What is Medicated Skincare Market Size?

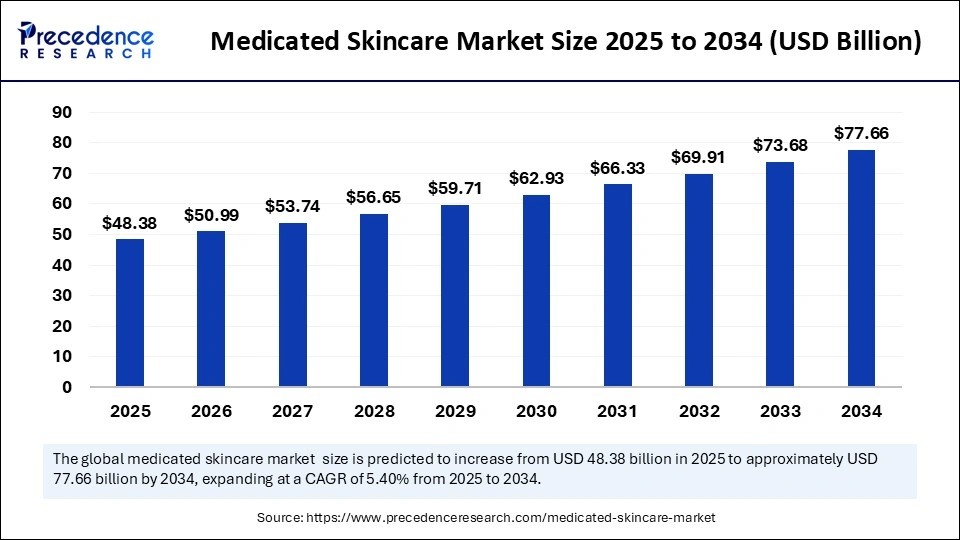

The global medicated skincare market size accounted for USD 48.38 billion in 2025 and is predicted to increase from USD 50.99 billion in 2026 to approximately USD 77.66 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. The growth of the market is driven by the rising demand for clinically proven products to manage and treat skin conditions.

Market Highlights

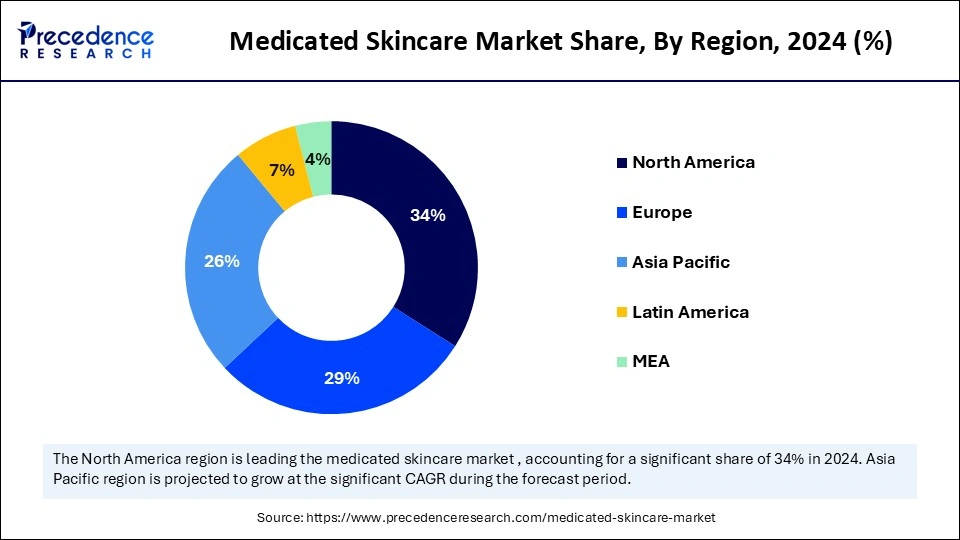

- North America held the largest share of the medicated skincare market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By skin condition, the acne segment held a significant share of 32% in 2024.

- By skin condition, the psoriasis segment is projected to show considerable growth over the forecast period.

- By ingredient, the anti-inflammatories segment contributed the biggest market share of 28% in 2024.

- By ingredient, the natural/organic ingredients segment is anticipated to grow at a significant rate between 2025 and 2034.

- By application, the creams segment held the largest share of the market in 2024.

- By application, the lotions segment is expected to register considerable growth during the projection period.

- By distribution channel, the dermatology clinics segment dominated the market in 2024.

- By distribution channel, the retail pharmacies segment is expanding at a notable CAGR over the forecast period.

Market Overview

Medicated skincare products, also known as cosmeceuticals, are laboratory-manufactured formulations used for the treatment, management, and enhancement of various skin conditions. Their formulations are often developed in collaboration with dermatologists and specialists. Medicated skincare products are subject to stricter regulations than normal cosmetics, with specified protocols applied in the selling or application of these products. Medicated skincare products have proven effective in managing conditions such as acne, rosacea, hyperpigmentation, and dermatitis, as well as help in skin repair after surgery or a dermatological procedure.

The growth of the medicated skincare market is witnessing rapid growth due to the rising awareness of skin health and its direct connection to overall well-being. The demand for dermatologist-recommended products is rising due to the increasing consciousness about skin diseases among people, especially the younger population. The rising incidences of skin conditions such as acne, eczema, and psoriasis are also contributing to the growth of the market.

How does Artificial Intelligence Impact the Medicated Skincare Market?

Artificial Intelligence is changing the landscape of the market for medicated skincare by providing personalized and predictive skincare. AI-driven skin analysis tools can define skin types, state the presence of conditions, including acne, dryness, or hyperpigmentation, and recommend certain treatments. Several dermatologists are leveraging AI tools to deliver customized skincare. AI also helps in the development of personalized skincare products and treatment plans. In addition, AI helps in the development of new formulations.

Medicated Skincare Market Growth Factors

- Increased Awareness: People have become more aware of skin health, shifting their focus toward a preventative healthcare approach. This, in turn, boosts the demand for clinically tested skincare products.

- Prevalence of Skin Conditions: With the changing climate conditions and rising exposure to ultraviolet radiation, skin issues like premature aging, hyperpigmentation, and skin cancer are rising. This, in turn, boosts the demand for medicated skincare products.

Market Outlook

- Industry Growth Overview: The medicated skincare market is expected to experience robust growth between 2025 and 2034, driven by rising incidence of dermatological conditions, heightened consumer demand for clinically validated treatments, and broader access via online and OTC channels. Ongoing innovation in active formulations and digital dermatology also supports market growth.

- Global Expansion: The market is expanding globally, driven by rising dermatological conditions, greater awareness of skin health, innovation in ingredients and formulation, the rise of tele-dermatology, and strategic M&A between market players. Emerging regions offer opportunities for growth through increased access to dermatological care, expanded e-commerce channels, and a growing middle-class population seeking effective, affordable treatments.

- Major Investors: Major investors in the market include large consumer-health and dermocosmetic companies, global dermatology brands, and private equity firms. They contribute by funding clinical formulation development, expanding through acquisitions, and supporting skin treatment startups.

- Startup Ecosystem: The market's startup ecosystem is vibrant, with ventures leveraging AI diagnostics, microbiome science, and personalized formulations to address dermatological needs. These startups partner with pharma/beauty players, target niche skin conditions, and scale rapidly through digital-first channels and regulatory innovations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.38 Billion |

| Market Size in 2026 | USD 50.99 Billion |

| Market Size by 2034 | USD 77.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Skin Condition, Ingredient, Application, Distribution Channel and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Consumer Awareness

The rise in awareness among people about skin health and the importance of scientifically proven products and treatments is one of the major factors driving the growth of the medicated skincare market. Social media such as YouTube and Instagram, and even some skincare blogs, play a crucial role in spreading awareness regarding skin conditions and treatments. Moreover, influencer marketing has a significant impact on boosting the sales of medicated skincare products. Dermatologist-recommended brands are becoming popular because people are seeking solutions that support long-lasting skin health. The rising trend of preventive skincare is also fueling the growth of the market. With the rising desire for glowing skin, younger demographics are spending on products aimed at addressing Acne, UV damage, and early signs of ageing, supporting the growth of the market.

Restraint

High Costs and Regulatory Hurdles

Most of the clinically tested and dermatologist-recommended products are expensive. This limits access for some consumers, especially those from low-income groups. The limited accessibility to dermatology services in some areas, especially rural areas, further limits the adoption of medicated skincare products. In addition, obtaining regulatory approvals for medicated skincare is time-consuming and requires substantial investments in clinical trials. This significantly impacts the final cost of the product and hampers the growth of the market.

Opportunity

Increasing Demand for Natural and Organic Ingredients

The rising consumer demand for natural and organic ingredients creates immense opportunities in the medicated skincare market. Consumers have become more aware of the drawbacks of synthetic chemicals used in skincare products, boosting the demand for natural alternatives that are gentler and promote skin health without any side effects. Manufacturers are also expanding their product portfolio by incorporating botanicals and natural formulations, such as chamomile, tea-tree oils, and aloe vera. Moreover, the rising demand for personalized skincare products is opening up new avenues for market growth.

Segment Insights

Skin Condition Insights

The acne segment led the medicated skincare market with a significant share in 2024. This is mainly due to the increased prevalence of acne, especially in teenagers and young adults. Changes in hormone levels, genes, and lifestyles are major factors behind the increased acne prevalence. Medical skincare products such as benzoyl peroxide, salicylic acid, and retinoids are topical treatments that help control acne. For moderate to severe acne, dermatologists prescribe skincare products such as creams, lotions, and serums. Increased development of new formulations further bolstered the segmental growth.

The psoriasis segment is projected to show considerable growth over the forecast period. Psoriasis is an autoimmune disease that makes it difficult for skin cells to grow fast, thus giving red scaly patches on the skin. Medicated treatments, including topical steroids, biologics, and phototherapy, are essential to control the symptoms of psoriasis. These treatments alleviate inflammation, slow skin cell growth, and relieve the discomfort of the condition. Increasing awareness about psoriasis and the rising development of biological therapies are expected to drive the growth of the segment. Moreover, a growing acceptance of biologics for moderate to severe cases is likely to support segmental growth.

Ingredient Insights

The anti-inflammatories segment held the largest share of the medicated skincare market in 2024. This is mainly due to the increased number of cases of skin disease like eczema and psoriasis, creating the need for anti-inflammatory products. Anti-inflammatories are responsible for reducing redness, swelling, and irritation, which provides relief to individuals experiencing skin irritation. Medications and skincare products containing anti-inflammatory agents, including corticosteroids, calamine, and non-steroidal variants such as zinc oxide, are very popular to treat a range of skin diseases.

The natural/organic ingredients segment is anticipated to grow at a significant rate in the upcoming period. Medicated skincare products made from organic and natural ingredients, including chamomile and calendula, are a holistic solution to manage skin conditions. Natural ingredients are gentle to the skin, so they become the preferred option among those with sensitive skin.

Application Insights

The creams segment led the medicated skincare market with the largest share in 2024. Creams contain active ingredients and moisturizing properties, making them suitable to manage and treat various skin issues, like acne, eczema, and psoriasis. Creams are capable of addressing a wide variety of skin problems by reducing inflammation, controlling the buildup of bacteria, and maximizing hydration of dry and irritated skin. Creams are widely preferred for their ease of use and ability to provide barriers for longer periods.

The lotions segment is expected to register considerable growth during the projection period. Lotions are often used for dry skin. Lotions offer hydration, reducing skin irritation associated with dryness. They contain active ingredients such as corticosteroids, anti-inflammatories, and antibacterial agents. Since lotions are easily absorbable by the skin without leaving greasy residue, they are a preferred choice for use in a daily skincare routine. The growing concerns about dry skin are likely to contribute to segmental growth.

Distribution Channel Insights

The dermatology clinics segment held a major share of the medicated skincare market in 2024. This is mainly due to the increased preference for prescription-based skincare products. These products are routinely used for mild as well as severe skin conditions that need effective treatment. Dermatologists provide expert recommendations, building trust with patients. Moreover, dermatology clinics offer personalized skincare plans tailored to individual needs.

The retail pharmacies segment is anticipated to expand at a notable growth rate over the forecast period. The growth of the segment can be attributed to the availability of OTC as well as prescription skincare products in these pharmacies. OTC medicated skincare products are easily obtained from these pharmacies regardless of the need for a prescription, making them convenient for consumers to deal with common skin problems, including acne, dry skin, and minor rashes. The increasing trend of self-care is boosting the demand for OTC products, supporting segmental growth.

Regional Insights

U.S. Medicated Skincare Market Size and Growth 2025 to 2034

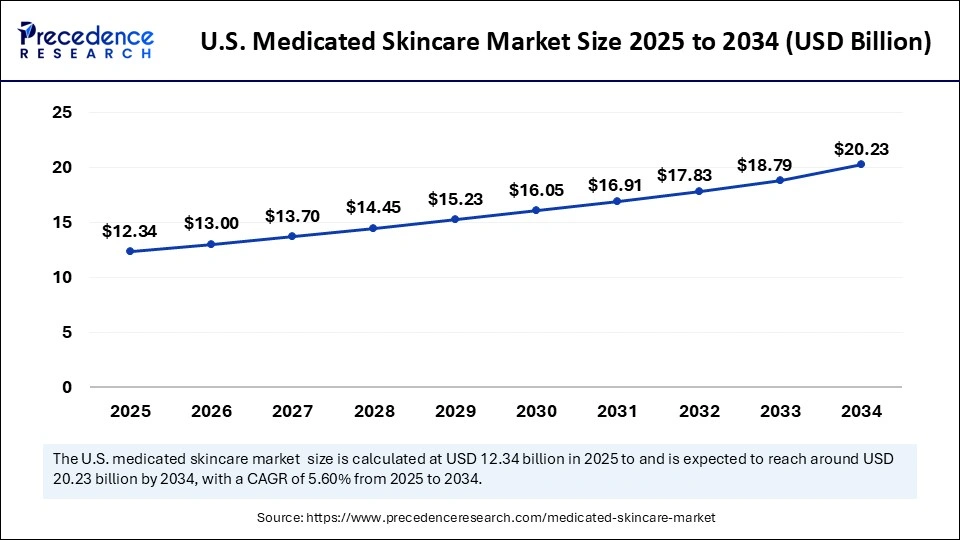

The U.S. medicated skincare market size is exhibited at USD 12.34 billion in 2025 and is projected to be worth around USD 20.23 billion by 2034, growing at a CAGR of 5.62% from 2025 to 2034.

North America dominated the medicated skincare market by holding the largest share in 2024. This is mainly due to the increased concerns about skin health and the importance of medicated skincare solutions among people. With the increased prevalence of acne and eczema, there is a high demand for clinically tested skincare products. Moreover, an aging population drives the demand for anti-aging products. Some of the well-known skincare product manufacturers have their roots in North America, such as Procter & Gamble and Unilever, ensuring that high-quality medicated skincare products are available.

U.S. Medicated Skincare Market Trends

Major trends in the U.S. medicated skincare market include increasing demand for clean-label and multifunctional products that combine therapeutic actives with gentle, skin-friendly ingredients. Over-the-counter (OTC) solutions are growing quickly, driven by easier access through tele-dermatology and digital pharmacy platforms, while prescription treatments continue to develop with innovative formulations. Additionally, personalized and AI-enabled skincare is gaining popularity, allowing for tailored treatments and more precise, clinically supported solutions for individual skin concerns.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The rising standard of living and increasing consumer disposable income are major factors supporting the growth of the market in the region. Growing concern of skin health among the populations, especially youngsters, is driving the demand for medicated skincare products. With the increased urbanization and pollution levels, the number of cases of skin issues is rising, boosting the demand for skincare products. The rapid expansion of dermatology clinics in emerging countries like China, India, Japan, and South Korea is supporting the growth of the market in the region.

Why is Europe Considered a Significant Market?

Europe is considered to be a significantly growing area. The growth of the medicated skincare market in Europe can be attributed to the growing awareness about the benefits of preventative skincare. There are rising concerns about early aging among youngsters. This, in turn, boosts the demand for anti-aging skincare products that solve skin conditions like wrinkles, fine lines, and pigmentation. Europe's strong regulatory environment further contributes to market growth. Moreover, consumers are willing to commit to high-quality medicated skincare solutions that are clinically proven. The demand for natural and organic skincare products is also rising in the region, driving the growth of the market.

China Medicated Skincare Market Analysis

China is a major contributor to the Asia Pacific medicated skincare market due to its large and increasingly affluent population, which is driving higher demand for effective skin treatments. Rising awareness of skin health, coupled with expanding access to dermatological care and strong e-commerce channels, further supports market growth. Additionally, the growing preference for clinically backed, therapeutic skincare products in urban centers underscores the country's significant role in the regional market.

Germany Medicated Skincare Market Trends

Germany leads the market in Europe, thanks to its strong pharmaceutical heritage, high consumer trust in science-based skin treatments, and large, mature beauty care spending base. German regulatory standards also emphasize safety and efficacy, which has contributed to the popularity of dermatologically tested and pharmacy-recommended medicated products across the region.

What Potentiates the Growth of the Latin America Medicated Skincare Market?

The market in Latin America is experiencing robust growth, propelled by increasing consumer awareness of dermatological health, rising disposable income and urbanization, the expansion of pharmacy and online retail channels, and tailored product launches that address regional skin concerns and climatic conditions. Brazil leads the Latin American market due to its large middle-class consumer base with increasing spending power, well-established dermatology and pharmacy infrastructure, strong presence of both international and local skincare brands, and high online and offline retail penetration that caters to various skin types.

How Big is the Opportunity for the Growth of the Market in the Middle East and Africa?

The Middle East and Africa offer significant opportunities to expand the medicated skincare market, driven by rising dermatological awareness, young urban populations, and rising disposable incomes. Limited access to dermatologists is boosting the demand for teledermatology. Moreover, the entry of global brands, the growth of e-commerce and pharmacy channels, the high demand for climate-adapted and traditional ingredient formulations tailored to regional skin concerns, and regulatory improvements are supporting market expansion.

UAE Medicated Skincare Market Trends

The UAE leads the medicated skincare market in the Middle East and Africa, thanks to high healthcare and skincare expenditures, a strong pharmacy and dermatology clinic infrastructure, and its role as a regional launch hub for global brands. Advanced logistics, globally aligned regulations, and a diverse, multicultural population with varied skin concerns further boost the adoption of premium, clinically validated medicated products, establishing the UAE as the main gateway for expanding into the region.

Value Chain Analysis

- Research & Development : Research and development begin with the identification of dermatological conditions and unmet therapeutic needs, followed by active ingredient screening, formulation development, and stability/safety assessments. Pre-clinical evaluation is conducted to validate efficacy, irritation potential, and compatibility before advancing to clinical testing.

Key Players: Johnson & Johnson (Neutrogena Dermatologics), L'Oréal Dermatological Beauty (CeraVe, La Roche-Posay, Vichy), Galderma, Beiersdorf (Eucerin), Unilever (Dermalogica), Procter & Gamble (Olay Clinical), Amorepacific Dermatology Research, and Research institutes/universities with dermatology programs. - Clinical Trials & Regulatory Approval : Clinical trials are executed in phased studies to evaluate product safety, efficacy, and skin-condition outcomes, followed by long-term tolerability assessments. Upon successful completion, regulatory dossiers are submitted to the relevant authorities for approval, based on clinical evidence, ingredient compliance, labeling, and safety documentation.

Key Players: U.S. FDA, European Medicines Agency (EMA), Health Canada, UAE Ministry of Health and Prevention (MOHAP), CDSCO India, Brazil ANVISA and South Africa SAHPRA, and Contract research organizations (IQVIA, Syneos Health, ICON). - Manufacturing & Packaging : Production includes bulk formulation of active ingredients with precise concentration control, followed by hygienic filling, sterilization, tamper-proof packaging, and dermatology-grade quality testing to ensure consistency and safety across batches.

Key Players: Lonza, Catalent, Evonik, DSM Nutritional/Active Ingredients, BASF Care Creations, Merck KGaA, and OEM/ODM dermatology contract manufacturers. - Distribution & Commercialization : Products are distributed to dermatology hospitals and clinics, pharmacies, online retail channels, and direct-to-consumer platforms. Marketing strategies emphasize clinical evidence, dermatologist endorsements, and targeted communication to consumers with specific skin conditions.

Key Players: Walgreens Boots Alliance, CVS Health, Watsons, Sephora, Amazon/PharmacyE-commerce platforms, and Dermatology clinic chains and specialty pharmacies. - Patient Support & Services : Post-purchase programs guide patients in correct product use, regimen personalization, and progress tracking. Support includes tele-consultation, ingredient education, subscription refill services, and aftercare for chronic dermatological conditions.

Key Players: Online dermatology platforms (Curology, Skin+Me, Nurx), Hospital dermatology departments, Tele-dermatology service providers, and Brand-run patient support centers (CeraVe, Eucerin, La Roche-Posay Skin Schools).

Key Players in Medicated Skincare Market and Their Offerings

- Galderma — Offers a broad portfolio across therapeutic dermatology and dermocosmetics, from prescription therapeutics (e.g., Differin) to dermatologist-recommended consumer lines for sensitive and compromised skin (e.g., Cetaphil).

- L'Oréal Group — Operates a large dermatological beauty division (CeraVe, Vichy, SkinCeuticals) focused on clinically validated actives, plus strategic acquisitions to expand medical/dermocosmetic reach.

- Unilever — Markets professional and science-led skin brands (notably Dermalogica within its portfolio) and invests in education-driven, clinic-aligned products and distribution for skin health professionals.

- Dermalogica — A professional, education-led brand delivering targeted clinical treatments, professional peels, and home regimens used by skin therapists to treat acne, sensitivity, pigmentation, and aging.

- La Roche-Posay (L'Oréal) — A dermatologist-recommended dermocosmetic range with clinically formulated treatments for acne, atopic dermatitis, pigmentation, and photoprotection (Effaclar, Toleriane lines).

- PCA SKIN (PCA / “PCS Skin”) — Focuses on medical-grade peels, corrective serums, and clinically backed protocols sold via clinics and professionals for acne, hyperpigmentation, and resurfacing.

- Johnson & Johnson (Neutrogena / Kenvue brands) — Delivers widely accessible medicated OTC treatments (salicylic/benzoyl peroxide cleansers, retinol serums, and targeted acne solutions) positioned for both consumer and pharmacist channels.

Recent Developments

- In February 2025, Obagi Medical announced its latest revolutionary innovation to its popular SUZANOBAGIMD range. The newly launched products, Super Antioxidant Serum and Moisture Restore hydration refreshing cream, provide up-to-date treatments of the most common skin concerns like discoloration and brightening, oxidative stress, and hydration to keep the healthy skin barrier function.

- In December 2024, Hydrinity Accelerated Skin Science entered into a partnership with Photonence, a supplier and trusted healthcare partner, to represent its products in India. Hydrinity Accelerated Skin Science is currently distributed in 17 international markets and is excited to expand into India.

- In October 2024, Eucerin, a global leader in skincare for dermatology, announced the official launch of its products on Nykaa, one of the largest beauty and wellness platforms in India, marking its entry into the Indian marketplace.

Segments Covered in the Report

By Skin Condition

- Acne

- Psoriasis

- Eczema

- Rosacea

- Others

By Ingredient

- Anti-inflammatories

- Antibacterials

- Antifungals

- Antioxidants

- Moisturizers

- Synthetic ingredients

- Natural/organic ingredients

- Chemical-based ingredients

By Application

- Creams

- Lotions

- Ointments

- Gels

- Serums

By Distribution Channel

- Dermatology Clinics

- Online Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting