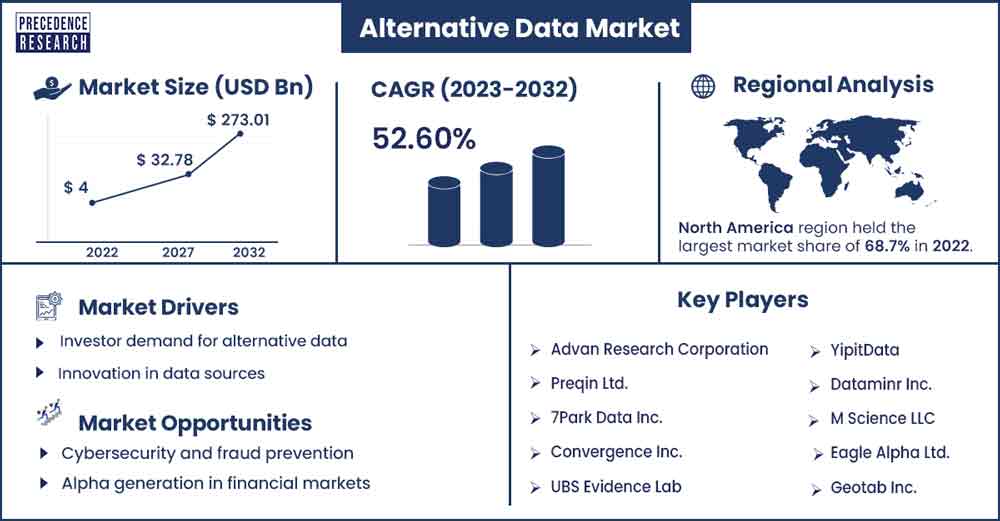

Alternative Data Market Will Grow at CAGR of 52.6% By 2032

The global alternative data market size was exhibited at USD 4 billion in 2022 and is anticipated to touch around USD 273.01 billion by 2032, expanding at a CAGR of 52.6% from 2023 to 2032.

Market Overview

In financial analytics and market insights, alternative data has emerged as a powerful tool, providing a comprehensive understanding of market dynamics beyond traditional sources. One key source of alternative data lies in financial transactions, specifically Credit and Debit Card Transactions. Businesses and investors can gain valuable insights into consumer behaviour, spending habits, and overall economic activity by analysing patterns and trends in these transactions. Moreover, email receipts offer a unique window into consumers' purchasing behaviour and preferences, as analysing this data can help businesses tailor their strategies to meet customer needs effectively.

Geo-location data, particularly foot traffic records, provides a spatial dimension to market analysis. By tracking consumer movement, businesses can optimize their physical locations, marketing strategies, and inventory management. Moreover, the proliferation of mobile devices has given rise to mobile application usage data, which can be a goldmine for understanding user preferences and engagement. This data is particularly valuable for tech companies and app developers seeking to enhance user experience and optimize their products.

Beyond transactional and user-related data, alternative data sources extend to satellite and weather data. This information is crucial for agriculture, energy, and insurance industries, where weather patterns can significantly impact business operations and investment decisions. Social and sentiment data provide insights into public opinions and attitudes, allowing investors to gauge market sentiment and potential shifts in consumer preferences. Web scraped data and web traffic data further contribute to this wealth of information, offering a digital perspective on market trends and online consumer behaviour.

Various industries and end-users benefit from leveraging services provided by the alternative data market. Hedge fund operators can use it to gain a competitive edge in financial markets, while investment institutions can enhance their risk assessment and portfolio management strategies. Retail companies can optimize inventory and marketing efforts based on consumer insights, and other end-users across diverse sectors can harness alternative data for a range of applications.

Regional Snapshot

North America stands as a major region in the alternative data market, harnessing a diverse array of sources to gain unparalleled insights into various sectors. Leveraging data from credit and debit card transactions, satellite and weather data, email receipts, geo-location records, web scraped information, mobile application usage, sentiment data, web traffic statistics, and other data types, the region has established itself as a hub for cutting-edge analytics.

Among the primary end users driving the adoption of alternative data in North America are hedge fund operators, investment institutions, retail companies, and other entities seeking a competitive edge in the alternative data market. These data-driven insights empower hedge funds to make more informed investment decisions, aid investment institutions in optimizing their portfolios, and provide retail companies with valuable consumer behaviour trends.

The influence of North America in the alternative data landscape is further accentuated by its dominance in industries such as finance, technology, and retail. Hedge fund operators leverage alternative data to identify market trends and potential investment opportunities, while investment institutions employ it for risk assessment and portfolio management. Retail companies, on the other hand, utilize this wealth of information to enhance customer experiences, optimize supply chains, and refine marketing strategies.

Telecom Analytics Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.08 Billion |

| Projected Forecast Revenue by 2032 | USD 273.01 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 52.6% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Investor demand for alternative data

Financial institutions and investors actively seek alpha, striving for a competitive advantage by leveraging unique insights from unconventional data sources. Pursuing alpha involves identifying market trends, predicting asset price movements, and gaining an informational edge over competitors. Additionally, alternative data plays a pivotal role in risk management, enhancing models to provide a more comprehensive understanding of market and investment risks. By integrating diverse datasets, investors can better assess potential challenges, make informed decisions, and navigate complex market dynamics more confidently.

In the quest for alpha generation, a hedge fund incorporates alternative data, analysing satellite imagery of global shipping patterns. This unique insight into trade flows enhances their market positioning. Simultaneously, the fund employs sentiment analysis from social media data to improve risk models, mitigate potential market volatility, and optimize portfolio risk management.

Innovation in data sources

Within the alternative data market, innovations in data sources has ushered in a transformative era with the emergence of novel alternative data types. Satellite imagery is revolutionizing sectors like agriculture and infrastructure, offering real-time observations for crop health assessment, urban planning, and disaster response. In the realm of the Internet of Things (IoT), the interconnectedness of devices provides granular data on various processes, enabling predictive maintenance in manufacturing, optimizing energy consumption, and enhancing supply chain visibility.

Another cutting-edge technology is sentiment analysis, a sophisticated technique in natural language processing, which mines insights from textual data like social media comments and news articles. This not only aids companies in understanding public perception but also empowers investors to gauge market sentiment. As these innovative data types become more mainstream, industries are at the forefront of leveraging these rich information sources to make data-driven decisions, foster innovation, and gain a competitive edge in an increasingly dynamic and interconnected global landscape.

Restraint

Data privacy concerns

Data privacy concerns have become a significant restraint in the alternative data market, particularly when dealing with sensitive information obtained from individual behaviours. For instance, consider a scenario where a hedge fund aims to utilize mobile location data to analyse foot traffic around retail locations. The fund might want to assess consumer trends and make investment decisions based on this alternative data.

Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union, require companies to obtain explicit consent from individuals before collecting and processing their personal information. In this case, obtaining consent for tracking the location data of individuals could be challenging due to privacy considerations. Individuals may be apprehensive about sharing such data, especially if they are not fully aware of how their information will be used or if they don't trust the entities collecting the data.

Opportunities

Cybersecurity and fraud prevention

In cyber security and fraud prevention, the integration of alternative data sources has become instrumental in fortifying organizational defences against evolving threats. Organizations are increasingly relying on non-traditional data to bolster their security postures and stay ahead of cyber adversaries. Monitoring network traffic, user behaviour, and external threat intelligence through diverse data sets enables a more comprehensive understanding of the cybersecurity landscape.

Alternative data sources, such as anomaly detection algorithms analysing network traffic patterns, can unveil irregularities that may signify a potential cyber threat. This proactive approach enhances early threat detection, allowing organizations to respond swiftly and mitigate the impact of security incidents. The combination of traditional security measures with insights derived from alternative data sources creates a more robust definition of cyber threats and contributes to a comprehensive fraud prevention strategy.

Alpha generation in financial markets

In the dynamic landscape of financial markets, alpha generation remains a paramount objective for institutions and hedge funds. The strategic utilization of alternative data has emerged as a game-changer, offering unparalleled insights that go beyond traditional market indicators. By tapping into unconventional sources such as satellite imagery, social media sentiment, and transaction data, financial entities can discern unique patterns and trends. Armed with these distinctive insights, they can make informed investment decisions ahead of the competition, thereby gaining a competitive edge and achieving alpha. The integration of alternative data enhances the precision and foresight of financial strategies, amplifying the potential for outperformance in the ever-evolving markets.

Recent Developments

- In June 2023, DataInnovate Solutions entered the alternative data market with the launch of their cutting-edge product, InfoPulse AI. This innovative platform leverages artificial intelligence to analyze diverse datasets, providing businesses with actionable insights for informed decision-making in the ever-evolving landscape of alternative data.

- In June 2023, DataSphere Innovations made a significant entry into the alternative data market as they launched their platform, DataHarbor. This cutting-edge tool aims to revolutionize how businesses access and utilize unconventional data sources, providing a comprehensive and dynamic approach to decision-making.

Major Key Players

- Advan Research Corporation

- Preqin Ltd.

- 7Park Data Inc.

- Convergence Inc.

- UBS Evidence Lab

- YipitData

- Dataminr Inc.

- M Science LLC

- Eagle Alpha Ltd.

- Geotab Inc.

- Jumpshot

- JWN Energy

- Ravenpack International SL

- The Earnest Research Company

- Thinknum Inc.

- Talkingdata

Market Segmentation

By Data Type

- Credit & Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite & Weather Data

- Social & Sentiment Data

- Web Scraped Data

- Web Traffic

- Other Data Types

By Industry

- Automotive

- BFSI

- Energy

- Industrial

- IT & Telecommunications

- Media & Entertainment

- Real Estate & Construction

- Retail

- Transportation & Logistics

- Other Industries

By End User

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Other End-users

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2054

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308