What is Pen Needles Market Size?

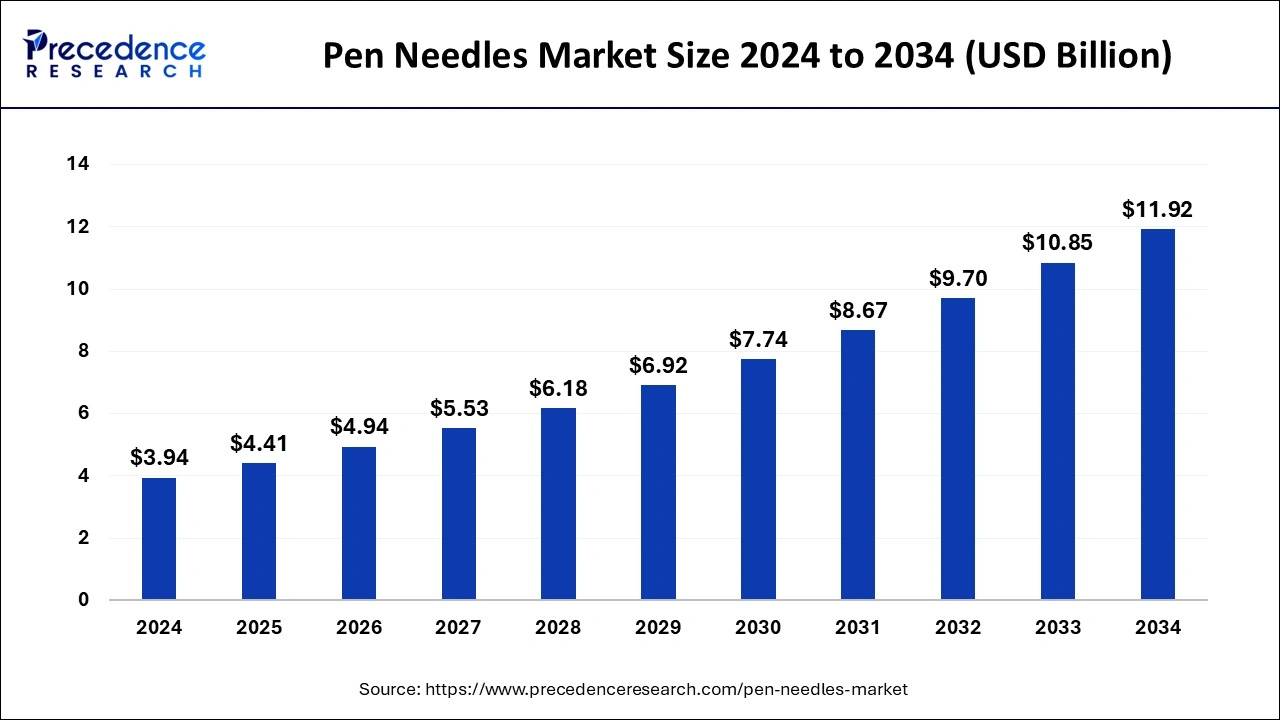

The global pen needles market size accounted for USD 4.41 billion in 2025 and is predicted to increase from USD 4.94 billion in 2026 to approximately USD 11.92 billion by 2034, expanding at a CAGR of 11.71% from 2025 to 2034.

Market Highlights

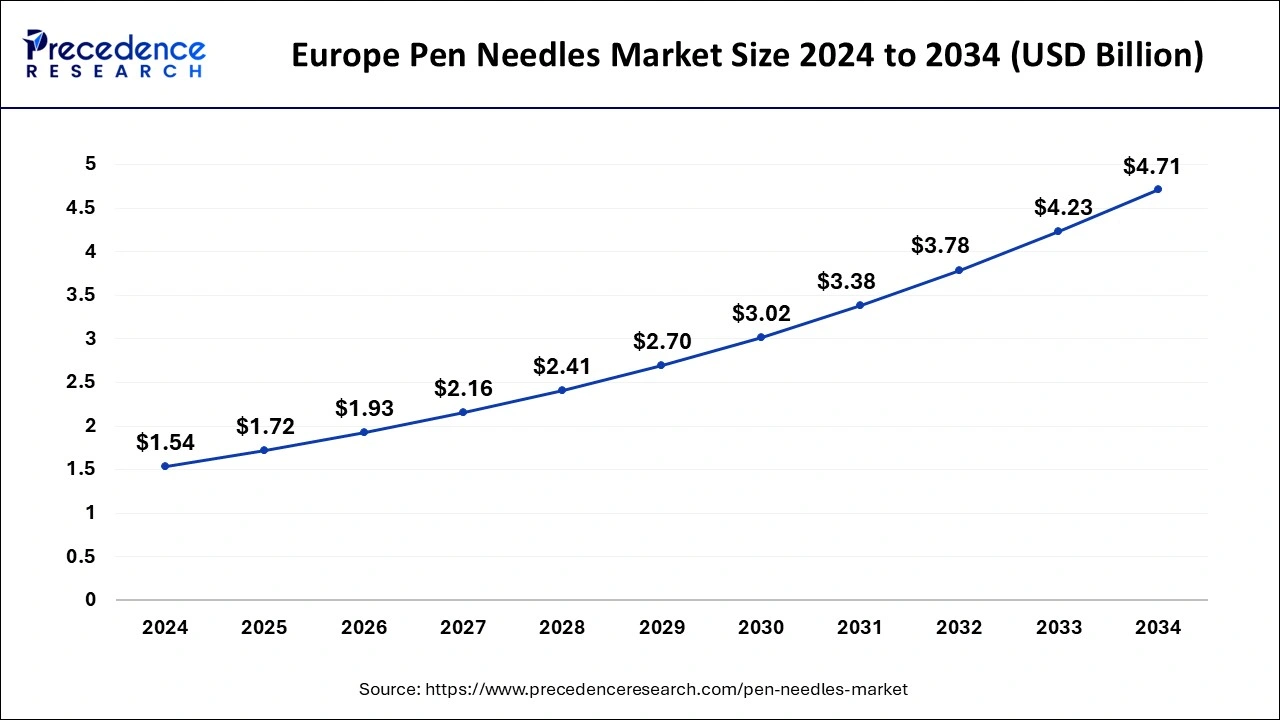

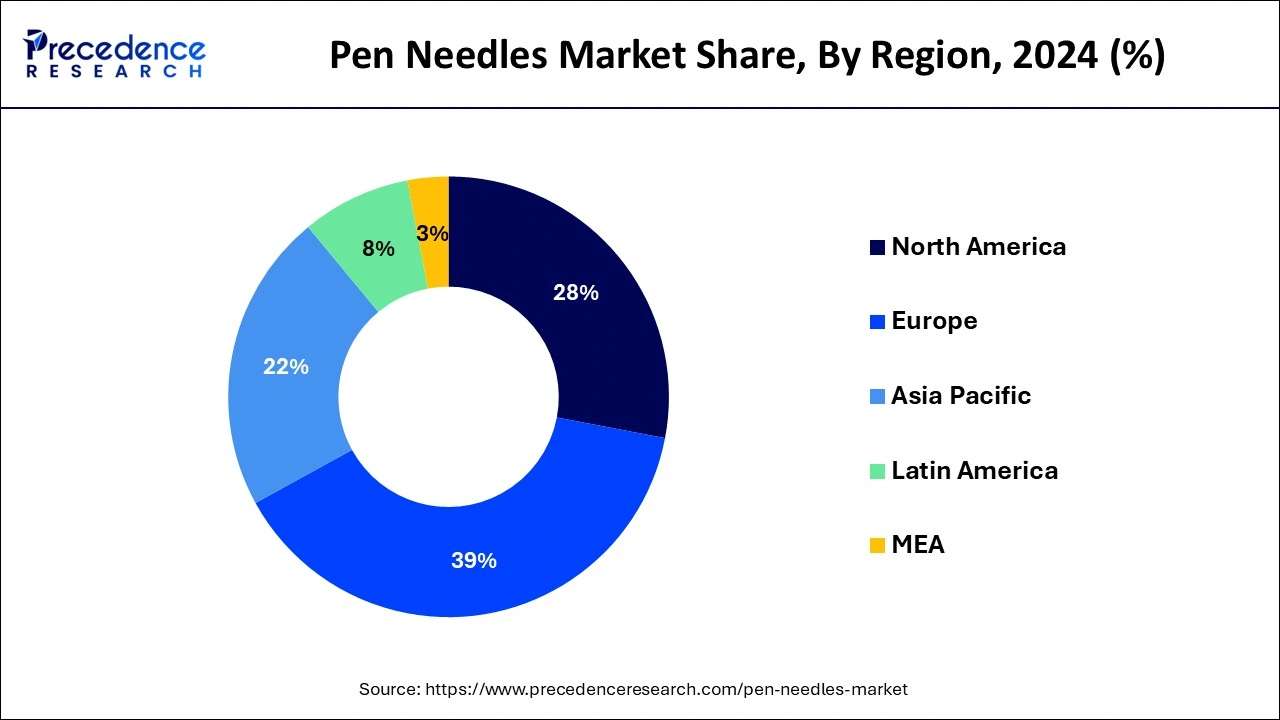

- Europe contributed more than 39% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

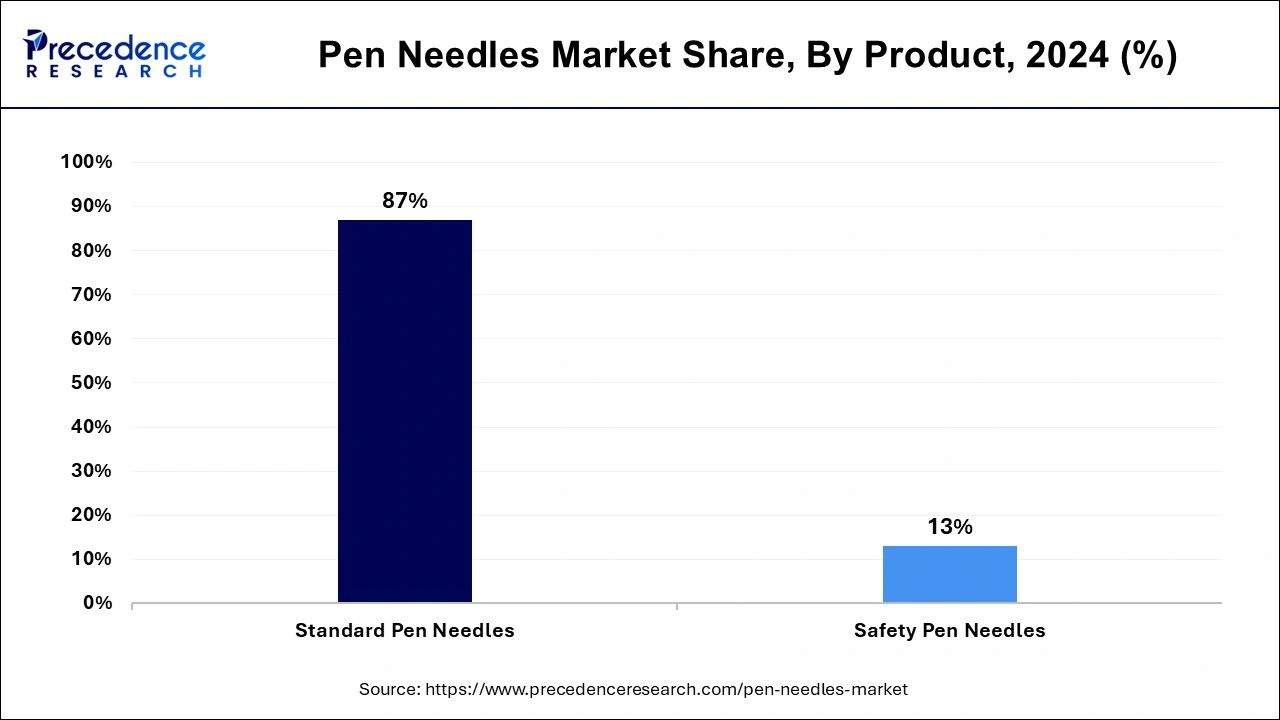

- By product, the standard segment has held the largest market share of 87% in 2024.

- By product, the safety pen needles segment is anticipated to grow at a remarkable CAGR of 13.1% between 2025 and 2034.

- By needle length, the 8mm segment generated over 35% of revenue share in 2024.

- By needle length, the 4mm segment is expected to expand at the fastest CAGR over the projected period.

- By therapy, the insulin therapy segment generated over 78% of revenue share in 2024.

- By therapy, the glucagon-like-peptide-1 segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Pen needles are small, disposable devices used in conjunction with insulin pens for the administration of insulin in diabetic patients. These needles play a crucial role in simplifying the process of insulin injection, providing a convenient and efficient method for individuals managing diabetes. Typically featuring a fine, short, and thin design, pen needles are designed to minimize pain and discomfort during injection while ensuring accurate and consistent dosage delivery.

The usage of pen needles has become a standard practice in diabetes management, offering patients a discreet and user-friendly way to self-administer insulin. With varying needle lengths and gauges, individuals can choose a needle size that suits their comfort and injection preferences. The innovation of pen needles has significantly improved the quality of life for diabetic patients, promoting better adherence to treatment regimens and enhancing overall diabetes care.

Pen Needles Market Growth Factors

- Increasing Diabetes Prevalence: The rising global incidence of diabetes continues to drive demand for pen needles, as more individuals require efficient insulin delivery.

- Advancements in Needle Technology: Ongoing innovations in needle design, such as ultra-thin and painless options, contribute to market growth by improving patient comfort and compliance.

- Growing Aging Population: The expanding elderly population, particularly in developed nations, boosts the need for reliable and user-friendly insulin delivery methods, propelling the pen needles market.

- Preference for Self-Administration: Increasing patient preference for self-administration of insulin fosters market growth, as pen needles offer a convenient and discreet option for at-home use.

- Government Initiatives for Diabetes Management: Supportive healthcare policies and initiatives worldwide aimed at enhancing diabetes management contribute to the growth of the pen needles market.

- Technological Integration with Smart Devices: Integration of pen needles with smart devices for data tracking and monitoring enhances patient engagement and further drives market expansion.

- Rise in Obesity Rates: The global obesity epidemic correlates with a higher risk of diabetes, amplifying the demand for pen needles as an essential tool in diabetes management.

- Increased Awareness and Education: Growing awareness campaigns about diabetes and the importance of proper insulin administration contribute to market growth by encouraging product adoption.

- Improved Needle Safety Features: Incorporation of advanced safety features, such as retractable needles and needle shields, enhances the safety profile of pen needles, driving market expansion.

- Expanding Healthcare Infrastructure: Improving healthcare infrastructure, especially in developing regions, facilitates better access to diabetes care products, including pen needles.

- Rising Disposable Income: Increasing disposable income levels allow more individuals to afford the convenience and benefits offered by pen needles, stimulating market growth.

- Collaborations and Partnerships: Collaborations between pharmaceutical companies and pen needle manufacturers foster market expansion by combining expertise and resources.

- Customization Options: The availability of a variety of needle lengths and gauges allows users to customize their insulin delivery, contributing to market growth through increased product appeal.

- Telemedicine Adoption: The growth of telemedicine platforms increases the accessibility of diabetes care, driving demand for pen needles as part of remote treatment options.

- Global Economic Development: Economic growth in emerging markets enhances the affordability and availability of pen needles, supporting market expansion.

- Continuous Product Launches: The introduction of new and improved pen needle products with enhanced features attracts consumers and sustains market growth through product innovation.

- Focus on Patient Convenience: Manufacturers' emphasis on creating user-friendly, easy-to-handle pen needle devices enhances patient convenience and contributes to market growth.

- Rising Healthcare Expenditure: Increased spending on healthcare, especially in developed countries, positively impacts the adoption of advanced diabetes management tools like pen needles.

- Regulatory Support: Stringent regulatory standards and approvals for pen needle safety and efficacy bolster consumer confidence and drive market growth.

- Global Pandemic Impact: The COVID-19 pandemic's focus on health awareness and the importance of managing chronic conditions like diabetes has elevated the demand for pen needles, emphasizing their role in home-based care.

Pen Needles Market Trends

- Rising diabetes prevalence is driving growth, as more patients require insulin and other injectable therapies that use pen needles.

- Patients prefer shorter and thinner needles, which are less painful and easier to use, increasing adoption of ultra-thin and short-length designs.

- Safety-engineered pen needles are gaining popularity, reducing the risk of accidental needlestick injuries for both patients and healthcare workers.

- Self-injection at home is increasing, as more people administer insulin or GLP-1 therapies themselves, supporting convenience and better adherence.

- Online sales of pen needles are growing, providing easier access to patients who may not regularly visit pharmacies.

- The aging population is boosting demand, as chronic conditions requiring injectable medications are more common among older adults.

- Manufacturers focus on comfort and innovation, with features like micro-gauge needles and advanced safety designs improving the patient experience and reducing medical waste.

Market Outlook

- Industry Growth Overview: Due to diabetes and other chronic conditions that require injectable therapies are becoming more common pen needles are seeing rapid growth. Demand is rising as more people use insulin pens and GLP-1 treatments.

- Sustainability Trends:The focus is on safety and waste reduction. Shorter, thinner, and safety-engineered needles improve patient comfort while minimizing medical waste and the risk of accidental injury.

- Global Expansion: Adoption is increasing worldwide, with mature markets in North America and Europe leading and emerging markets like the Asia Pacific and Latin America growing rapidly as healthcare access and chronic disease prevalence rise.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.41 Billion |

| Market Size in 2026 | USD 3.94 Billion |

| Market Size by 2034 | USD 11.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.71% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Needle Length, Therapy, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising diabetes prevalence and patient preference for self-administration

The increasing worldwide occurrence of diabetes is a primary driver propelling the demand for pen needles. As more people grapple with diabetes, the need for practical and user-friendly insulin delivery methods intensifies. Pen needles emerge as a solution that is not only efficient but also empowers patients to administer insulin independently. The rise in diabetes prevalence directly correlates with a heightened demand for pen needles, establishing them as a crucial tool in managing the condition.

Furthermore, there is a noticeable uptick in patients preferring self-administration. Contemporary healthcare principles emphasize patient involvement in their treatment, and pen needles align seamlessly with this philosophy. By allowing individuals to take charge of their insulin therapy, pen needles enhance patient satisfaction and contribute significantly to the growing market demand for a preferred and self-administered insulin delivery system.

Restraint

Cost concerns and needlestick injuries

Cost concerns and needlestick injuries act as significant restraints on the pen needles market. The expense associated with pen needles can be a substantial barrier, limiting accessibility for individuals with financial constraints or those residing in regions with inadequate healthcare coverage. This financial hurdle may deter potential users from adopting pen needles as their preferred insulin delivery method, hindering market growth. Additionally, despite advancements in safety features, concerns about needlestick injuries during disposal persist.

Healthcare professionals and patients alike worry about accidental needle pricks, which may lead to hesitancy in embracing pen needles. The perceived risk of injury could contribute to reluctance among both healthcare providers and individuals with diabetes, impacting the widespread acceptance and adoption of pen needles in the market. Addressing these concerns through cost-effective solutions and further enhancing safety features is crucial to overcoming these restraints and promoting the broader use of pen needles in diabetes management.

Opportunity

Patient education programs and sustainability initiatives

Patient education programs represent a significant opportunity in the pen needles market by empowering individuals with diabetes. As awareness about the condition grows, educating patients on the benefits and proper usage of pen needles becomes crucial. Comprehensive programs that provide information on self-administration techniques, safety features, and the advantages of using pen needles can enhance acceptance and foster market expansion. Informed patients are more likely to opt for these devices, driving demand and contributing to the overall growth of the market.

Sustainability initiatives are creating opportunities by addressing environmental concerns associated with pen needle disposal. As the world focuses on eco-friendly practices, manufacturers exploring sustainable materials and disposal options for pen needles can gain a competitive edge. Environmentally conscious consumers are more likely to choose products with minimal ecological impact, presenting an avenue for market differentiation. Embracing sustainability not only meets consumer expectations but also aligns with global trends, positioning pen needle manufacturers to tap into a growing market segment concerned about both personal health and environmental impact.

Segment Insights

Product insights

In 2024, the standard pen needle segment held the highest market share of 87% on the basis of the product. In the pen needles market, the standard segment refers to conventional pen needles widely used for insulin delivery. These needles typically have a fixed length and gauge, providing a standardized approach to insulin administration. Trends in the standard segment include ongoing efforts to enhance needle technology for improved patient comfort, safety features to minimize needlestick injuries, and advancements in manufacturing processes to ensure cost-effectiveness. Despite the growth of specialty pen needles, the standard segment continues to dominate, meeting the needs of a broad patient population seeking reliable and straightforward insulin delivery solutions.

The safety pen needles segment is anticipated to witness the highest growth with a significant CAGR of 13.1% during the projected period. The safety pen needles segment in the pen needles market refers to devices designed with enhanced safety features to minimize the risk of needlestick injuries. These needles often incorporate mechanisms such as retractable or shielded needles, providing an added layer of protection for healthcare professionals and patients during and after use.

A prevailing trend in the safety pen needles segment involves continuous innovation in safety technologies, including automatic needle retraction systems and user-friendly designs. These advancements aim to further reduce the occurrence of needlestick injuries and enhance the overall safety profile of insulin delivery devices.

Needle Length Insights

According to the needle length, the 8mm segment has held a 35% revenue share in 2024. The 8mm segment in the pen needles market refers to a specific needle length commonly used in insulin pens for subcutaneous injections. This segment is popular due to its versatility, suitable for a broad range of patient populations. Trends indicate a growing preference for shorter needle lengths, like 8mm, as they offer a balance between effective insulin delivery and reduced discomfort. This trend aligns with the industry's focus on enhancing patient experience, emphasizing painless and convenient injection methods for improved adherence to insulin therapy.

The 4mm segment is anticipated to witness the highest growth over the projected period. The 4mm segment in the pen needles market refers to needles with a length of 4 millimeters. This segment is characterized by its suitability for individuals with varying body types, offering a shorter and less intrusive option for insulin injection. A prominent trend in this segment is the increasing preference for shorter needle lengths, driven by the emphasis on patient comfort and the recognition that shorter needles can reduce the fear and discomfort associated with injections. The 4mm segment reflects a user-centric approach, aligning with the evolving needs and preferences of individuals managing diabetes.

Therapy Insights

According to the therapy, the insulin segment has held a 78% revenue share in 2023. The insulin segment in the pen needles market refers to devices specifically designed for the administration of insulin, a vital hormone for diabetes management. As a key trend, there is a continual shift toward the development of pen needles with advanced features, such as ultra-thin needles and painless injection options, enhancing patient comfort. Additionally, customization options in needle lengths and gauges within the insulin segment cater to the diverse needs of patients, contributing to the overall trend of personalized and patient-centric insulin therapy.

The glucagon-like-peptide-1 segment is anticipated to witness the highest growth over the projected period. In the realm of pen needles, the GLP-1 segment pertains to devices tailored for the delivery of GLP-1 receptor agonists, commonly prescribed for type 2 diabetes treatment. A noteworthy trend within this sector is the growing favorability towards GLP-1 receptor agonists, attributed to their effectiveness in blood glucose control and potential weight management benefits. With an increasing number of patients choosing GLP-1-based therapies, the demand for dedicated pen needles compatible with these medications is on the ascent, signifying a notable uptrend in this specific segment of the market.

Regional Insights

Europe Pen Needles Market Size and Growth 2025 to 2034

The Europe pen needles market size is evaluated at USD 1.72 billion in 2025 and is projected to be worth around USD 4.71 billion by 2034, growing at a CAGR of 11.83% from 2025 to 2034.

Europe has held the largest revenue share of 39% in 2024. Europe holds a major share in the pen needles market due to several factors. The region has a high prevalence of diabetes, driving the demand for efficientinsulin delivery methods. Additionally, robust healthcare infrastructure, stringent regulatory standards, and a well-informed patient population contribute to the widespread adoption of pen needles. The presence of key market players and a proactive approach toward technological advancements in diabetes management further solidify Europe's prominent position in the global pen needles market.

Asia-Pacific is estimated to witness the highest growth. The region benefits from a high prevalence of diabetes, developing healthcare infrastructure, and a significant diabetic patient population. Favorable reimbursement policies, widespread awareness about advanced diabetes management tools, and early adoption of innovative medical technologies contribute to the market's substantial share. Additionally, ongoing research and development activities and strategic collaborations among key market players in Asia Pacific further solidify the region's leading position in the global pen needles market.

Value Chain Analysis

- R&D & Product Innovation: Focus is on developing safer, thinner needles and smart injection systems to improve patient comfort, usability, and adherence. Digital integration supports therapy monitoring.

Key Players: Leading R&D players include BD, Terumo, Ypsomed, and Owen Mumford, known for needle design innovation. - Distribution to Hospital Pharmacies:Pen needles are distributed through hospital and retail pharmacies with proper packaging and storage standards. Efficient logistics ensure continuous availability.

Key Players: Companies excelling in distribution include BD, Terumo, and Owen Mumford, leveraging established logistics networks. - Patient Support and Services: Companies provide training on injection techniques, digital adherence tools, home delivery, and educational resources to improve compliance and usability.

Key Players: Companies providing strong patient support include Ypsomed, BD, and Terumo, focusing on training, subscription models, and home-delivery services.

Key Technological Shifts

|

Technology/Shifts |

Impact |

|

Safety-Engineered Designs |

Automatic shields and retractable needles reduce the risk of needlestick injuries. |

|

Ultra-Thin & Short Needles |

Finer, shorter needles make injections less painful, improving patient comfort. |

|

Eco-Friendly Materials |

Biodegradable hubs and caps help reduce medical waste and environmental impact. |

|

Smart / Connected Pens |

Compatibility with digital pens allows dose tracking and integration with health apps. |

|

Ergonomic Designs |

Improved grips, color-coded gauges, and lubrication aid patients with dexterity or vision issues. |

|

Advanced Safety Shields |

Enhanced activation mechanisms ensure reliable shielding and reduce accidental exposure. |

Pen Needles Market Companies

- Becton, Dickinson and Company

- Novo Nordisk A/S

- Ypsomed AG

- Owen Mumford Ltd.

- HTL-STREFA S.A.

- Terumo Corporation

- Allison Medical, Inc.

- Artsana S.p.A.

- Trividia Health, Inc.

- Perrigo Company plc

- B. Braun Melsungen AG

- UltiMed, Inc.

- Simple Diagnostics

- Arkray, Inc.

- GlucoRx Ltd.

Recent Developments

- Roche Diabetic Care introduced pen needles featuring ACCU-FINE technology, emphasizing painless insulin administration. This technological advancement aligns with the industry's continuous efforts to enhance patient comfort and compliance in insulin delivery, marking a notable contribution to the evolving landscape of diabetes management. Both announcements highlight the ongoing efforts within the market to bring forth cutting-edge solutions for more effective and patient-friendly insulin administration.

Segments Covered in the Report

By Product

- Standard Pen Needles

- Safety Pen Needles

By Needle Length

- 4 mm

- 5 mm

- 6 mm

- 8 mm

- 10 mm

- 12 mm

By Therapy

- Insulin

- Glucagon-like-Peptide-1 (GLP-1)

- Growth Hormone

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting