Piping and Fittings Market Size and Forecast 2025 to 2034

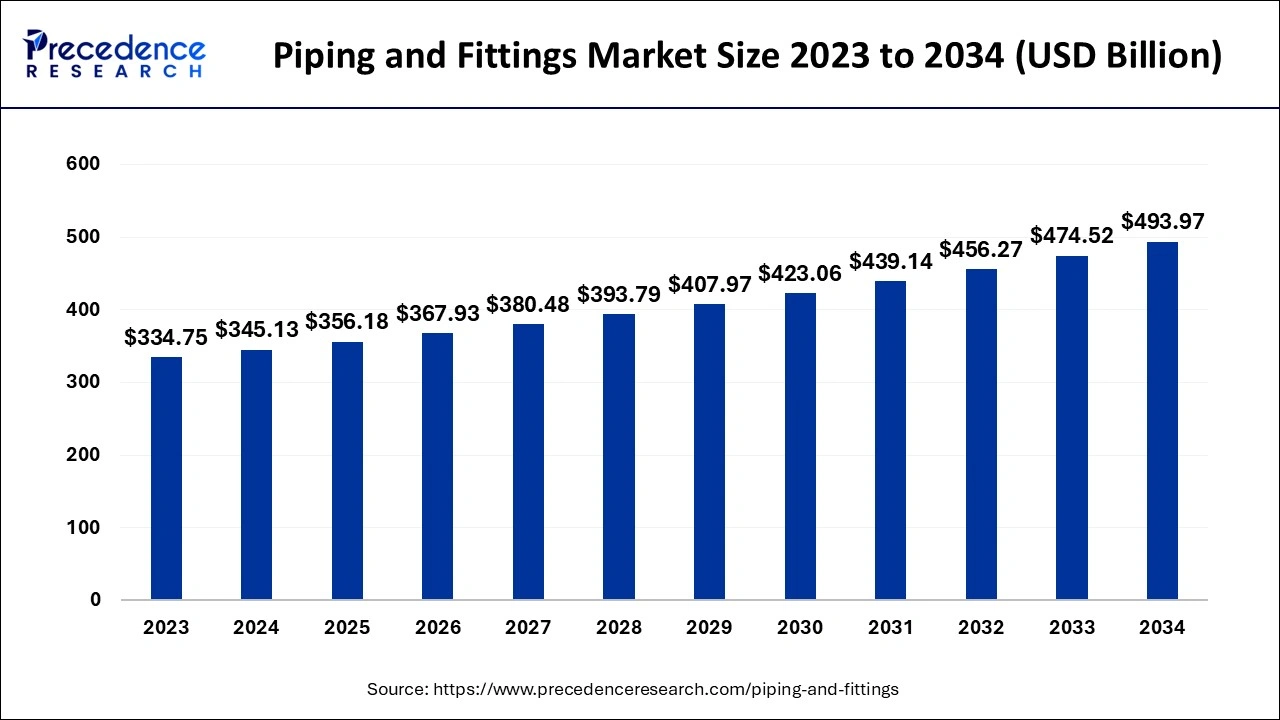

The global piping and fittings market size was accounted at USD 345.13 billion in 2024 and is predicted to surpass around USD 493.97 billion by 2034, representing a CAGR of 3.65% from 2025 to 2034. The increasing demand for efficient drainage and water supply in urban areas and other parts of the country is driving the growth of the market.

Piping and Fittings Market Key Takeaways

- The global piping and fittings market was valued at USD 345.13 billion in 2024.

- It is projected to reach USD 493.97 billion by 2034.

- The piping and fittings market is expected to grow at a CAGR of 3.65% from 2025 to 2034.

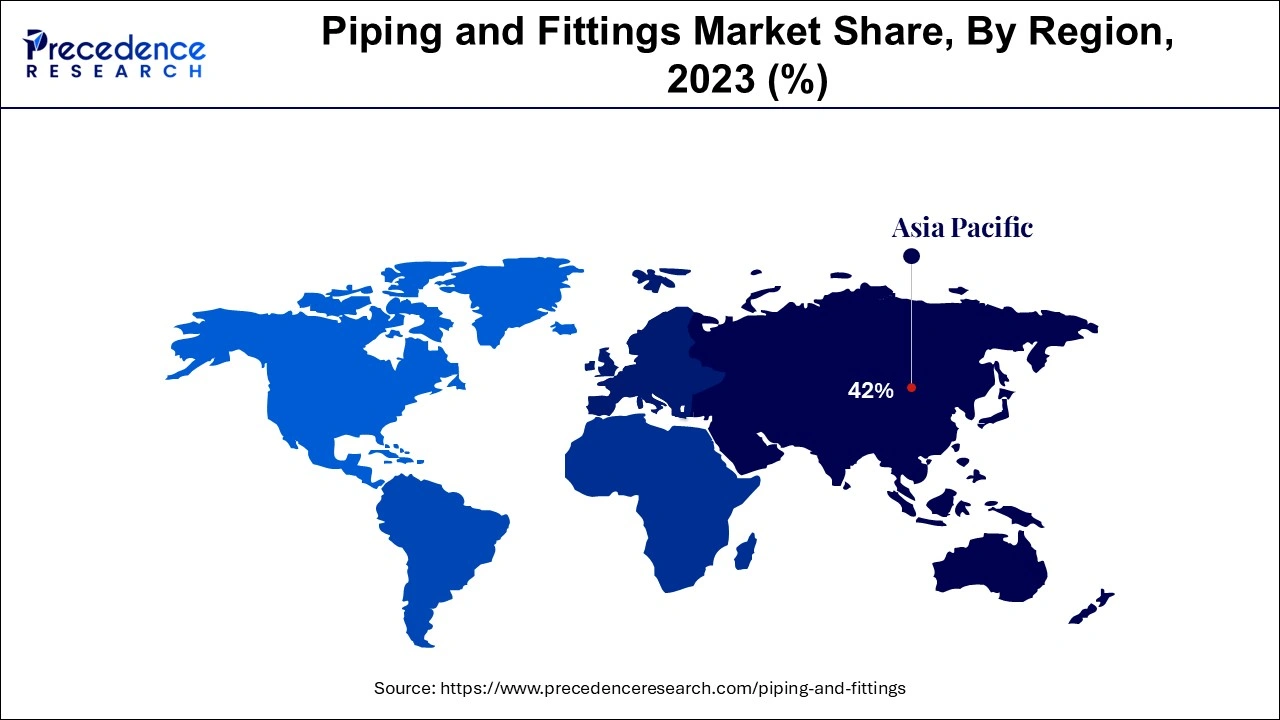

- Asia Pacific dominated the piping and fittings market with the largest market share of 42% in 2024.

- North America has anticipated significant growth during the forecast period.

- By type, the steel pipe segment registered its dominance over the market in 2024.

- By type, the plastic/PVC segment is predicted to witness the fastest growth in the market over the forecast period.

- By application, the residential segment held a dominant presence in the market in 2024.

- By application, the commercial segment is expected to grow significantly the market over the studied period of 2025 to 2034.

How Can AI Impact the Piping and Fittings Market?

The integration of artificial intelligence into pipe fitting manufacturers helps transform industrial operations. AI helps the pipe fitting manufacturer in processes like quality control, and it is used to maintain the quality of pipe fittings during the production process. Predictive maintenance, with this AI, helps monitor the status of the machinery and predict maintenance if required. AI can optimize the best combination of temperature, speed, and pressure for required output. And AI can efficiently manage supply chain management by predicting demand and inventory levels. Thus, all these advancements help in the growth of the piping and fittings market.

- In July 2024, Novarc Technologies Inc., a company specializing in the full-stack robotics design and manufacturing of cobots and computer vision AI for automated welding applications, launched the NovEye Autonomy (Gen 2), a real-time vision processing system aiming to improve the weld quality based on data collection and model improvement in the to fully automate the pipe welding process with enhancing productivity and delivering the highest quality welds.

Asia Pacific Piping and Fittings Market Size and Growth 2025 to 2034

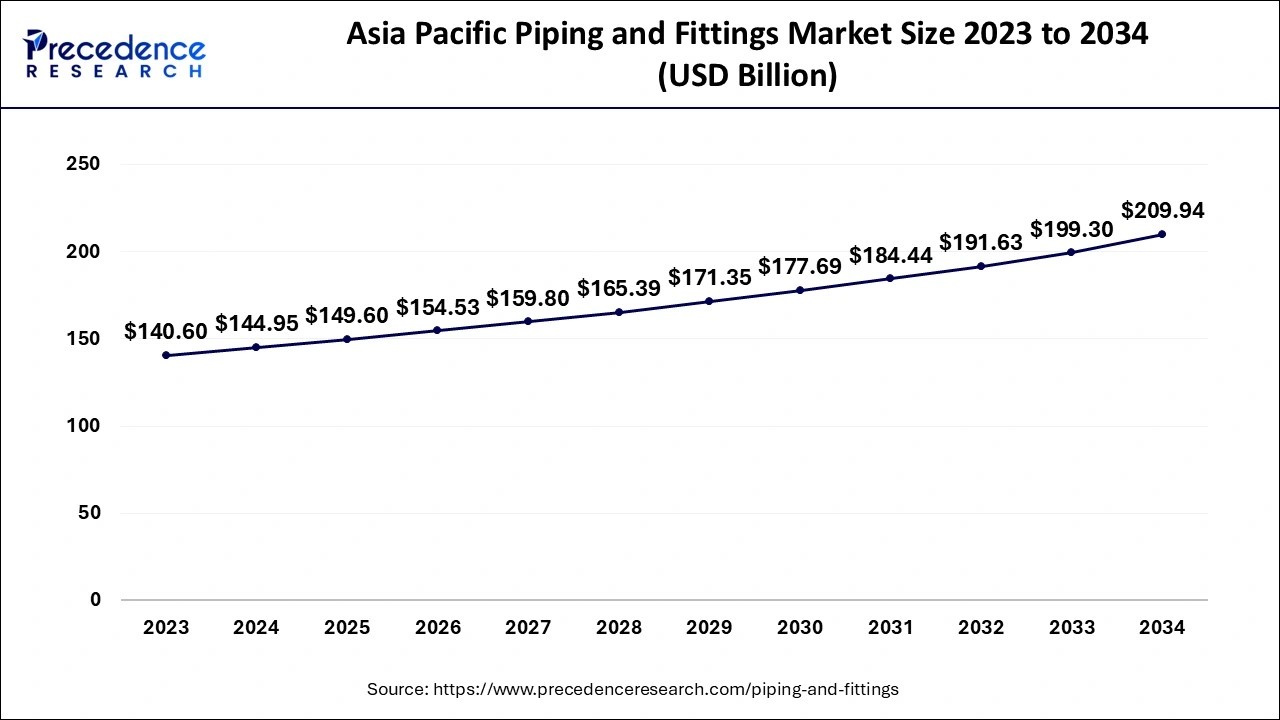

The Asia Pacific piping and fittings market size was exhibited at USD 144.95 billion in 2024 and is projected to be worth around USD 209.94 billion by 2034, with a CAGR of 3.77% from 2025 to 2034.

Asia Pacific dominated the piping and fittings market in 2024. The growth of the market is attributed to the rising population and urbanization across regional countries like China, India, Japan, and South Korea, which is driving the demand for rapid growth in residential and commercial properties to cater to the demand for rising population and foreign investment in the development in the industrialization is contributing in the demand for the piping and fittings market. Additionally, the rising government interventions in the development of commercial buildings and the development of efficient drainage systems in the rural and urban areas of the country are driving the growth of the piping and fittings market across the region.

- The Indian population is projected to expand to 1.64 billion by 2047, and 51% of the population is likely to live in urban areas, according to the United Nations. India is one of the leading recipients of the FDI, which inflows in the construction (infrastructure) activities $33.91 Bn (Apr 2000 to Mar 2024).

- The Indian construction industry is predicted to reach $1.4 trillion by 2025. The development of the cities is expected to generate 70% of India. The construction industry in India is working in 250 sub-industries within linkage across the industries.

- The demand for the residential sector is rapidly increasing, with an estimated 600 million people expected to live in the urban areas by 2030, causing the demand for 25 million additional mid-end and affordable units.

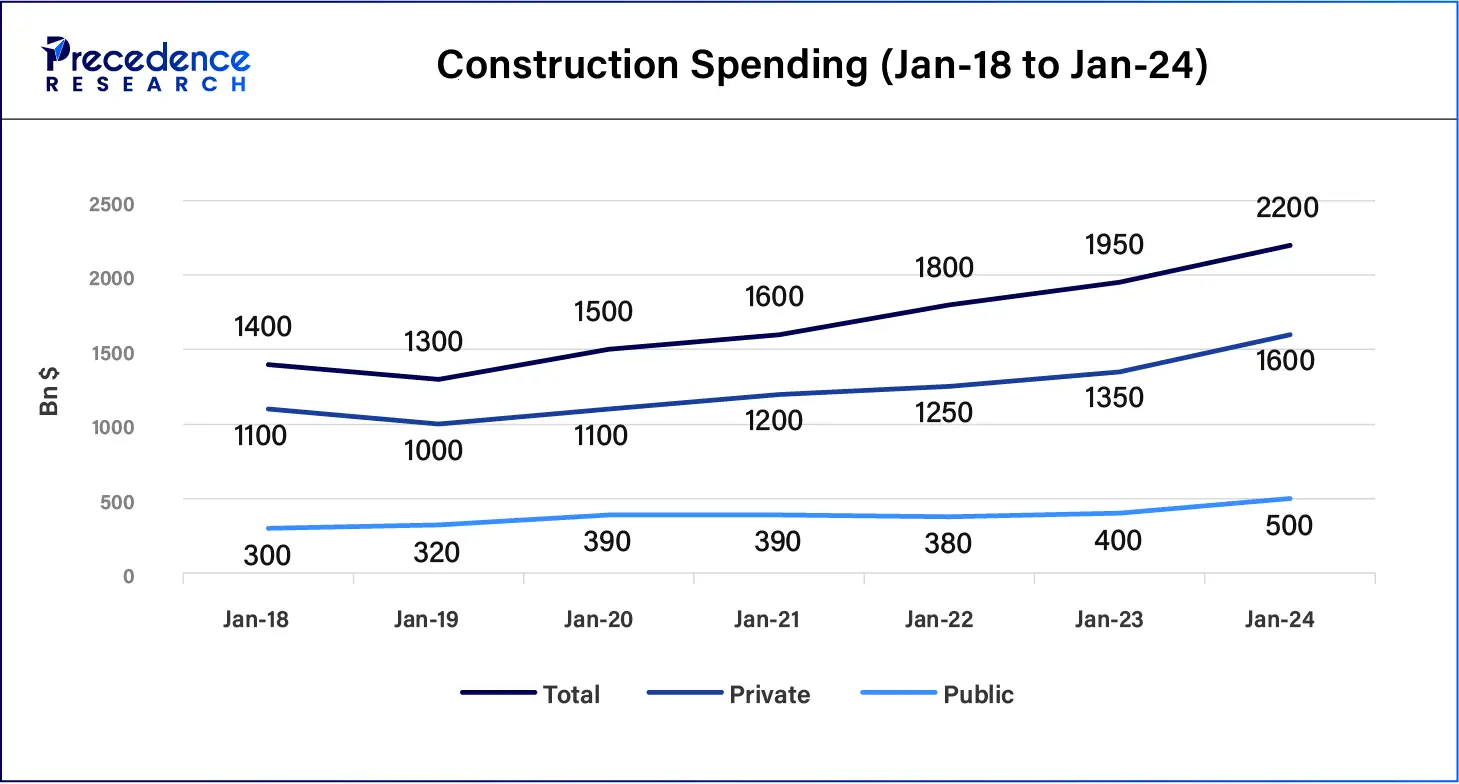

North America anticipates significant growth in the market during the forecast period. The growth of the market is attributed to the availability of well-developed economies in countries such as the U.S. and Canada and the rising urbanization in the countries and the rising construction industry and the enhancements in residential and commercial buildings are driving the demand for efficient piping and fittings in the industry for the efficient water supply and drainage system in the buildings are accelerating the growth of the piping and fittings market in the region.

- The expenditure in the construction industry in May 2023 was predicted at a seasonally adjusted annual rate of $1,925.6 billion, with 0.9% and 0.5% increase in the revised April anticipated of $1,909.0 billion.

- The expenditure in the private construction industry was predicted at a seasonally adjusted annual rate of $1,513.2 billion, with 1.1% and 0.3% increase in the revised April anticipated of $1,497.2 billion.

- The expenditure in the public construction industry was predicted at a seasonally adjusted annual rate of $412.42 billion, with 0.1% and 1.0% increase in the revised April anticipated of $411.8 billion.

Market Overview

The piping and fittings are the most efficient and essential material or type of product in the buildings that provide the water and energy supply and are essential for the drainage system from the buildings and cities that drive the growth of the market. The piping system is an essential element that helps in flowing any type of fluid or gas. The piping helps in various applications such as in irrigation, swage management, and water supply in the different end-use industries such as chemicals, pharmaceuticals, oil and gas, energy, and others are driving the demand for the piping and fittings market.

Piping and Fittings Market Trends

Sustainable Piping Solution News:

- In September 2024, Syensqo introduces the Ryton PPS XE-5000NA. The launch is the innovative extrudable polyphenylene sulfide (PPS) technology designed to transform the sustainability and performance of piping materials.

- In August 2024, Inpipe Sweden AB, a leading market player that has worked in environmental sustainability and technological progress for over 30 years and manufacturer of sustainable and innovative piping solutions introduced the groundbreaking UV-cured GRP liners.

- Netafim India, a leading provider of smart irrigation solutions launched the FlexNet – a revolutionary mainline and sub-mainline piping for below and above ground drip irrigation systems for Indian farmers to make #FarmingSimplified.

- In July 2024, The Van Leeuwen Pipe and Tube Group introduced its brand called Van Leeuwen Impact, which is a CO2-reduced steel pipe and tube product.

Piping and Fittings Market Growth Factors

- Increasing population: The rising population across the world and the demand for residential and commercial buildings in the construction industry to cater to the demand of the population are driving the growth in the market.

- Rising urbanization: The increasing urbanization in economically developing countries and the rising preference in the migration from rural to urban areas for a better lifestyle, education, employment, and other are driving the demand for the residential sector or buildings and demand the piping in the water and energy supply in the buildings.

- Government policies: The increasing intervention of government bodies in the efficient water and energy supply and drainage system in urban and other areas of the country is contributing to the expansion of the piping and fittings market.

- Sustainability in operations: The rising acceptance of sustainable products or materials in the manufacturing of pipes which is recyclable, have longer lifecycles, and have corrosion resistance is expanding the piping and fittings market.

- Increasing competition: The increasing competition in the pipe manufacturing industries with the continuous evaluation and the launch of the new product range and the increasing intervention in the new market players are driving the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 493.97 Billion |

| Market Size in 2024 | USD 345.13 Billion |

| Market Size in 2025 | USD 356.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.65% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

The rise in the construction industry

The rising construction industry across the world due to the increasing population and the rapidly growing demand for residential and commercial buildings are driving the growth of the piping and fittings market. The rising industrialization and foreign investment in the development of the industries caused the increased demand for water supply and drainage systems, which contributed to the demand for piping and fittings. Additionally, the rising evaluation in the renovation of houses and buildings is also highly contributing to the expansion of the piping and fittings market.

Restraint

Limited strength and durability

The pipe fittings' strength and durability completely depend upon the material of the pipe and generally have limitations in the lifespan of pipes due to corrosion, temperature, and other factors restraining the growth of the piping and fittings market.

Opportunity

Advancements in the pipe fittings manufacturing process

The adaptation of the new technologies in pipe fittings manufacturing offers greater efficiency and productivity in the line of operations. Technological advancements such as robotics and automation, 3D printing, and smart manufacturing are driving the enhancements in operations. Additionally, sustainability in the piping and fittings, such as the use of eco-friendly materials, waste reduction, and energy efficiency in manufacturing, are collectively driving the expansion in the piping and fittings market.

Type Insights

The steel pipe segment registered its dominance over the piping and fittings market in 2024. The increasing construction industry is driving the demand for the piping industry. The rise in the demand for steel pipes from the construction industry, like in the residential and commercial sectors, has several benefits, including higher strength, durability, heat resistance, applications, cost efficiency, versatility, and sizing. The steel pipes are more prone to changing climatic conditions. Its corrosion resistance properties make them live a longer lifecycle. It can be used in different applications, including sewer and drainage purposes. It has a low maintenance cost, and the recyclability of the products is one of the main properties of the steel pipes, which makes them ideal for use in the different applications of the buildings.

The plastic/PVC segment is predicted to witness the fastest growth in the market over the forecast period. The higher prevalence in the acceptance of plastic and polyvinyl pipes due to their lower cost, lightweight, and other benefits are driving the growth of the segment. Plastic pipes are known for their sustainability and cost-effectiveness; they are recyclable and reusable and have higher durability, longer lifecycle, and higher corrosion resistance. Plastic pipes help in energy savings, decreased risk of leakage, and easier installation, which makes them offer higher efficiency and productivity, driving the growth of the segment.

Application Insights

The residential segment held a dominant presence in the piping and fittings market in 2024. The rising population and the economic growth in various countries are driving industrialization, and the rise in the construction industry and the rise in the real estate industry are driving the development and growth of residential and commercial buildings to cater to the demand of the rising population. The rising urbanization in developing countries due to the shifting and migrating of people from rural to urban areas for employment, studies, economic development, lifestyle standards, and others are driving the residential sector. Piping and fittings are essential elements in the housing sector for providing water in areas like kitchens, bathrooms, washing areas, and others.

The commercial segment will gain a significant market share over the studied period of 2025 to 2034. The rising demand for commercial buildings like hospitals, malls, corporate offices, government offices, shopping complexes, and other commercial plots is driving the demand for the market. The rising development in the regional countries is causing the growth in urbanization, and industrialization is driving the demand for commercial buildings, which is anticipated in the higher demand for the piping and fittings market.

Piping and Fittings Market Companies

- Saint-Globain

- Jaquar Corporation

- Kohler Company

- Hindustan Sanitaryware and Industries Ltd (Hindware)

- Aliaxis Group

- Alumasc Building Products

- Aluminum Roofline Products

- Amazon Civils

- Anglian Home Improvements

- Ash and Lacy Building Systems

- Marley Plumbing and Drainage

- Pegler Yorkshire Group

- PF Copeland Rainwater Systems

- McAlpine and Co.

Recent Developments

- In August 2024, Birla HIL Pipes, a subordinate of USD 3-billion CK Birla group, launched a new leak-proof solution in the pipe and fittings segment to add more value to the products that added price volatility and premiumise the portfolio.

- In August 2024, Aliaxis SA, a leading player that offers access to water and energy via fluid management solutions, announced the strategic deal for acquiring manufacturing assets of Johnson Controls' CPVC pipe and fittings business for light commercial sprinkler systems and the residential sector.

Segments Covered in the Report

By Type

- Steel Pipe

- Aluminium Pipe

- Copper Pipe

- Plastic/Polyvinyl Chloride Pipe

- Glass Pipe

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting