Patient Monitoring Devices Market Size and Forecast 2025 to 2034

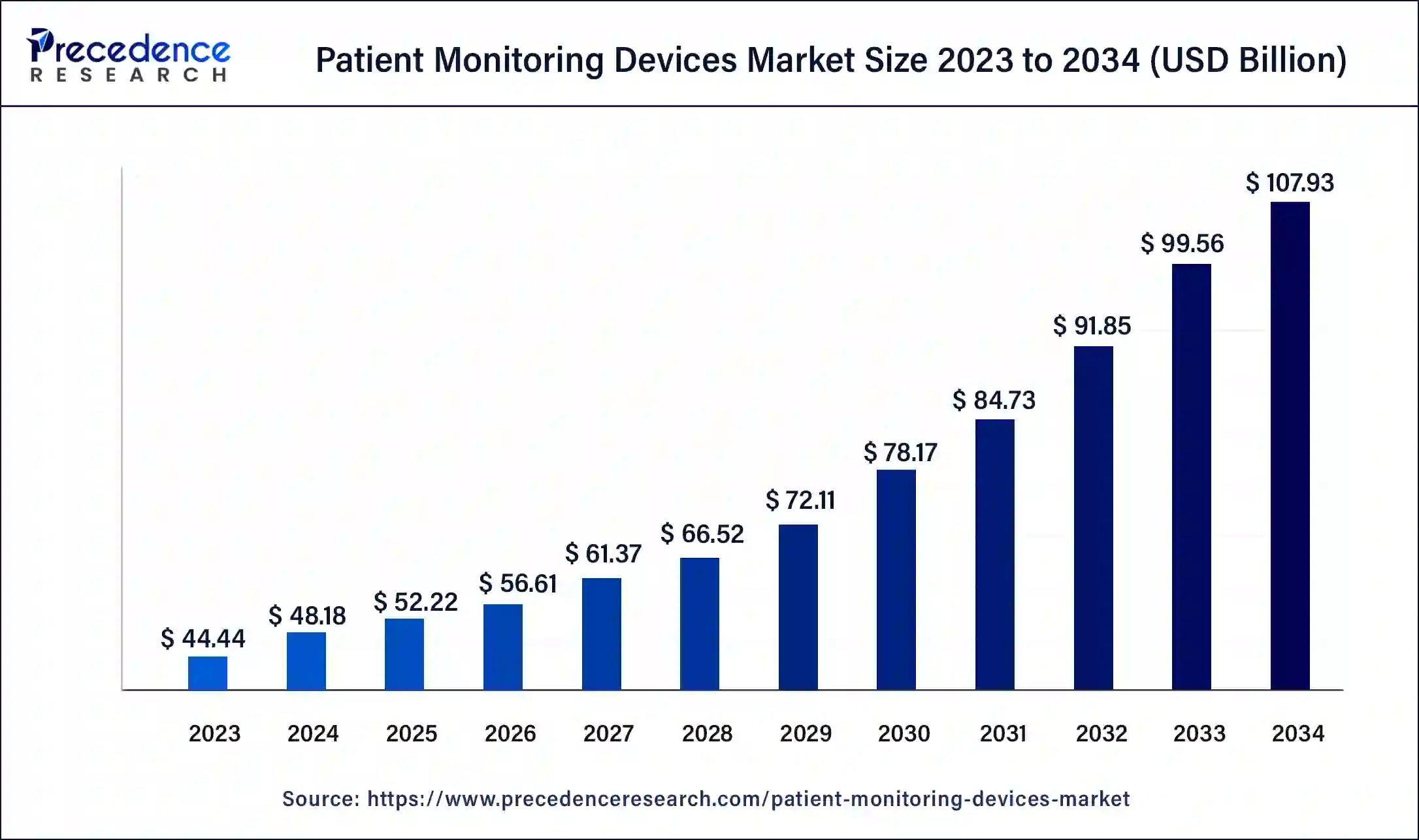

The global patient monitoring devices market size is valued at USD 52.22 billion in 2025 and is predicted to increase from USD 56.61 billion in 2026 to approximately USD 107.93 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034.

Patient Monitoring Devices Market Key Takeaways

- In terms of revenue, the patient monitoring devices market is valued at $52.22billion in 2025.

- It is projected to reach $107.93 billion by 2034.

- The patient monitoring devices market is expected to grow at a CAGR of 8.40% from 2025 to 2034.

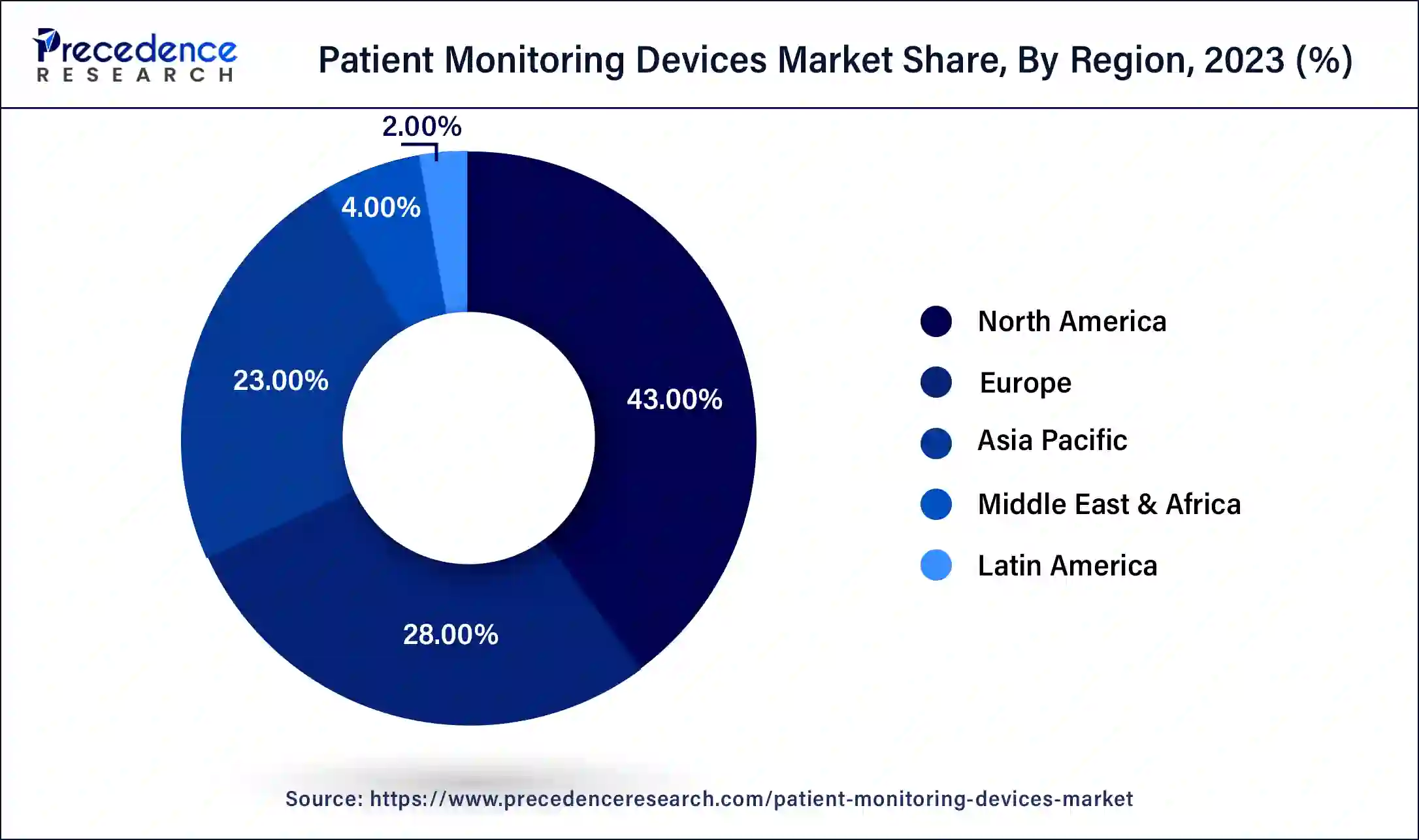

- North America contributed more than 43% of revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Product, the blood glucose monitoring device segment has held the major market share in 2024.

- By End-use, the patient monitoring devices segment contributed more than 52% of the market share in 2024.

Patient Monitoring Devices Market Growth Factors

The surge in demand for the patient monitoring devices to be used residentially is the primary factor that is expected to drive the growth of the Patient Monitoring Devices Market. Furthermore, the increasing cardiovascular disease across the globe where constant body monitoring is required by the patients is anticipated to fuel the growth of the market.

During the COVID-19 outbreak, the demand for the patient monitoring devices increased in the local hospitals and the healthcare facilities. To meet this demand the manufacturers of the patient monitoring devices fastened the production process for these equipment's and this attribute is expected to boost the growth of the patient monitoring devicesMarket. Additionally, the surge in chronic diseases such as cancer, diabetics, cardiac disorders, neurological conditions and others across the world is yet another factor that is anticipated to fuel the growth of the market.

With rapid technological developments, the patient monitoring devices manufacturing companies are innovating new equipment's that can accurately measure different body parameters. This factor is expected to drive the growth of the market. Furthermore, increasing demand for therapeutic and monitoring devices across the globe is expected to boost the growth of the market.

The surge in older population across the globe is a major factor that is fueling the growth of the patient monitoring devices market. The older generation people usually suffer from chronic diseases that need constant monitoring of their health condition and this boost the demand for the market. Also, the development of technologically advanced patient monitoring devices such as ventilators, nebulizers, oxygen monitors and many othersprovides comfort to the patients and therefore is anticipated to drive the growth of the market.

Cybersecurity Major Concern to Look at Patient Monitoring Devices

- In February 2025, the warning about a “black door” in the devices was given to both the FDA and the Cybersecurity and Infrastructure Security Agency (CISA, “an easy-to-exploit vulnerability that could allow a bad actor to alter its configuration.”

- In April 2025, the Irvine, California–based maker of patient monitoring devices, announced the discovery of unauthorized activity on its network. The attack has temporarily interfered with its ability to process, fulfill, and ship customer orders in a timely manner, according to the company.

- In April 2025, Masimo Corp., a medical device maker, announced its investigation into a cyberattack that has impacted its manufacturing facilities and limited its ability to fulfill orders.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.22 Billion |

| Market Size in 2026 | USD 56.61 Billion |

| Market Size by 2034 | USD 107.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Product Insights

Which segment of product type dominated the patient monitoring devices market in 2024?

The cardiac monitoring devices also accounted for a significant revenue share of over 20.1% in 2023. This is due to an increase in cardiovascular disease across the world, leading to stroke and heart attack, and other related diseases. Furthermore, technological developments, Government initiatives, regional expansion, and the presence of major market players contributed to the growth and expansion of the market.

Based on Product, the market is divided into bloodglucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, fetal & neonatal monitoring devices, neuromonitoring devices, weight monitoring devices and other. The blood glucose monitoring device has contributed significantly towards the growth of the patient monitoring devices owing the rapid increase in diabetics where the constant monitoring of blood sugar level is required.

The cardiac monitoring devices also amounted for a significant revenue share of over 20.1% in 2023 due to increase in cardiovascular disease across the world leading to stroke and heart attack. Furthermore, technological developments, Government initiative, regional expansion and the presence of major market players are estimated to boost the growth of the market.

End-use Insights

How did the hospital segment dominate the patient monitoring devices market in 2024?

The hospital segment is estimated to contribute the largest market share of about 52% in 2024. The surge in demand for better quality medical services and effective diagnosis of the disease in hospitals has fueled the growth of the market. The growing prevalence of chronic diseases has also contributed to the growth of the market.

On the basis on End-use, the patient monitoring devices market is categorized into hospitals, ambulatory surgery centers, home care settings and other. The hospital segment is estimate to contribute the largest markets share of about 52% in 2024. The surge in demand for availing better quality medical service and effective diagnosis of the disease in the hospitals has fueledthe growth of the market.

Furthermore, the home care segment is also witnessing a significant demand for the monitoring devices owing to a increase in chronic disease that needs regular monitoring of the patients. This entire factor is expected to drive the growth of the market.

Regional Insights

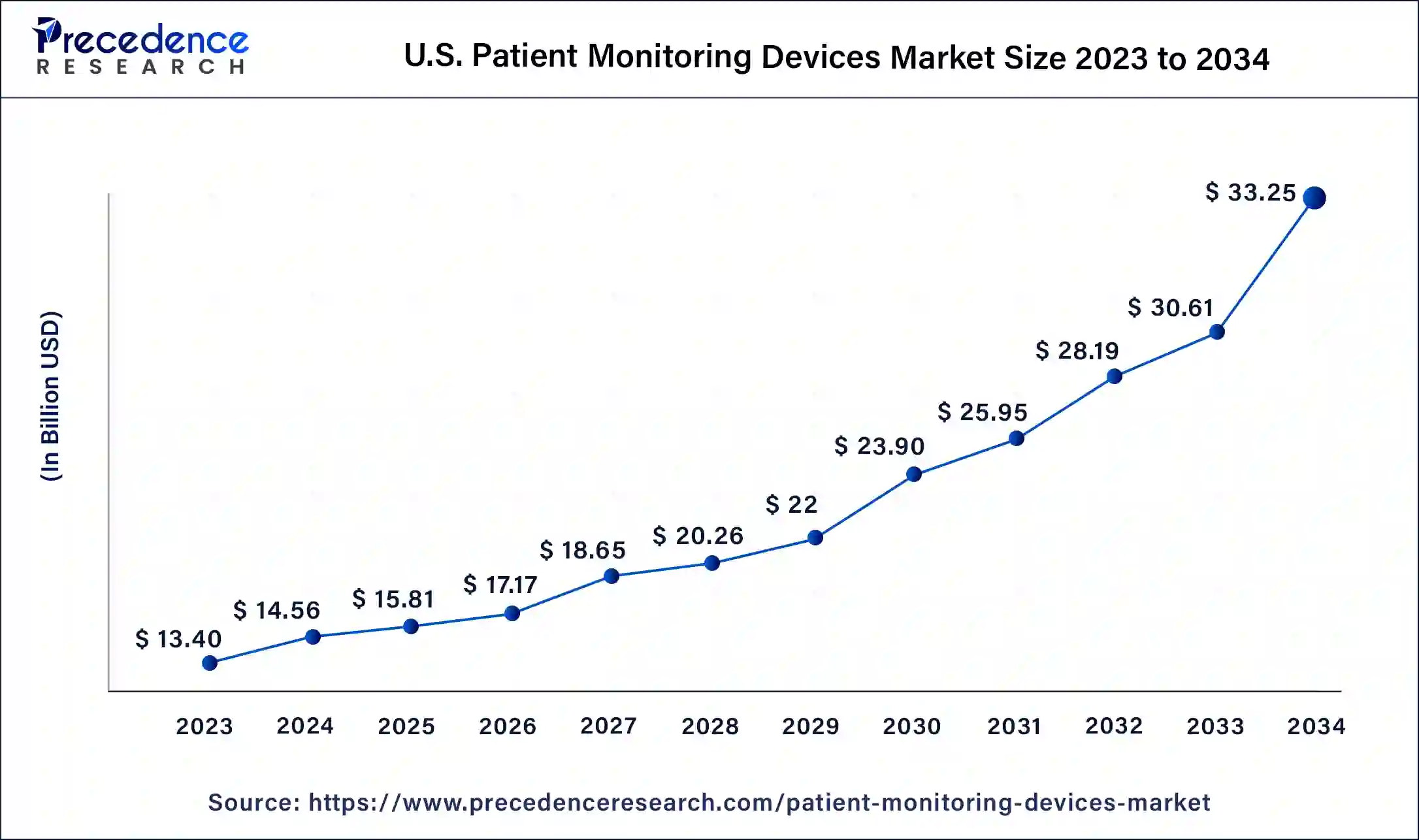

U.S. Patient Monitoring Devices Market Size and Growth 2025 to 2034

The U.S. patient monitoring devices market size was estimated at USD 15.81 billion in 2025 and is predicted to be worth around USD 33.25 billion by 2034, at a CAGR of 8.61% from 2025 to 2034.

North America is expected to lead the market accounting for largest market share of more than 43% in 2024. The increasing research and developmental activities in this region to develop advanced patient monitoring devices is anticipated to boost the growth of the market. Moreover, the rising infectious disease in the region and the presence major market players in this region will fuel the growth of market.

- In 2023, over 500 medical AI devices have undergone U.S. Food and Drug Administration (FDA) evaluation and received approval, including RPM-related medical devices.

U.S. Patient Monitoring Devices Market Trends:

The country has seen significant growth in the market, the growth I driven by various drivers due to the growing prevalence of chronic diseases and continuous monitoring of parameters in the aging population, which increases the demand for monitoring devices. Technological advancements for easy handling and patient control system solutions have contributed to the growth of the market and also helped in the expansion of the market in the country.

Asia Pacific region is also estimated to grow significantly over the forecast period due to the adoption of poor lifestyle such as improper diet, physical inactiveness, high sugar consumption and many others that leads to generation of chronic disease such as obesity, diabetics and others among the people in this region. The chronic disease needs regular monitoring in order to prevent them from becoming fatal for the patients. This attribute is estimated to drive the growth of the market in this region.

India Patient Monitoring Devices Market Trends:

India is experiencing steady growth in the market, driven by rapid growth in the medical devices sector, with a growing population and growing prevalence of chronic diseases, which require regular monitoring. The change in lifestyle preferences and change in eating habits have led to unhealthy norms, which lead to diseases, and this fuels the growth of the market and contributes to the expansion of the market in the country.

Patient Monitoring Devices Market Companies

- Abbott Laboratories

- Hill-Rom Holdings, Inc.

- Drägerwerk AG & Co. KGaA

- Edwards Lifesciences Corporation

- OMRON Corporation

- Masimo Corporation

- Compumedics Limited

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Nihon Kohden Corporation

- Natus Medical

- Medtronic plc (Ireland)

- Koninklijke Philips N.V.

- GE Healthcare

- Getinge AB

- Boston Scientific Corporation

- Dexcom, Inc.

- Nonin

- BIOTRONIK

- SCHILLER

- BioTelemetry, Inc.

Recent Developments

- In March 2025, a 10-year global initiative to propel one million low-income students into health technology careers was launched by Medtronic. The mission of the company, except for this initiative, is to 'alleviate pain, restore health, and extend life' with their technologies and therapies treating 70 health conditions.

- In March 2025, Smart Meter, a pioneering force in remote patient monitoring (RPM) technology, announced the revolutionized patient engagement with the launch of SmartHealth Solutions, a game-changing suite of AI-powered tools and applications, at the HIMSS 2025 National Conference in Las Vegas next week.

- In January 2025, AI ECG vendor Accurkardia announced the launch of FDA Breakthrough Device Designation (BDD) for its AI ECG AK+ Guard™ hyperkalaemia detection software. This investigational technology uses Lead I ECG data to alert patients and clinicians of moderate to severe episodes of hyperkalaemia (excess potassium in the blood) that can lead to sudden cardiac arrest, and designed to work with a wide range of 1-lead ECG FDA-cleared consumer and clinical wearables and adds to a growing number of AI-ECG algorithms now being utilised for wearables.

Segments Covered in the Report

By Product

- Cardiac Monitoring Devices

- ECG Devices

- Implantable Loop Recorders

- Event Monitors

- Mobile Cardiac Telemetry Monitors

- Smart/Wearable ECG Monitors

- Blood Glucose Monitoring Systems

- Self-monitoring Blood Glucose Systems

- Continuous Glucose Monitoring Systems

- Multi-parameter Monitoring Devices

- Low-acuity Monitoring Devices

- Mid-acuity Monitoring Devices

- High-acuity Monitoring Devices

- Temperature Monitoring Devices

- Handheld Temperature Monitoring Devices

- Table-top Temperature Monitoring Devices

- Wearable Continuous Monitoring Devices

- Invasive Temperature Monitoring Devices

- Smart Temperature Monitoring Devices

- Respiratory Monitoring Devices

- Pulse Oximeters

- Spirometers

- Capnographs

- Peak Flow Meters

- Hemodynamic/Pressure Monitoring Devices

- Hemodynamic Monitors

- Blood Pressure Monitors

- Disposables

- Fetal& Neonatal Monitoring Devices

- Fetal Monitoring Devices

- Neonatal Monitoring Devices

- Neuromonitoring Devices

- Electroencephalograph Machines

- Electromyography Machines

- Cerebral Oximeters

- Intracranial Pressure Monitors

- Magnetoencephalograph Machines

- Transcranial Doppler Machines

- Weight Monitoring Devices

- Digital

- Analog

- Other Patient Monitoring Devices

By End-use

- Hospitals

- Home Care Settings

- Ambulatory Surgery Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content