A2 Milk Market Size to Rise USD 31.51 Billion by 2030

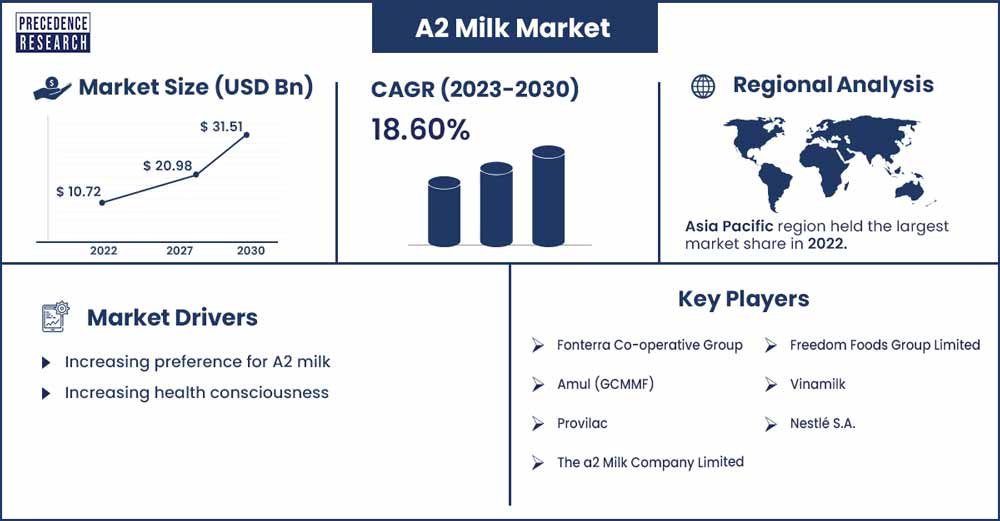

The global A2 milk market revenue was exhibited at USD 10.72 billion in 2022 and is projected to attain USD 31.51 billion by 2030, growing at a CAGR of 18.6% from 2022 to 2030.

Market Overview

A2 milk is a dairy milk known for its potential ease of digestion, especially for individuals who may have difficulty tolerating A1 beta-casein. If you enjoy the taste of regular dairy milk, are not lactose-intolerant, but often experience digestive discomfort after consuming traditional milk, A2 milk could be a suitable alternative.

A2 milk is known for its health benefits, offering higher protein content, easy digestibility, and essential nutrients. With 12% more protein, 25% extra vitamin A, 15% additional calcium, 33% more vitamin D, and 30% more good fat, A2 milk is increasingly used in infant formulas, contributing to its market growth. The lower levels of BCM-7 released during A2 milk digestion make it a preferred choice for baby food manufacturers, addressing concerns associated with stomach-related issues in infants. This growing demand for A2 milk is expected to fuel market expansion.

A2 milk serves as a rich source of omega-3 fatty acids, contributing to the overall growth and development of the human body. The increasing demand for A2 milk is driven by consumer health concerns and a growing awareness of its benefits, including a reduced risk of heart diseases, mitigation of dairy-related inflammation, and its suitability as an alternative to mother's milk. These factors collectively contribute to the market's growth.

The market for A2 milk is poised for growth due to factors like rising disposable income and increased awareness of its health benefits, such as immune system support, enhanced metabolism, and cognitive development, along with its usage in bakeries and confectioneries. Furthermore, the expansion of A2 milk product offerings, including cheese, infant formula, and baby food, coupled with the proliferation of hypermarkets, supermarkets, and online stores, presents a lucrative opportunity for market expansion.

To cut expenses and boost revenues, dairy businesses are moving to a direct distribution channel for A2 milk. During the first pandemic, A2 milk sales increased dramatically due to changing customer purchasing habits. Increased sales through internet and pantry stocking, particularly in China and Australia, resulted in higher profits for the A2 Milk Company. There is a noticeable rise in A2 milk sales outside the house in the worldwide market as the pandemic's impacts lessen and countries resume their regular routines. For example, in August 2022, The a2 Milk Company (a2MC) partnered with KidsCan, a well-known New Zealand charity that helps children affected by poverty. For the first three years, a2MC pledged to provide USD 130,000 a year to assist KidsCan's important work.

- A2 milk, with a fat percentage of around 4.8%, has a higher fat content than regular milk, which has about 3.6% fat. The market is growing due to the rising popularity of liquid A2 beta-casein milk, attributed to its natural flavour and mild taste.

- A2 milk is a variety of cow's milk mainly containing the A2 form of β-casein polypeptide, lacking the A1 type. It boasts 12% more protein, 25% more vitamin A, 15% more calcium, 33% more vitamin D, and 30% more cream than regular milk.

Regional Snapshot

Asia Pacific takes the lead in the A2 milk market, fueled by solid milk production, high demand, and the prevalence of A2-producing cow breeds. Following closely is Europe, known for its advanced dairy infrastructure. Asia Pacific, especially in countries like China and India, is a pivotal market due to the growing awareness of the benefits of A2 beta-casein milk. Moreover, the region is a key manufacturing hub for A2 milk, with readily available A2 breed cows and an increasing demand for dairy products.

The demand for A2 milk in the region will increase throughout the forecast period with multiple ongoing business acitivites. For instance, Hershey's and a2 Milk collaborated to introduce Hershey's a2 Milk's chocolate-flavoured milk in October 2021. These companies release very few new products in the market due to limited investments in research and innovation capabilities, which are essential for launching a new or improved product into the market.

- In August 2023, Amul announced the investment of Rs 800-1,000 crore to establish 12-14 new ice-cream manufacturing units and double its capacity by the end of next year. According to Jayen Mehta, MD of GCMMF (Amul), this investment includes greenfield and expanding existing projects.

- On June 16, 2023, Vietnamese dairy company Vinamilk announced a strategic partnership with six prominent global nutrition and bioscience companies. This collaboration underscores Vinamilk's international standing and dedication to delivering high-quality baby milk powder that meets international standards.

- In June 2022, Provilac announced the launch of lactose-free cow milk in India, expanding its existing portfolio of milk and related products. With a presence in Pune, Mumbai, and Hyderabad, Provilac currently serves 20,000 households.

A2 Milk Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 12.25 Billion |

| Projected Forecast Revenue by 2030 | USD 31.51 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 18.6% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising awareness regarding the health benefits of milk

The global recognition of the health benefits associated with milk has led to a shift in consumption patterns. Cow milk, a popular and nutritious choice, contains two main proteins, A1 and A2. A1 milk is derived from cows of Western ancestry that are prolific milk producers, resulting in widespread availability and consumption. Experiencing a surge in retail sales during the early stages of the pandemic, A2 milk witnessed changing consumer buying patterns. The A2 Milk Company strategically increased revenues by stocking products through reseller channels and online sales, notably in China and Australia. As the pandemic's impact diminishes and nations return to pre-pandemic conditions, the global market has evolved, observing a rise in out-of-home sales of A2 milk. Many dairy companies have opted for direct distribution to boost profit margins, minimizing intermediary costs.

Restraint

Limited market reach

The limited market reach of A2 milk is anticipated to create opportunities for global expansion. However, hindrances to market growth include the relatively high cost of A2 milk and the availability of more affordable vegan alternatives. There is a need for concrete evidence regarding the benefits of A2 milk. A significant challenge lies in addressing the need for more consumer awareness.

Opportunity

Availability in flavored packages

A2 milk is extensively consumed in its natural state and the product is now being available in the flavored packages as a packaged product with added flavors. Additionally, various processed milk options, comprising multiple types, such as full cream, low fat, no fat, and light varieties, A2 milk is consumed on a large scale in its original form. Enjoy widespread popularity, contributing to the substantial market share of milk-based beverages. In the infant formula segment, A2 milk market is observed to grow. Numerous health benefits of A2 milk, such as high protein and vitamin content, easy digestibility, and absence of antibiotics, make it a preferred choice for infant formulas.

A2 milk is predominantly packaged in cartons, primarily driven by the cost-effectiveness and ease of transportation associated with this packaging type. Additionally, using environmentally friendly raw materials further contributes to the growth of the carton packaging segment. Cans are anticipated to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period, primarily owing to their longer shelf life and reusability.

Recent Developments

- On September 13, 2023, the a2 Milk Company made a significant announcement about introducing its renowned a2 Platinum® Premium Infant Formula to the U.S. market. The product will be available in nearly 250 Meijer stores (already accessible) and 50 Wegman's stores (open from September 18). Customers can also make online purchases through a2nutrition.com, and the product will soon be offered on Amazon.com.

- In August 2022, SwadeshiVIP, India's prominent A2 Cow Milk brand, introduced A2 Shishu Milk, specifically designed for infants and kids. This new addition to their product line signifies SwadeshiVIP's commitment to expanding its presence and establishing dominance in the A2 milk market in the coming years.

Market Key Players

- Fonterra Co-operative Group

- Amul (GCMMF)

- Provilac

- The a2 Milk Company Limited

- Freedom Foods Group Limited

- Vinamilk

- Nestlé S.A.

Major Market Segments Covered:

By Form

- Powder

- Liquid

By Application

- Infant Formula

- Milk-based Beverages

- Bakery & Confectionery

- Dairy Products

By Packaging

- Carton Packaging

- Glass Bottles

- Cans

- Plastic Pouches & Bottles

By Distribution Channel

- Online Stores

- Grocery and Convenience Stores

- Hypermarkets and Supermarkets

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1232

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333