Automotive IoT Market is Rapidly Growing at a CAGR 22.40% By 2033

Navigating the Automotive IoT Market: Opportunities, Challenges, and Growth Forecasts

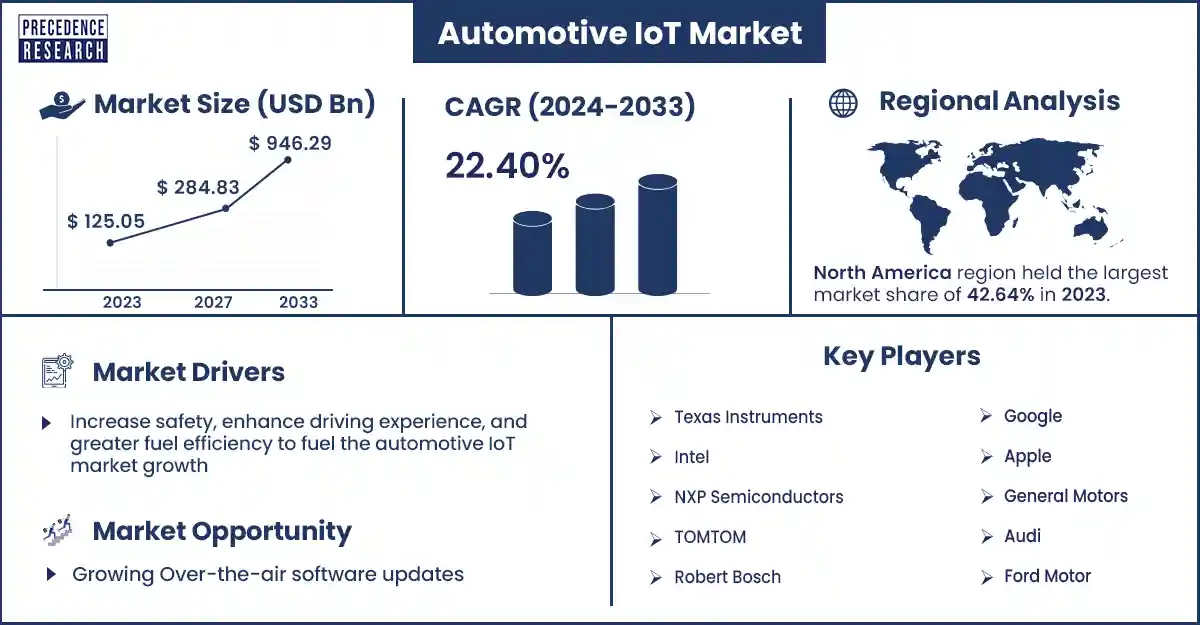

The global automotive IoT market size surpassed USD 125.05 billion in 2023 and is estimated to gain around USD 946.29 billion by 2033, growing at a CAGR of 22.40% from 2024 to 2033. Government funding and auto creators on next-generation vehicle-to-vehicle technologies drive the growth of the automotive IoT market.

Market Overview

The automotive IoT market deals with the use of IoT technologies in the automotive industry. This includes the use of software, sensors, and connected devices to improve vehicle efficiency, safety, and performance. Automotive IoT is a complex system of devices such as GPS trackers, cameras and sensors that provide correct-time information that authorizes improvement of the care manufacturing procedure and also more organized management. Demand for smartphone features in vehicles, increasing telematics orders by governments, and increasing demand for smart gadgets and maintenance alerts are anticipated to enhance the market growth.

The vehicle’s traffic alert and real-time incident, along with an increase in R&D costs, will create significant opportunities for the market. In addition, increasing technological developments in IoT, such as edge computing and 5G connectivity, are also expected to drive the market.

Increase safety, enhance driving experience, and greater fuel efficiency to fuel the automotive IoT market growth

IoT sensors help detect and prevent major accidents, alert drivers to potential hazards, and monitor a vehicle’s condition. Sensors can detect issue warnings and distracted or drowsy drivers to maintain the focus on driving. In addition, IoT sensors can avoid potential collisions and activate the steering and brakes to avoid an accident. Further, IoT automotive devices can enhance the overall driving experience by providing customized suggestions for food and entertainment, weather alerts, and real-time traffic updates. In addition, IoT devices can simplify tracking vehicle maintenance, locating charging stations, and finding parking spaces.

Further, IoT sensors can examine the vehicle components, tires, and engines to reduce emissions and optimize fuel consumption. IoT sensors can prompt the driver to inflate and detect an underinflated tire to improve fuel efficiency. Further, to avoid significant problems, IoT devices can help lower maintenance costs. Early detection allows drivers to prevent breakdowns and avoid expensive repairs that may result in expensive towing fees. These are major factors responsible for driving the growth of the automotive IoT market.

However, data security, privacy concerns, high implementation costs, and lack of standardization may restrain the growth of the automotive IoT market. The possible misuse of sensitive data, privacy, and data security are among the problems created by the rising amount of data produced by connected vehicles. Further, infrastructure investments, developments, and research can be more expensive for the integration of IoT technologies into vehicles, which may be banned for the market players. Further, the integration of IoT devices and smooth communication might be restrained by the lack of interoperability issues and established protocols among IoT devices in the automotive industry.

Automotive IoT Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 125.05 Billion |

| Projected Forecast Revenue by 2033 | USD 946.29 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 22.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive IoT Market Top Companies

- Vodafone

- TELUS

- Keysight Technologies

- AT&T

- Thales SA

- Microsoft

- Cisco

- IBM

- Ford Motor

- Audi (Germany)

- General Motors

- Apple

- Robert Bosch

- TOMTOM

- NXP Semiconductors

- Intel

- Texas Instruments

Recent Development by Keysight Technologies

- In April 2023, Keysight Technologies launched a compact network test solution for industrial and automotive IoT applications and devices to advance them.

Recent Development by Cisco and TELUS

- In February 2024, for the IoT focus on connected cars, TELUS and Cisco launched new 5G network capabilities in North America. This 5G network served as a foundation to help in test drives by automotive 5G Connected car manufacturers to create revenue opportunities for carmakers and drive the consumer’s experience.

Regional Insights

North America dominated the automotive IoT market in 2023. The growing demand for smart cities, increase in investments by the government, and different companies providing smart parking areas to vehicles are anticipated to drive the market growth in North America. The United States and Canada are the emerging countries in North America that use automotive IoT.

The U.S. is a hub of technological innovation and advancements that are incorporated into the automotive industry. In the United States, automotive is one of the largest markets in the world and the second largest market in vehicle sales and production. According to Autos Drive America, international automakers manufacture millions of vehicles in a year. In the United States, many auto manufacturers have transmission plants and conduct research, testing, and development design. The automotive industry is cutting-edge in innovation. New R&D innovations are reshaping the industry to a high level of opportunities.

The United States exported millions of heavy trucks and medium and light vehicles. The United States is anticipated to drive the growth of the automotive IoT market due to advanced factors such as government initiatives, available infrastructure, strong R&D capabilities, a highly skilled workforce, and a large customer market. Chevrolet, GMC, Chrysler, Dodge, Jeep, Ram Trucks, Ford, and Lincoln are the leading companies in the United States.

Europe stands as the second largest market for automotive IoT, driven by a strong emphasis on technological innovation and smart vehicle integration. Major automotive hubs like Germany, France, and the UK are leading the way, with significant investments in connected car technologies and smart infrastructure. The market's growth is fueled by rising demand for enhanced vehicle safety, autonomous driving features, and efficient traffic management solutions.

Market Potential and Growth Opportunity

Over-the-air software updates

Over-the-air software updates are cloud-authorized services that permit automotive industries to develop vehicle functions through remote sensing software. Automotive IoT over-the-air software services help vehicular systems to modify newly released data related to software updates for electronic control units, software that controls vehicle parts, telematics, infotainment, and many more. Over-the-air technology can directly download software on vehicular systems and can be used to upgrade external devices, including mobile devices connected with the vehicle.

Over-the-air software updates can avoid unnecessary visits to the service station as it works remotely. In addition, OTA software updates also allow automotive industries to solve problems regarding updates quickly and upgrade any advanced functionality without any hurdle. This opportunity must drive the growth of the automotive IoT market.

Automotive IoT Market News

- In February 2024, in China, Geespace, a company of Chinese carmakers, launched 11 LEO satellites to develop automotive technology for connected and self-driving cars.

- In September 2023, COSCO SHIPPING launched the digital supply chain platform to advance the automotive industry. The platform includes IoT, big data, AI, and 5G technology. The aim behind this launch was to build an eco-friendly and smart supply chain platform modified for automobile transportation.

Market Segmentation

By Communication

- Vehicle to Vehicle

- In vehicle communication

- Vehicle to infrastructure

By Offering

- Hardware

- Software

- Services

By Connectivity Form

- Embedded

- Tethered

- Integrated

By Application

- Navigation

- Infotainment

- Telematics

By End User

- OEM

- Aftermarket

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1922

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308