What is the Patient Simulator Market Size?

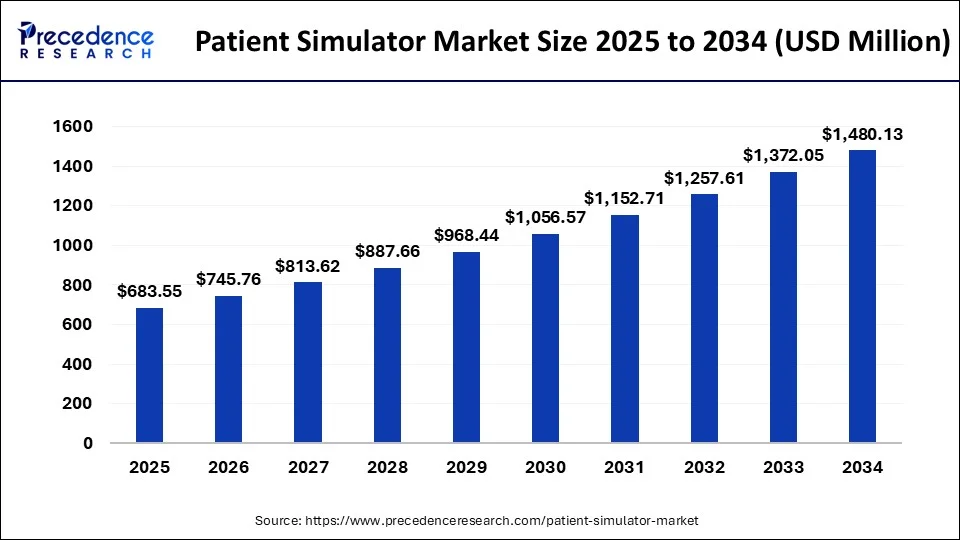

The global patient simulator market size accounted at USD 683.55million in 2025 and is predicted to reach around USD 1,592.45 million by 2035, growing at a CAGR of 8.83% from 2026 to 2035.

Patient Simulator Market Key Takeaways

- In terms of revenue, the patient simulator market is valued at $683.55 million in 2025.

- It is projected to reach $1,592.45million by 2035.

- The patient simulator market is expected to grow at a CAGR of 8.83% from 2026 to 2035.

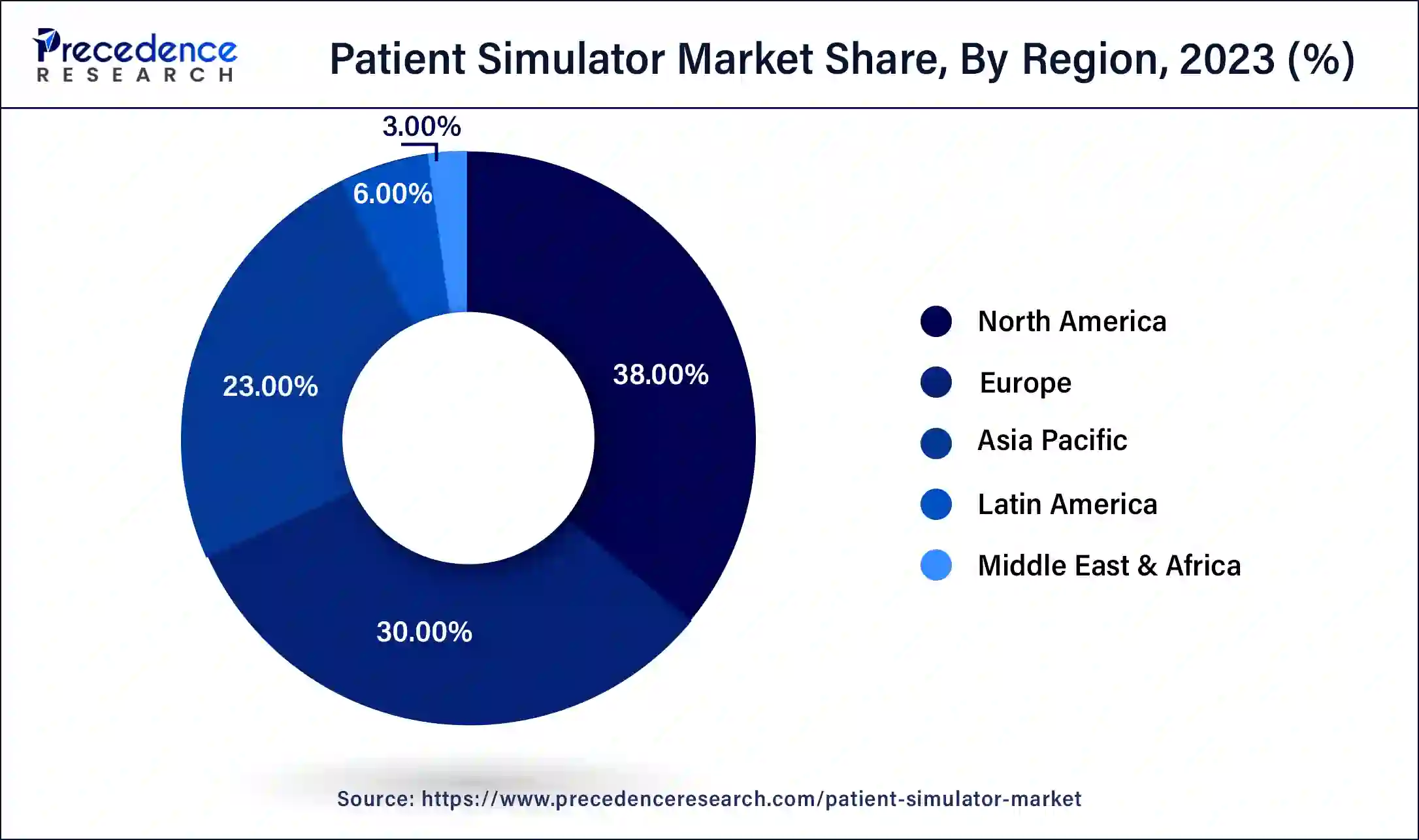

- North America contributed the highest revenue share of 38% in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By product type, the adult patient simulator segment has held the largest market share of 47% in 2025 and is anticipated to grow at a remarkable CAGR of 8.2% between 2026 to 2035.

- By technology, the low-fidelity simulators segment generated the highest revenue share of 43% in 2025.

- By technology, the medium-fidelity simulators segment is expected to expand at the fastest CAGR over the projected period.

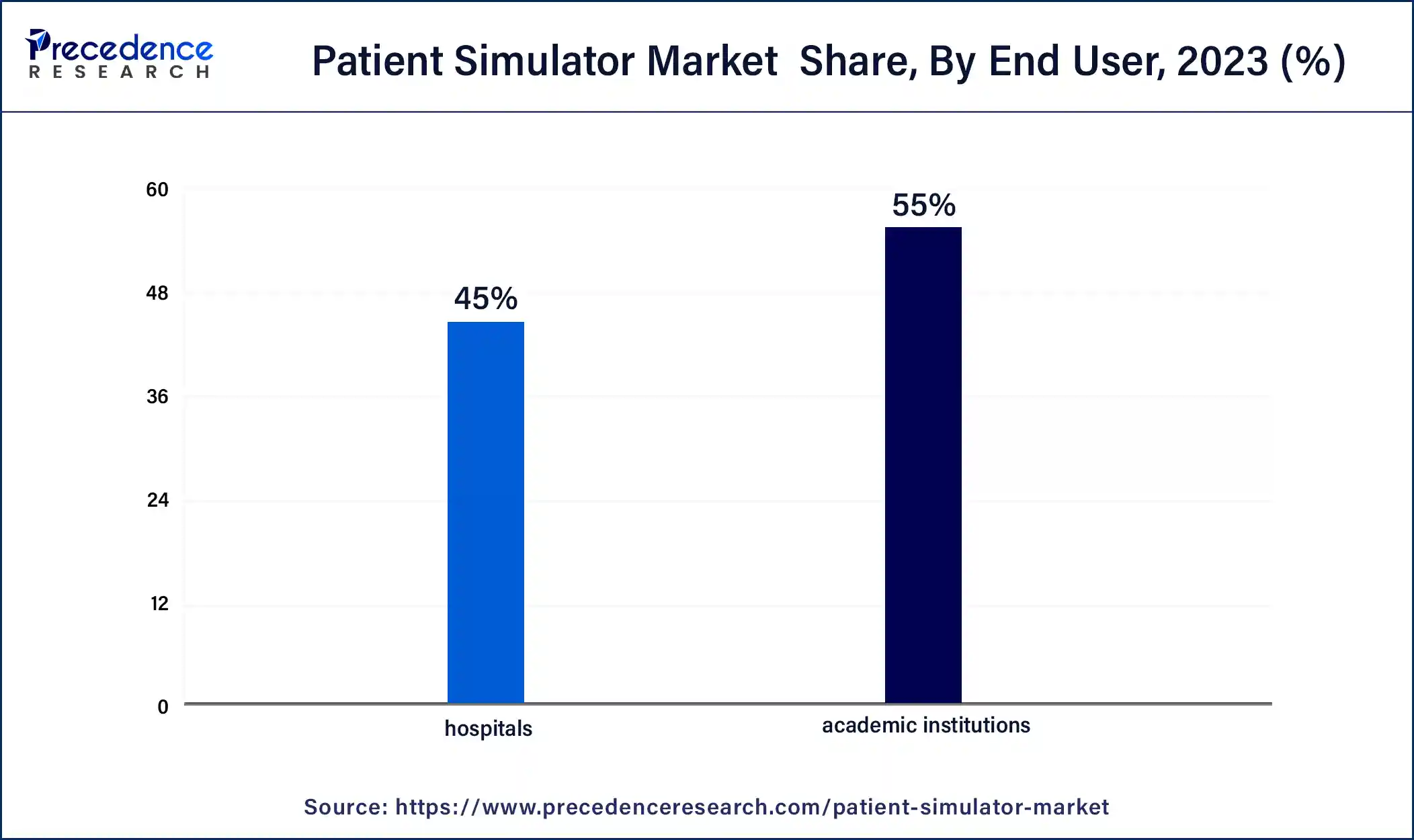

- By end user, the hospital segment generated the highest revenue share of 45% in 2025.

- By end user, the academic institutions segment is expected to expand at the fastest CAGR of 8.3% over the projected period.

What is the Patient Simulator?

A patient simulator, often referred to as a medical simulation manikin or simulator, is a sophisticated medical training and educational device designed to replicate human physiological functions, anatomy, and responses for the purpose of medical training, education, and research. These simulators are used in healthcare settings such as medical schools, nursing programs, hospitals, and other healthcare institutions to provide a realistic and controlled environment for training healthcare professionals, students, and researchers. As healthcare professionals increasingly rely on simulation-based training to enhance their clinical skills and knowledge, the patient simulator market has grown to provide innovative solutions for medical education and research.

Patient simulators can range from simple, low-fidelity models to highly sophisticated, high-fidelity manikins that replicate various physiological functions and responses. They can simulate a wide range of medical scenarios, including cardiac arrest, respiratory distress, surgical procedures, and more. These simulators often incorporate computer technology, sensors, and software to mimic human anatomy, vital signs, and responses to medical interventions accurately. Thus, patient simulators play a crucial role in healthcare education, allowing students and professionals to gain practical experience, improve their clinical skills, and build confidence without putting real patients at risk. They are widely used to train healthcare providers, from medical students and nurses to paramedics and physicians, in a safe and controlled learning environment.

How is AI contributing to the Patient Simulator Industry?

Training on hyper-realistic personalized training is AI-powered through LLMs and VR platforms. Virtual patients chat and react in real-time emotionally. The systems automatically modify the difficulty level according to the proficiency of learners. The performance analytics produce objective feedback in real time. Generative AI creates various patient identities in a complex dialogue. Live guidance that enhances clinical accuracy and confidence is provided through procedural modules.

Patient Simulator Market Growth Factors

- Increasing demand for medical education: The need for well-trained healthcare professionals has been on the rise, and medical schools, nursing programs, and healthcare institutions are continually seeking effective ways to train and educate their students. Patient simulators offer a safe and realistic environment for hands-on training and skill development, contributing to the growth of the market.

- Emphasis on patient safety: Patient safety is a top priority in healthcare, and the use of patient simulators allows healthcare professionals to practice and refine their skills without putting real patients at risk. As the healthcare industry places greater importance on patient safety, the demand for simulation-based training has increased.

- Technological advancements: Advances in technology have led to the development of high-fidelity patient simulators that can replicate human physiology and responses with a high degree of accuracy. These technologically advanced simulators provide a more immersive and realistic training experience, attracting healthcare institutions to invest in them.

- Accreditation and certification requirements: Regulatory bodies and accrediting agencies in the healthcare sector often require healthcare training programs to incorporate simulation-based education to meet accreditation and certification standards. This has driven the adoption of patient simulators in educational institutions and healthcare facilities.

- Shortage of clinical training opportunities: Many healthcare programs face limitations in providing students with sufficient clinical training opportunities due to factors such as a shortage of clinical sites and the need for patient privacy. Patient simulators offer a viable solution by providing controlled and repeatable training experiences.

- Research and development: Ongoing research and development efforts in the field of patient simulation have led to the creation of more versatile and sophisticated simulators, expanding their applications in various medical specialties. This research-driven innovation drives market growth.

- Global health challenges: Global health crises, such as the COVID-19 pandemic, have underscored the importance of healthcare preparedness and training. Patient simulators have played a vital role in training healthcare professionals for pandemics and other emergencies.

- Cost-effective training: Patient simulators, despite their initial investment, can be a cost-effective way to train healthcare professionals in the long run. They reduce the need for expensive equipment and disposable supplies used in real patient care scenarios.

- Industry partnerships: Collaborations between simulation technology companies and healthcare institutions have accelerated the development and adoption of patient simulators. Such partnerships often lead to the customization of simulators to meet specific training needs.

- Increased awareness and education: As awareness of the benefits of patient simulation spreads within the healthcare community, more institutions and educators are incorporating simulation-based training into their curricula.

Market Outlook

- Industry Growth Overview: The increasing demand for safe, immersive, competency-based clinical training across the globe.

- Global Expansion: Germany progresses in a gradual growth due to uniform education structures.

- Major investors: CAE Inc., 3 B. Laerdal Medical, Gaumard Scientific Surgical, 3B Scientific Mentice AB.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 8.83% |

| Market Size in 2025 | USD 683.55Million |

| Market Size in 2026 | USD 745.76 Million |

| Market Size by 2035 | USD 1,592.45Million |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Emphasis on patient safety

Patient safety is an utmost priority, and healthcare institutions are continuously seeking innovative ways to enhance it. Patient simulators have emerged as a pivotal tool in achieving this goal by providing a safe and controlled environment for healthcare professionals to learn, practice, and refine their clinical skills without putting real patients at risk. The inherent risk involved in traditional on-the-job training, where inexperienced healthcare professionals may inadvertently make mistakes that can jeopardize patient well-being is one of the vital reasons for driving demand across the market.

Patient simulators offer a lifelike and risk-free alternative, allowing learners to confront a wide array of medical scenarios, from routine procedures to life-threatening emergencies, and make errors without harming real patients. This invaluable opportunity to learn from mistakes and develop critical decision-making skills in a secure setting ultimately translates to enhanced patient safety when these professionals transition to real clinical settings.

Furthermore, the implementation of patient simulators aids in the standardization of training protocols, ensuring that healthcare professionals are consistently trained to the highest standards. This uniformity in education contributes to a more vigilant and competent workforce, reducing the likelihood of medical errors and adverse events. As healthcare institutions, medical schools, and regulatory bodies recognize the irreplaceable role that patient simulators play in improving patient safety, the demand for these simulation systems continues to escalate, fostering a safer and more reliable healthcare environment for all.

- In October 2024, MBJ Solutions, a German testing equipment specialist, launched two new products for developers of perovskite and perovskite silicon tandem devices. The MBJ Steady State Sun Simulator is designed for cells and small perovskite module research, and the MBJ Light Soaking Unit is for aging tests and preconditioning.

Restraint

High initial costs

Patient simulators offer numerous benefits for healthcare education, training, and patient safety, but the substantial upfront investment required can be a significant restraint on their widespread adoption. The initial cost of purchasing high-quality patient simulators, especially advanced, high-fidelity models that closely mimic human physiology, can be considerable. These simulators often come with a substantial price tag, making them less accessible to smaller healthcare institutions, medical schools, and training programs with limited budgets. These organizations may find it challenging to allocate the necessary financial resources for procuring patient simulators.

Furthermore, the financial commitment doesn't end with the purchase price. Operating and maintaining patient simulators also incur ongoing costs, including software updates, equipment maintenance, and the replacement of consumable supplies. These expenses can strain the budgets of institutions, further contributing to the perceived high cost of implementing simulation-based training programs. Therefore, some healthcare institutions and educational programs may be hesitant to invest in patient simulators or may opt for lower-fidelity models to reduce initial expenses. While cost-effective options are available, they may not provide the same level of realism and functionality as their more expensive counterparts, potentially limiting the effectiveness of the training provided.

Opportunity

Advancements in simulation technology

The continuous progress in virtual reality (VR), augmented reality (AR), artificial intelligence (AI), and haptic feedback systems has substantially elevated the capabilities and impact of patient simulators, creating a dynamic landscape of opportunities. Moreover, high-fidelity simulators can closely mimic human physiology, anatomy, and responses, providing learners with an immersive and lifelike training experience. This realism is crucial for healthcare professionals, as it enables them to practice a wide range of medical scenarios and procedures with a sense of authenticity that was previously unattainable.

Furthermore, the interactivity and immersion brought about by VR and AR technologies are transforming the learning process. Learners can engage in 3D environments, manipulate virtual instruments, and interact with computer-generated patients, promoting a deeper understanding of clinical tasks and enhancing decision-making skills.

AI-powered patient simulators introduce adaptability and personalization into training. These simulators can adjust scenarios and responses based on learner actions, thereby tailoring the training experience to individual skill levels and tracking progress over time. This adaptability enhances the efficiency of training and ensures that healthcare professionals are challenged and engaged at their appropriate level of expertise.

The ability to facilitate remote and collaborative learning is another remarkable opportunity arising from these advancements. Learners can engage in simulated scenarios from different locations, and instructors can guide and assess their performance in real-time. This is particularly pertinent in today's educational landscape, where remote and distributed learning has become increasingly important.

- In July 2024, Maximum Fidelity Surgical Simulations (MaxFi), a company that offers lifelike cadavers to create highly realistic surgical simulations for medical education, research, product development, and military training, announced that it has completed its USD 2.25 million seed funding round.

Segment Insights

Product Type Insights

In 2025, the adult patient simulator segment had the highest market share of 47% on the basis of the product type and is anticipated to rapidly expand over the projected period. Adult patient simulators are designed to replicate the anatomy, physiology, and responses of an adult human. They are used for training healthcare professionals, such as doctors and nurses, in a wide range of medical scenarios, from routine patient assessments to critical care and emergency situations. These simulators often include features like vital sign monitoring, airway management, and the ability to simulate various medical conditions and responses to interventions.

Technology Insights

In 2025, the low-fidelity simulators segment had the highest market share of 43% on the basis of the technology. Low-fidelity simulators are basic and less technologically advanced models that provide a simplified representation of human anatomy and physiological functions. These simulators are suitable for introductory or foundational training in healthcare. While they may not offer the same level of realism as higher-fidelity models, they are cost-effective and serve as entry-level tools for teaching basic clinical skills, such as CPR (Cardiopulmonary Resuscitation) or basic patient assessments.

The medium-fidelity simulators segment is anticipated to expand fastest over the projected period. Medium-fidelity simulators offer a balance between realism and cost-effectiveness. While they may not replicate human physiology and responses as accurately as high-fidelity simulators, they provide a realistic training environment for a broad range of medical scenarios. Medium-fidelity simulators are often used in healthcare education and training programs where a high level of realism is required, but budget constraints may limit the use of high-fidelity models. They offer valuable hands-on experience in a more affordable package.

End User Insights

In 2025, the hospitals segment had the highest market share of 45% on the basis of the end user. Hospitals are major end-users of patient simulators. These healthcare facilities use patient simulators for a variety of purposes. They are particularly valuable for training and assessing healthcare professionals within the hospital environment. Hospitals use patient simulators to enhance the skills and preparedness of their clinical staff, including doctors, nurses, and other healthcare personnel. Simulated scenarios may include emergency response training, surgical procedures, and critical care situations. Patient simulators in hospital settings also help in onboarding new staff and ongoing professional development.

The academic institutions segment is anticipated to expand fastest CAGR of 8.3% over the projected period. Academic institutions, such as medical schools, nursing programs, and other healthcare educational institutions, are prominent end-users of patient simulators. These institutions use patient simulators as integral components of their educational curricula. They offer students a realistic and safe environment for hands-on learning and clinical skill development. Academic institutions use patient simulators to train future healthcare professionals, including medical students, nursing students, and allied health students. These simulators are vital tools for preparing students to enter the healthcare workforce with the essential clinical competence required to provide high-quality patient care.

Regional Insights

What is the U.S. Patient Simulator Market Size?

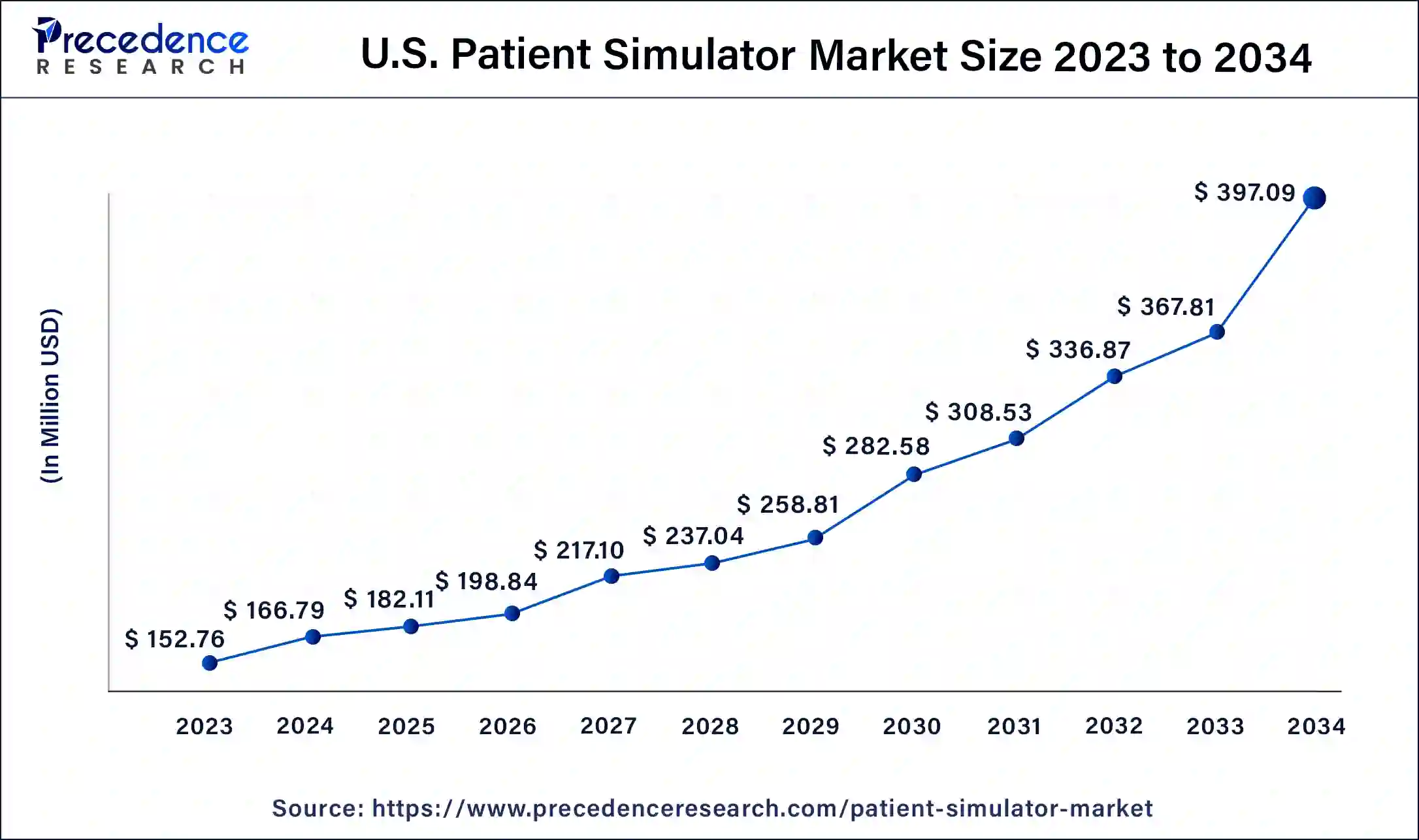

The U.S. patient simulator market size was valued at USD 182.11 million in 2025 and is expected to be worth around USD 427.48 million by 2035, growing at a CAGR of 8.91% from 2026 to 2035.

North America held the largest revenue share of 38% in 2025. North America is at the forefront of adopting advanced simulation technologies, including high-fidelity patient simulators with features like virtual reality (VR), augmented reality (AR), andartificial intelligence (AI). These technologies enhance the realism and effectiveness of patient simulators. Moreover, the region boasts numerous medical schools, nursing programs, and healthcare training institutions that extensively use patient simulators for educating and training future healthcare professionals. These institutions have been early adopters of simulation-based education.

U.S. Patient Simulator Market Trends

There is increased demand for high-fidelity trauma mannequins, such as female-specific mannequins. Companies invest in mobile laboratories and AI-based VRs. Integrated digital-based ecosystems are enhanced through consolidation. The training spreads out to the rural and remote regions.

Asia Pacific is estimated to observe the fastest expansion.The region is experiencing robust growth in the patient simulator market, driven by the increasing demand for healthcare professionals, the adoption of advanced medical technologies, and the growing emphasis on patient safety and quality healthcare. The market is experiencing significant growth, and as the region's healthcare and educational institutions continue to evolve and expand, the use of patient simulators is expected to play an increasingly vital role in healthcare training and patient safety initiatives across the region.

- In May 2024, Sakra World Hospital launched its Nursing Simulation Lab in Bengaluru. The lab was inaugurated by Teddy Duthel, French Foreign Trade Advisor in India (CCE Inde), who is also the Managing Director of Sonovision Germany, Sonovision Aetos India, and Sonovision Production Centres, along with Ramona Simion.

China Patient Simulator Market Trends

China's market is expanding rapidly as healthcare institutions and medical schools increasingly adopt simulation-based training to improve clinical skills and patient safety without risk to real patients. This growth is supported by significant government investments in medical education infrastructure and healthcare reform initiatives that emphasize standardized, high-quality training across hospitals and teaching centers.

Europe patient simulator market is driven by the increasing demand for healthcare professionals, the incorporation of advanced medical technologies, and the growing emphasis on patient safety and high-quality healthcare. Europe has faced global health challenges, such as pandemics. Patient simulators have played a vital role in training healthcare professionals to respond effectively to emergencies and manage patient care during these crises.\

Germany Patient Simulator Market Trends

High-fidelity simulators are strongly adopted to facilitate standardized competency frameworks. The organizations obtain technologies that are specialized and add to the digital and physical realism. Surgical and laparoscopic simulators become popular. EU-based manufacturers lead in terms of innovation.

Patient Simulator Market Players

- Surgical Science Sweden AB: Offers lapSim and EndoSim virtual reality simulators that are concerned with evidence-based excellence in minimally invasive robotic and endoscopic procedures training.

- MEDICAL-X: Creates ADAM-X and NENASim wireless high-fidelity simulators that provide real-life emergency internal medicine and neonatal life support training.

- Gaumard Scientific: Proposes HAL and Victoria simulators with AI conversational speech, with lifelike robotics to train complex neurological obstetric clinical scenarios.

Other Major Key Players

- Laerdal Medical

- CAE Inc.

- Simulab Corporation

- Kyoto Kagaku Co., Ltd.

- Limbs & Things LTD

- Mentice AB

- MedVision

Recent Developments

- In November 2025, Humber River Health is launching the James B. Neill Simulation Centre, a $10 million project supported by a $5 million donation from James B. Neill, to enhance Ontario's healthcare workforce. Opening in March 2026, it aims to train over 7,000 medical professionals annually. (Source: https://financialpost.com )

- In September 2025, VirtuaLensTM launched the Immersive IOL Simulator, a VR platform helping cataract patients explore and compare intraocular lenses pre-surgery. This innovation addresses challenges patients face in visualizing lens effects on daily life after cataract surgery, a common procedure worldwide. (Source: https://www.prnewswire.com )

- In November 2024, Newbase, a leader in metaverse-based medical education platforms, announced the launch of its new product, 'Medicrew', a platform designed to provide customized virtual reality (VR) education tailored to the clinical competency of healthcare professionals. Leveraging its expertise in international markets, cultivated through projects since 2023.

- In July 2024, Simulations Plus, Inc., a leading provider of modeling and simulation software and services for pharmaceutical safety and efficacy, announced the acquisition of Pro-ficiency Holdings, Inc. and its subsidiaries, a leader in providing simulation-enabled performance and intelligence solutions for clinical and commercial drug development.

- In January 2024, Laerdal Medical announced a global distribution partnership with SIMCharacters, an Austrian company specializing in neonatal simulation technology. The collaboration aims to revolutionize medical training and enhance healthcare simulation.

- In June 2023, Wolters Kluwer Health announced collaborating with Laerdal Medical and the National League for Nursing (NLN) to launch preclinical for Nursing.

- January 2022: Gaumard Scientific Co. launched one of the first advanced multidisciplinary patient simulator, HAL S5301. It feature life various functions such as movement to simulate symptoms of stroke and traumatic brain injury (TBI).

Segments Covered in the Report

By Product Type

- Infant Simulator

- Childbirth Simulator

- Adult Patient Simulator

By Technology

- High-fidelity Simulators

- Low-fidelity Simulators

- Medium-fidelity Simulators

By End User

- Hospital

- Academic Institutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting