Biofertilizers Market Revenue to Attain USD 4.18 Bn by 2033

Biofertilizers Market Revenue and Trends 2025 to 2033

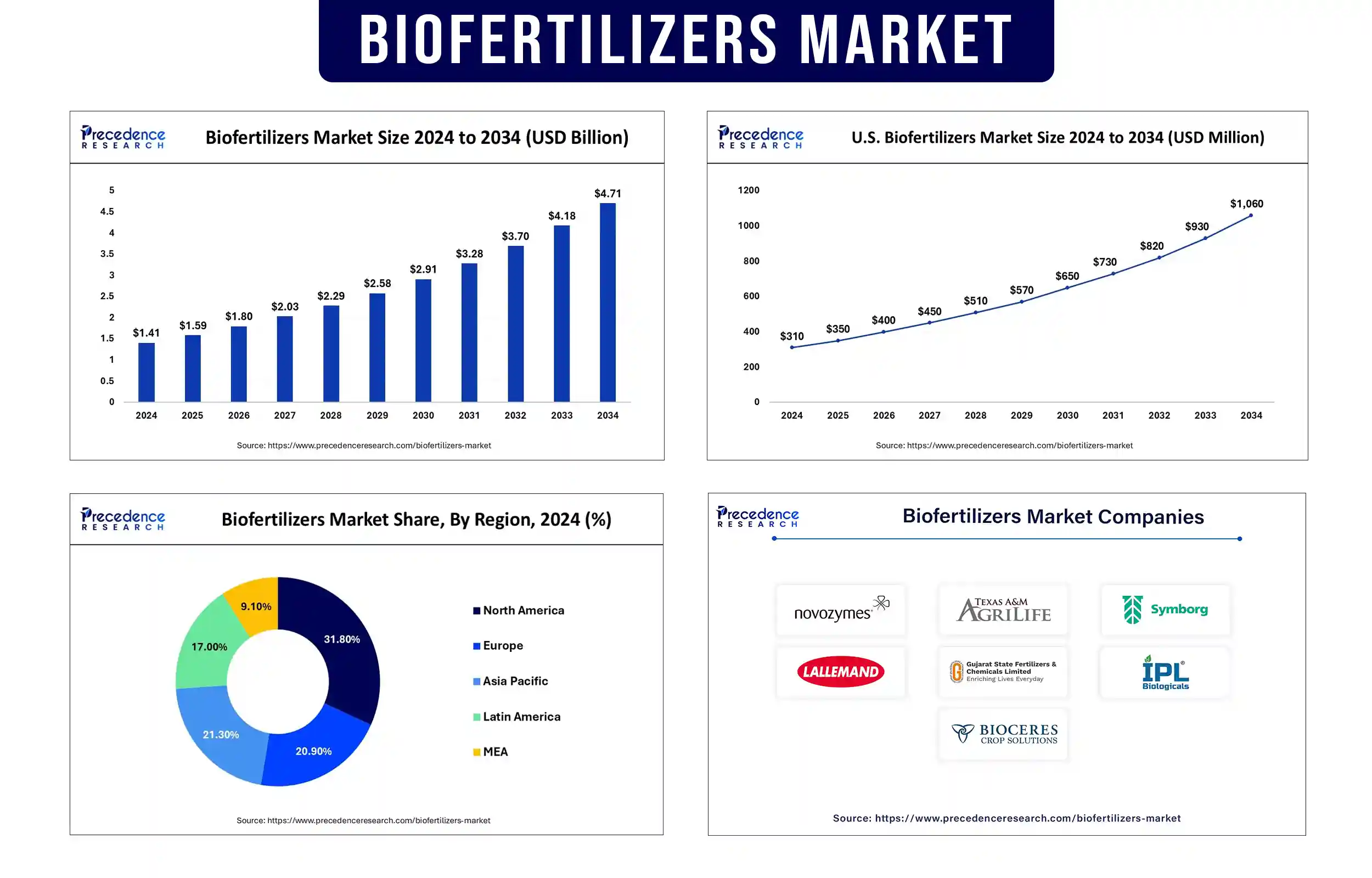

The global biofertilizers market revenue is reached USD 1.59 billion in 2025 and is predicted to attain around USD 4.18 billion by 2033 with a CAGR of 12.83%. The market is witnessing rapid growth due to the rising focus on sustainable agriculture practices, increasing awareness of environmental impact of synthetic fertilizers, and government initiatives promoting organic farming practices.

Market Overview

Biofertilizers consist of living microbes that stimulate the soil’s ability to make nutrients more available for the plant. As the world focuses on sustainable agriculture practices, biofertilizers are becoming essential to reduce the effects of harmful chemicals and enhance soil and crop performance. The rising demand for organic food and stringent regulations on artificial agrochemicals are all contributing to the rise of biofertilizer use, driving the growth of the market.

The growing area of farmland further supports market expansion. According to the International Federation of Organic Agriculture Movements (IFOAM), the global organic farmland area surpassed 99 million hectares in 2024, representing a significant opportunity for the biofertilizers market. Additionally, UNEP’s 2024 report pointed out that biofertilizers limit the production of greenhouse gases from agriculture because they reduce the usage of synthetic fertilizers, a large creator of nitrous oxide.

Key Trends in the Biofertilizers Market

Integration of Biofertilizers in Regenerative Agriculture

The growth of regenerative agriculture has led to a higher interest in using biological soil enhancers. The use of biofertilizers and the practice of applying compost are increasing to improve the soil’s quality and add more microbes. The FAO also pointed out in 2024 that biofertilizer use boosts nutrient cycling and lowers fertilizer needs by 20% in various farming ecosystems. The IFA stated that by applying biofertilizers and regenerative methods, farmers can increase their soil microbial biomass by approximately 12%. Furthermore, biofertilizers are crucial in regenerative agriculture due to their benefits for the soil, microorganisms, and crop production.

Technological Advancements in Microbial Formulation

Innovations in microbial encapsulation, shelf-life stabilization, and strain development are improving the effectiveness and efficiency of biofertilizers. Combining several strains when creating inoculants is becoming more popular. In 2024, FAO revealed that advanced encapsulation methods helped microbes survive under harsh conditions, boosting their performance by 25%. The latest research shows that biofertilizers boost nitrogen fixation in leguminous crops. ICAR’s study in 2024 reported that the combination of biofertilizers with nano-carriers could maintain microbial life for more than 40% longer. Additionally, such improvements in technology have caused improvements in biofertilizers that are more consistent, useful, and widespread across the world.

Government Initiatives and Organic Certification Programs

Governments worldwide are supporting biofertilizer adoption through subsidies, training, and organic certification programs. In 2024, the National Mission of India on Sustainable Agriculture (NMSA) allocated nearly USD 180 million to support farmers in using bio-inputs. Likewise, the European Commission imposed the EU Organic Regulation to include microbial fertilizers and make them available across member states. According to FAO, government aid in offering training and education for farmers boosts the adoption of biofertilizers. The EBIC has been collaborating closely with regulatory groups to ensure stricter standards for determining the effectiveness and safety of microbial products’ use in organic farming. Furthermore, these programs help farmers use biofertilizers more quickly and push for a greener world through sustainable agriculture.

Environmental and Climate Benefits

Biofertilizers contribute to sustainable agriculture by reducing soil degradation, water pollution, and greenhouse gas emissions. They help to keep soil quality good and ensure the pH does not become imbalanced, which supports farming. According to the IPCC’s 2024 adaptation report, the adoption of biological fertilizers could help cut agriculture-related emissions by over 20% by 2030. FAO stated in 2024 that biofertilizers improve nitrogen efficiency, leading to a significant reduction in greenhouse gas emissions. Additionally, ISME pointed out that healthy soil and reducing climate risks both rely on the vital work of microbial communities, supported by assessments. It is clear from these discoveries that biofertilizers play a major role in promoting environmental care and reaching global sustainability and climate goals.

Report Highlights of the Biofertilizers Market

Type Insights

The nitrogen fixing segment dominated the market in 2024 and is projected to continue its growth trajectory during the forecast period, driven by the widespread cultivation of leguminous crops and the critical role of nitrogen in plant metabolism. Rising emphasis on regenerative and organic farming practices around the world is expected to boost the demand for these inoculants, especially in countries with nitrogen-deficient soils.

The phosphate solubilizing segment is expected to expand at a significant CAGR in the upcoming period. The growth of the segment is attributed to the increasing awareness among farmers regarding phosphorus deficiency. Advancements in microbial strain development are boosting the adoption of phosphate-solubilizing biofertilizers across a wide range of crops.

Application Insights

The seed treatment segment accounted for the largest market share in 2024. This is mainly due to the precision, affordability, and ability of this treatment to ensure early colonization of microbes on plant roots. On the other hand, the soil treatment segment is anticipated to grow significantly over the forecast period. The growing emphasis on restoring soil health and microbial balance is likely to support segmental growth. This method allows broader and deeper microbial interaction within the rhizosphere, improving nutrient cycling and soil structure.

Crop Type Insights

The cereals & grains segment held the largest share of the global market in 2024, owing to the vast acreage dedicated to staple crops like rice, wheat, and maize. Government support programs and the high responsiveness of cereals to microbial inputs drive the extensive use of biofertilizers in these crops. Meanwhile, the oilseeds & pulses segment is projected to grow at the fastest rate during the projection period. The increasing consumer demand for protein-rich and plant-based foods is fueling the growth of the segment. In addition, oilseeds such as soybean and sunflower benefit significantly from microbial inoculants that enhance nutrient availability and disease resistance.

Regional Outlook

North America led the biofertilizers market by holding the largest share in 2024. This is mainly due to a strong focus on sustainable farming and improving the health of the soil. There are plans underway in the U.S. and Canada to incorporate biofertilizers into traditional and organic farming. In 2024, SARE from the USDA added more grants focused on developing biofertilizers and educating farmers. In 2024, the FAO stated that North American farmers are turning to biofertilizers to become less dependent on chemical fertilizers and improve how nutrients are used.

Asia Pacific is expected to experience significant growth, driven by rising levels of soil degradation and classes for farmers. Farmers in countries like India, China, and Indonesia are adopting biofertilizers rapidly due to the growing awareness of sustainable farming. India introduced the “BioNutrient Revolution” in 2024, hoping to apply biofertilizers to two million hectares of land by 2026. The International Fertilizer Association noted that there are efforts in China to create microbial inoculants that meet the requirements of local soils. Furthermore, by using biofertilizers, Asia Pacific is leading the way in helping agriculture stay sustainable and protect the soil.

Biofertilizers Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.59 Billion |

| Market Revenue by 2033 | USD 4.18 Billion |

| CAGR from 2025 to 2033 | 12.83% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biofertilizers Market News

- In January 2025, Super Crop Safe Ltd. (SUCROSA Group) introduced Super Gold WP+, a next-generation biofertilizer combining mycorrhizal inoculants with vital nutrients. Designed to reduce dependence on traditional chemical fertilizers like urea and DAP, the product enhances crop yield while supporting environmental sustainability. It reflects a shift toward eco-friendly farming solutions.

- In December 2024, Yara launched its YaraSuna portfolio at Agromek 2024, featuring six organic and organo-mineral fertilizers designed to support regenerative agriculture. These high-organic carbon micropellet formulations aim to boost soil health and crop resilience. The product line aligns with global efforts to transition toward sustainable nutrient management.

- In September 2024, KRIBHCO and Novonesis signed a strategic MoU to expand agri biosolutions in India. Their first initiative is the launch of ‘KRIBHCO Rhizosuper’, a Mycorrhizal Biofertilizer enhanced with Novonesis’ LCO Promoter Technology. The collaboration aims to improve crop productivity and soil health across a broad range of crops.

Biofertilizers Market Key Players

- CBF China Biofertilizer

- Novozymes A/S

- Agrilife

- Symborg SL

- Lallemand Inc

- Gujrat State Fertilizers & Co Ltd.

- IPL Biological

- Bioceres SA

- Americal Vanguard Corporation

Market Segmentation

By Type

- Nitrogen Fixing

- Phosphate Solubilizing

- Others

By Application

- Seed Treatment

- Soil Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2780

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344