What is the Nutraceutical Packaging Market Size?

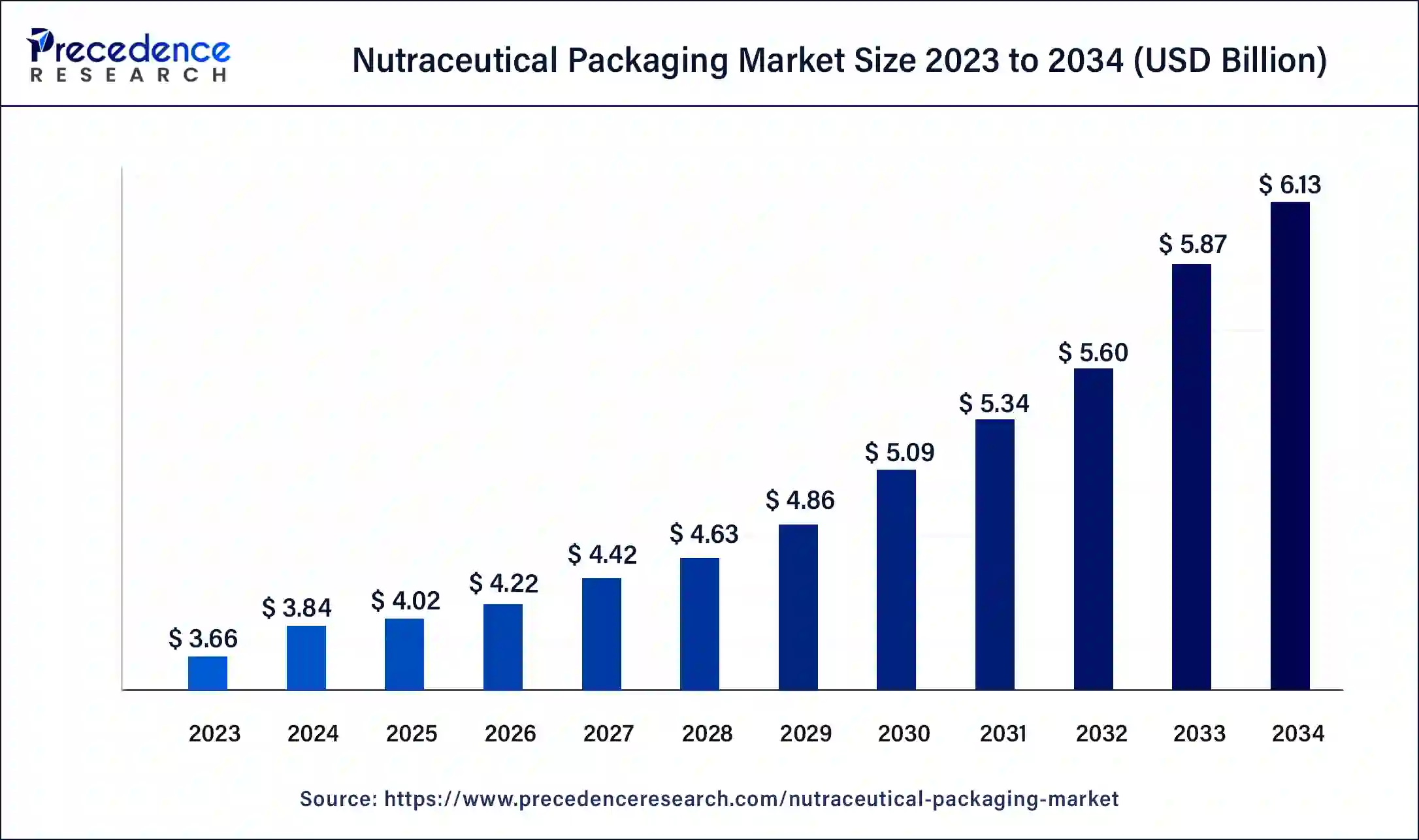

The global nutraceutical packaging market size was valued at USD 4.02 billion in 2025, calculated at USD 4.22 billion in 2026 and is expected to reach around USD 6.40 billion by 2035, expanding at a CAGR of 4.76% from 2026 to 2035. The nutraceutical packaging market size reached USD 1.94 billion in 2025.

