What is Baby Food Market Size?

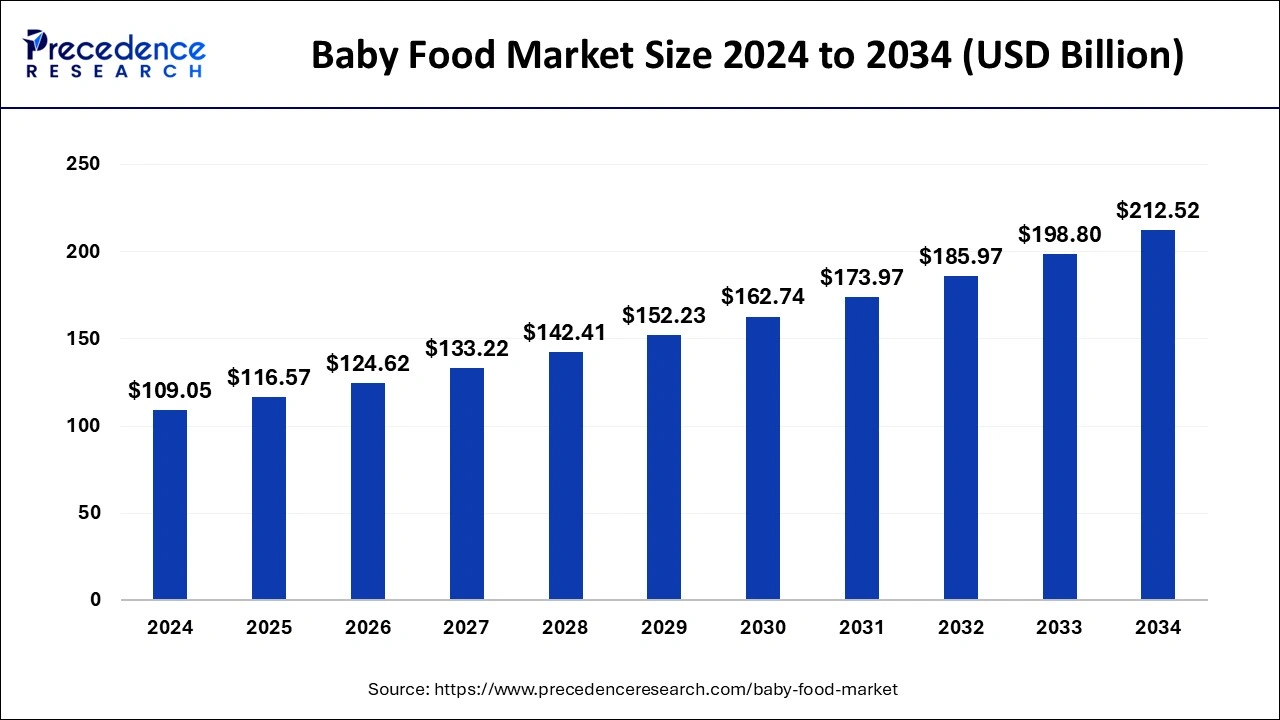

The global baby food market size is worth around USD 116.57 billion in 2025 and is anticipated to reach around USD 225.64 billion by 2035, growing at a CAGR of 6.83% from 2026 to 2035. This market is proliferating due to increasing awareness regarding the benefits of high-quality baby nutrition requirements.

Market Highlights

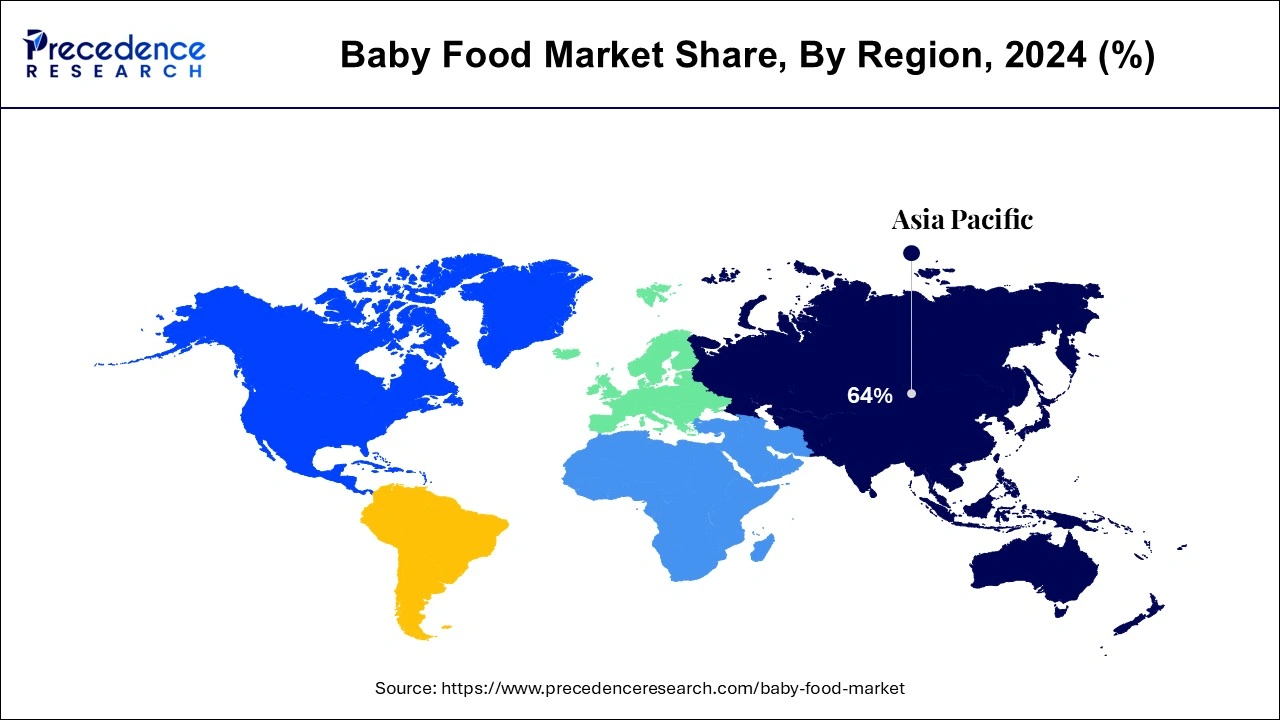

- Asia Pacific dominated the global market with the largest market share of 64% in 2025.

- North America is projected to expand at the notable CAGR during the forecast period.

- By type, the ready to eat segment has held the largest market share in 2025.

- By distribution channel, the hypermarket segment captured the biggest market share in 2025.

AI Integration in the Baby Food Market

With the integration of artificial intelligence in the baby food market there is a huge aspect of evolution. It helps to track the market issues associated with baby food and supports better formulation which can add extra benefits for the baby's development. It can detect any ingredient mismatch that can affect the market growth. AI influences market development by gathering consumer reviews that can help in better decision-making and identifying the quality of raw materials. It can detect nutritional benefits required for a baby and help to keep the quality intact. It can also help in developing personalized nutritional plans according to the requirements.

The increased awareness on innovative food products, organized retail marketing activities and increased number of working mothers, decreasing infant mortality rate and increasing parental concerns are all responsible for the growth of this market. During the pandemic, the parents were more conscious about the health of their babies and even though there were lockdowns across the nations the growth in this market has been seen even during the pandemic. In order to provide the infants with organic and healthier supplements and food products, the parents across the world are investing only in these food products. The baby food is soft, easily digestible meal which is created by keeping in mind the human babies aged between 4 to 6 months or up till two years of age.

Baby Food MarketGrowth Factors

- A rising number of working women influence the baby food market to fulfil the nutrition requirements of the baby.

- The growing non-lactation problem influences the market players to develop enhanced quality baby food which results in the development of the market.

- The rising population also contributes profoundly to this market by raising the demand for baby food.

- Continuous enhancement of products by market players increases the reliability of the consumers which ultimately increases the demand of the market.

- Rising knowledge about its effect on the developing brain, nervous system, and muscles increases the usage of baby food.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 116.57 Billion |

| Market Size in 2026 | USD 124.62 Billion |

| Market Size by 2035 | USD 225.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.83% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Category, Types, Distribution Channel, Ingredients, Formulation, Health Benefit, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Category Insights

On the basis of category, the baby food market can be segmented into organic and conventional foods. Although the organic baby food is extremely good quality and have more nutrition value, but they are expensive, so this is a setback in the growth for this market. The conventional foods have shown a good growth in the previous years and it is expected to grow during the forecast period.

Type Insights

On the basis of the type of the baby food, the market can be segmented into dried baby food, ready to feed baby food, milk formula, and other types. The ready to eat baby food product accounts for the largest share in terms of revenue. It includes porridge, purees, squash. All these food items are ready to eat. As the number of working women is increasing in the economics across the world, the segment is expected to grow.

Apart from this, the dried food segment, which includes the cereals, fruits and vegetables, should also see a growth during the forecast period. The dried baby food segment is expected to grow at a CAGR of 13% as they have a good shelf life and they are easy to prepare.

Distribution Channel Insights

On the basis of the distribution channel, the hypermarket or the supermarket segment is expected to have the largest share, in the overall market it happens to have 35% of the total market size. As there is a great awareness and popularity of these food products amongst the people of the Asia Pacific region the supermarkets are expected to grow during the forecast. This segment provides aggressive marketing and lucrative pricing schemes.

Apart from the supermarkets, the online distribution channel is also expected to grow during the forecast. The online distribution channel is expected to have CAGR of 13.2% during the forecast period.

Ingredients Insights

The fats and oils segment dominated the market in 2025. These are highly in demand as fats and oils contain high nutritional value essential for infants. Fats are an important source of energy and play a crucial role in the development of the brain in infants. These are high sources of omega-3 fatty acids which are necessary for cognitive development during the growth period. These fats and oils play a crucial role in the absorption of several vitamins such as vitamins A, D, E, and K.

Formulation Insights

The powder formula segment dominated the market in 2025. The rising demand for powder formula is due to several reasons such as convenience, nutritional balance, cost-effectiveness, accessibility and various others. These are easy-to-store and hassle-free products which require mixing with water or breast milk while using. Powder formula fulfil all the nutrition required of the baby and it can be created according to individual requirements. These are low-cost solutions which provide the nutrition required for the development of the baby. Powdered formulas are available almost everywhere which makes it more desired among other products.

Health Benefits Insights

The muscular development segment dominated the market in 2025. The overall growth of an infant is essential which is the major focus of the market players. There is a rising issue of underweight babies which has enhanced the focus on developing food which can contribute significantly to the development of the muscles. Proper muscle development helps in developing mobility, motor skills, and overall health of the baby.

Regional Insights

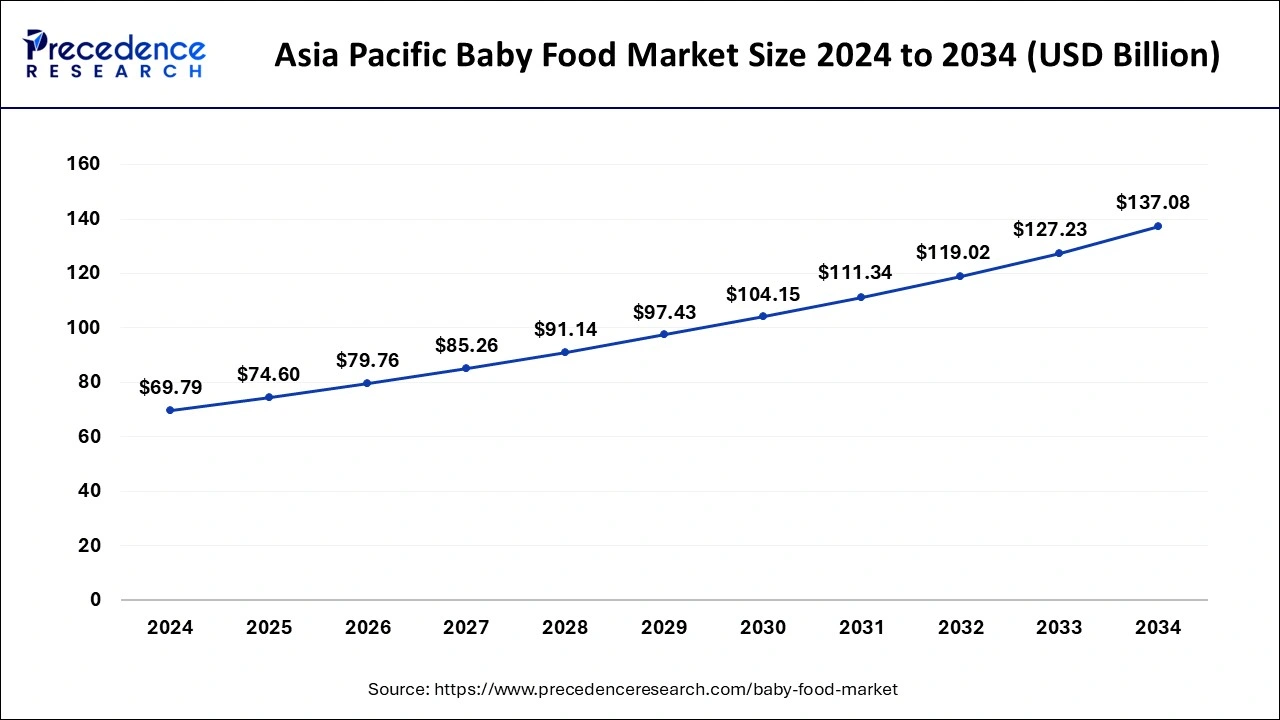

Asia Pacific Baby Food Market Size and Growth 2026 to 2035

The Asia Pacific baby food market size is exhibited at USD 74.60 billion in 2025 and is projected to be worth around USD 145.83 billion by 2035, growing at a CAGR of 6.93% from 2026 to 2035

The Asia Pacific market had the largest revenue in the previous years and it is expected to exhibit promising gains during the forecast period. As there is an increase in the working women population and an awareness of various baby food products that provide the nutrition and ensure the health of the babies the market is expected to grow. Due to diverse distribution options and strong marketing channels, the market shall grow during the forecast.

What Potentiates the Market in Europe?

As a large number of raw material providers for the baby food are present in the European region. Stringent regulations and cutthroat competition among the manufacturers had led to a diversification in the product portfolio and an increase in the nutritional value of the food. The major players are actively engaged in mergers and acquisitions in order to provide a competitive edge. The global players also ensure partnership with the medium,small retailers or enterprise in order to provide the preferred baby food. Lot of revenue is spent on marketing and creating awareness regarding the products that these companies offer. So, the global food market is expected to grow during the forecast.

China Baby Food Market Trends

In Asia Pacific, China led the marketplace in Asia owing to rapid urbanization, rising birth rates, and a surge in disposable incomes. Also, the sudden transition from a one-child policy to a three-child policy raises the potential consumer base for the market. Chinese parents have higher disposable income as compared to other countries in the region, which can be spent on organic, high-end, and safe infant food products.

UK Baby Food Market Trends

In Europe, the UK dominated the marketplace in Europe for the year 2025 due to the growing parental awareness regarding organic nutrition along with the concerns regarding traditional food products. Moreover, an increasing preference for simple and transparent ingredients, free from pesticides and additives is boosting the demand for organic baby food.

What Makes North America a Significant Region?

North America is considered a significant region in the baby food market. This is mainly due to rising parental awareness regarding infant nutrition and the benefits of high-quality baby food products. Parents are increasingly seeking healthy, safe, organic, and natural baby foods in order to ensure that their infants get optimal nutrition for adequate growth and development. Busy lifestyles have also increased the demand for convenient and ready-to-eat baby food options. Additionally, the increasing number of working mothers and the rise in dual-income households have fueled the demand for packaged baby food products.

How is the Opportunistic Rise of Latin America in the Baby Food Market?

Latin America is expected to experience an opportunistic rise in the market in the upcoming years. This growth is driven by factors such as a growing middle-class population and their increasing ability to afford premium baby food products. Rapid urbanization led to an increase in working mothers who prefer ready-to-feed baby food products due to time constraints. Health awareness is another significant factor, as parents are increasingly seeking natural and organic baby food options for their children. Additionally, the region is also witnessing the expansion of modern retail channels, including supermarkets and e-commerce, which have improved accessibility to baby food products.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) offers significant opportunities in the baby food market, driven by strong competition among global brands, local manufacturers, as well as organic and clean-label producers. Various companies in the region are actively investing in research and development to introduce new flavors, nutritional profiles, and convenient packaging formats. This growth and development are due to increasing urbanization efforts and a growing emphasis on early childhood nutrition. Regulatory agencies in the region are also playing a vital role by setting up stringent quality and safety standards, ensuring that products meet international norms.

Value Chain Analysis

- Raw Material Sourcing : This stage involves procuring materials like milk, cereals, fruits, vegetables, and protein sources. These ingredients must meet high, stringent food safety and quality standards, as these are meant to be consumed by infants.

Key Players: Arla Foods, Cargill, Fonterra - Manufacturing Process: In this stage, manufacturers produce infant formulas, cereals, purees, snacks, and even ready-to-feed meal packs.

Key Players: Nestle, Danone, Abbott - Distribution Process; In this stage, baby food is sold through supermarkets, pharmacies, pediatric clinics, and even online platforms.

Key Players: Walmart, CVS Health, Walgreens

Baby Food Market Companies

- Nestlé (Gerber Products Company)

- Danone S.A.

- Reckitt Benckiser (Mead Johnson & Company, LLC)

- Abbott

- Feihe International Inc.

- Fries land Campina

- Bellamy's Organic

- Kraft Heinz

- HiPP GmbH & Co. Vertrieb KG

- Perrigo

- Arla Food

Recent Development

- In October 2024, Nestle India launched 14 variants of its baby food brand Cerelac without refined sugar. This development follows a global controversy regarding the company's practice of adding sugar to its baby food products in developing South Asian countries, including India. The company reports that it has decreased the added sugar content by 30% in its products over the past five years.

(Source: https://www.business-standard.com) - In August 2024, Happa Foods, a leading baby food start-up, announced its expansion into the global market, introducing its organic fruit and vegetable-based baby meals to six countries: Kuwait, Oman, Maldives, Kenya, Seychelles, and the UAE. This milestone marks Happa Foods as the first Indian brand to export baby puree, heralding a new era in the Indian baby food industry. (Source: https://www.zawya.com)

- In October 2024, Nestle announced the launch of Cerelac variants with zero refined sugar for the Indian market, putting to rest concerns about added sugar in the baby food product. According to the FMCG giant's exchange filing, the cereal-based product range will now include 21 variants, of which 14 will be free of refined sugar. (Source: https://www.business-standard.com)

- In August 2024, Today, M&S launched its first-ever baby club ‘The Parent Hood' exclusive to members of M&S' loyalty program, Sparks. As more families choose to shop at M&S; family shoppers +24% in Food and with an expanding customer base in Clothing & Home, this year, M&S is doubling down on its intent to continue to broaden its appeal for families. (Source: https://corporate.marksandspencer.com)

- In August 2024, Happa Foods announced the launch of its baby food start-up. It is considered the first baby food in India to export baby puree.

- In October 2024, Nestle announced the launch of ‘no refined sugar' cerelac for infants.

Segments Covered in the Report

By Category

- Organic

- Conventional

By Types

- Milk Formula

- Dried

- Ready-to-Feed

- Other

By Distribution Channel

- Drugstores/ Pharmacies

- Supermarkets/Hypermarkets

- Convenience Store

- Online Channels

- Other Distribution Channels

By Ingredients

- Fats and Oils

- Lactose

- Protein

- Flour

- Flavour Enhancer

- Vitamins & Minerals

- Others

By Formulation

- Powder

- Liquid

By Health Benefit

- Brain & Eye Development

- Muscular Growth

- Bones & Teeth Development

- Blood Enhancement

- Nervous System

- Vascular System

- Body Energy

- Other

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting