What is the A2 Milk Market Size?

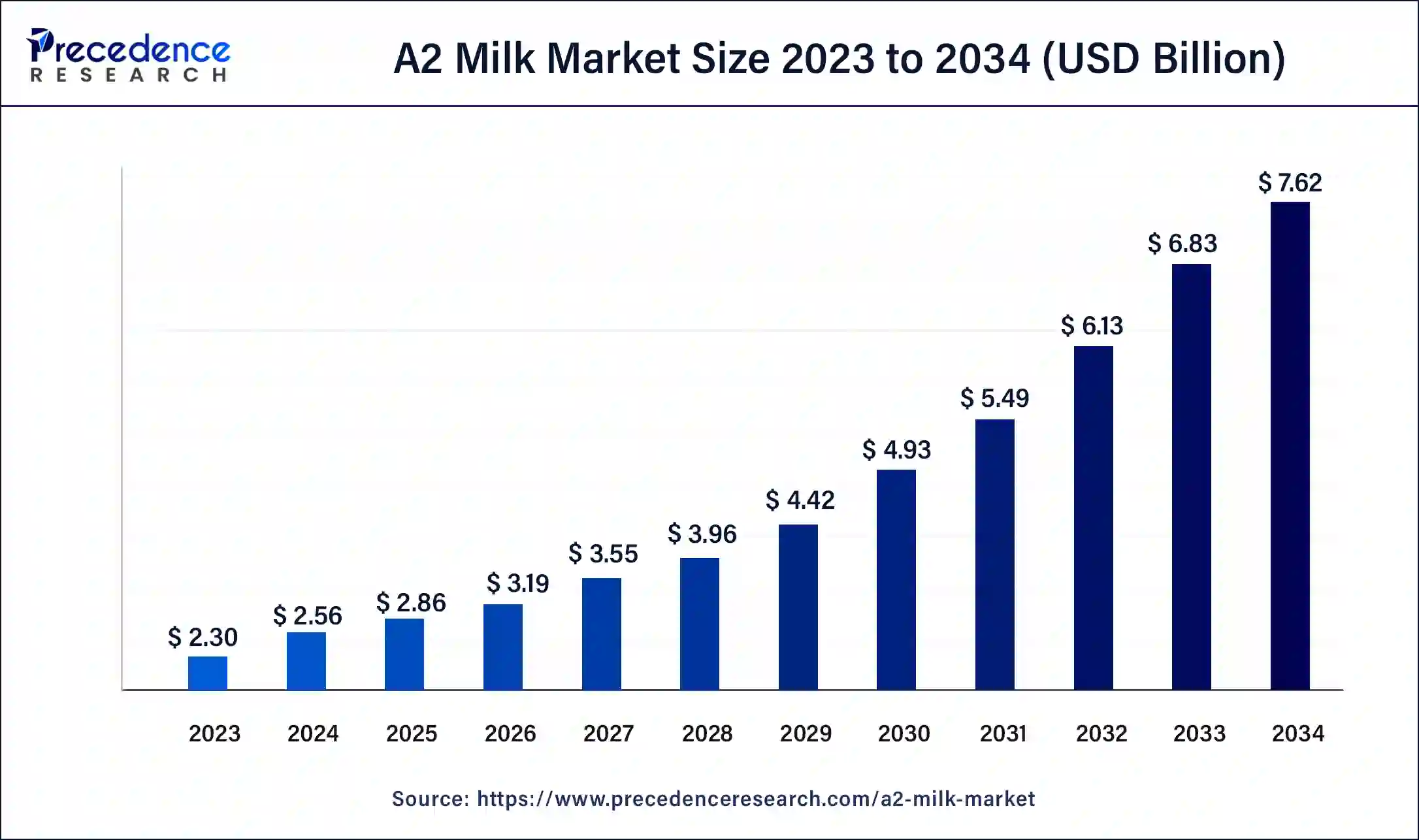

The global A2 milk market size is calculated at USD 2.86 billion in 2025 and is predicted to increase from USD 3.19 billion in 2026 to approximately USD 7.62 billion by 2034, at a CAGR of 11.5% from 2025 to 2034. The rising awareness about health and well-being, increasing health consciousness among the population, and growing usage of A2 milk in infant formula are expected to drive the growth of the A2 milk market during the forecast period.

A2 Milk Market Key Takeaways

- In terms of revenue, the market is valued at $2.86 billion in 2025.

- It is projected to reach $7.62 billion by 2034.

- The market is expected to grow at a CAGR of11.50% from 2025 to 2034.

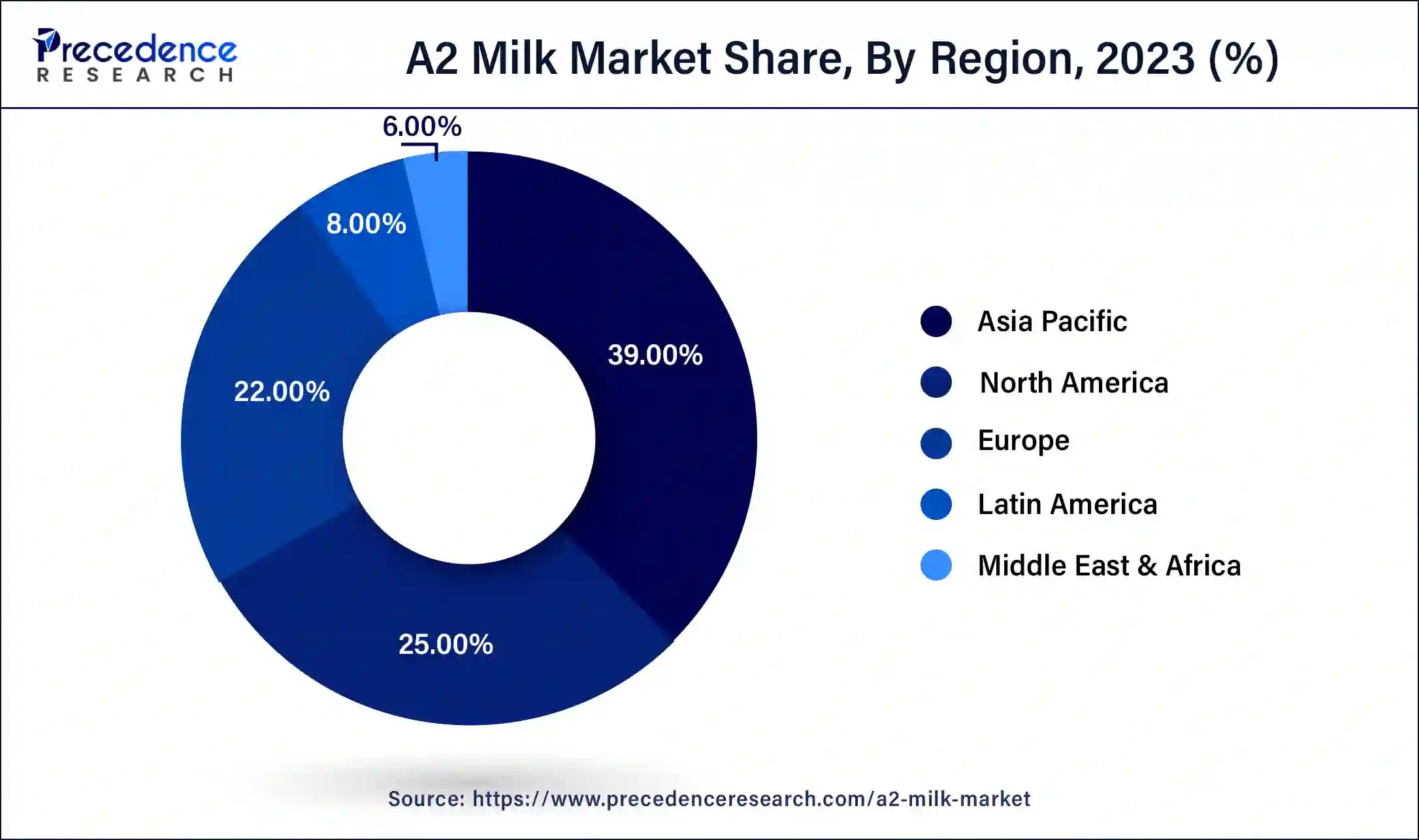

- Asia Pacific led the global market with the highest market share of 39% in 2024.

- By form, the liquid segment has held the largest market share in 2024.

- By application, the milk-based beverages segment captured the biggest revenue share in 2024.

- By packaging, the carton packaging segment registered the maximum market share in 2024.

- By distribution channel, the hypermarkets and supermarkets segment has held the highest market share in 2024.

Market Overview

Milk that contains only A2 beta-casein polypeptide is called A2 milk. A2 milk is a type of cow's milk that generally lacks a type of β-casein polypeptide called A1, and has majorly the A2 form. A2 milk has 12% more protein, 25% more vitamin A, 15% more calcium, 33% more vitamin D and 30% more cream. Also, research on A2 milk consumption have shown that regular consumption of A2 milk can assist in slowing down of muscle catabolism, thus improving muscle recovery. Milks from Guernsey, Jersey, Asian herds etc. comprise majorly A2 beta casein. A2 milk consists of beta casein protein that varies by one amino acid at 67th place in chains of amino acids. When we compare A1 milk with A2 milk, A2 is better digested as compared to A1. Digestion of A1 occurs in intestine and peptide named beta-casomorphin-7 (BCM-7) is produced enzymatically from the A1 β-casein variant. Beta-casomorphin (BCM) protein belongs to opioid peptide group and has been reported that presence of BCM-7 causes stomach discomfort, lactose intolerance, and other gastrointestinal problems and is assumed to be associated with increased risk of type 1 diabetes and heart diseases. A2 β-casein variant do not cause such discomfort and therefore is more preferable as compared to A1.

A2 milk has high nutritional content which is essential for the growth of an infant. A2 milk has health benefits because of high protein content, easily digestible properties, good source of calcium, important vitamins and minerals etc. and is similarly free of antibiotics and hormones. A2 milk has 12% additional protein, 25% extra vitamin A, 15% more calcium, 33% more vitamin D and 30% more good fat content. Thus, it is being widely used to manufacture the infant formula helping drive the market growth of A2 milk. Milk is an important dietary staple and integral part of baby food. Milk with A1 beta casein has shown to release increased levels of BCM-7 in infants which are linked with various stomach related disorders. Whereas, A2 milk digestion releases lower levels of BCM-7. Thus, A2 milk is widely preferred in infant formulas by baby food manufacturers, which has led to increase in demand for A2 milk which will boost the market growth in the coming years.

Technology Advancement

The A2 milk market is transforming with technological advances improving both productivity and product value. Dairy genomics technology is empowering dairy farmers to enhance the genetic stock of their herds by identifying cows that make milk containing A2 beta-casein only, without the A1 variant. This can assist in breeding steering programs and guarantees for supply of credible A2 milk. For lactating consumers, this could imply less difficulty and fewer stomach problems.

Advanced technologies in the automation of milking systems as well as monitoring systems, have greatly simplified the work done in dairy farms. These modern dairy farming equipment make it possible to maintain hygiene standards during milk collection and processing, thus avoiding contamination. This allows users to trace the milk origins, not only securing but also improving the brand trust.

A2 Milk Market Growth Factors

- Increasing preference for A2 milk

- Growing use of A2 milk in infant formula

- Increasing health consciousness

- Rapid spread of knowledge related to health and well-being

- Increase in consumer spending in developing regions

- Rise in disposable income

- Increasing preference for sustainable and organic products

- Launch of new products by multinationals

Market Outlook

- Industry Growth Overview- The market is experiencing strong growth driven by rising consumer awareness of digestive health, increasing demand for infant nutrition and premium dairy products, and a shift toward easily digestible, nutrient-rich milk alternatives worldwide.

- Global Expansion- The A2 milk market is expanding globally due to growing health-conscious consumer demand, rising adoption in infant formulas and functional dairy products, and increasing awareness of the digestive benefits of A2 milk across North America, Europe, and Asia-Pacific.

- Major investors- Major investors in the market include institutional stakeholders such as Perpetual Limited, BlackRock, and The Vanguard Group, holding significant equity. Institutional ownership accounts for over half of shares, providing strong financial backing and supporting market growth.

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 7.62 Billion |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size in 2026 | USD 3.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.5% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Application, Packaging, Distribution Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Growing consumer preferences

A2 milk is gaining immense attention as consumer preferences evolve toward ethical, organic, and natural choices. Various brands produce A2 milk-based products in environmentally responsible ways. Some even focus on better animal welfare practices, such as grass-fed cows, appealing to a customer base concerned with ethical considerations and sustainability. Moreover, the rising awareness about the benefits of consuming A2 milk is expected to drive the market. A2 milk strengthens teeth and bones and promotes cell and tissue growth. A2 milk is equivalent to a mother's milk. Thus, it is widely used in infant formulae. Several players focus on developing A2 milk-based products to meet the increasing demand.

- In September 2023, the a2 Milk Company announced that its highly associated a2 Platinum Premium Infant Formula hit the stores in the U.S. with initial distribution in nearly 50 Wegman's stores (available 9/18) and 250 Meijer stores (available now).

Restraint

High cost of A2 milk

Indian-origin cows produce A2 milk; however, the production per cow is minimal. Moreover, the nutritious nature of A2 milk raises its overall value, thereby increasing its adoption in infant formulae and dietary products. These factors may create a gap between demand and supply. However, the gap between demand and supply of A2 milk further increases the final product's costs, leading to a higher cost of A2 milk than A1 milk, thus restraining the market growth.

Opportunity

Inclination toward sustainable production of A2 milk

Sustainability helps with community and individual well-being. It promotes a better economy with equitable wealth distribution, fewer emissions, and less waste and pollution. Moreover, a sustainable milk production approach can minimize the environmental impact of dairy farming and increase social endorsement and animal welfare. Customers with higher moral standards demand A2 milk dairy products. Thus, various companies producing A2 milk-based products focus on sustainability in their packaging, processing, production, and other procedures, contributing to enhancing the growth of the A2 milk market in the coming years. For instance,

- In July 2023, the a2 Milk Company expanded its portfolio by launching grass-fed whole milk and grass-fed 2% reduced fat milk. The company also announced that these products are certified by nonprofit certifier A Greener World (AGW).

Form Insights

The liquid segment held the largest market share in 2024. Increasing preference for a liquid form of A2 milk contributed to the segment's growth. Liquid form of milk highly preferred for direct consumption. It helps customers derive maximum nutrients, such as calcium, proteins, minerals, and vitamins. These vitamins support the maintenance of the nervous system's health. Fresh A2 milk also involves more selenium and phosphorus than powdered milk. The gentle taste and natural flavor of liquid A2 milk increase its adoption in beverages, accelerating the market growth.

Application Insights

The milk-based beverages segment accounted for a large share of the market in 2024 due to the increasing demand for flavored liquid formulae. A2 milk is consumed on a large scale in its original form and is also sold as a packaged product with added flavors. Moreover, processed milk, such as no-fat, full-cream, low-fat, and light varieties, is also very popular.

The infant formula segment is projected to expand at the highest CAGR during the forecast period, owing to the rising usage of A2 milk in infant formula. The A2 milk is widely being used in infant formulas due to multiple health benefits associated with it, such as high protein and vitamin content, easy digestibility, and absence of antibiotics. Moreover, it replaces mother's milk.

Packaging Insights

The carton packaging segment led the market in 2024, holding the largest share. The high use of carton packaging for A2 milk is mainly due to its low cost and is easy to transportation. Moreover, the rising usage of environmentally friendly packaging materials contributed to the growth of the carton packaging segment.

The cans segment is expected to expand at the highest CAGR during the forecast period due to their longer shelf life and reusability. Cans are widely used to pack liquid beverages. Furthermore, cans can be recycled, thereby reducing waste and aligning well with sustainable packaging.

Distribution Channel Insights

The hypermarkets and supermarkets segment led the market in 2024, accounting for a major market share. The rapid expansion of supermarkets and the availability of a wide range of products under a single roof are the major factors contributing to the segment's growth. Moreover, hypermarkets and supermarkets often have separate shelves with controlled temperature for dairy-based products, which avoids spoilage. Thus, customers find it convenient to buy everyday needs in such shops.

The online stores segment is anticipated to expand at the fastest growth rate in the coming years due to the convenience provided by these stores. Online platforms often have a separate section for dairy-based products, allowing users to easily find the products they want. The increasing internet usage for shopping, higher convenience, and reduced lead time are major factors boosting the sale of A2 milk through online stores.

Regional Insights

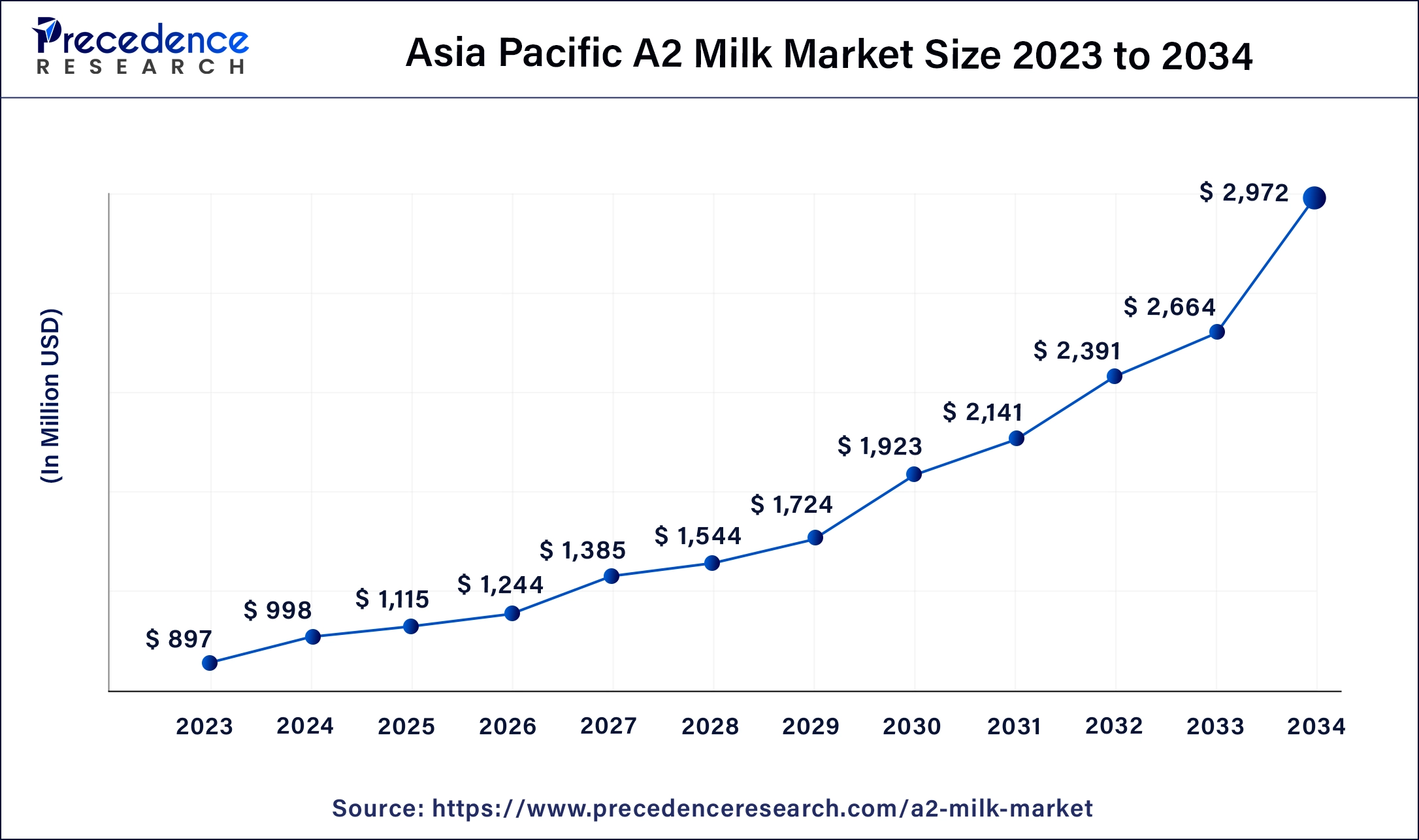

Asia Pacific A2 Milk Market Size and Growth 2025 to 2034

The Asia Pacific A2 milk market size is estimated at USD 1,115 million in 2025 and is predicted to be worth around USD 2,972 million by 2034, at a CAGR of 11.7% from 2025 to 2034.

Asia Pacific dominated the A2 milk market in 2023 due to the increasing demand for dairy products and the wide availability of A2 breed cows in the region. Moreover, the increasing awareness about the benefits of A2 beta-casein milk among the population, growing health-conscious population, and rising production of A2 milk in emerging countries, such as India and China, contributed to the regional market growth.

The market in Europe is expected to expand at the fastest growth rate during the forecast period due to the presence of the state-of-the-art dairy infrastructure. Furthermore, the rising demand for dairy products boosts the market. On the other hand, North America is anticipated to witness a rapid growth rate in the coming years due to the high spending on premium food products, rising awareness about the availability of healthy food options, and increasing cases of lactose intolerance.

China Enhances A2 Milk- Driving Growth Through Health and Nutrition Awareness

China's A2 milk market is expanding due to increasing consumer awareness about digestive health and the benefits of A2 over A1 milk. Rising demand for infant formula and functional dairy products, coupled with higher disposable incomes, urbanization, and government support for high-quality dairy production, is driving growth. Additionally, concerns over gastrointestinal discomfort from regular milk and a preference for premium, nutritious options are boosting A2 milk adoption across the country.

UK: Boosting Growth Through Health and Digestive Benefits

The UK market is growing due to rising consumer demand for easily digestible, high-quality dairy products and increasing awareness of the health benefits of A2 over A1 milk. Growth is supported by a strong dairy industry, higher disposable incomes, and the popularity of A2 milk in infant nutrition and functional foods. Additionally, concerns over lactose intolerance and digestive discomfort are encouraging more consumers to choose A2 milk.

U.S. Consumers Drive Growth with Rising Demand for A2 Milk

The U.S. market is growing due to increasing consumer awareness of digestive health and the advantages of A2 over A1 milk. Rising demand for premium and functional dairy products, including infant formulas, along with higher disposable incomes, urban lifestyles, and health-conscious trends, is driving adoption. Additionally, concerns about gastrointestinal discomfort and a preference for natural, nutrient-rich milk are further fueling market growth across the country.

Value Chain Analysis

Raw Material Procurement

- The main raw material for A2 milk is milk from cows producing only the A2 beta-casein protein.

- Specialized procurement processes are required to source, test, and transport this specific type of milk.

- Ensures quality and consistency in A2 milk production.

Product Conceptualization and Design

- The product line will be marketed as a premium, organic, and ethically sourced dairy brand.

- Emphasizes easy digestibility compared to standard milk products.

- Expands beyond liquid milk to include a variety of A2 dairy products, meeting diverse consumer preferences and needs.

Top Vendors and their Offerings

Frontera- Provides A2 milk products, focusing on high-quality, easily digestible dairy options including fresh milk and flavored variants.

Amul- Offers A2 milk sourced from select indigenous cow breeds, supplying packaged milk and infant nutrition products.

Provilac- Produces A2 milk and dairy products, emphasizing nutritional benefits and digestive comfort for consumers.

Vinamilk- Supplies A2 milk and related dairy items, promoting health benefits and suitability for families and children.

Nestlé- Offers A2 milk-based products, including infant formula and packaged milk, highlighting enhanced digestibility and nutritional value.

A2 Milk Market Companies

- Fonterra Co-operative Group

- Amul (GCMMF)

- Provilac

- The a2 Milk Company Limited

- Freedom Foods Group Limited

- Vinamilk

- Nestlé S.A.

Recent Developments

- In February 2025, a2 Milk Company (a2MC) launched its a2 Genesis infant formula across mainland China around late FY25, due to increasing demand for more advanced baby nutrition. The product contains three HMOs (human milk oligosaccharides are natural compounds present in human milk) as well as prebiotics, probiotics, and DHA, as part of the purpose of the a2 Genesis infant formula to support infant nutrition and development.

- In November 2024, Farmery launched A2 cow milk, fresh farm-to-table, and packaged A2 cow milk in a sustainable glass bottle. The 1-litre bottle costs INR 120; the product is available for customers in New Delhi.

- In October 2024, a2 Milk Company (a2MC) entered the market in Vietnam and is launched a premium range across six dairy products, including a2 Platinum junior milk drink, mother nutrition, milk powders, and UHT long-life full-cream milk.

- In June 2024, Mother Dairy launched buffalo A2 milk for consumers in the NCR region. Mother Dairy expanded its species-based milk portfolio after exceptional consumer patronage of cow milk with the introduction of buffalo milk.

- In April 2024, the A2 Milk Company launched ‘Only a2 Will Do', an innovative new brand platform, and ‘Tough Tummies,' a campaign that celebrated A2 Milk's natural absence of the A1 protein found in most conventional milk.

- In October 2023, Little Farms launched exclusive bannister downs milk at their retail stores. With its eco-friendly packaging, made with 35% chalk, this nutrient powerhouse, with additional iron, calcium, zinc, and B12, has no added sugar and is easy to digest due to its A2 rich, A1-poor profile.

Segments Covered in the Report

By Form

- Powder

- Liquid

By Application

- Infant Formula

- Milk-based Beverages

- Bakery & Confectionery

- Dairy Products

By Packaging

- Carton Packaging

- Glass Bottles

- Cans

- Plastic Pouches & Bottles

By Distribution Channel

- Online Stores

- Grocery and Convenience Stores

- Hypermarkets and Supermarkets

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting