What is the Milk Packaging Market Size?

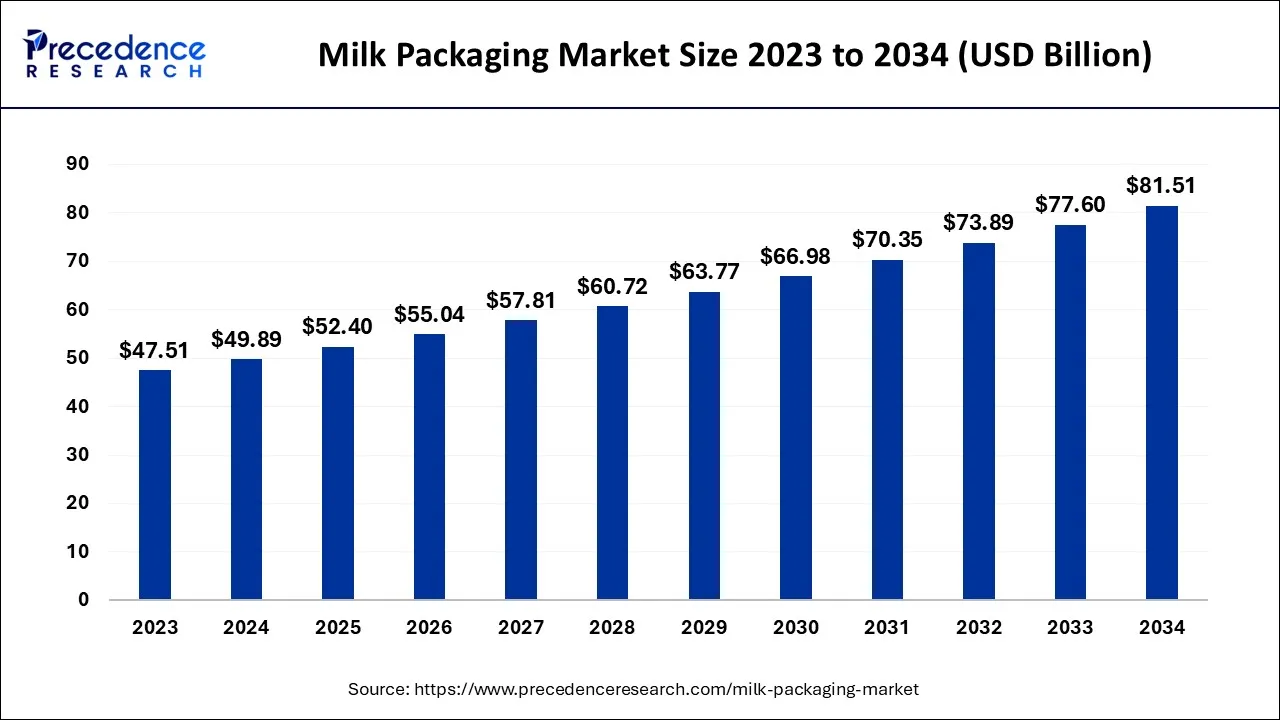

The global milk packaging market size is accounted at USD 52.40 billion in 2025 and predicted to increase from USD 55.04 billion in 2026 to approximately USD 85.42 billion by 2035, representing a CAGR of 5.01% from 2026 to 2035.

