What is the Nasal Aspirate Testing Market Size?

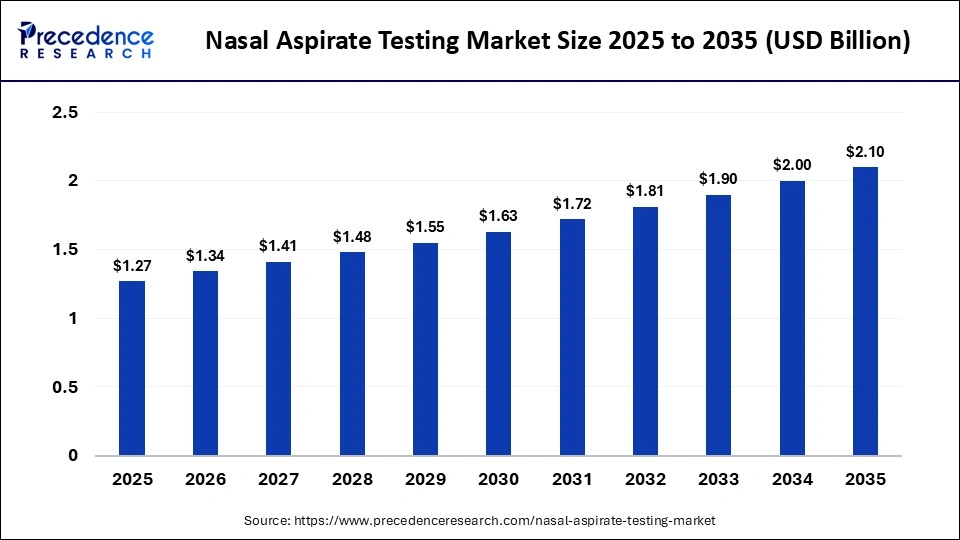

The global nasal aspirate testing market size accounted for USD 1.27 billion in 2025 and is predicted to increase from USD 1.34 billion in 2026 to approximately USD 2.10 billion by 2035, expanding at a CAGR of 5.13% from 2026 to 2035. One key driver of the market is the growing prevalence of respiratory infections, which has heightened the demand for accurate diagnostic tools to detect pathogens. Additionally, advancements in technology and increased awareness of the benefits of non-invasive testing methods are further propelling market growth.

Market Highlights

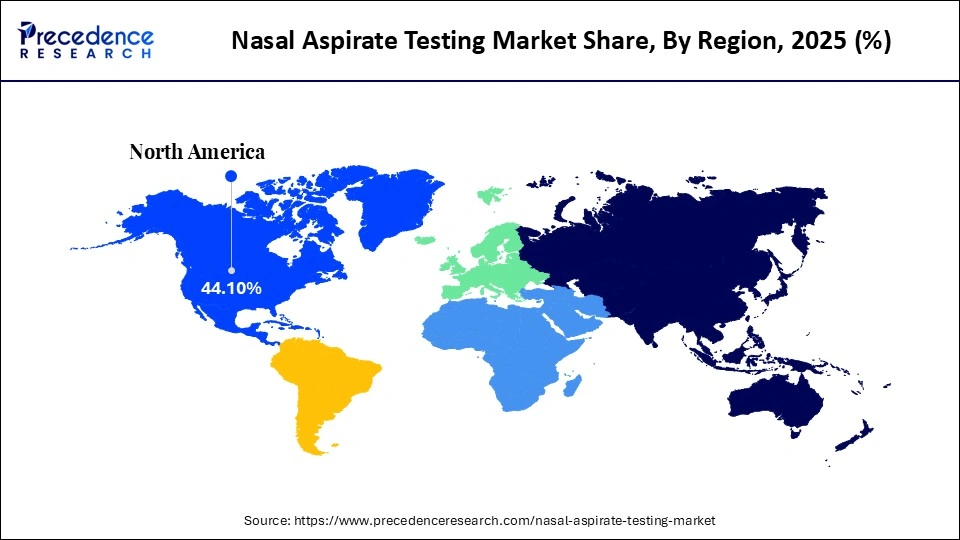

- North America dominated the global nasal aspirate testing market with a share of approximately 44.1% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

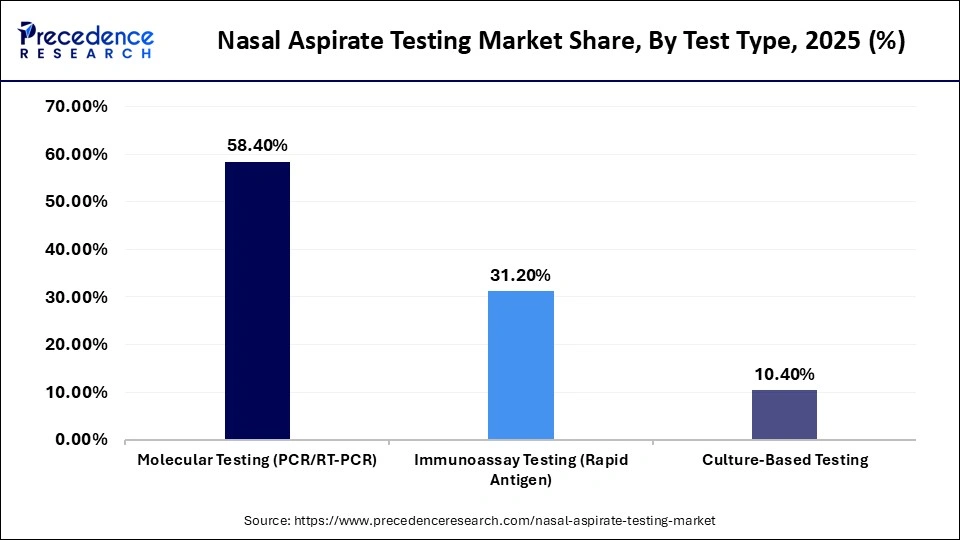

- By test type, the molecular testing segment dominated the market by holding a share of approximately 58.4% in 2025.

- By test type, the immunoassay testing (rapid antigen) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

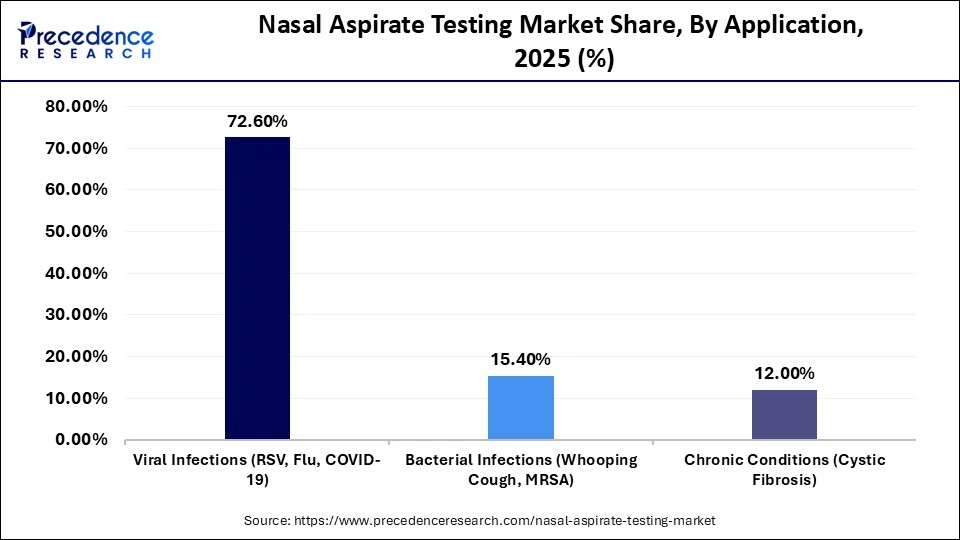

- By application, the viral infections segment accounted for a considerable revenue share of approximately 72.6% in the market in 2025.

- By application, the bacterial infections segment is expected to grow with the highest CAGR in the nasal aspirate testing market during the studied years.

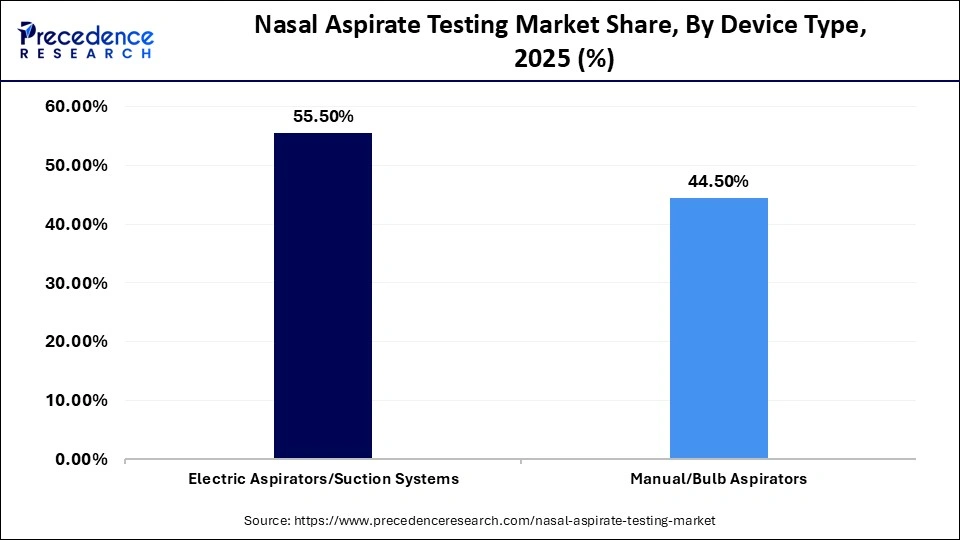

- By device type, the electric aspirators/suction systems segment registered its dominance over the global market with a share of approximately 55.5% in 2025.

- By device type, the manual/bulb aspirators segment is expected to gain the highest share of the market with a CAGR between 2026 and 2035.

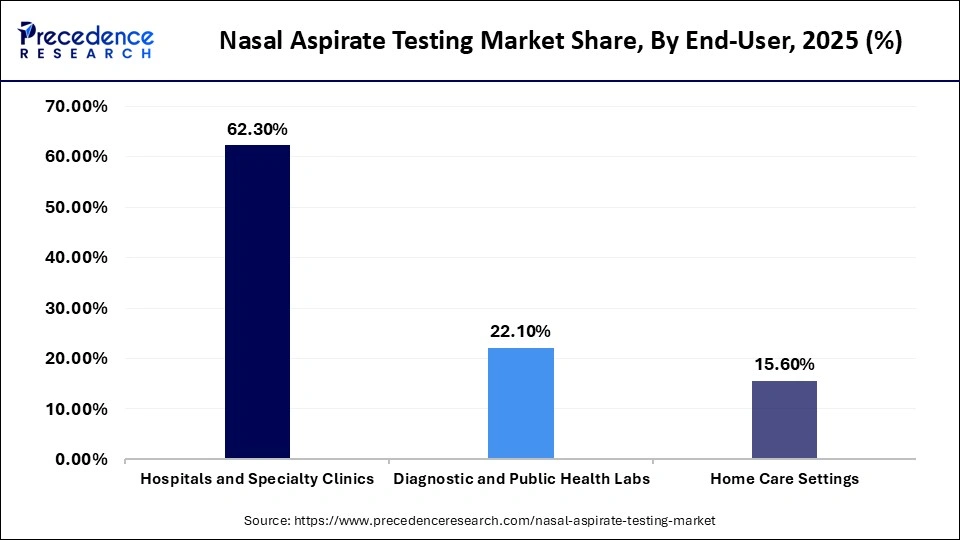

- By end-user, the hospitals & specialty clinics segment held a major revenue share of approximately 62.3% in the market in 2025.

- By end-user, the diagnostic & public health labs segment is expected to show the fastest growth with a CAGR over the forecast period.

What is Nasal Aspirate Testing?

The nasal aspirate testing market involves the clinical procedure and diagnostic tools used to collect and analyze nasal secretions for respiratory pathogens. Unlike simpler swabs, nasal aspiration uses saline and suction (catheters/syringes) to obtain higher-quality samples from the nasopharynx, which is critical for sensitive detection of viruses like RSV, influenza, and COVID-19 in pediatric and geriatric patients.

Impact of AI on Nasal Aspirate Testing

Nasal aspirate testing is revolutionizing with the increasing use of artificial intelligence (AI), facilitating automated sample analysis, pattern recognition, and decision-support systems that enhance diagnostic accuracy. AI-based algorithms are also being incorporated into molecular and immunoassay systems to quickly discriminate between viral and bacterial pathogens. Machine learning models optimize workflow efficiency in the laboratory by decreasing manual errors in the process and increasing the speed of work. Moreover, AI-based data analytics can be used in epidemiological surveillance and outbreak prediction, which brings strategic value beyond individual-level diagnostics.

Nasal Aspirate Testing Market Trends

- Point-of-care Diagnostics: Point-of-care (PoC) diagnostics are highly preferred to enable testing outside traditional clinical laboratories, eliminating the need for visiting any healthcare organization. The increasing use of PoC testing kits potentiates the demand for nasal aspirate testing.

- Molecular and Multiplex Testing Platforms: Advances in genomic technologies have enabled the detection of multiple pathogens responsible for causing respiratory illnesses.

- Respiratory Disease Screening: People are more aware of respiratory disease screening to prevent future complications and enhance access to early treatment. The growing awareness is due to government initiatives and awareness campaigns.

- Digital Health and Lab Automation: The integration of advanced technologies, such as AI and ML, automates laboratory processes, reducing manual errors and enhancing diagnostic efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.27 Billion |

| Market Size in 2026 | USD 1.34 Billion |

| Market Size by 2035 | USD 2.10 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Test Type, Application, Device Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Test Type Insights

Why the Molecular Testing Segment Dominated the Nasal Aspirate Testing Market?

The molecular testing segment dominated the market with a share of approximately 58.4% in 2025, driven by the increasing prevalence of respiratory infections and advancements in non-invasive diagnostic technologies. With a focus on molecular testing, the integration of AI and automated systems is enhancing diagnostic accuracy and efficiency across various healthcare settings.

The immunoassay testing segment is expected to be the fastest-growing between 2026 and 2035, owing to its capability to provide timely and reliable samples with minimal sample preparation. Their applicability in both hospital and diagnostic laboratory environments is further boosting their use in high-throughput screening and in point-of-care environments.

Application Insights

How the Viral Infections Segment Dominated the Nasal Aspirate Testing Market?

The viral infections segment registered its dominance over the global market with a share of approximately 72.6% in 2025, driven by the rising prevalence of influenza, RSV, and other respiratory viruses. The necessity to diagnose quickly and help to treat illnesses and control infection remains in high demand. The ability of nasal aspirate testing to rapidly identify these viral pathogens plays a crucial role in timely patient management and outbreak control, further driving demand for these diagnostic solutions.

The bacterial infections segment is expected to expand rapidly in the market in the coming years, due to the increased focus on early detection of viral versus bacterial respiratory illness by clinicians. The increase in microbial stewardship awareness is also fueling the need to have proper bacterial detection using nasal aspirate samples.

Device Type Insights

Which Device Type Segment Led the Nasal Aspirate Testing Market?

The electric aspirators/suction systems segment led the global market with a share of approximately 55.5% in 2025, because they have steady suction control, efficacy, and are applicable in a high-volume clinical setting. They are common in hospitals and specialty clinics, which facilitates standardization and reliability in sample collection.

The manual/bulb aspirators segment is expected to witness the fastest growth in the market over the forecast period, due to its low expenditure, portability, and simplicity of use in outpatient and resource-constrained facilities. This segment is growing with more home care and primary healthcare facility adaptations.

End-User Insights

Why Did the Hospitals & Specialty Clinics Segment Dominate the Nasal Aspirate Testing Market?

The hospitals & specialty clinics segment held the largest revenue share of approximately 62.3% in the market in 2025, because of high inflow of patients as well as the availability of state-of-the-art diagnostic facilities. Such environments are dependent on nasal aspirant testing to diagnose respiratory diseases within a short time and make clinical decisions.

The diagnostic & public health labs segment is expected to show the fastest growth over the forecast period, fueled by the growing disease surveillance initiatives and centralized testing schemes. An increase in investment in lab automation and molecular diagnostics is also boosting adoption in this segment.

Regional Insights

How Big is the North America Nasal Aspirate Testing Market Size?

The North America nasal aspirate testing market size is estimated at USD 560.07 million in 2025 and is projected to reach approximately USD 936.60 million by 2035, with a 5.28% CAGR from 2026 to 2035.

Why North America Dominated the Nasal Aspirate Testing Market?

North America held a major revenue share of approximately 44.1% in the market in 2025, driven by the presence of key players and favorable regulatory policies. The region showcases a blend of urban centers and vast natural landscapes. It is known for its strong economies, with the U.S. being one of the largest economies globally, followed by Canada and Mexico. Furthermore, North America has a well-developed healthcare infrastructure, which significantly influences markets like nasal aspirate testing. The increasing prevalence of respiratory diseases in urban areas has heightened the demand for advanced diagnostic tools in this region

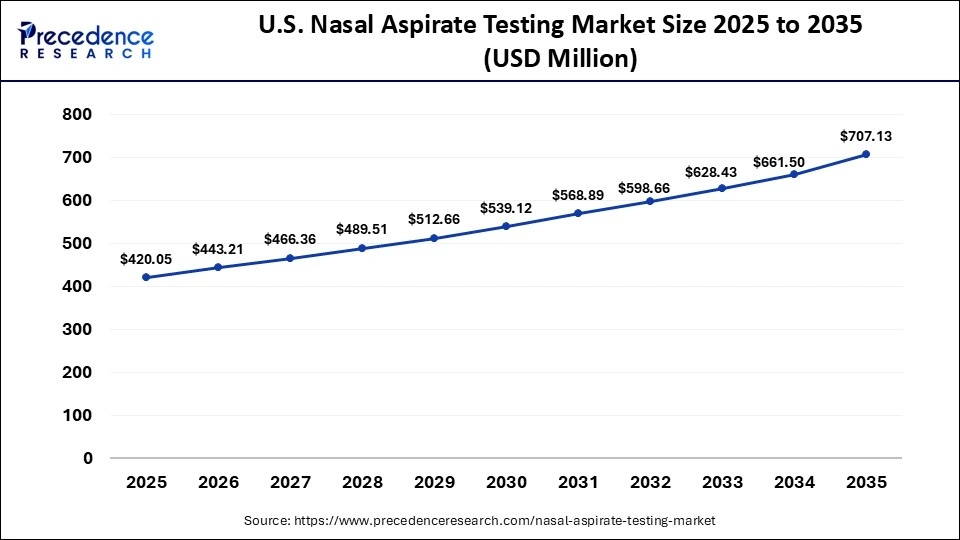

What is the Size of the U.S. Nasal Aspirate Testing Market?

The U.S. nasal aspirate testing market size is calculated at USD 420.05 million in 2025 and is expected to reach nearly USD 707.13 million in 2035, accelerating at a strong CAGR of 5.35% between 2026 and 2035.

U.S. Country-level Analysis

In the U.S., robust investments in research and development have propelled innovations in diagnostic technologies, making it a leading market for nasal aspirate testing. Canada's emphasis on public health has led to increasing awareness and acceptance of non-invasive testing methods among its population. Meanwhile, Mexico's growing healthcare sector, fueled by an expanding middle class, presents opportunities for diagnostic companies to introduce new testing solutions. Analyzing these factors helps to understand the unique challenges and opportunities each country presents in the context of the market.

How is Asia-Pacific Growing in the Nasal Aspirate Testing Market?

Asia-Pacific is expected to host the fastest-growing market in the coming years, driven by expanding healthcare infrastructure, rising respiratory disease burden, and increasing demand for rapid diagnostic solutions. Growing investments in public health programs and infectious disease surveillance are accelerating the adoption of advanced testing technologies across the region. Rising awareness around early detection of respiratory infections among pediatric and geriatric populations is further fueling market expansion. Additionally, improving access to point-of-care diagnostics and increasing government initiatives to strengthen laboratory networks support sustained growth momentum.

Country-level Analysis

China leads growth due to large patient volumes, substantial healthcare spending, and a strong government focus on respiratory disease diagnostics. India is experiencing rapid market expansion, supported by growing diagnostic capacity, rising disease prevalence, and increased adoption of cost-effective testing solutions. Southeast Asian countries such as Indonesia and Thailand are also expanding nasal aspirant testing through public health initiatives and improved healthcare access. Together, these markets are expected to drive Asia Pacific's leadership in the global nasal aspirant testing market.

Nasal Aspirate Testing Market Value Chain Analysis

- R&D

Research and development efforts are focused on improving sample collection efficiency, assay sensitivity, and compatibility with automated diagnostic platforms. Companies are investing in novel biomarkers, enhanced reagents, and AI-assisted analytics to improve clinical relevance and speed of nasal aspirant testing.

Key Players: Roche Diagnostics, Abbott Laboratories, Qiagen, and BioMérieux

- Clinical Trials and Regulatory Approvals

Clinical trials play a critical role in validating the accuracy, safety, and clinical utility of nasal aspirate-based diagnostic tests across diverse patient populations.

Key Players: Roche Diagnostics, Abbott Laboratories, Hologic, Cepheid (Danaher), and Siemens Healthineers

- Formulation and Final Dosage Preparation

Formulation processes involve the development of optimized reagents, buffers, and assay components that ensure stability and accuracy of nasal aspirate samples. Manufacturers focus on ensuring compatibility with both manual and automated diagnostic instruments.

Key Players: Qiagen, Bio-Rad Laboratories, Merck KGaA, and Agilent Technologies

- Packaging and Sterilization

To ensure sample integrity and avoid contamination during the supply chain, packaging and sterilization play an important role. Sophisticated sterile package solutions are applied to increase shelf life and adhere to the standards of infection control.

Key Players: 3M, Steris, Cardinal Health, West Pharmaceutical Services, and Gerresheimer

- Distribution to Hospital Pharmacies

The distribution networks are optimized in such a way that nasal aspirate testing kits reach hospital pharmacies and diagnostic laboratories in time. Effective cold-chain logistics and inventory management systems can be used to preserve product quality and availability.

Key Players: McKesson Corporation, Cardinal Health, AmerisourceBergen, Owens, and Medline Industries

- Patient Support and Services

Patient support services aim to enhance access to testing, awareness, and compliance, especially in high-risk and pediatric groups. Training programs and educational material facilitate the proper collection of samples and their interpretation.

Key Companies: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Quest Diagnostics, Labcorp

Who are the Major Players in the Global nasal Aspirate Testing Market?

The major players in the nasal aspirate testing market include Abbott Laboratories, Roche Holding AG, Becton, Dickinson and Company, Siemens Healthineers AG, Thermo Fisher Scientific Inc., BioMérieux SA, Danaher Corporation, QIAGEN N.V., QuidelOrtho Corporation, Hologic, Inc., Lucira Health, Mesa Biotech Inc., LumiraDx Limited, OraSure Technologies, Inc., and Sherlock Biosciences.

Recent Developments in the Nasal Aspirate Testing Market

- In January 2026, the CDC provided an update on the 2025-2026 flu season, highlighting that influenza activity was low during the period but projected to rise as the season progresses. Vaccination efforts were emphasized to enhance community immunity and protect vulnerable populations. The CDC also urged individuals to stay informed about flu symptoms and the importance of seeking timely medical attention if needed.(Source: https://www.cdc.gov)

- In January 2025, researchers developed a nasal swab test to identify specific subtypes of asthma in children, leading to more personalized treatment approaches. This test uses a molecular platform to analyze biomarkers associated with various asthma phenotypes, improving the diagnosis and management of the condition.(Source:https://www.nhlbi.nih.gov)

- In August 2025, BioMérieux announced that it received the U.S. Food and Drug Administration (FDA) approval for its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini for the addition of Anterior Nasal Swab, signifying its readiness for commercial use in the U.S. This innovative test was designed for the rapid detection of RSV, particularly in children.

Segments Covered in the Report

By Test Type

- Molecular Testing (PCR/RT-PCR)

- Immunoassay Testing (Rapid Antigen)

- Culture-Based Testing

By Application

- Viral Infections (RSV, Flu, COVID-19)

- Bacterial Infections (Whooping Cough, MRSA)

- Chronic Conditions (Cystic Fibrosis)

By Device Type

- Electric Aspirators/Suction Systems

- Manual/Bulb Aspirators

By End-User

- Hospitals & Specialty Clinics

- Diagnostic & Public Health Lab

- Home Care Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting