Baby Safety Products Market Revenue to Attain USD 409.64 Bn by 2033

Baby Safety Products Market Revenue and Trends 2025 to 2033

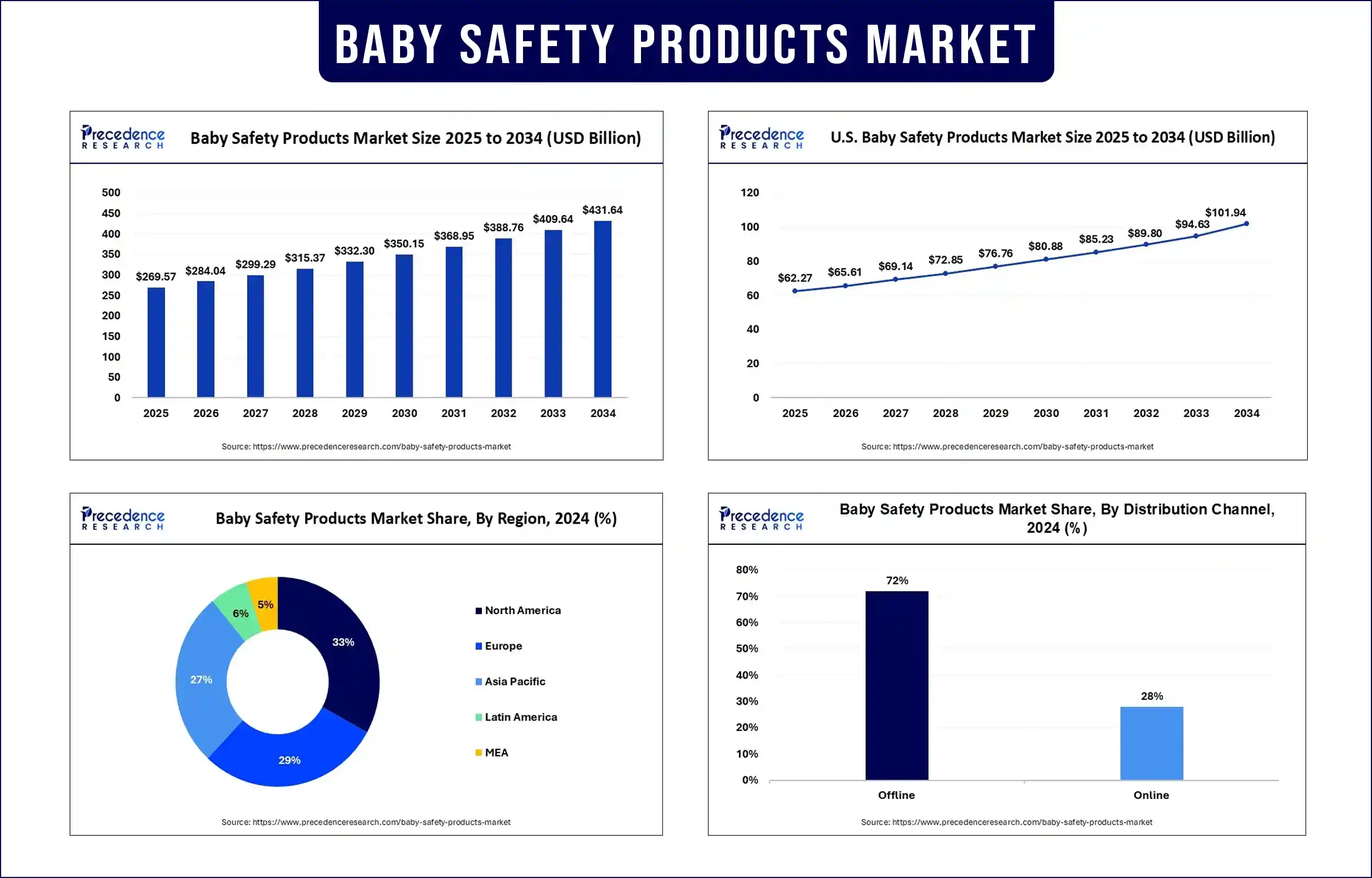

The global baby safety products market revenue is reached USD 269.57 billion in 2025 and is predicted to attain around USD 409.64 billion by 2033 with a CAGR of 5.37%. The worldwide baby safety products market is expected to witness significant growth due to rising parental awareness about infant safety, increasing urbanization, and advancements in safety technologies.

Market Overview

The baby safety products market comprises many pieces of equipment that help to make the lives of infants and toddlers safer. Such products include baby monitors, car seats, corner guards, cabinet locks, and safety gates. The modern parenting trends toward preventive care lead to the high usage of baby safety products. According to the U.S Consumer Product Safety Commission (CPSC), more than 66,400 children under the age of five are treated in emergency departments yearly due to injuries. This creates the need for safety products for babies. In addition, the rise of e-commerce is improving accessibility to baby safety products, sustaining the market’s long-term growth.

Baby Safety Products Market Trends

Awareness Campaigns

State governments and NGOs are launching awareness campaigns to raise awareness among parents about child safety. Organizations such as Safe Kids Worldwide emphasized that the correct application of baby safety products may reduce the possibility of injuries. Such campaigns educate parents about baby care and regular checks on the equipment to ensure the maintenance of safety standards. In 2024, the U.S Centers for Disease Control and Prevention (CDC) emphasized that unintentional injuries were the leading cause of death in the U.S. in children aged 1-4, stressing the importance of preventative measures.

Smart Safety Devices Integration

Modern monitoring systems are revolutionizing child safety. The advent of baby monitors equipped with AI with motion detection, cry alerts, and night vision is transforming the way caregivers monitor children. Recently, the updated report by the National Institute of Standards and Technology (NIST) was published, which recommended that manufacturers provide multi-layered security controls to baby monitoring technologies. These recommendations eliminate the weaknesses in Wi-Fi and Bluetooth-enabled devices commonly used in nurseries. Furthermore, as more attention has been given to child privacy, health agencies are also encouraging parental learning concerning the secure configuration of devices.

Stringent Regulatory Frameworks for Product Safety

New guidelines for the safety of products by agencies, such as the European Commission and ASTM International, are boosting consumer confidence in the quality of products. EN 1930:2020 governs safety barriers and gates to prevent access to dangerous spaces. Such regulations require strict examination of the product and appropriate labelling, which is important to parents in making informed decisions. The developed and the emerging markets experience a rise in the demand for compliant safety products backed by regulatory assistance. The Consumer Product Safety Improvement Act (CPSIA) updated new standards for infant sleep products and crib safety, with more stringent testing requirements

Urbanization and Nuclear Families Driving Demand

There has been rapid urban development and an increase in nuclear families are increasing dependence on external child safety tools. The World Bank reports that growing urban density limits outdoor play and increases indoor safety concerns. Parents in urban areas prefer to spend more on baby safety products, such as the corner guards, electrical outlet covers, and bath safety items, as little time available for keeping an eye. As families adjust to living in smaller spaces, the demand for portable and adjustable safety devices increases.

Report Highlights of the Baby Safety Products Market

Product Type Insights

The baby car seat segment dominated the market with the largest share in 2024. This is mainly due to the increased awareness among parents about the importance of child safety in vehicles and the enforcement of stringent child safety regulations. Moreover, continuous improvements in the design and safety features of baby car seats, such as advanced crash protection and ease of installation, have contributed to this segment's growth.

The monitors segment is projected to grow at the fastest rate in the coming years. This impressive growth is largely attributed to the increasing demand for baby monitoring devices that enable parents to monitor their child's health and well-being remotely. Additionally, rising concerns about sudden infant death syndrome (SIDS) have prompted more parents to invest in advanced monitoring solutions for peace of mind.

Distribution Channel Insights

The offline segment accounted for the largest market share in 2024. Physical stores, including baby specialty retailers and large retail chains, continue to be the preferred shopping option for many parents due to the ability to physically examine products and receive personalized advice. Furthermore, the offline channel offers a sense of reassurance, as customers can rely on expert opinions to ensure the safety and quality of products for their children.

The online segment is projected to expand at the highest CAGR during the projection period. The growing trend of online shopping, bolstered by the convenience of home delivery and the availability of a broader selection of products, is anticipated to fuel the growth of the online distribution channel. Additionally, the growth of mobile commerce and the use of social media platforms for product recommendations are expected to contribute to the accelerated growth of the online channel.

Regional Outlook

North America dominated the baby safety products market in 2024 due to its well-established safety standards, strong consumer awareness, and the presence of major market players. The CPSC and AAP influence product design actively via guidelines and recall systems that deal with possible dangers even before the products reach the homes. The U.S Consumer Product Safety Commission issued over 40 recalls of infant and toddler products in the year 2024, a highly focused Product Safety Commission (CPSC) that aims at preventing injuries through proactive regulation. Additionally, the National Institutes of Health (NIH) implemented community-based training modules for new parents, which cover illustrations on installing safety gates, securing furniture, and the effective use of smart baby monitors.

Asia-Pacific is anticipated to experience the fastest growth in the coming years, owing to increasing birth rates, urbanization, and parental spending on child safety. The government-led education programs in nations such as India, China, and Indonesia are playing an important role in forming secure parenting practices. The World Health Organization (WHO) pointed out that Injury is a major cause of death in children over one year of age in the South-East Asia (SEA). In 2004, the region had the second highest rate of unintentional child injuries, creating the need for baby safety products.

Baby Safety Products Market Key Players

- Artsana Spa

- Baby Trend Inc.

- BREVI MILANO Spa

- Bugaboo North America Inc.

- Compass Diversified

- Dex Products Inc.

- Dorel Industries Inc.

- Goodbaby International Holdings Ltd.

- Jane Group

- KidKusion Inc.

- Mommys Helper Inc.

- Mothercare in Ltd.

- Newell Brands Inc.

- North States

- Nuna International BV

Baby Safety Products Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 269.57 Billion |

| Market Revenue by 2033 | USD 409.64 Billion |

| CAGR from 2025 to 2033 | 5.37% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Baby Safety Products Market News

- In April 2024, Steelbird Baby Toys, a subsidiary of Steelbird Hi-tech India, the world’s largest helmet manufacturer, announced its entry into the child safety segment with the launch of baby helmets designed specifically for cycling and skating. The unveiling took place at the Ride Asia Exhibition in New Delhi, where the brand also introduced anti-skid baby bathers. This strategic expansion signals Steelbird’s growing focus on the baby toys and safety market, reinforcing its commitment to innovation in child protection.

- In June 2024, Lifelong Online, a leading Indian e-commerce brand for consumer goods, ventured into the baby care segment with the launch of a comprehensive new product line. Aimed at modern parents, the collection includes wearable breast pumps, strollers, bottle warmers, collapsible baby bathtubs, anti-slip bathers, and baby car seats. Each product has been designed to prioritize convenience, safety, and modern functionality, meeting the evolving needs of today’s fast-paced parenting lifestyle.

- In September 2023, Johnson’s Baby introduced a new digital film campaign highlighting mothers’ desire for safe baby care ingredients. The initiative supports the brand’s commitment to transparency and innovation, featuring the rollout of its upgraded packaging integrated with augmented reality (AR) features. Johnson’s is enhancing consumer engagement by implementing AR experiences across 25,000 retail outlets in India. The campaign also includes interactive sessions with influencers and parenting communities to promote the use of AR in helping caregivers choose safe, high-quality products for their babies.

Market Segmentations

By Product Type

- Car Seats

- Strollers

- Monitors

- Others

By Distribution Channel

- Offline

- Online

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2738

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344