Milk Packaging Market Key Takeaways

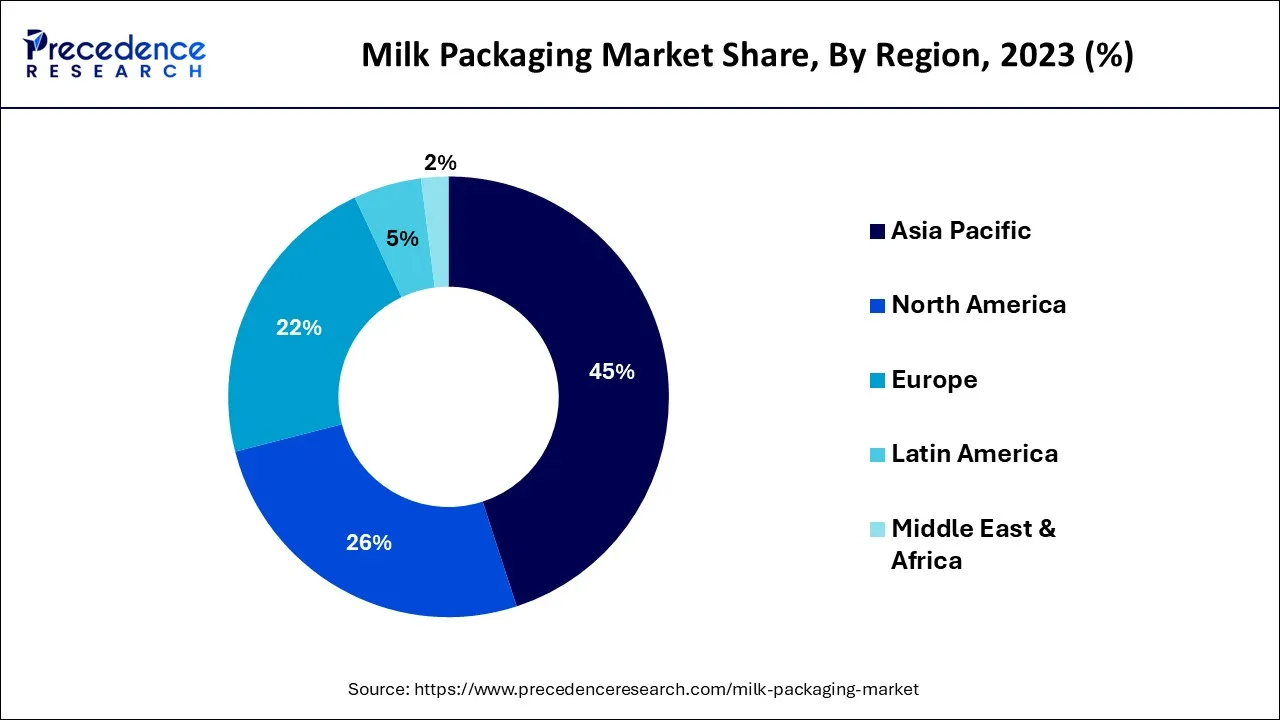

- Asia Pacific region has generated more than 45% of revenue share in 2025.

- By Material, the plastic segment has captured for the largest market share in 2025.

- By Material, the others segment is expected to expand at the remarkable CAGR of 5.74% from 2026 to 2035.

- By Packaging Type, the pouches and bags segment contributed for the highest market share in 2025.

- By Packaging Type, the cartons segment is expected to expand at the quickest CAGR of 5.40% from 2026 to 2035.

What is Milk Packaging?

Milk packaging is the process of using various types of containers to transport, identify, safeguard, and facilitate milk merchandising. It helps the packaged milk's shelf life extend from a few hours to weeks and months. It protects against germs and other outside elements like light and moisture.

In addition, milk packaging serves as an essential conduit between the producer and the consumer to ensure the safe delivery of the milk through various production, transportation, storage, distribution, and marketing stages. It also allows manufacturers to distinguish their products from those of their competitors.

Milk Packaging Market Growth Factors

The market's anticipated expansion will be driven by small households' widely used preference for single-serve milk packages. In addition, a rise in the population's health consciousness has increased the demand for milk as a source of protein and calcium. It has also been established that milk is the main source of vitamin D and minerals, which will drive the growth of the milk packaging market in the coming years.

Additionally, one of the major factors propelling the expansion of the milk packaging industry globally is the accessibility of flavored milk products. Over the coming years, the industry for milk packaging will see profitable growth due to the expanding use of milk in the preparation of various milk products. According to the forecast, an increase in the consumption of dairy products and bakery goods, along with shifting societal norms, will amplify the business boom.

Furthermore, emerging economies are anticipated to fuel demand for and growth in new flavors and products that focus on health. Moreover, the demand for flavored milk is expected to rise globally due to consumers' impulsive eating patterns brought on by their hectic work schedules, which is anticipated to fuel the growth of the global milk packaging market in the years to come. Furthermore, it is anticipated that the manufacturers' increased R&D efforts and technological advancements will create opportunities for revenue growth both during the forecast period and in the years to come.

Market Outlook

- Industry Growth Overview:

The milk packaging market is experiencing significant growth, driven by increasing global dairy demand, urbanization, and customers' requirements for safety, convenience, and sustainability, with trends favoring eco-friendly materials such as recycled PET, aseptic cartons, and single-serve formats. - Global Expansion:

The market is experiencing significant global expansion, driven by increasing dairy demand, urbanization, and growing awareness of health, focusing on natural materials, single-serve formats, and developed tech for longer shelf life. Asia Pacific is dominated in the market due to huge milk production and booming demand from increasing urbanization. - Major investors:

Major investors in the market are global giants such as Tetra Pak, Amcor, SIG Combibloc, and Elopak, focusing heavily on sustainable, lightweight materials and automated aseptic lines.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.40 Billion |

| Market Size by 2035 | USD 85.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.01% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Materia and By Packaging Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Market Dynamics

Driver

Rising preferences for sustainability in packaging

Consumers are becoming more environmentally conscious and actively seeking sustainable packaging options, including milk. They are looking for packaging materials that are recyclable, biodegradable, compostable, and made from renewable resources. Milk brands that offer sustainable packaging options can attract environmentally conscious consumers and build brand loyalty, which will lead to increased sales and market share.

Many milk brands and manufacturers have set their own sustainability goals as part of their corporate social responsibility initiatives. Considering the rising initiatives for sustainable packaging, the preference for sustainability in packaging is intended to drive the growth of the milk packaging market.

Restraint

Waste management concerns

The lack of adequate recycling infrastructure, particularly for complex or multi-layered milk packaging materials, can restrain the growth of the milk packaging market. Many milk packaging materials, such as laminates or composites, may not be easily recyclable or have limited recycling options, which can result in them being disposed of as waste, leading to environmental concerns.

The absence of efficient and accessible recycling options can hinder the sustainability credentials of milk packaging and limit its growth potential, especially in regions or markets where recycling infrastructure is underdeveloped or insufficient.

Opportunity

There are creative packaging methods in addition to paper-based packaging and packaging in plastic containers. UHT (Ultra High Temperature) milk can now be packed in completely sterile aseptic pouches with the necessary barrier properties to give them a shelf life of up to 90 days because of innovations in milk polybags.

These long-lasting milk pouches are made with nylon-based LDPE poly films that are thicker. This kind of packaging method significantly reduces the price of packaging and shipping UHT milk. A self-standing sterile pouch with an air-filled handle for holding and pouring, known as the Ecolean concept, is one of many innovations in milk packaging. As a result, the Milk Packaging Market is expanding due to the numerous innovations in milk packaging.

Segment Insights

Material Insight

Plastic accounted for the largest market share. This expansion is attributable to the increasing popularity of plastic in milk packaging. Milk packaging typically uses plastic containers or packages, and the exploding innovations in plastic milk packaging are further fueling the development of this industry.

Additionally, the others market is predicted to expand at the fastest CAGR of 5.74% from 2024 to 2034 due to the increasing adoption of innovative milk packaging techniques like aseptically packaged milk using Tetra Paks for milk packaging with benefits like ultra heat-treated, not needing to be refrigerated, and 100% recyclable with guaranteed good quality milk making them the preferred option by every health care professional over the conventional milk containers.

Packaging Type Insights

The Pouches and Bags Segment accounted for the largest market share in 2025. This increase can be attributed to the increasing popularity of pouches and bags for milk packaging. Milk can be packaged in bags and pouches instead of plastic bottles and containers. The advantages of pouches include secondary packaging, which makes the entire process automated, systematic, and quick. It also helps maintain food safety and quality standards while maintaining a count of pouches and crates combined with bagged milk, which is more affordable to produce and purchase and is therefore preferred in nations like Canada. These factors are further boosting the expansion of the Pouches and Bags segment.

Additionally, the Cartons segment is predicted to expand at the fastest CAGR of 5.40% from 2024 to 2034due to the prominent use of cartons in milk packaging due to their benefits such as superior presentation, customer and seller friendliness, low cost, environmental friendliness, lightweight, and simple availability in comparison to other milk packaging methods like those including plastic containers.

Regional Insights

What is the Asia Pacific Milk Packaging Market Size?

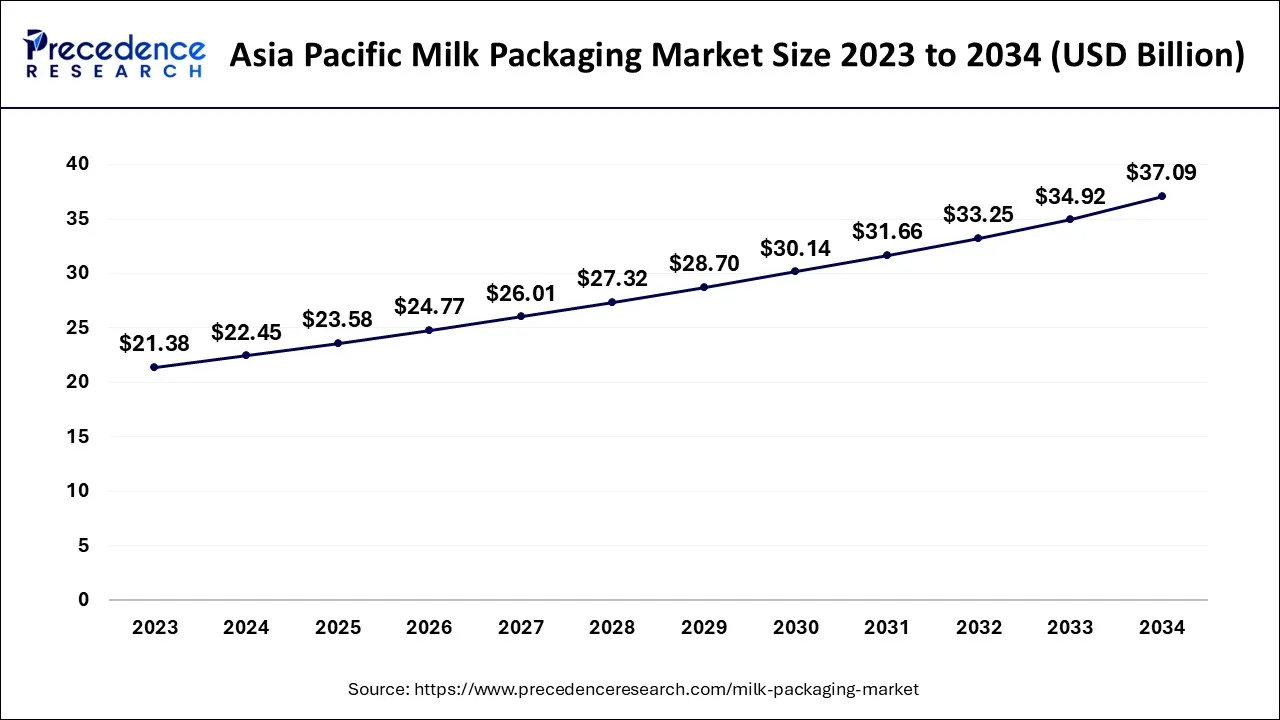

The Asia Pacific milk packaging market size is exhibited at USD 23.58 billion in 2025 and is projected to beMilk Packaging Market worth around USD 39.26 billion by 2035, growing at a CAGR of 5.23% from 2026 to 2035.

The Milk Packaging Market is expected to be dominated by Asia Pacific during the forecast period. The largest producers and consumers of milk in the Asia Pacific region are the region's developing nations, particularly India and China. Additionally, the presence of a dense population and the escalating industrial innovations are promoting the development of the Milk Packaging Market throughout the forecast period. Products containing lactose are typically accepted by consumers in the Asia Pacific region, opening up new lactose-free options. The growing concerns about children's nutrition will also balance the consumption of dairy products and accelerate the expansion of the milk packaging market in the coming years.

Asia Pacific: Strong Manufacturing & Technology

Many farmers in the Asia Pacific region rely heavily on the dairy industry for their income. The Milk Packaging sector is expected to experience the highest growth during the forecast period. In nations like India, where there is an enormous discrepancy between demand and supply, more than 15% of the world's milk is produced. In addition, the Indian government has decided to follow up with the ban on the imports of milk and milk products under these unfavourable conditions. Additionally, this has helped regional farmers greatly in increasing their yield.

The government also encourages foreign businesses to boost domestic production. Furthermore, it is widely used in many other countries in the Asia Pacific, including China. As a result, the focus on raising milk production is anticipated to fuel the expansion of the Milk Packaging Market in the Asia Pacific region.

India: Milk Packaging Market Trends

India is the global largest milk producer, creating massive domestic demand for packaging services, specifically cost-effective and sustainable, such as cartons and pouches. Increasing urbanization in countries like China and India increases demand for convenient, long-shelf-life products and processed dairy, which requires progressive packaging.

North America: Strong manufacturing and technology

North America is the fastest-growing market, as well-established dairy farming, effective processing, and extensive distribution networks support large-scale packaging processes. Supportive government guidelines and strict FDA standards ensure high quality and increase customer trust, driving market growth.

U.S. Milk Packaging Market Trends

The U.S. is increasingly accepting novel packaging designs and technologies that enhance shelf life, sustainability, and safety. The U.S. leads in Research and Development (R&D) for packaging technology, rising adopting automation, advanced materials, and smart sensors.

Europe: Rapid growth in smart factories

Europe is significantly growing in the milk packaging market due to stringent EU guidelines such as the PPWR & Single-Use Plastics Directive, which drives force innovation in reusable, recyclable, and biodegradable packaging, making Europe a top leader in eco-friendly services. Major organizations are spending in sustainability, carbon neutrality, and effectiveness, often through partnerships, to maintain scale and meet regulatory demands, which contributes to the growth of the market.

The UK Milk Packaging Market Trends

The UK's long-lasting practice of milkmen delivering fresh milk in glass bottles has recognized a high national standard for freshness and daily consumption, which drives the growth of the market. Rising retail shifted to supermarkets, and major customers demanded the same level of quality, driving rapid automation of high-performance packaging.

Latin America: Growing Dairy Demand & Sustainable Packaging Needs

The number of milk-based products sold in Latin America is increasing every year, thanks to the increase in population size and urbanization, as well as the increase in organized retail. Sustainability initiatives are taking hold among dairy processors, with interest in cost-efficient, flexible packaging systems.

Brazil Milk Packaging Market Trends

Brazil is leading growth among countries with strong dairy production, increasing demand for prepackaged milk products, and increasing use of aseptic cartons that have an extended shelf life. Technological improvements in packaging machinery, barrier coatings, and sterilization processes are enhancing product quality, shelf life, and operational efficiency.

Middle East and Africa: Long-Life Products Driving Market Growth

Long-life (shelf-stable) milk sales are increasing across the MEA region due to geographic and climatic conditions and limitations of cold-chain logistics. The use of aseptic cartons and multi-layer packaging has made it possible for producers of these types of products to have long-term storage and to move their products to regional and cross-border customers.

Saudi Arabia Milk Packaging Market Trends

Saudi Arabia has the highest growth potential within the MEA region, due to strong local dairy companies, relatively high levels of milk consumption per individual, and significant investment into innovative packaging systems. Advances in packaging technologies and automation are improving product safety, barrier performance, and production efficiency across dairy processors.

Value Chain Analysis of the Milk Packaging Market

- Raw Materials and Polymers: The first part of the milk packaging value chain comprises raw materials supplied from various sources, including plastics, paperboard, aluminum foil, and bio-based materials.

Key Players: SABIC, BASF, and Dow. - Packaging Manufacturing and Converting: At this stage, the raw materials are changed into different types of packaging such as pouches, cartons, bottles, and flexible packaging formats.

Key Players: Tetra Pak, SIG Group, and Amcor. - Distribution and Branding: The final step in the milk packaging value chain consists of logistics, customized branding, and installation of packages to dairy plants. Successful brands that have an effective supply chain need to demonstrate cold chain compatibility, regional compliance, and uniqueness within the marketplace.

Key Players: Berry Global, Sealed Air, and Huhtamaki.

Milk Packaging Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Amcor Limited |

Switzerland |

Defensive product portfolio |

In November 2025, Amcor, ProAmpac, and Tetra Pak are advancing recyclable, compostable, and renewable-material packaging. |

|

Evergreen Packaging |

United States |

robust operational execution |

Evergreen Resources provides global, cost-effective packaging solutions with a focus on quality and supply chain risk reduction. |

|

Tetra Pack |

Switzerland |

sustainable, multi-layered packaging |

Tetra Pak has unveiled a focused range of dairy-centric innovations at Drinktec India 2025 |

|

Global Closure Systems |

Netherlands |

heritage-driven brand, and vast intellectual property |

GCS is a significant company in the packaging industry, specifically within the caps and closures sector |

|

Indevco |

Lebanon |

Strong focus on sustainability and innovation |

INDEVCO Group is a multinational organization with a broad range of products in different sectors, such as Raw Materials and Packaging, Consumer Disposables |

Other Major Key Players

- Ball

- Blue Ridge Paper Products

- Elopak

- Clondalkin Group Holdings

- Crown Holdings

- Graham Packaging

- CKS Packaging

- Essel Propack

- Fabri-Kal

- Consolidated Container

- Exopack Holdings

Recent Developments

- In February 2023, a United Kingdom-based milk and grocery supplier brand, Milk & More, announced the launch of reusable packaging for milk products in order to promote convenient and easy delivery solutions. The company aims to reuse up to 3 million packages in the coming years.

- In February 2022, a leading packaging solution provider, Tetra Pack, announced the launch of its first-ever holographic packaging in India for Warna, a prominent milk products brand in India.

- In February 2022, Brakes announced the launch of a sustainable packaging solution for its milk products. The new packaging solution launched by Brakes is fully renewable, which makes the company UK's first wholesaler of plant-based packaging.

Segments Covered in the Report

By Material

- Plastic

- Paper & Paperboard

- Others

By Packaging Type

- Cans

- Bottles/Containers

- Cartons

- Pouches/Bags

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting