What is Medical Drones Market Size?

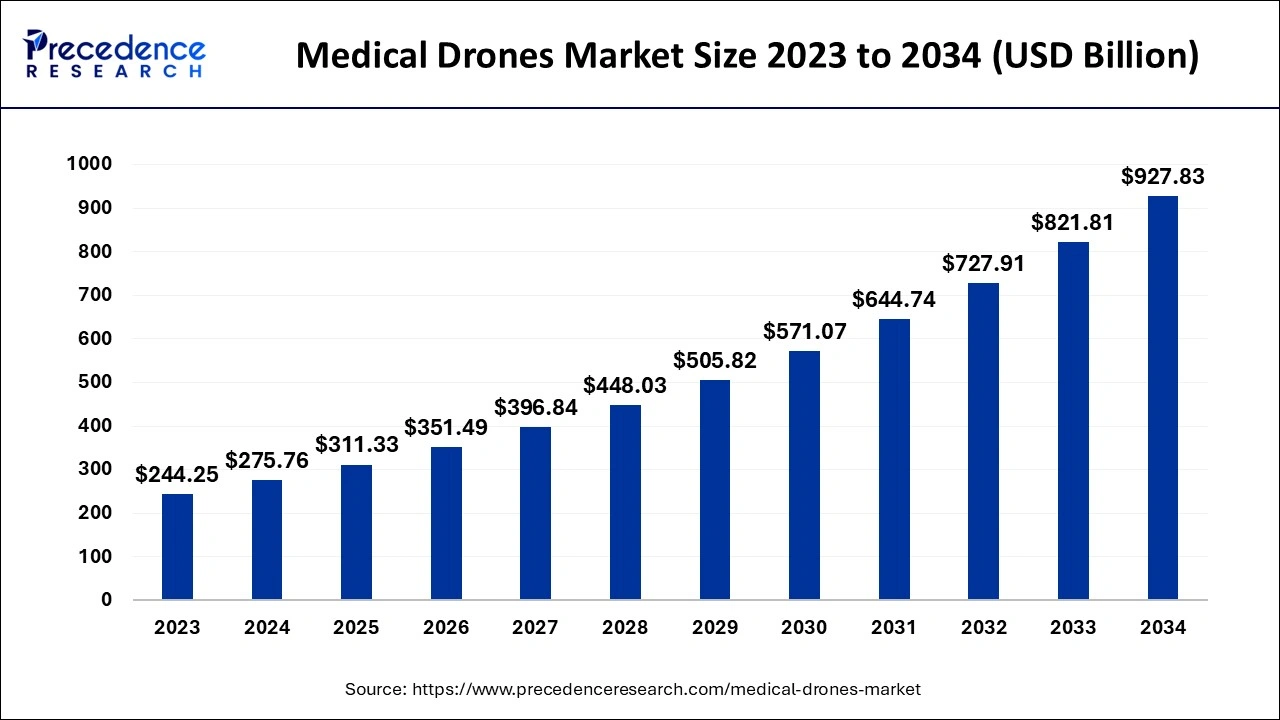

The global medical drones market size estimated at USD 311.33 billion in 2025 and is anticipated to reach around USD 1025.77 billion by 2035, expanding at a CAGR of 12.66% from 2026 to 2035

