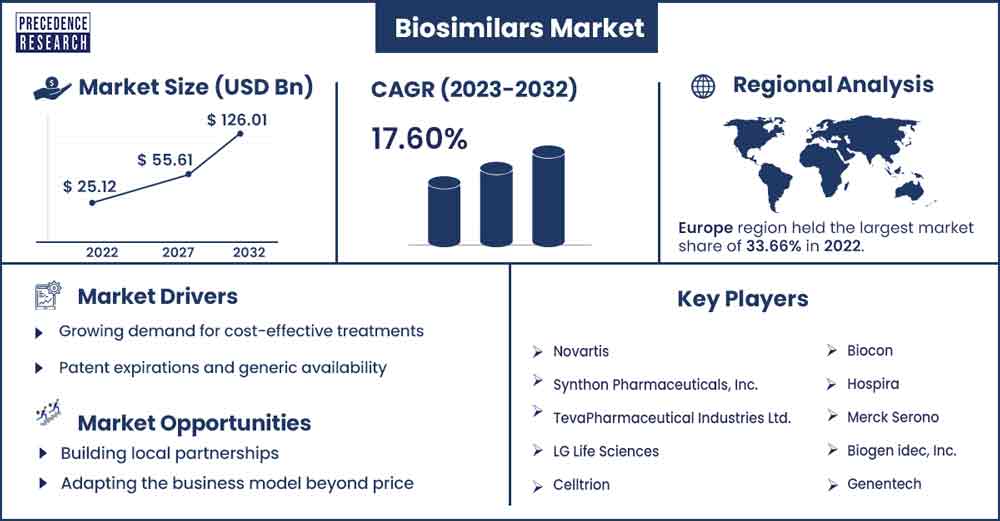

Biosimilars Market Will Grow at CAGR of 17.6% By 2032

The global biosimilars market size was exhibited at USD 25.12 billion in 2022 and is anticipated to touch around USD 126.01 billion by 2032, expanding at a CAGR of 17.6% from 2023 to 2032.

Market Overview

The biosimilars market is a sector within the biopharmaceutical industry focused on developing and producing medicines highly similar to biological treatments, known as biologics. Biosimilars are designed to have the same safety profile, efficacy, and purity as the original biologic, but they are typically less expensive. This makes them an attractive alternative for patients and healthcare providers seeking cost-effective treatment. Biosimilars are crucial in therapy areas like immunology, oncology, supportive care, ophthalmology and diabetes mellitus.

One key aspect of biosimilars is their administration via infusion or injection. This delivery method allows them to be used in various therapy areas, contributing to their growing market presence. Moreover, the biosimilars market is growing due to their ability to offer cost-effective alternatives to original biologics, increasing treatment options and patient access. They are subject to stringent approval processes that ensure their safety and efficacy, playing a critical role in the broader healthcare industry.

Regional Snapshot

Europe is the dominant region in the global biosimilars market. In Europe, many people are adopting biosimilars, the most significant growth factor for growth in the market. Regulatory authorities play an essential role in the adoption of biosimilars. Europe has vital innovation and research in the biotech sector, which often leads to the development of advanced therapies such as biosimilars. One of the growth factors is the cost-effectiveness of treatments for chronic diseases. The increase in chronic diseases in the population and approval of numerous biosimilars in many nations and regulatory authorities are expected to rapidly boost the acceptance of biosimilars globally. The increasing awareness about biosimilar drugs and their effectiveness is also boosting the demand for biosimilars globally.

These biosimilars are designed to have the same safety profile, efficacy, and purity as the original biologic, but they are typically less expensive. The oncology segment, in particular, dominates the biosimilars market, mainly due to the lower price point and the large number of cancer patients, which has made cancer treatment more affordable and accessible. And that is another reason for growth in such regions like Europe.

Biosimilars Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 29.39 Billion |

| Projected Forecast Revenue by 2032 | USD 126.01 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.6% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for cost-effective treatments

One of the main drivers for the biosimilars market is the increasing demand for cost-effective treatments. Patients and healthcare systems alike are looking for alternatives to expensive biologic drugs. Biosimilars, which are highly similar to their original biologic counterparts, offer the potential for reduced costs without compromising on safety or efficacy. This makes them attractive to payers and patients, contributing significantly to the market's growth.

Patent expirations and generic availability

Another factor fueling the growth of the biosimilars market is the expiration of patents for many biological drugs. The availability of biosimilars after patent expiration helps sustain the use of these essential treatments, ensuring that patients continue access to them even as the cost of the original biologics may change.

Regulatory advances and standards

Regulatory advances and establishing standards for biosimilars have also played a role in driving the market. Regulatory bodies worldwide are setting guidelines to ensure that biosimilars meet the same quality standards as their original biologic products. This not only assures patients and healthcare providers but also creates a stable environment for developing and commercializing biosimilars.

Collaborative approaches and strategic partnerships

Collaborative approaches and strategic partnerships are becoming increasingly common in the biosimilars market. Companies are partnering with pharmacies, prescription benefit managers (PBMs), and other stakeholders to supply their products and demonstrate their value. This collaborative model allows biosimilar companies to leverage the established networks of their partners and reach a wider audience, accelerating the adoption of biosimilars and driving market growth.

Restraints

Challenges and barriers to access

Accessing biosimilars in the U.S. healthcare system can be challenging due to several factors. Providers often comply with insurance preferences due to the system's complexities, which can limit the options available to patients. Further barriers arise from formulary restrictions and insurance coverage issues, making it difficult for healthcare providers to prescribe specific biosimilars.

Underutilization due to commercial insurance restrictions

Despite the benefits of biosimilars, such as lower costs compared to their biological counterparts, they need to be more utilized in many cases. One reason is commercial insurance restrictions, which can make biosimilars less attractive to healthcare providers and patients. These restrictions can limit the choice of biosimilars available to patients and affect the overall utilization rates of these products.

Complex development process

The development process for biosimilars is complex and requires extensive research and validation. This can be a significant hurdle for companies entering the market, as they must invest heavily in R&D to demonstrate similarity to the reference biologic. The high development cost and rigorous regulatory requirements can deter new entrants and slow down the market penetration rate for biosimilars.

Regulatory uncertainty

Regulatory uncertainty can act as a restraint on the biosimilars market. Although regulatory bodies are working to streamline the approval process for biosimilars, the need for clear guidelines can create uncertainties that could delay product launches or increase costs. Moreover, regulations across different jurisdictions must be consistent to challenge the international expansion of biosimilar products.

Opportunities

Building local partnerships

Building local partnerships is a powerful strategy for emerging-market biosimilar companies. Local companies can better understand the market and navigate complex regulatory environments than multinationals. They can also reduce manufacturing costs and tap into local knowledge. Multinationals can form partnerships with regional players to enter these markets, leading to rapid penetration and building on existing relationships with government bodies and customers.

Adapting the business model beyond price

Companies are exploring ways to adapt their business models beyond focusing on price to increase access in emerging markets. This could involve strategies that enhance the value proposition of biosimilars, such as improving patient outcomes, simplifying the administration process, or offering more convenient dosage forms.

Recent Developments

- In February 2024, nine biosimilars for the world's top-selling drug, Humira (adalimumab, AbbVie), were launched, boosting the US pharmaceutical market.

Key Market Players

- Celltrion

- Biocon

- Hospira

- Merck Serono

- Biogen Idec, Inc.

- Genentech

- Novartis

- Synthon Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- L.G. Life Sciences

Market Segmentation

By Product

- Monoclonal Antibodies

- Somatropin

- Insulin

- Erythropoietin

- Follitropin

- Others

By Application

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Diseases

- Others

By Manufacturer

- Contract Research and Manufacturing Services

- In-house

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1359

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308