Non-load Bearing Walls Market Size and Forecast 2025 to 2034

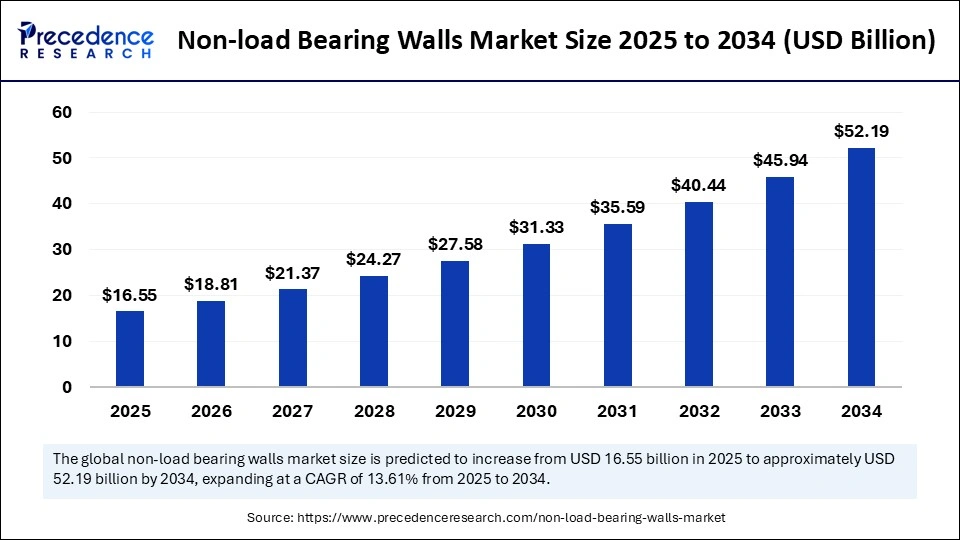

The global non-load bearing walls market size accounted for USD 14.57 billion in 2024 and is predicted to increase from USD 16.55 billion in 2025 to approximately USD 52.19 billion by 2034, expanding at a CAGR of 13.61% from 2025 to 2034. The market growth is attributed to the rising demand for energy-efficient, flexible, and quick-to-install partition solutions in both new construction and renovation projects worldwide.

Non-load Bearing Walls MarketKey Takeaways

- In terms of revenue, the non-load bearing walls market is valued at $16.55 billion in 2025.

- It is projected to reach $52.19 billion by 2034.

- The market is expected to grow at a CAGR of 13.61% from 2025 to 2034.

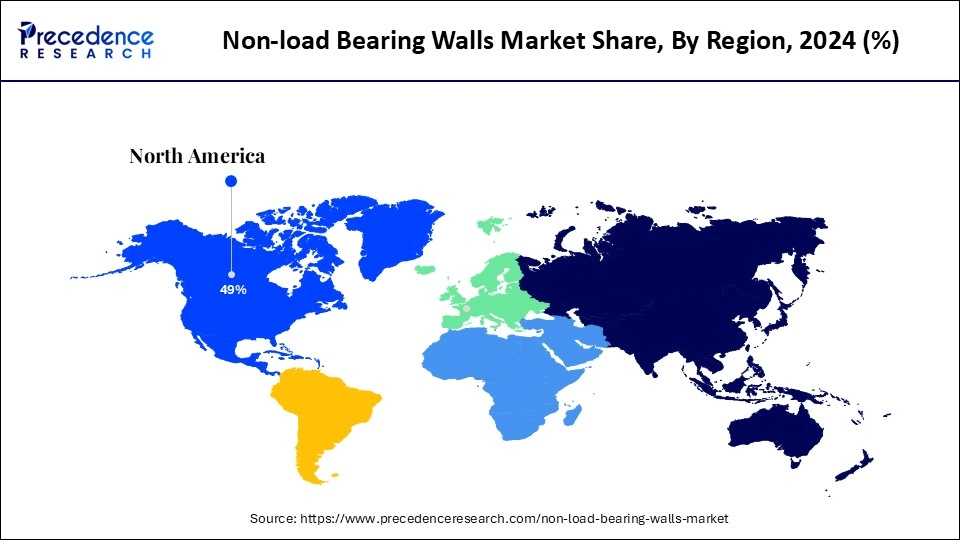

- North America dominated the non-load bearing walls market with the largest revenue share of 49% in 2024.

