What is the Peer to Peer (P2P) Lending Market Size?

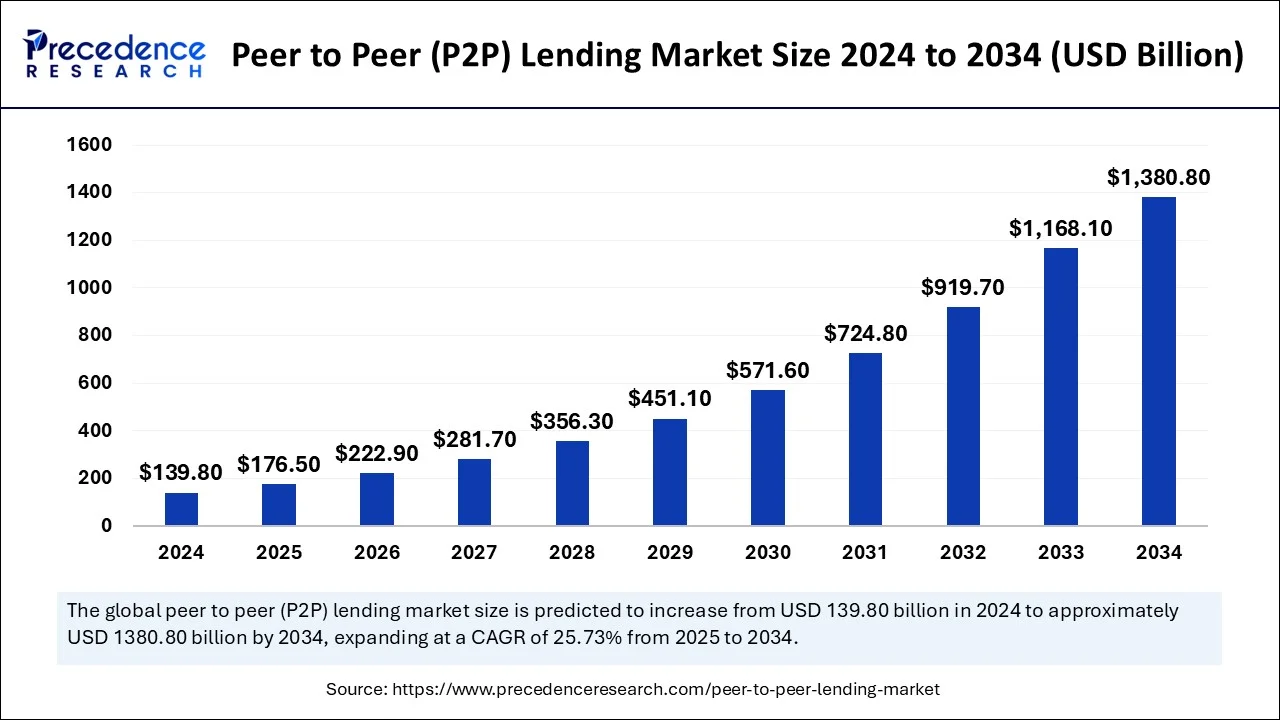

The global peer to peer (P2P) lending market size is accounted at USD 176.50 billion in 2025 and predicted to increase from USD 222.90 billion in 2026 to approximately USD 1,380.80 billion by 2034, expanding at a CAGR of 25.73% from 2025 to 2034. The growth of the peer-to-peer (P2P) lending market is attributable to the increasing requirement for education loans and healthcare financing. Owing to the high gross domestic product (GDP), favorable economic policies, and early adoption of the latest financial alternatives, the peer-to-peer (P2P) lending market is predicted to grow remarkably.

Key Takeaways

- In terms of revenue, the peer to peer (P2P) lending market is worth $176.5 billion in 2025.

- The market is projected to reach $1,380.80 billion by 2034.

- The market is expected to grow at a compound annual growth rate (CAGR) of 25.73% from 2025 to 2034.

- The U.S. country led the North American market and contributed 63% of the market share in 2024.

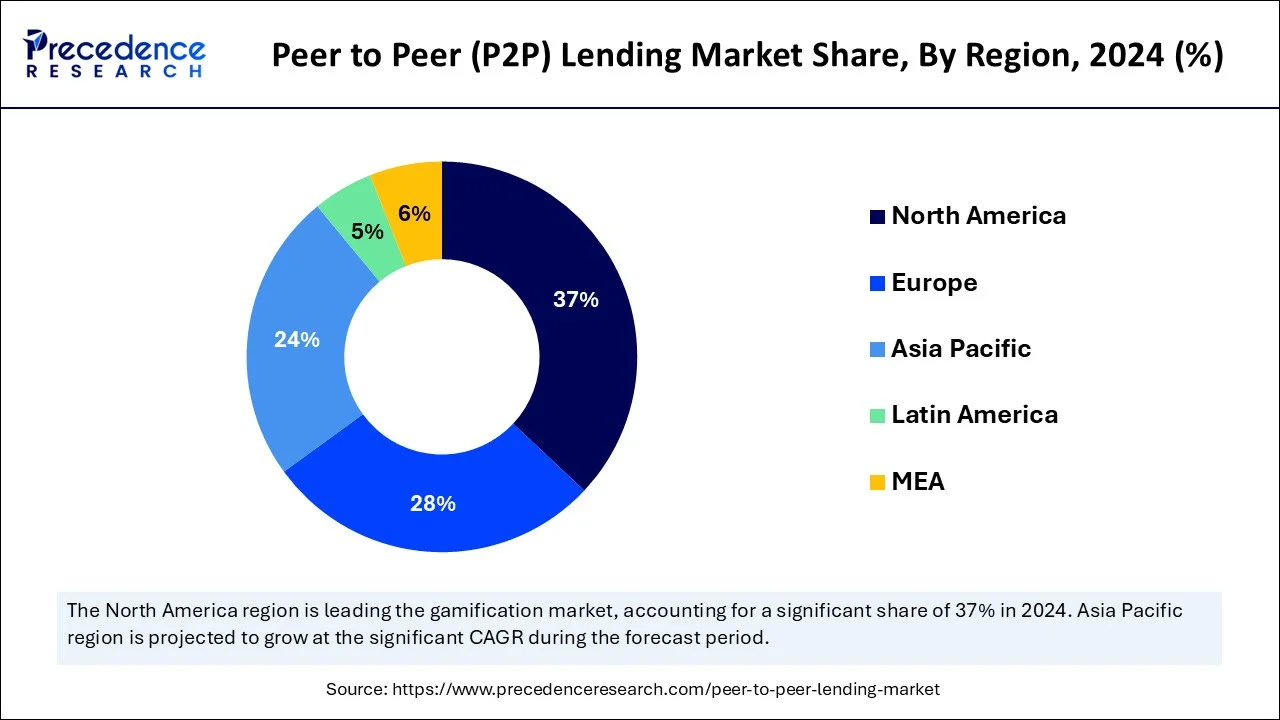

- North America dominated the global market with the largest market share of 63% in 2024.

- Asia Pacific is expected to expand at a solid CAGR of 25.52% during the forecast period.

- By business model, the marketplace lending segment is projected to experience the highest growth rate in the market during the forecast period of 2025 to 2034.

- By type of loan, the consumer lending segment captured the highest market share in 2024.

- By type of loan, the business lending segment is expected to grow with the highest CAGR between 2025 and 2034.

- By Business model, the traditional lending segment held a major market share in 2024.

- By business model, again, the marketplace lending segment is anticipated to grow at the fastest rate during the forecast period of 2025 to 2034.

Impact of Artificial Intelligence (AI) on the Peer to Peer (P2P) Lending Market

P2P lending is typically done through AI platforms that match borrowers with potential lenders. P2P lending offers secured lenders and unsecured lenders. However, most loans in P2P lending are unsecured personal loans. Secured loans are rare in the industry and are usually secured by luxury goods. Technologies like artificial intelligence (AI) and machine learning (ML) help increase the efficiency of P2P lending.

AI is revolutionizing peer-to-peer lending by improving risk assessment and matching borrowers with lenders. Advanced AI systems can even be used to reach and engage customers. With technologies like voice chat AI, peer-to-peer lending companies can manage phone calls and attract customers at a larger and smaller scale. This will lead to the growth of the peer-to-peer (P2P) lending market through the use of AI-driven technologies like WIZ to facilitate customer crystallization and dissemination.

How has AI benefited the market?

Artificial intelligence(AI) has played a transformative role in the Peer to Peer (P2P) lending market by enhancing operational efficiency, improving credit risk assessment, and enabling more personalized borrower lender interactions. AI driven algorithms analyse vast amounts of structured and unstructured data, including alternative credit indicators like transaction history, digital footprint, and behavioural patterns, to generate more accurate credit scores for borrowers who may lack traditional credit histories. This has significantly expanded access to loans for underserved population. Additionally, AI powered Chabot's and automated customer service tools streamline borrower support, reducing overhead costs and improving user experience. Fraud detection systems also benefit from AI's ability to spot anomalies and suspicious activities in real time, helping platforms maintain compliance and minimize risk. Overall, AI has strengthen the reliability and scalability of P2P platforms, making them more attractive to both investors and borrowers in an increasingly digital financial ecosystem.

Growth Factors of the Peer to Peer (P2P) Lending Market

- P2P lending connects lenders and borrowers through a platform that makes access to credit easier. It has the advantages of simple information, fast processes, and a large number of borrowers, which has led to the growth of the peer to peer (P2P) lending market.

- P2P lenders often offer lower interest rates than traditional lenders because they have lower administrative costs and do not have to pay for personnel or staff, which has led to the growth of the peer to peer (P2P) lending market.

- P2P lending platforms are available to people who cannot get a loan from traditional lenders due to credit history or other reasons, which has led to the growth of peer to peer (P2P) lending market.

- P2P lending platforms use technology to facilitate credit checks and loan approvals, they have a faster approval process than traditional lenders, which has led to the growth of the peer to peer (P2P) lending market.

- P2P lending has become popular in recent years because it offers an alternative to traditional lending, which is often slow, expensive, and inaccessible to many, which has led to the growth of the peer to peer (P2P) lending market.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 222.90 Billion |

| Market Size in 2025 | USD 176.50 Billion |

| Market Size by 2034 | USD 1,380.80 Billion |

| Growth Rate from 2025 to 2034 | 25.73% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, Business Model, and Geography |

Market Dynamics

Driver

Flexible Investment Options

Depending on their interests and risk tolerance, investors can manually search through the loans that are accessible on the platform and select which ones to invest in. As a result, investors have complete control over their financial choices and can customize their portfolios to meet certain needs or tastes. To spread risk and possibly boost rewards, investors can distribute their money among a number of loans.

Additionally, some platforms provide investors with the opportunity to divide their investment into multiple loans of lesser amounts by offering the option to invest in fractional loan parts. Investors can continually reinvest their profits without human interaction thanks to the automatic reinvestment options offered by many platforms. Thereby, the emergence of flexible investment options act as a driver for the peer to peer (P2P) lending market.

Restraint

Credit Risk Concentration

In peer to peer (P2P) lending market, credit risk concentration is the extent to which a platform's loan portfolio is exposed to a limited number of borrowers or a certain category of borrowers. Should a substantial percentage of loans be originated in a certain geographic area, the platform would be vulnerable to regional legislative changes or economic downturns. The platform may be subject to industry-specific risks if loans are concentrated within a certain industry. For instance, in the event of a downturn in the technology industry, a platform that extends loans primarily to borrowers in that industry may be more vulnerable.

Opportunity

Social Impact Investing

Lending to people or companies that support good social change or have a social mission may be the primary focus of social impact investors. This factor is observed to offer opportunity for the peer to peer (P2P) lending market. This can entail making loans to small companies in marginalized areas, encouraging the development of sustainable energy sources, sponsoring programs for education, or offering microloans to company owners in developing nations.

Platforms that offer clear parameters for assessing the social or environmental impact of investments are frequently given preference by social impact loan investors. Platforms that have strong social and environmental standards, actively engage with borrowers to understand their needs and impact, and are open and honest about their lending methods may be given priority.

Type Insights

The consumer lending segment dominated the peer to peer lending market in 2024. This dominance is attributed to the growing demand for quick and hassle free personal loans, often for debt consolidation, home improvement, or educational purposes. The ease of access, minimal documentation, and faster approval processes in P2P platforms have made them an attractive alternative to traditional banking systems, specially among younger borrowers and those with limited credit history.

On the other hand, the business lending segment is projected to grow at the fastest rate during the forecast period from 2025 to 2034. Small and medium sized enterprises (SMEs) which often face challenges in obtaining funding from traditional banks due to stringent credit requirements, are increasingly turning to P2P platforms for working capital, equipment financing or expansion purposes. This segment is expected to thrive as fintech platforms continue to tailor services to meet the unique needs of small businesses.

Peer to Peer Lending (P2P) Market Revenue USD Bn), By Type, 2022 and 2024

| Type | 2022 | 2023 | 2024 |

| Consumer Lending | 55.2 | 69.5 | 87.6 |

| Business Lending | 32.8 | 41.3 | 52.2 |

End User Insights

The consumer credit loan segment dominated the peer to peer (P2P) lending market in 2024. Consumer credit loans are perceived to be less risky as compared to other loans, such as small business loans or personal loans for entrepreneurs. This perception often attracts more lenders to participate in the segment. Consumer credit loans generally offer more predictable returns to investors or lenders due to the regular repayment schedules and lower default rates compare to other types of loans.

Advancements in technology and data analytics allow such platforms to assess borrowers' creditworthiness more accurately, mitigating the risk associated with consumer credit loans. The segment also caters to wide range of borrowers, from those with excellent credit scores to those with subprime credit, offering lucrative opportunities for lenders and investors.

The student loans segment is observed to witness the fastest rate of expansion during the forecast period. Student loans often come with longer repayment period compared to other types of loans, offering lenders with a steady stream of income over an extended period. In many countries, governments offer support for student loans, reducing the risk for lenders. The demand for student loans is high due to the rising cost of education, especially higher education. This creates a significant market for lenders to tap into.

The individual segment held the largest share of 70.00% in the 2024 global peer to peer lending market. The individuals are the key end users to fuel the market. There are types of borrowers accelerating businesses of the lenders and loan applications, like subprime, near-prime and prime borrowers. Where subprime is essential for financial inclusion, near-prime refers to the liason segment, and prime serves low risk and a balanced landscape of the market. The segment is trending due to the involvement of a major population in the loan or lending procedure.

The businesses segment is expected to grow at a CAGR of 21.00% during the forecast period. The startups and SMEs are the major reasons for the rise of the global peer to peer lending market. The emerging various businesses in the different markets encompass multiple resources to gain a financial baseline to flourish in the respective area. Since in the growing business spectrum, the money lenders play an important role. To uncover opportunities, the segment has been largely involved in the global peer to peer industry.

Peer to Peer Lending (P2P) Market Revenue USD Bn), By End User, 2022 and 2024

| End User | 2022 | 2023 | 2024 |

| Consumer Credit Loans | 31.0 | 39.0 | 49.2 |

| Small Business Loans | 23.5 | 29.6 | 37.4 |

| Student Loans | 19.1 | 24.0 | 30.1 |

| Real Estate Loans | 14.4 | 18.2 | 29.4 |

Business Model Insights

The traditional lending segment held the largest market share in 2024. Traditional lenders benefit from strong brand recognition and extensive marketing efforts, which can attract borrowers seeking loans and investors looking for investment opportunities. Traditional lenders generally have access to larger pools of capital, including deposits and institutional funding, enabling them to offer a wider range of loan products and more competitive interest rates compared to peer to peer platforms that rely on individual investors' funds.

Traditional lenders, such as banks and credit unions typically have long-standing reputations and established trust with consumers. This makes borrowers more inclined to seek financing from these institutions rather than from relatively new peer to peer platforms.

In 2024, the traditional lending segment where the platform simply connects lenders and borrowers without holding loans ir participating in the lending itself held the leading position in the market. This model has been popular due to its transparency and ease of operation, offering a peer driven ecosystem that reduces reliance on financial intermediaries.

However, the marketplace lending segment is expected to witness the fastest growth from 2025 to 2034. Marketplace lending platforms often use more sophisticated risk modelling, automation, and underwriting techniques. They may also co-lend or manage portfolios actively, which attracts institutional investors and supports rapid scaling. The increased adoption of AI and data analytics to assess borrower creditworthiness and manage risk more efficiently is anticipated to drive the expansion of this model.

The alternate marketplace lending segment held the largest share of 65.00% in the 2024 global peer to peer lending market. The segment is in its revolutionary era in the P2P lending landscape. It spotlights the major platforms' roles as online agents standing as a middle person for investors and borrowers. The segment is leading with advanced security for the borrower's profile and their confidential information. The primary function of alternative marketplace lending is to offer an efficient online platform.

The various options and customisation to the preferences, keeping both investors and borrowers at the same frequency of responsiveness and responsibility, have accelerated the market. The hybrid lending (involving institutional investors) and platform-facilitated lending have promoted the alternate marketplace lending segment.

The traditional lending segment is expected to grow at a CAGR of 25.70% during the forecast period. The traditional lending is an option to the conventional banking system, inspecting its developed function as the initial financial liaison. The growing, stringent eligibility criteria in traditional banks require a trusted, suitable lending understanding to carry out the loan procedure or lending procedure.

The direct lender-to-borrower has bolstered the segment and introduced major changes to the perspective of the global peer-to-peer lending according to the preferences of the individuals.

Peer to Peer Lending (P2P) Market Revenue USD Bn), By Business Model, 2022 and 2024

| Business Model | 2022 | 2023 | 2024 |

| Marketplace Lending | 38.7 | 48.8 | 61.5 |

| Traditional Lending | 49.3 | 62.1 | 78.3 |

Funding Method Insights

While the report offers limited data on the breakdown by funding method, it is evident that individual funding has traditionally led this segment, with a large number of retail investors seeking higher returns through P2P platforms. However, the market is witnessing a growing presence of institutional funding, which is expected to be a key driver moving forward. Institutional funding, which is expected to be a key driver moving forward. Institutional investors are increasingly participating in P2P markets due to improved risk assessment tools, AI driven underwriting processes, and the ability to access diversified portfolios at scale. This shift is expected to shape the funding landscape in the coming years, although individual participation remains foundational.

Loan Type Insights

The consumer loans segment held the largest share of 50.00% in the 2024 global peer to peer lending market. Consumer loans regarding home renovation, medical expenses, personal needs, family expenses, and debt consolidation have been increasingly gaining traction in the market. The segment is leading with the means of numerous reasons for every individual opting for the loan. The segment is trending with the growing need of individuals who leverage the businesses of online loan applications and ensure the best interest rate suitable for the earnings of the salaried and other populations.

The real estate loans segment is expected to grow at a CAGR of 22.50% during the forecast period. The segment plays a complementary and prominent role in P2P lending as it delivers an optional funding source for borrowers and enables excellent investment opportunities for the lenders. The real estate loans offer short-term financing solutions based on the nature of the loan, like residential and commercial. The segment promotes home and business loans.

Repayment Term Insights

The medium-term loans (1-5 years) segment held the largest share of 55.00% in the 2024 global peer to peer lending market. The segment depends on the type of loan a person is opting for. Consumer loans are leading ahead with their emergency or materialistic requirements that fuel the market specifically. The family expenses, home renovation and other personal needs cover the medium-term loans and repayment according to the said interest rate. The lender's profit accelerates depending on its business strategy and platform.

The short-term loans (up to 12 months) segment is expected to grow at a CAGR of 23.00% during the forecast period. The segment is aligned with the basic expenses requirement that most individuals go through. The segment is in demand among youth and salaried-based individuals liable to pay monthly, according to the eligibility of the individual. With the rapid inflation fluctuation and basic needs fulfilment, the short-term loans are in demand and further stimulate the lenders' and loan application developers' business.

Regional Insights

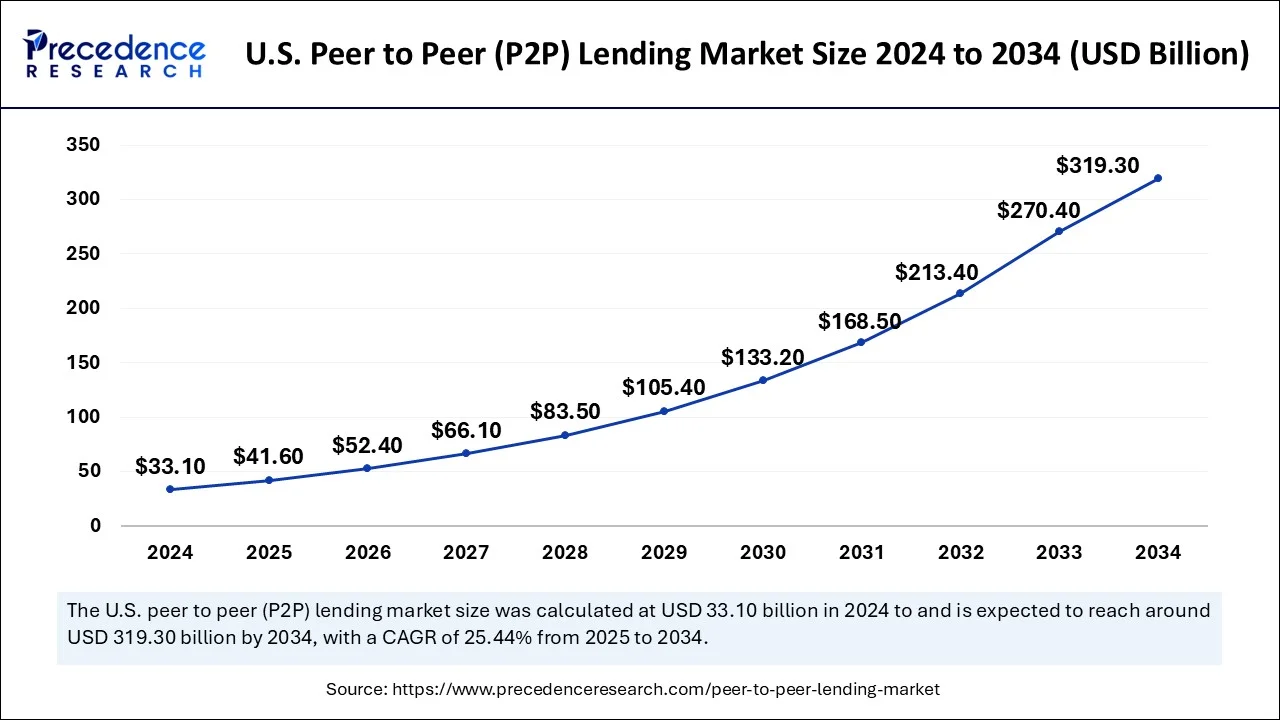

U.S. Peer to Peer (P2P) Lending Market Size and Growth 2025 to 2034

The U.S. peer to peer (P2P) lending market size is exhibited at USD 41.60 billion in 2025 and is projected to be worth around USD 319.30 billion by 2034, growing at a CAGR of 25.44% from 2025 to 2034.

North America led the peer to peer (P2P) lending market in 2024 by holding 37% of the market share. North America generally has a more conducive regulatory environment for P2P lending compared to other regions. Regulatory clarity and frameworks that facilitate lending activities have allowed platforms to operate more smoothly and attract both borrowers and investors.

North America generally has a more conducive regulatory environment for P2P lending compared to other regions. Regulatory clarity and frameworks that facilitate lending activities have allowed platforms to operate more smoothly and attract both borrowers and investors. North America has a well-established credit infrastructure, including credit bureaus and scoring systems, which facilitates the assessment of borrower creditworthiness. This infrastructure reduces the risk for lenders participating in P2P lending platforms and encourages investor participation.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China dominates the peer to peer (P2P) lending market in Asia-Pacific region. The peer to peer (P2P) lending market is growing in Asia-Pacific region due to growing number of small and medium sized enterprises. The government of emerging nations such as China and India are constantly taking efforts for the promotion of cashless technologies. This factor is boosting the growth of peer to peer (P2P) lending market in the region.

Europe

In Europe, the P2P lending ecosystem is maturing, particularly in countries such as the United Kingdom, Germany, and the Nordic nations, which are emerging as regional leaders. Harmonized, Germany, and the Nordic nations, which are emerging as regional leaders. Harmonized regulatory frameworks within the European Union have encouraged cross-border expansion of platforms like Funding Circle, Zopa, and Bondora, facilitating increased transparency and scalability. Notably, the UK remains at the forefront in terms of both business lending volume and platforms innovation, edging out other markets in overall activity. While dominant markets help anchor the region, smaller European countries such as Estonia, with these dominant markets help anchor the region, smaller European countries such as Estonia, with platforms like Bondora are building their fintech momentum, though remain in relative comparison modest in scale.

Latin America

Latin America's P2P lending market is still nascent but expanding rapidly, propelled by surging fintech creation, alternative credit demand, and rising internet mobile penetration. Mexico and Brazil currently lead the region in P2P activity, with Argentina and Chile also gaining traction. Platforms like Afluenta have pioneered regional expansion, offering personal and commercial lending across countries. Yet the regional growth depends heavily on evolving regulatory environments. Nations such as Mexico and Brazil have enacted specific fintech regulations, while other like Uruguay and Argentina continue to refine or lack comprehensive frameworks creating both growth opportunities and regulatory uncertainty. Furthermore, the rappid proliferation of fintech start-ups particularly those catering to undeserved population points to fertile yet challenging market for P2P lenders.

Peer to Peer (P2P) Lending Market Companies

- Avant LLC

- Zopa Bank Limited

- Funding Circle

- Social Finance Inc.

- Kabbage Inc.

- RateSetter

- Lending Club Corporation

- Prosper Funding LLC

- LendingTree LLC

- OnDeck

Recent Developments

- July17, 2025- Funding Circle, once a retail peer to peer lending pioneer, has staged a notable comeback. The UK- based platform extended substantially more credit in the first half of 2025 compared to the prior year, translating into a return to profitability after restructuring and existing the U.S. market. Under new leadership, the company reversed a sizable loss into a modest profit and is on track to boost its pre-tax profits and revenues by 2026. This turnaround underscores renewed investor confidence and the firm's shift toward institutional funding models.

- June 12, 2025- The Carlyle Group has joined with Citigroup to roll asset backed financing specially targeted at fintech lenders. This initiative aims to meet escalating demand for scalable funding solutions within the P2P and fintech lending sectors. By combining Carlyle's infrastructure financing expertise and Citi's extensive private credit capabilities, the partnership signals strong institutional confidence in fintech's growth and opens new funding pathways for emerging lending platforms

- In January 2025, LenDenClub, a prominent P2P lending platform announced the launch of a new daily earning loan that allows lenders to earn daily interest with principal repayments. With this offering, lenders and investors can get a choice of loans starting from nine months tenure.

- In October 2024, IndiaP2P launched a new version of its services, the Monthly Income Plan-Plus. This offering adheres to the RBIs updated and faster settlement guidelines for P2P lending. Under this offering, lenders can earn up to 18% per annum interest with monthly payouts.

- In December 2024, Defender Global announced the launch of P2P lending platform while securing $235,000 for real-world projects. The company has settled the aim to position itself to meet the rising demand for asset-backed and accessible investment.

Segments Covered in the Report

By Business Model

- Traditional Lending

- Direct Lender-to-Borrower

- Alternate Marketplace Lending

- Platform-Facilitated Lending

- Hybrid Lending (involving institutional investors)

By Loan Type

- Consumer Loans

- Debt Consolidation

- Home Renovation

- Medical Expenses

- Family Expenses

- Other Personal Needs

- Small Business Loans

- Working Capital

- Equipment Financing

- Expansion Loans

- Real Estate Loans

- Commercial

- Residential

- Student Loans

By End-User

- Individuals

- Prime Borrowers

- Near-Prime Borrowers

- Subprime Borrowers

- Businesses

- Small and Medium Enterprises (SMEs)

- Startups

By Repayment Term

- Short-term Loans (up to 12 months)

- Medium-term Loans (1-5 years)

- Long-term Loans

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting