Plasticizers Market Size and Forecast 2025 to 2034

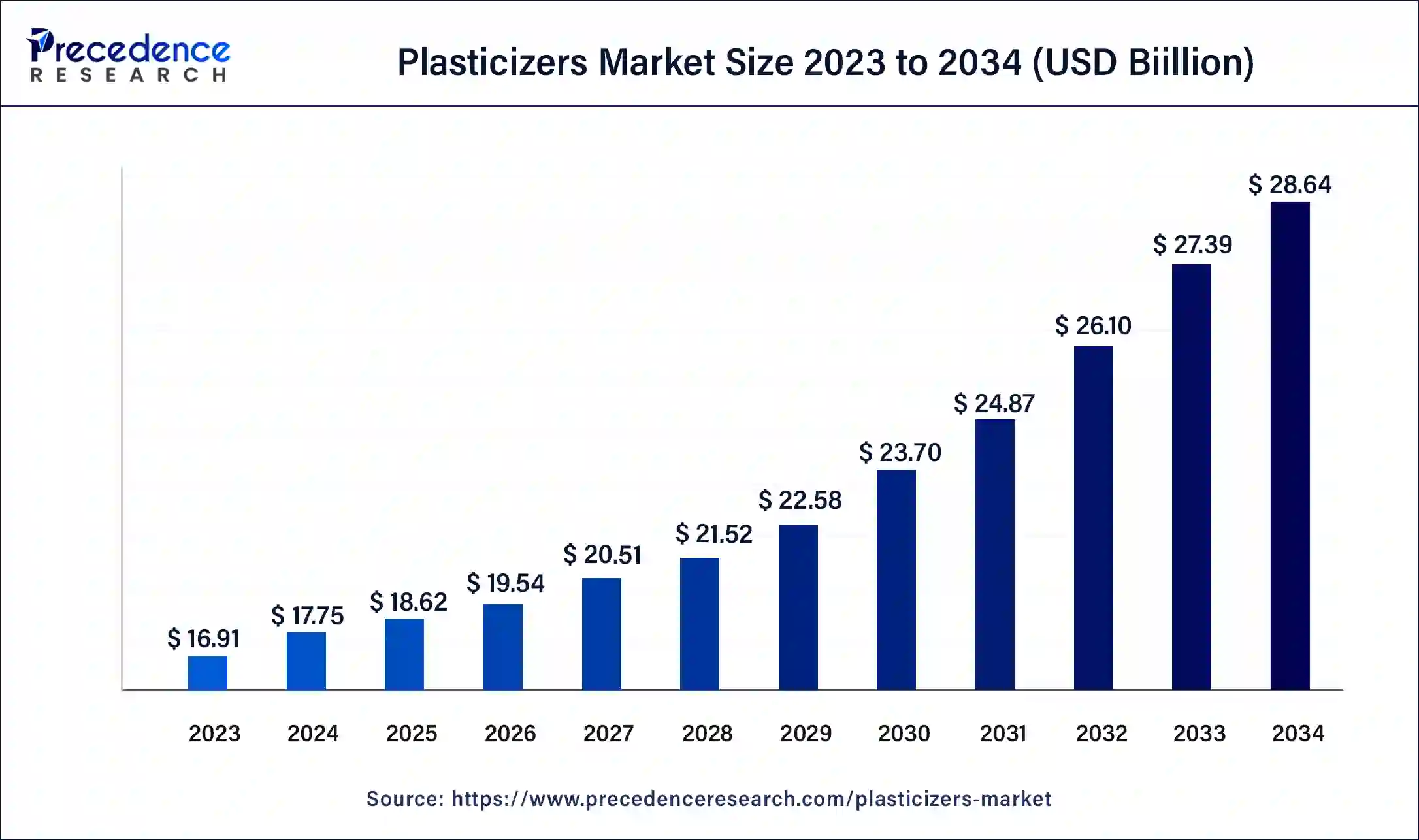

The global plasticizers market size was estimated at USD 17.75 billion in 2024 and is predicted to increase from USD 18.62 billion in 2025 to approximately USD 28.64 billion by 2034, expanding at a CAGR of 4.90% from 2025 to 2034.

Plasticizers Market Key Takeaways

- In terms of revenue, the plasticizers market is valued at $18.62 billion in 2025.

- It is projected to reach $28.64 billion by 2034.

- The plasticizers market is expected to grow at a CAGR of 4.90% from 2025 to 2034.

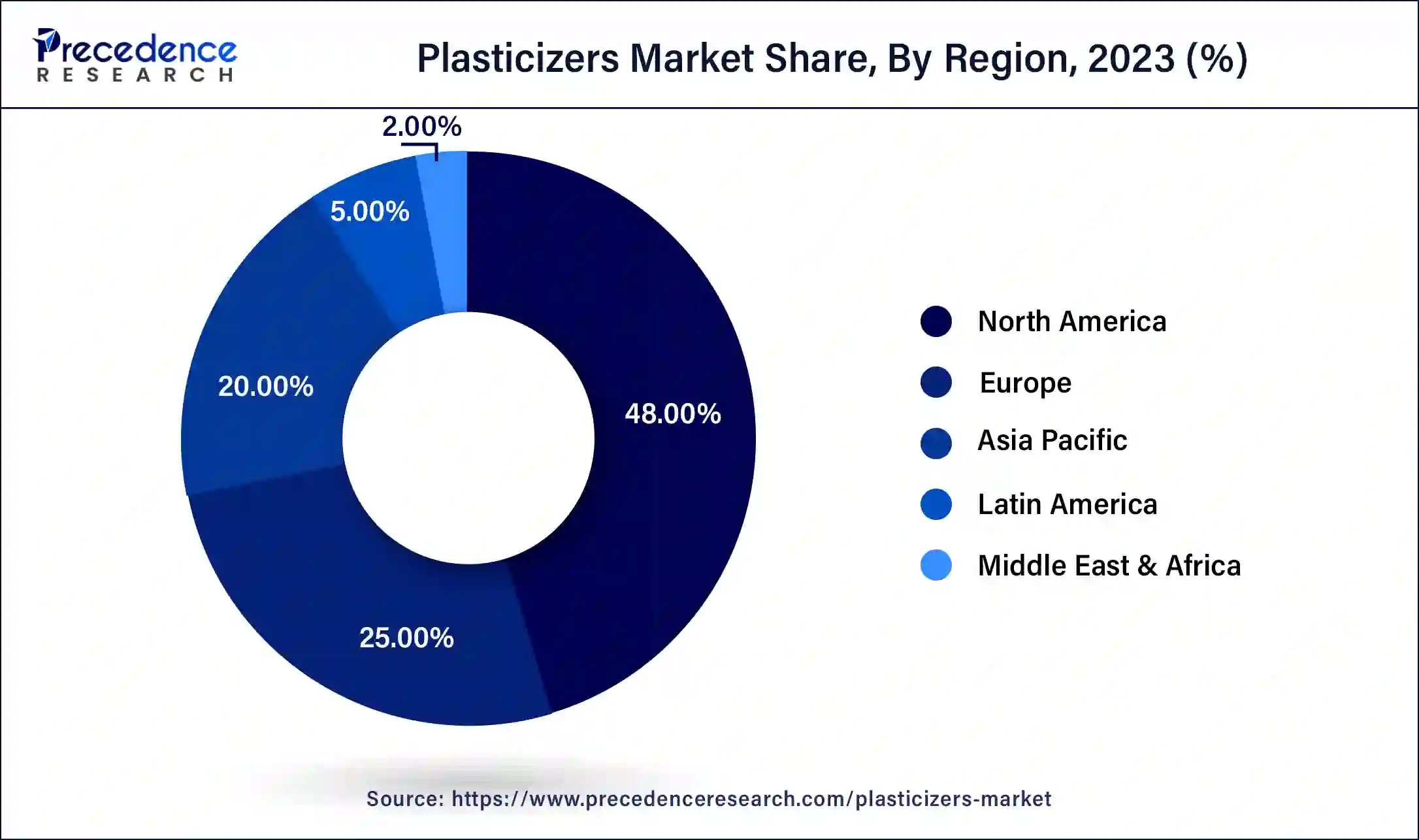

- North America contributed more than 48% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the phthalates segment segment has held the largest market share of 34% in 2024.

- By type, the aliphatic dibasic esters segment is anticipated to grow at a remarkable CAGR of 5.2% between 2025 and 2034.

- By application, the wires & cables segment generated over 31% of revenue share in 2024.

- By application, the consumer goods segment is expected to expand at the fastest CAGR over the projected period.

U.S. Plasticizers Market Size and Growth 2025 to 2034

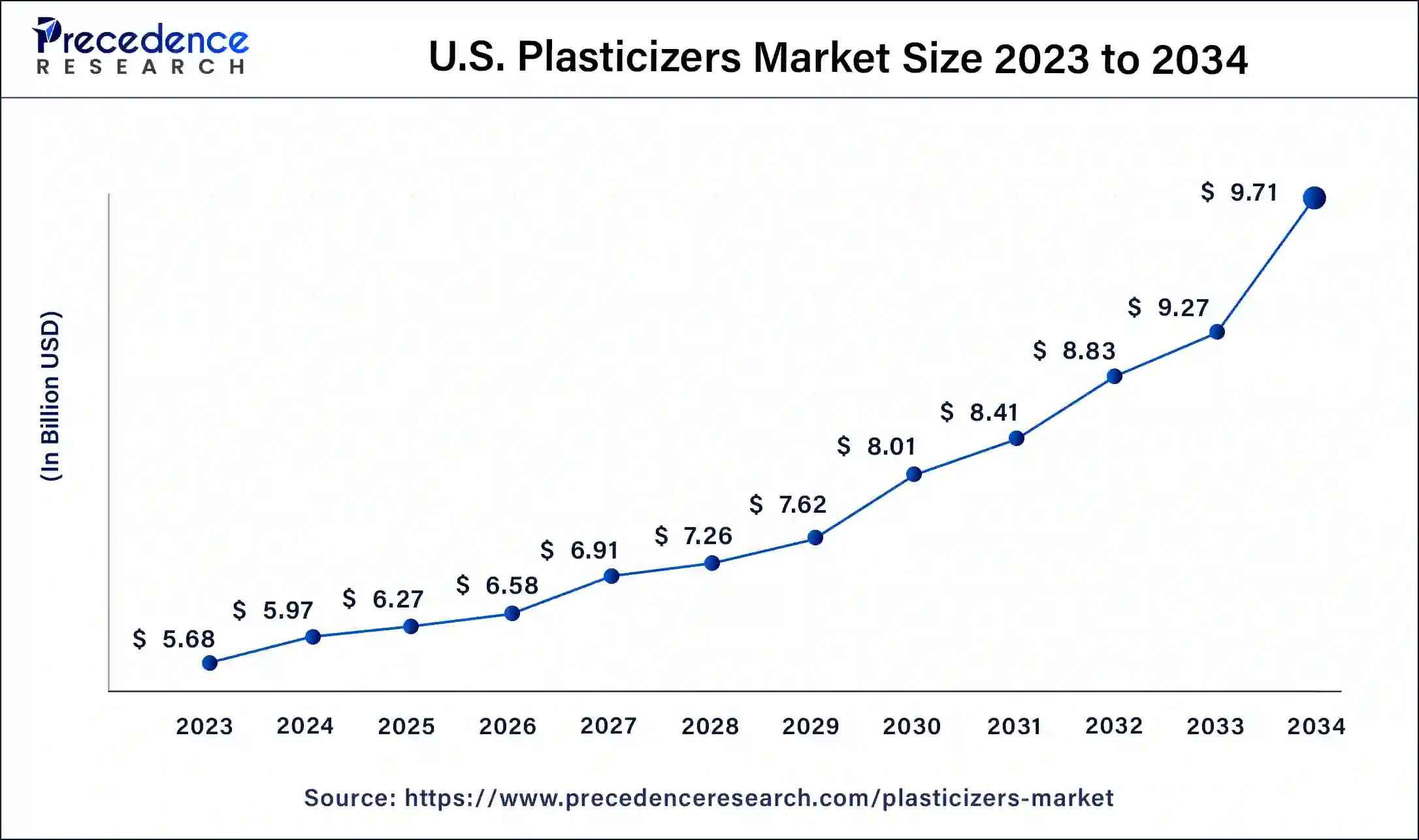

The U.S. plasticizers market size reached USD 5.97 billion in 2024 and is anticipated to be worth around USD 9.71 billion by 2034, poised to grow at a CAGR of 4.98% from 2025 to 2034.

North America has held the largest revenue share of 48% in 2024. North America holds a major share of the plasticizers market due to a robust demand across diverse industries, including construction, automotive, and consumer goods. The region's stringent environmental regulations have driven the adoption of eco-friendly plasticizers, contributing to market growth. Additionally, a thriving construction sector, coupled with increasing investments in infrastructure projects, has elevated the demand for plasticizers. The presence of key market players, technological advancements, and a focus on sustainable practices further solidify North America's significant position in the global plasticizers market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the plasticizers market due to rapid industrialization, robust construction activities, and increasing automotive production in countries like China and India. The region's burgeoning population, urbanization, and rising disposable income contribute to the high demand for flexible materials in various applications.

Additionally, favorable government policies, infrastructure development, and a growing consumer goods sector further fuel the demand for plasticizers. The dynamic economic growth and expanding end-use industries position Asia-Pacific as a key player, holding a major share in the global plasticizers market.

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by a rising demand for flexible PVC in sectors such as construction, automotive, and healthcare. The region's focus on sustainable and non-phthalate plasticizers is driving innovation and product reformulation. Regulatory frameworks from REACH and the European Chemicals Agency (ECHA) promote the use of bio-based and safer alternatives. Moreover, ongoing renovation efforts in the European construction industry and trends toward lightweighting in automotive production further enhance the demand for high-performance, environmentally friendly plasticizers. Germany and France are at the forefront of research and industrial application of advanced plasticizer technologies.

Germany

Germany is a crucial player in the European plasticizers market, supported by its strong automotive and construction industries. The nation advocates for sustainable chemical practices, promoting the use of bio-based and low-toxicity plasticizers. German companies are prioritizing research and development to create phthalate-free options that comply with EU standards. With its established chemical manufacturing infrastructure, Germany serves as a central hub for the advancement and distribution of next-generation plasticizer products.

Major Key Trends in Plasticizers Market

- Transition to Bio-Based Plasticizers: Industries are progressively embracing bio-based plasticizers derived from renewable sources such as vegetable oils, aligning with sustainability objectives and decreasing dependence on conventional petroleum-based plasticizers.

- Growing Utilization in Medical Applications: The medical sector is witnessing an increased demand for non-toxic, flexible plasticizers, where safety and regulatory adherence are paramount for products like IV bags and tubing.

- Advancements in High-Performance Plasticizers:Manufacturers are innovating high-performance plasticizers that deliver exceptional thermal stability, flexibility, and weather resistance, ideal for use in rigorous settings such as automotive and outdoor construction.

Market Overview

Plasticizers serve as essential additives in the production of plastics, playing a key role in enhancing their flexibility, durability, and workability. These substances are integrated into plastic formulations to increase elasticity and render the material more adaptable to bending and stretching. By lowering the glass transition temperature of the polymer matrix, plasticizers ensure that the plastic remains pliable even at lower temperatures, broadening its utility across diverse applications like packaging, toys, medical devices, and construction materials.

Phthalates, a commonly used class of plasticizers, has raised concerns regarding potential health and environmental risks. Consequently, there has been a push towards developing and adopting alternative plasticizers that maintain desired material properties while addressing associated issues. The choice of plasticizer hinges on specific application requirements, with careful consideration given to factors such as safety, performance, and compliance with regulatory standards.

Plasticizers Market Growth Factors

- Growing construction activities worldwide drive the demand for plasticizers in applications such as PVC pipes, cables, and flooring.

- The expanding automotive industry relies on plasticizers for manufacturing flexible components like automotive interiors, wire coatings, and sealants.

- The dynamic packaging sector fuels the need for plasticizers in the production of flexible packaging materials, ensuring durability and flexibility.

- The demand for flexible and lightweight consumer goods, such as toys and packaging, propels the growth of the plasticizers market.

- The increasing use of plastics in medical devices, coupled with stringent safety standards, drives the demand for specialized plasticizers.

- Ongoing research and development in material science contribute to the discovery of new and improved plasticizer formulations, expanding market growth.

- Evolving environmental regulations and standards impact the development of eco-friendly plasticizers, meeting sustainability demands.

- Continuous advancements in plasticizer manufacturing technologies enhance efficiency, quality, and application versatility.

- Urbanization projects and infrastructure development create a sustained demand for plasticizers in various construction applications.

- Rising disposable income levels contribute to higher consumer spending on products that incorporate plasticizers, such as flexible packaging and luxury items.

- The growth of the renewable energy industry drives demand for plasticizers in solar panels, wind turbines, and other energy-efficient technologies.

- The globalization of trade increases the demand for packaging materials, boosting the plasticizers market, especially in the logistics and shipping sectors.

- Consumer awareness and preferences for eco-friendly products stimulate the development and adoption of bio-based and non-phthalate plasticizers.

- The proliferation of electronic devices fuels the demand for plasticizers in applications such as wire insulation and electronic components.

- The industrialization of emerging economies leads to an increased requirement for plasticizers in various industrial applications.

- The textile industry's expansion drives the use of plasticizers in synthetic fabrics and coatings for textiles.

- Shifting lifestyles and consumer preferences towards convenience and innovative products contribute to the growth of the plasticizers market.

- The maintenance and replacement of automotive components contribute to a continuous demand for plasticizers in aftermarket products.

- Industries seek high-performance plasticizers to meet specific requirements in terms of durability, flexibility, and safety.

- Growing investments in R&D activities by key players drive innovations in plasticizer formulations, opening new avenues for market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 17.75 Billion |

| Market Size in 2025 | USD 18.62 Billion |

| Market Size by 2034 | USD 28.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phthalates, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Construction industry growth and rising packaging industry

The growth of the construction industry and the expanding packaging sector significantly drive the demand for plasticizers in the market. In the construction industry, plasticizers play a pivotal role in enhancing the flexibility and durability of various materials, including PVC pipes, cables, and flooring. As construction activities continue to surge globally, there is a heightened need for these additives to ensure the integrity and longevity of construction materials, contributing to the robust demand for plasticizers.

Simultaneously, the rising packaging industry is a major catalyst for increased plasticizer demand. Flexible packaging materials, crucial for accommodating changing consumer preferences and the growing e-commerce landscape, heavily rely on plasticizers to impart flexibility and resilience. The dynamic nature of the packaging sector, driven by innovations and sustainability concerns, fuels the continual requirement for plasticizers to meet the evolving demands of this critical market segment. Together, the construction and packaging industries form a formidable force propelling the sustained growth of the plasticizers market.

Restraint

Environmental and health concerns

Worries about the environment and human health are putting a squeeze on the growth of the plasticizers market. Certain types of plasticizers, especially phthalates, are being closely examined due to their potential harm to ecosystems and people. This increased awareness has led to stricter rules and a growing preference for more sustainable options. As society becomes more conscious of the environmental and health implications associated with conventional plasticizers, there is a mounting call for industries to adopt greener practices.

While this shift towards eco-friendly options is commendable for its sustainability benefits, it poses challenges for manufacturers in terms of reformulating products, adjusting production processes, and ensuring consistent performance. Consequently, environmental and health concerns act as formidable hurdles, requiring the plasticizers industry to navigate a landscape that demands both effectiveness and reduced environmental impact to meet evolving standards and consumer expectations.

Opportunity

Growing demand for bio-based plasticizers

The escalating demand for bio-based plasticizers is emerging as a significant opportunity in the plasticizers market. As sustainability gains traction, there is a growing preference for plasticizers derived from renewable sources, presenting a lucrative market segment for manufacturers. Bio-based plasticizers, sourced from materials such as plant oils, offer a more environmentally friendly alternative to traditional options, aligning with the heightened awareness of eco-conscious consumers and stringent regulatory standards.

Manufacturers in the plasticizers market can capitalize on this trend by investing in research and development to create innovative bio-based formulations. The development of these sustainable alternatives not only meets the increasing demand for environmentally responsible products but also positions companies favorably in the competitive landscape. Companies that successfully navigate this shift towards bio-based plasticizers have the opportunity to capture market share and contribute to the overall sustainability goals of the plastics industry.

Type Insights

The phthalates segment had the highest market share of 34% in 2024. Phthalates, a prominent type in the plasticizers market, are chemical compounds commonly used to enhance the flexibility of plastics. Despite their widespread use, the phthalates segment faces challenges due to environmental and health concerns, prompting a shift towards non-phthalate alternatives.

Regulatory restrictions on certain phthalates have catalyzed this transition, with the market witnessing a growing trend of innovation in non-phthalate formulations. Manufacturers are increasingly investing in research to develop safer and more sustainable plasticizer options, aligning with the industry's evolving preferences and regulatory landscape.

The aliphatic dibasic esters segment is anticipated to expand at a significant CAGR of 5.1% during the projected period. Aliphatic dibasic esters, a type of plasticizer widely used in the plastic industry, are derived from aliphatic acids and alcohols. These esters boast excellent solvating properties, making them suitable for diverse applications like coatings, adhesives, and flexible PVC formulations.

A noteworthy trend in the plasticizers market is the increasing preference for aliphatic dibasic esters due to their low toxicity, enhanced biodegradability, and alignment with stringent environmental regulations. This shift underscores the industry's commitment to adopting sustainable and environmentally friendly plasticizer alternatives.

Application Insights

The wires & cables segment has held a 31% revenue share in 2024. In the plasticizers market, the wires and cables segment refer to the incorporation of plasticizers in the manufacturing of flexible and durable materials used for insulation and sheathing in electrical wiring and cable applications. Plasticizers enhance the flexibility and resilience of these materials, ensuring optimal performance in various conditions.

A notable trend in the wires and cables segment of the plasticizers market involves the increasing demand for non-phthalate plasticizers, driven by regulatory considerations and a growing emphasis on environmental sustainability. Manufacturers are innovating formulations to meet these evolving requirements while maintaining the desired properties of flexibility and durability in wires and cable applications.

The consumer goods segment is anticipated to expand fastest over the projected period. The consumer goods segment in the plasticizers market encompasses the use of these additives in products such as toys, packaging materials, and household items. In recent trends, there's a growing emphasis on producing flexible and durable consumer goods, driving the demand for plasticizers. The market observes a shift towards eco-friendly formulations to meet consumer preferences for sustainable and safe products. As regulations tighten and awareness of environmental impacts increases, manufacturers within the Consumer Goods segment are exploring non-phthalate and bio-based plasticizers to align with these evolving trends.

Plasticizers Market Companies

- BASF SE

- Eastman Chemical Company

- ExxonMobil Corporation

- Dow Inc.

- Evonik Industries AG

- LG Chem Ltd.

- Arkema SA

- LANXESS AG

- UPC Group

- Perstorp Holding AB

- KLJ Group

- Shandong Qilu Plasticizers Co. Ltd.

- ADEKA Corporation

- Nan Ya Plastics Corporation

- Bluesail Chemical Group Co., Ltd.

Recent Developments

- In January 2024, Perstorp has launched Pevalen Pro 100, a non-phthalate plasticizer composed of 100% renewable carbon. This innovation significantly lowers the product's carbon footprint by around 80% in comparison to fossil-based alternatives, enhancing the environmental profile of flexible PVC applications without compromising performance.

- In August 2023, Lanxess has rolled out a new plasticizer named adipic acid dihydrazide-2-ethylhexyl ester (ADH), produced from renewable raw materials and free from phthalates and heavy metals, providing an environmentally sustainable option to traditional plasticizers.

- In December 2023, Aekyung Chemical Co. has acquired VINA Plasticizers Chemical Company (VPCHEM), augmenting its production capabilities and bolstering its market position in Southeast Asia. This acquisition aligns with Aekyung's strategic growth plan in the plasticizers industry.

- In December 2022,BASF, a German multinational, joined forces with StePac Ltd. from Israel to pioneer next-generation sustainable packaging tailored for the fresh produce sector. This collaboration aimed to address environmental concerns by developing innovative and eco-friendly packaging solutions for the agricultural industry.

- In April 2021, the Eastman Chemical Company made a strategic move by acquiring 3F Feed & Food, a leading European entity specializing in the technical and commercial development of additives for both animal feed and human food. This acquisition strengthened Eastman Chemical Company's position in the feed and food additive market, enhancing its capabilities in providing high-quality solutions for both industries.

- Further contributing to industry advancements, Evonik's Coating Additives Business Line introduced a multifunctional polymer additive for powder coating formulations in December 2022. This innovation showcased versatility in formulations, accommodating various inorganic fillers, pigments, and organic pigments, including carbon black. Evonik's commitment to developing advanced additives continues to drive progress in the coatings industry.

Segments Covered in the Report

By Phthalates

- Terephthalates

- Trimellitates

- Epoxides

- Phosphates

- Sebacates

- Extenders

- Aliphatic Dibasic Esters

- Others

By Application

- Flooring & Wall

- Film & Sheet Coverings

- Wires & Cables

- Coated Fabrics

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content