Nutraceutical Packaging Market Key Takeaway

- In terms of revenue, the nutraceutical packaging market is valued at USD 4.02 billion in 2025.

- It is projected to reach USD 6.40billion by 2035.

- The nutraceutical packaging market is expected to grow at a CAGR of 4.76% from 2026 to 2035.

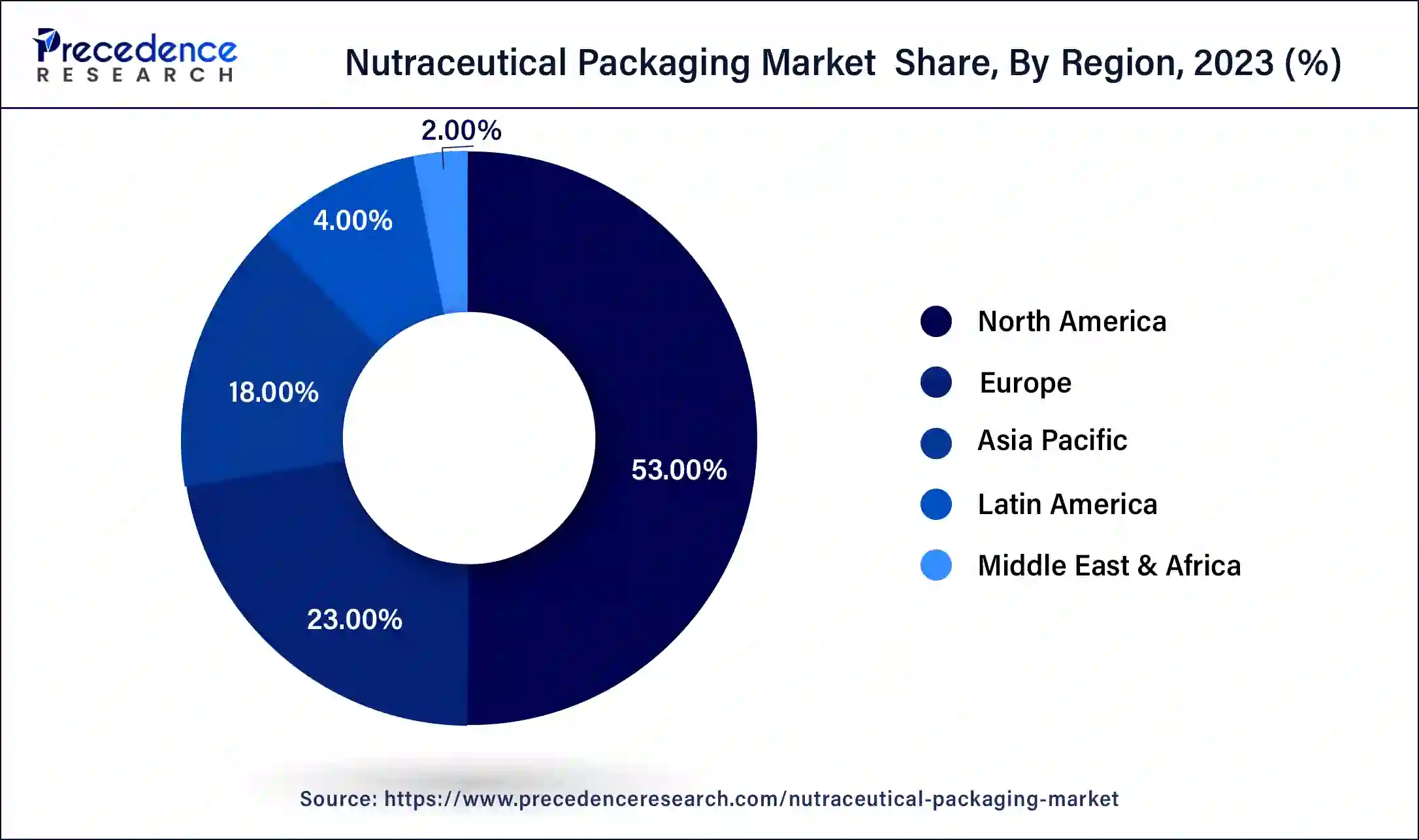

- North America dominated the market with the largest market share of 53% in 2025.

- Europe is expected to grow with the highest CAGR in the market during the forecast period.

- By packaging type, the bottles and jars segment has generated more than 36% of market share in 2025.

- By packaging type, the bags & pouches segment is expected to grow to the highest CAGR in the market during the forecast period.

