What is the Milk Protein Market Size?

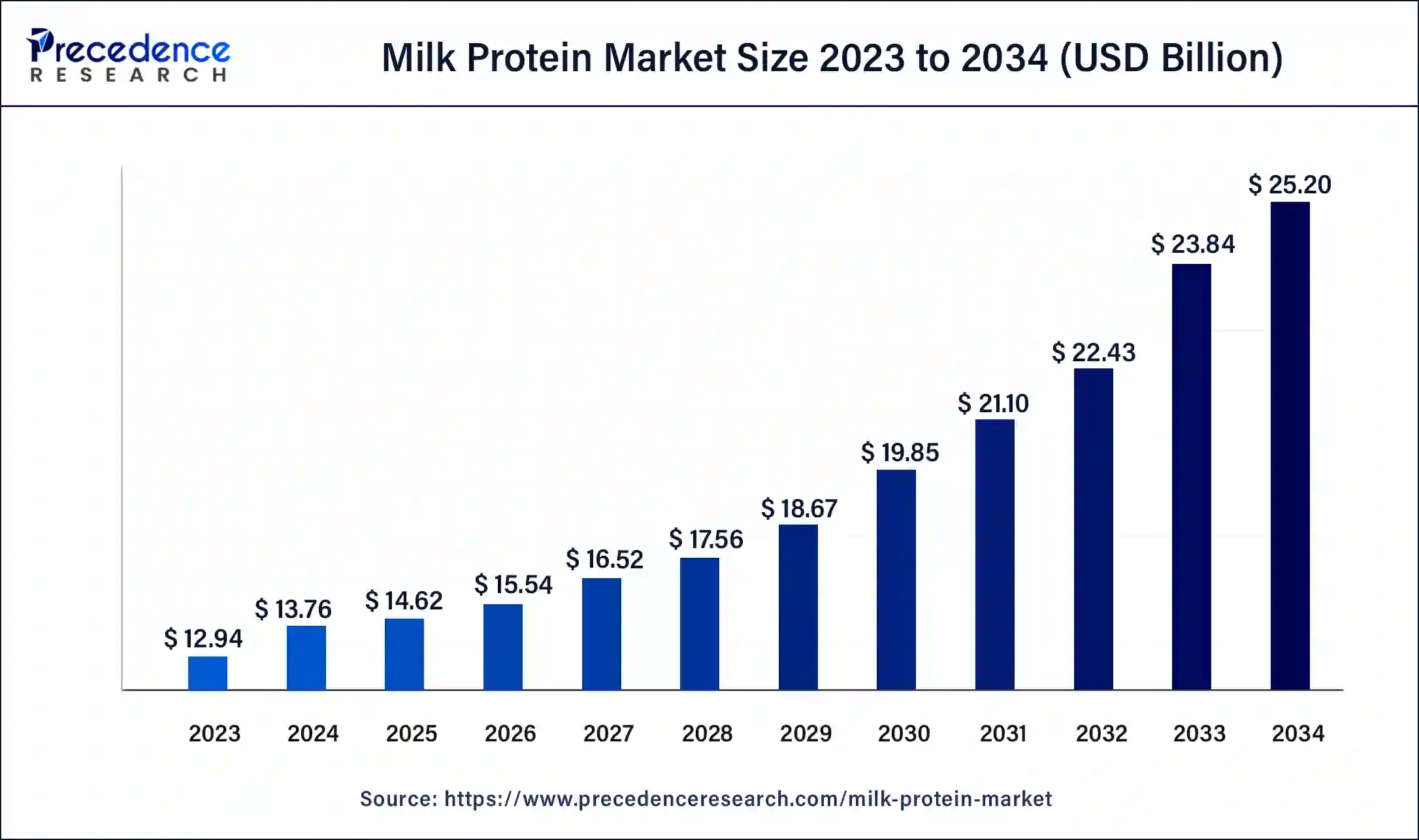

The global milk protein market size is calculated at USD 14.62 billion in 2025 and is predicted to increase from USD 15.54 billion in 2026 to approximately USD 26.59 billion by 2035, expanding at a CAGR of 6.16% from 2026 to 2035.

Milk Protein Market Key Takeaways

- The global milk protein market was valued at USD 14.62billion in 2025.

- It is projected to reach USD 26.59billion by 2035.

- The milk protein market is expected to grow at a CAGR of 6.16% from 2026 to 2035.

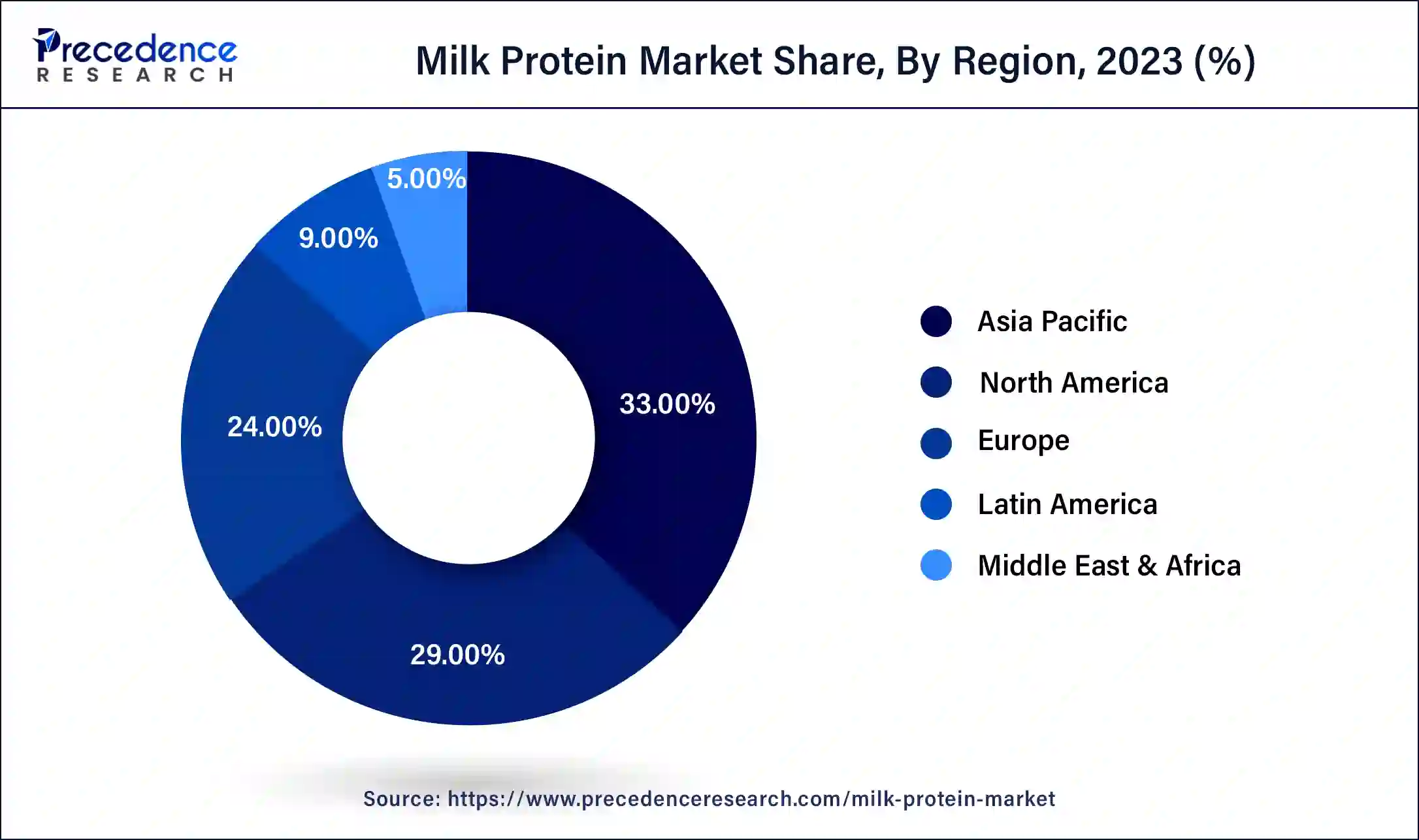

- Asia-Pacific contributed 33% of market share in 2025.

- North America is estimated to expand the fastest CAGR between 2025 and 2035.

- By product type, the hydrolyzed segment held the largest market share of 45% in 2025.

- By product type, the isolates segment is anticipated to grow at a remarkable CAGR of 6.6% between 2026 and 2035.

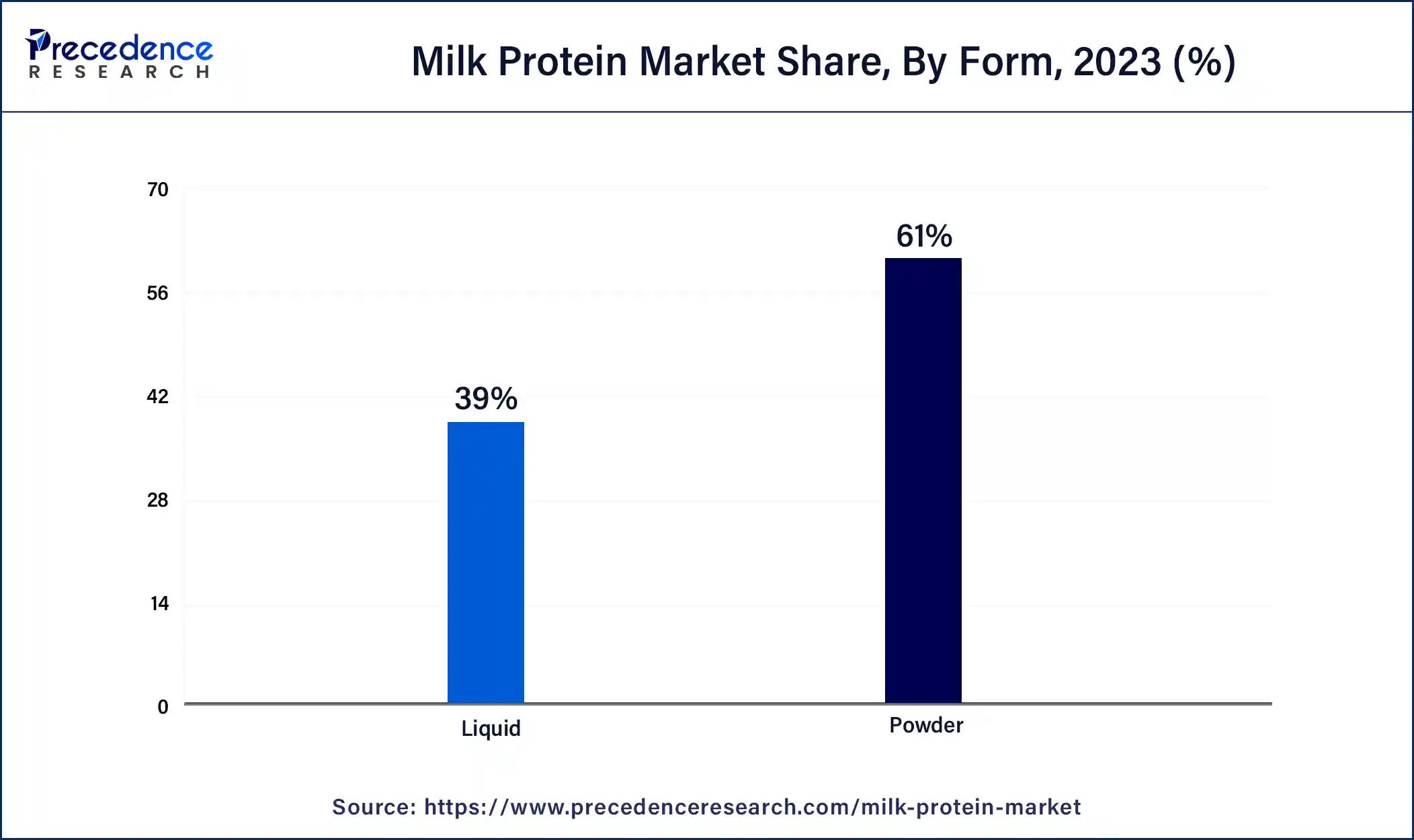

- By form, the powdered segment generated over 61% of market share in 2025.

- By form, the liquid segment is expected to expand at the fastest CAGR over the projected period in the milk protein market.

- By application, the food & beverages segment generated over 22% of market share in 2025.

- By application, the nutraceuticals & dietary supplements segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Milk protein is a type of nutrient found in milk and dairy products. It is made up of two main types: casein and whey protein. Casein forms the majority of milk protein and is known for its slow digestion rate, providing a steady release of amino acids into the bloodstream. Whey protein, on the other hand, is quickly absorbed by the body and is often used in sports supplements due to its ability to promote muscle growth and recovery.

In addition to supporting muscle health, milk protein also plays a role in various bodily functions, including immune system regulation and hormone production. It is a valuable source of essential amino acids, which are the building blocks of proteins that our bodies cannot produce on their own. Milk protein is commonly used in a wide range of food products, including yogurt, cheese, protein shakes, and nutrition bars, contributing to their nutritional content and providing consumers with important health benefits.

Artificial Intelligence: The Next Growth Catalyst in Milk Protein

AI is significantly impacting the milk protein industry by optimizing production efficiency, ensuring product quality and safety, and driving new product innovation. Through AI-powered sensors and data analytics, dairy farmers can implement precision management strategies, such as tailored nutrition plans and early disease detection, which ultimately lead to enhanced milk yield and protein consistency.

In processing plants, machine learning algorithms and computer vision systems facilitate real-time quality control and predictive maintenance, minimizing waste and operational costs.

Milk Protein Market Growth Factors

- Growing awareness among consumers about the health benefits of milk proteins, such as muscle building, weight management, and overall nutrition, is driving demand. Consumers are actively seeking products with higher protein content to meet their dietary needs.

- The demand for functional foods and beverages fortified with milk proteins is on the rise. These products offer added health benefits such as improved digestion, enhanced immunity, and increased satiety. As consumers become more health-conscious, they are seeking out products that offer additional nutritional value.

- The sports nutrition industry is experiencing significant growth, fueled by increasing participation in sports and fitness activities worldwide. Milk proteins, especially whey protein, are favored by athletes and fitness enthusiasts for their ability to support muscle growth, repair, and recovery.

- Advances in processing technologies have led to the development of innovative milk protein products with improved functional properties and nutritional profiles. Techniques such as microfiltration and ultrafiltration help retain the bioactive components of milk proteins, making them more appealing to consumers.

- With the rise of veganism and plant-based diets, there is increasing demand for plant-based milk protein alternatives. Manufacturers are developing plant-based proteins derived from sources like peas, soy, and almonds to cater to the preferences of vegan and flexitarian consumers, promoting the expansion of the milk protein market.

- Milk proteins are finding new applications in non-food industries such as cosmetics, pharmaceuticals, and animal feed. For example, whey protein is used in skincare products for its moisturizing and anti-aging properties, while casein is utilized in pharmaceutical formulations for controlled drug delivery. This diversification of applications is driving market growth and creating new market streams for manufacturers.

Milk Protein Market Data and Statistics

- According to a survey conducted by the International Food Information Council, 77% of consumers consider protein content when making food choices.

- In 2021, approximately 48.2% of individuals throughout Saudi Arabia engaged in physical and sporting activities for at least 30 minutes per week. The supplements segment saw protein consumption reaching a volume of 8,234.4 tons in Saudi Arabia in 2022.

- During 2020, there was a notable 3.50% decrease in the year-on-year growth rate, primarily due to gym closures resulting from lockdowns and COVID-19-related restrictions in the United States, the United Kingdom, China, India, and Germany.

- By June 2022, the finalized strategic agreement between the New Zealand Exchange (NZX) and the European Energy Exchange (EEX) to jointly acquire a stake in Global Dairy Trade (GDT) alongside the Co-op was confirmed, as reported by Fonterra.

Market Outlook

- Market Growth Overview: The milk protein market is expected to grow significantly between 2025 and 2034, driven by the rising consumer focus on muscle building, weight management, and combating protein deficiency, integration of milk proteins into everyday food and beverages, and the rising need in geriatric and clinical nutrition.

- Sustainability Trends: Sustainability trends involve sustainable farming practices, circular economy and waste reduction, and ethical sourcing and animal welfare.

- Major Investors: Major investors in the market include Fonterra Co-operative Group Limited, Arla Foods Amba/Arla Foods Ingredients Group P/S, Glanbia PLC/Glanbia Nutritionals, Lactalis Corporation/Lactalis Ingredients, Royal FrieslandCampina N.V./FrieslandCampina Ingredients, Kerry Group Plc., and Nestle S.A.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 26.59 Billion |

| Market Size in 2025 | USD 14.62 Billion |

| Market Size in 2026 | USD 15.54 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.16% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of lactose intolerance

The rising prevalence of lactose intolerance is boosting the growth of the milk protein market as an alternative source of protein for individuals who cannot tolerate lactose, a sugar found in milk. Lactose intolerance is a condition where the body lacks the enzyme lactase needed to digest lactose properly, leading to digestive discomfort such as bloating, gas, and diarrhea after consuming dairy products. As a result, people with lactose intolerance often seek lactose-free or low-lactose alternatives to meet their nutritional needs.

Milk protein, particularly whey and casein protein isolates, offers a solution for individuals with lactose intolerance by providing high-quality protein without the lactose content found in whole milk. These milk protein supplements and fortified products cater to consumers looking for dairy-free protein options, contributing to the growth of the milk protein market. As awareness of lactose intolerance increases and more people seek dairy alternatives, the demand for milk protein products is expected to continue rising, driving market expansion in the coming years.

Restraint:

Increasing competition from plant-based protein alternatives

Increasing competition from plant-based protein alternatives poses a restraint on the market demand for milk protein. As more consumers opt for plant-based diets due to health, environmental, or ethical reasons, the demand for dairy-free protein sources rises. Plant-based protein options like soy, pea, and almond protein offer alternatives to traditional milk protein products, appealing to vegans, vegetarians, and those with lactose intolerance or dairy allergies. This competition from plant-based alternatives reduces the market share of milk protein products, limiting their overall demand.

Moreover, advancements in plant-based protein technology have led to the development of products that closely mimic the taste, texture, and nutritional profile of dairy proteins. These plant-based alternatives offer comparable protein content and functionality, further challenging the dominance of milk protein in the market. As a result, milk protein manufacturers face pressure to innovate and differentiate their products to maintain consumer interest and compete effectively in an increasingly crowded protein market.

Opportunity:

Targeting health-conscious consumers with specialized protein formulations

Targeting health-conscious consumers with specialized protein formulations presents significant opportunities in the milk protein market. As more individuals prioritize their health and fitness goals, there is a growing demand for protein-rich products that cater to specific dietary needs and preferences. Milk protein, known for its high-quality amino acid profile and digestibility, is well-positioned to meet these requirements. By developing specialized formulations such as low-fat, high-protein dairy products or protein-fortified snacks, manufacturers can capitalize on the increasing consumer interest in healthier food options.

Furthermore, the rising popularity of functional foods and beverages presents an avenue for innovation in milk protein formulations. Products fortified with milk proteins can offer additional health benefits beyond basic nutrition, such as muscle recovery, satiety, and immune support. By targeting health-conscious consumers with these value-added propositions, companies can differentiate their offerings in the market and tap into a lucrative segment of the population seeking convenient yet nutritious options for their active lifestyles.

Segment Insights

Product Type Insights

The hydrolyzed segment held the largest market share of 45% based on the product type. The hydrolyzed segment in the milk protein market refers to proteins that have been broken down into smaller peptides through hydrolysis, making them easier to digest and absorb. This segment is witnessing increasing demand due to its enhanced solubility, rapid absorption, and reduced allergenic potential compared to intact proteins. Hydrolyzed milk proteins are widely used in infant formula, sports nutrition, and medical nutrition products. As consumers seek faster recovery and better nutrient absorption, the hydrolyzed segment continues to grow.

The isolates segment is anticipated to witness rapid growth at a significant CAGR of 6.6% during the projected period. In the milk protein market, isolates refer to concentrated forms of milk proteins where the protein content is significantly higher compared to other components like fat and carbohydrates. Isolates are produced through filtration processes that remove most of the non-protein components, resulting in a purer protein product. A trend in this segment is the increasing demand for whey protein isolates, driven by their high protein content, fast absorption rate, and versatility in various applications such as sports nutrition, dietary supplements, and functional foods.

Form Insights

The powder segment held a 61% market share in 2025. In the milk protein market, the powder segment refers to milk protein products that have been processed into a powdered form. This includes whey protein powder, casein protein powder, and blends of both. Powdered milk protein products are versatile and convenient, allowing for easy incorporation into various food and beverage applications, such as protein shakes, smoothies, and baking recipes. Recent trends in this segment include the development of flavored and functional powder formulations to cater to diverse consumer preferences and nutritional needs.

The liquid segment is anticipated to witness rapid growth over the projected period. In the milk protein market, the liquid segment refers to products that are in liquid form, such as milk, yogurt drinks, and protein shakes. This segment encompasses ready-to-drink beverages and dairy-based liquids fortified with milk proteins like whey and casein. Trends in the liquid segment include the introduction of flavored milk protein drinks, convenient on-the-go protein shakes, and innovative formulations targeting specific consumer needs, such as high-protein yogurts and smoothies.

Application Insights

The food & beverages segment has held 22% market share in 2025. In the milk protein market, the food and beverages segment refer to the incorporation of milk proteins into various food and drink products. This includes dairy products like yogurt, cheese, and milk-based beverages, as well as non-dairy items such as protein bars, shakes, and baked goods. A prominent trend in this segment is the development of functional foods and beverages fortified with milk proteins to enhance nutritional value, cater to health-conscious consumers, and meet the growing demand for protein-rich options in the market.

The nutraceuticals & dietary supplements segment is anticipated to witness rapid growth over the projected period. In the milk protein market, the nutraceuticals and dietary supplements segment refers to products specifically formulated to enhance health and well-being. This includes protein powders, capsules, and bars designed to support muscle growth, weight management, and overall nutrition. Recent trends indicate a growing demand for milk protein-based supplements due to their perceived effectiveness in promoting muscle recovery, satiety, and overall fitness. Manufacturers are innovating with flavored variants, convenient packaging, and personalized nutrition solutions to cater to diverse consumer preferences within this segment.

Regional Insights

What is the Asia-Pacific Milk Protein Market Size?

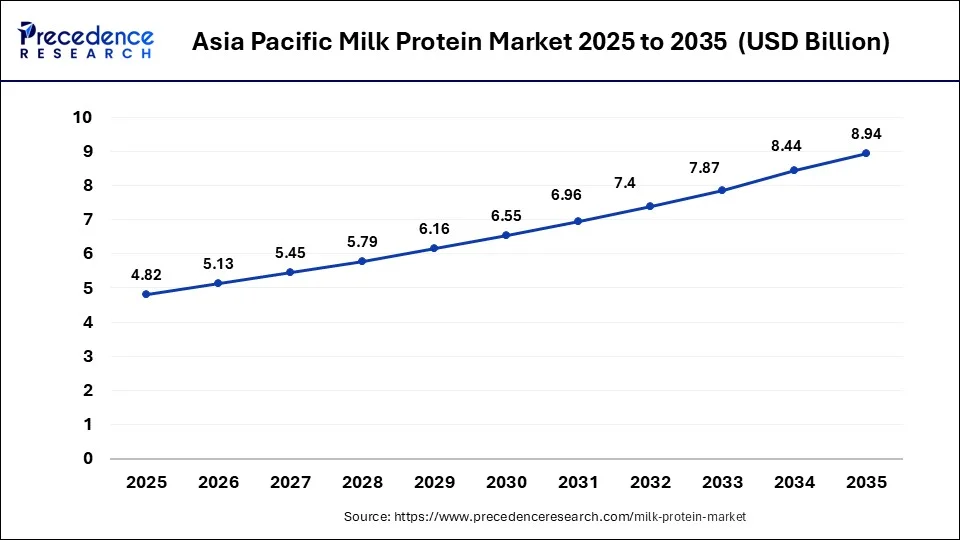

The Asia-Pacific milk protein market size was estimated at USD 4.82 billion in 2025 and is projected to surpass around USD 8.94 billion by 2035 at a CAGR of 6.37% from 2026 to 2035.

Asia-Pacific held a share of 33% in the milk protein market in 2025 due to several factors such as large population, increasing disposable incomes, and changing dietary preferences towards protein-rich foods contribute to its significant market presence. Additionally, rising health consciousness and awareness of the nutritional benefits of milk protein drive demand in countries like China, India, and Japan. Moreover, the presence of key dairy-producing nations and growing investments in food and beverage industries further propel the market's growth and dominance in the Asia-Pacific region.

China Milk Protein Market Trends

China's increasingly health-conscious urban population and the specific dietary needs of an aging demographic. As consumers prioritize muscle maintenance and gut health, there is a surge in demand for functional, on-the-go products like protein-infused snacks and high-quality meal replacements.

The North America region is experiencing rapid growth in the milk protein market due to several factors. Increasing consumer awareness about the health benefits of protein, coupled with a growing demand for functional foods and beverages, is driving market expansion. Additionally, the popularity of high-protein diets and sports nutrition products has surged, further boosting the demand for milk protein-based supplements. Innovations in processing technologies and product formulations are also contributing to market growth, meeting the evolving preferences of health-conscious consumers in the region.

U.S. Milk Protein Market Trends

The U.S.'s demand for convenient, ready-to-drink beverages and protein bars continues to rise among fitness enthusiasts. Simultaneously, an aging population is driving the adoption of specialized clinical products designed to combat sarcopenia and support muscle recovery. This shift toward functional, protein-enriched diets across all life stages has established the sector as a cornerstone of the broader U.S. health and wellness economy.

Meanwhile, Europe is experiencing notable growth in the milk protein market due to several factors. Increasing consumer awareness about the health benefits of milk protein, such as muscle building and weight management, is driving demand. Additionally, advancements in processing technologies have led to the development of innovative milk protein products with improved functionality, appealing to a broader consumer base. Furthermore, the rise of sports nutrition and functional food sectors in Europe has created opportunities for milk protein manufacturers to diversify their product offerings and expand their market presence, contributing to overall market growth.

Germany Milk Protein Market Trends

With Germany's surge in sports nutrition and metabolic wellness, consumers are increasingly seeking out high-protein dairy and functional snacks that leverage MPC for its superior texture and emulsification properties. This growth is sustained by a fitness-conscious population that views high-quality whey and milk proteins as essential for muscle health and healthy aging.

Milk Protein Market Companies

- Fonterra contributes to the milk protein market by leveraging its large milk pool in New Zealand to produce a wide array of specialized dairy ingredients, from casein to whey proteins, for global customers.

- Arla Foods Ingredients Group P/S specializes in refining whey, a byproduct of cheese production, into high-value protein ingredients for use in infant formula, medical nutrition, and performance optimization products.

- FrieslandCampina Ingredients utilizes the vast milk supply from its member farmers to create both whey and casein protein ingredients for a global market.

- Lactalis Ingredients, part of one of the world's largest dairy groups, provides a broad portfolio of milk proteins, including caseins, whey proteins, and milk protein concentrates, by efficiently processing large volumes of milk.

- Glanbia is a major global player, primarily through its Glanbia Nutritionals segment, which develops and produces a comprehensive range of advanced protein solutions derived from both milk and plant sources.

- contributes to the milk protein market by integrating its protein ingredients into broader taste and nutrition solutions for food and beverage manufacturers worldwide.

Other Major Key Players

- Dairy Farmers of America, Inc.

- DMK Deutsches Milchkontor GmbH

- Agropur Cooperative

- Saputo Inc.

- Nestle S.A.

- Chr. Hansen Holding A/S

- Groupe Lactalis SA

- Danone S.A.

- Land O'Lakes, Inc.

Recent Developments

- In November 2021, Lactalis Ingredients introduced novel high-protein product concepts utilizing Pronativ Native Micellar Casein and Pronativ Native Whey Protein, including high-protein shakes and high-protein pudding.

- In August 2021, Lactalis India unveiled Lactel Turbo Yoghurt Drink, a protein-enriched yogurt beverage, offered in mango and strawberry variants.

- During February 2021, FrieslandCampina Ingredients formed a partnership with Cayuga Milk Ingredients to produce its Refit milk proteins, MPI 90 and MPC 85.

Segments Covered in the Report

By Product Type

- Concentrates

- Hydrolyzed

- Isolates

- Others

By Form

- Powder

- Liquid

By Application

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Pharmaceutical

- Cosmetics & Personal Care

- Infant Formula

- Pet Care Industry

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting