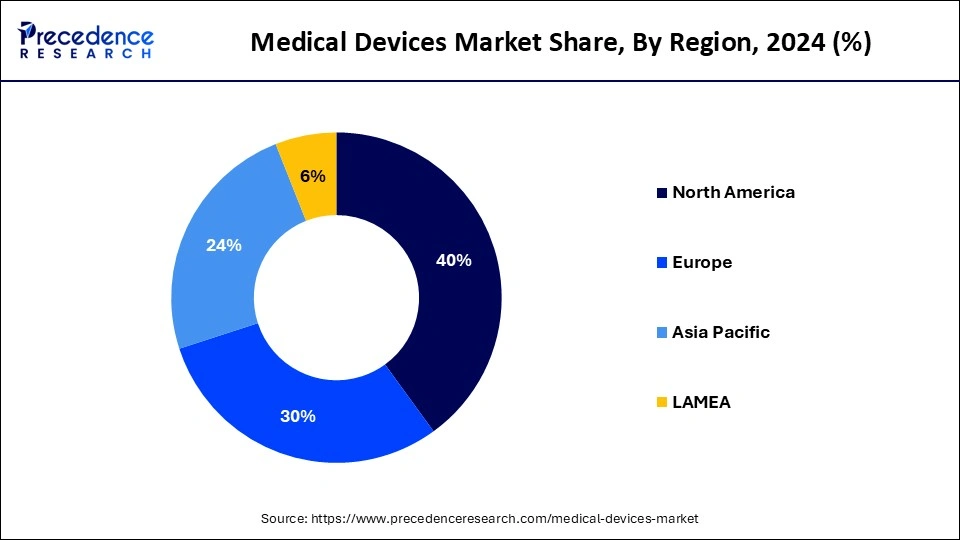

North America held the largest share of the medical device market in 2024. This is mainly due to its well-established healthcare system and advanced healthcare facilities that support the adoption of medical devices. The region is at the forefront of technological advancements, helping the North American medical device industry to develop innovative medical devices. The region is home to many well-known medical device manufacturing companies. Government support and initiatives and favorable reimbursement policies further support the adoption of medical devices.

The U.S. is a major contributor to the North American medical devices market. The U.S. stands as the global leader in medical device production. The rapid shift toward the home healthcare model is boosting the adoption of medical devices. The rising adoption of new and advanced medical technologies for enhancing critical disease diagnosis and treatment procedures is likely to impel the market growth in the region. In addition, the increasing prevalence of chronic conditions and increasing healthcare expenses contribute to regional market growth.

Asia Pacific is emerging as the fastest-growing region due to the rising prevalence of chronic diseases, such as diabetes, cardiovascular diseases (CVDs), and high blood pressure. These diseases often require regular monitoring to manage conditions and reduce fatalities. This, in turn, boosts the demand for monitoring devices, as they allow patients to check vital health parameters at home. With the rising healthcare costs, people are shifting toward home healthcare, boosting the adoption of medical devices.

India and China are expected to lead the Asia Pacific medical devices market. This is mainly due to the growing awareness about health and wellness, rising per capita income, and increasing aging population. As the population ages, the need for medical intervention increases, supporting market growth. Moreover, governments of these countries is investing heavily to advance healthcare infrastructure, contributing to market growth.

The medical devices market in the Asia Pacific region is expanding due to various factors, including the incorporation of digital solutions for medical processes by leading key players. Several capitalists are engaging in collaborating with Asian MEDtech enterprises and growing per capita GDP owing to evolving economies like India, China, and Japan.

The Internet of medical things, big data analytics, cloud computing are some of the examples where the MEDtech sector is integrating with these technologies to expand further and launch innovative methods for diagnosis and other healthcare-related results. This trend is significant due to a growing geriatric population who tend to witness more chronic diseases due to age-related declines in health, which further leads to growing consumption of medical supplies, fostering the medical devices market in Asia.

Increasing investment in Research & Development (R&D) activity by medical technology companies for the development of new and advanced medical devices and easy approval for those devices by the regulatory authorities expected to impel the market growth fro medical devices over the upcoming years. For instance, according to the U.S. Food and Drug Administration (USFDA) database, there were nearly 54 and 27 new medical devices approved and cleared by the institute in the year 2018 and 2017 respectively. Increasing demand for innovative therapies along with the technological advancements in the medical devices to overcome the unmet requirements in the healthcare sector considered as the prime factor supporting the growth of medical devices during the forthcoming years.

However, data security threat may hamper the market growth for medical devices as internet connection is required for transferring patient’s data from remote devices to the physician. Hence, this increases threat for data security. Rising trend for connected devices makes them attractive and thus increases the risk for data breaches or hacks. For instance, in March 2020, critical patient’s data including medical questionnaires, copies of driving license, passport, and national insurance number were leaked for over 2,300 patients of Hammersmith Medicines Research. The research firm was carrying out trials for COVID-19 vaccine on these patients.

| Report Highlights | Details |

| Market Size by 2034 | USD 1,146.95 Billion |

| Market Size in 2025 | USD 678.88 Billion |

| Market Size in 2024 | USD 640.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Therapeutic Application, End User, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Increasing Adoption of 3D Printing of Medical Devices

Surgical equipment, dental restorations, and orthopedic and cranial implants are among the medical items created via 3D printing. Medical gadgets and implants developed using 3D printing may be more successful than those made using mass production methods since they are made specifically for the physiology of a patient or even for a particular surgery. For instance, surgeons are already using personalized surgery and patient-specific 3D-printed equipment and implants during knee surgery, where they have discovered that they hasten recovery and lower patient pain levels. With 3D printing, there is a significant opportunity to raise product quality in density and orthodontic procedures.

Intricate Regulatory Requirements

Increased expenditures for new product development and patient service offerings are anticipated to result from regulatory reforms. The General Data Protection Regulation, which was implemented by the European Union, as well as adjustments to the device approvals, are a few of these developments connected to consumption confidentiality. The US FDA has prolonged the time period to complete the marketing authorization by 55% during the past decade by requesting additional clinical data to back up the security and effectiveness claims of medical equipment like endoscopic instruments. Investments in novel devices are strained by the possibility of lost sales as a result of device release delays and increased expenses as a result of demanding regulatory procedures, which has an impact on the expansion of the market for medical devices.

Technological Transformation in the Devices by the Companies

The majority of medical device companies are undergoing a significant technological shift that will ultimately transform them into MedTech entities. Manufacturers are using data to incorporate intelligence into their products in an effort to be closer to the end user, and it is swiftly evolving into a crucial component of the new device value proposition. Organizations are also participating in unconventional alliances. Future advancements in artificial intelligence will simplify the management of chronic diseases from the perspective of the patient. Technology will also have a significant impact on the prevention of treatment, cutting down on the amount of time spent in hospitals. For instance, industrial firms are increasingly concentrating on robotic surgery.

The therapeutic devices segment held the largest share of 49.20% in the 2024 medical devices market. This segment has flourished substantially over time in this market, with the emerging new technologies/devices in surgical, cardiovascular, orthopedic, and respiratory treatments. The surgical devices, such as powered surgical instruments, MIS instruments, and electrosurgical devices, contribute largely to surgeons' procedures, mostly enhancing the surgical setting.

The cardiovascular devices like defibrillators, stents, pacemakers, and catheters, orthopedic devices such as trauma fixation, arthroscopy, spinal and joint reconstruction devices, are improving treatments and encouraging new therapies in the global healthcare sector. The respiratory devices include ventilators, CPAP/BiPAP, and nebulizer devices significantly generalized in the hospitals and ambulatory spaces. The insulin delivery devices, infusion pumps, and dialysis equipment have accelerated this segment in the broad healthcare sectors, unveiling greater profit to the global medical devices industry.

The assistive and rehabilitation devices segment is expected to grow at a CAGR of 8.90% during the forecast period. This segment has discovered exponential growth in exoskeletons, robotic rehabilitation, hearing aids, and mobility aid devices. The mobility aids consist of wheelchairs, prosthetics, and walkers, which are in rising demand among the geriatric and disabled (handicapped) population. These devices are assistive to physically dependent patients. The advancement in this segment is slowly increasing with the increased disturbed conditions across different groups.

The hospitals segment held the largest share of 41.60% in the 2024 medical devices market. The hospital is an epicenter of emerging medical devices to bolster treatments for various diseases. Hospital setting needs to advance and modernize their treatment methods to benefit from the effective timeline of recovery rate. The medical devices' safety and efficacy measures are an instant solution to the emergency conditions, expanding overall survival. The market revives hospitals’ opportunities of developing new treatments, trusting medical devices to support the vast operations. The requirement and study of medical devices is primary in hospitals with the increasing prevalence of disease and emergency cases.

The home healthcare settings segment is expected to grow at a CAGR of 9.70% during the forecast period. The bedridden or geriatric populations are the major reason for the growth of this segment in this market. The steady development and access to hospital-like facilities and medical devices have largely led to increasing demand for home healthcare settings. This market has experienced exponential growth in most of the healthcare settings due to its effectiveness and accessibility to the treatments in less time without any time-consuming procedures.

The direct sales (distributors and dealers) segment held the largest share of 54.30% in the 2024 medical devices market. This segment involves the distribution of sales and profits between the medical device distributor and dealers. It is a prominent sales channel allowing manufacturers to build customer relationships, control marketing, and spread awareness mainly important at a platform requiring precise product knowledge. The manufacturers discover opportunities for marketing the new medical devices in the healthcare spectrum. The market uplifts and unlocks its potential mostly in a hospital setting.

The online sales segment is nearly to grow at a CAGR of 10.20% during the forecast period. It’s a transformational segment for the global market and a chance for new businesses. The B2B e-commerce platforms play a vital role in the online sales space. The distributors, suppliers, and manufacturers are rapidly adopting the B2B idea to expand new devices, sales, and fuel engagement reach across global customers. The online sales enable the availability of medical devices to all customers, mainly in remote areas. The direct-to-consumer sales enter through customers' (patients') requirements and end up accelerating the home healthcare setting.

The global medical devices market is highly fragmented owing to the presence of large number of market players on global as well as regional level. Among these companies, Medtronic capture the largest market share with diverse product portfolio and strong brand name in the global market. Apart from this, most of the industry players invest prominently in the Research & Development (R&D) activity to develop new products and upgrade the existing product list. Furthermore, these market players largely focus on expanding their distributors across the globe that allows companies to expand their product offerings.

By Product Type

By End-User

By Sales Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

July 2025

August 2024

January 2025