What is the Vegan Food Market Size?

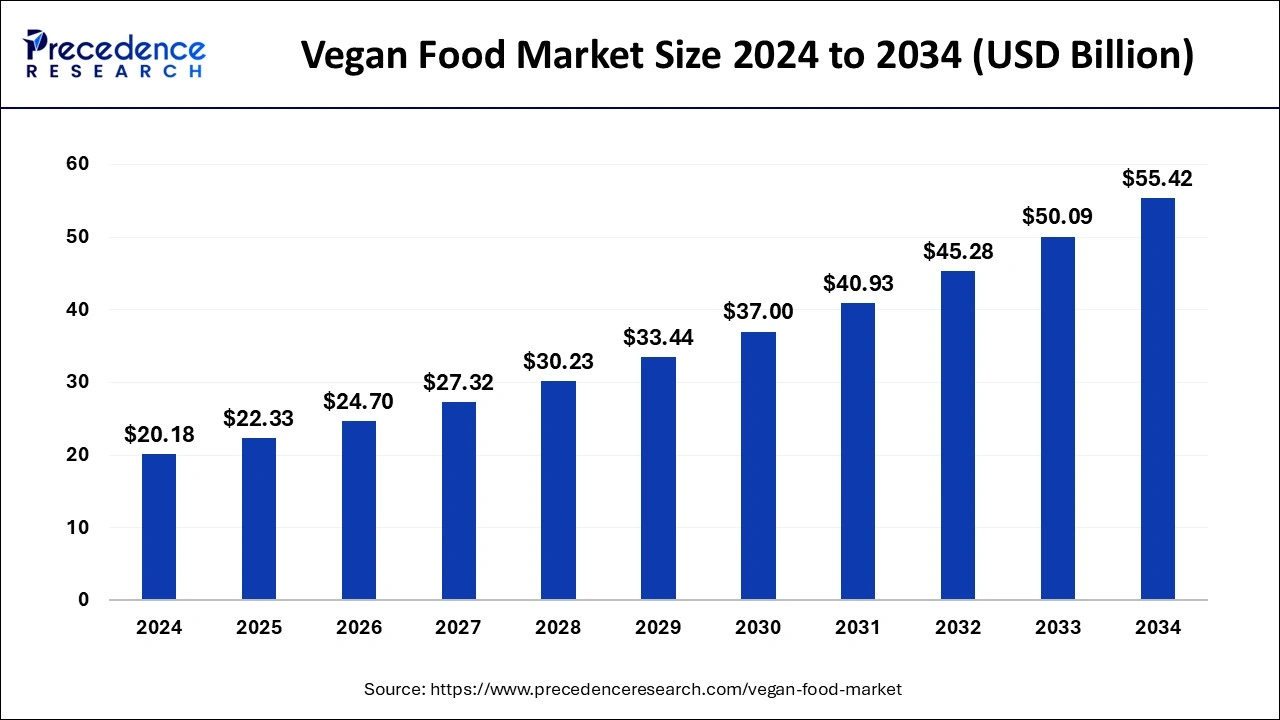

The global vegan food market size was estimated at USD 20.18 billion in 2024 and is anticipated to reach around USD 55.42 billion by 2034, expanding at a CAGR of 10.63% from 2025 to 2034.

Vegan Food Market Key Takeaways

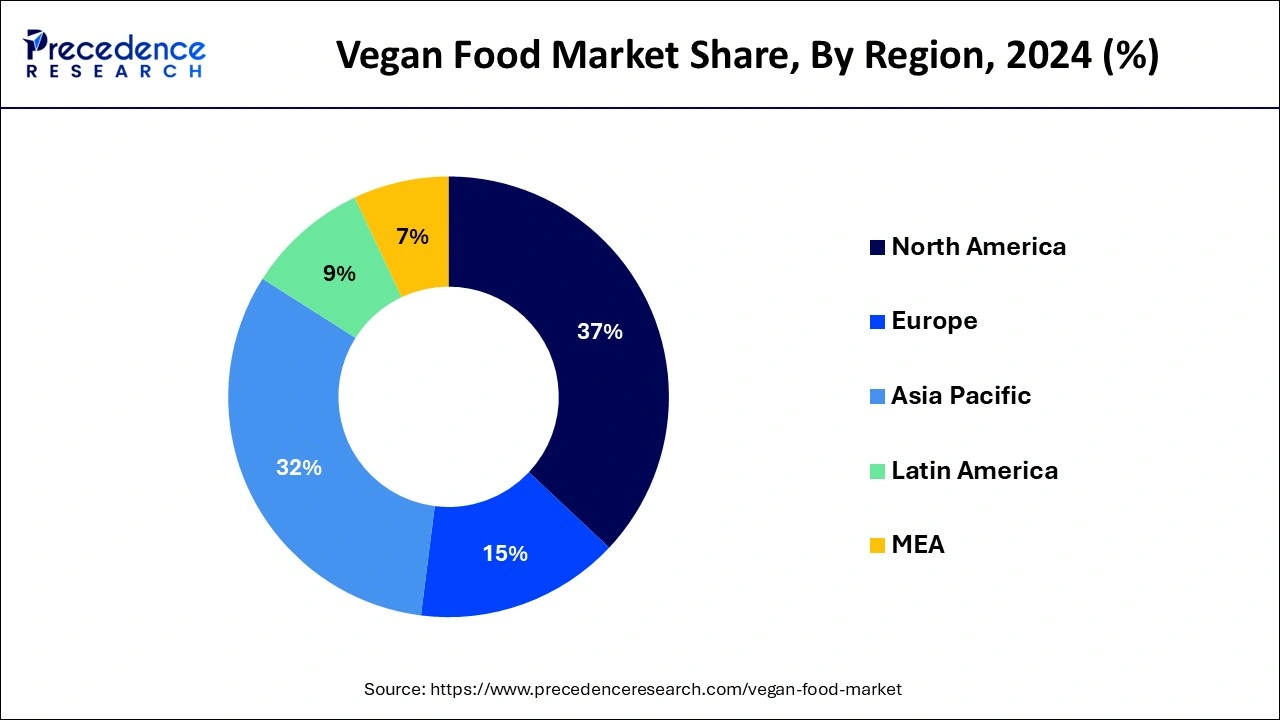

- North America dominated the global vegan food market with the largest share of 37% in 2024.

- Asia Pacific is expected to expand at a double digit CAGR of 11.52% during the forecast period.

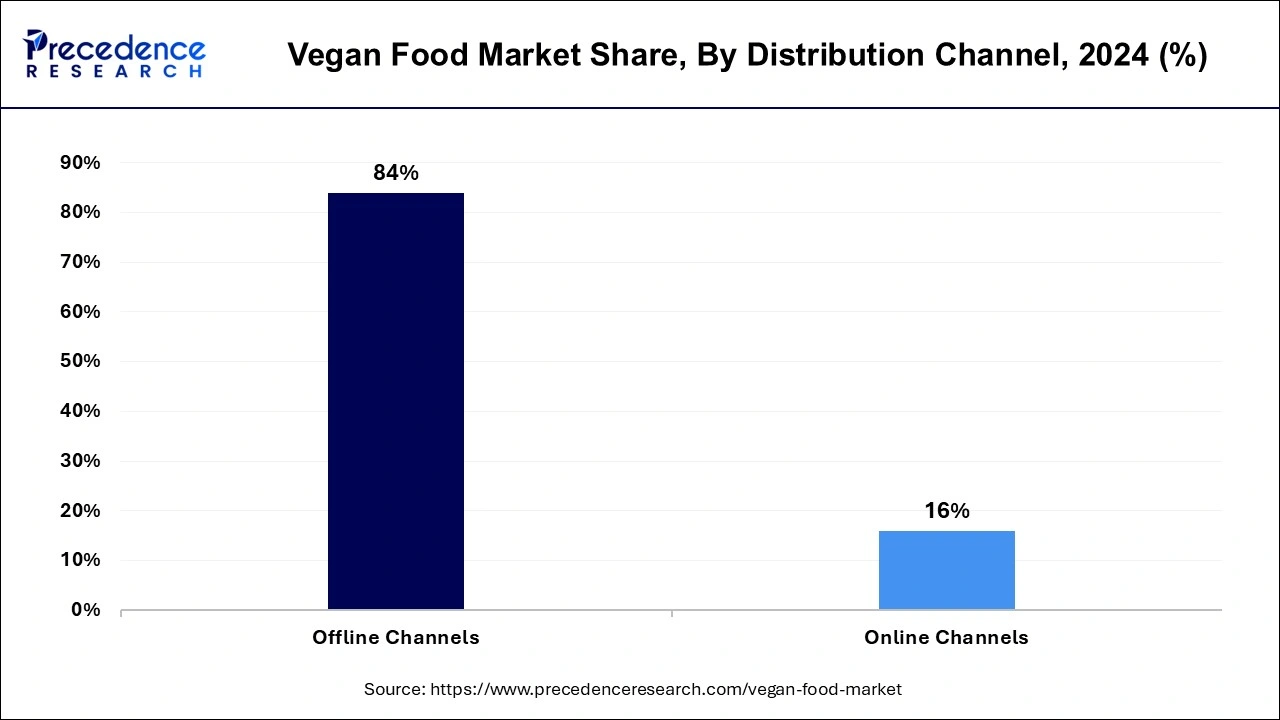

- By distribution channel, the offline channels segment has held the biggest market share of 84% in 2024.

- By distribution channel, the online channels segment is expanding at a notable CAGR of 11.43% during the forecast period.

AI in the Market

The vegan food sector is undergoing a major transformation due to Artificial Intelligence's power, which is applying innovation, customization, and efficiency in operations. Product development is greatly sped up by the advanced AI-assisted recipe development and ingredient mixing methods, and the uncovering of new plant-based ingredients that can give nutrition and taste a boost. Meanwhile, AI devises personalized diet plans for consumers based on their health goals and helps the company by optimizing the whole production process and cutting down on waste. The technology makes it easier to get information about the ingredients by tracing their sources and applying analytics to foresee consumer behavior, which gives the chance for the businesses to adjust their strategies. The technology's total application in the vegan food industry guarantees better decision-making and its gradual growth.

U.S. Vegan Food Market Size and Growth 2025 to 2034

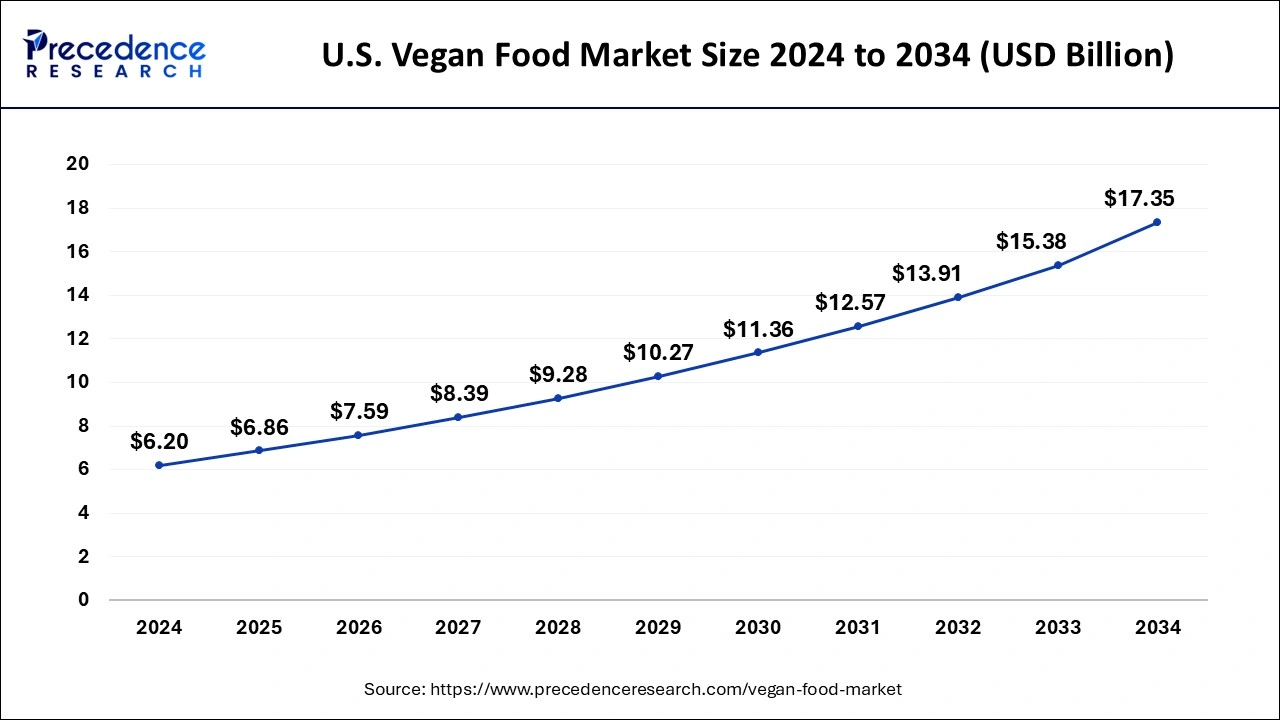

The U.S. vegan food market size was evaluated at USD 6.20 billion in 2024 and is predicted to be worth around USD 17.35 billion by 2034, rising at a CAGR of 10.83% from 2025 to 2034.

North America dominated the global vegan food market with the largest share of 37% in 2024. The awareness about the food industry and its impact on the environment is leaving to a growth in this market. Increased number of lactose intolerant people in US is fueling the demand for alternative dairy products in US. The North American region and the European region have the same purchasing pattern. The increased awareness about veganism is also increasing the revenue for the vegan restaurants in these regions. Major food chains like Starbucks and Domino's have launched vegan products in order to capture the consumer base in Europe. The number of vegan consumers in Europe is rising. Major market players in this region are trying to launch new innovative products in order to bring down the prices of the products and to improve the quality of these products.

In North America, the United States is the leading market for vegan food, driven by growing health consciousness, environmentally friendly attitudes, and the growing prevalence of lactose intolerant consumers. There has been a significant increase in new plant-based products from brands like Beyond Meat and Impossible Foods in mainstream grocery stores, and major retailers like Walmart and Whole Foods are adding and expanding vegan product selections. 59% of U.S. households purchased plant-based foods in 2024, similar to the prior year. (Source: https://gfi.org)

Asia Pacific is expected to expand at a double digit CAGR of 11.52% during the forecast period.As the younger generation in the Asia Pacific region is also aware about the climate and its association with the consumption of meat the demand for vegan products will rise in this region. The number of vegetarians in India is more but adopting an animal free diet is still low in this country. The availability of cruelty free products and the awareness about the same will play an important role in helping the growth of the vegan market in this region.

A rapidly emerging leader in the Asia Pacific vegan food market is China, which is exhibiting a change in dietary habits, food safety issues, and the adoption of government policies to promote alternative sustainable sources of food. The urban community is turning to plant-based diets, with new tech-driven innovations from startups and sustainability intentions from multinationals. As of 2024, Chinese traditional food suppliers partnered with plant-based protein companies to diversify their portfolios. China's commitment to green consumption and plant-based foods has strengthened with key government policies and plant-based food exhibitions held in Shanghai.

Market Overview

The increased awareness about benefits of the vegan diet is an important factor which is responsible for the growth of this market across various nation. The countries in the North American region, European region and the Asia Pacific region have a large percentage of vegan population. The outbreak of COVID-19 pandemic had impacted the tiger behavior of many nations. Increased awareness about the health and well being of the individuals have played an important role in the growth of vegan market. Owing to the benefits of the vegan diet there's a shift in the purchase patterns. There is an increased acceptance of the vegan product among the young population across the globe. There is an increasing demand for alternative dairy products, meat substitutes and other food substitute which is driving the market for the vegan food. Vegan food products are derived or processed from plant based sources. Vegan food products are offered as meat substitutes which are actually healthier than meat and provide a great taste and flavor. They are primarily made from ingredients like wheat, soy and others. Dairy free products and beverages are prepared from soy, rice, coconut and almond.

Vegan Food Market Growth Factors

Many consumers lead a sedentary lifestyle. Major population across the globe is suffering from health related complications like the cardiovascular disease or obesity. Increased awareness about animal health and animal cruelty in the food industry is encouraging consumers in order to shift to plant based food products. Vegan diet is growing popularly across many nations like US, Australia, New Zealand, UK, Australia, Ireland, Israel and Canada. American consumers have stopped the consumption of meat products. An increased awareness about the health benefits of the products that are plant based is increasing the consumer base of the vegan food industry. The other benefits provided by the plant based products are low risk of heart disease, lower risk of a stroke and premature death. An increased demand for alternative dairy products and meat substitutes it will help in adopting vegan diets. Consumers are also seeking nutritional alternatives. The market players are launching innovative and different food products in order to improve the consumer base and to enhance their image. Another reason for the growth of the vegan food market is the people who are lactose intolerant.

- The increasing health concern is making consumers place more emphasis on wellness and the prevention of lifestyle diseases, thereby turning the plant-based diets into a norm.

- The moral issues regarding animal mistreatment and the harm caused to the earth by animal farming are encouraging consumers to switch to plant-based products.

- There is a great demand for substitutes for dairy products as there is an increasing number of lactose-intolerant people and conscious consumers.

- There are continuous improvements made to the vegan food products in terms of flavor, consistency, and nutrition, which is attracting a larger audience.

- The modern trends in urbanized lifestyles are creating a demand for vegan food that is commonly available and accessible through busy lives and online marketplaces.

Industry Shifts

The vegan food market is transforming as society recognizes health aspects, environmental, and moral values more heavily. Companies strive to innovate food technology approaches to develop new products because plant-based alternatives continue to escalate throughout this shift. Major business investments drive vegan product development toward creating nutritious and tastier vegan options that market for enhanced accessibility. Plant-based items move into main consumer markets because the industry reacts to changing dietary trends, leading to worldwide vegan food market expansion.

Latest Technology

Homogenization is an essential process for the manufacturing of plant-based milk emulsions because it takes water and blends it with nuts and seeds to create emulsified blends. High-pressure homogenization will use specific temperature controls to produce textures and qualities of animal-based meats when producing meat alternatives. Membrane extrusion techniques increase procedure efficiency through two effects such as it protects equipment from wear and it separates the processed materials. High-end manufacturing methods have transformed vegan food manufacturing because they enable the industry to enhance taste and texture while supporting sustainability goals, which attract environmentally focused customers and health-oriented consumers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD55.42 Billion |

| Market Size in 2025 | USD22.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.63% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

On the basis of the product type the alternative dairy products are rapidly increasing. The alternative dairy products segment is growing as compared to the meat substitutes. They comprise of soy, elements and oats or other similar products. These products are beneficial for people who want to lose weight and also suitable for lactose intolerant people. Increased awareness regarding the health benefits of vegan products is expected to drive the market for this segment. Dairy alternatives was the largest segment till the recent years. About 65% of the global population is lactose intolerant and this also happens to create a demand for dairy alternative food items. The other products offered by the dairy alternatives or cheese, yogurt, snacks and ice cream which help in attracting the non vegetarians and increase the demand for this segment. The major market players are focusing on increasing the product portfolio as there could be rising cases of lactose intolerant people.

Distribution Channel Insights

The offline channels segment has held the biggest market share of 84% in 2024. The offline segment is expected to maintain its dominance over the forecast period. The offline segment involves many convenience stores, hypermarket, supermarket and other specialty stores. There is an increase in the number of supermarkets and hypermarkets across the globe that are helping in the sales of the product. Do to easy access and availability of vegan products in the brick and mortar stores the consumers prefer shopping from these stores.

The online channels segment is expanding at a notable CAGR of 11.43% during the forecast period. There has been major investments in online distribution channels by the major retail chains. Walmart has started delivering foods online. Many leading retail corporations that are multinational have started delivering food online. Due to the pandemic the ecommerce portals have become a major channel which is adopted by the consumers to buy these products. The access to these products from the comfort of the home and getting delivered them to the doorstep are increasing the trend for online shopping.

Vegan Food Market Companies

- Amy's Kitchen

- Danone S.A

- Tofutti Brands Inc.

- Ripple Foods Inc.

- Earth's Own Food Company Inc.

- The Archer Daniels Midland Company

- Daiya Foods Inc.

Recent Developments

- In April 2025, Vegan Food Group (VFG), a leading European plant-based food producer, has announced a ground-breaking partnership with Eat Just, Inc., the pioneering US food technology company. VFG is reinforcing its leadership in plant-based food innovation by committing a further £6.25 million across its UK and German manufacturing sites.

(Source: https://grocerytrader.co.uk) - In January 2024, MeliBio, a US-based producer of vegan honey, has partnered with organic food producer Narayan Foods to launch bee-free honey at ALDI-owned Hofer stores in Europe. Honey is often produced by managed non-native bees, which compete with wild native bees and reduce their diversity. Furthermore, managed bees can pass diseases to wild bees.

(Source: https://vegconomist.com) - In May 2024, Daiya launched a new Dry Powdered Mac & Cheese in 3 flavors: Cheddar, White Cheddar, and Aged Cheddar. They also had prepared a box of gluten-free pasta and a sachet of powdered cheese mix. This new product extends Daiya's existing line of vegan cheese and mac, shredded cheese, and pizzas.

- In March 2024, Impossible Foods announced the launch of its new identity focused on attraction to meat. The company is appealing to flexitarian and meat-eater consumers to accept that their foods taste better, are healthier, and are better for the environment.

- In April 2023, the Bel Group, a leader in the cheese market, and biotech start-up “Climax Foods Inc.” announced a collaboration to create plant-based cheese. Through this partnership, these two companies will create plant-based portions of Kiri, Laughing Cow, Babybel, Boursin, and Nurishh.

Value Chain Analysis

- Raw Material Procurement: This process includes the selection of certified vegan raw materials from farms that are sustainable and reliable sources of plant-based suppliers.

Key Players: Archer Daniels Midland Company (ADM), SunOpta, Eden Foods Inc. - Processing and Preservation: The whole process is to keep the quality, nutrition, and freshness through the conversion of raw materials into plant-based food products.

Key Players: Beyond Meat, Impossible Foods Inc., Daiya Foods Inc. - Quality Testing and Certification: This practice is to guarantee that products fulfill vegan standards, nutritional claims, and regulatory certificates for consumers' safety.

Key Players: Eurofins, SGS, BeVeg International, Sattvik Certifications - Packaging and Branding: The work concentrates on eco-friendly packaging coupled with ethical branding to bring out health and sustainability values.

Key Players: Beyond Meat, Amy's Kitchen, Tofutti Brands - Cold Chain Logistics and Storage: The process is to keep the quality of the vegan products by providing temperature-controlled conditions for the perishable products.

Key Players: Americold Realty Trust, Lineage, Inc., NewCold Coöperatief UA - Distribution to Retail, HoReCa: The trail is all set for the vegan food products to be taken to supermarkets, restaurants, and cafés, thus increasing the market reach.

Key Players: General Mills Inc., Danone S.A., Nestlé S.A. - Retail Sales and Marketing: Vegan food products are the subject of campaigns that highlight health and environmental advantages through the company's advertising activities.

Key Players: Walmart, Kroger, Amazon - Waste Management and Recycling: The company is adopting sustainable practices in waste reduction and recycling throughout production and distribution areas.

Key Players: Wastelink, Winnow, Leanpath

Segments Covered in the Report

By Product

- Dairy Alternative

- Cheese

- Dessert

- Snacks

- Meat Substitute

- Tofu

- TVP

- Seiten

- Quorn

- Others

- Others

By Distribution Channel

- Offline Channels

- Online Channels

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting