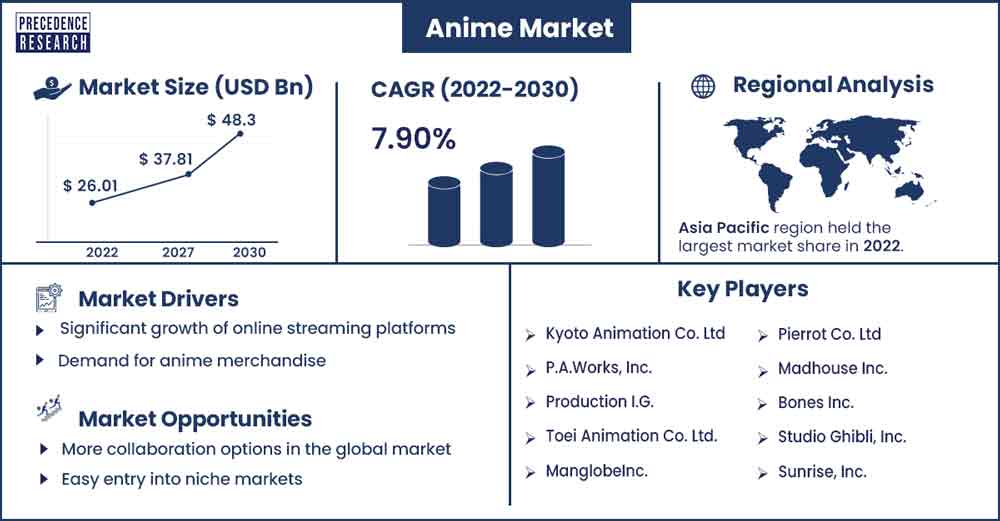

Anime Market Size To Rise USD 48.3 Billion By 2030

The global anime market size exceeded USD 26.01 billion in 2022 and is expected to rise to USD 48.3 billion by 2030, poised to grow at a CAGR of 7.90% from 2022 to 2030.

Market Dynamics

The anime market is experiencing a notable surge in growth on a global scale, which can be attributed to its diverse content that appeals to a broad audience transcending age and culture boundaries. Streaming platforms such as Crunchyroll and Netflix have played a vital role in expanding the reach of anime, while merchandising and gaming have also contributed significantly to revenue streams. Collaborations with other industries, such as fashion and technology, highlight the impact of amine culture. Despite challenges like production cost and competition, the anime market is expected to continue growing, fueled by dedicated fan communities and innovative storytelling.

Merchandising is a major driving force behind the anime industry. It offers a wide range of products, from merchandise to fashion, that fans can use to connect with their favourite series in a tangible way. This symbiotic relationship between content and merchandise enhances the overall anime experience and plays a significant role in the anime market's economic landscape.

- Crunchyroll has achieved a remarkable feat by surpassing 100 million registered users and securing over 5 million subscribers worldwide.

Regional Snapshot

Asia Pacific has been found to lead the global anime market. This dominance can be attributed to many artists, anime creators, production houses, and other related organizations in the region. The combined efforts of these entities have led to a plethora of anime being launched in the market over the past few years. Moreover, the presence of several diverse cultures within the region gives the market players artistic freedom to branch out from their niche genre and explore new alternatives. Local productions are rapidly gaining global exposure due to the rise of social media and growing interest in foreign cultures.

In India, the anime market has been experiencing significant growth; the most watched streaming platforms in India are Netflix and Crunchyroll. Widespread availability of anime content, as well as localization and dubbed efforts, has expanded the fan base beyond niche audiences. Social media platforms also play a crucial role in fostering anime communities, providing enthusiasts spaces to share content and engage in discussions. Merchandising efforts and the organization of anime-related events have further contributed to the anime market visibility; this trend collectively indicates a growing and vibrant anime market in India.

Japan's anime market is a powerful and influential force that is deeply rooted in the country's cultural fabric. With over 600 animation studios, Japan is also known as the hub of animation, and the diverse storytelling, innovative animation techniques, and iconic characters of anime hold a significant place in both domestic and global entertainment. Anime-themed tourism is a phenomenon, drawing enthusiasts to locations featured in beloved series. As a cultural center, the Japanese anime market remains a dynamic force, continuously shaping the landscape of the entertainment market.

China's anime market has experienced significant growth and transformation in recent years. This growth reflects the increasing interest in Japanese animation and the emergence of a vibrant domestic anime scene. While Chinese studios were initially influenced by Japanese anime, they are now actively producing their content, which combines traditional Chinese cultural elements with anime aesthetics. Collaboration between Chinese and Japanese animation studios has become a common occurrence across various media platforms, fostering cross-cultural exchanges. The success of domestically produced series like "Fog Hill Five Elements" demonstrates the potential of the industry.

Anime Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 27.96 Billion |

| Projected Forecast Revenue by 2030 | USD 48.3 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 7.9% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Significant growth of online streaming platforms

Streaming platforms offer a vast and diverse catalog of anime titles, allowing audiences worldwide to watch anime at their convivence. Aside from their established viewer base, these platforms provide appropriate exposure for their content in the form of advertisements and promotions. They also provide the developers with accurate statistical data about the market's favorability for their content, allowing opportunities for development. Furthermore, subscription-based models and ads contribute to revenue generation, sustaining the production of new anime content.

Demand for anime merchandise

Anime merchandising includes diverse products like clothing, accessories, stationery, and home decor. These products are not only a popular form of revenue generation for the copyright holders but also act as a form of advertisement for the media. Anime enthusiasts are always keen on acquiring limited edition collector's items such as action figures, posters, and art prints. Furthermore, avid fans purchase these articles as a form of solidarity towards their favorite anime. High-quality design and personalization options add to the demand for the anime market.

Restraint

High production cost

Top-quality animation has the power to captivate audiences and leave a lasting impact. Creators aspire to work on projects with innovative graphics features and new technologies; however, they need help with the associated high production costs. Despite the abundance of innovative technologies, the industry experiences a shortage of trained workforce due to the high degree of specialized experience required. These personnel are often forced to work long hours on a specific project with a low pay rate, creating dissatisfaction and loss of interest.

Piracy Content

Piracy has been a major issue in various industries, resulting in significant loss of revenue. Businesses often lose their customer to low-cost alternatives or due to a misplaced trust in low-quality duplicates. The media and entertainment industry especially faces plagiarism issues wherein their content is pirated from paid platforms onto free sites. Thus, reducing the viewership on the intended outlets and resulting in a loss of revenue. Widespread piracy can significantly reduce the income of anime producers and distributors, potentially impacting the financial sustainability of the industry.

Opportunities

More collaboration options in the global market

Collaboration with international studios and creators can result in innovative storytelling that incorporates diverse cultural influences. This allows market players to branch out from their niche genre and explore new or other popular ones. The subsequent joint productions can generate content that appeals to global audiences. Such cross-cultural media helps the growth of local creators and pioneers their development into international markets.

Easy entry into niche markets

As the media and entertainment industry experiences cross-cultural exposure in the forms of print, audio, and videos, creators have been exploring non-standard categories. Anime creators especially have been experimenting with niche markets and subgenres that can cater to specific interests. Specialized content can find enthusiastic audiences and can contribute to diversified growth.

- In December 2023, a new category of anime was introduced to the market. Titled "Culture fusion anime," this genre combines traditional elements from diverse cultures.

Recent Developments

- In 2023, The U.S. anime merchandise market, a subsegment of the anime market, recorded remarkable growth, with an extensive range of products, including action figures, apparel, accessories, books, and toys.

- In November 2023, Kadokawa Corporation launched an in-house animation studio by merging with existing ones and establishing new ones to combat talent shortages.

- In March 2022, Kinetix, an upcoming startup teamed with Adobe to make 3D animation aided by AI widely accessible to creators.

Major Key Players

- Kyoto Animation Co. Ltd

- P.A.Works, Inc.

- Production I.G.

- Toei Animation Co. Ltd.

- ManglobeInc.

- Pierrot Co. Ltd

- Madhouse Inc.

- Bones Inc.

- Studio Ghibli, Inc.

- Sunrise, Inc.

Market Segmentation

By Service

- T.V

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1306

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308