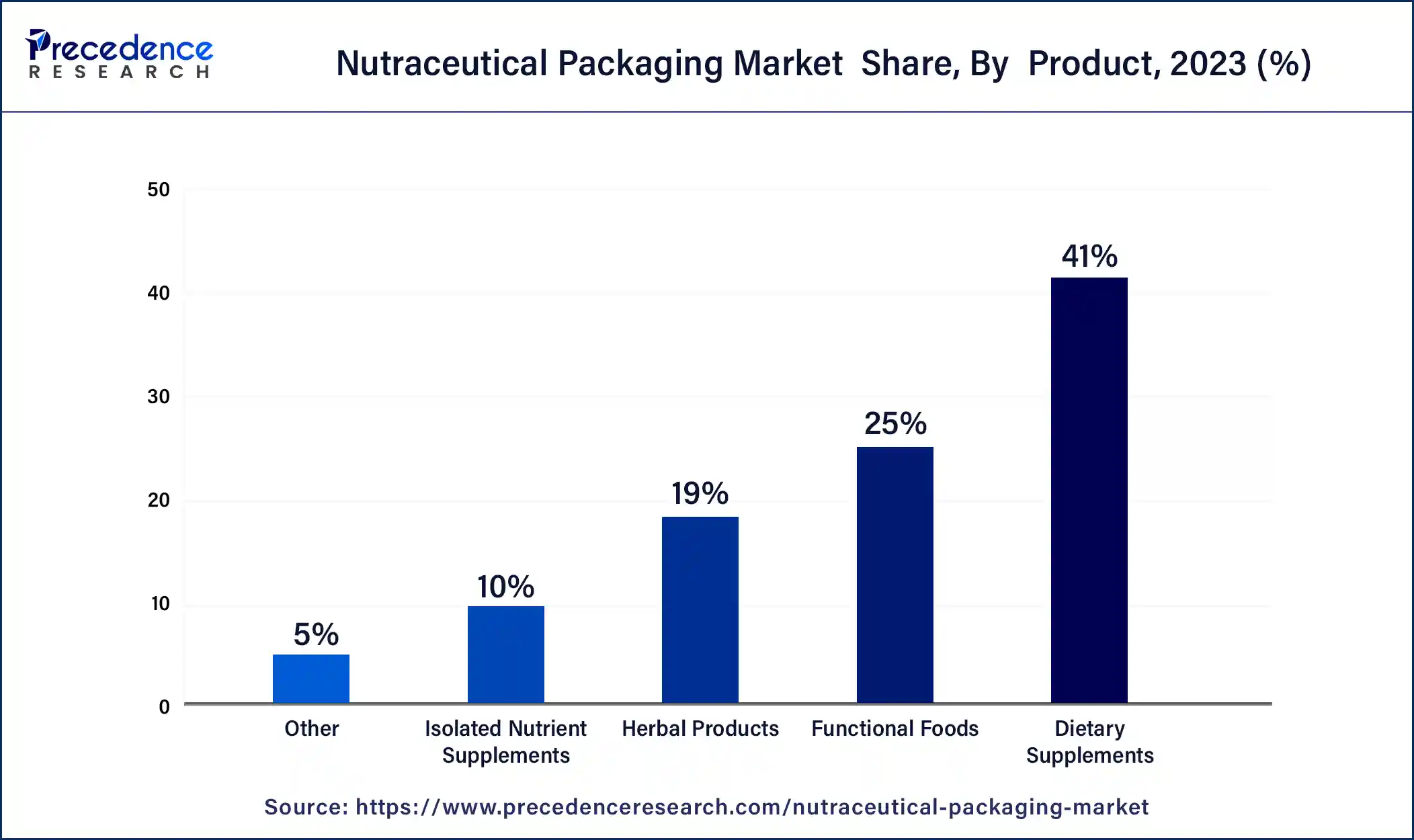

- By Product, the dietary supplement segment has contributed more than 41% of market share in 2025.

- By Product, the functional foods segment is expected to grow to the highest CAGR in the market by product during the forecast period.

- By material, the glass segment is expected to grow to the highest CAGR in the market during the forecast period.

Market Overview

The nutraceutical packaging market refers to the dedicated industry that offers packaging design specially for the products in the nutraceutical industry. Nutraceutical packaging may include features like temper evident seals, moisture barriers, UV protection, and child resistance closures depending on the specific need of the products and their intended use.

Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value. These health benefits are food products sold in the form of pills, powders, and liquids or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods. Nutraceutical packaging helps maintain product freshness, reduce transportation costs and overall carbon footprint, enhance shelf appeal, create convenient packaging, and boost the sustainability of nutraceutical products.

The nutraceutical packaging market is fragmented with multiple small-scale and large-scale players, such as Alpha Packaging, Amcor Limited, Gerresheimer AG, Mondi Plc., RPC Group, Graham Packaging Company, Sonoco Products Company, Constantia Flexible Group GmbH, ALPLA Werke Alwin Lehner GmbH & Co KG, Flex-pack, Innovia Film, Law Print & Packaging Management Ltd., American Nutritional Corporation, Wasdell Packaging Group, PontEurope, Arizona Nutritional Supplements LLC, Comar, Medifilm AG, Origin Pharma Packaging, CSB Nutrition Corporation, Nutra Solutions, etc.

Nutraceutical Packaging Market Growth Factors

- The rising popularity of nutraceutical products can boost the nutraceutical packaging market.

- Awareness of nutraceutical products, including information about nutraceuticals, the benefits and uses of nutraceutical products, etc., can boost the market.

- Bottles and jars are the most common packaging type of nutraceutical products. The bottles and jars are useful for liquids, tablets, capsules, soft gels, and gummies. These can boost the nutraceutical packaging market.

- Robotic packaging helps to streamline the entire packaging line, boost system accuracy, and increase productivity, which may derive the market.

- The benefits like temper evident seals, moisture barriers, UV protection, and child resistance closures of nutraceutical packaging can grow the demand for nutraceutical packaging, which may lead to the growth of the nutraceutical packaging market.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2035 | USD 6.40Billion |

| Global Market Size in 2025 | USD 4.02 Billion |

| Global Market Size in 2026 | USD 4.22 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Packaging Type, Product, Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising popularity of nutraceutical products

The rising popularity of nutraceutical products can boost the nutraceutical packaging market. Nutraceutical products are derived from food sources with health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

Nutraceutical products help to reduce the risk of chronic diseases, including cardiovascular diseases, diabetes, certain cancers, and age-related macular degeneration. Awareness of nutraceutical products, including information about nutraceuticals, the benefits and uses of nutraceutical products, etc., can boost the market for nutraceutical products.

- In August 2023, Herbalife launched the plant-based supplement line Herbalife V offering to the growing demand for plant-based products, including supplements. The products are certified USDA Organic, verified non-GMO, certified kosher, and certified plant-based and vegan by FoodChain ID.

Benefits of nutraceutical packaging

The benefits like temper evident seals, moisture barriers, UV protection, and child resistance closures of nutraceutical packaging can grow the demand for nutraceutical packaging, which may lead to the growth of the nutraceutical packaging market. Nutraceutical packaging may include benefits like temper evident seals, moisture barriers, UV protection, and child resistance closures depending on the specific need of the products and their intended use.

Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value, and if the benefits of packaging nutraceuticals are good, then there is a rise in demand for the nutraceutical packaging market.

Restraint

Negative impact on the environment

The negative impact of nutraceutical packaging on the environment may slow down the progress of the nutraceutical packaging industry. The packaging materials include plastic, glasses, metals, and paper. These materials are non-biodegradable materials, which means these materials do not decompose naturally.

Materials like plastics, glass, and metals take hundreds of years to degrade, are responsible for the cause of pollution, and are also harmful to animals. The packaging materials contain chemicals like bisphenol A (BPA) and phthalates. These compounds can come into the food and pose health risks.

Opportunity

Integration of robotic packaging

The integration of robotic packaging can be an opportunity for the nutraceutical packaging market. A packing robot can complete the operations such as filling, transporting, sealing, palletizing, opening, labeling, and code products. Robots can pack and load cartons and also fulfill secondary packaging applications, like printing a cartoon on the back of a cereal box. Robotic packaging helps to streamline the entire packaging line, boost system accuracy, and increase productivity, which may derive the nutraceutical packaging market.

Segment Insights

Packaging Type Insights

The bottles and jars segment dominated the nutraceutical packaging market by packaging type in 2025. Bottles and jars are the most common packaging type of nutraceutical products. The bottles and jars are useful for capsules, soft gels, liquids, tablets, and gummies. Their rigid shape protects the contents from moisture, oxygen, pests, and physical damage. The bottles and jars prevent the nutraceutical products from physical oxygen, damage, moisture, and pests. The transparent bottles and jars are best for showcasing nutraceutical products and their quality. Nutraceutical products are health benefits food products sold in the form of pills, powders, and liquids or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

The bags and pouches segment is expected to grow to the highest CAGR in the nutraceutical packaging market by packaging type during the forecast period. Bag-and-pouch packaging provides eco-conscious solutions that help keep nutraceuticals safe and fresh from fill through end-use. Nutraceutical packaging may include features like temper-evidence seals, moisture barriers, UV protection, and child-resistant closures depending on the specific needs of the products and their intended use.

Product Insights

The dietary supplement segment dominated the nutraceutical packaging market by product type in 2025. The dietary supplement is manufactured to improve and maintain the overall health of individuals. Dietary supplements are also useful in fulfilling the daily requirement for essential nutrients. The dietary supplements include vitamins, minerals, proteins, amino acids, bodybuilding supplements, essentially fatty acids, natural products (like extracts from plants, animals, algae, fungi, or lichens), fertility, prenatal, and pharmacotherapy.

- In June 2023, Nordic Naturals announced the expansion of its portfolio of products and enhanced access to its products through partnerships with Walmart. Through the partnerships, numerous Walmart locations now have three omega-3 products from the company, including Omega-3 soft gels, which provide 690 mg of total omega-3s for everyday heart and cognitive support.

The functional foods segment is expected to grow to the highest CAGR in the nutraceutical packaging market by product type during the forecast period. Functional foods are used for health promotion or disease prevention by adding ingredients that are essential for the individual or according to the disease. Functional foods include food, beverage, and supplement sectors, which are essential for individuals to prevent disease and promote health. Functional foods are further divided into four types. These include modified foods, medical foods, conventional foods, and foods for special dietary use.

Material Insights

The plastic segment dominated the nutraceutical packaging market by material type in 2025. The packing of plastic allows nutraceutical industries to protect, preserve, store, and transport products in a variety of ways. Plastics are used because of the combination of benefits like durability, safety, hygiene, security, lightweight, and design freedom. Examples ofplastic packaging include bottles, jars, bulk containers, trays, and blister packing.

The glass segment is expected to grow to the highest CAGR in the nutraceutical packaging market by material type during the forecast period. The glass is made by cooling a heated, fused mixture of silicates, lime, and soda to the point of fusion. After cooling, the glass comes in the condition of substance which is continuous with, and similar to, the liquid state but which, as a result of a reversible change in viscosity, has attained so high a degree of viscosity as to be for all practical purposes solid. There are two types of glass packaging used for nutraceutical products, bottles with a narrow neck, jars, and pots with wide openings.

Regional Insights

What is the U.S. Nutraceutical Packaging Market Size?

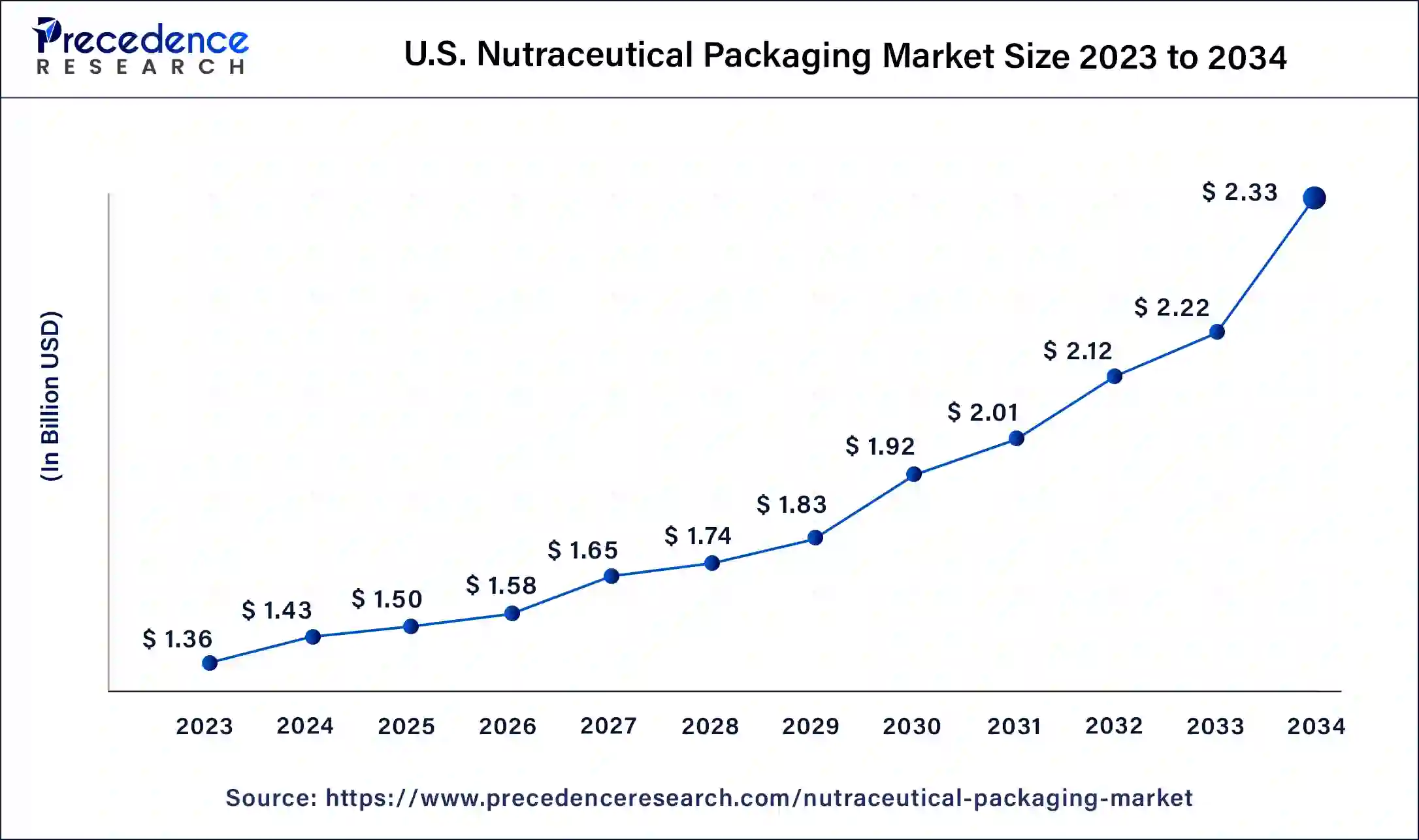

The U.S. nutraceutical packaging market size was calculated at USD 1.5 billion in 2025 and is projected to surpass around USD 2.43 billion by 2035 at a CAGR of 4.94% from 2026 to 2035.

North America dominated the nutraceutical packaging market in 2025. Nutraceutical products are derived from food sources with more health benefits in addition to their basic nutritional value. These health benefits are food products sold in the form of pills, powders, liquids, or also marketed as health-promoting or disease-preventing properties like vitamins, minerals, herbal supplements, and certain functional foods.

Nutraceutical products help to reduce the risk of chronic diseases, including cardiovascular diseases, diabetes, certain cancers, and age-related macular degeneration. The rising prevalence of such chronic diseases in North America countries promotes the market's expansion. Awareness of nutraceutical products, including information about nutraceuticals, the benefits and uses of nutraceutical products, etc., can boost the market for nutraceutical products in North America.

According to the 2023 CRN/Ipsos Consumer Survey finds that about three-quarters of Americans (74 percent) said that they are dietary or nutritional supplement users. Nearly 55 percent half of Americans report being regular supplement users. 74 percent of Americans and 83 percent of dietary supplement users said that they trust the dietary supplement industry. When it comes to maintaining the well-being of their health, roughly 9 in 10 (92 percent) supplement users said that they agree that dietary supplements are crucial. Such factors are expected to fuel the market growth in the region during the forecast period.

Europe is expected to grow to the highest CAGR in the nutraceutical packaging market by region during the forecast period. Europe has a growing population that is becoming more health-conscious, which increases the demand for nutraceutical products and has a positive impact on the nutraceutical packaging market. Additionally, the integration of robotic packaging can be an opportunity for the nutraceutical packaging market.

- In October 2023, the government of Catalonia, Spain, invested €7 million into alternative protein research from Plants, Fungi, and Bacteria. To scale up Catalonia's plant-based and fermentation-made food production and reduce food waste. The Centre for Innovation in Alternative Proteins (CiPA) will receive the funding, which is based across various sites throughout the region.

Germany Nutraceutical Packaging Market Trends

Germany is by far the fastest-growing country in terms of packaging products due to its strong nutraceutical manufacturing base, as well as a high degree of relative consumer trust towards regulated health care products. Smart and tamper-evident features, including QR codes and serialization, are being integrated to enhance product traceability, authenticity, and consumer engagement.

Growth of Health Awareness in Latin America

Demand for nutraceutical packaging in Latin America has increased because of an increase in overall health consciousness among consumers and improved retail distribution channels, resulting in increased supplement consumption among urban populations. The fastest-growing country in Latin America is Brazil, due to increased spending by the growing middle class and the increase in the number of available diet-related supplements.

Emerging Wellness Markets in the Middle East & Africa

The packaging market for nutraceuticals in the Middle East and Africa is growing, but at a much less aggressive rate than in either North America or Europe. Growth is primarily driven by rising lifestyle-related health concerns and an increasing number of retail outlets for both pharmaceutical and wellness-type products.

The fastest growing country in the Middle East & Africa (MEA) is Saudi Arabia, which is experiencing rapid growth due to its increasing investments made in health care, as well as rising consumer interest in preventative forms of nutrition.

Value Chain Analysis of the Nutraceutical Packaging Market

- Raw Material Sourcing: The sourcing of raw materials used for nutraceuticals is concentrated on food-grade plastics, glass, and aluminum that meet public health standards and stability from chemicals, moisture resistance, and long shelf life with respect to the raw material formulation of the nutraceuticals.

Key Players: Amcor, Berry Global, and strength-grade. - Material Processing and Conversion: The processing and converting of the finished product is through processes such as extrusion, molding, and laminating, and with properties such as durability, tamper-resistant, and providing dose protection to the finished product, all of which comply with regulations regarding the labeling and traceability of the finished product.

Key Players: AptarGroup, Gerresheimer, and Sealed Air. - Recycling and Waste Management: Recycling and managing waste focuses on the recovery of material, the use of mono-materials, and the use of post-consumer resin to minimize the amount of waste that is sent to landfill and support brand sustainable objectives.

Key Players: Tetra Pak, Huhtamaki, and DS Smith.

Nutraceutical Packaging Market Companies

- Alpha Packaging

- Amcor Limited

- Gerresheimer AG

- Mondi Plc.

- RPC Group

- Graham Packaging Company

- Sonoco Products Company

- Constantia Flexible Group GmbH

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Flex-pack

- Innovia Film

- Law Print & Packaging Management Ltd.

- American Nutritional Corporation

- Wasdell Packaging Group

- PontEurope

- Arizona Nutritional Supplements LLC

- Comar

- Medifilm AG

- Origin Pharma Packaging

- CSB Nutrition Corporation

- Nutra Solutions

Recent Developments

- In April 2025, TCI Biotech, a CDMO+ organization specializing in health and wellness products, unveiled its comprehensive US-based glass bottling solution for liquid supplements, positioning it as a cornerstone of its expanded CDMO+ services. It is designed for nutraceutical and wellness brands seeking premium, sustainable, and scalable solutions.

- In January 2023, Oliver Inc. announced the acquisition of Tap Packaging + Design ("Tap Packaging"). Tap Packaging is a leading manufacturer of custom folding cartons, serving customers in food and beverage, beauty, confectionery, health and wellness, and consumer goods markets.

- In May 2023, Vidya Herbs, an Indian-based company, announced its plans to create jobs for 100 people at Bunnell, United States, in the next three years paying an average of USD 42,000 annually. The company has already invested USD 20 million to equip its new U.S. herbal extracts manufacturing plant. The new facility has a 20,000-square-foot building.

- In February 2024, NBi FlexPack launched its flexible packaging manufacturer, producing custom solutions. Its products are made in the U.S. to allow for quick turnaround times for shipping in the U.S.

- In February 2024, Innovia Films, a leading material science pioneer that manufactures polyolefin film materials for labels and packaging, announced the extension of its product range for floatable polyolefin shrink films. The new film is a low-density white film made from polyolefin (WAPO) that maintains floatability when printed.

- In November 2023, SIG, a leading systems and solutions provider for aseptic packaging, announced the introduction of state-of-the-art filling machines for F&B leaders and startups in the India, Middle East, and Africa region.

- In September 2023, Amcor released the blog on ‘How Regulations and Needs Differentiate OTC and Dietary Supplement Packaging Selection Processes.' This blog includes OTC packaging regulations and recommendations, drivers behind dietary supplement packaging, and compliant packaging solutions for dietary supplements and OTC drugs from Amcor.

Segments Covered in the Reports

By Packaging Type

- Bottles and Jars

- Bags and Pouches

- Cartons

- Stick Packs

- Blister Packs

- Other

By Product

- Dietary Supplements

- Functional Foods

- Herbal Products

- Isolated Nutrient Supplements

- Other

By Material

- Plastic

- Glass

- Metal

- Paper and paperboard

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting