What is the Ophthalmic Packaging Market Size?

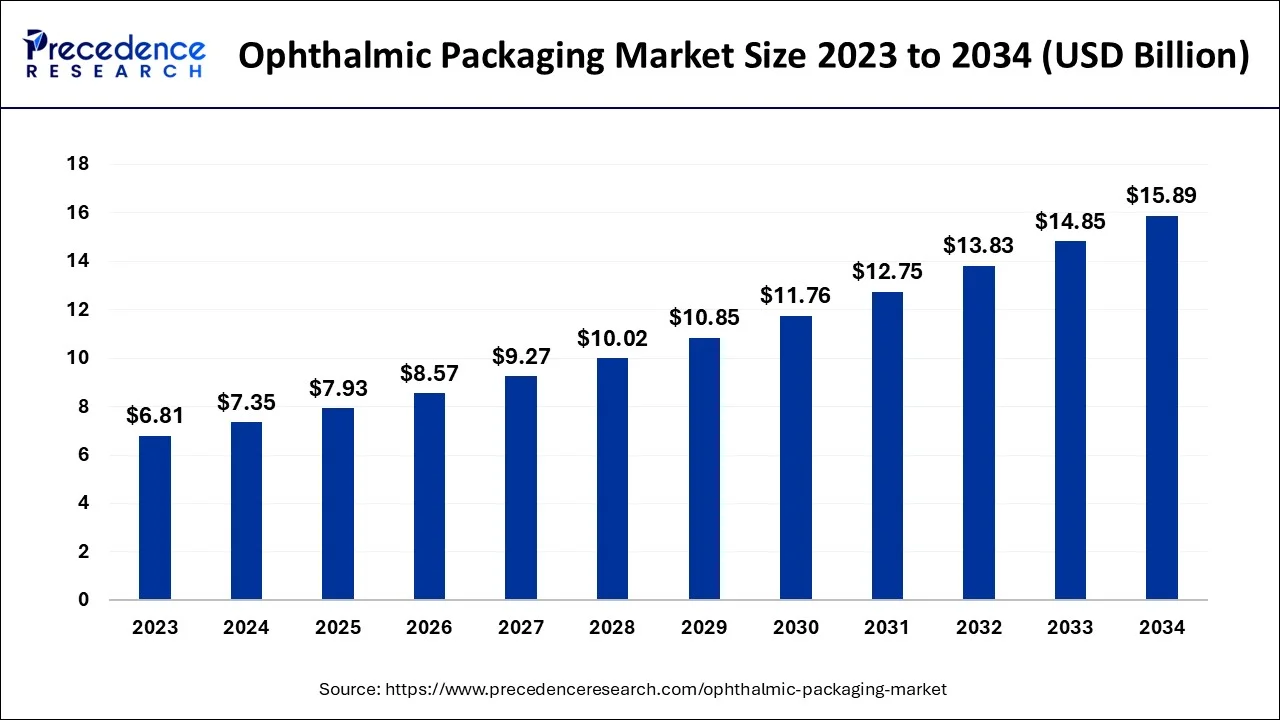

The global ophthalmic packaging market size is calculated at USD 7.93 billion in 2025 and is predicted to increase from USD 8.57 billion in 2026 to approximately USD 16.92 billion by 2035, expanding at a CAGR of 7.87% from 2026 to 2035.

Ophthalmic Packaging Market Key Takeaways

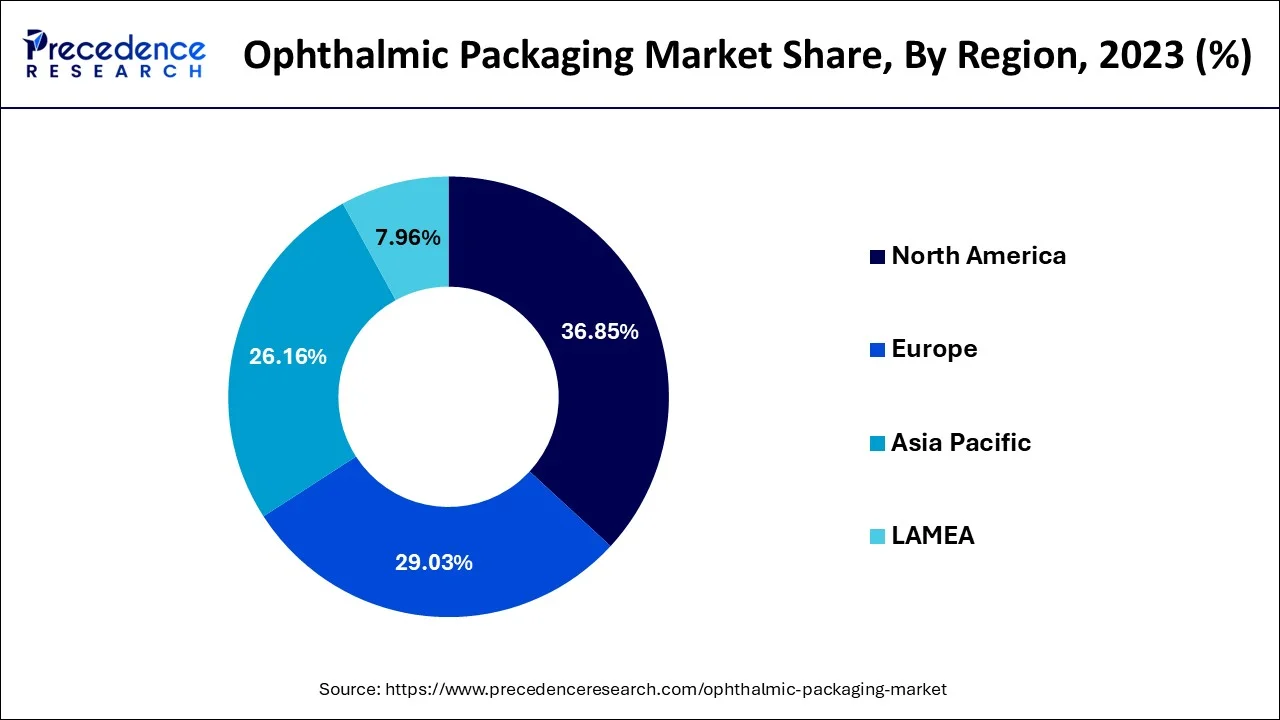

- North America generated more than 36.85% of the revenue share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 8.8% from 2026 to 2035.

- By application, the single dose packaging for wye drops is projected to experience the highest growth rate in the market between 2026 and 2035.

- By material, the plastic segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

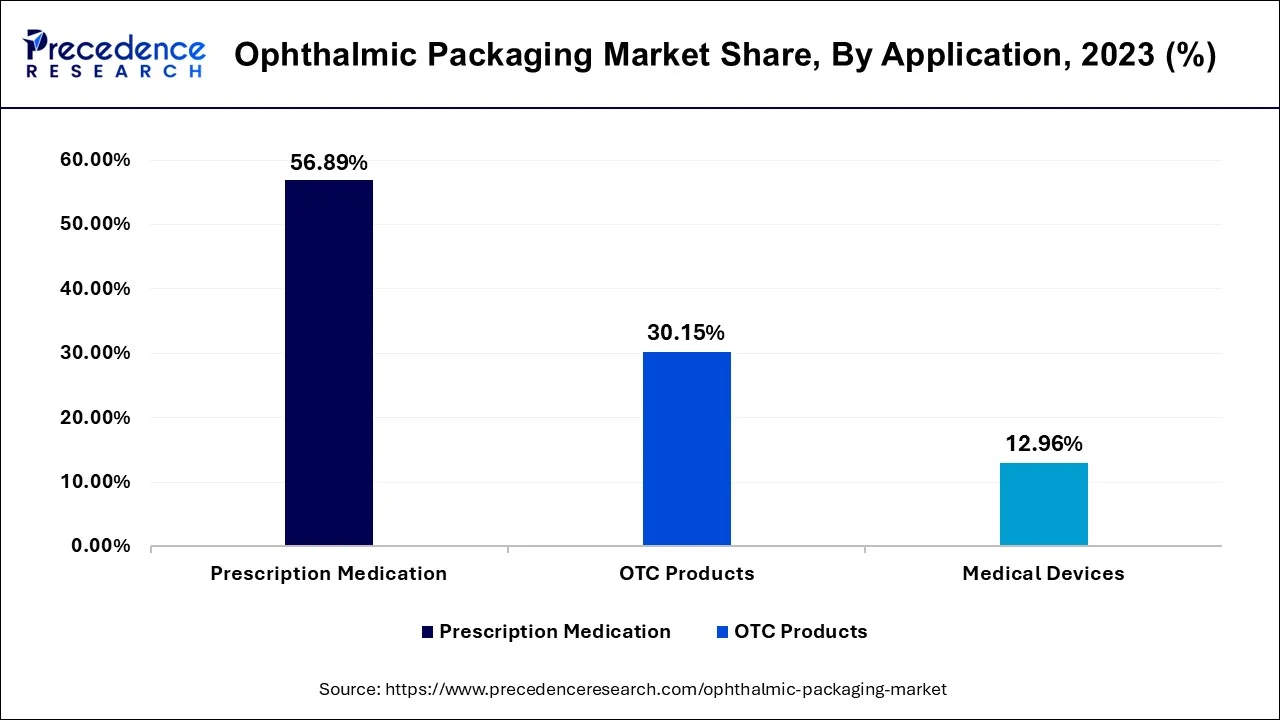

- By type, the prescription segment captured a significant portion of the market in 2025.

- By type, the OTC(over the counter) segment is anticipated to grow at the fastest rate between 2026 and 2035.

- By dose, the multi dose segment dominated the market in 2025.

- By dose, the multi dose segment is projected to continue experiencing the highest growth rate in the forecast period.

Market Overview

The ophthalmic packaging market refers to the industry involved in the production and distribution of packaging materials specifically designed for ophthalmic products and devices. Ophthalmic products include various pharmaceuticals, medical devices, and surgical instruments used for the treatment and diagnosis of eye-related conditions and diseases. Ophthalmic packaging plays a crucial role in ensuring the safety, integrity, and sterility of these products throughout their lifecycle. It involves the design, manufacturing, and distribution of packaging solutions that protect ophthalmic products from contamination, breakages, and other forms of damage. These packaging materials also provide information about the product, such as its ingredients, dosage instructions, expiration dates, and regulatory information. The ophthalmic packaging market encompasses a wide range of packaging formats, including vials, bottles, ampoules, blister packs, tubes, cartons, and labels. These packaging solutions are typically designed to meet specific requirements, such as maintaining the sterility of ophthalmic medications or protecting delicate surgical instruments from damage.

The market for ophthalmic packaging is driven by factors such as the increasing prevalence of eye disorders and diseases, the growing demand for advanced ophthalmic products, and stringent regulations regarding product safety and quality. Additionally, the rise in the aging population and the increasing adoption of contact lenses and other vision correction devices also contribute to the growth of this market.

- According to the World Health Organization, one in six individuals on the globe will be 60 or older by 2030. By this point, there will be 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. Between 2020 and 2050, the number of people 80 or older is projected to treble, reaching 426 million.

- According to the World Glaucoma Association, in 2020, glaucoma will affect 79.6 million people, according to estimates. In 2040, there will probably be 111.8 million people in the world. At least 50 percent of glaucoma sufferers are not aware of their condition. 90% of glaucoma cases in certain underdeveloped nations go undiagnosed.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.87% |

| Market Size in 2025 | USD 7.93 Billion |

| Market Size in 2026 | USD 8.57 Billion |

| Market Size by 2035 | USD 16.92 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of eye disorders

The rising prevalence of eye disorders and diseases, such as cataracts, glaucoma, and age-related macular degeneration, is driving the demand for ophthalmic products. This, in turn, fuels the need for specialized packaging to ensure the safety and efficacy of these products. For instance, according to the Centers for Disease Control and Prevention, in the United States, 12 million persons aged 40 and older have a visual impairment, of which 1 million are blind, 3 million have it after having their vision corrected, and 8 million have it because of uncorrected refractive error. In addition, there are 6.8% of children under the age of 18 who have an eye or visual issue that has been medically diagnosed. Children under the age of 18 make up about 3% of those who are blind or visually impaired, which is defined as having vision problems even while using glasses or contact lenses. Thus, the increasing prevalence of eye disorders is expected to propel the growth of the market during the forecast period.

Restraints

Environmental concerns

The increased focus on sustainability and environmental conservation poses challenges for the ophthalmic packaging market. The use of traditional packaging materials, such as plastics, can contribute to environmental pollution. Market players need to explore sustainable packaging alternatives and implement eco-friendly practices, which may require investments in research and development. Thus, the growing environmental concerns related to the use of plastics are expected to hamper the growth of the market during the forecast period.

Opportunities

Growth in e-commerce

The increasing popularity of e-commerce platforms for purchasing healthcare products presents an opportunity for ophthalmic packaging. Packaging solutions that are designed to protect products during shipping, enhance the unboxing experience, and provide clear product information can cater to the needs of online consumers and drive sales in the e-commerce channel. For instance, IBEF predicts that online retail penetration would increase from 4.7% in 2019 to 10.7% by 2024.

The number of online shoppers in India will reach 220 million by 2025. India's e-commerce industry is rated 9th in the world for cross-border growth, per a Payoneer analysis. In India, e-commerce is anticipated to increase from 4% of all retail sales of food and consumables, clothing, and consumer electronics to 8% by 2025. Therefore, the growth in the e-commerce sector drives the growth of the market during the forecast period.

Segment Insights

Application Insights

The fastest growing segment is the ophthalmic packaging market is single dose eye drop packaging, which is set to expand rapidly over the forecast period. The growth of this segment is fuelled by the rising preference for perspective free formulations, which are safer and more suitable for patients with sensitive eyes or chronic conditions requiring long term treatment. Single dose units also address the increasing demand for enhanced hygiene and reduced contamination risks, as they eliminate the need for multi-use that may introduce microbial exposure. Moreover, their convenience and portability make them attractive for both patients and healthcare providers, aligning well with trends toward patient centric and user friendly drug delivery systems.

Material Insights

The plastic segment is anticipated to grow worth the highest momentum on the coming years. Advances in plastic technology, including the development of medical grade and eco-friendly polymers, are driving adoption across the ophthalmic sector. Plastic packaging offers significant advantages such as lightweight design, durability and the ability to be molded into innovative formats suitable for unit dose multi-dose delivery. In addition, the shift toward sustainable and recyclable materials supports the wider use of plastics, as manufacturers respond to regulatory pressures and consumer awareness regarding environmental impacts. This combination of functional versatility, cost effectiveness, and sustainability is positioning plastic as the fastest expanding material choice in ophthalmic packaging.

The prescription segment maintained a leading position I the ophthalmic packaging market in 2024, as prescription-based ophthalmic treatment are crucial for managing chronic and severe eye disorders such as glaucoma, cataracts, and retinal diseases. The segment benefits from strong physician recommendations, strict regulatory oversight, and the reliance of gaining populations on specialized treatments that require safe, tamper evident, and sterile packaging. As these therapies often involve complex drug formulations, their packaging demands advanced materials and formats that preserve products efficacy and extend shelf life, further solidifying the dominance of prescription packaging in the market.

In contrast, the OTC segment is projected to expand rapidly and emerge as the fastest growing by type during the forecast period. This growth is driven by increasing consumer preference for self-care and easy access to eye care products such as artificial tears, redness relivers, and allergy eye drops. With greater awareness of eye health, rising screen usage leading to digital eye strain, and the availability of cost effective OTC solutions at pharmacies and retail outlets, the demand for OTC ophthalmic packaging is accelerating. The segment also benefits from frequent product innovation and user friendly packaging formats, making it highly attractive in terms of both convenience and affordability.

Dose Insights

The multi dose segment dominated the market in 2025, as it offers consumers a practical and economical solutions for long term use. Multi dose packaging is particularly popular and economical solutions for long term use. Multi dose packaging is particularly popular for chronic conditions requiring daily or frequent administration, as it providers consistent dosing, ease of use, and reduced packaging waste compared to single use alternatives. Advances in multi dose technology, including the incorporate of preservative free mechanisms an improved dispensing systems, have further strengthened its adoption in both prescription and OTC products. This combination of affordability, convenience, and innovation has enabled the multi dose segment to secure a strong foothold in the ophthalmic packaging industry.

Looking ahead, the multi dose segment is also predicted to witness significant growth during the forecast period. Its continued expansion is tied to the increasing demand for sustainable packaging solutions, as multi dose containers generate less plastic waste than single dose formats. Furthermore, manufacturers are introducing advanced multi dose systems that minimize contamination risks while maintaining product stability, making them a preferred choice for patients and healthcare providers alike. As consumer lifestyles become more reliant on accessible and long term eye care solutions, the multi dose format is set to retain dominance while accelerating at the fastest pace in terms of growth.

Regional Insights

What is the U.S. Ophthalmic Packaging Market Size?

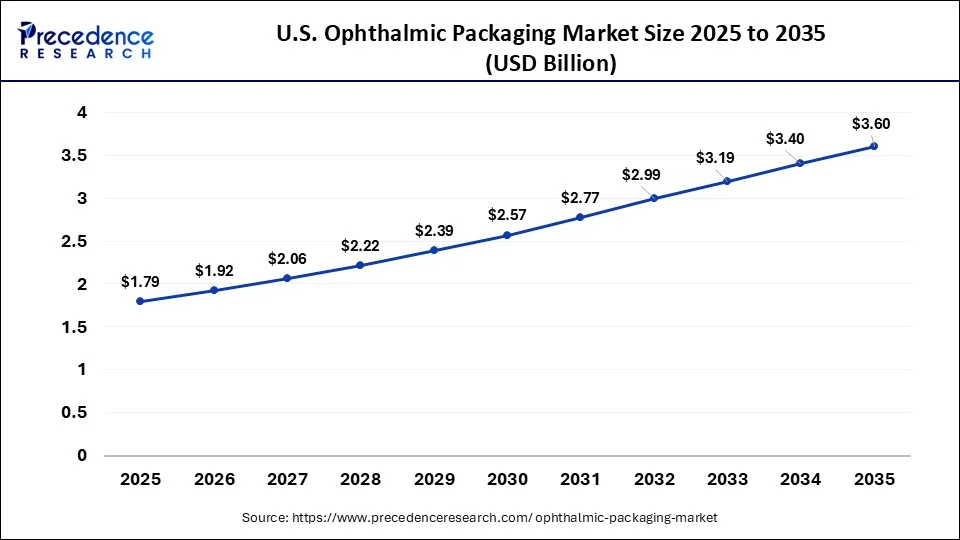

The U.S. ophthalmic packaging market size accounted for USD 1.79 billion in 2025 and is expected to be worth around USD 3.60 billion by 2035, growing at a CAGR of 7.24% from 2026 to 2035.

North America held the largest market share of more than 36.85% in 2025 and is expected to continue the same pattern over the forecast period. The regional growth is driven by factors such as an ageing population, increasing prevalence of eye disorders, technological advancements in ophthalmic products, and a robust healthcare infrastructure. For instance, according to the Population Reference Bureau (PRB) projections, the number of Americans 65 and older will nearly double from 52 million in 2018 to 95 million by 2060, increasing their percentage of the overall population from 16 percent to 23 percent.

Moreover, as per the study by Urban Institute, over the next 40 years, the number of Americans 65 and older will more than quadruple, reaching 80 million in 2040. Between 2000 and 2040, the proportion of persons 85 and older, who frequently require assistance with basic personal care, will nearly double. Furthermore, sustainability and environmental concerns are gaining prominence in North America. Market players in the ophthalmic packaging sector are increasingly adopting sustainable practices, such as using eco-friendly materials, reducing packaging waste, and implementing recycling programs. Therefore, these factors penetrate the market growth in the North American region over the forecast period.

The Asia Pacific is expected to grow at the highest CAGR over the forecast period.The growth in the region is attributed to the rising healthcare expenditure, large population base, increasing prevalence of eye disorders, and improving access to healthcare services. Moreover, there is rising awareness about eye health and the importance of regular eye examinations in the Asia-Pacific region. This increased focus on eye care translates into higher demand for ophthalmic products and subsequently drives the need for quality packaging solutions.

The Asia-Pacific ophthalmic packaging market comprises a mix of local packaging manufacturers and global companies. Local players often cater to domestic markets, while global companies have a significant presence and cater to both local and international demands. Key players in the region include Amcor Limited, SGD Pharma, Gerresheimer AG, Berry Global, Inc., and AptarGroup, Inc., among others. Thereby driving the market growth in the Asia Pacific region.

Europe: Packaging Innovation Based on Strong Regulatory Frameworks:

The growing demand for unit-dose and multi-dose pharmaceutical products is expected to drive further innovation in the European ophthalmic packaging market over the next few years. With increased focus by European governments on building an advanced health care infrastructure, as well as the adoption of preservative-free formulations and a move toward sustainable health care packaging, there are several factors supporting the continued growth of the ophthalmic packaging market.

Germany is expected to see the highest level of growth within the European ophthalmic packaging industry because it has an established infrastructure for pharmaceutical manufacturing, and it continues to invest significantly in sophisticated ophthalmic drug delivery systems.

Latin America: Increased Access to Eye Health Solutions:

The Latin American ophthalmic packaging industry is showing steady growth as improving health care access and awareness of eye diseases drive demand for ophthalmic products and increase the number of generic ophthalmic medicines produced. Cost-effective and compliant ophthalmic packaging is becoming more popular with Latin American pharmaceutical manufacturers.

Brazil is projected to be the region's most rapidly growing market due to a large and rapidly growing patient population, an expanding pharmaceutical manufacturing sector, and a growing desire for locally produced ophthalmic products.

Middle East and Africa: Growth and Modernization of Health Care Systems:

The Middle East and Africa region is displaying moderate growth relative to their respective countries, but there are many potential opportunities for growth. Development of hospital infrastructure, increases in the number of people suffering from diabetes related eye problems, and increased amounts of ophthalmic pharmaceuticals imported into the region all support the growth of the ophthalmic packaging market in MEA.

Consequently, there is also increased demand in the MEA region for more durable, sterile, and climate-resistant packaging formats for ophthalmic products.

Ophthalmic Packaging Market Value Chain Analysis

- Raw Materials and Polymer Engineering: Advanced polymer engineering must have low extractable levels and high transparency, as well as chemical and oxidation resistance to maintain drug stability and to ensure product safety for the patient.

Key Players: BASF SE, Dow Inc., SABIC, and Evonik Industries. - Precision Manufacturing & Sterile Molding Operations: Manufacturing operations consist of multiple precision manufacturing processes with extreme levels of control, such as injection molding, blow-fill-seal (BFS), aseptic filling, and bulk filling, to avoid any potential microbial contamination.

Key Players: Gerresheimer AG, SCHOTT Holding AG, Berry Global, and AptarGroup. - Filling, Labeling & Pharmaceutical Distribution: Increasingly, pharmaceutical packaging providers are collaborating with pharmaceutical manufacturers to design, develop, and deliver a variety of different formats, child-resistant packaging, and smart packaging, which can assist with dosing accuracy.

Key Players: West Pharmaceutical Services (WST), Becton, Dickinson & Company (BD), Nemera, and Amcor.

Ophthalmic Packaging Market Companies

- Amcor

- West Pharmaceutical Services, Inc.

- Gerresheimer AG

- SCHOTT AG

- AptarGroup, Inc.

- Akorn, Inc.

- Johnson & Johnson Vision

- Mitotech, SA

- Bausch & Lomb Incorporated

- AERIE PHARMACEUTICALS, INC.

- Novartis AG

- Merck Sharp & Dohme Corp.

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- ALLERGAN

- Santen Pharmaceutical Co.

- Teva Pharmaceutical Industries Ltd.

Recent Development

- In January 2025, Unither Pharmaceuticals entered the preservative free multi-dose (PFMD) ophthalmic packaging arena, leveraging Aptar's squeeze dispenser and Nemera's Noveila closing tip technology to prevent contamination without perspectives. Their Normandy facility supports aseptic filling with advanced isolation and in situ sterilization processes.

(Source: New-Generation Eyedroppers Make Preservatives Obsolete) - In April 2025, Rite dose is significantly boosting its sterile unit dose capacity, installing a seventh Synthon packaging line to double its output of individually wrapped vial medications including ophthalmic products underscoring its commitment to growing demand for high quality, single use sterile delivery systems.

Segments Covered in the Report

By Material

- Plastic

- Metal

- Glass

By Product Type

- Bottles & Vials

- Blister Packs

- Ampoules

- Squeezable Tubes

By Application

- Prescription Medication

- OTC Products

- Medical Devices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting