What is the Biopsy Devices Market Size?

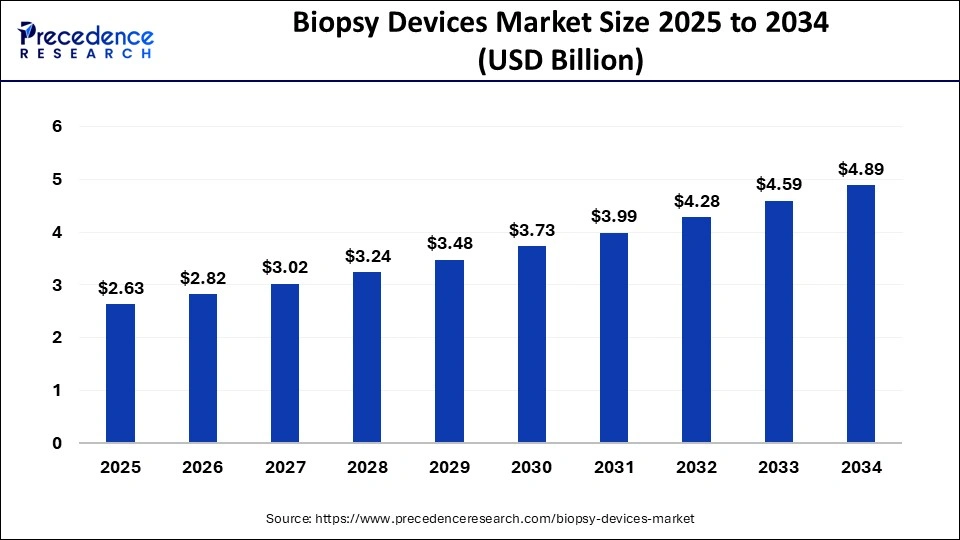

The global biopsy devices market size is calculated at USD 2.63 billion in 2025 and is predicted to increase from USD 2.82 billion in 2026 to approximately USD 4.89 billion by 2034, growing at a CAGR of 7.16% from 2025 to 2034.

Biopsy Devices Market Key Takeaways

- The global biopsy devices market was valued at USD 2.45 billion in 2024.

- It is projected to reach USD 4.89 billion by 2034.

- The biopsy devices market is expected to grow at a CAGR of 7.16% from 2025 to 2034.

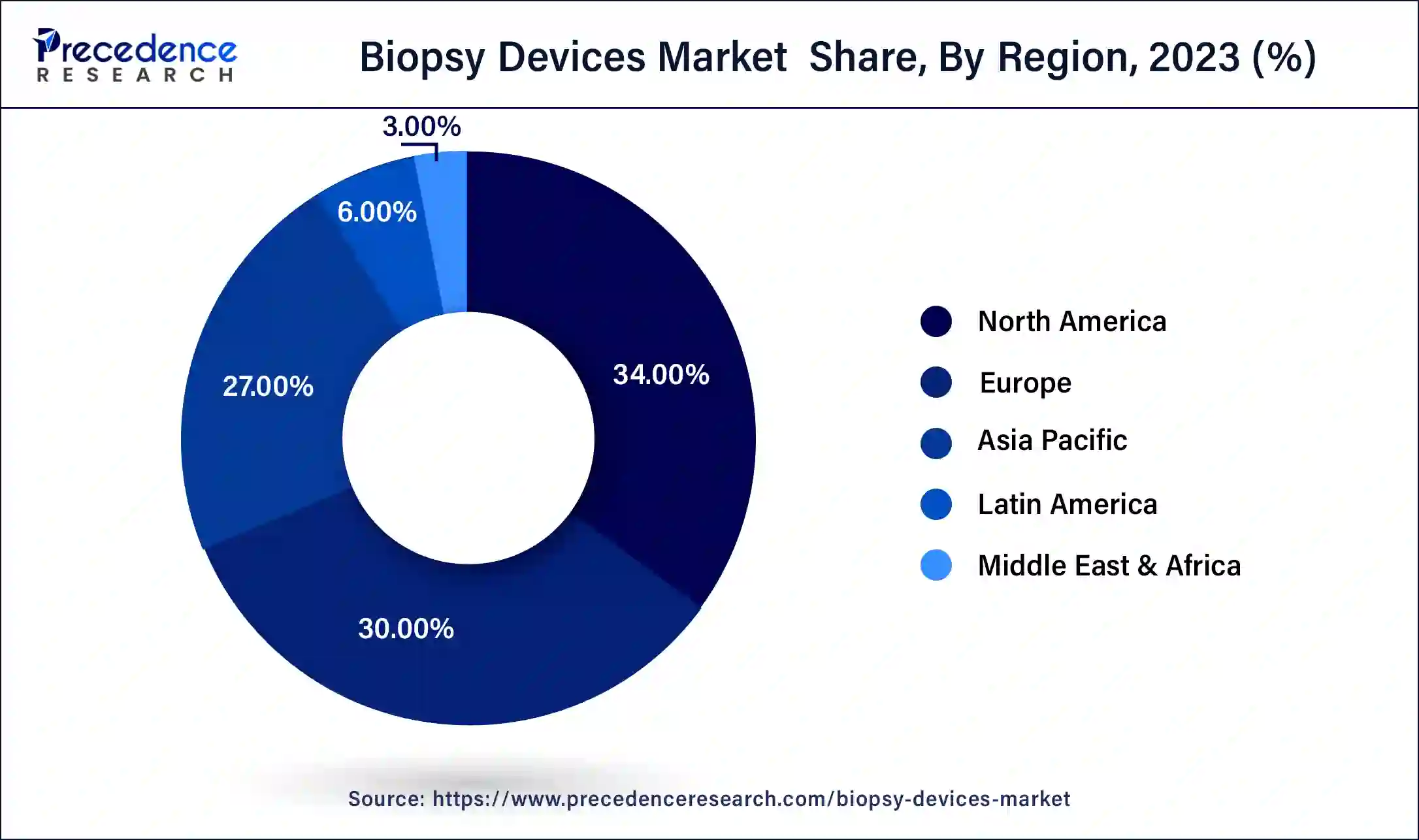

- North America region contributed more than 34% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the needle-based biopsy guns segment held the largest market share of 36% in 2024.

- By product, the biopsy needles segment is anticipated to grow at a remarkable CAGR of 8.6% between 2025 and 2034.

- By end use, the hospitals segment generated over 46% of revenue share in 2024.

- By end use, the clinics segment is expected to expand at the fastest CAGR over the projected period.

What are biopsy devices?

Biopsy devices are specialized medical tools designed for extracting small tissue samples from the body for diagnostic purposes. They are critical in identifying and studying various illnesses, especially cancer. These devices, used by medical experts like surgeons or interventional radiologists, come in different types, such as needles, forceps, or probes, tailored to specific organs or tissues.

In a biopsy procedure, a minute tissue sample is taken from a suspicious or abnormal area, enabling pathologists to examine it closely under a microscope. This examination yields crucial information about the tissue's nature, facilitating accurate diagnosis and treatment planning. Ongoing technological advancements in biopsy devices have resulted in minimally invasive techniques, reducing patient discomfort and expediting recovery. These tools are indispensable in modern healthcare, allowing for precise and targeted tissue sampling, thereby aiding in early disease detection and effective treatment strategies.

Biopsy Devices Market Growth Factors

- Technological Advancements: Ongoing innovations in biopsy device technology, such as the development of minimally invasive tools, are driving market growth by improving accuracy and reducing patient discomfort.

- Increasing Cancer Incidence: A rising prevalence of cancer worldwide is a key growth factor, propelling the demand for biopsy devices in the diagnosis and management of various cancers.

- Aging Population: The global increase in the aging population contributes to a higher incidence of diseases, particularly cancer, fueling the demand for biopsy devices for early detection and monitoring.

- Prevalence of Chronic Diseases: The growing incidence of chronic diseases necessitates frequent biopsies for accurate diagnosis and treatment planning, fostering market expansion.

- Rising Healthcare Expenditure: Increased healthcare spending globally supports the adoption of advanced biopsy devices, enhancing diagnostic capabilities and patient outcomes.

- Awareness Programs: Rising awareness about the importance of early disease detection through screening programs is boosting the demand for biopsy devices.

- Government Initiatives: Supportive government initiatives for cancer awareness and early diagnosis contribute to the growth of the biopsy devices market.

- Integration of Imaging Technologies: The integration of imaging technologies with biopsy devices improves precision, fostering their adoption in clinical settings.

- Patient Preference for Minimally Invasive Procedures: The growing preference for minimally invasive biopsy procedures among patients is a driving factor, reducing recovery time and enhancing overall patient experience.

- Expanding Biotechnology Industry: Growth in the biotechnology sector, coupled with increased research and development activities, stimulates advancements in biopsy device technology.

- Rising Disposable Income: Increasing disposable income levels enable more individuals to afford advanced healthcare services, including diagnostic procedures involving biopsy devices.

- Globalization of Cancer Care: The globalization of cancer care and standardization of diagnostic practices contribute to the widespread use of biopsy devices across regions.

- Advancements in Pathology Services: Technological advancements in pathology services, including digital pathology, are creating new opportunities for biopsy device market expansion.

- Strategic Collaborations: Collaborations between medical device manufacturers and healthcare providers for the development and distribution of biopsy devices drive market growth.

- Patient-Centric Healthcare: Growing emphasis on patient-centric healthcare encourages the adoption of advanced biopsy devices that prioritize accuracy and patient comfort.

- Increasing Demand for Personalized Medicine: The rising demand for personalized medicine necessitates precise diagnostic tools, boosting the market for biopsy devices.

- Emerging Markets: Expansion into emerging markets with increasing healthcare infrastructure contributes to the overall growth of the biopsy devices market.

- Rising Biopsy in Non-Oncological Conditions: Increasing utilization of biopsy devices in non-oncological conditions, such as inflammatory diseases, expands the market beyond cancer diagnostics.

- Telemedicine Trends: The growing prevalence of telemedicine practices amplifies the need for reliable diagnostic tools like biopsy devices to support remote healthcare services.

- Environmental Factors: The impact of environmental factors on health, including exposure to toxins and pollutants, underscores the importance of biopsy devices in understanding and addressing related health issues.

Biopsy Devices Market Outlook:

- Industry Growth Overview: From 2025 to 2030, the biopsy devices market is likely to grow steadily, given the increasing incidence of cancer and awareness of early diagnosis of cancer. Additionally, the popularity of minimally invasive procedures and imaging-guided biopsy procedures is supporting market growth in North America and the Asia Pacific.

- Global Expansion: Numerous top manufacturers are expanding into developing economies to satisfy the increasing demand for healthcare infrastructure. Many companies are also building regional manufacturing in Asia and Latin America to reduce costs and improve access.

- Key Investors: Increased healthcare spending, plus consistent demand for diagnostic procedures, has created considerable interest from private equity and medtech investors. Medtronic and BD, among others, have acquired niche players developing advanced solutions for biopsy.

- Startup Ecosystem: New startups are developing systems to provide AI-assisted guidance for biopsy, as well as smart needles that improve precision and reduce discomfort for the patient. For example, Lucida Medical (UK) is attracting investor interest in combining imaging AI to inform biopsy and mass decision-making in real-time.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 2.82 Billion |

| Market Size in 2025 | USD 2.63 Billion |

| Market Size by 2034 | USD 4.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Technological advancements and increasing disease burden

Technological advancements and the increasing disease burden drive the demand for biopsy devices in the healthcare market. Continuous innovation in biopsy device technology, marked by the development of minimally invasive tools, has significantly enhanced the precision and efficacy of diagnostic procedures. These advancements not only contribute to improved patient outcomes but also reduce procedural discomfort, fostering greater acceptance among both healthcare providers and patients.

- According to the data released by the World Health Organization (WHO)'s cancer agency, the International Agency for Research on Cancer (IARC), in February 2024, nearly 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. Lung cancer was the most commonly occurring cancer worldwide, with 2.5 million new cases accounting for 12.4% of the total new cases.

Simultaneously, the escalating global disease burden, notably the rising incidence of cancer and other conditions requiring diagnostic biopsies, intensifies the need for sophisticated and efficient biopsy devices. As healthcare systems worldwide prioritize early detection and personalized treatment strategies, biopsy devices play a pivotal role in delivering timely and accurate diagnostic information. The integration of cutting-edge technology into these devices enhances diagnostic capabilities, making them indispensable tools for healthcare professionals navigating the challenges posed by the increasing complexity and prevalence of diseases.

Restraint

Invasive nature and limited expertise

The invasive nature of certain biopsy procedures poses a significant restraint on the market demand for biopsy devices. Patients may express reluctance to undergo invasive tests due to concerns about pain, discomfort, or potential complications associated with the procedure. This reluctance can lead to a delay in seeking necessary diagnostic assessments, hindering the adoption of biopsy devices in clinical settings.

Additionally, the perception of invasiveness may contribute to patient anxiety, impacting overall patient compliance and satisfaction. Limited expertise required for some biopsy devices acts as another restraint.

The successful application of certain advanced biopsy technologies demands specialized skills and training, which may not be uniformly available across healthcare settings. The scarcity or uneven distribution of professionals with the requisite expertise may impede the widespread adoption of these devices, particularly in regions facing healthcare workforce challenges. This constraint underscores the importance of comprehensive training programs to ensure the effective and widespread utilization of biopsy devices in diverse healthcare environments.

Opportunity

Rising focus on liquid biopsy and point-of-care biopsy devices

The rising focus on liquid biopsy and the development of point-of-care biopsy devices represent significant opportunities in the market for biopsy devices. Liquid biopsy techniques, involving the analysis of blood or other bodily fluids for biomarkers, offer a less invasive and more accessible approach to diagnostics. This innovation allows for early detection of diseases, especially cancers, and facilitates monitoring of treatment responses. As liquid biopsies become integral to personalized medicine, biopsy device manufacturers have the opportunity to contribute to this evolving field by developing devices capable of analyzing circulating tumor DNA and other relevant biomarkers.

Simultaneously, the emergence of point-of-care biopsy devices is transforming diagnostic workflows by enabling rapid and on-site assessments. These devices are particularly valuable in resource-limited settings and urgent medical situations, providing real-time results and reducing the need for extensive laboratory infrastructure. The accessibility and efficiency offered by point-of-care biopsy devices create opportunities for improved patient care, especially in scenarios where timely diagnostic information is critical, such as emergency situations or remote healthcare settings. Both liquid biopsy and point-of-care devices cater to the growing demand for more patient-friendly, efficient, and accessible diagnostic solutions, driving positive momentum in the biopsy devices market.

Product Insights

In 2024, the needle-based biopsy guns segment had the highest market share of 36% on the basis of the product. Needle-based biopsy guns are a key segment in the biopsy devices market, encompassing devices designed for extracting tissue samples using a spring-loaded or compressed-air mechanism. These guns offer precise and minimally invasive tissue collection, aiding in the diagnosis of various medical conditions, especially cancers. Current trends in this segment include ongoing advancements in needle design for improved accuracy, enhanced safety features, and the integration of imaging technologies, such as ultrasound guidance. These innovations aim to make the biopsy process more efficient, reducing patient discomfort and contributing to the overall growth of the market.

The biopsy needles segment is anticipated to expand at a significant CAGR of 8.6% during the projected period. Biopsy needles constitute a vital segment in the biopsy devices market, serving as core instruments for tissue sample extraction. These needles are characterized by their diverse designs, including core biopsy, fine needle aspiration, and vacuum-assisted types.

A notable trend in this segment is the ongoing development of advanced biopsy needle technologies, such as those with improved precision, enhanced visibility under imaging, and reduced patient discomfort. The market witnesses a shift towards more minimally invasive and accurate biopsy needle options, reflecting a commitment to improving diagnostic outcomes and patient experiences.

End Use Insights

According to the end use, the hospitals segment has held 46% revenue share in 2024. In the biopsy devices market, the hospital segment refers to the utilization of biopsy tools and technologies within hospital settings for diagnostic and treatment purposes. As key healthcare institutions, hospitals are prominent end-users of biopsy devices, employing these tools across various medical specialties. A notable trend in this segment involves the increasing integration of advanced biopsy technologies, such as minimally invasive procedures and digital pathology, within hospital workflows. This trend aims to enhance diagnostic accuracy, streamline procedures, and contribute to improved patient outcomes within the hospital environment.

The clinics segment is anticipated to expand fastest over the projected period. The clinics segment in the biopsy devices market refers to healthcare facilities, independent of hospitals, that offer diagnostic and treatment services. Clinics play a vital role in biopsy procedures, providing a more accessible and streamlined environment for patients. A notable trend in this segment includes the integration of advanced biopsy technologies into clinic settings, allowing for quicker diagnoses and more patient-centric care. As clinics increasingly focus on expanding their diagnostic capabilities, the demand for biopsy devices in these settings is expected to continue growing.

Regional Insights

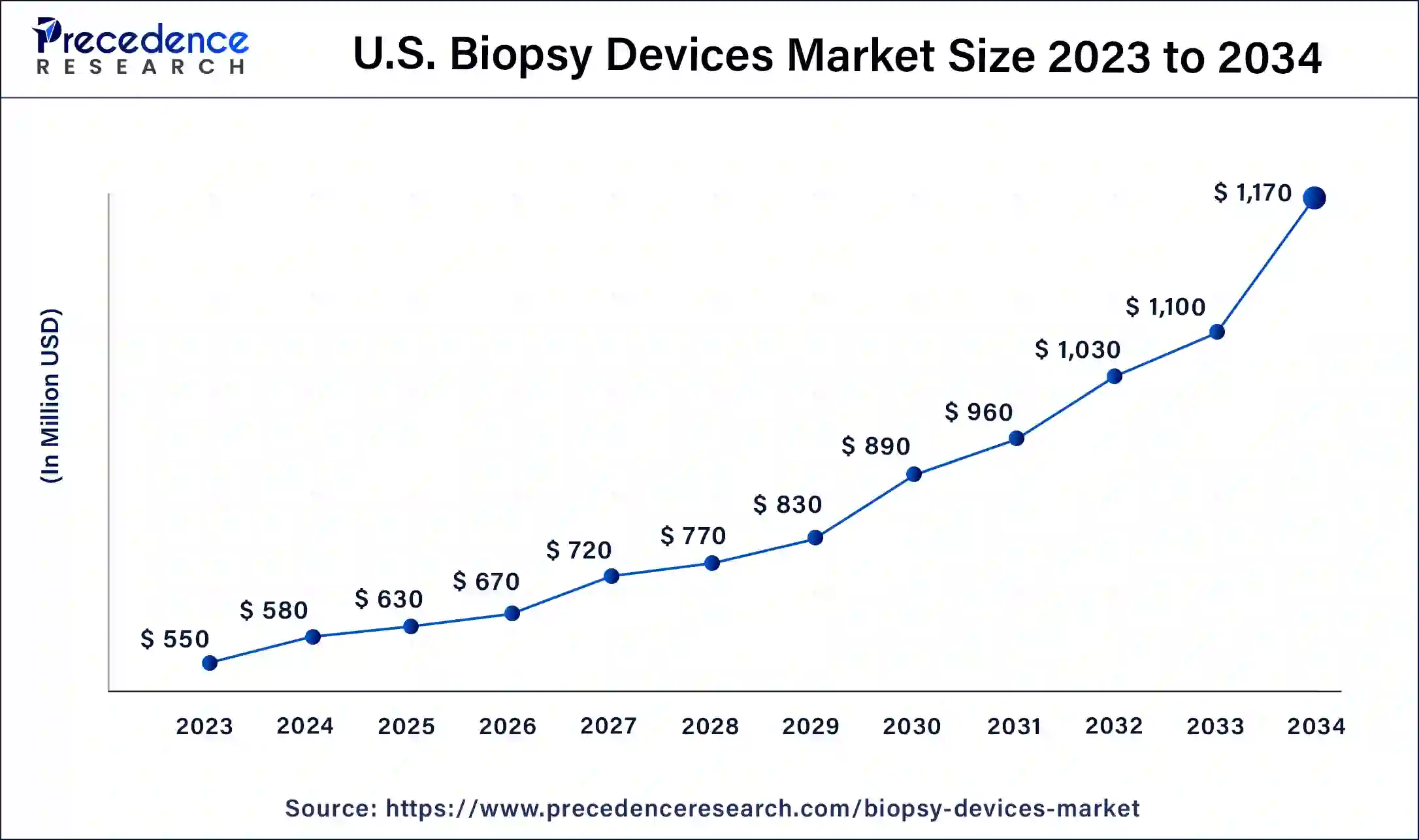

U.S. Biopsy Devices Market Size and Growth 2025 To 2034

The U.S. biopsy devices market size is valued at USD 630 million in 2025 and is expected to be worth around USD 1,170 million by 2034, at a CAGR of 7.27% from 2025 to 2034.

North America has held the largest revenue share of 34% in 2024 North America commands a significant share in the biopsy devices market due to factors such as a well-established healthcare infrastructure, high healthcare expenditure, and a robust research and development ecosystem. The region's emphasis on early disease detection, coupled with a rising incidence of cancer, propels the demand for advanced biopsy technologies. Additionally, a proactive regulatory framework and strong industry collaborations contribute to the dominance of North America in the biopsy devices market, with the presence of key market players and a focus on technological innovations further reinforcing its leading position.

- According to the CDC data published in May 2024, every year in the United States, 1.7 million people are diagnosed with cancer, and more than 600,000 die from it, making it the second leading cause of death.

Additionally, a proactive regulatory framework and rising adoption of key market strategies by the key market players to such as acquisition and collaboration, are expected to contribute to the dominance of North America in the biopsy devices market. For instance, in December 2024, PanGIA Biotech, a US-based biotechnology company, announced its international partnership, collaborating with Canary Oncoceutics. This collaboration introduced the PanGIA Prostate Assay, the world's first AI-integrated urine-based liquid biopsy for prostate cancer detection, marking its commercial debut in India.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the biopsy devices market due to factors such as the region's large and aging population, increasing prevalence of chronic diseases, and growing awareness about early disease detection. Rising healthcare investments, improving healthcare infrastructure, and a surge in demand for advanced diagnostic technologies contribute to the market's prominence. Moreover, the presence of key market players, strategic collaborations, and efforts to address unmet medical needs further drive the adoption of biopsy devices in the Asia-Pacific region, solidifying its major market share.

Why did the U.S. dominate the North American biopsy devices market?

The North American biopsy devices market was dominated by the U.S., with its advanced healthcare systems and increasing investment in cancer research. Government funding for national early cancer detection programs, as well as insurance coverage for testing, played a role in the overall growth of the market. Companies like Medtronic and Boston Scientific were significant players that were investing significantly in R&D when it came to innovations in precision-guided biopsy devices.

Why did China dominate the biopsy devices market in Asia-Pacific?

China was the leader of the biopsy devices market in Asia-Pacific, where significant investments in hospital modernization and cancer diagnosis initiatives were taking place. Changes in the government's health reform agenda also encouraged the use of precision medical devices. Domestic companies began partnering with international businesses to provide high-quality biopsy products at affordable prices. The growing urbanization and expenditure in healthcare also helped China further reinforce its position as a manufacturing and innovation hub for biopsies and diagnostic equipment.

What made Europe grow substantially in the global biopsy devices market?

The European biopsy devices market has grown substantially as a result of a strong level of medical research, good quality healthcare systems, and an initiative for early screening for cancer. Encouraging regulatory policies and government-funded research ultimately increased and spurred innovation. The region also has an emphasis on robotic and image-guided technologies for biopsy. Moreover, opportunities in the region consisted of technological partnerships, adopters, a merger between the public and private sector to improve diagnostic accuracy and improve patient outcomes in diagnosing cancer and other diseases involving tissue, and other diseases.

Germany Biopsy Devices Market Trends

Germany led the regional market because of their represented healthcare systems, and several strong medical research institutions. Hospitals in Germany have adopted digital devices and image-assisted biopsy equipment rapidly. Investment in and continued funding for R&D by local manufacturing companies and universities motivated clusters of innovation in imaging and diagnostic research.

What made Latin America grow rapidly in the biopsy devices market?

The growth of the biopsy devices market in Latin America was substantial, given the heightened awareness of cancer and the development of the diagnostic infrastructure. Countries in the region developed new technologies for the hospital sector and initiated government health programs. Furthermore, opportunities existed in the sector as local manufacturing of affordable devices was feasible, and the region offered opportunities for partnerships, upgrading rural areas with mobile diagnostics to bring awareness to gaps in early detection of disease.

Brazil Biopsy Devices Market Trends

Brazil was the largest market for market in Latin America, given the rising number of cancer cases and the modernization of healthcare. The public hospitals in Brazil adopted image-guided and minimally invasive biopsy systems. Expanding government initiatives for cancer screening and enhanced training for healthcare providers supported improved diagnosis rates. Moreover, expanding local manufacturing and partnerships with company imports for international brands also enhanced access to advanced biopsy devices in city hospitals and regional hospitals.

Why did the biopsy devices market in the Middle Eastern and African region experience notable growth?

The biopsy devices market in the Middle Eastern and African region experienced notable growth, driven primarily by increased investments in healthcare infrastructure, coupled with rising cancer incidence. Increased access to and improved diagnostic capacities, contributing to rapid advancements in diagnostic capacity, are now available in these countries for patients to access modern medical equipment. Government and private funding have encouraged the use of minimally invasive biopsy devices.

The UAE Biopsy Devices Market Trends

The UAE led the regional biopsy devices market through high spending on medical technology and rapid modernization of the healthcare system. Advanced hospitals in Dubai and Abu Dhabi quickly implemented robotic and imaging-guided biopsy systems. Government initiatives to create a medical tourism destination further impacted and fueled high levels of investment in diagnostic devices. In addition, collaborations with Western manufacturers resulted in greater access to the newest biopsy technologies and training programs in the country.

Biopsy Devices Market Players

- Medtronic plc

- Becton, Dickinson, and Company

- Hologic, Inc.

- Boston Scientific Corporation

- Olympus Corporation

- C. R. Bard, Inc. (acquired by BD)

- Cook Medical LLC

- FUJIFILM Holdings Corporation

- Mauna Kea Technologies

- Devicor Medical Products, Inc.

- Leica Biosystems Nussloch GmbH (Danaher Corporation)

- INRAD Inc.

- Argon Medical Devices, Inc. (acquired by Shandong Weigao Group Medical Polymer Company Limited)

- Scion Medical Technologies LLC

- MDxHealth SA

Recent Developments

- In February 2025, a professor of SOA University developed an automated oral biopsy device, which has received a U.S. patent. The device has simplified the process of biopsy, and its user-friendly, automated pen-like device is likely to revolutionise oral biopsy procedures.

- In September 2024, Owlstone Medical announced the launch of Breath Biopsy VOC Atlas to unlock disease biomarkers in human breath. Breath Biopsy VOC Atlas offers a catalogue of identified and quantified volatile organic compounds (VOCs) found in exhaled breath.

- In April 2025, SOPHiA GENETICS, a cloud-native healthcare technology company, proudly announced the expansion of its ongoing collaboration with AstraZeneca to accelerate the deployment of MSK-ACCESS powered with SOPHiA DDM worldwide. The expanded collaboration aims to accelerate liquid biopsy testing globally from AACR.

Segments Covered in the Report

By Application

- Needle-based Biopsy Guns

- Biopsy Guidance Systems

- Biopsy Forceps

- Biopsy Needles

By End Use

- Hospitals

- Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting