Samsung and SK Hynix Shares Affects Amid U.S. Regulations on Chip Manufacturing

Shares of the two leading players, Samsung and SK Hynix, dropped notably after the U.S. government made a decision to change authorization for chip production equipment in China. Samsung stock reduced by 2.30% and SK Hynix stock declined by 4.40%. This policy change will become mandatory after 120 days, when the previous exemption from the U.S. related to chip export restrictions for China expires. This has significantly affected both companies and their operations, as well as one-third of Samsung's DRAM and NAND production based in China. However, both companies have responded differently to the scenario. Samsung hasn’t responded to the changes yet, while Hynix plans to communicate with and address the Korean and U.S. governments to mitigate the business impact of these restrictions.

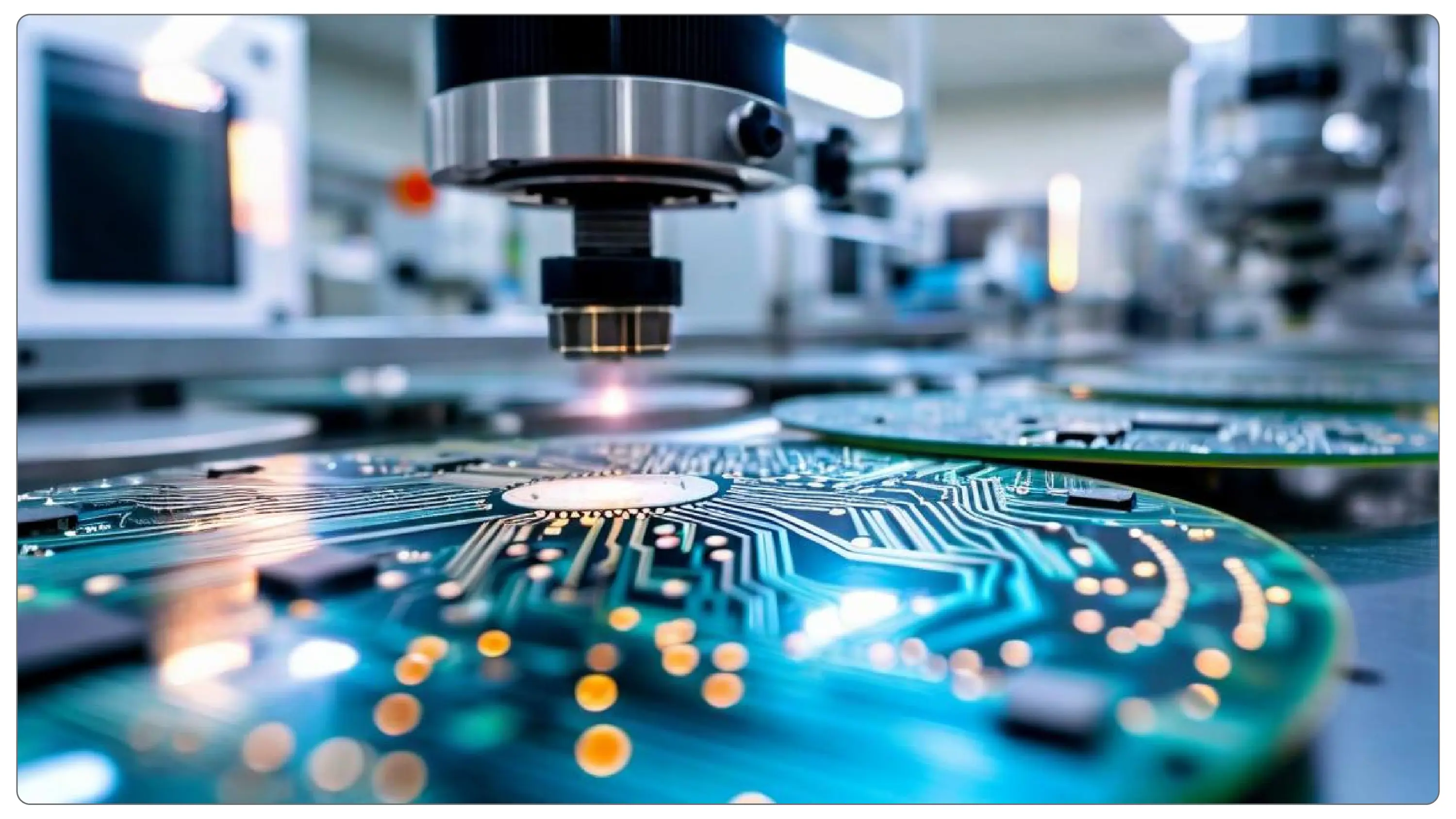

Due to a sudden policy shift by the U.S. government, the shares of two major players in South Korea's semiconductor market, Samsung Electronics and SK Hynix, have undergone drastic changes. This move has significantly affected companies' chip production capabilities in China.

What are the policy changes?

The U.S. government has restricted authorization that allowed Samsung Electronics and SK Hynix to leverage American semiconductor manufacturing equipment for their existing chip plants in China. This decision is seen as a strategic part of the U.S.'s efforts to restrict chip technology exports to China, stemming from the trade war. It ends exemptions that once protected companies from U.S. restrictions on chip-related exports to China.

These changes have marked a critical juncture for the global semiconductor industry, showcasing the continuous dispute between two of the leading countries globally, the U.S. and China, that would affect entire global economy including economies of developing countries like India, Japan, Russia, Korea and others who are dealing with these nations regarding various businesses to adjust their global strategies for production and sales. As a result, shares of the different chip assembly and product supply companies also experienced a significant impact on their stock prices. For example, Hana Micron fell to 1.7%, and Hanami Semiconductor shares decreased by 4.4%.