What is the Pet Snacks And Treats Market Size?

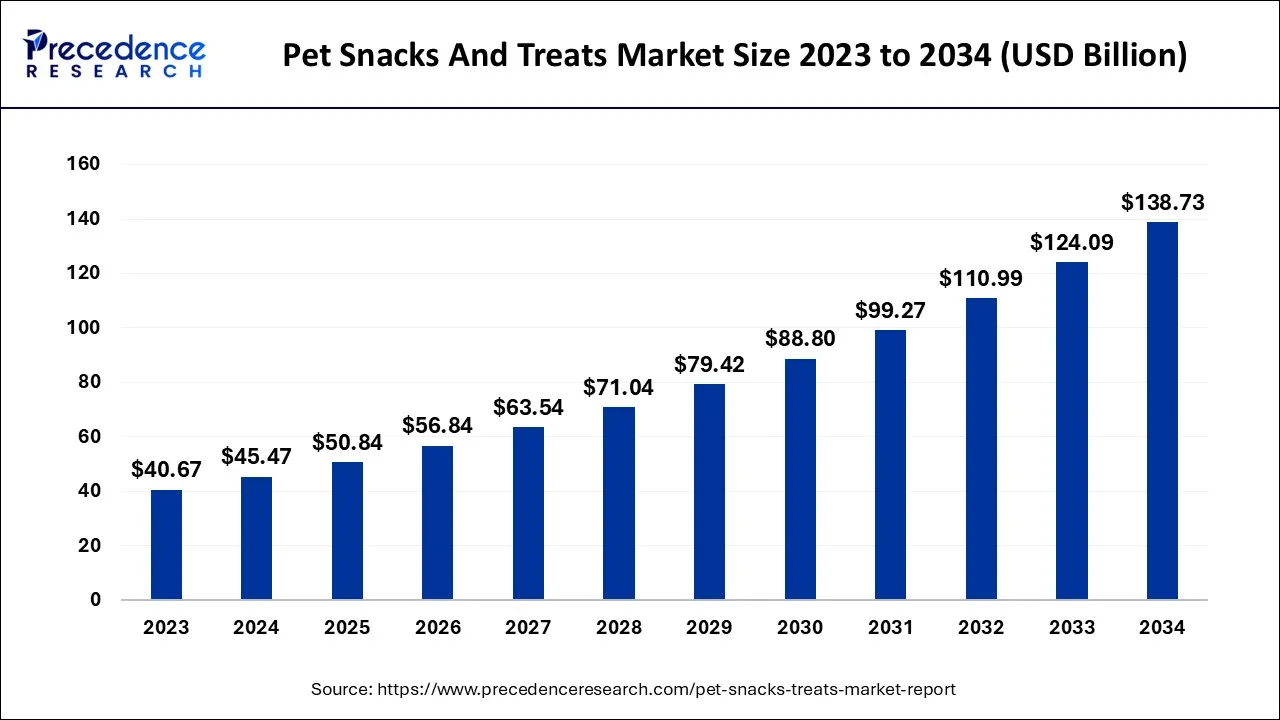

The global pet snacks and treats market size is expected to be valued at USD 50.84 billion in 2025 and is anticipated to reach around USD 138.73 billion by 2034, expanding at a CAGR of 11.8% over the forecast period from 2025 to 2034.

Market Highlights

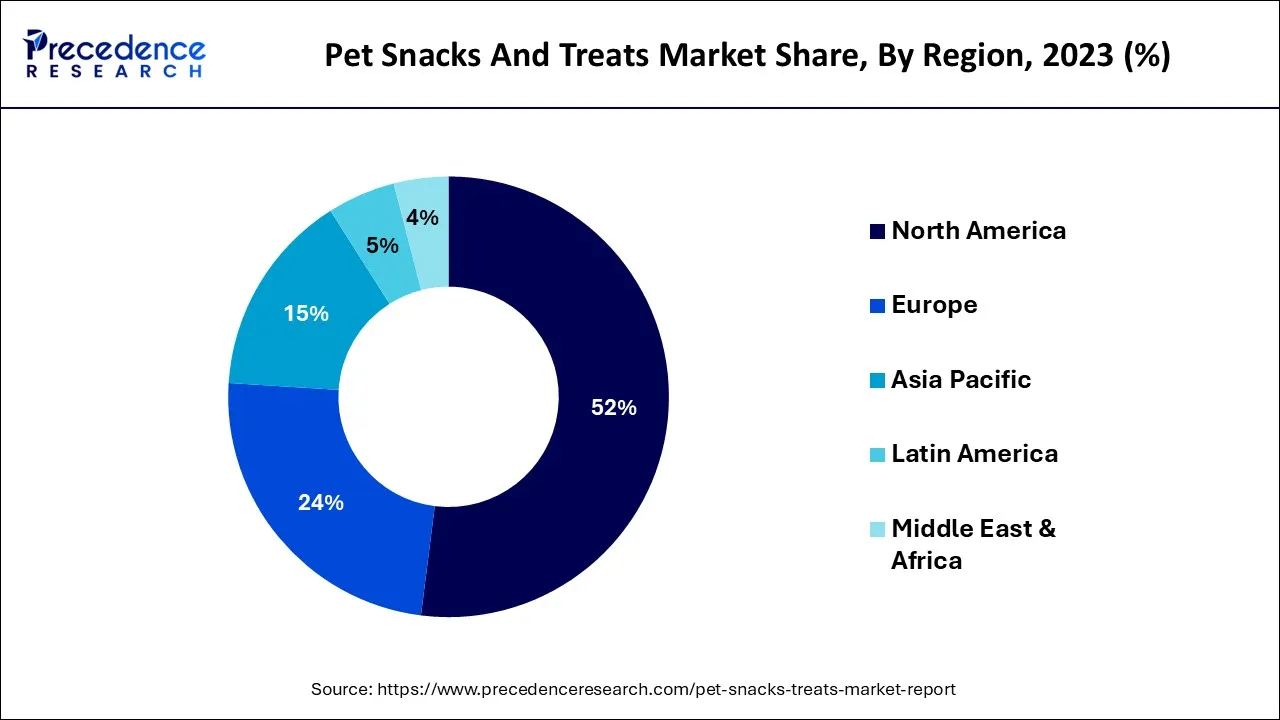

- North America led the global market with the highest market share of 52% in 2025.

- By product, eatables segment has accounted highest revenue share of over 65.4% in 2025.

- The chewable segment is expanding at a CAGR of 12.1% over the forecast period.

- By pet type, dogs segment has accounted revenue share of over 68% in 2025.

- The cats segment is growing at a registered CAGR of 19.9% between 2025 and 2034.

- By distribution channel, the supermarkets & hypermarkets segment was highest revenue holder in 2023 which was 44.8%.

- The online segment is poised to grow at a CAGR of 11.5% over the forecast period.

“Healthy Indulgence Driving Pet Treat Demand”

Pet snacks and treats are the food products offered to various pets and they are derived from animal material and plant material. This is a specialized product provided to dogs, cats, and other aquatic animals. Different kinds of beverages, treats and snacks are available for pets. Treats are offered to the pets to bring about positive behavior in them.

Snacks are instrumental in increasing the nutritional intake of pets. The products are available in the form of dried fruits, dried vegetables, and biscuits. Pet snacks and treats are also available in the form of roasted grains. Different types of treats consist of dental chews, jerky and other products. All these products are available in the form of powder, wet products, and dry products.

Pet Snacks And Treats Market Growth Factors

- Increasing awareness about the nutrition and health of pets will lead to increased consumption of pet snacks and treats in the coming years.

- An increase in disposable income has also played a significant role in the growth of the market.

- Healthy treats and specialty snacks are offered in the market.

- The adoption of pets in various nations has increased significantly due to which the demand for these products has also increased.

- A variety of flavors and options are available in the market for cats and dogs. Different alternatives are expected to drive market growth.

- Easy availability of these products on the e-commerce platforms is anticipated to drive market growth.

- Growing needs for new formats and products will lead to the development of innovative products.

- To ensure the well-being and health of the pets the visits to veterinary doctors have also increased due to which few functional foods are prescribed.

- The introduction of plant-based products for pets has provided good opportunities for the growth of the market as few animals have dietary issues like allergies and obesity.

The market is expected to grow in the long run due to the growing demand for functional treats. Few health benefits are associated with the consumption of these treats when the nutritional content of these products is taken into consideration. Treats can be prepared industrially, and they are available in the form of biscuits, semi-moist treats, dried parts of various animals, and extruded products.

To prevent anxiety, and bad breath and to increase the immunity of pets these treats have gained popularity. They also help in improving the coat of the pets and the skin of the pets. Functional treats are available in the form of products that are beneficial for the joints and the teeth. Pet owners make use of these treats to improve their relationship with pet animals. New companies are entering the market to specialize in the production of various palatable treats and snacks.

Pet Snacks and Treats Market Outlook

- Market Overview- With pet owners increasingly considering their pets as family members, thus demanding more premium and indulgent pet food products, the growth of the pet snacks and treats market continues to surge. Even globally, we can see growing nutritional awareness and transparency in ingredient sourcing drive purchasing behavior.

- Global Growth- Rapidly urbanizing populations with rising disposable incomes along with developing retail infrastructure are enabling deeper market penetration in emerging markets, enabling multinational brands to expand into Asia and Latin America via local partnerships and multiple channels.

- Research and Development- Manufacturers are continuing to invest to innovate their offerings by formulating new blended functional, organic, single source, and sustainability focused claims. Broadly, technology in processing and preservation is enabling longer shelf life while still maintaining quality.

- Consumer and Retail Trends- In a digitalized retail environment, purchasing behavior has shifted for pet owners as they now look to purchase based on subscription for delivery, and influence by brands. Social media campaigns and direct to consumers are becoming indispensable to brand loyalty and identifying niches.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 50.84 Billion |

| Market Size in 2026 | USD 56.84 Billion |

| Market Size by 2034 | USD 138.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.0% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Pet Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased number of pet parents

The number of people owning pets has increased globally. These pets are considered family, and they are considered for all their daily activities. Millennials own the largest number of pets across the globe. These pet owners are constantly on the lookout for natural supplements, delicious and healthy food, and a fresh diet and these pet owners certainly choose quality over price.

Increased sales through e-commerce platforms

Millions belong to the digital generation and most of these pet parents prefer shopping online. The availability of various products on online platforms and certain ads posted on social media websites play an instrumental role in the sales of pet snacks and treats.

Rapid urbanization

Small mammals are also adopted as pets by most urban couples across the globe. Unlike former generations, millennials are more open to innovative and advanced products. They do not hesitate to spend more money to gain quality products for their pets and all of these factors are expected to drive market growth to a great extent in the coming years.

Restraints

Expensive products

Various products offered to pets in the form of snacks are expensive in nature. The lower-income group may not be able to afford such products, and this happens to restrain the growth of the market to a greater extent.

Opportunities

Growing demand for senior formulation

To meet the nutritional needs of senior dogs and cats, prominent companies are engaged in designing nutrition-specific foods to provide an adequate number of vitamins, minerals, calories, and proteins to pets. This kind of diet plays a significant role in controlling obesity in senior pets. These formulations will also help in increasing their immunity and managing their joint pains. Such formulations can be enriched with omega-3 fatty acids to reduce inflammation in pets.

Vegan and vegetarian diets are gaining popularity

To reduce the carbon footprint of pets parents are looking out for options in vegan diets and vegetarian diets. Recent studies have shown that millennials can afford to spend 20% more on snacks and treats for their pets. Sustainable options will gain popularity in the coming years and provide major growth opportunities during the forecast period.

The trend of pet humanization will drive the market growth

These companions are seen as family members and the pet parents do not hesitate on buying high-quality and premium products for their pets. In the past, if the sales of these products are taken into consideration it can be seen that the consumption of high-quality and premium products has shown the fastest growth.

Challenges

Strict rules and regulations are associated with snacks and treats.

Market growth will be obstructed by stringent regulations. All of these products are highly regulated. When it comes to Western countries the policies adopted by these nations challenge the growth of the market. The utilization of ingredients undergoes a stringent examination. The commercialization of these products is also strict, and this is also expected to harm the growth of the market. Even though good quality and premium products are available in the market they are expensive, and this is also another reason that will pose an obstacle to market growth.

Segments Insights

Product Insights

The eatables segment dominated the market in the past. New products are launched constantly to meet the growing demand for innovative products. Natural ingredients are used in premium products to meet the growing need for functional foods. The vegan diet is also gaining popularity and prominent players are engaged in offering such snacks and treats.

Pet owners are likely to purchase vegetarian snacks and treats for pets on a large scale in the coming years due to the benefits associated with the consumption of such products.

Snacks and treats are available in chewable form. This segment is also expected to register significant growth. In the elderly pet, broken or loose teeth lead to indigestion, and to address this issue snacks and treats are offered in the form of chewable. Many market players are launching chewable products to meet the nutritional demand of aging pets.

Pet Type Insights

The highest compound annual growth rate will be registered in the cat segment. To ensure the good health of cats and other pets the need for functional foods and premium food is expected to increase. Although various companies are engaged in the production of cat food, a large number of snacks and treats are consumed by the dog segment.

Digestive disturbance and allergies are expected to create more demand for a vegan diet, and this shift in the consumption of snacks and treats will drive market growth.

Distribution Channel Insights

The hypermarket and supermarket segments will generate maximum revenue. A variety of pet foods are available at these stores. Various flavors and the availability of vegan food products will drive market growth for this segment during the forecast period. The major chains of these stores provide a variety of premium products.

After the outbreak of the COVID-19 pandemic, the online segment has gained momentum. The shopping habits of people have changed to a great extent due to the advantages provided by e-commerce platforms. The availability of discounts on products at a single place with lucrative offers and doorstep delivery will increase the sales of pet snacks and treats through this mode.

Regional Insights

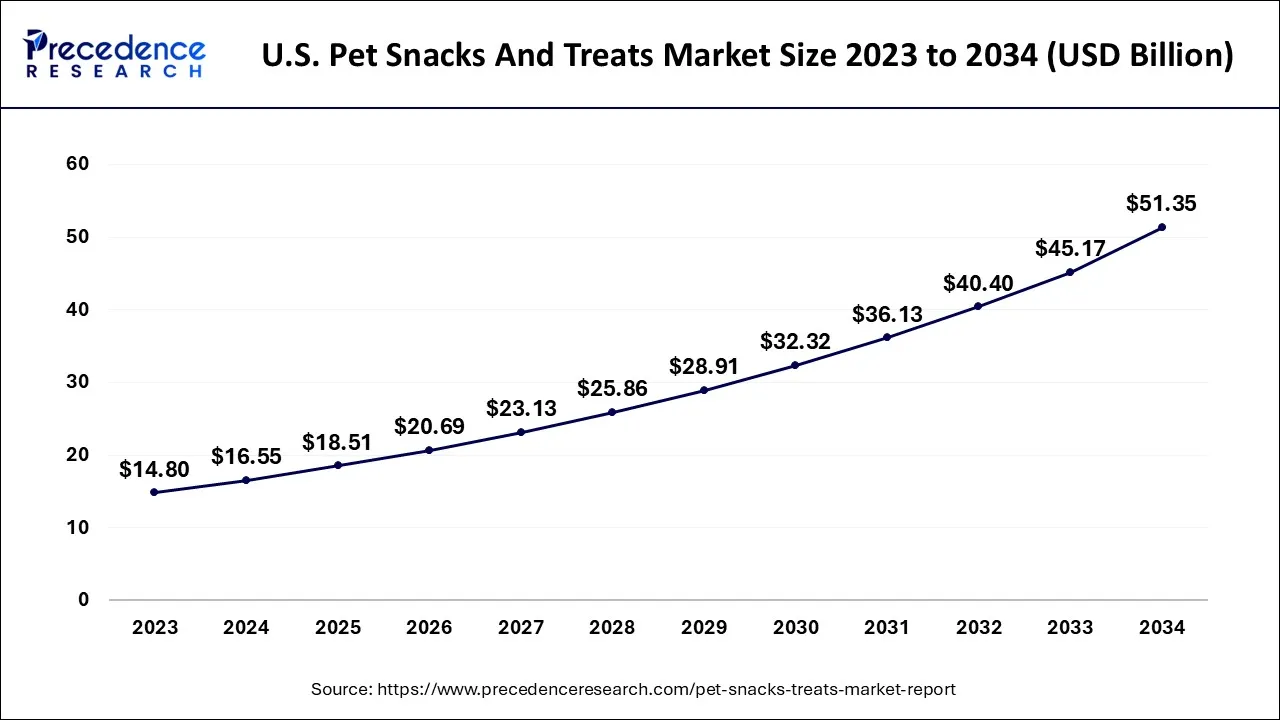

U.S. Pet Snacks And Treats Market Size and Growth 2025 to 2034

The U.S. pet snacks and treats market size is exhibited at USD 18.51 billion in 2025 and is projected to be worth around USD 51.35 billion by 2034, growing at a CAGR of 11.99% from 2025 to 2034.

The majority share is held by the North American market across the globe. Different types of pets are adopted on a large scale in North American nations. This happens to be the most important reason for the growing demand for pet snacks and treats in this region. Pet humanization is gaining popularity in most nations across the globe and similar is the case in the North American region due to which the demand for pet snacks and treats has grown tremendously.

The constant demand for nutrition will lead to the manufacturing of healthy products for pets. The amount of money spent on premium and high-quality products in the North American region is the most.

The constant need for safe and sustainable food products is expected to drive market growth in European nations. The ingredients used in the manufacturing of pet snacks and treats in the European nation demand better transparency. Highly conscious pet parents in the European nation led to the introduction of new and innovative products in the market.

What is Making Europe Strong?

The increase in pet population and growing trend toward pet humanization are supporting the significant growth of the pet snacks and treats market. Consumers are more health conscious about their pets and don't mind spending more for nutritious, functional, and grain-free treats. The increasing presence of pet specialty retail stores, along with the ease of shopping online also contributes to growth in the region.

The fastest growth will be registered in the Asia Pacific nations, especially in the countries like China, Australia, and Japan. The revenue generated in these nations is maximum. Important food products for cats and dogs have a greater demand in Japan. Significant growth will be registered in India in the anticipated time frame. The amount of expenditure made on premium food products is expected to grow during the forecast period. Investments made by the prominent market players for the developing nations have also grown significantly in recent times and this is also expected to drive market growth.

What is Making Latin America Fast Growing?

Latin America has emerged as a booming region for pet snacks and treats, driven by the steady increase pet ownership and rising disposable income in Latin American countries like Brazil, Mexico, and Chile. The societal shifts of urbanization and changing family strucutres provide stronger support for companion animal adoption, encouraging market penetration. Local manufacturers are producing less expensive yet desirable alternatives to established brands and appealing to the middle-income population.

Pet Snacks and Treats Market Companies

- Mars, Incorporated and its Affiliates

- Nestlé

- SCHELL & KAMPETER, INC

- The J.M. Smucker Company

- Hill's Pet Nutrition, Inc.

- Addiction Foods

- Wellness Pet Company

- Spectrum Brands, Inc.

- Unicharm Corporation

- Blue Buffalo Co., Ltd

Receent Developments

- In February 2025, A London-based startup has launched the first commercially available pet treats made with lab-grown chicken meat in the UK, marking a breakthrough in sustainable animal-free pet food.

- In June 2025,RBC Capital Markets upgraded General Mills Inc. (GIS) to “Outperform”, citing a 3% organic sales increase in its North America pet segment and potential upside from its fresh-pet launch.

- In June 2025, Ultimate Pet Nutrition expanded its retail footprint by launching its Nutra Complete freeze-dried dog food and Nutra Thrive supplement across 650 Pet Supplies Plus stores in the U.S., marking its first major brick-and-mortar rollout.

Segments Covered in the Report

By Product

- Eatables

- Chewables

By Pet Type

- Dogs

- Cats

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Pet Stores

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting