Biofilter Market Size To Rise USD 7.64 Billion By 2032

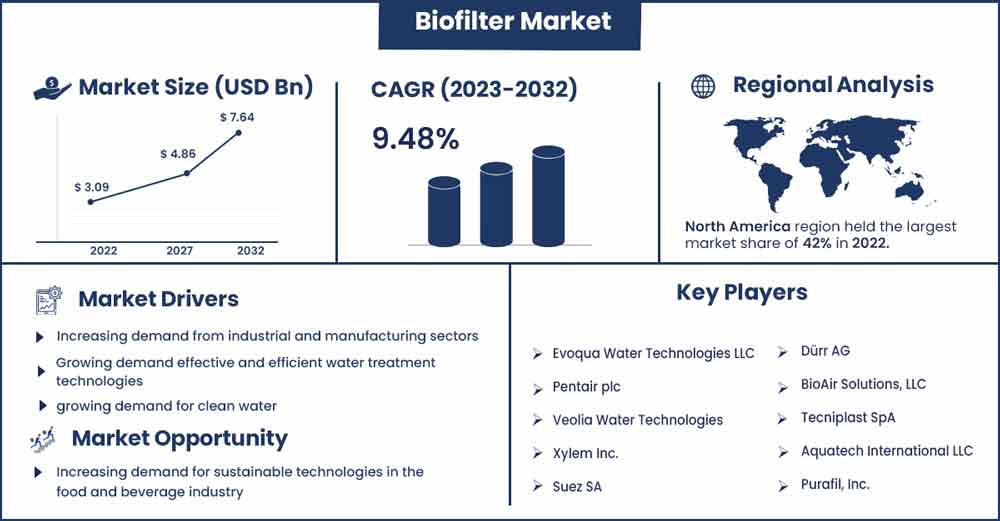

The global biofilter market size surpassed USD 3.09 billion in 2022 and is projected to rise to USD 7.64 billion by 2032, anticipated to grow at a CAGR of 9.48 percent during the projection period from 2023 to 2032.

The growth of the biofilter market is driven by various factors, including increasing concerns about air and water pollution, strict regulations and guidelines imposed by government bodies, and the need for sustainable solutions. Advancements in biofilter technology, such as the development of remote monitoring and control systems, are also driving the market’s growth.

Regional Landscape:

The Asia-Pacific region is expected to be the fastest-growing biofilter market. The increasing industrialization and urbanization in countries such as China, India, and Japan have led to rising environmental concerns and the need for sustainable air and water treatment solutions. Additionally, the growing demand for clean air and water, coupled with increasing environmental regulations, is driving the adoption of advanced technologies such as biofilters in various industries in the region. Furthermore, the Asia-Pacific region has a large population and a rapidly growing middle class, driving the demand for food and beverage products. As a result, the food and beverage industry in the region is expanding rapidly, leading to an increased demand for sustainable water treatment solutions such as biofilters. Moreover, the Asia-Pacific is a major producer of aquaculture and aquaponics products. The growing demand for seafood and the declining availability of wild fish stocks has led to the expansion of the aquaculture industry, which in turn has led to an increased demand for biofilters.

Biofilter Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.38 Billion |

| Projected Forecast Revenue by 2032 | USD 7.64 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.48% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Driver: Increasing demand from industrial and manufacturing sectors

The industrial and manufacturing sectors are some of the most significant users of biofilters. These sectors produce large volumes of wastewater and air pollutants, which need to be treated before they can be discharged into the environment. Biofilters are becoming increasingly popular as a cost-effective and sustainable solution for treating wastewater and controlling air pollution. In the wastewater treatment industry, biofilters are commonly used to remove organic pollutants and nutrients from wastewater. These pollutants can harm the environment if they are not appropriately treated. Biofilters work by using microorganisms to break down pollutants into harmless substances.

This process is called bioremediation and is a natural, eco-friendly method of treating wastewater. In the air pollution control industry, biofilters remove volatile organic compounds (VOCs), ammonia, and other pollutants from industrial emissions. VOCs are a significant source of air pollution and can have adverse health effects on humans and the environment. Biofilters use microorganisms to break pollutants into harmless substances like carbon dioxide and water. This process is called biofiltration and is an effective method of controlling air pollution.

The increasing demand for sustainable and eco-friendly practices in the industrial and manufacturing sectors is driving the adoption of biofilters. Many companies are pressured to reduce their carbon footprint and adopt sustainable practices. Biofilters are viewed as a green technology that can help companies meet their sustainability targets while improving their bottom line by reducing the cost of wastewater treatment and air pollution control. In conclusion, the increasing demand from the industrial and manufacturing sectors is one of the critical drivers of the biofilter market. As companies become more environmentally conscious, biofilters are becoming an increasingly attractive solution for treating wastewater and controlling air pollution.

Restraint: Limited effectiveness for certain pollutants

While biofilters are effective at removing many types of pollutants, they may not be as effective for certain types of pollutants, such as volatile organic compounds (VOCs), which can limit their usefulness in some applications. VOCs are a diverse group of organic chemicals in many industrial and commercial settings, such as manufacturing paint and coatings, printing, and chemical processing. These compounds can contribute to the formation of ground-level ozone and other air pollutants that can negatively impact human health and the environment. Therefore, reducing their emissions is a critical need in these industries. Biofilters rely on microorganisms to break down pollutants, and they work best for pollutants that can be easily biodegraded. However, some VOCs are not easily biodegraded, which can limit the effectiveness of biofilters for these pollutants.

Additionally, biofilters may not be as effective for pollutants with high concentrations or when there is high variability in pollutant concentrations. To address this issue, alternative technologies such as activated carbon adsorption or thermal oxidation may be more effective for VOC removal. These technologies can be more expensive than biofilters but may be necessary for specific applications where biofilters are ineffective. Thus, the limited effectiveness of biofilters for certain pollutants, such as VOCs, can be a significant restraint for the biofilter market. While biofilters remain an effective and cost-efficient option for many types of pollutants, the need for alternative technologies for specific applications may limit their adoption in some industries.

Opportunity: Technological advancements

Technological advancements have led to the developing of more efficient and cost-effective biofilters, creating new opportunities for manufacturers to invest in R&D and develop innovative and advanced biofilters. One area of advancement is using microbial fuel cells (MFCs) in biofilters. MFCs use bacteria to generate electricity by breaking down organic matter, and they can be integrated into biofilters to enhance their efficiency. Using MFCs, biofilters can generate electricity while removing pollutants from air or water streams, creating a sustainable and cost-effective treatment system. Another area of advancement is the use of nanotechnology in biofilters.

Nanotechnology can be used to develop advanced filter materials that have improved properties, such as increased surface area and enhanced adsorption capabilities. These materials can be used in biofilters to improve efficiency and reduce operating costs. Furthermore, advances in sensors and monitoring systems have enabled real-time monitoring of biofilters' performance, allowing for proactive maintenance and optimization of the treatment process. This can improve the efficiency and effectiveness of biofilters and reduce operating costs.

In addition, advances in automation and control systems have enabled the integration of biofilters into larger treatment systems, such as wastewater treatment plants. This creates opportunities for manufacturers to develop biofilters that can be easily integrated into existing treatment systems, providing a cost-effective and sustainable solution for environmental management. Therefore, technological advancements have created new opportunities for manufacturers to invest in R&D and develop innovative and advanced biofilters. These advancements can enhance the efficiency and effectiveness of biofilters, reduce operating costs, and provide a sustainable solution for environmental management.

COVID-19 Impacts:

The COVID-19 pandemic has impacted the biofilter market by causing delays in installation and maintenance, reducing investment in new projects, and shifting demand for specific applications, such as the increased need for biofilters in healthcare facilities. The pandemic has also accelerated the adoption of remote monitoring and control systems, increased focus on employee health and safety, and raised awareness of the importance of sustainability. Overall, the pandemic has both positively and negatively impacted the biofilter market.

Type Landscape:

The activated carbon biofilter segment is estimated to grow faster during the forecast period. This is due to the increasing demand for air pollution control, stringent government regulations, growing awareness of environmental sustainability, a wide range of applications, and technological advancements. The demand for activated carbon biofilters is driven by the need to control air pollution, a global environmental concern. Activated carbon biofilters effectively remove a wide range of pollutants from contaminated air, making them an attractive solution for environmental protection. Stringent regulations to control air pollution have been implemented by various governments worldwide, creating a strong demand for activated carbon biofilters. These regulations require industries to reduce their pollutant emissions to comply with environmental standards, and activated carbon biofilters are an effective solution for achieving these goals.

The increasing awareness of environmental sustainability and the need to reduce carbon emissions has led to the adoption of green technologies like activated carbon biofilters. Activated carbon biofilters provide an eco-friendly solution for pollution control, and their adoption is expected to increase in the coming years due to the growing awareness of environmental sustainability. Activated carbon biofilters can be used in various applications, including odor control, solvent recovery, and gas purification. Their versatility and adaptability make them an attractive solution for multiple industries, including chemical, petrochemical, food processing, and pharmaceuticals. Advances in technology have led to the development of more efficient and cost-effective activated carbon biofilters, which has led to increased adoption of this technology. Newer technologies like granular activated carbon (GAC) and powdered activated carbon (PAC) have improved the efficiency and effectiveness of activated carbon biofilters, driving their demand in the market.

Filter Media Landscape:

The moving bed filter media segment is expected to grow during the forecast period. Moving bed filter media have several advantages over other types of filter media, including their high surface area, which provides a large amount of space for beneficial bacteria to grow and process waste. This makes them highly effective in removing harmful substances from water, such as ammonia and nitrite. Additionally, moving bed filter media are designed to move freely within a biofilter, which helps prevent clogging and ensures that the filter media remain in constant contact with the water. Due to their efficiency and low maintenance requirements, moving bed filter media is becoming increasingly popular in aquaculture systems and wastewater treatment plants. As such, the demand for moving bed filter media is expected to grow in the coming years, making it a promising segment within the biofilter market.

Application Landscape:

The odor abatement segment is estimated to grow during the forecast period. The combination of regulatory compliance, public health concerns, cost-effectiveness, sustainability, and industry-specific factors drive the growth of odor abatement in the biofilter market. In many industries, odor control is required by law to ensure compliance with environmental regulations. These regulations may include limits on the concentration of certain odor-causing compounds in the air, and odor control technologies such as biofilters may be required to meet these limits. Regulatory compliance is a crucial driver of the odor abatement market, particularly in waste management and wastewater treatment industries. In addition, Odors from industrial processes and other sources can be a nuisance to nearby residents and businesses and impact public health. Exposure to certain odors can cause respiratory problems, headaches, and other health issues. As a result, there is growing demand for effective odor abatement technologies that can reduce the impact of odors on public health and quality of life. Furthermore, In some industries, such as food processing and petrochemicals, odors can be a significant problem due to the nature of the materials being processed. In these industries, effective odor abatement technologies are essential for maintaining a safe and productive workplace and ensuring regulatory compliance and public health.

End user Landscape:

The aquaculture industry is estimated to grow faster during the forecast period. Aquaculture involves farming fish, shellfish, and other aquatic organisms in controlled environments such as tanks, ponds, and raceways. Aquaculture systems use biofilters to maintain water quality by removing excess nutrients and harm from water, such as ammonia and nitrite from water. This is important for the health and growth of farmed aquatic organisms. The aquaculture industry is expanding rapidly due to the increasing demand for seafood and the declining availability of wild fish stocks. As the industry grows, effective and sustainable water treatment solutions such as biofilters are needed. Biofilters offer a cost-effective and environmentally friendly solution for maintaining water quality in aquaculture systems.

In addition to their water treatment capabilities, biofilters can be used in aquaponics systems. Aquaponics is a sustainable food production system that combines aquaculture and hydroponics. These systems treat the water in the aquaculture component, which is then circulated to the hydroponics component to provide nutrients for plant growth. This closed-loop system is highly efficient and can produce a range of fruits, vegetables, and aquatic organisms in a small space. Therefore, the combination of environmental sustainability, cost-effectiveness, and the increasing demand for aquaculture and aquaponics products is driving the growth of biofilters in the aquaculture industry. As the industry expands, the need for effective and sustainable water treatment solutions such as biofilters is expected to increase.

Key Developments:

- In March 2021, an environmental technology company Anua and sustainable infrastructure solutions provider, WEC Projects, announced a partnership to develop and promote Anua's biofiltration technology in South Africa.

- In February 2020, Suez announced the launch of a new biofiltration system for treating odorous compounds in wastewater treatment plants.

Company Profiles and Competitive Intelligence

- Evoqua Water Technologies LLC

- Pentair plc

- Veolia Water Technologies

- Xylem Inc.

- Suez SA

- Dürr AG

- BioAir Solutions, LLC

- Tecniplast SpA

- Aquatech International LLC

- Purafil, Inc.

Segment Covered in the report:

By Type

- Biological Aerated Biofilter System

- Denitrification Biofilter System

- Activated Carbon Biofilters

- Fixed Films

- Fluidized Bed Filter

By Filter Media

- Ceramic Rings

- Bio Balls

- Moving Bed Filter Media

- Others

By Application

- VOC Treatment

- Nitrification

- Denitrification

- Odor Abatement

- Others

By End-user

- Storm Water Management

- Water & Wastewater Collection

- Chemical Processing

- Food & Beverage

- Aquaculture

- Biopharma Industry

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2754

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333