Market Highlights

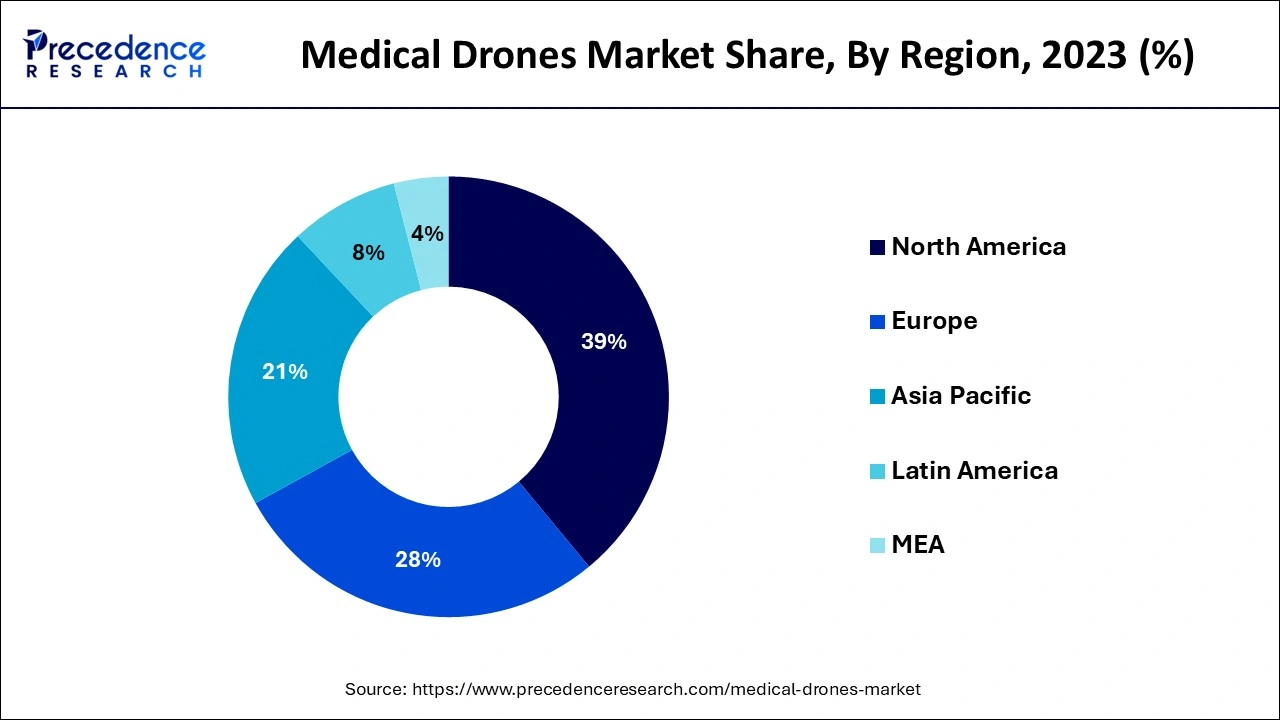

- North America medical drone market is valued at USD 107.55 million in 2025.

- Blood transfer segment is expected to grow at a CAGR of 23% between 2026 to 2035

- In 2025, the fixed wing segment dominated the market with a revenue share of 53.28%

- In 2025, the rotary wing segment accounted market share of over 31.62%.

Market Overview

In regions with easy access, drones are quite useful for delivering medical supplies including drugs, vaccines, and aids. These medical drones are used to provide secure and quick distributions in remote, conflict-torn, or inaccessible places. Recent years have seen a rise in the use of medical drones by the government and healthcare organizations to assist fight infectious and fatal diseases. All throughout the world, drones are being tested for use in healthcare. It is a tool that enhances current transportation networks and has advantages over conventional methods in certain situations. By enabling just-in-time delivery of vital medical supplies and devices, accelerating lab testing turnaround times, and lowering the cost of normal prescription care in rural areas, drone use presents a chance to improve healthcare, particularly in remote and/or underserved environments.

Depending on the model and size, drone prices can vary. Drones generally have lower startup and ongoing costs than more conventional modes of transportation. The majority of drones are fairly simple to use and don't have a steep learning curve. Drones can also be conveniently launched by medical professionals from parking lots, roofs, and nearby fields. A growing number of government efforts, public acceptability, and the use of medical drones are all contributing to the expansion of the global market for medical drones. The medical drones are subject to certain tight rules, though.

Medical Drones Market Growth factors

The market for medical drones is expanding significantly due to a number of different considerations. Undoubtedly, one of the major driving forces is the increasing participation of governments around the world. One of the largest advances in this area is the expanding use of drones in the health care industry. These drones help carry the essential medicines, vaccines, and blood-related supplies around the world by taking care of a number of vital criteria. The ability to quickly transport supplies to medical staff makes these drones more well-liked by the general public, which ultimately helps patients receive treatment without interruption. Medical drone sales are rising as their market share is expanding and more of them are being used in disaster or emergency situations. Additionally, these drones are competent enough to accurately deliver the required medical supplies to patients' beds. With all these advantages, medical drones are becoming more and more accepted by the general public, which can greatly aid in the market's growth. Governments and OEMs have moved more quickly to adopt and begin flexible laws, approvals, experiments, and test flights for medical uses as a result of the epidemic. As a result, numerous nations quickly began evaluating the effectiveness of UAVs.

Time is essential and can be a lifesaver in the healthcare industry. This is why it's imperative to move as quickly and efficiently as possible when moving biomedical samples between hospitals or laboratories. The majority of hospitals and laboratories utilise conventional courier services, so even though each sample is small and light, they frequently need to wait for a minimum volume before sending it. Delivery times are not always consistent because they depend on traffic conditions, which might further slowdown the procedure. Because they can offer faster, less expensive, and more dependable delivery services, drones present a good option in this situation.

Market Key Trends: Wings of Wellness

The medical drone market is soaring with innovation, powered by the urgency to transform healthcare delivery in both urban and remote areas. One of the key trends shaping this sector is the increased adoption of autonomous drones for time-sensitive medical deliveries, especially for emergency kits, vaccines, and blood samples. The demand for on-demand delivery and faster access to healthcare essentials has led to a shift from traditional logistics to drone-based systems, supported by miniaturised payload systems and enhanced flight automation. Furthermore, regulatory relaxation and the emergence of hybrid drone models capable of both vertical take-off and long-range travel are pushing the limits of operational range and terrain adaptability. Another notable trend is the growing collaboration between public health bodies, tech startups, and drone manufacturers to create robust networks for critical delivery routes. The role of AI-integrated navigation, real-time tracking, and cold-chain management systems embedded in drones is revolutionising how pharmaceuticals and organs are transported. This is gradually reshaping the healthcare infrastructure by reducing delivery time from hours to minutes, even in disaster-prone or rural locations.

Market Outlook

- Market Growth Overview: The medical drones market is expanding, driven by increasing demand for fast, contactless delivery of medical supplies, vaccines, blood, and diagnostic samples. Advancements in drone technology, along with rising use in emergency response and remote healthcare access, are driving market growth. Rising collaboration between drone manufacturers, healthcare providers, and governments also contributes to market growth.

- Global expansion: The market is expanding worldwide, supported by successful pilot programs transitioning into full-scale operations. Emerging economies are leading adoption due to infrastructure challenges and urgent healthcare needs. Developed regions are integrating drones into emergency response and hospital logistics. Moreover, international partnerships and cross-border trials are accelerating technology transfer, contributing to the global expansion of the market.

- Major Investors: Major investors in the market include drone technology companies, healthcare providers, logistics firms, and government agencies. They contribute by funding R&D, developing autonomous and long-range drone systems, expanding delivery networks, and partnering on large-scale medical drone deployment programs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 311.33 Billion |

| Market Size in 2026 | USD 351.49 billion |

| Market Size by 2035 | USD 1025.77 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.66% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Service Type, Technology, Package Size, Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Depending upon the type, therotary wingsegment is the dominant player and is anticipated to have the biggest impact on medical drones market. The rotary-wing segment maintained a dominant share due to the considerable demand for rotary wing for medical supplies, public area cleaning, monitoring and surveillance applications during the COVID-19 pandemic worldwide. Additionally, effective VTOL capabilities and confined area operability have an impact on the market growth of the rotary-wing category. They can hover in position for extended periods of time, are far more agile than other types of UAVs at low airspeeds, are simpler to operate than other types of UAVs generally, can takeoff and land in confined locations, and take less time to set up, takeoff, and land, among other benefits.

Due to increased need for extended endurance and range, heavy and large payload carrying capabilities, and a wide area of coverage for medical applications, the hybrid category is predicted to rise as the fastest-growing segment. In addition to improving capabilities for applications such as crop imaging, military surveillance, emergency response, and remote infrastructure inspection, hybrid drones may one day enable drone package delivery. Any number of industrial-strength uses can be made for the drone. The engine weighs around 17 pounds and has a maximum power output of 10 kilowatts. The lift motors, backup batteries, and onboard electronics, including computers, sensors, and communications gear, are all powered by gasoline-powered generators. Users only need to refuel to resume flying; the inbuilt batteries never need to be recharged. The forms of flight control include fully autonomous and semi-autonomous.

Service Type Insights

During the projected period, the government segment is anticipated to be the largest in the medical drones market. Inaccessible places can benefit greatly from the deployment of medical drones to deliver medications, vaccines, and other supplies. These medical drones provide safe and quick distribution in inaccessible, distant, or conflict-torn locations. In order to assist minimize infectious and life-threatening infections, the usage of medical drones in government and healthcare services has recently gained popularity.

Due to the increasing demand among hospital facilities for UAV-based deliveries for various medical applications, such as human organ logistics, medical supply logistics, and other medical applications, the hospital-based segment is expected to experience the fastest growth during the forecast period. The speed, altitude, acceleration, and drones' ability to carry an AED and properly deliver it to a bystander are all factors that affect how quickly they can react. Drone dispatch to arrival time is 5.21 minutes as opposed to 22 minutes for an ambulance. A smartphone app might be used to call a drone. Bystanders would receive instructions from the drone on how to administer CPR and begin using the automated defibrillator until help arrived from the emergency services. These facilities and improvements are driving the drones market in the hospital based segment.

Logistical Application Insights

The market's dominating category has generally been emergency blood logistics, and this trend is expected to continue during the projection period. The increased demand and acceptance rate for unmanned system logistics to supply blood samples and pathological blood products is responsible for this segmental expansion.

The market's fastest expanding area is the logistics for vaccines. Due to the strong demand for vaccinations for numerous diseases, epidemics, viral outbreaks, and the continuing COVID-19 pandemic, it increases during the projection period. The ability of medical drones to quickly transport immunizations to remote locations is one factor in the development. Additionally, a number of organizations, including UNICEF, are sponsoring medical drones to provide vaccines in remote locations and during emergencies, which is promoting segment growth.

Regional Insights

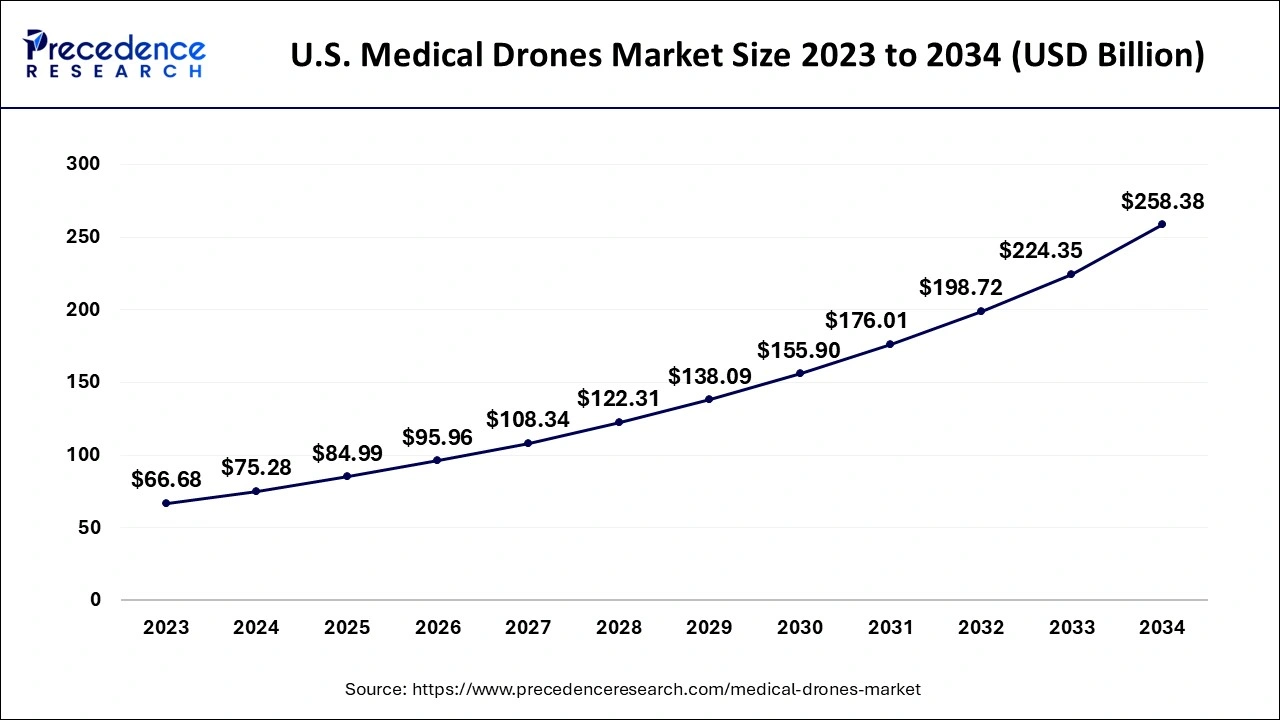

U.S. Medical Drones Market Size and Growth 2026 to 2035

The U.S. medical drones market size is evaluated at USD 84.99 billion in 2025 and is predicted to be worth around USD 286.81 billion by 2035, rising at a CAGR of 12.93% from 2026 to 2035

The highest market share and dominant position in the medical drones market belongs to North America during the forecast period. This region includes U.S. and Canada. The market for medical drones in this region is expanding as a result of customer demand for them and technological advancements. The development of medical drones has received significant research funding, and hospitals, clinics, and ambulatory surgical centers have used medical drones widely. These factors have led to the expansion of the North American medical drones market. Additionally, the U.S. and Canada both have important rules that support the use of drones in the healthcare industry, which also helps the market expand in the area.

North America, a Skyward Bound

North America currently dominates the global medical drone market, owing to its strong regulatory support, significant investment in drone technology, and expansive healthcare infrastructure. Countries like the United States and Canada are leading this transformation. In the U.S., government bodies such as the Federal Aviation Administration (FAA) have streamlined permissions under programs like the Beyond Visual Line of Sight (BVLOS) operations and the UAS Integration Pilot Program, which has fast-tracked medical drone trials and real-time emergency services. The U.S. also benefits from initiatives like state-funded public-private partnerships aimed at supporting drone corridors between medical centres, while Canada has adopted air corridor models across isolated regions to address access barriers in Indigenous communities. These government-backed frameworks, combined with the presence of key technology developers and healthcare innovators, give North America a distinct edge in scalability, deployment, and infrastructure integration.

The market growth in Asia Pacific, the third-largest area, is due to the region's high adoption rate, investments by OEMs and governments, the presence of OEMs there like DJI, and market expansion by international market players like Zipline. Moreover, one of the main motivating elements is undoubtedly the increasing participation of governments from all around the nations in the region. Additionally, significant investments have been made in the fields of research and development.

Europe Ascends Fast: From Pilot Projects to Mainstream Adoption

Europe is emerging as the fastest-growing market for medical drones, transitioning from small-scale pilot projects to larger, regulated delivery frameworks. The region's progressive aviation laws and environmental sustainability goals have aligned well with the need for low-emission, efficient medical logistics. Countries such as Germany, the Netherlands, France, and the Nordics have accelerated investments in drone R&D, largely driven by public health imperatives and climate-conscious delivery systems.

Europe is considered as second largest region in the medical drones market. This region includes UK, Germany, and France. Several nations have become more adaptable and are prepared to change the administrative rules that are already in place, making it simple for medical drones to enter the healthcare industry. This market expansion is due to accommodating rules, high government and OEM investment rates in unmanned technology, and a flood of government initiatives for a strong healthcare system in light of the pandemic.

What Potentiates the Market in Latin America?

The medical drones market in Latin America is driven by the need to improve healthcare access and delivery speed in remote and geographically challenging regions. Governments and healthcare providers are increasingly adopting drone-based solutions for transporting blood, vaccines, and emergency medical supplies as part of pilot and expansion programs. Growing investment in digital healthcare infrastructure and logistics innovation is further strengthening the market's growth potential across the region.

Brazil leads the market due to its large healthcare network and ongoing drone trials for medical deliveries. The country is seeing rising adoption driven by emergency response needs and urban healthcare logistics, while Chile benefits from supportive regulations and advanced drone testing environments. Colombia is emerging as a growth market through public–private partnerships in healthcare innovation, and other countries such as Peru and Argentina are gradually exploring medical drone applications through pilot programs and regulatory developments.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the medical drones market, driven by healthcare access challenges and proactive government initiatives. Drones are increasingly deployed to deliver medical supplies to remote and underserved areas, with supportive policies and smart healthcare programs accelerating adoption in the Middle East. In Africa, limited road infrastructure further boosts the need for drone-based medical logistics, making the region a high-potential market for growth in medical drone solutions.

The UAE leads adoption of medical drones through advanced healthcare systems and smart city initiatives, while Saudi Arabia is expanding usage as part of its Vision 2030 healthcare transformation programs. Rwanda serves as a global benchmark with well-established drone networks for blood and vaccine delivery, and Ghana is steadily expanding drone-based healthcare logistics to reach rural communities.

Medical Drones Market Companies

- DHL

- Embention

- Flirtey

- Matternet

- Vayuvision

- Volocopter GmbH

- Volansi, Inc.,

- Flytrex Inc.,

- Airbus

- Zipline International Inc

- AT&T Intellectual Property.

- EHang

Key Market Developments

- Avy BV, a Dutch manufacturer of UAVs, has announced a partnership with Robotic Skies Inc., a global provider of drone maintenance services, for the creation of an in-field fleet support program for Avy's burgeoning fleet of autonomous long-range life-saving UAVS. This partnership will help maintain Avy's sizable operational fleet for vital medical and humanitarian flight operations across the globe.

Segments Covered in the Report

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Service Type

- Hospital-based

- Independent

- Government

By Technology

- Fully Autonomous

- Semi-autonomous

- Remotely Operated

By Package Size

- Less than 2 KG.

- 2 - 5 KG.

- Greater than 5

By Application

- Emergency Blood Logistics

- Vaccine Logistics

- Emergency Organ Logistic

- Others

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting