Medical Simulation Market Size and Forecast 2024 to 2034

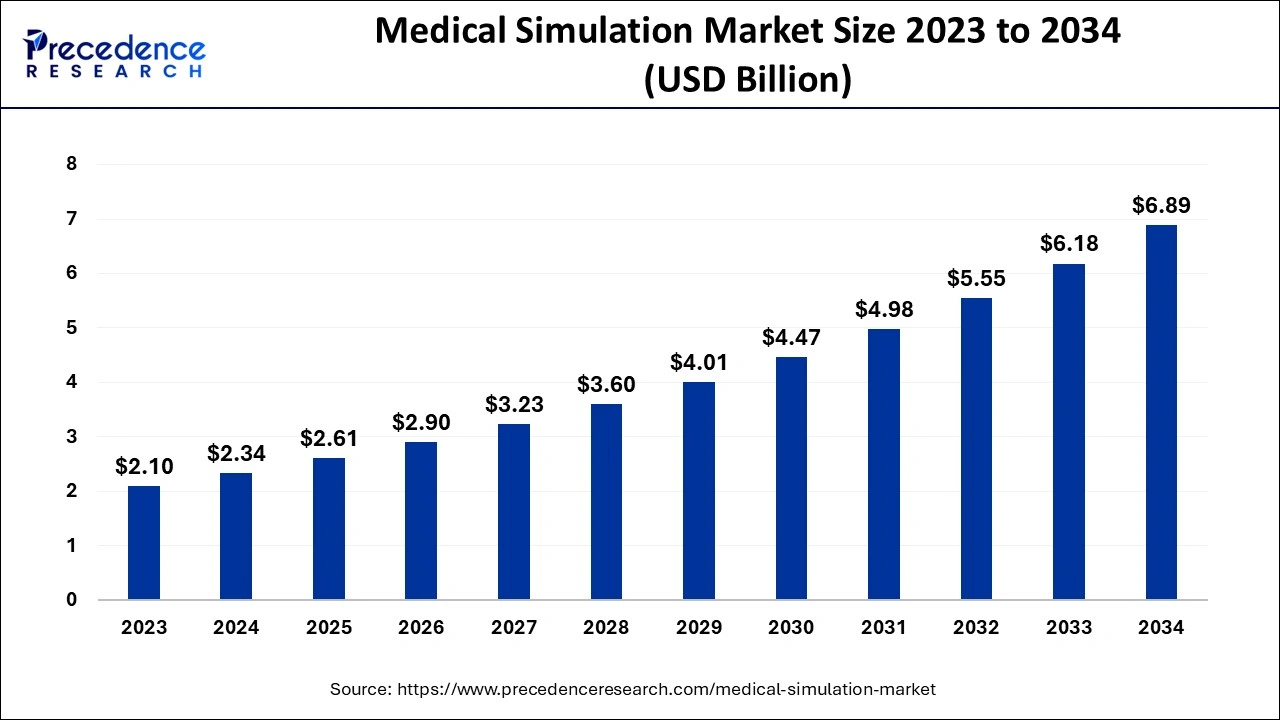

The global medical simulation market size was estimated at USD 2.34 billion in 2024 and is anticipated to reach around USD 6.89 billion by 2034, expanding at a CAGR of 11.40% from 2025 to 2034.

Medical Simulation Market Key Takeaways

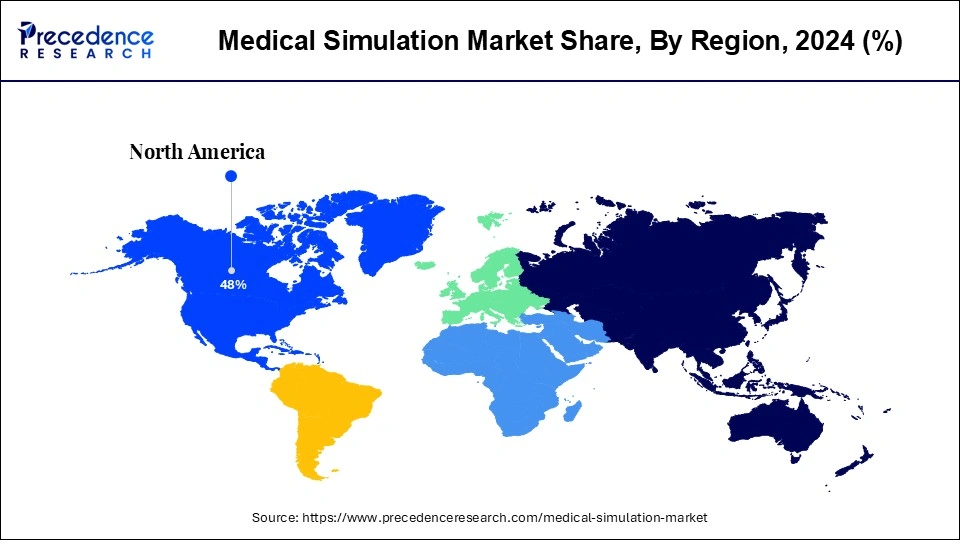

- The North America region has held the highest revenue share of around 48% in 2024.

- By end-use, the academic institute's segment has contributed a market share of 31.7% in 2024.

- By technology, the procedure rehearsal segment has accounted market share of over 41.6% in 2024.

- By product, the healthcare anatomical model segment has captured a market share of 33% in 2024.

U.S. Medical Simulation Market Size and Growth 2025 to 2034

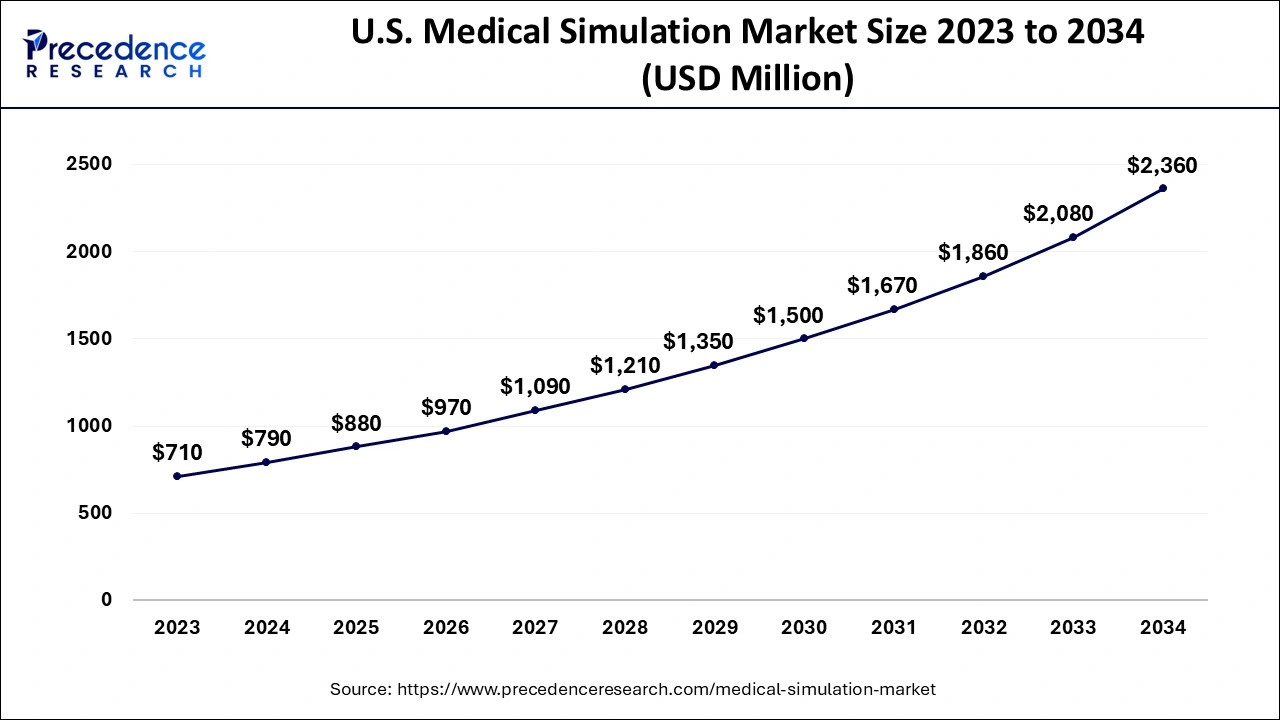

The U.S. medical simulation market size was evaluated at USD 0.79 billion in 2024 and is predicted to be worth around USD 2.36 billion by 2034, rising at a CAGR of 11.57% from 2025 to 2034.

In 2024, North America held the largest share of the worldwide medical simulation market, and it is expected to continue this position during the forecast period. This is due to an increase in medical mistakes, the presence of important actors, rising healthcare costs, technological improvements, and an increase in regional government activities. However, due to the region's growing population, the boom in institutions offering medical simulation services, and rising investments, Asia-Pacific is expected to experience significant development.

Asia Pacific is the fastest growing market for the medical simulation market with a significant CAGR during the forecast period, propelled by increasing healthcare spending, heightened awareness of patient safety, and the adoption of cutting-edge technologies. Nations such as Japan, China, and India are investing in simulation-based education to improve medical training and minimize clinical mistakes. The incorporation of virtual reality (VR) and augmented reality (AR) into simulation programs is further driving market growth. Government initiatives aimed at enhancing healthcare infrastructure and the rising demand for minimally invasive procedures are also fostering significant growth in this region. Leading companies are concentrating on forming strategic alliances and innovating their products to seize new opportunities.

Japan

Japan's medical simulation market is growing swiftly, fueled by an aging demographic and a rising incidence of chronic health issues. The nation's commitment to patient safety and medical education has led to the adoption of sophisticated simulation technologies, particularly VR and AR. Investments in healthcare infrastructure, along with government backing for innovative training approaches, are further stimulating market expansion. Collaborations between universities and tech companies are promoting the advancement of state-of-the-art simulation solutions.

Europe is observed to grow at a considerable growth rate in the upcoming period, supported by strict regulatory standards and a robust focus on patient safety. The region's dedication to advanced medical education has facilitated the widespread integration of simulation technologies in healthcare facilities. Nations like Germany, France, and the UK are investing in state-of-the-art simulation centers and integrating VR and AR into their medical training programs. Partnerships between academic institutions and industry leaders are driving innovation, resulting in the creation of high-fidelity simulators and comprehensive training curriculums. This proactive stance establishes Europe as a frontrunner in adopting advanced medical simulation practices.

Germany

Germany plays a significant role in Europe's medical simulation market, emphasizing high standards in medical education and patient safety. Healthcare facilities in the country are embracing advanced simulation technologies to improve clinical training and decrease medical errors. Government initiatives encouraging digital transformation in healthcare, along with partnerships between educational institutions and tech providers, are driving progress. Germany's proactive measures to integrate simulation into medical training are enhancing market growth.

Market Overview

The need to uphold regulatory compliance, the rising need for healthcare cost containment and the requirement to increase patient-centricity are the drivers propelling market expansion. However, a lack of qualified IT specialists and security issues are in some ways limiting the growth of the worldwide medical simulation industry.

The functions and characteristics of a particular actual object or process are represented by a medical simulation, which is a virtual copy of genuine actions or events. It's a form of simulation that's used to instruct and prepare people for careers in medicine. Simulations can happen in a classroom, in real-world situations, or in venues designed specifically for them.

Medical simulation is a training technique that allows healthcare professionals to practice tasks and methods in actual situations using virtual reality or simulation models. Medical simulation enables the deliberate application of clinical skills as opposed to the apprentice model of learning.

The term "simulation" refers to an artificial model of a real-world process used to further educational objectives through experiential learning. Any educational activity that uses simulation tools to simulate clinical circumstances is referred to as simulation-based medical education.

The rise of the medical simulation market is being driven, in part, by an increase in the usage of simulation in the healthcare industry, an increase in mortality from medical errors, and the desire to improve patient safety outcomes. Growing in popularity, virtual and augmented reality have proven beneficial for communication and training in healthcare simulation programs. For instance, virtual reality (VR) may be used to help faraway students collaborate on procedures like operations. Students may use their knowledge in practice and correct their errors because of this. Virtual and augmented reality may be a great supplement to hands-on training that involves performing surgery and putting IVs in healthcare simulation.

Medical Simulation MarketGrowth Factors

Patient safety and outcomes can be improved by the expanded use of simulation-based training and certification of healthcare personnel. As a result, the addressable market would be substantially more than it is now, which is mostly dependent on education. In low- and middle-income countries, patient harm in healthcare is responsible for roughly 2.6 million deaths annually, ranking it as the 14th biggest cause of morbidity and mortality, according to a 2019 study released by the WHO. The most harmful mistakes include diagnosis and medical care. Clinicians who participate in simulation training may become more knowledgeable and confident.

Healthcare organizations throughout the world have made reducing medical mistakes and ensuring patient safety and high-quality treatment a top priority. 2019 WHO publication claims that roughly 25% of patients worldwide have difficulties as a result of hazardous surgical care methods. Additionally, the University Health Network reports that more than 28,000 Canadians died in 2019 as a result of avoidable medical mistakes. According to the Journal of Patient Safety, between 210,000 and 440,000 fatalities in the US occur each year as a result of avoidable medical mistakes; in 2019, they made up one-sixth of all annual deaths in the country. Each year, these mistakes cost somewhere around USD $1 trillion. In 2018, the market for reporting drug errors was valued $326 million. Of this, knowledge-based mistakes accounted for one-third.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.34 Billion |

| Market Size in 2025 | USD 2.61 Billion |

| Market Size by 2034 | USD 6.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.40% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

Growing technological advancements

- The market is expected to develop as a result of factors such as the choice for less invasive treatments, growing technical improvements, and a focus on patient safety. Different market participants have been adversely affected by the COVID-19 epidemic. According to Canadian Aviation Electronics, Ltd., a significant portion of the market for simulation goods is made up of medical and nursing schools. This has made it more difficult for them to fulfill contracts and deliver on current orders.

- Due to border limitations, COVID-19 started to affect demand early in the fourth quarter of the 2020 fiscal year in Asia, and later in March, in North America and Europe. Customers in the hospital sector were primarily concerned with managing urgent operational demands as a result of the ongoing healthcare crisis rather than their training requirements. In the short term, this can mean less attention and funding allocated to routine operations and training programs. Throughout the epidemic, manufacturing activity for medical supplies continued. Other businesses also showed a similar demand trend.

Medical simulation in healthcare creates a safe learning environment

- Healthcare practitioners and researchers may test out novel clinical procedures and develop the abilities of their teams and individual members in a secure learning environment created by medical simulation. Artificial patients are a common feature of simulation applications; these patients can exhibit symptoms and react to simulated treatments. Specialists can improve their professional abilities in this way without endangering patients' lives.

Key Market Challenges

- Operational challenges - Most medical procedures interact with diverse tissues in some way. The majority of the time, tissues are heterogeneous and very anisotropic. A good medical model must be instantly computable in order for its reactions to operator inputs to be immediately available. For instance, during a straightforward incision, the scalpel first cuts through the skin, which is made up of several tissues, before moving on to cut through adipose tissue, muscular tissue, and finally an organ. The scalpel will in this instance cause blood vessels to rupture and spill blood. The scalpel will continue to cut through over 10 distinct tissues. For a more realistic training environment in medicine, the tissue reactions (visual, haptic, and olfactory) in each scenario must be acceptable. Patients may exhibit more realistic behaviors as a result of the use of physics-based modeling and simulation techniques for tissue modeling. They are not sensitive enough to provide a real-time performance of different tissues, nevertheless.

Key Market Opportunities

The use of simulation for training healthcare professionals helps them gain confidence, knowledge, and expertise

- The use of simulation in healthcare training gives staff members the confidence, knowledge, and skills they need to increase patient safety. In order to improve patient safety results and further reduce medical mistakes, simulation offers a chance to better educate and train professionals. There are several simulators on the market that offer consistent, repeatable training and exposure to more patients and settings outside of standard clinical practice. Numerous technical developments in the medical field have increased the necessity for simulation.

- Additionally, due to better healthcare infrastructure, growth in unmet healthcare demands, and an increase in the occurrence of medical mistakes in populations, there are possibilities in underserved, emerging markets with significant potential. The availability of numerous facilities offering these minimally invasive procedures is an emerging opportunity for the key market players to invest in the healthcare simulation market and will subsequently accelerate market growth while providing significant growth prospects for the market over the course of the forecast period.

Product and Services Insights

The market is divided into web-based simulators, simulation training services, healthcare anatomical models, and healthcare simulation software based on goods and services. Task trainers, patient simulators, ultrasound simulators, interventional/surgical simulators, endovascular simulators, dental simulators, and eye simulators are other categories within the healthcare anatomical model industry.

In 2024, the healthcare anatomical model category accounted for more than 33% of the market. These simulators are proven useful for conducting tests and combinations before settling on designs, procedures, or systems in the research and production sectors, particularly in the medical devices sector. Over the course of the forecast period, these variables are predicted to support the segment's expansion.

Technology Insights

The medical simulation market is divided into the virtual patient simulation, 3D printing, and procedural rehearsal technologies on the basis of technology. In 2024, the procedural rehearsal technology market had the highest share, accounting for 41.6%. The need for process rehearsal technology is anticipated to increase as a result of the increased number of medical mistakes and the resulting demand for patient safety. Technology advances are being worked on by industry participants, and this is projected to drive market expansion.

During the projected period, the virtual patient simulation market is anticipated to grow at a profitable CAGR of over 19.3%. Technology has several uses in the academic programs of medical schools. 3D Systems, Simulaids, Simulab Corporation, and Surgical Science Sweden AB are businesses that deal in virtual patient simulation.

End-Use Insights

Military organizations, academic institutions, research facilities, and hospitals are the different end-use segments of the market. With a share of 31.7% in 2024, the academic institutes' sector had the majority. Due to the existence of several academic research groups engaged in the study of complex biological systems using computer models, the market for academic research institutions is predicted to continue growing. For instance, using PBPK modeling, the NIDDK investigated how medicines that are excreted from the kidneys through organic anion transporters are affected by decreasing kidney function.

Due to a gradual shift in emphasis toward advanced learning, the introduction of cutting-edge simulation-based technologies, the full utilization of simulation models in medical procedures, the growing emphasis on minimizing errors, and the cost-effectiveness of procedural training for medical doctors, the hospitals' segment is anticipated to experience the fastest growth rate of about 16.9% during the forecast period.

Medical Simulation Market Companies

- CAE Healthcare, Inc

- Simulab Corporation

- 3D Systems, Inc

- Cardionics

- Simulaids

- Mentice

- Laerdal Medical

- Kyoto Kagaku Co., Ltd

- Gaumard Scientific

- Intelligent Ultrasound (MedaPhor Ltd.)

- Limbs & Things LTD

Recent Developments

- In March 2025, Oxford Medical Simulation redirected its efforts from the NHS to the U.S. market due to the complicated procurement processes within the UK. The company secured contracts with prominent U.S. healthcare systems, aiming to deliver VR-based training solutions that enhance clinical skills and patient safety

- In May 2025, Goodwin University revealed plans for a $3 million nursing simulation center. This facility will include high-fidelity mannequins and specialized medical environments, offering students extensive, hands-on training experiences to prepare them for real-world clinical situations.

- In July 2024, MediSim VR launched Chennai's inaugural immersive VR training laboratory at the Sri Ramachandra Institute of Higher Education and Research. This facility provides students with realistic medical scenario simulations in a safe setting, enhancing their procedural competency and confidence

- May 2021:With the release of CAE Vimedix 3.2, a new product from CAE Inc., the CAE Vimedix simulation platform now delivers enhanced fidelity, ultrasonography realism, 3D/4D ultrasound, and multiplanar reconstruction (MPR).

Market Segmentation

By Product and Services

- Anatomical Models

- Patient Simulators

- High-Fidelity Simulators

- Medium-Fidelity Simulators

- Low-Fidelity Simulators

- Task Trainers

- Interventional/Surgical Simulators

- Laparoscopic Surgical Simulators

- Gynaecology Surgical Simulators

- Cardiac Surgical Simulators

- Arthroscopic Surgical Simulators

- Other Interventional/Surgical Simulators

- Endovascular Simulators

- Ultrasound Simulators

- Dental Simulators

- Eye Simulators

- Patient Simulators

- Web-Based Simulation

- Medical Simulation Software

- Performance Recording Software

- Virtual Tutors

- Simulation Training Services

- Vendor-Based Training

- Educational Societies

- Custom Consulting and Training Services

By Technology

- Virtual Patient Simulation

- 3D Printing

- Procedure Rehearsal Technology

By End-Use

- Academic Institutes

- Hospitals

- Military Organizations

- Research

- Medical Device Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting