What is the Infant Formula Market Size?

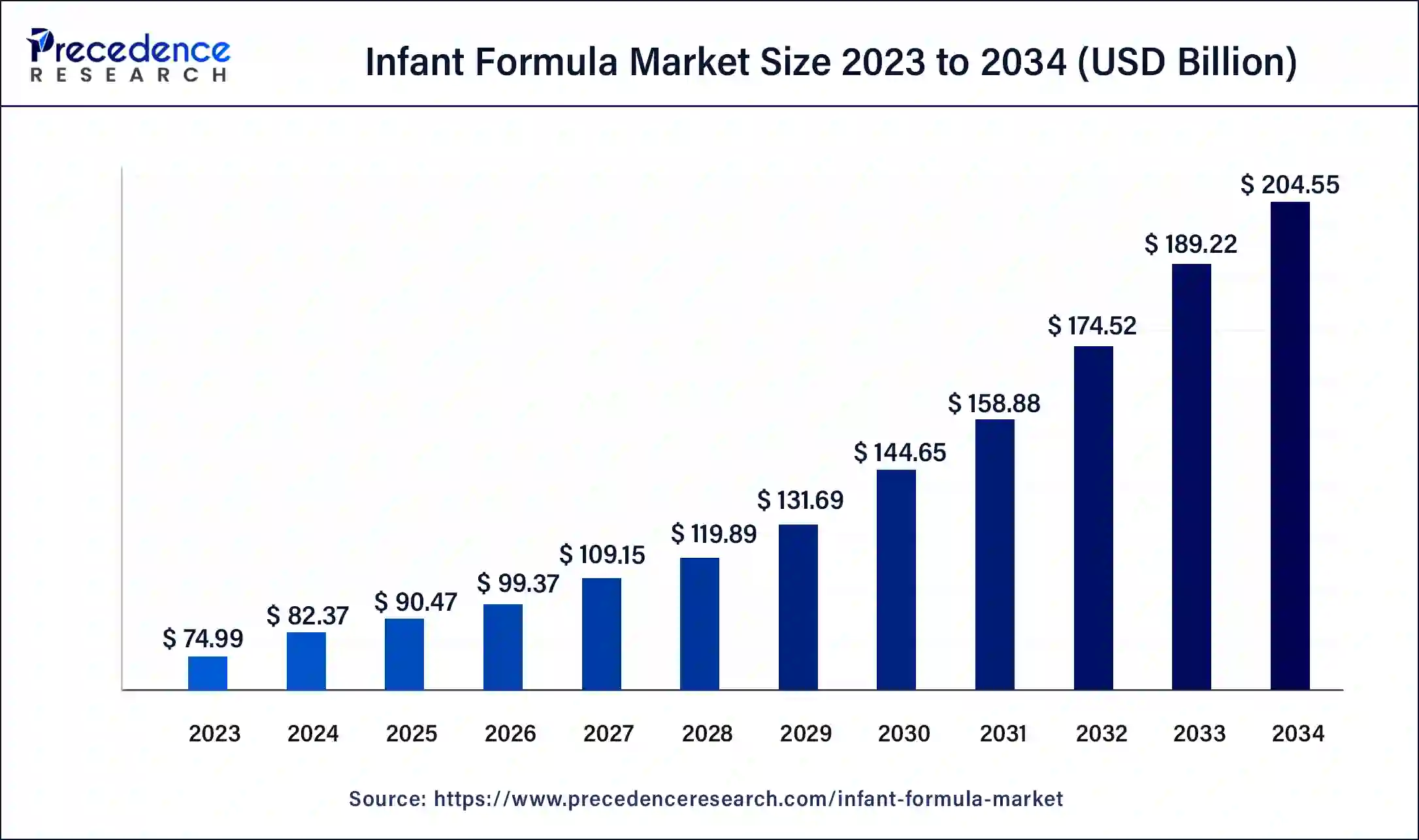

The global infant formula market size is calculated at USD 90.47 billion in 2025 and is predicted to increase from USD 99.07 billion in 2026 to approximately USD 221.06 billion by 2035, expanding at a CAGR of 9.35% from 2026 to 2035.

Market Highlights

- In terms of revenue, the market is valued at USD 90.47 billion in 2025.

- It is projected to reach USD 221.06 billion by 2035.

- The market is expected to grow at a CAGR of 9/52% from 2026 to 2035.

- The supermarkets distribution channel segment is poised to register growth at a 9.35% CAGR from 2026 to 2035.

- The online distribution channel segment is registering at a CAGR of 11.2% between 2026 and 2035.

- The North America infant formula market is growing at a steady CAGR of 4.8% from 2026 to 2035.

How is AI contributing to the Infant Formula Industry?

Artificial intelligence enhances infant formula development through its ability to create personalized nutrition solutions while ensuring safety and driving product development. The algorithms create personalized nutrient profiles, which develop manufacturing standards for smart feeding devices and analyze growth patterns while identifying contaminants and enhancing supply chain operations to deliver safer products and improved results with data-driven product development.

Infant Formula Market Growth Factors

Infant formula is specially designed formula for infants, preferably under one year of age. Many Governments Safety and Standards Agency of India (FSSAI), World Health Organization (WHO) and others have specific regulations to ensure high quality of products. Strict regulations on product quality are expected without hesitation. For example, in 2019, the FSSAI drafted new rules relating to standards for infant formula, milk substitutes for premature infants, and milk substitutes for infants.

The global infant formula market is projected to grow strongly due to the growing global demand for organic food for children under 5 years of age. The increasing cases of malnutrition in children and infants have spurred demand for infant formula.

An increasing number of working mothers around the world have encouraged baby food companies to introduce nutrient-rich supplements to ease the need for convenient nutrition. At the same time, companies are adopting environmentally friendly methods for packaging materials, which has increased the growth prospects of key companies.

Key companies including Nestlé SA, Danone and Abbott Nutrition are working to develop animal-free baby foods that contain the same nutrients as breast milk. Cases of stunting, malnutrition and increasing numbers of women unable to breastfeed have increased the demand for infant formulas globally.

Trade Analysis of Infant Formula Market

- The world imported 5249 shipments of infant formula between July 2024 and June 2025.

- A total of 438 exporters supplied shipments, which reached 466 buyers across the globe.

- During this time period United States emerged as the leading country with 3288 shipments.

- Vietnam imported 2021 shipments, which showed high regional market demand.

- Mexico ranked next with 1992 shipments, which facilitated international trade between countries.

What are the Key Trends in the Infant Formula Market?

- There has been growing parental focus on product safety, digestibility, and nutrition, thus increasing demand for premium or specialty formulas such as organic, lactose-free, and hypoallergenic ones.

- Technological developments regarding formula composition, such as incorporating prebiotics & probiotics, HMOs (human milk oligosaccharides), DHA/ARA, are also driving innovation and sales acceptance.

- Brands and companies all over the world are seen investing heavily in research and development activities to come up with formulas that closely resemble breast milk to promote immune system development.

- Ready-to-feed and single-serve formats are becoming increasingly popular in the market due to their convenience purposes.

Market Outlook

- Industry Growth Overview: The industry experiences its current expansion because working mothers and urban living patterns create a higher need for premium, specialized infant nutrition products.

- Sustainability Trends: The industry shows increasing adoption of sustainable practices through its usage of environmentally friendly packaging methods and carbon-neutral production processes, together with its implementation of plant-based product alternatives.

- Global Expansion: The European market experiences increased demand while others develops its premium product market through better distribution and export activities.

- Major Investors: The major investors in research and manufacturing facilities for Nestlé, Danone, Abbott Laboratories, Reckitt Benckiser, and FrieslandCampina.

- Startup Ecosystem: The startup ecosystem attracts parents to Bobbie, ByHeart, and Kabrita through their organic clean-label products and their goat milk formula offerings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 90.47Billion |

| Market Size in 2026 | USD 99.07 Billion |

| Market Size by 2035 | USD 221.06Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.35% |

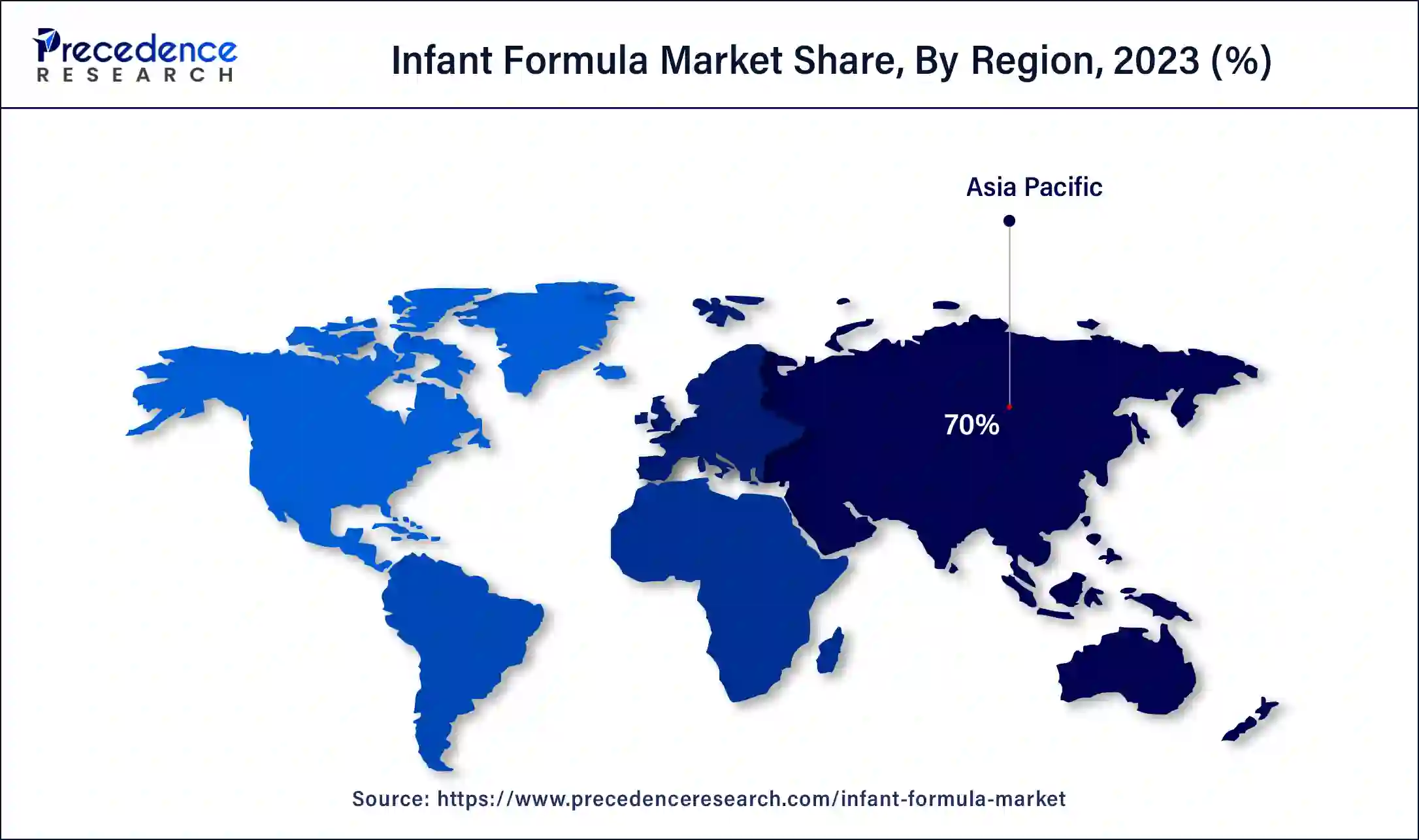

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

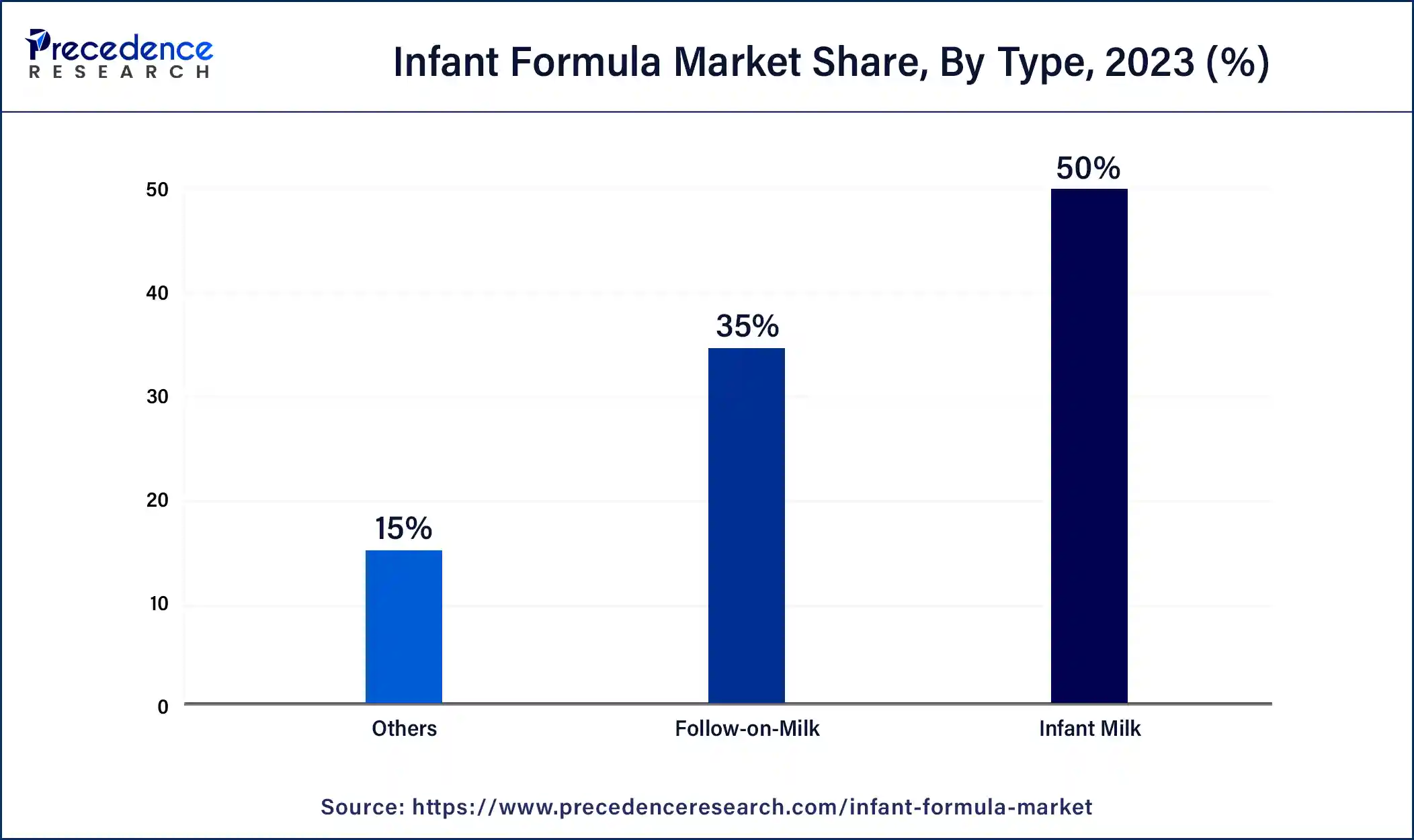

The infant milk formula segment accounted largest revenue share in 2025 and is expected to dominate during the forecast period. The demand for infant formula segment is continuously growing as it is one of the key segments when there are no accepted alternatives in the market. The limited availability of convenient and nutrient-rich products has grown and created innovative products in the market. The growing prosperity of consumers towards their infants in the wide range of baby formulas available in the market.

However, the follow-on- milk segment is expected to witness the highest CAGR in global market in further milk preparation to mimic the nutritional function of breast milk due to its high protein, calcium, iron content and the growing market for infant formula. Additionally, with infants with low iron intake or poor weaning nutrition, subsequent milk requirements are expected to increase at a healthier rate.

Distribution Channel Insights

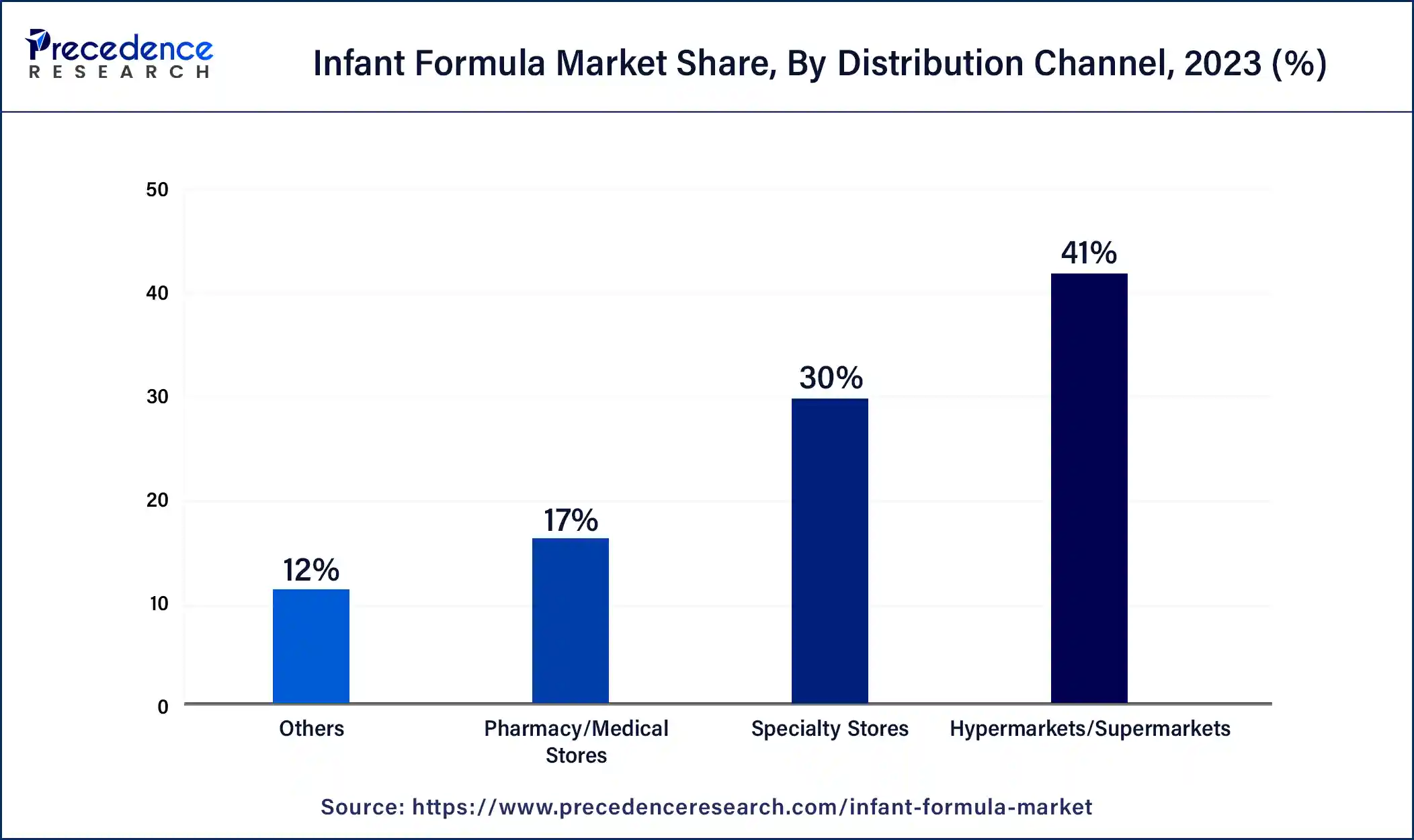

The supermarkets & hypermarkets segment accounted the highest revenue share of 41% in 2024. The market has witnessed rapid demand through supermarkets & hypermarkets channels. The separate sections for babies, product bundles, programs, discounts, offers and convenient shopping experiences for shoppers under one roof has increases the footfall for infant formula which in turn is contributing in fueling the growth of the overall market In terms of value sales.

However, the specialty store is expected to be the fastest growing segment during the forecast period. This is because the store offers a wide range of baby substitutes as well as other baby care products under one platform along with convenient way to shop with consumers to buy from specialty stores.

Regional Insights

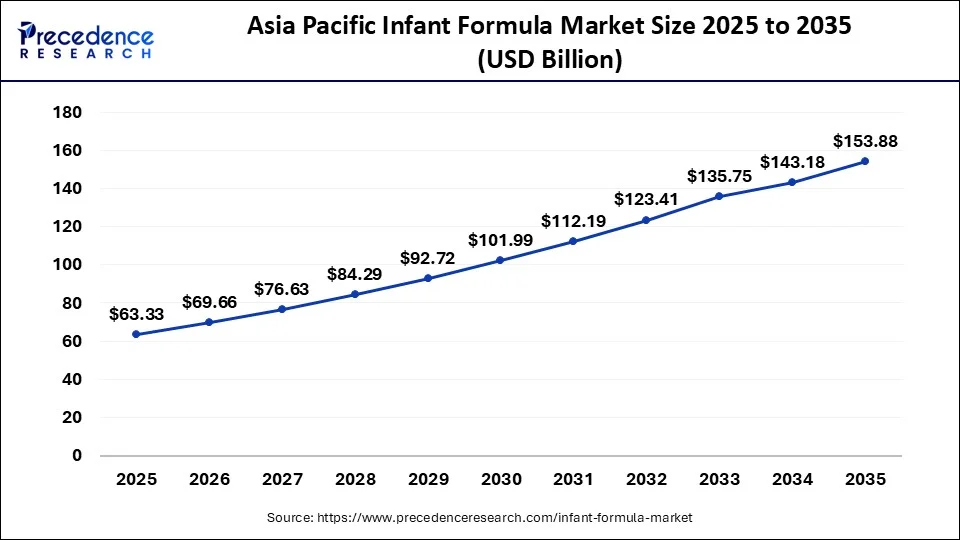

Asia Pacific Infant Formula Market Size and Growth 2026 to 2035

The Asia Pacific infant formula market size is projected at USD 63.33 billion in 2025 and is expected to be worth around USD 153.88 billion by 2035, at a CAGR of 9.28% from 2026 to 2035.

Asia-Pacific region accounted largest revenue share in 2025. The APAC market is mainly driven by strong demand stemming from high birth rates in countries such as China and India. Additionally, domestic industry and a greater reliance on imports amid growing demand for growth, quality and higher premiums. The presence of China, the largest consumer of baby and infant food products in the world, is contributing in bolstering the market growth. In addition, China's decision to abolish the "one-child" policy and increase the birth rate is expected to fuel the market growth.

- In Asia Pacific, China led the market owing to the surge in middle-class population and income, rapid urbanization, and the growing number of working mothers. Also, the withdrawal of the one-child policy and the deployment of the three-child policy has led to an increase in births optimizing the market growth further in the country.

North American infant formula demand is expected to grow at a steady growth rate during the forecast period. Additionally the US is expected to contribute the majority of infant formula sales in this region. The growing demand for organic baby formula has increased production by large companies, facilitating a growing demand across the country. The increase in the number of women entering the workforce and the demand for nutritious baby food are contributing to the growth in this region.

In North America, the U.S. dominated the market due to the changing lifestyles, rising awareness of infant nutrition, and technological innovations in formula composition. In addition, The Food and Drug Administration (FDA) plays a significant role in maintaining the manufacturing and safety of infant formula. The FDA ensures that this formula is safe and offers adequate nutrition for healthy infant growth.

France and Germany are expected to record healthy growth over the forecast period. France and Germany are the main producers and exporters in the global infant formula market. The growing demand for organic baby food has spurred demand for infant formula throughout Germany. The presence of nationally known companies, the infant formula industry is growing with the increasing popularity of online stores across the country. The growing penetration of online pharmacies and retail stores is facilitating the growing nationwide demand for infant formula. An increasing number of working mothers in Germany and France contribute to the increase in infant formula production. Thus, the aforementioned facts are contributing in driving the overall growth of the market in terms of value sales.

Europe is expected to grow at a notable rate over the forecast period. The growth of the region can be attributed to the rising disposable income, changing lifestyle changes, and an increasing middle-class population. Additionally, consumers in the region are seeking organic, high-quality, and specialized formulas, with those for specific dietary allergies and restrictions.

What Drives the Market in Latin America?

The infant formula market in Latin America is expected to grow at a steady rate in the upcoming period, driven by the region's emphasis on production, distribution, and consumption of formula-based nutrition for infants and toddlers. The market offers diverse formulations catering to different dietary needs, medical conditions, and parental preferences. The regional market growth is also fueled by rising birth rates, increasing maternal employment, advancements in nutritional science, and growing awareness of the importance of early childhood nutrition, boosting demand for specialized formula products.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers significant opportunities in the infant formula market, driven by an increased awareness of infant nutrition, the rising number of working mothers, and innovative advancements being made in product development and technology, thus fueling the demand for nutritious and safe feeding options. The increasing awareness of food allergies and lactose intolerance among infants is also prompting a shift toward hypoallergenic and plant-based formulas. Additionally, rising consumer preference for organic, non-GMO, and easily digestible infant nutrition options is enhancing market demand.

What are the Advancements in the Infant Formula Market in Latin America?

Brazil Infant Formula Market Trends: Growing awareness of early childhood nutrition is driving demand for fortified and specialized infant formula products. Government regulations in the country are also helping in ensuring high product quality, thus boosting consumer trust in branded infant formula products.

Urbanization, higher disposable incomes, and more working mothers are expanding the market for convenient formula products and boosting e-commerce and modern retail channels. Regulatory oversight by Brazil's health authorities ensures strict composition and safety standards, influencing product development and building consumer trust.

What are the Key Growth Factors in the Infant Formula Market in the Middle East and Africa?

Saudi Arabia Infant Formula Market Trends: Functional and fortified formulas are witnessing rapid growth in the region due to rising awareness of infant gut health and brain development. Innovations in infant nutrition are also gaining traction, giving rise to personalized formula solutions based on genetic and individual health data.

Value Chain Analysis

- Ingredient Sourcing : This stage involves sourcing raw materials, such as cow milk, whey proteins, rice, vegetable oils, and carbohydrates.

Key Players: Fonterra, BASF, Arla Foods - Manufacturing and Processing: Here, manufacturers blend all the ingredients to meet age-specific nutritional requirements. The production process involves pasteurization, spray drying, blending, and hygienic packaging.

Key Players: Nestle, Danone, Abbott - Distribution Process: In this stage, infant formula is sold through supermarkets, pharmacies, hospitals, and e-commerce platforms.

Key Players: Walmart, CVS, Walgreens

Top Companies in the Infant Formula Market & Their Offerings

- Nestle S.A.: Offers stage-based nutrition through brands like NAN and Lactogen, focusing on immunity and brain development.

- Danone SA: Provides scientifically backed formulas under Aptamil and Cow & Gate, specialized for gut health and development.

- Abbott Laboratories: Produces the Similac range, including specialized options for digestive sensitivities and metabolic needs.

- Yili Group: Develops infant and toddler milks specifically tailored to the nutritional requirements of the Asian market.

- The Kraft Heinz Company: Manufactures milk-based formulas and baby foods designed for simple, nutritious early-life feeding.

- Bellamy's Organic: Specializes in certified organic, toxin-free formulas made from high-quality Australian dairy.

- Perrigo Company plc: Leading producer of store-brand (private label) formulas that meet the same FDA standards as major brands.

- Reckitt Benckiser Group plc:Markets the Enfamil brand, prioritizing brain-nourishing nutrients like DHA and ARA.

- Royal FrieslandCampina N.V.: Produces the Friso brand, utilizing a gentle processing method to preserve natural milk proteins.

- Arla Foods amba: Delivers organic and conventional formulas sourced directly from its farmer-owned dairy cooperative.

Recent Developments

- In January 2025, the FDA announced a plan titled Long-Term National Strategy to Increase the Resiliency of the U.S. Infant Formula Market. It is designed to secure a safe, consistent, and diversified infant formula supply, addressing vulnerabilities exposed by the 2022 formula shortage that left shelves empty and families in crisis. (Source: https://www.techtarget.com)

- In April 2025, Bobbie announced its fourth infant formula since the company's launch in 2021: after three years of development, Bobbie Organic Whole Milk Infant Formula is here. As the first and only USDA Organic Whole Milk infant formula manufactured in America, this industry-first product redefines high-quality infant nutrition. (Source: https://www.businesswire.com)

- In February 2025, Iceland launched new infant formula labels in a bid to bring more clarity around products and help parents make informed choices. Partnering with infant feeding charity Feed, the move marks the latest step in the supermarket's joint campaign to reduce the cost of baby formula in the market.

- In February 2020, Else Nutrition, manufacturer and distributor of cleansing ingredients, plant-based nutritional products and organic toddler formulas formulated with an exclusive almond formula, buckwheat and tapioca.

- In August 2019, Danone Nutricia, a brand of Danone SA, launched a new product, Karicare Toddler with New Zealand sheep's milk in New Zealand.

- In January 2019, Arla Foods Elements, a subsidiary of Arla Foods amba, launched a safe food optimized for infants.

- Fats and Oils Specialist, Bunge Loders Croklaan (BLC), in January 2021, announced the launch of a new premium lipid ingredient for infant formula that claims to regenerate breast milk in flavor and taste.

- In March 2021, 108LABS announced its new animal-free infant formula, Colostrupedis, featuring cell-grown breast milk molecules derived from human breast cell agriculture and is formulated with the ability to extensively neutralize human secreted antibodies.

Segments Covered in the Report

By Type

- Infant Milk

- Follow-on-Milk

- Others

By Product

- Infant Formula

- First Infant Formula

- Follow-on Formula

- Growing-up Formula

- Specialty Baby Formula

- Baby Food

- Prepared Food

- Dried Food

- Other Baby Foods

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacy/Medical Stores

- Specialty Stores

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content