- Asia Pacific is expected to expand at a significant CAGR from 2025 to 2034.

- By material type, the gypsum board segment held a significant share of the market in 2024.

- By material type, the metal studs segment is projected to grow at a considerable CAGR between 2025 and 2034.

- By system type, the traditional segment contributed the biggest market share of in 2024.

- By system type, the prefabricated segment is projected to expand at a significant CAGR during the forecast period.

- By construction type, the residential segment dominated the market in 2024.

- By construction type, the commercial segment is expected to grow at a significant CAGR over the projected period.

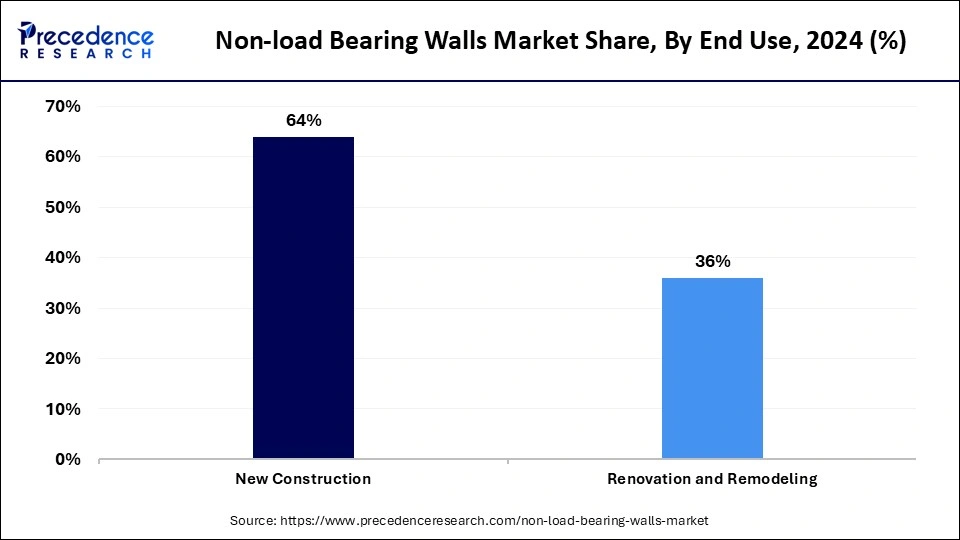

- By end-use, the new construction segment held the major revenue share of 64% in 2024.

- By end-use, the renovation & remodeling segment is anticipated to grow at a notable CAGR in the coming years.

Impact of Artificial Intelligence on the Non-load Bearing Walls Market

Architecture firms use Artificial Intelligence to adjust wall products according to individual architectural designs, making the prototyping process much faster. AI technology enables engineers to find the most suitable partition wall placement, considering sound resistance and fire and thermal properties. On construction sites, using AI and robotics speeds up the process of erecting mass-produced non-load bearing walls and diminishes the amount of labor required. AI also optimizes wall designs for space utilization. AI tools analyze architectural patterns and suggest optimal layouts.

How Big is the U.S. Non-load Bearing Walls Market?

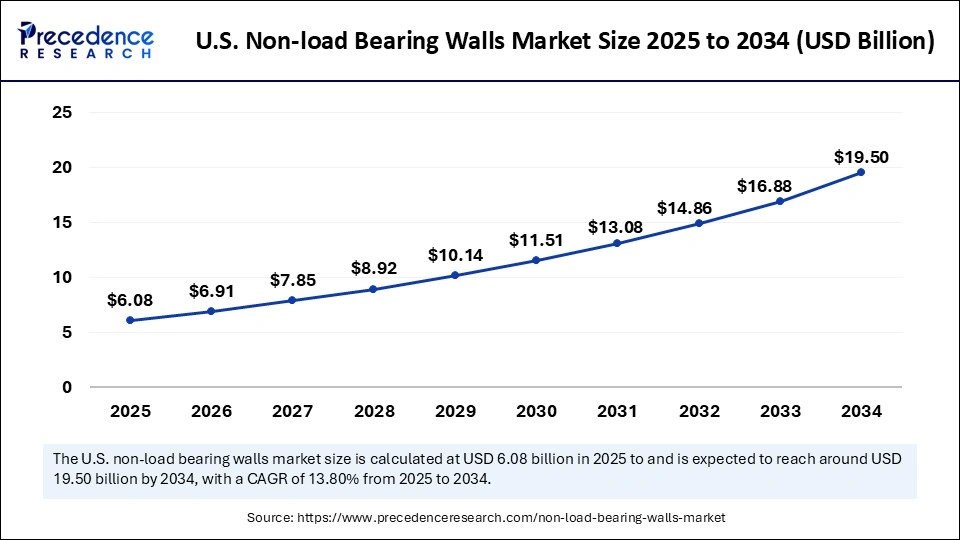

The U.S. non-load bearing walls market size was exhibited at USD 5.35 billion in 2024 and is projected to be worth around USD 19.50 billion by 2034, growing at a CAGR of 13.80% from 2025 to 2034.

Why did North America lead the non-load bearing walls market?

North America led the market by capturing the largest share in 2024. This is mainly due to increased building renovation and modernization activities. More businesses shifted toward sustainable construction. The Department of Housing and Urban Development (HUD) noted in its 2024 report that substantial money was being allocated for modernizing old buildings, mainly in cities that require flexible and efficient interiors.

The NAHB predicts that the assembly and production of modular and prefabricated wall systems is likely to increase since it helps reduce waste and improve how walls are built. Acoustic and fire-resistant non-load-bearing wall systems are becoming popular for inclusion in homes and workplaces. The Construction Specifications Institute (CSI) recommended making non-load bearing walls the same throughout the construction industry for easier building. Furthermore, due to the BMRA's influence, the circular economy concept is supported by reusing and recycling materials in the region is expected to boost the sustainable non-load bearing walls market.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increasing urban infrastructure development and a thriving construction sector in China, India, and Southeast Asian countries. To meet the need for affordable housing and smart city plans, architects are investing in systems that allow for speedy and cost-effective development.

A high number of construction permits and investments in commercial real estate support regional market growth. There is a strong focus on green building, energy saving, and preventing fires, boosting the demand for gypsum boards and metal studs. In 2024, national standards bodies in Asia worked to ensure their codes were aligned with ISO and ICC standards, making compliance and progress in the industry much easier. Furthermore, regional branches of the World Green Building Council contributed to a rise in interest in eco-friendly partition materials, thus propelling the market in this region.

Europe is considered to be a significantly growing area. The growth of the non-load bearing walls market in the region can be attributed to strict building codes, strong focus on sustainability, and rising urban renewal efforts. Standardization by CEN helped achieve greater harmony between different building standards for walls, leading to improvements in safety, saving energy, and protecting the environment. Both the Green Deal and Renovation Wave in the EU in 2024 increased the need for energy-saving, reusable, and low-carbon materials in construction and renovations. The use of prefabricated and modular construction grew in Europe, owing to a need to save time and lower waste. Moreover, the Construction Specifications Institute (CSI) supported growth by emphasizing quality control and careful assessment for the whole life of non-load-bearing walls.

Market Overview

The worldwide non-load bearing walls market is expanding rapidly due to the rising construction activities. Non-load-bearing walls separate areas of the building, protect against fire, insulate noise, and provide finishing touches. These walls are made from advanced materials, including gypsum board, metal studs, and prefabricated panels, which help complete construction in less time and save on energy as well. The increase in building permits, along with the rising need for interior walls, supports market expansion. Furthermore, the International Code Council (ICC) and the European Committee for Standardization (CEN) set standards for building construction, including fire, acoustic, and eco-friendly aspects of building components, facilitating the growth of the market.

Non-load Bearing Walls Market Growth Factors

- Increasing Focus on Sustainable and Lightweight Building Materials: With the increasing focus on sustainability, the demand for eco-friendly, lightweight materials is rising. This significantly boosts the growth of the market.

- Rising Urbanization and Infrastructure Development: Rapid urbanization and infrastructure development are driving the need for efficient, fast-installation partition systems to support accelerate building projects.

- Advancements in Prefabrication and Modular Construction: Innovations in off-site manufacturing and modular designs are boosting construction speed, quality control, and labor efficiency.

- Regulations Regarding Fire Safety and Energy Efficiency: Stringent building codes and sustainability regulations are propelling the development and adoption of high-performance wall materials.

- Rising Renovation and Retrofitting Activities: Increased focus on remodeling and interior space reconfiguration is driving demand for flexible, easy-to-install non-load-bearing walls.

- Rising Adoption of Eco-Friendly and Recyclable Materials: Market players are capitalizing on sustainability trends by developing recyclable and low-impact wall systems, boosting market growth.

- Technological Innovations in Acoustic and Thermal Insulation: Continuous improvements in soundproofing and insulation performance are enhancing the functional appeal of non-load-bearing walls in various end uses.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 52.19 Billion |

| Market Size in 2025 | USD 16.55 Billion |

| Market Size in 2024 | USD 14.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, System Type, Construction Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Flexible Interior Configurations in Modern Construction

Increasing demand for flexible interior layouts is anticipated to drive the growth of the non-load bearing wall market. The need for adaptable spaces is rising that can be easily configured across commercial and residential construction. As people demand more flexible room designs, non-load bearing wall systems are likely to be adopted more widely in building construction. In architecture, reducing the need for structural changes is important for spaces that are reconfigured. Non-load bearing walls easily adapt to various constructions, enhancing soundproofing and insulation properties. Architectures prefer using partition walls in offices, co-living areas, and retail units. The U.S. Department of Housing and Urban Development (HUD) updated the most significant changes to Manufactured Home Construction and Safety Standards in 2024, and 90 of the new or improved rules are now in place. As a result of these updates, homes with open layouts and modules are made more quickly and are more affordable for American families. Furthermore, the U.S. Census Bureau revealed that 1,471,200 houses and apartments were approved for building in 2024, leading more people to install non-load-bearing walls.

Restraint

Concerns Over Long-Term Durability

Concerns regarding the long-term durability, wear, impact resistance, and maintenance of lightweight partition systems hamper the growth of the non-load bearing walls market. Public spaces, such as hospitals and schools, experience high traffic, prioritizing safe and dependable construction. If drywall or composite partitions become damaged, it reduces users' trust, while masonry or concrete alternatives do not face the same challenge. Low perception of this area is likely to cause delays in using composite materials in major infrastructure areas. Moreover, compliance with stringent building codes and fluctuations in the prices of raw materials limit the growth of the market.

Opportunity

High Demand for Lightweight Materials and Green Construction

There is a high demand for sustainable and lightweight materials in green building practices, which is likely to create immense opportunities in the non-load bearing walls market. Builders are demanding eco-friendly and lightweight building materials, so that their projects are in line with environmental certifications, such as LEED and BREEAM. Walls made from recyclable gypsum, engineered wood, and fiber cement are both energy efficient and emit less carbon than traditional walls. Architects use these resources to make buildings sustainable and flexible in design. According to the World Green Building Council, buildings are responsible for 39% of global energy-related carbon emissions. This encourages builders to opt for more robust and sustainable, non-load-bearing wall systems, which is expected to fuel the market growth in the coming years.

By Material Type Analysis

Why Did the Gypsum Board Segment Dominate the Non-Load Bearing Walls Market in 2024?

The gypsum board segment dominated the non-load bearing walls market with a significant share in 2024. This is mainly due to the increased adoption of gypsum boards due to their ease of installation, cost-effectiveness, and excellent fire-resistance. Because gypsum boards are easy to finish and suit diverse architectural styles, contractors and builders use them in both residential and commercial projects. Furthermore, the adoption of gypsum board grew as a result of fire safety and sound insulation regulations that are part of the building code published by the International Code Council (ICC).

The metal studs segment is projected to grow at a considerable CAGR during the upcoming period, as they are strong and can adjust to today's construction methods. As cities grow and buildings become taller, the demand for maintaining structure and light materials rises. Metal studs allow for easy installation of mechanical, electrical, and plumbing systems, which speeds up the design and completion of a building. To improve the performance of metal studs, manufacturers focus on strong, protective coatings and new shapes. Moreover, their lower environmental impact due to their ability to recycle and the decrease in waste is expected to drive the segment growth.

By System Type Analysis

Why Did the Traditional Segment Lead the Non-Load Bearing Walls Market in 2024?

The traditional segment held the largest share of the non-load bearing walls market in 2024. This is mainly due to the increased acceptance of traditional building practices in the last few years. Traditional non-load-bearing walls are well known for being less expensive. Contractors and builders choose traditional walls in residential and commercial areas with limited space. They are easy to customize and easy to install according to typical construction practices. Moreover, traditional systems offer different ways to finish the building and are easy to modify during building on-site, facilitating the steady growth of the segment.

The prefabricated segment is projected to expand at a significant CAGR during the forecast period, as they are efficient and can be adapted into sustainable building practices. To deal with a lack of workers and cut down construction time, developers and contractors are using prefabricated walls. Off-site production of prefabricated wall panels allows architects and builders to combine mechanical, electrical, and plumbing components without interruptions once the panels are installed on-site. The rising focus on reducing CO2 emissions further drives segmental growth. According to the World Green Building Council's 2024 report, prefabricated systems are widely recognized for their role in reducing CO2 emissions.

By Construction Type Analysis

Why Did the Residential Segment Dominate the Non-Load Bearing Walls Market in 2024?

The residential segment dominated the non-load bearing walls market in 2024. This is mainly due to the increasing government investments in housing projects. Non-load-bearing walls are used in residential constructions to divide home spaces. In an effort to finish projects more quickly and follow strict building regulations, homebuilders focused on installable and low-priced wall systems that are lightweight. Using gypsum board and metal studs enables residential buildings to resist fires, reduce noise, and easily follow different architectural designs. Additionally, as non-load-bearing walls are easy to modify, they help accelerate remodeling activities in both city and suburban regions.

The commercial segment is expected to grow at a significant CAGR over the projected period, owing to increasing urbanization and rising renovation of office spaces. Using prefabricated non-load-bearing walls made construction cheaper and much faster, helping to deal with the shortage of workers. The rising focus on optimizing office spaces is likely to support segmental growth.

By End-use Analysis

Why Did New Construction Dominate the Non-Load Bearing Walls Market in 2024?

The new construction segment held the largest share of the non-load bearing walls market in 2024. This is mainly due to the increased construction activities worldwide. Structural partitions were installed by developers soon after starting the building process to ensure they comply with the latest fire safety, acoustic, and energy rules. The 2024 construction report from the U.S. Census Bureau revealed that permits for commercial and residential building increased, creating the need for flexible and prefabricated walls. Builders can use prefabricated and modular wall panels to tackle labor issues and finish projects on time.

The renovation & remodeling segment is anticipated to grow at a notable CAGR in the coming years, owing to the growing popularity of reorganizing old and aged infrastructure. Property owners often prefer to install non-load bearing walls during retrofitting since they are quick to fit and remove without harming the building. Rising refurbishment of office spaces is driving the growth of the segment. Additionally, non-load-bearing walls allow for the reuse, resulting in less waste generation during remodeling.

Non-load Bearing Walls Market Companies

- Armstrong World Industries, Inc.

- Beijing New Building Materials Public Limited Company (BNBM)

- Cemex S.A.B. de C.V.

- CertainTeed Corporation

- China National Building Material Corporation (CNBM)

- Etex Group

- Gypsum Management & Supply, Inc.

- James Hardie Industries plc

- Johns Manville Corporation

- Knauf Insulation GmbH

- LafargeHolcim Ltd.

- Rockwool International A/S

- Saint-Gobain S.A.

- Schluter Systems L.P.

- USG Corporation

Recent Developments

- In April 2025, ROCKWOOL introduced Smartrock, a dual-layer stone wool insulation board with an integrated smart vapor retarder. Designed for mass wall assemblies, it offers continuous insulation, thermal regulation, and vapor control, aligning with modern building codes and sustainability goals in retrofit and new construction.

- In February 2025, AkzoNobel launched RUBBOL WF 3350, a waterborne wood coating with 20% bio-based content under its Sikkens brand. The product delivers durability and performance while advancing renewable material use, reinforcing the company's push toward sustainable innovation in construction finishes.

- In July 2023, nitiWall Corporation unveiled its prefabricated, high-performance, fully unitized wall panel system for use in new construction and deep energy retrofits.

(Source: https://theprint.in)

(Source: https://www.rockwool.com)

(Source: https://www.akzonobel.com)

(Source: https://www.aninews.in)

Segments Covered in the Report

By Material Type

- Concrete

- Glass

- Gypsum Board

- Metal Studs

- Wood Studs

- Others

By System Type

- Modular

- Pre-Fabricated

- Traditional

By Construction Type

- Commercial

- Industrial

- Residential

By End Use

- New Construction

- Renovation and Remodeling

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting