Activated Carbon Market Revenue to Attain USD 16.45 Bn by 2033

Activated Carbon Market Revenue and Trends 2025 to 2033

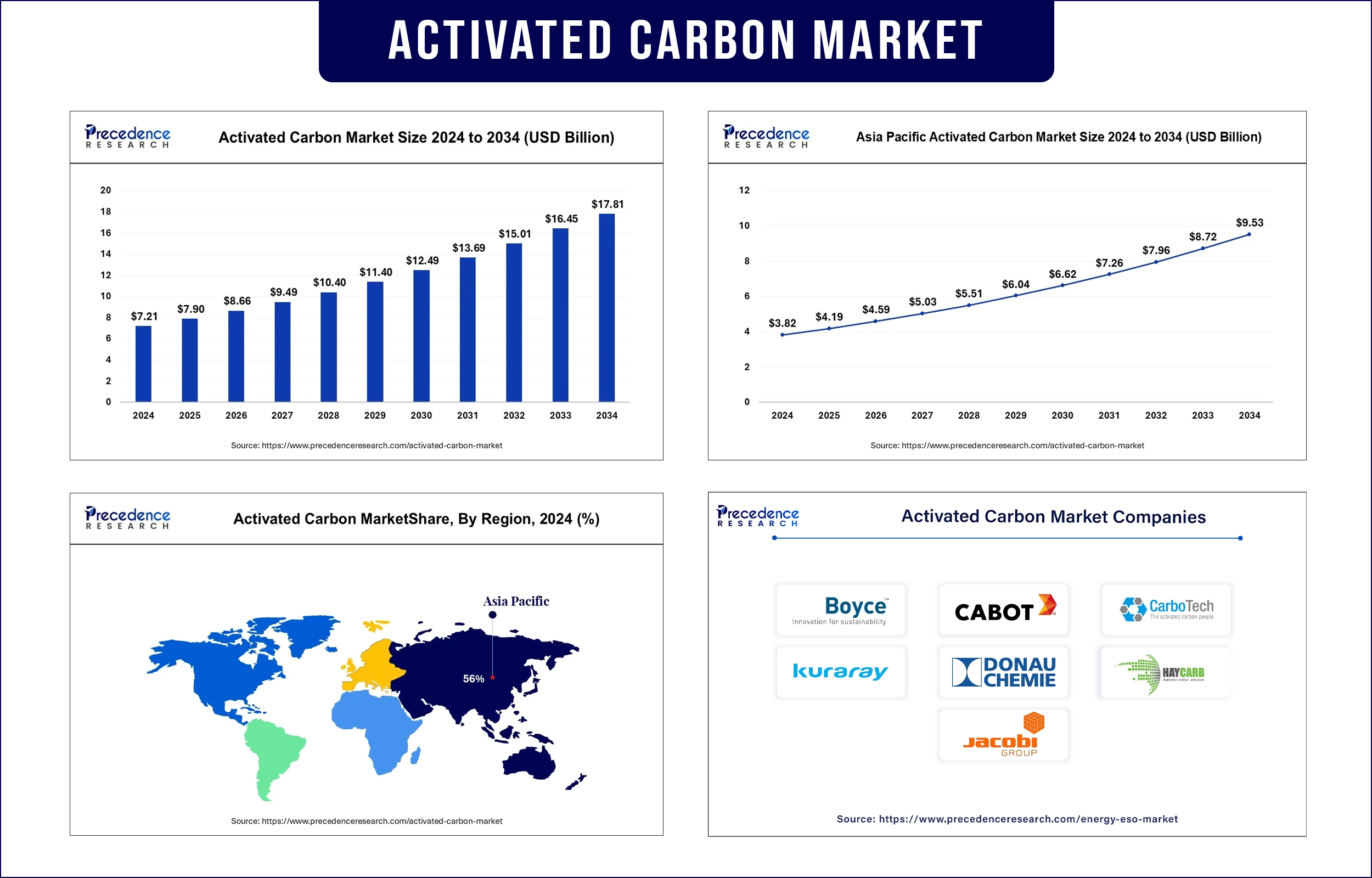

The global activated carbon market revenue surpassed USD 7.90 billion in 2025 and is predicted to attain around USD 16.45 billion by 2033, growing at a CAGR of 9.46%. The global market is anticipated to witness strong growth, driven by increasing demand for water purification, air filtration, and industrial applications.

Market Overview

Industrial applications of activated carbon use materials derived mainly from carbon-based raw materials, such as coconut shells and coal, wood, and peat, to perform filtration and purification tasks. The major industries utilize activated carbon for diverse applications throughout water treatment facilities and the purification of air, food production, and pharmaceutical industries.

Activated carbon market expansion occurs due to strict environmental rules and rising requirements for clean water for drinking purposes. Drinking water facilities use activated carbon as a highly efficient technology to remove organic contaminants from water, which stands as a top recommendation by the U.S. Environmental Protection Agency (EPA). Activated carbon technologies gain accelerated adoption because industrial facilities focus on lowering their emissions and enhancing environmental cleanliness.

Report Highlights

- By type, the granulated activated carbon (GAC) segment dominated the activated carbon market due to its high adsorption efficiency, longer operational life, and wide application in municipal water treatment and industrial air purification. Its porous structure and reusability make it ideal for continuous processes, especially in fixed-bed systems. The powdered activated carbon (PAC) is projected to gain momentum owing to its rapid adsorption capabilities and ease of dosing in batch systems. PAC finds growing usage in emergency water treatment, food processing, and pharmaceutical purification due to its flexibility and lower operational costs.

- By application, the gas phase segment is anticipated to lead during the forecast period, driven by its critical role in controlling volatile organic compounds (VOCs), industrial air emissions, and odorous gases. Environmental agencies and regulatory mandates continue to push industries toward cleaner air discharge, reinforcing the segment’s growth. The liquid phase segment is projected to maintain a steady role, especially in drinking water purification, wastewater treatment, and decolorization processes in the food and beverage sector. Consistent demand from municipal utilities and regulatory focus on water quality ensure this segment remains stable and essential.

Market Trends

Growing Demand for Water Purification

The activated carbon market rises with the growing demand for purified, safe drinking water. Public health, along with environmental sustainability, depends crucially on activated carbon filters, which effectively eliminate pollutants from pesticides to herbicides and industrial chemical components. Therefore, advanced purification systems are becoming increasingly necessary. Activated carbon technologies step forward as a crucial framework for global water security initiatives because of growing climate-related water availability issues.

- The 2023 World Water Development Report, published by the United Nations, reveals that billions of people across the world do not have access to properly managed clean drinking water services.

Rising Air Pollution Control Requirements

The need to control industrial air emissions serves as the main factor that drives activated carbon utilization. The World Health Organization (WHO) reports that yearly premature deaths caused by air pollution reach 6.7 million globally. Activated carbon solutions perform vital functions in three different sectors since they extract volatile organic compounds (VOCs) alongside dangerous gases from flue gas treatments, automotive emissions, and industrial facilities.

- Active carbon filtration systems used by cities generated improvements in the amount of airborne toxins, according to the WHO's Air Pollution and Health Report 2024.

Technological Advancements in Activated Carbon Production

Modern techniques in activated carbon manufacturing through bio-based approaches combined with enhanced pore design result in improved efficiency and lower environmental impact of the material. Due to its support of sustainable activated carbon research from renewable biomass, the U.S. Department of Energy pursues initiatives that advance green chemistry. Activated carbon continues to make progress with innovations that support sustainability targets worldwide to reinforce its environmental protective properties.

- The National Institutes of Health (NIH) published in 2024 research demonstrating that advanced bio-derived carbons possess excellent capabilities to trap emerging contaminants, which include pharmaceutical substances and PFAS compounds.

Strict Environmental Regulations Promoting Market Growth

Governments throughout the world have established demanding environmental control standards for industrial emissions and wastewater output regulations. The Environmental Protection laws of the United States require industrial facilities to deploy efficient pollution control technologies, including activated carbon as their main component. The commercial market experiences vast demand because of mandatory standards compliance. These worldwide initiatives boost the essential position that activated carbon maintains for protecting public health while advancing environmental sustainability.

Regional Outlooks

Asia Pacific

Asia Pacific is expected to maintain its leadership position in the activated carbon market due to industrial growth trends, population centralization trends, and increasing environmental quality awareness. China and India currently develop pollution reduction policies that they carry out using programs, including China's Action Plan for Prevention and Control of Air Pollution and India’s National Clean Air Programme.

The World Health Organization showed in 2024 that 80% of the Asia-Pacific urban population faced air quality guideline violations, which demonstrates the necessity for enhanced air purification systems. The United Nations Environment Programme (UNEP) recognized activated carbon technologies as essential components for national plans to lower both airborne particulate matter and industrial pollutants in 2024. Activated carbon filtration technologies continue to grow in significance due to increasing governmental water project investments throughout Southeast Asia.

North America

The North American activated carbon market is projected to register the fastest growth, driven by regulatory standards, extensive water treatment applications, and rising expenditures on renewable manufacturing methods. The U.S. EPA engages in regulatory activities alongside vast industrial carbon activation applications for environmental remediation, which strengthens this market region.

The Centers for Disease Control and Prevention (CDC) disclosed data in 2024 showing that improved industrial air filtration systems with activated carbon effectively reduced occupational exposure to dangerous substances. The National Institutes of Health (NIH) showcased that activated carbon technologies played a key role in enhancing public and healthcare facility indoor air quality.

Activated Carbon Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 7.90 Billion |

| Market Revenue by 2033 | USD 16.45 Billion |

| CAGR | 9.46% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In February 2025, Great Wall Filtration launched new activated carbon filter sheets into mass production. The company announced that its independently developed high-performance activated carbon filter board has passed comprehensive technical verification and is now in mass production.

- In May 2024, Organic Recycling Systems Limited (ORS) proudly introduced GAC-01, the latest addition to its innovative product line under the brand name Alpha Carbon. GAC-01 represents a significant advancement in water treatment filtration media, offering a biomass-based activated carbon granule made from various discarded biomass feedstocks, notably coconut shells.

- In May 2024, Indcarb Activated Carbon Private Limited, based in Palakkad, launched inline water filters for water purifiers using the activated carbon produced from coconut shells. The products, which will be available for sale starting next month, include components such as sediment filters, pre-carbon filters, and post-carbon filters.

Activated Carbon Market Key Players

- CarbPure Technologies

- Boyce Carbon

- Cabot Corporation

- Kuraray Co.

- CarboTech AC GmbH

- Donau Chemie AG

- Haycarb (Pvt) Ltd.

- Jacobi Carbons Group

- Kureha Corporation

- Osaka Gas Chemicals Co, Ltd

- Evoqua Water Technologies LLC

- Oxbow Activated Carbon ALC

- Carbon Activated Corporation

Market Segmentation

By Type

- Powdered

- Granulated

- Extruded

- Others

By Raw Material

- Coal Based

- Coconut Shell Based

- Wood Based

- Others (Including Petroleum Pitch)

By Application

- Liquid Phase

- Gas Phase

By End User

- Water Purification

- Air Purification

- Food & Beverage

- Industrial Chemicals

- Metal Extraction

- Pharmaceuticals

- Automotive

- Catalyst

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/1961

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344