Orthodontics Market Size and Forecast 2025 to 2034

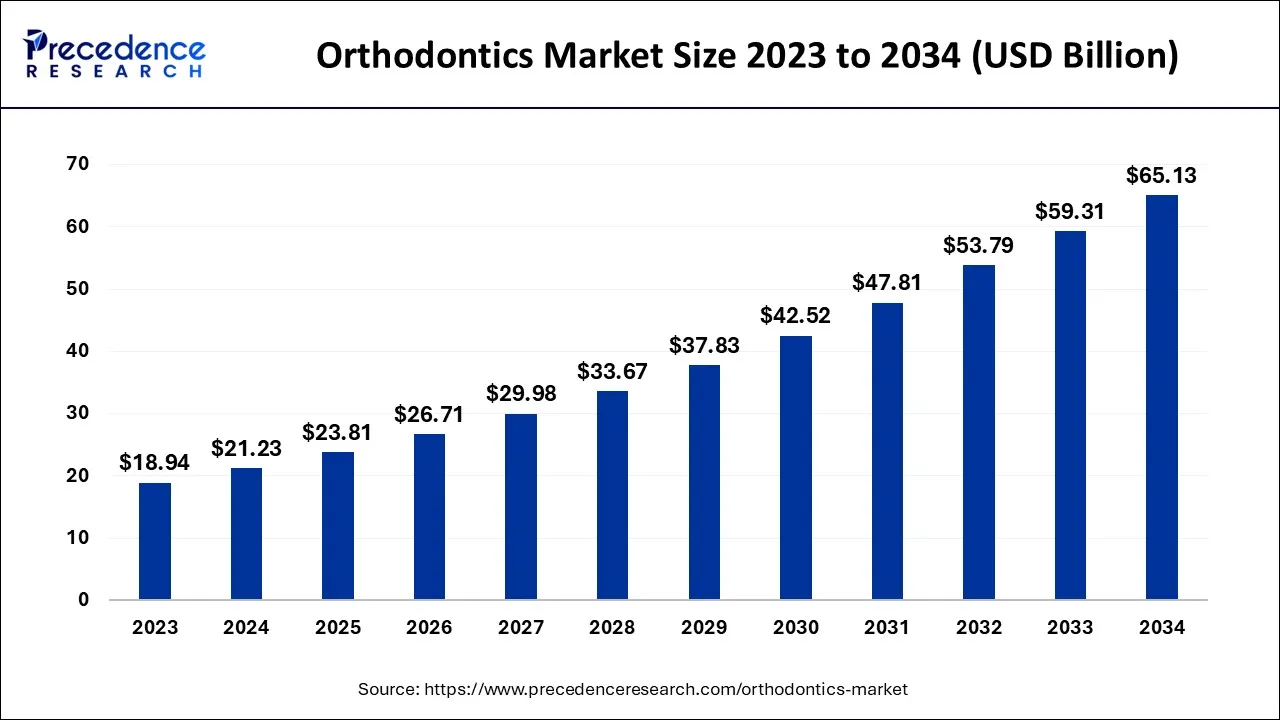

The global orthodontics market is expected to be valued at USD 21.23 billion in 2024 and is anticipated to reach around USD 65.13 billion by 2034, expanding at a CAGR of 11.9% over the forecast period from 2025 to 2034.

Orthodontics Market Key Takeaways

- The global orthodontics market was valued at USD 21.23 billion in 2024.

- It is projected to reach USD 65.13 billion by 2034.

- The market is expected to grow at a CAGR of 11.9% from 2025 to 2034.

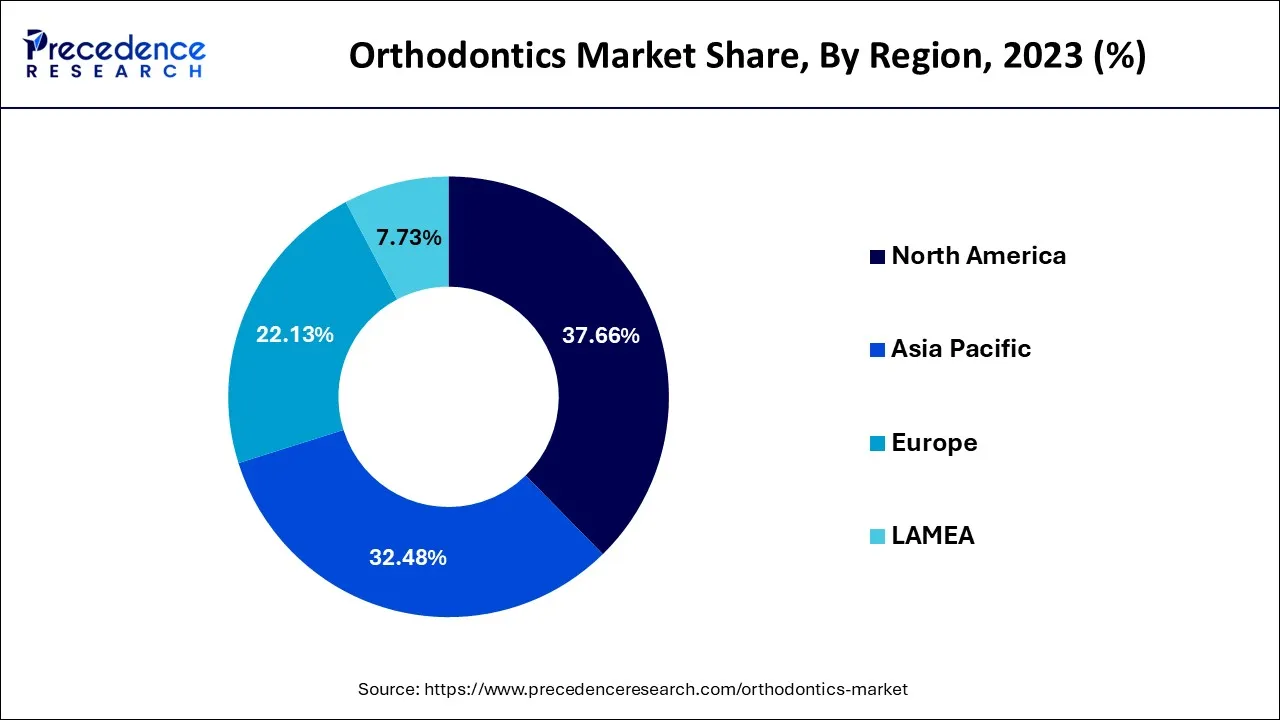

- North America region lead the global market and generated more than 37.55% of revenue share in 2024.

- Asia Pacific is expected to capture the second-largest position in the global market from 2025 to 2034.

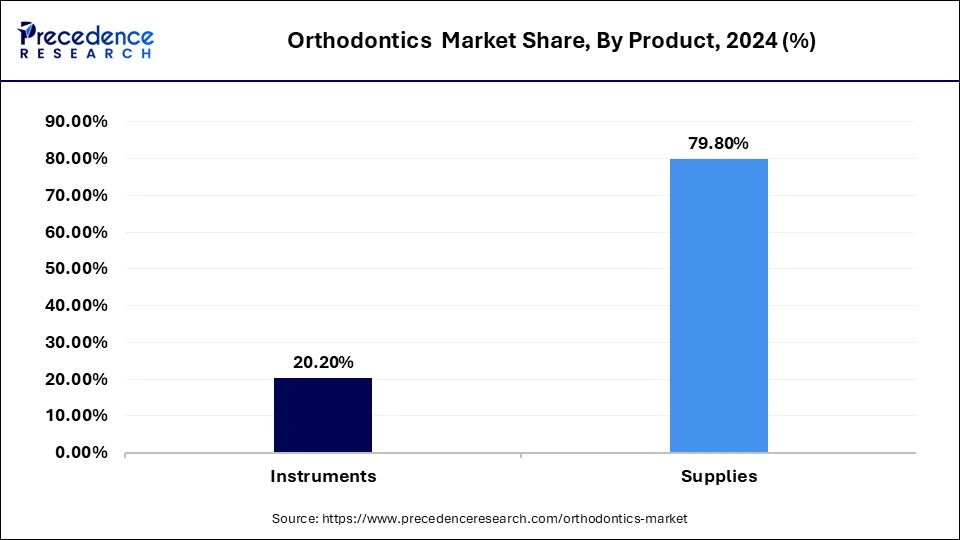

- By product, the instruments segment is anticipated to show considerable growth in the market over the forecast period.

- By age group, the adults segment held a significant share in 2024.

- By age group, the children segment is anticipated to show considerable growth in the market over the forecast period.

AI Integration in the Orthodontics Market

Artificial intelligence is playing a great role and is creating a robust impact in the orthodontics market by expanding clinical accuracy, operational performance, as well as patient interaction. AI simplifies the process of designing and producing braces and clear aligners, thus reducing the number of manual errors and the time of delivery. This method increases accessibility to care and improves patient convenience and compliance. With continued evolution of the technology, there will be additional orthodontic tools, orthodontic diagnostic and treatment planning innovations through AI.

U.S. Orthodontics Market Size and Growth 2025 to 2034

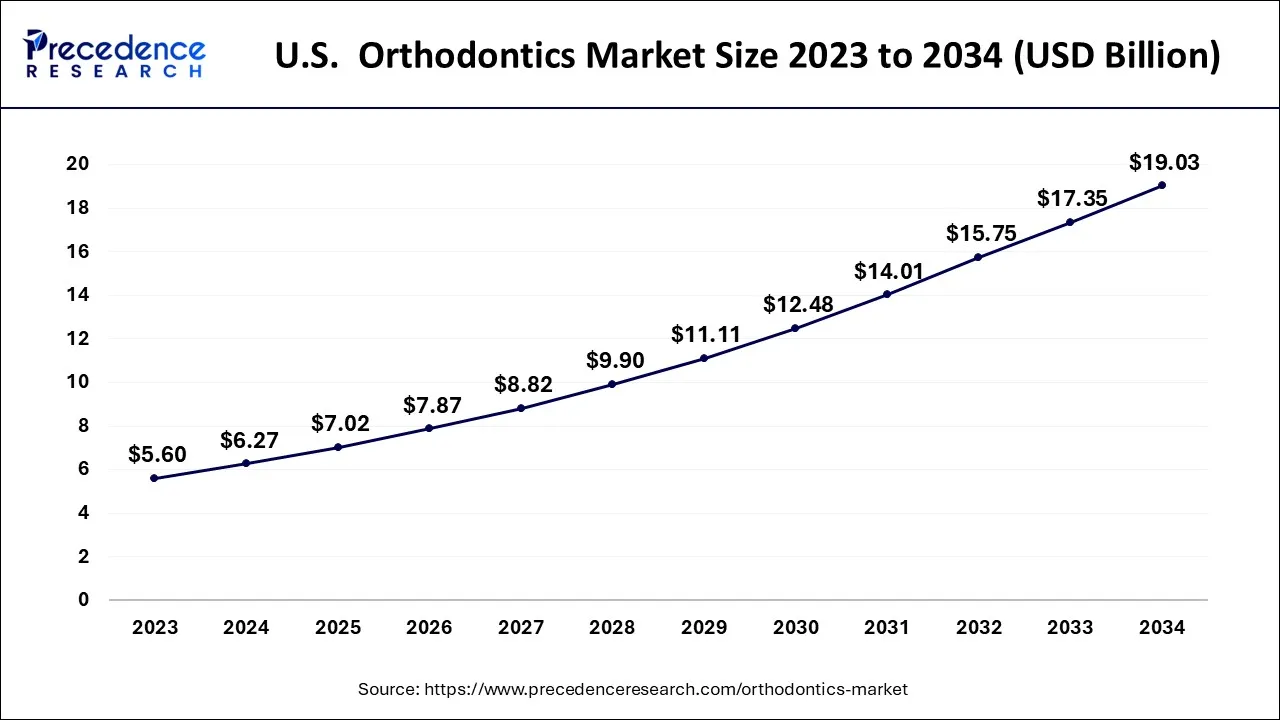

The U.S. orthodontics market size is accounted for USD 6.27 billion in 2024 and is projected to be worth around USD 19.03 billion by 2034, poised to grow at a CAGR of 11.8% from 2025 to 2034.

North America was the dominating orthodontics market in 2024. The presence of developed healthcare infrastructure, increased adoption of advanced technologies in the orthodontic clinics, and increased awareness among the consumers regarding the aesthetic orthodontics are the major driving forces. Moreover, the presence of adequate number of dentists and orthodontists in region are supporting the market growth. According to the American Dental Association, there were around 10,568 active orthodontists in US by the end of 2017. The rapidly growing geriatric population in US is another factor that can be held responsible for the market growth in the region. According to the Rural Health Information Hub, there are over 46 million geriatric people living in US and this number is expected to reach at around 90 million by 2050.

U.S. Orthodontics Market Trends

Orthodontics market in the U.S. shows tremendous growth, owing to the rising demand for aesthetically-appealing and advanced methods of treatment. Due to increasing importance towards the appearance of dental structures and the comfort of dental products, the popularity of clear aligners, especially in adults and teens, is high. The technological breakthrough in the perspectives of accuracy, speed, and personalization in orthodontics has greatly improved the results and the satisfaction of patients greatly related to 3D imaging, intraoral scanning, and AI treatment planning. The advanced nature of the health care system and the awareness considering oral care and beauty help in the expansion of the market within the country.

Asia Pacific is estimated to be the most opportunistic segment during the forecast period. Asia Pacific is characterized by the presence of huge youth population. Moreover, the rising number of children and geriatric population in the region is expected to significantly drive the orthodontics market in Asia Pacific. The growing prevalence of dental malocclusions, rising number of private dental clinics, and rising adoption of advanced equipment are expected to positively impact the market growth. The prevalence of malocclusions is estimated to range from 20% to 43% in India. The prevalence of malocclusions in China was around 45% among the pre-school children in China from 1988 to 2017, as per the studies. This is a major factors behind the growth of the market.

China Orthodontics Market Trends

The orthodontics market in China is growing at a high rate and is propelled by urbanization and high disposable income, which has triggered a change in consumer preference. Children are particularly prone to malocclusion, crooked teeth, and bite problems. There is immense demand for clear aligners and esthetically more pleasant solutions among working professionals. Moreover, the growing dental infrastructure, the rising influx of global dental brands, and the state-funded healthcare growth are speeding up access to high-quality orthodontic services in China. The dynamics make China one of the most promising and fastest-growing areas in the world orthodontics industry.

Europe is expected to grow significantly in the orthodontics market during the forecast period. Europe is experiencing a rise in various dental disorders, which increases the demand for orthodontic treatment options. This is further supported by the government as well. Thus, this promotes the market growth.

UK

The industries in the UK are developing various new approaches to deal with the increasing demand of the population. At the same time, the adoption of various technologies is also enhancing their production rates. Furthermore, regulatory agencies are helping in improving the safety of these products.

Germany

The increasing dental disorders in Germany are increasing the use of various dental treatment options. At the same time, the research in industries as well as institutes is rising, which in turn, results in new collaborations. Thus, these collaborations, as well as new innovations, are further supported by the government investments.

Orthodontics Market Growth Factors

The global orthodontics market is primarily driven by the growing prevalence of malocclusion, rising awareness regarding the dental problems, technological advancements in the orthodontic treatments, and surging number of dentists across the globe. Moreover, the rising adoption of advanced software and imaging modalities is resulting in the improved quality of treatment. The rapidly growing geriatric population across the globe is another important factor that is expected to propel the market growth. The old age people are more susceptible to the dental disorders and hence will play a crucial role in the demand for the orthodontic services.

The global orthodontics market is significantly driven by the children and teens. The increased prevalence of dental disorders among the teens and children has significant contributions in the orthodontics market growth. Moreover, the rising number of road traffic accidents especially in the developing and underdeveloped markets may have a considerable impact on the demand for the orthodontic treatments. According to the World Health Organization, around 93% of the road traffic accidents occur in the low and middle income countries. The rising awareness regarding the oral hygiene, rising popularity of dental tourism, and increasing concerns regarding the dental aesthetics among the population is driving the market growth.

The orthodontics industry is witnessing a huge demand for the dental aesthetics amongst all age groups. The introduction of the clear aligners have gained rapid traction in the market. The consumers are increasingly preferring the clear aligners over the traditional wire braces owing to the increased comfort and enhanced aesthetics associated with the clear aligners. The rising consumer expenditure on the aesthetic dentistry is exponentially driving the market.

According to the American Academy of Cosmetic Dentistry, the average patient spent US$ 5,477 in 2017 in US. This number was US$ 4,116 in 2015. Hence, the rising expenditure of the patients in thecosmetic dentistry is further expected to fuel the growth of the global orthodontics market in the forthcoming future. Moreover, the introduction of advanced technologies like 3D scanners, virtual imaging, IoT, and AI in the orthodontics tools and diagnostic devices have significantly fostered the market growth in the past few years. The rising investments of the top market players in the research and development of advanced orthodontics products and equipment integrated with the advanced technologies like AI, wireless connectivity, and IoT is another factors that is expected to augment the growth of the global orthodontics market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.81 Billion |

| Market Size by 2034 | USD 65.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Age Group, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising Burden of Dental Ailments

The driver in the orthodontics market is the rising number of cases of dental conditions, more specifically malocclusion. Malocclusion is perhaps the most received dental deformity in the world and happens when teeth do not fit properly or when jaws are not placed together. It could be as a result of heredity, trauma, developmental abnormalities, or childhood habits like thumb sucking and overusage of pacifiers. The markets are also growing due to the number of public campaigns, the escalation of the level of disposable income, as well as improvement in the availability of dental care, especially in novel economies. As the prevalence of dental malocclusion continues to be of concern, innovativeness and availability of healthcare providers and manufacturers of orthodontic products are on the frontline.

Restraint

Side Effects Associated with Orthodontic Treatment

There are orthodontic procedures that take too long, and this poses a huge challenge to the development of the orthodontics market. Long-term treatment may also have a variety of side effects, especially when it is improperly executed or in case the patients fail to maintain their oral hygiene. The possible complications are chronic pain and discomfort, and the development of periodontal diseases. There are other effects of extended wear of orthodontic appliances, which include temporomandibular joint disorders (TMD), root resorption, enamel decalcification, and higher predisposition to cavities. The most common kind of orthodontic bracket, which is worn by teens, has risks such as gum inflammation, soft tissue trauma, allergic reactions, and oral ulcers.

Opportunity

Unmet Needs of Patient Population

The patients in low and middle-income nations cannot access cost-effective and efficient orthodontic services because of the high cost of treatment and the scarcity of oral specialists. The gap in the demand is an effective opportunity to expand services to manufacturers and healthcare organizations at affordable rates through mobile clinics, tele-orthodontics, and cost-effective models of providing treatment.

Moreover, various firms are focusing on R&D and making co-operations to bring quality and low-cost orthodontic products with regard to various demographics. These efforts are to reduce the gaps in treatments and enhance access, particularly to children and underserved groups. As attitudes to oral health and aesthetics experience a rising evolution, as insurances expand coverage, and as a move toward more minimally invasive solutions takes place.

Product Insights

The instruments segment is expected to grow at a significant CAGR over the forecast period. Instruments that are in use by the orthodontists to diagnose, plan the course of treatment, and perform treatments like bracket, wire adjustment, and aligner fitting. In emerging economies such as India and Australia, there is a vast increase in the number of clinical visits made to rectify dental corrections, especially on the basis of increasing awareness with regard to oral health and the changes in disposable income.

Such an increase in the demand can also be supported by the development of digital technologies, e.g., 3D imaging and computer-aided design (CAD) that allows orthodontists to provide their patients with highly personalized and accurate treatment options. Consistent product innovation, enhanced ergonomics, and presence of multi-functional tools that increase the efficiency of procedures also aid the expansion of the segment.

Orthodontics Market Revenue, By Product, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Instruments | 3,397.08 | 3,815.92 | 4,288.27 |

| Supplies | 13,503.72 | 15,121.28 | 16,940.01 |

End User Insights

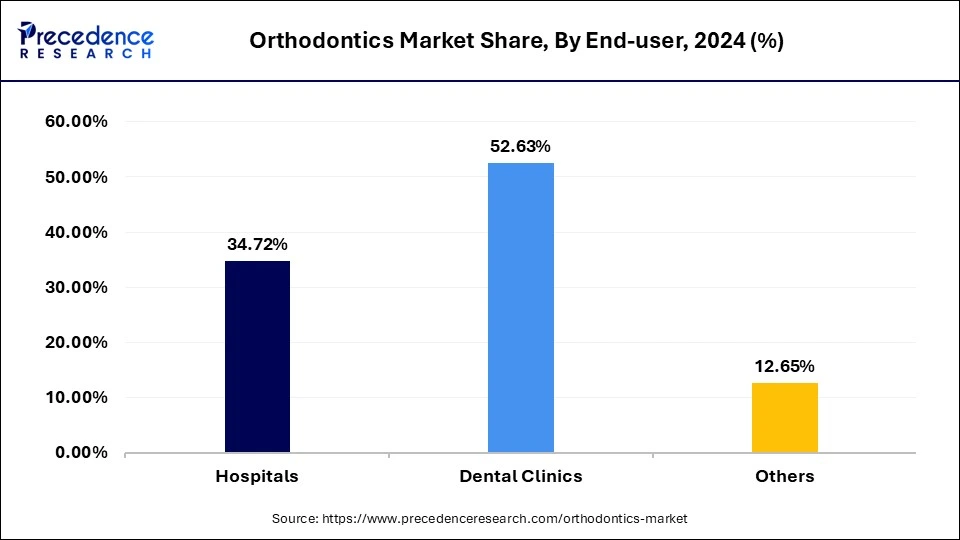

Based on the end user, the dental clinics segment dominated the global orthodontics market in 2024. The increase in the number of private dental clinics and practitioners across the globe has exponentially contributed towards the market growth. The presence of well-equipped dental clinics especially in the developed markets like Europe and North America has driven the growth of the orthodontics market in the past few years. According to the American Association of Orthodontists, the number of professional active orthodontists has increased by 15% since the year 2001. Therefore, the growing number of orthodontists across the globe is fostering the growth of the global orthodontics market.

The hospitals segment is expected to grow at a considerable rate during the forecast period. This is due to the rising penetration of hospitals across the globe. Moreover, the improving reimbursement policies regarding the orthodontics procedures and growing number of multi-specialty hospitals across the developing and developed nations is expected to augment the growth of the hospitals segment in the upcoming future.

Orthodontics Market Revenue, By End User, 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Hospital | 5,891.64 | 6,588.33 | 7,370.64 |

| Dental Clinics | 8,841.23 | 9,936.23 | 11,171.77 |

| Others | 2,167.93 | 2,412.63 | 2,685.88 |

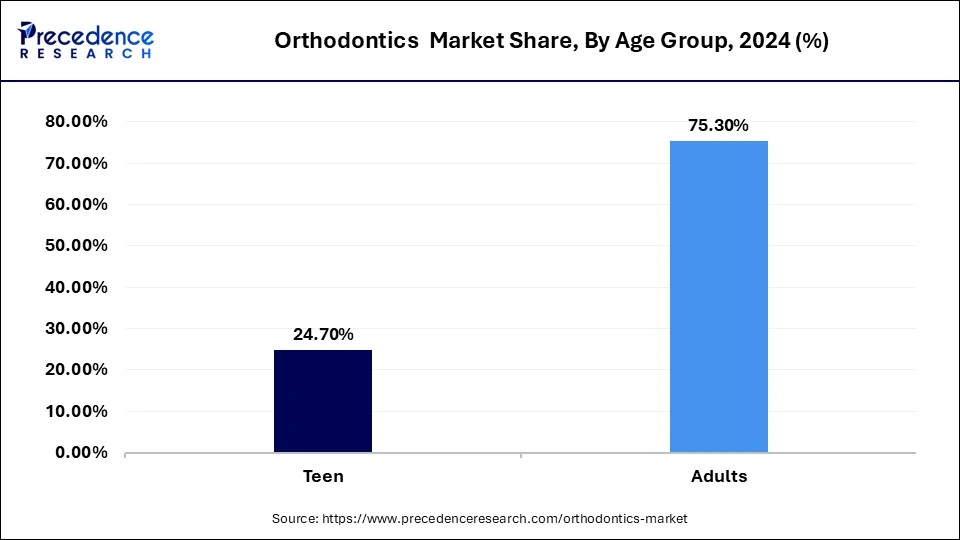

Age Group Insights

The adults contributed the most revenue in 2024 and are expected to dominate throughout the projected period. The growing interest among the adult population can be attributed to the growing rates of awareness on the health and cosmetic results of orthodontic treatment. The addition of less noticeable and minimally invasive treatment methods, like the clear aligners and ceramic braces, has severely enhanced the acceptance rate among adult patients. The orthodontic care has further become more popular in this population group due to advances in curative methods, the shortening of curative procedures, and the availability of low-cost financing plans. The adults can make their own financial decisions and have more inclination to spend on the longer-term maintenance of oral health and overall physical attractiveness.

The children segment is expected to grow substantially in the orthodontics market. Most children and adolescents have widespread teeth and dental alignment problems in terms of malocclusion, crowded teeth, and misaligned jaws, and therefore, important to intervene early to deal successfully with them. Moreover, the technological improvement in orthodontics, including personalized clear aligners and pest treatment design, provides less painful and attractive options to children, which also augments the demand. In addition, the orthodontic specialists are accessed earlier through the use of public health campaigns and the inclusion of dental screening in schools.

Orthodontics Market Revenue, By Age Group, 2022-2024 (USD Million)

| Age Group | 2022 | 2023 | 2024 |

| Teen | 4,199.89 | 4,691.82 | 5,243.67 |

| Adults | 12,700.91 | 14,245.37 | 15,984.61 |

Orthodontics Market Companies

- 3M Company

- Align Technology, Inc.

- American Orthodontics

- Danaher Corporation

- Dentaurum GmbH & Co. KG

- DENTSPLY International, Inc.

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

Latest Announcement by Industry Leaders

- In September 2024, under 510(k), the NiTime Clear Aligners, the first aligner system to be skewed to shorter wear periods, got cleared by the U.S. Food and Drug Administration (FDA). These aligners can be used in treating all classes of dental malocclusions. Ren Menon, Co-founder of OrthoFX, has said that NiTime Clear Aligners lead to the most relevant breakthrough in the field of polymer science in orthodontics as it solves various critical issues related to the treatment between the providers and their patients. ( Source : https://www.prnewswire.com )

Recent Developments

- In May 2025, a new website was launched and announced by Baker Orthodontics. This website will provide information about the credentials of their team led by Dr. Kyle Baker, services, as well as approach to care, with a seamless user experience for current and prospective patients.

- In May 2025, the National Medical Products Administration (NMPA) in China approved the Invisalign Palatal Expander System, developed by Align Technology, Inc. It can be used for skeletal and dental malocclusion in primary, permanent, and mixed dentition.

- In May 2025, for adult patients, Sean Liu Orthodontics is providing options for more clear aligner. Furthermore, to meet the rising expectations for discreet orthodontic care, the SureSmile Aligners and Invisalign systems are also made available. (Source:https://finance.yahoo.com), (Source: https://finance.yahoo.com),

(Source:https://news.marketersmedia.com)

Segments Covered in the Report

By Product

- Instruments

- Supplies

- Fixed

- Archwires

- Brackets

- Bands and Buccal Tubes

- Others

- Removable

- Retainers

- Aligners

- Others

- Fixed

By End User

- Hospitals

- Dental Clinics

- Others

By Age Group

- Adults

- Children

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- MEA

- Latin America

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting