What is the Bio Plasticizers Market Size?

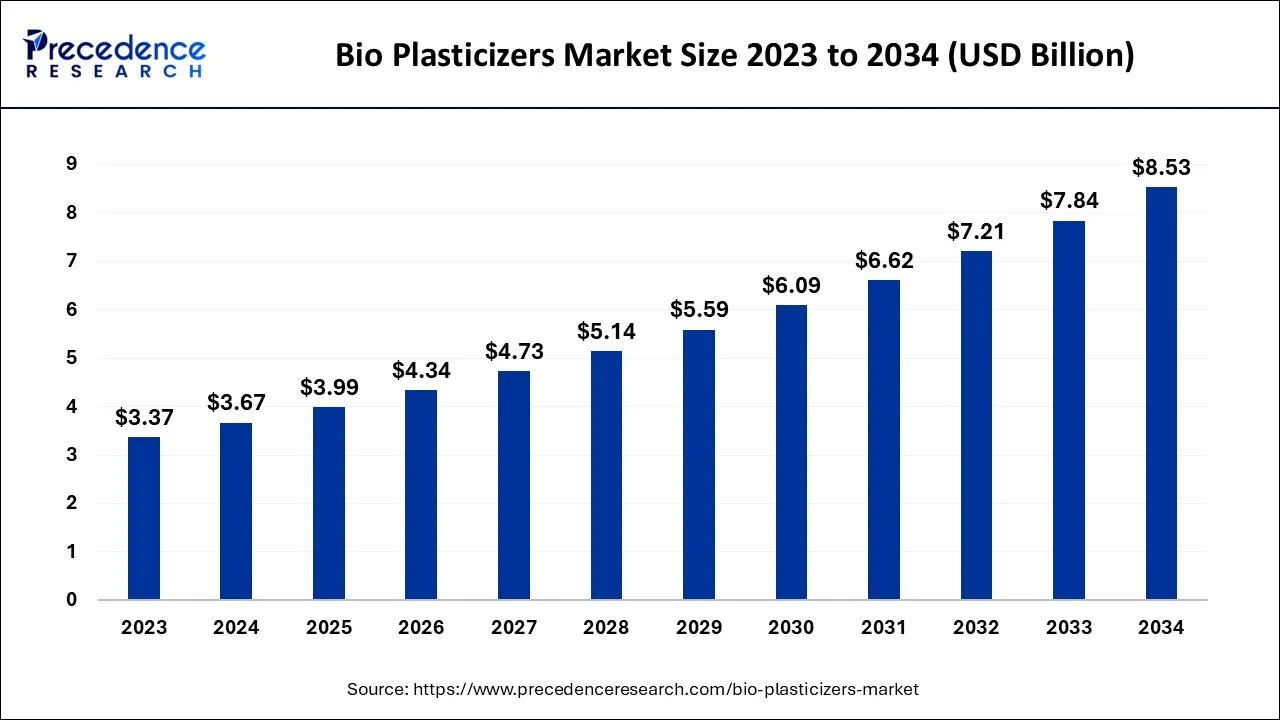

The global bio plasticizers market size is accounted at USD 3.99 billion in 2025 and predicted to increase from USD 4.34 billion in 2026 to approximately USD 8.53 billion by 2034, representing a CAGR of 8.8% from 2025 to 2034. Government, mergers, acquisitions, and partnerships are taking initiatives to incorporate innovative and advanced technology to propel the bio plasticizers market growth.

Bio Plasticizers Market Key Takeaways

- Europe dominated the bio plasticizers market in 2024.

- Asia Pacific is expected to grow at the fastest rate in the coming years.

- By product, the soybean oil segment registered the maximum market share in 2024.

- By application, the packaging materials segment has held the highest market share in 2024.

Exploring the Bio Plasticizers Market: Applications, Innovations, and Market Potential

A plasticizer is a material added to other polymeric cores to assist the processing of the polymer, impart plasticity, flexibility, and softness and lessen brittleness. These additives are widely employed in PVC cables, resins, wire jacketing, vinyl floor covering, medical apparatus, automobile elements, packaging substances, and consumer commodities. Bio-plasticizers are based on natural sources and are renewables. It is produced from raw materials such as soybean oil, stearic acid, starch, and castor oil.

Bio-based surfactants are mixtures that supply oleochemicals to fats and oils and or ripe sugar-like molasses. These surfactants are usually made in small quantities and at a high value, especially for premium consumer goods. They are particularly advantageous because they may be produced using renewable resources.

Yet, continuous alterations in environmental protocols, guidelines, and blending strategies are critical constraints that manufacturers face, reinforcing the threat to global bio-plasticizer trading. Furthermore, packaging firms opt for low-cost yet eco-friendly petrochemical alternatives without incriminating on product performance and are anticipated to set off market growth.

Raising awareness about the harmful effects of using plastics has forced U.S. consumers to shift to green materials, resulting in a constant surge in the global industry. These resins are vital to modify a polymer's characteristics to fit a particular use in which it is to be used.

Bio Plasticizers Market Growth Factors

The market is driven by targeting sustainable development. Bio plasticizers are nowadays used as an alternative to PVC. Consumers rely on bio-plasticizers for multiple applications, expanding the market worldwide with the growing concern about the environment. Consumers are inclined towards naturally occurring substances which again propels the market growth.

In 2020, the total worth of innovating construction was about USD 1,469 billion in the U.S. In 2021, it touched USD 1,590 billion with an expansion rate of 8%, eventually raising the need for flooring and wall coating, increasing the demand for bio-plasticizers market. Bio-plasticizers are a phthalate-free alternative in a broad range of consumer commodities, mainly food packaging, cosmetics, toys, and medical apparatus.

It has some physical properties, such as being malleable, softer and less brittle. It is derived as a biological chemical integrated into polymers to become a pliable and workable substance, recently gaining much attention. Manufacturing bio-based plasticizers usually call for high-priced inputs. Furthermore, it plays a significant role in improving the properties of polymers, which later aid in better usage.

Bio Plasticizers Market Outlook

Industry Growth Overview:

The market for bio plasticizers is set for rapid growth from 2025 to 2034 as industries quickly shift to renewable, non-toxic additives that meet changing environmental regulations. The main driver is the replacement of phthalate-based plasticizers with safer, plant-based alternatives in flexible PVC, biopolymers, and elastomeric applications.

Sustainability Trends:

Innovation and investment in the bio plasticizers industry continue to be driven by sustainability, as producers and end users seek low-carbon, circular chemistry. Evonik and Dow are working on developing new process chemistry and renewable intermediates to make their processes more efficient and reduce lifecycle emissions. These sustainability efforts are also supported by corporate ESG frameworks and consumer awareness, which call for transparent, safe, and traceable sourcing of materials.

Global Expansion:

The market is expanding globally as manufacturers seek closer access to renewable feedstock sources and new markets. In North America, particularly the United States, local incentives for bio-based production are driving significant investment in feedstock processing and capacity expansion. This internationalization not only diversifies supply chains but also enhances resilience against regional policy changes and feedstock price volatility.

Major Investors:

Institutional investors and private equity are actively investing in the bio plasticizers sector as they get stable margins, a sustainable growth profile, and good alignment with ESG principles. Capital is being invested in renewable materials portfolios by funds such as KKR, BlackRock, and TPG Rise Climate, with a focus on large-scale technologies in bio-intermediates and green polymer additives. The technical complexity of the sector and the long regulatory payback period create high barriers to entry, which is appealing to strategic investors seeking defensible niches.

Startup Ecosystem:

The startup ecosystem is rapidly evolving, driven by advancements in biotechnology, materials science, and green chemistry. New companies, including Checkerspot (USA), BioAmber (Canada), and Polymateria (UK), are pioneering enzyme-based esterification methods and biodegradable additive technologies that are safer and more effective than traditional phthalates. This expanding start-up ecosystem is likely to play a crucial role in the development of the next generation of renewable, circular plasticizer technologies as sustainability becomes a core requirement across all industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.53 Billion |

| Market Size in 2026 | USD 4.34 Billion |

| Market Size in 2025 | USD 3.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.8% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing need for polyvinyl chloride for different purposes. Rise in the number of packaging firms and increasing concern for safe and eco-friendly plastic films. Developing PVC as an economically used polymer is linked to evolving additives utilized in plasticization. Expanding consumer insights and a confined supply of harmful phthalate push bio-plasticizers' advancement. When phthalate plasticizers are in direct touch with bodily fluids, they are a health trouble.

Since they are readily miscible in organic solvents like saliva and plasma, it is feasible to ingest or absorb them throughout routine medical processes. Once absorbed, they get preserved in the fatty tissue of humans and, thus, can disrupt the growth of an embryo. Therefore, eco-friendly plant-based plasticizers for food packaging substances, medical products, and consumer goods are being developed due to the ban on phthalate-based plasticizers.

Restraints

Global bio-plasticizers market spread might be affected due to the high production price. Furthermore, the strict guidelines related to bio-plasticizers are expected to hinder the market size in the forecast period. Inconsistency in raw substance prices and using highly harmful raw materials in the output of ethylene carbonate restrain the market growth.

Opportunities

Increment in the use of bio-based plasticizers. Polyvinyl chloride records a portion of 85%-90% of the plasticizers consumed internationally, which is used in various ways, like electric cables and roofing membranes, wire insulation, and wall and floor covering. PVC is also used in automotive and paints, and inks spheres. As bio-plasticizers are non-toxic, they are progressively gaining traction as a vital element in the industry; they are also used in transportation industries, automotive, packaging, pharmaceuticals, medical devices, building and construction.

With advancements and innovations in production and process technologies, the need for bio-plasticizers is expected to grow significantly higher than regular plasticizers. This development is mainly driven by help from governments of different regions in the form of grants for making easy business policies.

Product Insights

Considering the product type, the global bio-plasticizers market has been divided into succinic acid, epoxidized soybean oil (ESBO), citrates, castor oil, and others. Of these, epoxidized soybean oil holds the most market revenue share. The resilience of plasticizers rises after the insertion of ESBO because of the epoxidation procedure of carbon-carbon double bonds in vegetable oil. Succinic acids are drafted into plastic additives that build flexible PVC with comparable mechanical properties to DOA.

They assist in manufacturing bio-based additives that are phthalate-free and hold higher renewability content than traditional synthetic counterparts. Likewise, castor oil and its derivatives are also used to make rigid, flexible, semi-rigid bio-plasticizers. It displays resistance to pigment dispersion and hydrolysis and is remarkably compatible with polyether polyols.

Citrates are nature-derived, biodegradable, and compostable plasticizers for PLA, PVC, PHA, and other biopolymers. Recycled bio-based polymers promptly gain repute since they decline harmful environmental effects and assure secure advantages and high bonuses to vegetable oil producers.

Application Insights

Based on the application insights, the global bio-plasticizers market works on various applications such as packaging material, textiles, agriculture and horticulture, consumer goods, automotive and transport, building & construction, medical devices, flooring and walls, wires and cables, and others. Out of all mentioned above, packaging materials are projected to dominate the market by generating the most considerable bio-plasticizer revenue.

Automobile interior fabrics are also drawn from natural-based polymers that offer similar mechanical properties to conventional synthetic counterparts. Packaging materials segments will witness an average expansion rate during the predicted period. Global packaging corporations have enforced standard manufacturing and easily flexible processes to laminate the particular application need of customers, mainly in food packaging.

Eco-friendly plastics produce eco-friendly irrigation pipes, tarps, drip tape, nursery pots, soil fumigation film, and silage bags. Emerging environmental restraints related to increasing carbon footprints, improved properties of finished products, and enhanced durability are expected to have the edge over synthetic plastics.

Regional Insights

What Made Europe the Dominant Region in the Bio Plasticizers Market in 2024?

Europe dominated the bio plasticizers market by capturing the largest share in 2024, due to strong regulatory frameworks like REACH, the EU Green Deal, and increased funding for green chemistry. Partnerships between chemical manufacturers and biorefinery plants are expected to strengthen supply chain resilience. The region's commitment to carbon neutrality and strong R&D in bio-based formulations are also likely to support its long-term leadership in the market.

Germany Bio Plasticizers Market Analysis

Germany is expected to lead the European bio plasticizers market due to its strong policy framework supporting carbon neutrality and green chemistry innovation. The adoption of these products is likely to be driven by increasing demand in the construction, consumer goods, and automotive sectors. Germany's national circular economy policy and collaborations with biopolymer producers also promote a more sustainable approach to feedstock integration and reduce dependence on petrochemical derivatives.

What Makes Asia Pacific the Fastest-Growing Market for Bio Plasticizers?

Asia Pacific is expected to grow at the fastest rate in the upcoming period, driven by rapid industrialization, expanding manufacturing bases for polymers, and abundant natural feedstocks. The leading adopters are China, India, and Japan, supported by government initiatives that promote the use of biodegradable, environmentally friendly materials. The biorefining and technological innovation efforts among regional producers are also being carried out at significant costs, establishing Asia Pacific as the global production hub.

China Bio Plasticizers Market Trends

China leads the Asia Pacific bio plasticizers market due to large-scale biopolymer production, government-supported green manufacturing policies, and abundant agricultural feedstock. The Made in China 2025 project promotes the use of green materials in innovation, particularly in packaging and automotive interiors. The increasing domestic consumption of biodegradable plastics and focus on export-oriented production reinforce China's global leadership in plasticizer manufacturing.

What Potentiates the Growth of the Market in North America?

Strict environmental policies, the phase-out of phthalates, and the large quantities of soybean feedstocks are expected to boost the growth of the bio-plasticisers market in North America. There is increasing demand in the U.S. and Canada for environmentally friendly additives in packaging, automotive, and healthcare. Furthermore, the growing consumer preference for safer materials is likely to continue supporting the region's dominance until 2030.

U.S. Bio Plasticizers Market Trends

The growth of the U.S. bio plasticizers market is driven by a strong industrial infrastructure. Supportive policies from the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy (DOE) are boosting bio-based R&D. Market penetration is likely to increase through higher use of epoxidized soybean oil and citrate plasticizers in flexible PVC production.

How is the Notable Rise of Latin America in the Bio Plasticizers Market?

The market in Latin America is expected to grow at a notable rate due to the expansion of agricultural resources and rising environmental awareness in countries like Brazil and Mexico. The supply of castor and soybean oil feedstocks offers competitive advantages to local bio-based chemical manufacturing. Growing demand in flexible packaging, flooring, and consumer goods industries has further enhanced the region's potential in the global value chain.

Brazil Bio Plasticizers Market Trends

Brazil is expected to lead the bio plasticizers market in Latin America due to the availability of abundant natural feedstocks like soybean and castor oil. The country's existing agro-industrial sector and government policies that promote green chemistry are driving market growth. Companies such as Braskem are at the forefront of producing renewable chemicals and exporting biopolymers, enhancing Brazil's competitiveness.

What Factors Support the Growth of the Bio Plasticizers Market in the Middle East and Africa?

The growth of the market in the Middle East and Africa is driven by regional efforts to diversify industries and promote sustainability through chemical innovations. Government-supported programs to develop bio-based products in the UAE, Saudi Arabia, and South Africa are also increasing interest in renewable plasticizers. The expanding construction, packaging, and cable manufacturing sectors are expected to boost market adoption.

Saudi Arabia Bio Plasticizers Market Analysis

The Saudi Arabian market is likely to grow due to the country's Vision 2030 program, which focuses on economic diversification and sustainable industrial development. The Saudi Industrial Development Fund (SIDF) is funding initiatives to advance the use of renewable feedstocks and green chemicals. The market is also driven by increased investment by SABIC and foreign partnerships to produce non-phthalate and bio-based plasticizers.

Bioplasticizers Market - Value Chain Analysis

Raw Material Sourcing - The value chain begins with the procurement of renewable feedstocks, including vegetable oils (soybean, castor, palm, linseed), starch, and citric acid. These bio-based raw materials form the backbone of sustainable plasticizer production, replacing fossil-based inputs like phthalates.

- Key Players: Cargill, Archer Daniels Midland (ADM), Wilmar International, IOI Oleochemicals, BASF SE.

Intermediate Chemical Processing - Natural feedstocks are converted into key intermediates, such as fatty acid esters, epoxidized oils, and citrate derivatives, through processes such as esterification, epoxidation, and hydrogenation. These intermediates determine the flexibility, thermal stability, and biodegradability of the final bio-plasticizers.

- Key Players: Emery Oleochemicals, Evonik Industries AG, OXEA GmbH (OQ Chemicals), LANXESS, Perstorp Holding AB.

Bio-Plasticizer Manufacturing - In this stage, intermediates are formulated into bio-plasticizers tailored for specific polymer systems, including PVC, biopolymers, and elastomers. Producers focus on creating phthalate-free, non-toxic, and high-performance alternatives compatible with existing manufacturing processes.

- Key Players: Avient Corporation, Matrica SpA, Jungbunzlauer Suisse AG, Roquette Frères, DIC Corporation.

Compound Formulation & Product Integration - Bio-plasticizers are blended with polymers and other additives to create flexible PVC, bioplastic compounds, or coatings. These formulations are customized for various end-use industries, including packaging, automotive interiors, construction materials, and medical devices.

- Key Players: Teknor Apex Company, PolyOne (now Avient), BASF SE, Solvay, Dow Inc.

Distribution & End-Use Application - Finished bio-plasticized materials are distributed to downstream manufacturers producing films, cables, flooring, toys, and other flexible goods. Growing regulatory bans on phthalates and rising demand for eco-friendly products are accelerating adoption across consumer and industrial markets.

- Key Players: LG Chem, Mitsubishi Chemical Group, Arkema, NatureWorks LLC, Clariant AG

Bio Plasticizers Market Companies

- Avient Corporation (USA): Avient delivers advanced polymer and bio-based plasticizer solutions designed to enhance flexibility, sustainability, and performance across packaging, consumer goods, and industrial applications.

- Matrica SpA (Italy): A joint venture between Versalis and Novamont, Matrica specializes in renewable chemistry, producing bio-plasticizers derived from vegetable oils to replace traditional fossil-based additives.

- Dow (USA): Dow develops high-performance and environmentally friendly plasticizers that improve flexibility, durability, and processability in polymers for automotive, construction, and packaging industries.

- Solvay (Belgium): Solvay offers innovative bio-based and non-phthalate plasticizers designed to meet stringent safety and sustainability standards in consumer goods, construction, and electrical applications.

- DIC Corporation (Japan): DIC manufactures sustainable plasticizers and resin additives that enhance flexibility and environmental compliance for coatings, films, and flexible packaging markets.

- OXEA GmbH (Germany): OXEA, a part of OQ Chemicals, produces oxo intermediates and specialty esters used in advanced non-phthalate and bio-plasticizer formulations for flexible PVC and polymer systems.

- Emery Oleochemicals (Malaysia): Emery Oleochemicals is a global leader in natural-based chemical solutions, offering bio-plasticizers made from renewable fatty acids for sustainable polymer and elastomer applications.

- Roquette Frères (France): Roquette provides starch-based, plant-derived plasticizers that deliver excellent biodegradability and performance in biopolymers used for packaging and consumer products.

- Evonik Industries AG (Germany): Evonik develops high-efficiency, environmentally friendly intermediates and additives used in next-generation plasticizer technologies for durable and sustainable materials.

- PolyOne Corporation (USA): Now operating under Avient, PolyOne's product portfolio includes innovative bio-based plasticizers and sustainable polymer modifiers engineered for flexible and high-performance materials.

- LANXESS (Germany): LANXESS produces specialty and phthalate-free plasticizers that ensure superior performance, safety, and sustainability in automotive, flooring, and wire and cable applications.

- Hebei Jingu Plasticizer Co. Ltd (China): Hebei Jingu is a leading Chinese manufacturer of green, renewable plasticizers, offering epoxidized soybean oil and bio-plasticizer products for PVC and polymer markets.

- Jungbunzlauer Suisse AG (Switzerland): Jungbunzlauer manufactures citrate-based, bio-derived plasticizers made from natural resources, used widely in medical, food packaging, and children's toy applications.

- Jiangxi East Huge Dragon Chemical Co. Ltd (China): This company specializes in producing eco-friendly, non-phthalate plasticizers, focusing on sustainable and flexible solutions for cables, flooring, and film products.

Recent Developments

- On October 8, 2025, Bhageria Industries Limited began commercial production of 12 new plasticizers and various ethoxylates at its Boisar Palghar facility, targeting domestic and international markets in cables, flooring, and automotive sectors.

- In October 2024, Evonik Oxeno expanded the production of its INA-based plasticizers, ELATUR CH (DINCH) and ELATUR DINCD, which have quickly become standard solutions for customers.

- In January 2025, Versalis launched Nareglax, a partially bio-based (38% bio-carbon) phthalate-free plasticizer for NBR, CR, and PVC, offering a sustainable alternative to DOS and DOA.

Segments Covered in the Report

By Product

- Epoxidized Soyabean Oil (ESBO)

- Castor Oil Based Plasticizers

- Succinic Acid

- Citrates

- Others

By Application

- Packaging Material

- Textiles

- Agriculture and Horticulture

- Consumer Goods

- Automotive and Transport

- Building and Construction

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content